Monthly Recurring Revenue (MRR) Explained: Definitions + Formulas

MRR: What is it?

What is MRR? Monthly Recurring Revenue is how much money your company can be expected to bring in every month. Generally, this has to do with subscription costs, retainers, and other predictable purchasing habits. The rationale behind MRR is simple: you need to be able to project out your company’s future revenue. The calculations behind it can be more complex.

Going beyond the simple MRR meaning, MRR is a functional metric through which you can gauge your company’s income and success. If your MRR is growing over time, your business is growing; if your MRR is shrinking, then your company may experience lean times in the future. MRR trends are incredibly important to subscription-based businesses, because they compound over time. Once MRR begins shrinking, it can be difficult to control.

A company must calculate its MRR not only based on its active subscriptions, but also whether these active subscriptions are trending upwards or downwards. In the case of subscriptions or contracts that are ending, the company must also track which customers are ending their subscriptions, and which new subscriptions are coming on board.

Every recurring revenue-based business needs to have an MRR calculator that can project out the future performance of the business, based on the active contracts it will have in the following months. Ideally, a business will be able to use its MRR calculations to project out a year at a time, so the company can review and analyze its future finances.

An MRR calculator will be unique to a business. Some businesses have predictable recurring revenue: they have year long contracts with customers. Other companies have less predictable recurring revenue: their customers can sign up and cancel at any time, so they need to pay more attention to general trends. Over time, a company will develop a firmer understanding of its MRR.

Most advanced accounting and customer relationship management suites can be used to produce reports related to MRR. This is especially true for accounting solutions and point-of-sale systems which are specifically designed for handling subscription fees.

In addition to MRR itself, a company needs to pay attention to its churn: the amount of customers coming and going. All these stats, together, are going to form the basis of the company’s strategies, informing the company on how the business is doing, how customers are responding to it, and whether the company is currently growing or shrinking.

Revenue vs Recurring Revenue

Recurring revenue is a core tenant of a SaaS (software as a service) company. As defined by Investopedia, “Recurring revenue is the portion of a company’s revenue that is expected to continue in the future. Unlike one-off sales, these revenues are predictable, stable and can be counted on to occur at regular intervals going forward with a relatively high degree of certainty.”

For example, if you had a customer paying you $10 a month for a subscription or service that would be $10 in MRR (monthly recurring revenue) or $120 in ARR (annual recurring revenue).

Different Types of MRR

New MRR

New MRR (monthly recurring revenue) is exactly what it sounds like. Any new MRR from customers.

Net New MRR

Net new MRR takes into account different MRR metrics to calculate what your new MRR is after expansion/upsells, churned customers, reactivated customers, and contracted customers (more on these below).

Expansion/Upsell MRR

Expansion monthly recurring revenue is MRR from gained from existing customers when they upgrade their subscriptions

Churned MRR

MRR lost from existing customers when they downgrade or cancel their subscriptions

Reactivated MRR

Reactivated MRR is when a customer that had previously churned comes back as a paying customer.

Contracted MRR

Contracted MRR is when a customer downgrades their account to one that is less expensive. For example, going from a $20/month plan to $10/month plan.

Why is accurate MRR tracking so important?

Having an accurate approach to tracking MRR is vital to your startup’s success. At the end of the day, you need revenue to survive and having the correct number accessible at all times is important to understanding how your business is performing. While it can be easy to inflate your MRR to attract investors and customers, it is important to have an accurate number for a few reasons:

