Aumni, a J.P. Morgan company, recently announced its shutdown, sending a wave of uncertainty through the venture capital ecosystem. For many investors, Aumni played a central role in managing portfolio data, tracking performance, and reporting to LPs. Its sudden closure left teams questioning how to preserve their workflows and protect institutional knowledge.

The news around Aumni’s closure made one thing clear: investors need tools they can count on for the long haul. When platforms are dependent on outside funding to survive, their stability becomes a variable and that creates risk for firms managing long-term capital and relationships

The Impact on Venture Capital Investors

The shutdown of Aumni isn’t just a technical hiccup; it’s a real operational challenge for many venture firms. Aumni VC users had come to rely on the platform for structured data capture, deal documentation, and LP-ready reporting. With Aumni shutting down, workflows have been interrupted midstream, and many firms are now facing gaps in visibility, delayed reporting timelines, and growing uncertainty about how to replace key functionality.

More than anything, the shutdown has reinforced the need to choose tools that are financially stable, simple to implement, and purpose-built for investor workflows. Platforms that were designed for other markets or are still evolving often fall short when reliability matters most.

Why Leading Firms Are Choosing Visible

As firms search for a stable, long-term tools to replace Aumni, many are turning to Visible. Built specifically for venture capital investors, Visible offers a complete suite of solutions that combine structured data centralization, reporting flexibility, and portfolio intelligence. Each product is designed to scale with your fund and support your internal workflows without unnecessary complexity.

Fuel Ventures, one of the UK’s most active early-stage investors, moved to Visible to streamline quarterly reporting across more than 200 portfolio companies. According to their team, "Visible enabled us to drastically improve our response rates, streamline our workflows, and ultimately produce better reporting in less time." This kind of operational leverage is what many firms are now looking for in the post-Aumni landscape.

Visible stands apart with tools that support your entire investment workflow:

