Founders are in constant competition for 2 resources — capital and talent. In order to attract the best talent, founders need a culture, strong business model, capital, etc. to bring in new talent. However, talent will also require financial means and ownership to take the leap to work for a startup.

Related Resource: How do you Determine Proper Compensation for Startup CEOs and Early Employees?

In order to best attract top talent, founders need to have a gameplan to split and distribute equity in their business. Learn more about splitting equity with co-founders, early employees, and advisors below.

What is the difference between equity and stock?

Stock and equity are generally one in the same. As put by the team at Investopedia, “Equity, typically referred to as shareholders’ equity , represents the amount of money that would be returned to a company’s shareholders if all of the assets were liquidated and all of the company’s debt was paid off in the case of liquidation.” This is largely made up of shares or stock, which can be defined as, “A stock, is a security that represents the ownership of a fraction of the issuing corporation.”

Understand Options vs Shares

When determining how to split equity amongst your founders and early employees, it is important to understand the language you’ll encounter. Learn more about the difference between equity and stock below:

What are options?

Note: When determining your startup equity structure, we recommend consulting with your lawyer.

Investopedia defines employee stock options as, “a type of equity compensation granted by companies to their employees and executives. Rather than granting shares of stock directly, the company gives derivative options on the stock instead. These options come in the form of regular call options and give the employee the right to buy the company’s stock at a specified price for a finite period of time.”

What are shares?

As defined by Investopedia shares are, “Shares are units of equity ownership interest in a corporation that exist as a financial asset providing for an equal distribution in any residual profits, if any are declared, in the form of dividends. Shareholders may also enjoy capital gains if the value of the company rises.”

Key differences between stock options and shares

Options and shares are closely related. Ultimately an option gives the founding team the “option” to buy shares at a set price at a later date. When determining how to split up equity among your early team and founders remember that it can be a tool to keep everyone involved motivated and invested in the success of your business.

Related Resource: What is a Cap Table & Why is it Important for Your Startup

Company ownership

When it comes to company ownership, stock options and shares have slightly different meanings. As put by the team at Seed Legals, “Shares give the holder immediate ownership of a stake in the company. Options are the promise of ownership of a stake in the company at a fixed point in the future, at a fixed price. Option holders only become shareholders when their options are exercised and have converted into shares.”

Related Resource: Startup Syndicate Funding: Here’s How it Works

Vesting Schedules

As we wrote in our Employee Stock Options Guide, “when you receive a stock option this is not actual shares but rather the ability to buy shares at a later date. In order to retain employees, most companies will include a vesting schedule with their offer. This is the schedule in which you will have the ability to exercise your shares. A vesting schedule usually takes place over a period of time and may be split over the course of a few years or milestones.

The most common vesting schedule for startups is a time-based schedule. This means that you’ll receive a set amount of shares over a set amount of time. Usually, there is a “cliff” which is a set date when you get the first portion of your shares.

The most common startup setup is a 4-year vesting schedule with a 1-year cliff. This means that after working for a company for a full year, the employee will receive the first quarter of their shares (1-year cliff). After the first year, the employee will receive their remaining shares over the next 3 years on a specific calendar. Usually 1/36 of the remaining shares each month.”

Cash Requirements

As options are the ability to buy stock at a future date at a set price, employees will likely need cash to exercise their stock options. On the flip side, stockholders will not need to cash to exercise, as they already have their ownership/stock in the business.

Taxes

Determining when to exercise stock options can have tax implications. As put by the team at Crunchbase, “For incentive stock options—popular among startups—in addition to paying the strike price to buy those stock options, employees face taxes based on the difference in a company’s fair market value, and could potentially be exposed to alternative minimum tax as well.”

Splitting Startup Equity with Founders

There is no “one size fits all” strategy for distributing startup equity. Determining how to split equity among investors and later employees is fairly straightforward, but determining the equity split among founders and the earliest employees can be tricky. You can learn more about dilution and distributing equity with investors here.

Even the most experienced leaders struggle with the issue of fairly dividing startup equity. To help alleviate the stress, we laid out a few thoughts for determining how you want to split your startup equity.

Related Resource: The Main Difference Between ISOs and NSOs

When do you split founder equity?

Generally speaking, you will want to split founder equity in the earliest days of the business. If you are approaching investors for a pre-seed or seed round of capital and have yet to split equity with the founding team that could be a red flag for investors. By getting the buy-in from the founding members you’ll be able to approach customers, investors, and partners easier knowing the founding team is motivated and invested in the success of the business.

Generally, if you are about to make the leap to be a full-time founder you will want to understand your equity split by this point too.

How do you split founder equity?

Splitting startup equity among startup founders is one of the first tough decisions a founding team will make. If you do a quick Google search for how to split startup equity among founders, you’ll get countless different ideas and suggestions.

Commonly, you’ll see lawyers, startup founders, and VCs recommending to split depending on a number of different qualities. We’ve listed a few examples below:

- Experience – Do you have experience running and scaling a successful startup?

- Expertise – Do you have knowledge in the specific market you’ll be operating?

- Ideas/Intellectual Property – Did someone come up with the original idea for the company and turn it into intellectual property?

- Time – Are you dedicated to the company?

As investor and founder Mike Moyer puts it; “The right way to think about equity is to think about a startup as a gamble… The value of each person’s bet is always equal to the unpaid fair market value of his or her contribution. Each day people bet time, money, etc. The betting continues until the company reaches break even or Series A.”

On the other hand, Michael Siebel, CEO of YC, offers a controversial take for splitting startup equity: equal equity splits among co-founders. Michael shares many reasons why it makes sense to equally split your startup equity and not use the factors listed above.

