Key Takeaways

-

Discover how VC portfolio monitoring software helps venture capital firms track investments, analyze performance, and streamline LP reporting for better decision-making.

-

Learn the key features to look for, like automated data collection, customizable dashboards, and predictive analytics, to manage portfolios efficiently.

-

Understand common challenges such as data inconsistency and scalability, and how the right software can overcome them.

-

Explore best practices for effective portfolio monitoring, including standardized KPIs and real-time analytics to identify trends and mitigate risk.

-

See real-world examples and find guidance on choosing the best VC portfolio monitoring software, including scalable options like Visible.

Venture capital firms rely on precise data and insights to manage their investments effectively. The right VC portfolio monitoring software can streamline fund performance tracking, improve LP reporting, and enhance decision-making. In this guide, we’ll explore the importance of portfolio management, key features to look for, common challenges, best practices, and how to choose the best VC portfolio monitoring software for your firm.

“Over the past two years, the number of firms identified as ‘data-driven VCs’ rose from 151 to 235, with about 65% of them now relying on internally built tools for the majority of their desk work- including portfolio monitoring. ”

Understanding VC Portfolio Monitoring Software

At its core, portfolio monitoring software helps venture capital firms track and analyze their investments. It provides real-time insights into company performance, valuation trends, and liquidity events. By consolidating data from multiple portfolio companies into a single platform, investors can make informed decisions faster.

Portfolio Monitoring Meaning in Business

In the VC industry, portfolio monitoring meaning in business refers to the process of gathering and analyzing data to assess the health of investments. This ensures firms can make informed decisions, identify emerging trends, and provide accurate reports to stakeholders. Effective portfolio monitoring allows VC firms to maximize returns while mitigating risks associated with early-stage investing.

Why Portfolio Monitoring Matters for VC Firms

The importance of portfolio management in venture capital cannot be overstated. Effective tracking allows firms to identify high-performing companies and allocate resources accordingly, mitigate risk by spotting early warning signs in struggling startups, and provide accurate and transparent updates to LPs. Additionally, strong portfolio monitoring can streamline due diligence for follow-on investments, helping firms make more confident and data-driven decisions.

LP Reporting Meaning

LPs (Limited Partners) expect regular, detailed updates on fund performance. LP reporting meaning refers to the structured communication of financial and operational data, ensuring investors stay informed. VC firms must provide clear, data-backed reports that highlight the fund’s overall performance, key risks, and strategic insights to maintain LP confidence.

Key Features to Look for in VC Portfolio Monitoring Software

Selecting the right VC portfolio management software involves evaluating features that align with your firm’s needs. Some essential capabilities include automated data collection to streamline updates from portfolio companies, a performance metrics dashboard for real-time tracking of key financial indicators, customizable LP reporting to meet investor expectations with clear, structured reports, and portfolio management examples that provide case studies and historical data analysis for benchmarking. Other key features include integration with financial tools, scenario modeling to predict future portfolio performance, and compliance tracking to ensure regulatory adherence.

Common Challenges in VC Portfolio Monitoring

One common issue is data inconsistency, as startups report metrics in different formats and at varying levels of detail. Another challenge is scalability, with firms needing software that grows alongside their portfolio without adding unnecessary complexity. Additionally, investor expectations continue to rise, making it essential for VCs to provide detailed yet digestible performance reports. Addressing these challenges requires selecting a robust software solution that centralizes data, offers automation, and allows for customized reporting.

How VC Portfolio Monitoring Software Enhances LP Reporting

Transparent and efficient LP reporting is a cornerstone of successful venture capital management. The right VC portfolio monitoring software ensures consistency in reporting formats, accuracy in financial performance updates, and compliance with investor expectations. By automating data collection and analysis, firms can reduce manual errors and present a clearer picture of fund performance.

Portfolio Monitoring Meaning Example

Consider a VC firm managing a diverse portfolio of early-stage startups. With portfolio monitoring software, they can track revenue growth, operational efficiency, and market trends, all essential for crafting compelling LP reports. For example, a firm investing in SaaS startups may use portfolio monitoring software to track ARR growth and churn rates across its portfolio.

Free vs. Paid VC Portfolio Monitoring Software

Firms exploring free portfolio management software should weigh the trade-offs between cost and functionality.

