A Guide to How Venture Capital Works for Startups and New Investors

What is Venture Capital?

Venture capital is oftentimes a glorified funding option in Silicon Valley and the startup world. In short, it is a funding option that allows VC funds to buy equity in a startup. In turn, a startup is giving up a percentage of its ownership with the hopes of growing its valuation and creating a successful exit for everyone on the cap table.

As put by the team at Investopedia, “Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from well-off investors, investment banks, and any other financial institutions.”

To better understand the topic, find out more about the types of venture capital funding, when it’s used, potential benefits and pitfalls, the origins, and what it’s like to work for a venture-backed business.

Related resource: How to Get Into Venture Capital: A Beginner’s Guide

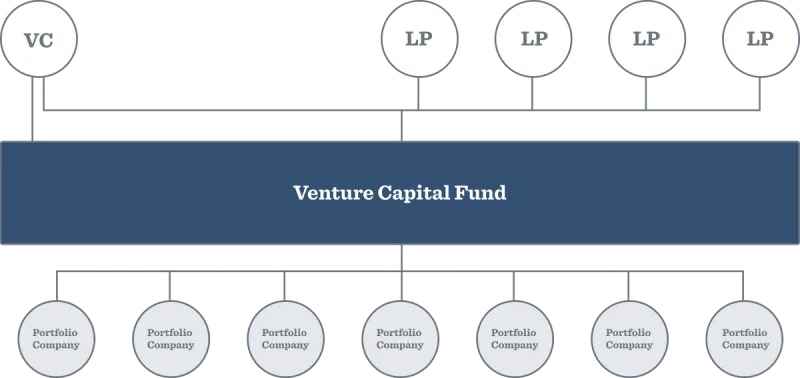

Who is Involved in Venture Capital?

To better understand venture capital, you need to understand the people and players involved. For a quick rundown check out the definitions below:

- VC Fund — As put by the team at Investopedia, “Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from well-off investors, investment banks, and any other financial institutions.”

- General Partner — As put by the team at AngelList, “The general partner of a venture fund raises and allocates investor capital and supports the founders of the companies they invest in.”

- Limited Partners — As put by the team at VC Lab, “Limited Partners (LPs) are investors in your fund that provide capital. The most common types of LPs are high net worth individuals, pension funds, family offices, sovereign funds and insurance companies – just to name a few.”

Let’s start with the entrepreneur or startup founder. If a founder is looking for capital for their business they might look to venture capital. As we mentioned above, venture capital is an equity funding option for startups.

VC firms and funds invest in many companies (and the best ones are able to raise multiple funds). At the end of the day they are looking to create outsized returns for their investors. So who are their investors? Limited partners. LPs have limited control over the management of the VC fund. However, it is important to understand the LP <> GP/VC fund relationship to understand a VC fund’s motives.

Limited partners are generally large investment firms that are investing across many asset groups — many of them public markets. As investing in VC funds is typically a small % of their overall portfolio, it is important for VC funds to generate returns in line or greater than the public assets in their portfolio. Because of this, VC funds will turn to founders and startups with the potential to create massive returns.

Related Resource: Understanding Power Law Curves to Better Your Chances of Raising Venture Capital

How Venture Capital Firms Work

To best understand how a VC fund works you need to understand where they get their capital from and how they make money themselves. As we wrote in our Ultimate Guide to Fundraising, “In simplest terms, VCs go through a consistent life cycle that goes something like this: raise capital from LPs, generate returns through risky venture investments, generate returns in 10-12 years, and do it again.”

At the start of a VCs lifecycle, they raise capital from limited partners (LPs). LPs are generally institutional investors (pension funds, endowment funds, family offices, etc.) that use venture capital funds to diversify their investments. From here, a VC deploys the capital they’ve raised from LPs into startups and other investments with the goal of generating returns for their LPs.

Venture capital funds have traditionally been a very risky investment (with a huge upside) so LPs will generally only put a small percentage of their capital into venture funds. As Scott Kupor, Managing Partner at Andreessen Horowitz, mentioned in his book, Secrets of Sand Hill Road, “If you invested in the median returning VC firm, you would have tied up your money for a long time and have generated worse results than the same investment in Nasdaq or S&P 500.”

10-12 years after raising a fund, VCs are expected to generate returns for their LPs. If a fund manages to generate meaningful returns for their LPs they will raise another round and repeat the cycle.

In fact, VC funds follow a power law curve — a small % of funds, generate a large % of returns. Internally, VC funds also follow a power-law curve — meaning a small % of their startup investments create a large % of their returns for LPs. This means that VC funds are in search of startups that have the opportunity to generate massive returns and “return the fund” to their LPs. As we wrote in our post on power-law curves,

“This means that a small % of VC funds take home a large % of venture returns. VCs are constantly working to make their way into the “winning” part of the curve so they can continue to attract capital from limited partners.

How does a VC fund become a “winner?” The best VC funds portfolio returns also follow a power-law curve. A small % of a VC fund’s investments will yield the majority of its returns. What does all of this mean for a founder?”