The more equity, the more motivation. The more motivated your founding team, the higher the changes for success. Another reason Michael shares is the idea that if the CEO or Founder does not value co-founders, no one else will, either. For example, if co-founder equity greatly varies, this suggests to your investors that the certain co-founders might not be as valuable or qualified. As Michael puts it, “Why communicate to investors that you have a team that you don’t highly value?”

Related Reading: How do you Determine Proper Compensation for Startup CEOs and Early Employees? + 4 Ways To Find the Perfect Startup Co-Founder

Still searching for your co-founder? Check out why Yaw Aning, Founder of Malomo, believes finding a solid co-founder is one of the best things you can do when building your company:

Equity for employees

Once you have determined your equity split among founders, you’ll be able to use your remaining equity and option pools to attract top talent. If you want your earliest employees to be your most impactful, creating an emotional attachment to your startup’s success is vital. Your first hires are key, and creating the perfect split between their salary, equity, and benefits can be difficult. There is no magic formula for splitting startup equity among your earliest hires.

When do you give equity to employees?

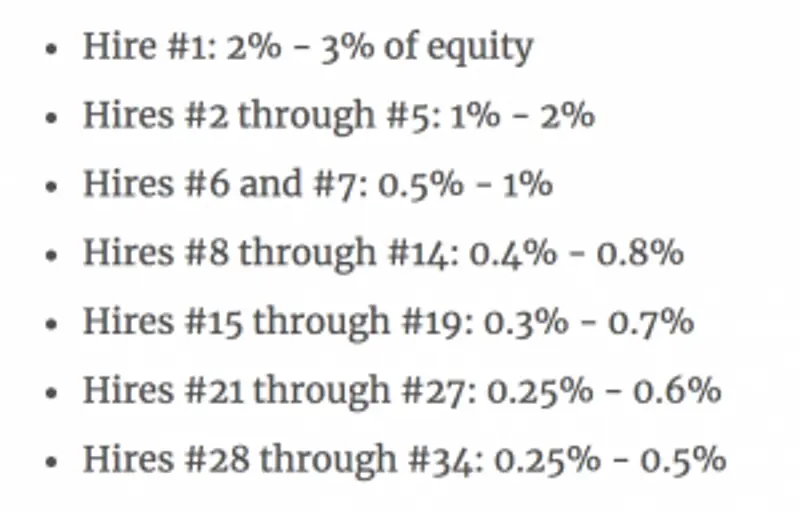

Leo Polovets, VC at Sosa Ventures, studied job postings and laid out the typical amount of equity depending on what number hire the person is:

Splitting startup equity with your first hires will often require negotiations, and the process will vary from employee to employee. Once you start hiring outside your core team, you’ll want some type of predictable system in place for sharing equity.

There is no right answer for sharing startup equity with co-founders and early-stage employees. It is more art than science in the earliest days. Just remember to be fair as you’ll be spending every day with these people. A solid relationship among the founding team will greatly increase the chances of building a successful company.

How do you distribute equity to employees?

As we wrote in our Employee Stock Options guide, “Deciding when and how to issue employee stock options can be a difficult task. A startup or founder needs to understand how much they should pay employees in cash and then add in stock options. When setting out to issue stock options it probably looks something like this:

- Define the role you are looking to hire. Decide what their total compensation should be. This can be taken from similar job postings and the market as a whole.

- Decide how much of their total compensation you would like to pay in cash (AKA their salary).

- Determine the gap between their salary and total compensation. This is entirely up to the startup or founder. It can be difficult to place a number here as the value of the company is solely on paper. Samuel Gil of JME Partners recommends doubling the value here. For example if there was a $10K difference in their salary and total compensation a startup should offer $20K in added compensation.

- The next step is to determine the exercise price for the stock options. As Samuel Gil writes, “As we have previously reasoned, we will assume that a fair price for the stock options is the same as the price of the common stock. So, how much is the common stock worth? The most frequent procedure is to apply a discount (e.g. 25%) to the latest preferred stock value, since common stock doesn’t have the same economical and political rights that preferred stock (what VCs usually buy) does.”

- Issue the number of shares. This is up to the startup and founder but can be calculated with the logic above. If you find the common stock price to be $5 and need to compensate an employee $20K that would be 4000 shares. This can be quite subjective as we need to remember dilution and valuation can rapidly change.”

Splitting equity can sound intimidating when approaching it for the first time. By taking care of it and having a game plan in your early days will help as you continue to scale your business. To learn more about specific stock options and equity structure check out our employee stock options guide here.

Related Reading: How do you Determine Proper Compensation for Startup CEOs and Early Employees?

Dividing equity for directors and advisors

Outside of employees and investors, startups have the ability to give other stakeholders in the business equity. One of the common/debated people startups grant equity to are both directors and advisors.

Equity for directors

Ultimately, determinig to give equity to directors is a choice startup founders can make. If you do decide to give equity to directors, you should expect to give up less than .25% of your business. As put by the team at TechCXO, “Independent directors also expect to receive equity grants along with their cash compensation. The amount and frequency of such grants also varies by the stage of the company. However, an early stage company should expect to grant 0.1% to 0.25% of equity with a vesting period of 2 to 3 years. Additional annual grants are also expected”

Equity for advisors

As we know by now, equity is a prized possession for startups. However, there are countless people and shareholders along the way that will help move your business forward. We constantly are asked if you, as an early-stage founder, should share equity with advisors and mentors.

Support your startup’s growth with Visible

In order to best keep all of your stakeholders headed in the right direction, founders need a system in place to keep tabs on their most expensive asset — equity. By regularly communicating with investors, teammembers, and advisors, founders will be able to tap into their capital, resources, network, and experience.

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.