The Current Fundraising Landscape in Europe

The fundraising landscape in Europe has evolved significantly in recent years, presenting both challenges and opportunities for founders seeking capital. Understanding the current environment is crucial for successfully navigating the fundraising process.

Key Trends in the European Fundraising Landscape

- Increased Caution and Selectivity: The European VC landscape has become more cautious, with average fund sizes decreasing and larger funds gaining prominence. This shift reflects a preference for scale and stability amidst economic uncertainties. Investors are emphasizing differentiation, strategic alignment, and transparency to attract limited partners (LPs).

- Sectoral Shifts and Focus on Resilience: Despite a general downturn, certain sectors like greentech, healthcare, and deeptech have continued to attract significant investment. These sectors are seen as more resilient and future-proof, aligning with a broader strategic shift towards sustainable and socially responsible investments.

- Extended Fundraising Cycles: Fundraising cycles have lengthened due to increased demand for capital and more rigorous due diligence processes. The competition among VC firms has intensified, with LPs favoring experienced managers who can demonstrate a strong track record and deep market knowledge.

- Emphasis on ESG Criteria: Environmental, Social, and Governance (ESG) factors have become a significant consideration for investors. LPs are increasingly prioritizing investments that align with ESG criteria, reflecting a global trend towards responsible and sustainable investing.

- Cross-Border Investments: There is a growing trend towards cross-border investments within Europe. This shift highlights the importance of networking and building relationships across different regions to tap into a broader pool of capital.

Regional Differences in the European Fundraising Landscape

Navigating the fundraising landscape in Europe requires an understanding of the unique characteristics and opportunities within each region. Founders should leverage the strengths of their local ecosystems while being mindful of the potential challenges. By tailoring their strategies to the specific dynamics of Western Europe, the Nordic countries, or Eastern Europe, entrepreneurs can better position themselves for successful fundraising and growth.

Western Europe: Vibrant Startup Ecosystems

Key Hubs: London, Berlin, Paris

Western Europe boasts some of the most vibrant startup ecosystems globally, particularly in cities like London, Berlin, and Paris. These hubs are renowned for their dynamic environments and access to a wide range of investors.

- London: As one of the leading financial centers in the world, London offers unparalleled access to venture capital and a diverse pool of investors. The city is home to numerous accelerators and incubators, providing robust support for startups at various stages. Additionally, London’s strong legal and financial infrastructure makes it an attractive destination for founders.

- Berlin: Known for its creative and tech-savvy culture, Berlin has become a hotspot for startups, particularly in the tech and creative industries. The city benefits from relatively lower living costs compared to other Western European capitals, which can be advantageous for early-stage companies. Berlin’s vibrant community and numerous co-working spaces foster a collaborative environment conducive to innovation.

- Paris: Paris has emerged as a significant player in the European startup scene, thanks to initiatives like Station F, the world’s largest startup campus. The French government’s pro-business reforms and tax incentives have further bolstered the city’s attractiveness to entrepreneurs and investors alike. Paris also benefits from a rich cultural scene and a strategic location within Europe.

Nordic Countries: Innovation and Governmental Support

Key Characteristics: Innovation, Strong Governmental Support

The Nordic region, comprising countries like Sweden, Denmark, Finland, and Norway, is renowned for its innovative spirit and strong governmental support for startups.

- Innovation: Nordic countries consistently rank high in global innovation indexes. The region’s emphasis on research and development, combined with a strong educational system, creates a fertile ground for cutting-edge startups, particularly in sectors like fintech, cleantech, and healthtech.

- Governmental Support: Governments in the Nordic countries provide substantial support to startups through grants, subsidies, and favorable regulatory frameworks. Initiatives like Sweden’s Vinnova and Finland’s Tekes offer financial assistance and resources to help startups scale. Additionally, the Nordic model of collaboration between the public and private sectors enhances the overall ecosystem.

Eastern Europe: Growing Tech Hubs

Key Hubs: Warsaw, Budapest

Eastern Europe is witnessing the emergence of several tech hubs, particularly in cities like Warsaw and Budapest. These regions offer unique advantages, though they also present certain challenges.