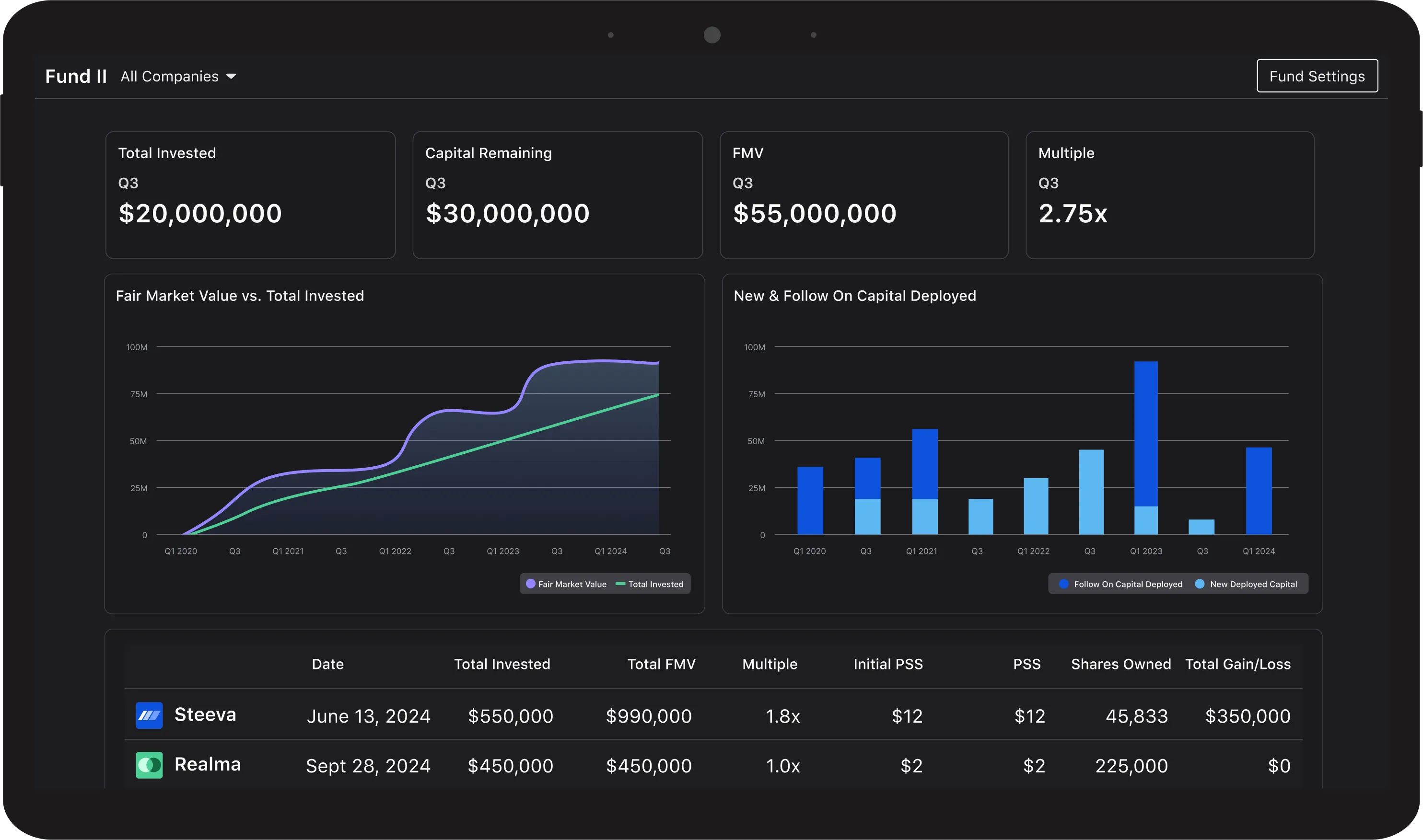

- Portfolio Monitoring: Collect structured KPIs and documents from portfolio companies without requiring founder logins. Easily parse and structure data shared via email or documents. Track updates, set reporting cadences, and keep your most important data in one place.Portfolio Intelligence: Filter and segment your portfolio by stage, sector, or custom metrics. Identify trends and performance gaps with real-time insights that drive internal strategy.

- LP Reporting: Build dashboards, benchmarks, and tear sheets that slot directly into LP updates and internal presentations. Eliminate manual slide-building and reduce reporting cycles.

Visible is also investing in the future of portfolio data with AI tools that help investors move faster and more efficiently:

- AI Inbox: Turn email updates and documents into structured data. Eliminate copy-paste work and capture insights directly from founder communications. As Christina Leveda of Fuel Ventures shared, “Visible's AI Inbox has revolutionized our communication management at Fuel Ventures Ltd. Its seamless integration of AI provides invaluable insights, streamlining our workflow. A game-changer for any VC firm looking to stay ahead.”

- AI MCP Server: Powerful dashboards with machine-curated performance insights across sectors, stages, and fund-level views. Surface trends that support strategic decisions without extra overhead.

- AI Updates: Founders can automatically generate investor updates using submitted financials, KPIs, and documents. Streamline the founder experience while improving data quality.

With Visible, investors gain a platform that supports both immediate needs and long-term growth. It is more than a replacement for Aumni. It is a forward-looking solution built to strengthen fund operations for years to come.

Transitioning from Aumni Without Disruption

Firms navigating the transition away from Aumni need more than a temporary fix. They need a stable, structured solution that can be deployed quickly. Visible is actively supporting funds through this process by mapping existing workflows, importing historical data, and setting up dashboards that align with each firm’s specific needs.

For Cartography, a lean team with a growing portfolio, the Visible onboarding process was intentionally lightweight. "We were up and running quickly without having to overhaul our entire tech stack," their team noted.

Emergence Capital echoed this, sharing that Visible allowed their team to build a reporting process that aligned with how they work, while still offering flexibility to evolve. “The transition was smooth, and we now have full visibility without adding operational overhead.”

The migration process is designed to prioritize continuity. Teams can retain past updates, preserve key documents, and continue reporting cycles without interruption. With a track record of onboarding over 800 funds globally, Visible combines responsive support with clear best practices to make the transition smooth and strategic.

This level of support is essential. Investors cannot afford to miss reporting deadlines or lose visibility into portfolio performance. By switching to Visible, firms are not just replacing a tool. They are upgrading their operational infrastructure with a platform built for long-term use.

Move Forward with a Purpose-Built Solution

For investors exploring their next step, this is more than a moment to replace what was lost. It is a chance to adopt a platform that offers stronger data, greater control, and a better experience for both internal teams and portfolio companies.

Airtree Ventures, one of the leading venture firms in Australia, transitioned to Visible to bring consistency and structure to its portfolio data. “Visible helped us align internally on what we care about most and how we measure it,” their team said. For them, the platform became a core piece of operational infrastructure, not just another tool.

Visible is actively helping firms move forward. With powerful monitoring tools, purpose-built reporting, and AI capabilities that improve efficiency, we offer a complete solution that grows with your fund.

If your team is evaluating alternatives, now is the time to connect. Request a demo to see how Visible can support your workflows, enhance reporting, and help you build stronger relationships with founders and LPs.