Getting regular, high-quality, and actionable data from portfolio companies is important. It allows investors to make better investment decisions, provide better support to companies, and share meaningful insights internally across the firm and with LPs.

This practice should also be highly valuable for founders. They should be able to share wins and challenges and seek support from their investors. The reporting process should only take companies 3 minutes to complete (if not, something may be wrong with how the investor is asking for structured data or the reporting company may not be as familiar with their key metrics as they should be).

Below are some best practices to make sure you get:

- High response rates from companies

- Structured data (comparing apples to apples)

- Actionable insights

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

Set Reporting Expectations Early On

✔️ Tip: Set expectations during the onboarding process (if not sooner)

It’s way easier to set reporting expectations with companies early on (and with fewer companies) rather than changing your reporting requirements a few years into your relationship with portfolio companies.

Some investors choose to outline their reporting expectations in a side letter as a part of the investment documents.

It's recommended that investors also have a dedicated conversation around reporting expectations during the onboarding process.

Related Resource: A Guide to Onboarding New Companies to Your VC Firm

When and How Often to Collect Portfolio Data

✔️ Tip: Collect data at a predictable frequency

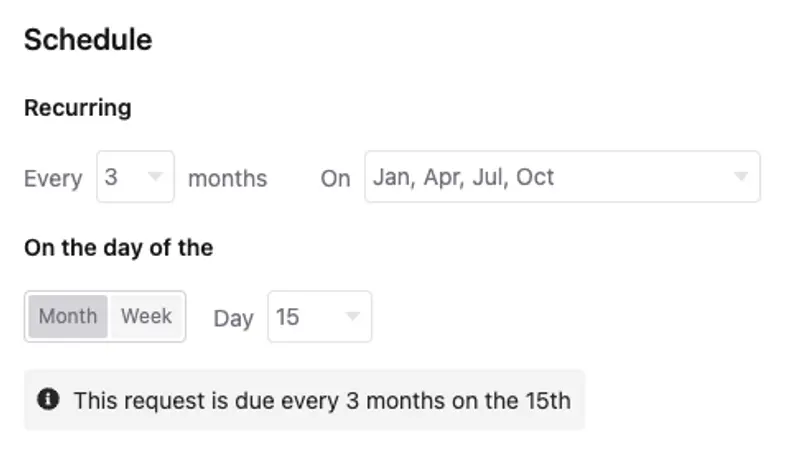

Set the expectation that you will be sending a Request for company data the same time every reporting cycle. Visible has data that shows that Mondays are great due dates and if you’re sending out quarterly Requests for data, we suggest giving your companies 2-4 weeks after quarter close to get their information back to you.

Don’t randomly switch between the 10th, the 30th, etc. This makes it difficult for founders to prioritize your reporting requirements and gives the impression that your due dates don’t really matter.

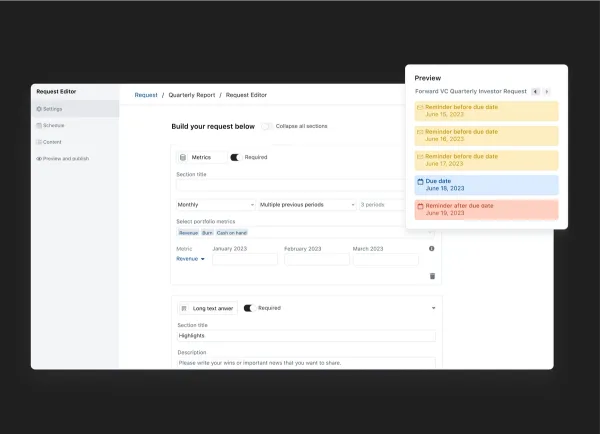

Visible makes scheduling data Requests and subsequent reminders a breeze for investors. Investors can select the due date, email notification dates, and customize the messages that will get sent out to portfolio companies.

✔️ Tip: Collect data at an appropriate frequency

We recommend the following cadences. This is 100% customizable as every fund is different.

- Weekly – Companies in an accelerator program

- Monthly – Pre-seed investments

- Quarterly – Pre-seed, Seed, Series A, Series B + investments

What Data to Collect from Portfolio Companies

✔️ Tip: Less is more

Don’t send a Request asking for ‘nice to have’ metrics. Only ask for the information you really need and are going to use. We suggest starting small, getting a rhythm, and expanding the data as needed.

Metrics

✔️ Tip: Ask for only 5-15 metrics

Depending on how closely you work with companies, ask for 5-15 metrics and no more. If you’re not taking actionable next steps based on a metric (ex: reporting to LP’s, providing more hands-on support, informing investment decisions) then it's likely you don't need to be asking for it.