- Warsaw: As the capital of Poland, Warsaw has become a burgeoning tech hub with a rapidly growing startup scene. The city offers lower operational costs compared to Western Europe, making it an attractive destination for early-stage startups. However, the investment ecosystem is still developing, and founders may find fewer investors compared to more established markets.

- Budapest: Hungary’s capital, Budapest, is another rising star in the Eastern European tech landscape. The city benefits from a skilled workforce and a vibrant entrepreneurial community. Similar to Warsaw, Budapest offers lower costs, which can extend the runway for startups. However, access to capital remains a challenge, with fewer local investors available.

Navigating the Legal and Regulatory Landscape

By navigating the legal and regulatory landscape effectively, European startups can establish a solid foundation for growth and innovation. Ensuring compliance and protecting intellectual property are critical steps in building a sustainable and competitive business.

Legal Structures

Company Formation

Choosing the right legal structure is a foundational step for any startup. In Europe, several common legal structures are suitable for startups, each with its advantages and implications.

- Limited Liability Company (LLC): This is one of the most popular legal forms due to its flexibility and the limited liability it offers to its owners. LLCs can vary slightly in terms of regulations and formation procedures across different European countries. Generally, an LLC can be formed by one or more individuals or entities, and the owners are not personally liable for the company’s debts beyond their initial investment.

- Societas Europaea (SE): The SE is a public company structure that allows businesses to operate across multiple European countries under a unified legal framework. This can be particularly advantageous for startups planning to expand internationally within Europe. The SE offers flexibility in terms of corporate governance and can be formed through mergers or as a holding company, among other methods.

Regulations and Compliance

Compliance with regulatory requirements is essential for operating legally and maintaining investor confidence.

- General Data Protection Regulation (GDPR): GDPR compliance is mandatory for businesses operating in Europe. This regulation governs data protection and privacy for all individuals within the EU and the European Economic Area (EEA). Startups must ensure they have robust data protection measures in place, including obtaining explicit consent for data collection, implementing data protection by design, and appointing a Data Protection Officer (DPO) if necessary. Non-compliance can result in significant fines.

- Other Regulatory Considerations: Depending on the industry, there may be additional regulations to comply with, such as financial regulations for fintech startups or health regulations for biotech companies. It’s crucial to stay informed about sector-specific requirements and ensure ongoing compliance through regular audits and updates to company policies.

Intellectual Property (IP)

Patents and Trademarks

Protecting intellectual property is vital for safeguarding a startup’s innovations and maintaining a competitive edge.

- Patents: Patents protect inventions by granting the patent holder exclusive rights to use, sell, or license the invention for a specific period, typically 20 years. To secure a patent in Europe, startups must file an application with the European Patent Office (EPO). The application process involves a detailed description of the invention, claims defining the scope of protection, and technical drawings. Patents are essential for tech startups and others with novel products or processes.

- Trademarks: Trademarks protect brand names, logos, and slogans that distinguish a company’s goods or services. Registering a trademark with the European Union Intellectual Property Office (EUIPO) provides protection across all EU member states. The registration process involves a search to ensure the trademark is unique, followed by the submission of an application detailing the trademark and the goods or services it covers.

IP Strategy

Developing a comprehensive IP strategy can add significant value to a startup and protect its core assets.

- Assessing and Prioritizing IP: Start by identifying all potential IP assets, including patents, trademarks, copyrights, and trade secrets. Prioritize these based on their importance to your business model and competitive advantage. For example, a tech startup might focus on patents for its innovative technologies, while a consumer goods company might prioritize trademarks.

- Protection and Enforcement: Once identified, take steps to protect your IP through appropriate registrations. Regularly monitor the market for potential infringements and be prepared to enforce your rights through legal action if necessary. This not only protects your assets but also demonstrates to investors that you are proactive in safeguarding your business interests.

- Leveraging IP: Consider how your IP can be leveraged to create additional value. This could include licensing agreements, strategic partnerships, or even using IP as collateral for financing. An effective IP strategy can enhance your company’s valuation and provide additional revenue streams.

Biggest VCs in Europe

1. Global Founders Capital

Global Founders Capital is a fund that invests worldwide across any sector and stage. As put by their team, “Global Founders Capital is a globally oriented, stage agnostic venture capital firm that empowers gifted entrepreneurs worldwide.