Avoid Misleading Metrics

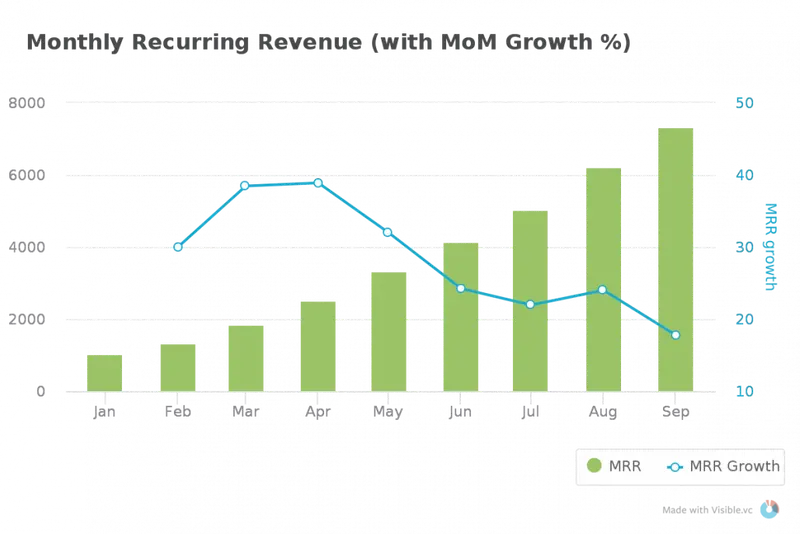

Be honest with the size of monthly recurring revenue (MRR) numbers and your month over month growth (MoM) percentage. Your investors are likely assessing revenue figures from a number of portfolio companies, which means they know where to find weak spots. Don’t look unprepared.

Don’t pass off big growth rates on small numbers

If you’re still gaining traction as a startup, your month over month numbers may be tiny. So boasting mega percentages in MoM growth will be laughable to seasoned investors if you’re passing the rate off as sustainable growth at scale.

Don’t hide MoM fluctuation

Your numbers can fluctuate. That’s perfectly normal. Especially over the course of quarter, a SaaS company can often begin their first two months hitting only 50 percent of its mark, but rally for more than 50 percent in the final month on the back of the groundwork down in the beginning. Make sure your founders now how your numbers may fluctuate from month-to-month.

How to Calculate MRR

Consolidate content from How to Calculate Net MRR into this section -> Use all content below the internal linking navigation and restructure accordingly to flow with the “Different Types of MRR” section.

MRR Formulas

New MRR Formula

New MRR does not offer a formula but rather a list of things to avoid. Like:

- Full value of multi-month contracts: If you have quarterly, semi-annual, or annual contracts, normalize them to a monthly rate. Take the full subscription amount paid and divide it by the number of months in the contract. For example, your customer pays you $1,200 for an annual subscription. Dividing that by 12 gives you a monthly rate of $100 which you should use in your MRR calculation instead of $1,200.

- One-time payments: One-time payments are not recurring, so you shouldn’t include them in your MRR calculation. One-time payments are not the same as multi-month payments. Even though a customer is paying a lump sum payment for those months, you expect the customer to make another lump sum payment at the end of the subscription period. With one-time payments, you don’t expect the customer to make another subscription payment.

- Trialers: Until trial customers convert to being regular customers, don’t include their expected subscription values in your MRR calculation.

Net New MRR Formula

Net MRR gives your company a holistic overview of revenue gained from new subscriptions and upsells/upgrades and revenue lost from downgrades and cancellations. The formula looks like this:

Expansion/Upsell MRR Formula

Expansion and upsell MRR do not require their own formulas but rather definitions within your company. Generally speaking, expansion and upsell MRR are simply current customers that expand their account to pay more the next. E.g. upgrading from $10 a month to $30 a month is $20 in expansion MRR.

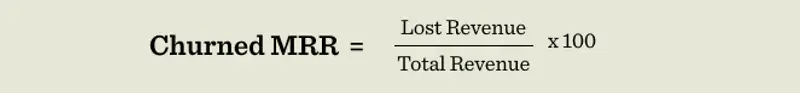

Churned MRR Formula

Simply take the revenue lost through non-renewal or cancellation and divide that number by the revenue you had at the beginning of the given period. If, for example, you started the quarter with $10,000 in revenue, but lost $480 through that quarter, your churn rate is 4.8% quarterly.

