Calculating Your Customer Churn Rate

How do you know how many customers you can lose? Of course, you want to lose as few customers as possible and save as much revenue as you can. However, the reality is any startup is going to shed some clients no matter how well they perform. But both churn rates can help answer two vital questions facing your company: are you targeting the right customers? Is your company big enough?

Customer churn isn’t the same as revenue churn. The first refers to the number of customers that cancel their subscriptions. Revenue churn is simply the amount annual money lost in a month or year.

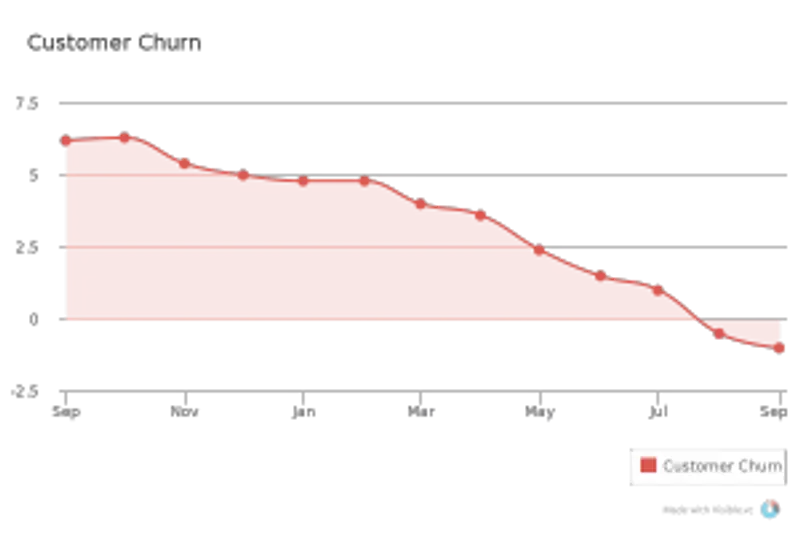

In the early days, you should have a higher churn rate than what your company will average over its lifespan. In your first few years, you can expect as high as a double-digit churn rate and not need to hit the panic button. But if you’re not seeing a steady drop year over year, you may have the wrong client base or need to invest more money in your client success team.

Talk to your clients that renew. Why did they continue the service? If they love what you offer, they may be the key to unlocking the best set of customers you can target. You don’t want your startup to waste time worrying over cancelled subscriptions if these clients are a natural mismatch and your current set of renewals can help find signal for your product and its go-to-market fit. Sometimes the best strategy for reducing churn rate happens at the acquisition stage.

When it comes to determining an acceptable churn rate, it’s every bit as important to understand the size of your customers’ business as it is your own company. You can accept about three to five percent of your small to medium sized businesses portfolio every month or less than 10 percent annually. As enterprise level businesses go, aim for a churn rate less than one percent. Your churn rate should continue to decline in subsequent years until you reach negative churn.

Reaching negative churn—monthly or annually—is going to be one of the most attractive metrics your company can showcase to its investors. It’s good to have a portfolio of customers “that are like high-yield savings accounts.” Negative churn, also known as account expansion, occurs when the new revenue you are earning from current customers (whether it comes from upsells or cross-sells) exceed the revenue you are losing from customers that cancel their subscriptions. As Lincoln Murphy writes: “Remember, it’s a lot easier to get more money from a customer who’s happy and already paying you than it is to get money for the first time from non-customers.”

Negative churn can also serve as one of the key metrics to judge your client success efforts, as expanding your account revenue beyond your subscription loss will help determine if your team is moving in the right direction. Tomasz Tunguz has even advocated for startups to aim for negative churn when deciding their pricing model and developing a customer success strategy. You’ll want to keep your eye on your minimizing your churn rate and show a sharp decline as years go on, but make sure to set forth on a path that will reach negative churn as your holy grail.

Related Reading: How To Calculate and Interpret Your SaaS Magic Number