- Global. We support founders in all geographies.

- Stage agnostic. We back companies across all stages and throughout the lifecycle.

- Operational. Our platform offers founders all the support they need to scale.”

Location

Global Founders Capital is located in Berlin but they invests in companies across the globe.

Portfolio Highlights

Global Founders Capital has invested in 900+ companies. Over their course of investing, they’ve backed popular companies such as:

- Canva

- Delivery Hero

- Slack

- Brex

Funding Stage

Global Founders Capital invests across all stages and business lifecycles.

2. Hiventures

As put by their team, “Hiventures is the biggest and most active capital investment partner of the development of Hungarian enterprises.

Our mission is to provide resources for the growth and innovation of Hungarian enterprises by offering unique capital financing solutions. Our investment programmes are available from the idea phase to large enterprises, which allows us to cover the entire entrepreneurial ecosystem and thus improve its competitiveness. We are a reliable and flexible investment partner of our portfolio companies in terms of development and crisis management as well.”

Related Resource: Private Equity vs Venture Capital: Critical Differences

Location

Hiventures is located in Hungary and funds companies that are located in Hungary.

Portfolio Highlights

Some of Hiventure's most popular investments include:

- Likespace

- Neonectar

- Unreal Industries

Funding Stage

Hiventures has multiple funds that invest in stages from pre-seed to seed and growth stage.

3. High-Tech Grunderfonds

As put by their team, “HTGF is a venture capital investor for innovative technologies and business models. We successfully support the best founders whose ideas can revolutionize entire industries and improve people’s lives – from seed to exit.

As a seed investor, we have financed 700 start-ups in the industrial tech, digital tech, life sciences, and chemicals sectors. We have overseen more than 160 exits, including IPOs. When founding your company together with us, you benefit from an experienced partner at your side.”

Location

HTGF has offices in both Bonn and Berlin and invests in companies with headquarters in Germany.

Portfolio Highlights

Some of High-Tech Grunderfonds most popular investments include:

- Instagrid

- Taxdoo

- Orbex

Funding Stage

HTGF is focused on seed-stage companies that have been around for less than 3 years. As put by their team, “We flexibly invest up to 1 million euros in the seed round – as lead investor, but also gladly together with partners. You can bring this with you or we will contact suitable investors from our network for you.

In total, we can invest 4 million euros across all financing rounds and we open doors.”

4. Seedcamp

As put by their team, “We invest early in world-class founders attacking large, global markets and solving real problems using technology.

We are first-cheque investors, backing founders with ticket sizes between £300K-500K. We have led first rounds in unicorn businesses like TransferWise, Revolut, and Hopin along with the likes of Pleo and Sorare.

You may have already raised a small amount of capital from friends and family but this is most likely your first round of institutional investment. It doesn’t matter where in your product development you are; if you think the Seedcamp Network — the most powerful, collaborative, connected, and experienced network you’ll find — can help supercharge your idea, you’ve come to the right place.”

Learn more about Seedcamp by checking out their Visible Connect profile →

Location

Seedcamp is located in London.

Portfolio Highlights

Seedcamp has invested in 460+ companies. Some of their most popular investments include:

- Wefox

- Primer

- UiPath

Funding Stage

Seedcamp tries to be the first check in a company. They typically write checks between £300K and 500K.

5. Par Equity

As put by the team at Par Equity, “Founded in 2008, our investment model is designed to identify and back the most innovative, high growth technology companies in the North of the UK. We’re based in Edinburgh and we’re investing across Northern England, Northern Ireland and Scotland.

Key to our success is our distinctive hybrid investment model, combining our discretionary managed funds with the skills, expertise and contacts of the Par Investor Network – a large and engaged pool of investors and mentors with a track record of founding, growing and selling companies, who can add value throughout the investment life cycle.

This investment strategy, fusing the experience of angel investors with the professionalism and rigour of an experienced venture capital fund manager, is a force multiplier for Par Equity, delivering better outcomes for the investors and the entrepreneurs.”

Learn more about Par Equity by checking out their Visible Connect profile →

Location

Par Equity is located in Edinburgh and invests in companies across Northern England, Northern Ireland, and Scotland.