Reactivated MRR Formula

Reactivated MRR is when a customer who churned in the past becomes a customer again. For example, if an old, churned customer comes back at $100/mo that would be $100 in reactivation MRR.

Contracted MRR Formula

Just like expansion MRR, contracted MRR does not require a formula but rather a definition. Contracted MRR is generally when a current customer downgrades their account but stays a customer. E.g. downgrading from a $30/mo plan to $10/mo plan would be $20 in MRR contraction.

Related Resource: EBITDA vs Revenue: Understanding the Difference

How to Grow MRR

There are hundreds of different strategies and models intended to help SaaS companies grow their MRR. From sales development representatives to product-led growth there are many shapes and sizes that work. At Visible, we have a few that we find to be most interesting and successful.

Product-Led Growth

From our post, “How SaaS Companies Can Best Leverage a Product-Led Growth Strategy,” we state PLG as:

“A successful PLG strategy gets your product in the hands of your customers as fast as possible and starts solving their problems right away. “Growth in [PLG] companies has a significant viral component.” Jon Falker of GLIDR writes, “Users can get unique value from the product or service right away and can benefit from helping to attract other new users.” This is why freemium models are remarkably effective in a PLG environment. By providing the user with a valuable experience upfront, you can inspire more frequent use, greater shareability, and focus on the premium aspects of your product that will drive purchasing decisions and ultimately retain these customers.”

Retain Current Customers

The easiest way to grow your business is to keep your current customers. Just about everyone preaches the old adage that, “it is cheaper to retain a current customer than buy a new one.” You can read more about reducing churn and retaining customers below.

Invest in What Works

While it is not a specific strategy, we find the most successful companies invest in what works to grow MRR. If your business has an incredible organic strategy, awesome! You can double down there to increase MRR with predictability. If you have a strong sales team, put more resources there. While experimenting has it benefits, investing in what works is an integral part of successful, early-stage companies.

Related Reading: What is a Startup’s Annual Run Rate? (Definition + Formula)

Why MRR Churn Rate is So Important To Monitor

Most companies spend a great deal of time and financial resources on customer acquisition. This is particularly true in those early months and years of a startup. Acquiring new customers never gets old and watching your sales grow is a good indicator that you have a product that sells. But having a product or service that sells is not the only metric in determining the success of your company. Customer churn is another key metric to be concerned about.

How to Calculate Churn Rate for Your SaaS Startup

While determining an accurate churn rate for some products and services can be challenging, calculating the churn rate for a SaaS is relatively easy. Simply take the number of customers lost through non-renewal or cancellation and divide that number by the number of total customers you had at the beginning of the given period. If, for example, you started the quarter with 10,000 customers, but lost 480 of them through that quarter, your churn rate is 4.8% quarterly.

Churn Rate Impact

Startups can often overlook churn rate in the early days of building their business. As we said, during this period it is all about the sales. But if you will be looking for investors, you can be sure they will be looking at churn. Churn rate is a huge indicator of customer satisfaction and can foretell the future of your company.

If you have a churn rate of 4% a month, that may make you feel pretty good. You could view that as a 96% retention rate. But if you are churning 4% of your customers each month, you are turning over almost half of your customers each year. As your business grows, the number of customers lost will increase, placing even more pressure on creating new sales.

Monthly SaaS Churn Rate

If you are doing it right, your customer churn rate should trend like this over time…one of the few times that “up and to the right” is the opposite of what you want.

You can determine the actual cost in dollars of churn by multiplying the number of customers lost by your average customer worth. It can really get your attention when expressed in actual dollars.

How to Minimize Your Churn Rate

If you are uncomfortable with your churn rate, it is time to start talking to your customers and your recently lost customers. Determine what you are doing right, and the reasons churn is happening at the rate it is. It could be something easily fixed like better communication or small product improvements. But you can’t address it if you don’t have a churn rate to track. It is especially critical for new and growing companies.

