For the venture capital world, 2023 has largely been characterized by slowed fundraising activity. Over the year, we’ve seen thousands of founders utilize Visible to update investors, track key metrics, and manage their fundraising efforts. Learn more about how founders utilized Visible to strengthen relationships with current and potential investors during a challenging year below:

Update Your Investors

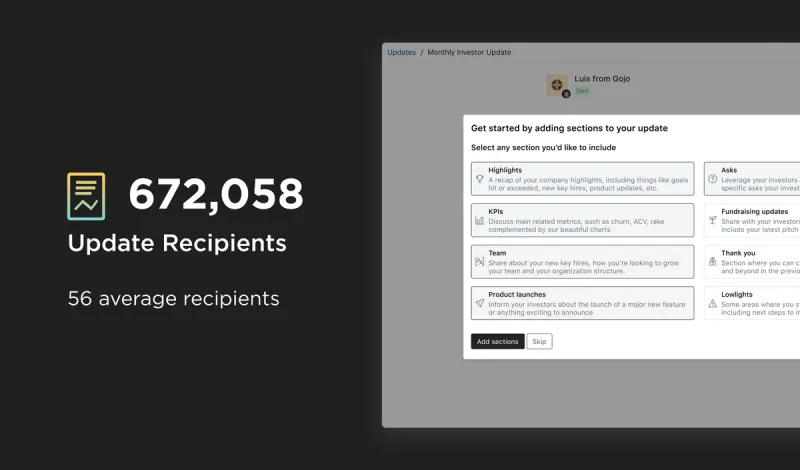

Over 672,000 investors received a Visible Update in 2023. The average Visible Update was sent to 56 investors — more than the number of current investors most founders have. We’ve seen founders leverage updates to nurture their potential investors to help strengthen relationships for when it is time to “actively” raise.”

Check out a few Visible Update features we released in 2023 below:

- Build out updates using best practices from other founders with content blocks

- Add past updates to your Visible Data Room to help show potential investors your commitment to communication

- Turn your Visible Requests from investors into a shareable update with Visible AI

Share Your Pitch Deck

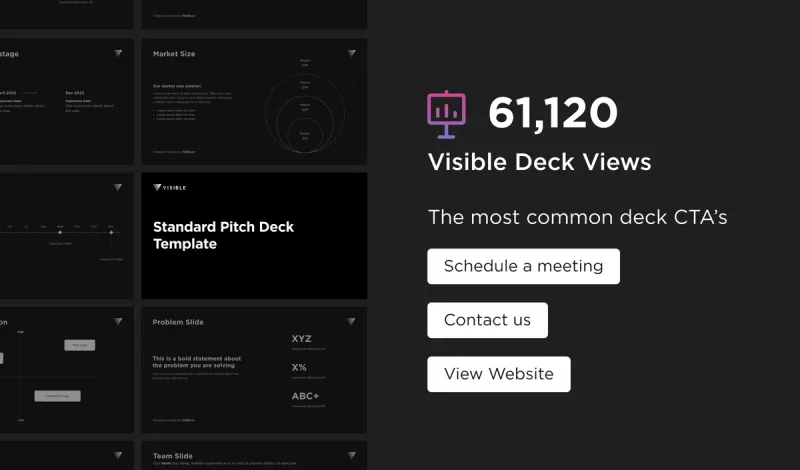

With 61,000+ Visible Deck views in 2023, we can learn how founders approach their pitch deck sharing. Like previous years, July and August saw pitch deck sharing slow down with activity picking up in October and November — surpassing activity from the spring and early 2023. We found that pitch decks with 12 or fewer slides receive the most activity/views from investors.

Check out a few of the Visible Deck features we released in 2023 below:

- Add decks directly to your Visible Data Room

- Move investors down your fundraising funnel with call-to-actions

Build Your Data Room

We launched Visible Data Rooms in 2023! With data rooms, you can now manage all parts of your fundraising funnel with Visible. Find investors with Connect, our free investor database. Track your conversations in our Fundraising CRM. Share your pitch deck with potential investors. And communicate with current and potential investors with Updates. Over 30,000 files were uploaded to Visible Data Rooms in 2023.