Portfolio Highlights

Some of Par Equity’s most popular investments include:

- Aveni

- Cumulus

- Kibosh

Funding Stage

Par Equity looks to invest in companies with more than £20k of monthly revenue and are seeking to raise between £0.5m to £10m.

6. Partech

As put by their team, “Partech is a global investment platform for tech and digital companies, led by ex-entrepreneurs and operators of the industry spread across offices in San Francisco, Paris, Berlin and Dakar.

We invest from €200K to €75M in a broad range of technologies and businesses for enterprises and consumers, from software, digital brands and services to hardware and deep tech, across all major industries.”

Learn more about Partech by checking out their Visible Connect profile →

Location

Partech has offices in San Francisco, Paris, Berlin, and Dakar and invests in companies across the globe.

Portfolio Highlights

Some of Partech’s most popular investments include:

- Alan

- OneFocus

- Bolt

Funding Stage

Partech has multiple funds and invests in companies from seed to growth stages.

Related Resource: Breaking Ground: Exploring the World of Venture Capital in France

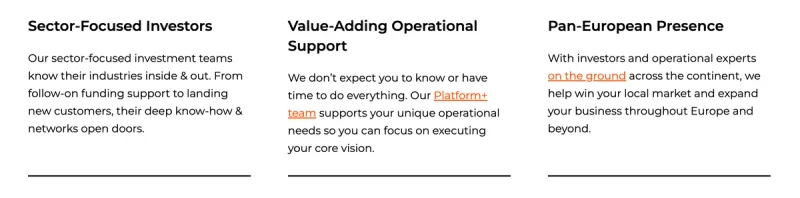

7. Speedinvest

As put by the team at Speedinvest, “We refuse to be just another investor who sends you money and shows up at board meetings to provide “advice.” Our mission is to empower you throughout your journey with actionable, aligned and game-changing support.

From day one, you have full access to our experienced investors, Platform+ operational experts and global networks of industry partners. Whatever you need to succeed, we do everything in our power to help make it happen.”

Learn more about Speedinvest by checking out their Visible Connect profile →

Location

Speedinvest has offices in Berlin, London, Munich, Paris, and Vienna and funds companies that are located in Europe.

Portfolio Highlights

Some of Speedinvest’s most popular investments include:

- Wefox

- Bitpanda

- Primer

Funding Stage

As put by their team, “We are early-stage investors with a strong focus on pre-seed and seed rounds. But to be honest, some of our best investments were stretching the limits of how “seed” is defined, so we grant ourselves some flexibility here.”

8. Octopus Ventures

As put by their team, “Octopus Ventures is one of the largest and most active venture capital investors in Europe. Our mission is simple – to invest in the people, ideas and industries that will change the world.

For the last few years, we’ve focused our efforts, and our investments, on three areas where we think we can make the biggest impact. We focus on building a more sustainable planet, empowering people and revitalizing healthcare.”

Learn more about Octopus Ventures by checking out their Visible Connect profile →

Location

Octopus Ventures has offices in London, Manchester, and New York.

Portfolio Highlights

Octopus has funded over 180 companies. Some of their most popular investments include:

- Graze

- Elliptic

- Lollipop

Funding Stage

Octopus Ventures invests in companies from pre-seed to series B. Learn more about how their process changes depending on stage here.

Related Resource: A Quick Overview on VC Fund Structure

9. Hoxton Ventures

We take risks on brilliant people and products. We work with founders on a mission to change the one thing they think is fundamentally broken in the world. We welcome young or first-time founders who are technical or domain experts in their field.

Our focus is finding Europe’s best early stage tech startups and building them into large revenue, category-defining companies. We believe great companies are built by great teams, not by venture capitalists. Some might call our approach old-school.

We lead pre-seed or seed rounds. We invest at fair terms and reserve capital to continue investing through a company’s journey. We typically invest between $500k to $5 million, although we have gone as low as $250,000 and as high as $10 million. We like to aim for an ownership position between 10% to 20%.

When we believe in your vision, market and team, we get conviction quickly. We often write the first large check a company receives. We aren’t afraid of being the only investor, but are happy to invest alongside others.