Only a small percentage of funds create large returns, which means a majority fail. If a VC fund fails it means that its investments are also failing — or failing to generate the huge returns they need.

Related resource: Understanding the Advantages and Disadvantages of Venture Capital for Startups

Private Equity vs. Venture Capital

Venture capital is technically a form of private equity. However, venture capital focuses on all equity and smaller investments that reward high-risk, high-reward scenarios. On the flip side, private equity firms are generally geared towards later stage companies that have a proven track record.

Related Resource: Private Equity vs Venture Capital: Critical Differences

Angel Investors vs. Venture Capitalists

An angel investor is generally a wealthy individual who is looking to invest spare cash in an alternative investment. Unlike a VC, angel investors are not professionals nor do they have limited partners investing in them. Angel investors are typically more hands-off and can be a great source for introductions to other investors, customers, and others.

Related Resource: How to Find Investors

Types of Venture Capital

Typical explanations of the types of venture capital divide it into three main groups, based on the business stage that needs funding. This list provides a brief explanation of these venture capital types and the various business stages that they may apply to:

Related Reading: A Quick Overview on VC Fund Structure

Early-stage

This might include seed financing, Series A funding, etc. which is usually just a small amount of capital that will help the founders qualify for other loans. True startup financing provides enough capital to finish a service’s or product’s development. In contrast, startups might also get first-stage financing after they have finished development and need more funds to begin operating as full-scale business.

For example, Crunchbase and newsletters are full of new VC deals being completed every day. You can check out Uber’s timeline of early-stage funding rounds here.

Expansion

This kind of venture capital helps smaller companies expand significantly. For instance, a thriving restaurant may decide it’s time to open more locations in nearby communities. Sometimes, it also comes in the form of a bridge loan for businesses that want to offer an IPO.

For example, if you take a look at Uber’s timeline of investments you’ll notice they start raising massive rounds via private equity around 2015 as they gear up for an IPO.

Acquisition

Sometimes called buyout financing, this type of funding may help acquire other businesses or sometimes, just parts of them. For instance, some groups may use acquisition financing to buy into a particular product or concept, rather than using it for buying the entire company.

Pros and Cons of Venture Funding for Startups and Small Businesses

Pros of Venture Funding

Venture funding comes with a number of advantages. One of the beauties of venture capital is the fact that a founder has to invest no capital of their own so they can grow at a rapid rate.

No Personal Capital

One of the biggest advantages of raising venture capital is that you do not have to use any of your personal capital. You can grow your company and valuation while deploying others’ capital. However, this does come with high expectations and responsibility.

Investor Support

As VC funds continue to innovate, the support they provide startups has continued to evolve. VC funds will help founders with anything from determining go-to-market motions to mental health to hiring & fundraising.

Extensive Network

The startup & VC world is a tightknit community. Many VC funds and their partners have extensive networks of other funds, founders, potential hires, and customers.

Enhanced Growth

VC funds allow companies to deploy millions of dollars in capital and grow at a quicker rate than they would with alternative venture funding options.

Cons of Venture Funding

Of course, on the flip side there are some disadvantages. While venture capital offers the opportunity to grow rapidly, it also has some downsides when it comes to ownership.

Increased Dilution

Raising venture capital means you are selling equity in your company. Because of this, founders will own a smaller percentage of their company.

Convoluted Decision-Making

Because of their diminished ownership, founders can potentially lose their ability to make decisions solely based on their needs and have to take into consideration the needs of their investors and partners.

Long-Winded Time Commitment

Fundraising can be an incredibly time-consuming and difficult process for many startup founders. It can take away a founder’s time from focusing on building or selling a product.

If you’ve determined that venture capital may not be the best option for you there are always alternatives. Over the last few years, there has been an explosion of funding options that are founder-friendly. Check out some population options here.

The Process of Getting Funded by a Venture Capital Firm

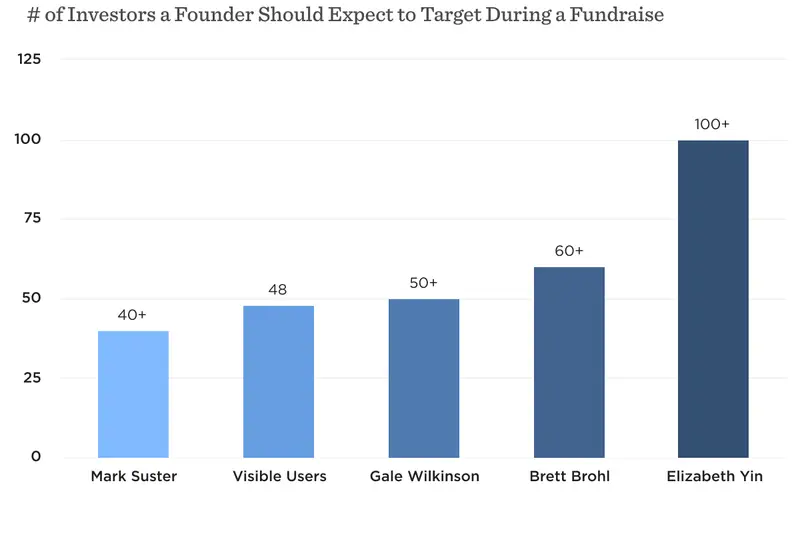

At Visible we like to compare a venture capital fundraise to a B2B sales funnel. You are adding potential investors to the top of your funnel, taking meetings and nurturing them in the middle, and closing them, and onboarding them to your cap table at the bottom. Below are 6 high-level steps. If you’re interested in a more in-depth look check out our Ultimate Guide to Fundraising.

