What is Portfolio Monitoring

Portfolio monitoring in the context of Venture Capital is the process of tracking the performance of investments in a venture fund. The primary focus of portfolio monitoring is tracking the financial metrics of a company but it also includes monitoring key operational changes, fluctuations in companies’ valuations, and trends in the respective company’s market or industry.

We recently asked 50+ investors to choose their top three reasons for collecting structured data as a part of their portfolio monitoring processes.

You can find a summary of the results below —

Top three reasons investors take portfolio monitoring seriously:

- Investors want to better understand how their companies are performing in general

- Investors want to provide better support to companies

- Investors need to provide updates to Limited Partners

How to Monitor Venture Capital Portfolio Companies

Investors struggle to monitor their portfolio companies effectively because if they hear from companies at all, it’s in a format that is unstructured and in a frequency that is unpredictable. This makes it extremely difficult for investors to have an accurate data set from which they can draw meaningful insights or share updates with their Limited Partners.

Investors who effectively monitor their portfolio companies have a process in place to collect structured updates from their companies on a regular basis — from day one. In the early days of a fund when there are typically less than 10 companies, this can look like sending an Excel file or Google Sheet template to portfolio companies via email and asking them to complete it and send it back.

It’s important to have a reporting process in place from day one because the more time that passes, the harder it can be to change portfolio company behavior when it comes to reporting.

As a fund’s portfolio grows, this process becomes cumbersome and investors often find they are wasting time chasing companies, trying to keep track of which companies have responded and which haven’t, and collating numerous templates into a master portfolio data file.

Visible helps over 400+ investors streamline the way they collect, analyze, and report on their portfolio data.

What Metrics to Track for VC Portfolio Companies

To monitor the performance of portfolio companies it’s crucial to track the right metrics across all your companies. The most common metrics to track include:

- Revenue

- Cash Balance

- Monthly Net Burn Rate

- Runway

- Net Income

- Headcount

Read more about which metrics to collect from portfolio companies and why.

Based on data from the 400+ funds using Visible, most investors are asking for their companies to report 8 metrics and 1-2 qualitative questions on a quarterly basis.

Learn more about VC Portfolio Data Collection Best Practices in our guide.

VC Portfolio Monitoring Template

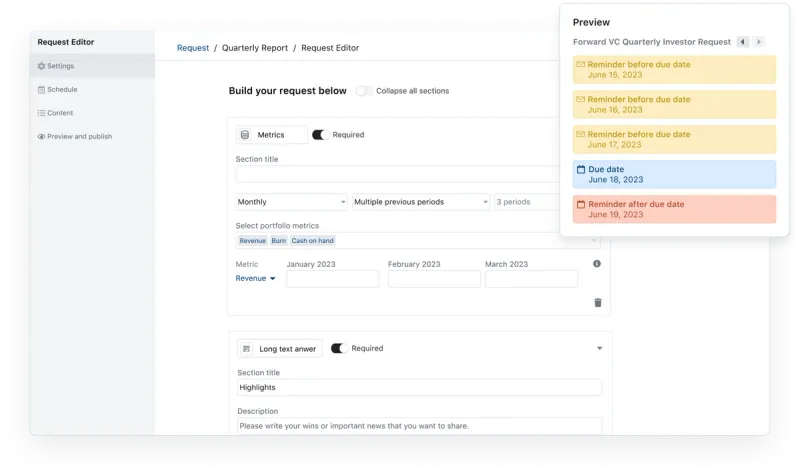

Visible provides investors with a streamlined, founder-friendly way to collect structured data from portfolio companies on a regular basis. The solution in Visible that empowers investors to easily collect KPIs is called a Request.

Visible allows investors to build custom data Requests that support:

- Automated email reminders to reduce chasing companies

- Assigning custom metrics to certain companies

- Sending a Request to multiple points of contact

- Asking for budget vs actuals

- Secure linked-based forms for companies

- Portfolio companies reporting in multiple currencies

Check out an Example Request in Visible.

Portfolio Monitoring Tips for Venture Capital Investors

Set expectations early on.

- Consider outlining your reporting requirements in a side letter

- Have a process in place to collect data from day one — it’s harder to change reporting behavior change later on

- Incorporate reporting expectations into your onboarding process

Check out this Guide to Onboarding New Companies into Your VC Portfolio.

Communicate the why to portfolio companies.

- Explain how responses will help inform portfolio support

- Explain which data will be shared with LPs and which is just for internal processing

- Explain how it will be used to inform follow on investment decisions

Make your data Requests founder-friendly.

- Don’t ask for more than 5-8 metrics

- Use metric definitions to reduce back-and-forth

- Send your Request at the same time every period

- Make sure you have the right points of contact at the company

- Don’t make your companies create an account if they don’t want to

Turning Your Portfolio Data into Meaningful Insights

After going through the effort to collect structured data from portfolio companies the next important step is turning into important insights that can be shared with your team and eventually your Limited Partners.

Visible has a suite of tools to help with portfolio data analysis including

- Robust, flexible dashboards that can be used for Internal Portfolio Review meetings

- Portfolio metric dashboards to help with cross-portfolio insights

- Tools to slice and dice your portfolio data by custom segments

Over 400+ Venture Capital investors are using Visible to streamline their portfolio monitoring and reporting.