We work hard behind the scenes to maximize value. We provide introductions, help make key hires, provide market intel, ink strategic partnerships and handle difficult operational issues. Sometimes we might even spark crazy acquisition offers. Often, our work is providing a sage perspective that comes from living through multiple market cycles, and having the forthrightness to hold honest conversations others shy away from.

Having spent most of our working lives in Silicon Valley, we aim to replicate in Europe what we saw work in California. We dream big and are unashamedly ambitious for our companies.

Learn more about Hoxton Ventures by checking out their Visible Connect profile →

Location

London, England, United Kingdom

Portfolio Highlights

Hoxton Ventures has made 105 investments.

- Cogna

- Fluent

- Baseimmune

- Inoviv

- Fabrica AI

Funding Stage

We lead pre-seed or seed rounds.

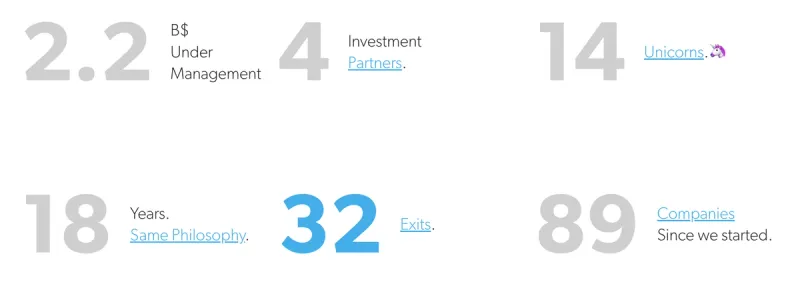

10. 83North

3North is a global venture capital firm with more than $2B under management that invests in European and Israeli entrepreneurs creating global businesses.

Our philosophy remains the same since we started operating 17 years ago and is centered around the belief that venture is not a scalable business.

We are four equal partners; we have worked together for many years and our operation is lean. Our small size ensures a very high level of trust in the partnership. This translates into transparent and quick processes which are critical for entrepreneurs.

Despite our focused approach, we invest globally (US, Europe, Israel) and operate across many segments. We can do this because we rely mainly on word of mouth and referrals from our own entrepreneurs and executives.

Learn more about 83North by checking out their Visible Connect profile →

Location

London, England, United Kingdom

Portfolio Highlights

83North has made 224 investments.

- Snappy

- Vertice

- Orbem

- Lendbuzz

- floLIVE

Funding Stage

Seed, Series A, Series B, Series C, Series D, Growth

11. Kima Ventures

Kima Ventures promotes the growth of startups, supporting them in the fastest and most effective ways.

We fund ambitious, cohesive teams with stellar learning and execution curves.

Investing in 2 to 3 startups per week, all over the world.

Learn more about Kima Ventures by checking out their Visible Connect profile →

Location

Paris, Ile-de-France, France

Portfolio Highlights

Kima Ventures has made 774 investments.

- Zenly

- TransferWise

- PayFit

- Carta

- Sqreen

- Front

Funding Stage

Early Stage Venture, Seed

12. Atomico

Atomico is a risk capital group. They are entrepreneurs with global perspectives who invest their own capital in passionate entrepreneurs with powerful ideas. Through their experience building Skype, Joost and Kazaa, they understand the value of game-changing business models and have created a worldwide ecosystem to help accelerate the growth of the companies in which they invest.

Learn more about Atomico by checking out their Visible Connect profile →

Location

London, England, United Kingdom

Portfolio Highlights

Atomico has made 227 investments.

- Klarna

- Lilium

- HingeHealth

- MessageBird

Funding Stage

Pre-seed, Seed, Series A, Series B, Series C, Growth

Looking for Investors? Try Visible Today!

At Visible, we oftentimes compare a venture fundraise to a traditional B2B sales and marketing funnel.

- At the top of the funnel, you are finding potential investors via cold outreach and warm introductions.

- In the middle of the funnel, you are nurturing potential investors with meetings, pitch decks, updates, and other communications.

- At the bottom of the funnel, you are working through due diligence and hopefully closing new investors.

Related Resource: The Understandable Guide to Startup Funding Stages

Just as a sales and marketing team has dedicated tools, shouldn’t a founder that is managing their investors and fundraising efforts? Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.