Learn more about data room improvements we released in 2023 below:

- Share your Visible Data Room via link

- Add a call-to-action to your Visible Data Room to help move investors down your funnel

- Preview documents and PDFs directly in data rooms

Manage Your Fundraise

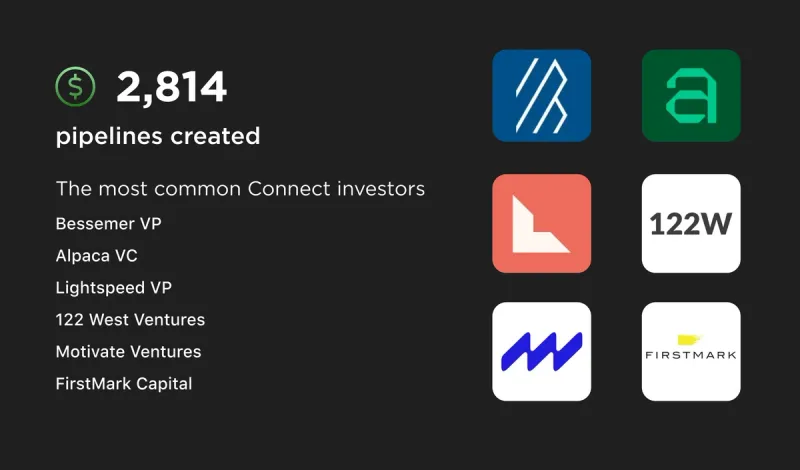

Founders created 2,800+ Visible Pipelines in 2023. Like Decks, we saw the number of pipelines being created slow in the summer and pick back up in the fall — a promising sign for 2024. As fundraising has slowed in 2023, founders are utilizing Visible Pipelines to keep tabs on their ongoing conversations so they can raise faster when the time is right.

Learn more about some of the Visible Pipeline features we released in 2023:

- Add multiple investors from Visible Connect, our free investor database, to your fundraising pipeline in one click.

- Better navigate between investors and stages with our new fundraising table and UI

- Automatically log conversations outside of Visible with BCC

Track Key Metrics

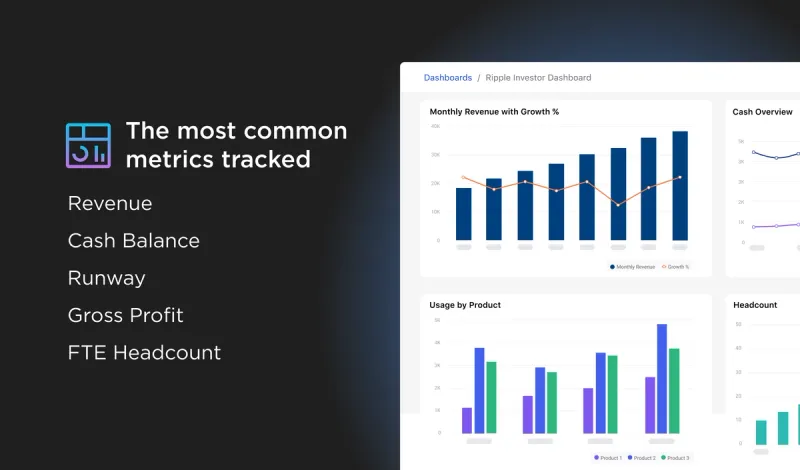

A core role of a startup founder is to track high-level metrics and share them with investors and stakeholders. For first-time founders, determining which metrics to track and who to share them with can be intimidating.

To help, we analyzed our data to find what the most commonly tracked and shared metrics in Visible were in 2023:

- Revenue

- Cash Balance

- Runway

- Gross Profit

- FTE Headcount

Check out some of the improvements we made to dashboards, metrics, and integrations in 2023 below:

- Display changes to key metrics with waterfall charts

- Liven up your charts with gradient charting options

- Improve dashboard sharing with our improved widget and dashboard design.