The pitch deck is the core marketing asset that jumpstarts any fundraising effort. It acts as the catalyst for connection, conversation, and relationship building.

How Pitch Deck Sharing Works

We talked to hundreds of founders, and three problems emerged around pitch deck sharing:

- I’m not sure how prepared a potential investor is before heading into a meeting.

- I’m under-networked. I share my deck to get meetings but want to understand who is engaged.

- I iterate on my deck every hour. Sharing the latest version is a pain.

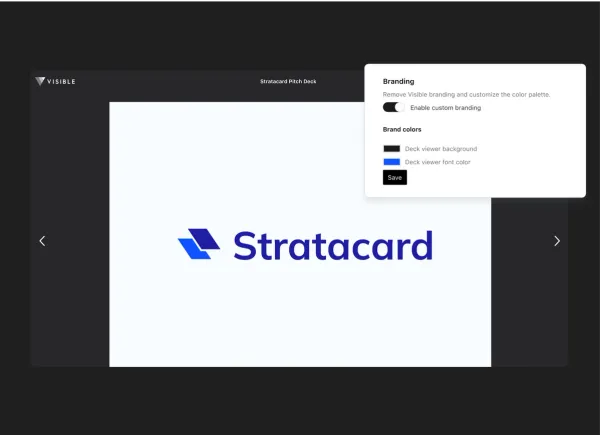

Introducing Visible Pitch Decks

Today, we are launching Decks. A dead-simple way to host and share a pitch deck on Visible. Decks are completely integrated with our fundraising crm and leading investor updates platform. You’ll be able to set customized sharing permissions, notifications when investors view your deck, upload new versions without clicking a button, and understand how potential investors have engaged with your content.

Just as a sales team has dedicated tools for their day-to-day, founders need dedicated tools for managing the most expensive asset they have, equity. Our community can now find investors, track a fundraise, and share a pitch deck directly from Visible and completely integrated.

Want to see a Deck hosted on Visible in action? Take a look here.

Whether we are building fundraising automation with our Zapier Connection or crafting integrations with companies like ProfitWell, we are driven by giving founders a better chance of success. It is going to be a very fun fall 😉

Up & to the right,

Mike & The Visible Team