The most common metrics investors ask for include:

- Revenue

- Cash Balance

- Cash Burn

- Headcount

- Runway

Related resource: Which Metrics Should I Be Collecting from Portfolio Companies

View examples of data Requests in Visible.

✔️ Tip: Use a metric description to reduce back-and-forth

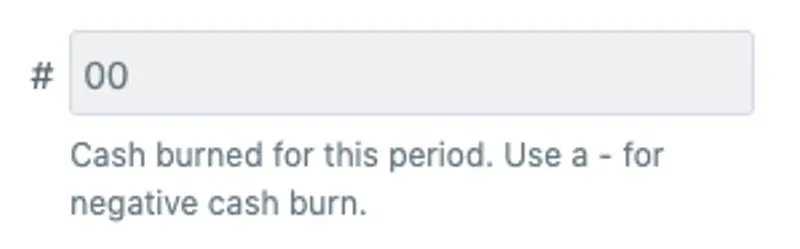

If you are asking for Burn and don’t provide context, you might get 15 different variations. Should it be negative? Should it be trailing 3 months or the current month? Should it include financing? Be descriptive about what you want.

Qualitative Questions to Ask Portfolio Companies

✔️ Tip: Define what type of information you're looking for

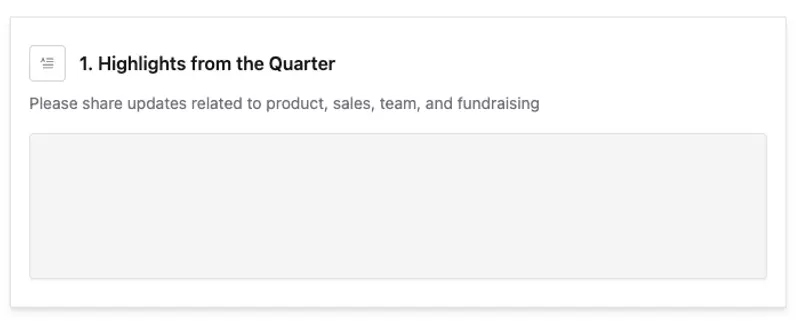

As an investor, it's a great idea to give companies the opportunity to share support requests on a regular basis. Consider including a description to clarify what type of support your firm can provide companies.

Additionally, most investors also ask for companies to report narrative highlights and lowlights from the question. It's important to clarify what type of information you're actually looking for so companies are not wasting time sharing information an investor is not actually going to use.

Implementing a Portfolio Monitoring Platform

✔️ Tip: Notify your companies two weeks in advance

Introducing Your Companies to Visible

As the most founder-friendly solution on the market, we ensure that requesting data is a frictionless process for founders. This means founders don’t need to create an account in order for Investors to get value out of the platform (ie: No log-in required!).

Still, it's a great idea to give your companies notice about the adoption of Visible so they can keep an eye out for the first Request that will land in their inbox.

Feel free to use our Intro Copy Template to notify your companies about the adoption of Visible two weeks in advance of your first Request deadline.

Customize Your Domain

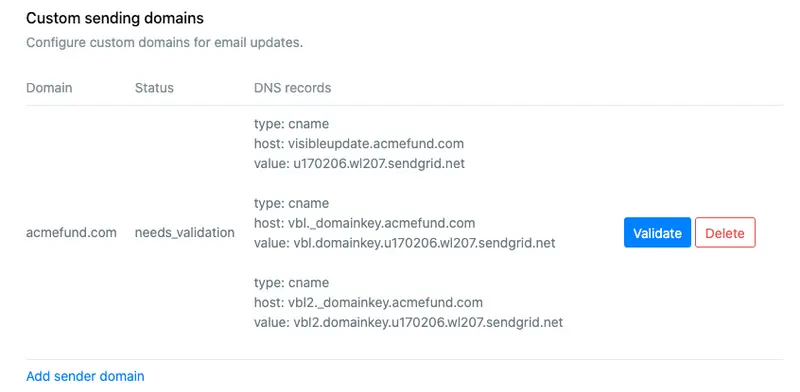

Investors can white-label the automatic emails that are sent from Visible so that the emails use their firm's domain. You can also customize the sender address to anyone at your firm.

Visible's Customer Support

All Visible customers get world-class support and a dedicated Investor Success Manager. We provide an efficient, hands-on onboarding experience, training for new team members, and support on an ongoing basis.

Visible is trusted by over 350+ VC funds around the world to help streamline their portfolio monitoring and reporting.