MRR churn is the percentage of revenue lost every month due to cancellations. Naturally, every business wants to reduce this churn. Tracking this churn is especially important for marketing strategies: if churn percentage is rising, that means that more customers are unsatisfied, even if MRR and subscriptions may be going up. The company may need to improve upon its customer retention strategies.

A large percentage of churn is never good: it costs more to acquire a new customer than it does to retain an old one. Because of this, companies that want to reduce their overhead and scale upwards need to concentrate on keeping the customers they have. If MRR churn is consistently increasing, then the company may risk a revenue drought.

Churn is fundamental to an SaaS company’s growth, and luckily the churn calculation is fairly simple: a company need only find the percentage of revenue lost via cancellations. As long as the company knows its current MRR and its churn percentage, it can also project out how much revenue it will lose to churn every month.

MRR and MRR churn for a company may look like this:

- The company currently has $50,000 in recurring subscription fees.

- In the prior month, the company lost $5,000 in cancellations, but gained $10,000 in new accounts.

- In the next month, it can be anticipated the company will lose $5,000 but gain $10,000.

- The company’s projected recurring subscription fees for the next month will be $55,000.

- The company’s current MRR churn rate is 10%.

Apart from this, the company’s growth is at around 10%, and trends over time will tell the company whether its MRR churn rate and its new account subscription rate are going up or down.

As with MRR, a company can use a spreadsheet or another calculator system to determine its churn metrics. MRR and churn should be a part of the company’s financial statements, and should be regularly reviewed for core insights into how the company is doing and whether any changes need to be made in its retention policies.

Churn rate vs. retention rate: churn rate differs slightly because it is the rate of revenue that is being churned away from the company, rather than the amount of customers retained. A company could have a high churn rate alongside a high retention rate if they are frequently losing high value customers but retaining large volumes of low value customers.

In general, companies are able to reduce their churn rates by improving upon customer satisfaction. Regular surveys regarding customer satisfaction and improved customer service are usually key to reducing churn rates and improving overall customer retention. Companies may also need to identify any gaps in their current product and service offerings if they find that customers are frequently leaving, or are leaving to competing companies.

Other SaaS Metrics

MRR and churn rate are only two of the SaaS metrics that your company should be tracking. As an SaaS company, your metrics are going to be of exceeding importance. Most SaaS companies need to scale fairly aggressively, and must constantly be moving. Sales and sticky revenue are more important for SaaS companies than others, as widespread adoption is a key to success.

Here are a few of the most important SaaS metrics, in addition to SaaS churn and MRR:

Customer lifetime value

This is the total amount that a customer is expected to spend on the platform throughout their entire relationship with it. For SaaS startups, it may be difficult to gauge customer lifetime value, but it’s important when determining how much to spend to acquire and retain customers.

Customer acquisition cost

This is the total amount it costs to acquire a customer, which will often be compared to the customer lifetime value. Ideally, a company should be able to reduce customer acquisition cost to at least a third of the customer’s value.

Customer retention rates

Poor customer retention isn’t just bad for finances; it’s an indicator that there could be a core issue with the solution itself. Customer retention rates are always a major feature of revenue development.

Customer acquisition rates

Customer acquisition relates directly to how fast your company is growing. Your customer acquisition needs to be continuously outpacing your customer churn; otherwise, your platform is going to experience shrinkage. Over time, customer churn tends to grow. Customer acquisition must grow as well.

Number of active users

Your number of active users is one of the most direct metrics that you can use to determine your success. Your revenue may be shrinking, but your active users are growing: that means that you have a product that can be monetized, you just need to work on your monetization and your commitment strategies.

A SaaS metrics spreadsheet can make it easier for you to track all the important metrics for your financial statements. Likewise, there are a number of software platforms that are designed to keep track of your financials for you. These products can be used to produce reports for your financial meetings, and to give you a better handle on how your company is growing and developing within the SaaS space.

Changes within the SaaS market can happen quickly. Your growth trends are going to mean everything in terms of your company’s performance, especially within highly competitive spaces. Being able to accurately predict your growth into the future comes from a thorough understanding of your numbers right now.