If you read newspaper headlines you might think every successful startup jumps from funding round to funding round and celebrates its extreme growth along the way. However, building a startup is incredibly difficult and every founder is faced with ups and downs along the way.

If you hear the term “down round” at a VC event, heads will turn. But if your startup is around long enough, chances are the thought of a down round will cross your mind. Learn more about what a down round is and how you can try to avoid one below:

What is a Down Round?

As put by the team at Investopedia, “A down round refers to a private company offering additional shares for sale at a lower price than had been sold for in the previous financing round.

Simply put, more capital is needed and the company discovers that its valuation is lower than it was prior to the previous round of financing. This “discovery” forces them to sell their capital stock at a lower price per share.”

While not celebrated by newspaper headlines, down rounds are a natural occurrence during a startup lifecycles. Learn more about down rounds below:

Reasons Why a Down Round Occurs

There are a number of reasons why a down round occurs. Startups are impacted by everything from internal decisions to macro events. Learn more about a few of the common reasons why a down round mights happen below:

The Company Fails to Reach Necessary Earnings Milestones

First and foremost, and most simply, a startup might fail to reach milestones they laid out during previous funding. In the early stages, startups generally have little to no traction and are setting milestones and projections based on a small dataset and history.

If a startup is raising capital to last them 12-18 months at a seed round and are setting milestones for the next 12-18 months, investors will want to see that progress. If the startup is not at those milestones or showing strong progress, raising at a higher valuation will be difficult.

With that said, it is important to be intentional and realistic when setting expectations and milestones during a fundraise. You will want to see your expectations high enough to entice investors but realistic enough to achieve. Of course, there are plenty of instances where you might miss your milestones but are showing strong traction and product development that might warrant a higher valuation.

New Competitors are Grabbing Market Share

There are also changes to markets that will impact a startup’s funding path. Markets, especially emerging tech markets, will see new competitors pop up often. In the lifecycle of an early-stage startup, navigating competition and standing out among your peers is crucial.

Related Resource: How to Model Total Addressable Market (Template Included)

Investors want to see that your company is grabbing market share and becoming an authority in the space. If there are hot new startups or large corporations entering your market (e.g. Amazon building a tool in your space), investors will feel less motivated to fund your company at a higher valuation.

General Financing Requirements are Becoming More Stringent

Another common reason for down-round funding is the macroeconomic environment. Venture capitalists are institutional investors and have a duty to return capital to their investors/LPs (limited partners). When times get tough, VC investment decision-making will likely get more stringent.

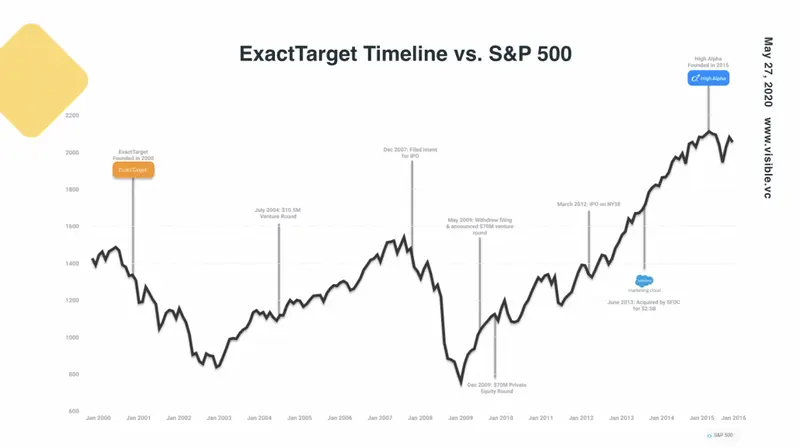

While it can make a founder feel totally helpless, there are steps you can take during downtimes to see your startup through. One company that excelled through multiple downturns was ExactTarget. We interviewed former ExactTarget CEO, Scott Dorsey, to understand how they navigated both the Dot-Com Bubble and The Great Recession. Learn more below:

Related Resource: 4 Takeaways From Our Webinar with Scott Dorsey

Three Ways to Potentially Avoid a Down Round

Now that we know the reasons why down rounds tend to happen, we can start digging into ways to help you avoid a down round. Of course, there are times when they are inevitable but there are steps that can be taken to help your odds of success:

1) Cut Costs to Make Money Last Longer

As we mentioned earlier, we interviewed Scott Dorsey, former CEO of ExactTarget, to understand how to succeed through a downtown. “While cash has always been king, Scott mentions that it is even more important during a downturn. As a founder, you need to have a deep understanding of your cash flow and burn rate.

It may be difficult to fundraise during a downturn but you need to be able to show your investors that you can (1) make it through a downturn and (2) thrive on the other side. If you can successfully display that you’re in a good cash position and ready to thrive after, you’ll improve your odds of raising capital.”

If you can successfully cut costs and maintain your burn rate, you have the opportunity to stand out among other startups and generate interest from potential investors. Scott also recommends communicating often with your team and building an even closer relationship with your customers.

Of course, cutting costs doesn’t only make sense during a downturn. If your company is struggling to hit milestones or find product-market fit, it might make sense to extend your runway so you can continue to develop your product and refine your go-to-market approach.

Related Resource: 6 Metrics Every Startup Founder Should Track

2) Raise Bridge Financing

As put by the team at Investopedia, “Bridge financing “bridges” the gap between the time when a company’s money is set to run out and when it can expect to receive an infusion of funds later on. This type of financing is most normally used to fulfill a company’s short-term working capital needs.

There are multiple ways that bridge financing can be arranged. Which option a firm or entity uses will depend on the options available to them. A company in a relatively solid position that needs a bit of short-term help may have more options than a company facing greater distress. Bridge financing options include debt, equity, and IPO bridge financing.”

Related Resource: How to Secure Financing With a Bulletproof Startup Fundraising Strategy

3) Consider Renogiatiating with Investors

Of course, you can turn to your current investors and re-negotiate to work your way through a downturn. If you’ve been regularly communicating and updating your investors, chances are they will know the position of your company. If they’re aware of your status and believe in your ability to execute a plan, there is a chance they will be inclined to re-negotiate or help you work through a downturn.

Related Reading: Startup Syndicate Funding: Here’s How it Works

Steer Clear of a Down Round With Visible’s Help

While there is no silver bullet to avoid a down round, there are steps a founder can take to avoid the potential of a down round. By taking your fundraise seriously and approaching it with a sales strategy, you’ll be able to better build momentum and focus on what truly matters, building your business.

Learn more about how you can use Visible to help find investors, share your pitch deck, and track the status of your raise. Try Visible for free for 14 days here.