Best VC Portfolio Monitoring Software Free

Some free tools offer basic reporting, but they may lack advanced analytics and forecasting capabilities, seamless integrations with financial platforms, and automated LP reporting features. For firms serious about fund performance tracking, investing in comprehensive VC portfolio monitoring software is often the best choice. Free tools may be suitable for emerging VC firms with smaller portfolios, but as investment strategies become more complex, paid solutions provide the necessary scalability and customization.

Best Practices for Effective Portfolio Monitoring

To get the most value from portfolio monitoring software, VC firms should establish a consistent reporting framework that ensures portfolio companies submit key metrics on a regular basis. Defining standardized KPIs, such as revenue growth, burn rate, and customer acquisition cost, allows for more accurate comparisons across investments. Firms should also leverage real-time analytics to identify emerging trends, proactively addressing risks and capitalizing on opportunities. Another best practice is aligning reporting with LP expectations by customizing dashboards and reports to highlight the most relevant insights.

Portfolio Monitoring in Action: Real-World Examples

Portfolio Monitoring Meaning Example

A Series A-focused VC firm uses portfolio monitoring software to track revenue milestones across its startups. This allows them to identify which companies are ready for follow-on investments, provide LPs with data-driven performance insights, and streamline due diligence for future funding rounds. In another example, a firm investing in deep tech startups might use scenario modeling to predict capital needs based on different market conditions.