Step 1: Determine if VC is Right for Your Business

The first step to getting funded by a venture capital firm is to understand if venture capital is right for your business. This means that you believe you can grow at a rapid clip and generate massive returns for a VC fund to return to their LPs. Before setting out to build a list of investors, we suggest picturing what your ideal investor looks like and building out a list from there.

Over the course of a fundraise, we recommend building a list of 50+ investors. It is important to keep this in mind when building a list and founding routes for introductions. Learn more about why 50-100 investors in our post here.

Step 2: Prepare Your Deck, Docs, and Metrics

If you believe you have what it takes to raise venture capital you need to start putting the pieces in place to get started. Going into a fundraise, you should have docs (pitch deck, financials, cap table, etc.) and your core metrics ready to go. Learn more about preparing your pitch deck and other documents here.

Step 3: Find Investors

Once you have your documents in place it is time to start finding investors for your business. It is important to make sure that you find investors that are right for your business. The average VC + founder relationship is 8-10 years so it is important to make sure you are starting a relationship with the right funds and person.

Learn more about the ideal investor persona here.

Step 4: Pitch Investors and Take Meetings

Once you start reaching out to investors (cold outreach or warm introductions) you’ll start sitting meetings and have the opportunities to pitch investors.

Check out our guide for meeting with and pitching investors here.

If you find an investor who is ready to fund your business, awesome! You’ll move on to the following steps. For a more in-depth look at the next steps, check out our blog post here.

Step 5: Due Diligence

After a pitch, if an investor decides they want to move forward with an investment they will begin due diligence. You can expect an investor to audit your financials, survey your employees and customers, and deeper study the market. Great VCs will offer a checklist to help set expectations during the due diligence process. Over the course of due diligence, you will likely need to share a data room. Learn more about how you can build a data room with Visible below:

Related Resource: What Should be in a Startup’s Data Room?

Step 6: The Term Sheet

If you make it past due diligence, you will be presented with a term sheet. If the terms look good, you are set! Learn more about navigating your term sheet here.

Origins of Venture Capital

In one way or another, forms of venture capital have probably financed innovations since people latched onto the idea of bartering. For instance, a plucky inventor may have come up with a better idea for a grindstone but lacked the resources to create it on his own. Another villager may have liked the idea, so he exchanged stone and labor for part ownership in the new and better-milled grain producer.

Still, for much of the history of venture capital, investors favored loans over equity. In the past, investors lacked ways to gain good information about all the details of a business. Also, until fairly recently, the concept of limited liability did not exist as it does now. Investors feared that they may offer money to a company in exchange for part ownership. In exchange, they might get unpleasantly surprised by massive debts that the original founders had already piled up. As part-owners, they would also face partial responsibility for these loans. The concept of limited liability helped relieve some of these concerns and encourage more equity funding.

It took until after WWII for the United States to develop a true private equity system. An investment of $70,000 in DEC in 1957 gained credit as one of the early success stories after that initial funding grew to $35 million by the IPO in 1968. The Great Recession changed the nature of venture capitalists to some degree. Most lately, venture capital groups have focused more upon offering other value, besides just funding, to the small businesses or startups they want to help fund.

As mentioned above, part of the deal may include business expertise, facilities, and other helpful assets beyond money. Thus, many venture capitalists look for startups or small businesses that they understand how to fix or help, beyond those that just need investments.

Working for a Venture-Backed Company

How is working for a venture-backed company different from working within an established corporation? As we noted in our guide to Startup Culture, working for a startup can offer employees many of the same benefits that investing in one provides venture capital providers. Of course, employees may not initially enjoy the large salaries and perks that a large and established corporation can provide. A few perks of working at a venture-backed company over a large corporation:

- Ownership — the ability to own projects and individual metrics that move the company forward.

- Collaboration — have the opportunity to work cross-functionally with other teams and individuals

- Growth — quickly advance and grow your skills as the company grows.

Because the company is small, employees may need to wear multiple hats, and some employees enjoy the challenge and chance to explore various facets of their company. In lieu of the highest salaries or best retirement plan, some startups also offer flexible schedules and other soft benefits that might also appeal to some very good employees. Working for a venture-backed company offers some challenges over taking a job with an established firm; however, the right startup or small business can also promise great rewards.

Find out if VC is right for your company with Visible

Understanding how venture capital works is an important step to determining if venture capital is right for your business. If you believe venture capital is right for your business, let us help. Find investors using Visible Connect, our free investor database, to kick off your fundraise.