As a venture capital investor, it’s critical to maintain accurate, up-to-date information about your portfolio companies and investment data. This helps investors make data-informed investment decisions, provide better portfolio support, fulfill audit requirements with relative ease, and not to mention, impress LPs.

What’s even better than just having your data well-organized and easy to find, is when investors can seamlessly turn that data into meaningful insights that are easy to share with internal team members and stakeholders.

Below we describe three different dashboard types supported in Visible that help investors surface and communicate important updates about their portfolio.

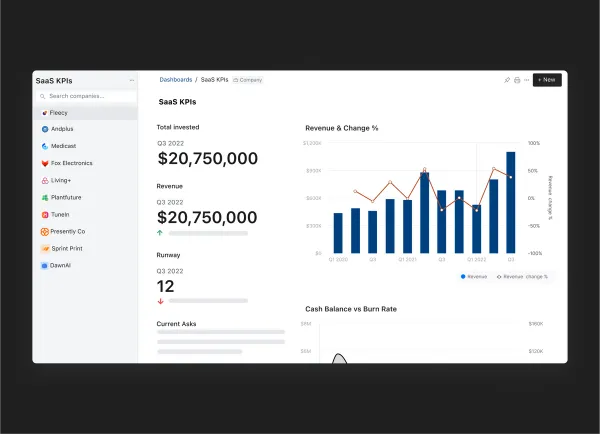

Flexible Dashboards for Internal Portfolio Reviews

Flexible dashboards in Visible allow investors to integrate metric data, investment data, and properties directly into a dashboard. The flexible grid layout means investors have control over how they want to visualize and communicate updates to their team.

Investors commonly use these dashboards to facilitate internal portfolio review meetings which keeps their team up to date and engaged about important updates across the portfolio.

View flexible dashboard examples in the guide below.

Fund Performance Dashboards for Communicating with LPs

Visible allows investors to track, visualize, and share key fund performance metrics. Investors can choose from 14+ different chart types and use custom colors to incorporate their branding into their dashboards.

The fund metrics supported in Visible include:

- TVPI

- DPI

- RVPI

- MOIC

- IRR

- Unrealized and realized FMV

- Total Invested

- Capital Called

- and more.

Learn about the 30+ fund metrics supported in Visible.

Related resource: VC Fund Performance Metrics 101

View a Fund Performance Dashboard example in the guide below.

Portfolio Metric Dashboards for Cross-Portfolio Analysis

As a venture capital portfolio grows, it’s helpful for investors to be able to pull quick insights across all their companies. Visible’s Portfolio Metric Dashboards let investors compare performance across the entire portfolio for a single metric. This view can be filtered by a custom segment and time period. Visible also automatically calculates quick insights such as:

- Total

- Min

- Max

- Median

- Quartiles

View a Portfolio Metric Dashboard in the guide below.

Visible’s dashboards give investors control over how they want to track and visualize their portfolio KPIs and investment data. Learn more about Visible.