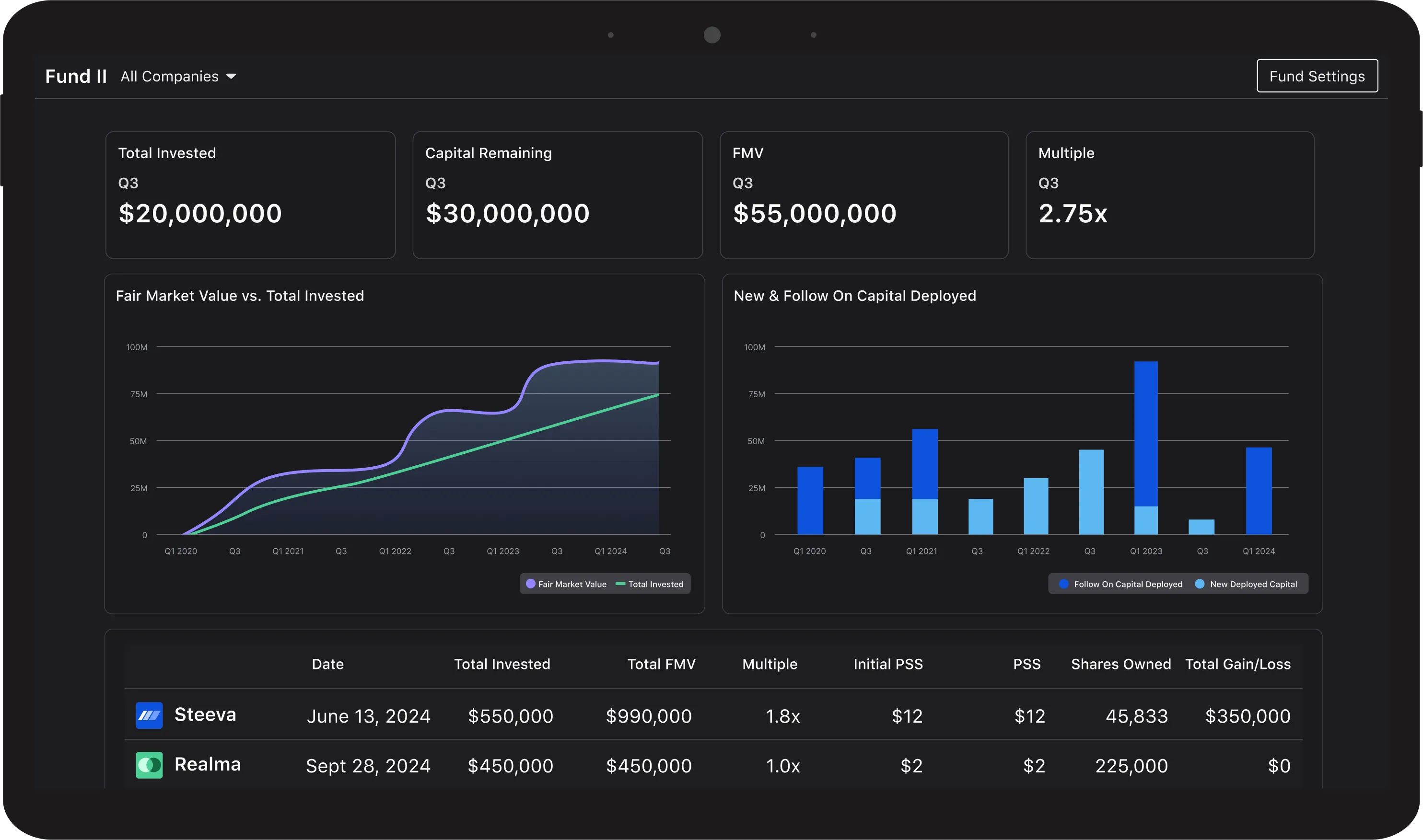

Visible Portfolio Management: A Closer Look

Visible Portfolio Management is trusted by 660+ VC Funds across the globe. Investors thrive with Visible by streamlining portfolio monitoring, tracking fund performance, reporting to stakeholders, and uncovering portfolio insights. VC Funds use Visible to collect data from 90%+ of their companies and turn the data into actionable reports for team members and investors.

How to Choose the Best VC Portfolio Monitoring Software

When evaluating the best VC portfolio monitoring software, consider firm size and investment strategy to tailor features to the complexity of your portfolio. LP reporting needs should also be assessed to ensure the software can generate investor-ready reports. Finally, user experience and integration capabilities should be considered to choose a platform that works with your existing tech stack. VC firms should also seek software that offers predictive analytics, benchmarking tools, and strong customer support to maximize long-term value.

Conclusion: The Future of VC Portfolio Monitoring

As venture capital becomes more data-driven, VC portfolio monitoring software will play an even greater role in optimizing fund performance. Firms that embrace advanced tracking and reporting tools will gain a competitive edge, ensuring stronger investor relationships and more successful outcomes. By leveraging the right VC portfolio management software, firms can enhance transparency, improve decision-making, and drive long-term success in an increasingly complex investment landscape.

Technology will continue to shape the way VC firms track investments and manage risk. AI-powered analytics, automated LP reporting, and seamless integration with financial platforms will become standard features. As expectations from LPs and regulatory bodies increase, adopting the best VC portfolio monitoring software will be essential for staying ahead in the competitive venture capital market. Additionally, a streamlined user experience with easily customizable features will be key for VC firms to maintain a competitive edge in an ever-evolving environment.

Frequently Asked Questions

What is VC portfolio monitoring software and why is it important?

VC portfolio monitoring software helps venture capital firms track investment performance, consolidate data, and create accurate LP reports. It provides real-time insights into valuations, financial metrics, and trends, enabling investors to make faster, data-driven decisions while improving transparency with Limited Partners (LPs).

What key features should I look for in the best VC portfolio monitoring software?

The best VC portfolio monitoring software offers automated data collection, customizable LP reporting, performance dashboards, and seamless integration with financial tools. Advanced options also include predictive analytics, scenario modeling, and compliance tracking to ensure accuracy and scalability as your portfolio grows.

How does VC portfolio monitoring software improve LP reporting?

This software streamlines LP reporting by automating data collection, ensuring consistency in financial metrics, and generating investor-ready reports. VC firms can provide timely, transparent updates on fund performance, reducing manual errors and strengthening trust with Limited Partners.

Are there free VC portfolio monitoring software options?

Yes, some free VC portfolio monitoring software solutions exist, offering basic reporting and data tracking. However, they typically lack advanced analytics, forecasting tools, and seamless integrations. Paid solutions are recommended for larger or more complex portfolios that require scalability and comprehensive features

What is the difference between VC and private equity portfolio monitoring software?

While both track investment performance, VC portfolio monitoring software focuses on early-stage startups and growth metrics like ARR and churn. Private equity portfolio monitoring software often emphasizes mature businesses, detailed financial statements, and leveraged buyout metrics, requiring more extensive compliance and risk analysis tools.

How can VC firms implement best practices for portfolio monitoring?

VC firms should define standardized KPIs, establish consistent reporting schedules, and leverage real-time analytics to identify trends early. Customizing dashboards for LP expectations and using automated tools ensures accurate, efficient data collection and improves decision-making across the investment lifecycle.

How do I choose the right VC fund management software for my firm?

Consider your firm’s size, investment strategy, and LP reporting needs. Look for VC fund management software with robust integrations, predictive analytics, and an intuitive interface. Prioritize platforms that provide strong customer support and can scale as your portfolio and investor requirements grow.