Hiring and attracting top talent is a major responsibility of any startup founder. In order to compete with large corporations, startups oftentimes have to get creative to attract top talent.

One of the top benefits a startup can offer is employee stock options. This gives an employee potential upside and ultimately aligns both parties. There are two major forms of stock options — NSOs (non-qualified stock options) and ISOs (qualified incentive stock options).

How do you know what type of stock options to use for your company? Check out our breakdown of both ISOs and NSOs below:

Note: We always recommend seeking advice from lawyers or councils when working with your equity.

What Are Qualified Incentive Stock Options or ISOs?

As put by the team at Investopedia, “An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income. Non-qualified stock options (NSOs) are taxed as ordinary income.”

The main difference between ISOs and NSOs are the tax structure and possible benefits. Traditionally, ISOs are awarded to high-value employees.

How Are ISOs Taxed?

As mentioned above, ISOs are taxed at the capital gains rate. This means that ISO holders are subject to tax benefits as the capital gains rate is generally lower than the ordinary income rate. It is worth noting that ISOs are taxed at the time of selling the stock (not when vesting or exercising).

When an employee (or person) is granted sock options there is a strike price (which is the value at the time of granting). Once an employee decides to exercise their options, they have the ability to sell their stock or hold on to the stock. If the same person sells their stock at (the fair market value) at a later date the difference between the strike price and fair market value is the profit — or what the employee is taxed on.

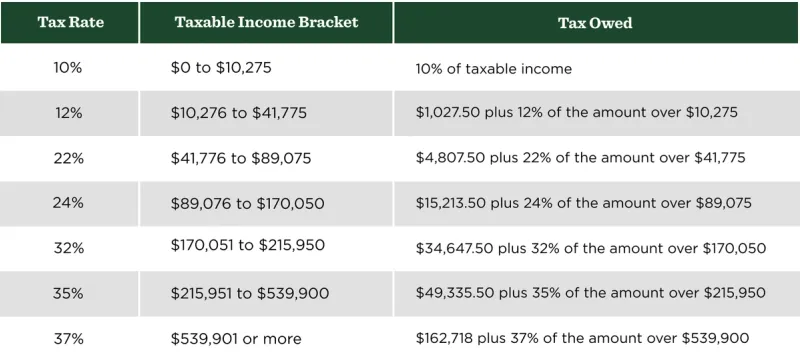

Check out the long-term capital gains tax rates in 2022 (for the US) below:

Learn more about other tax implications and the alternative minimum tax (AMT) in our next section.

The Impact AMT Has on ISOs

According to the IRS, “The alternative minimum tax (AMT) applies to taxpayers with high economic income by setting a limit on those benefits. It helps to ensure that those taxpayers pay at least a minimum amount of tax.” So what does this mean for ISOs?

While very rare and generally reserved for high-earning individuals, the AMT can be triggered if the profile from selling ISOs is large enough. This means that the stock seller will be subject to more taxes and negate some of the benefits of an ISO.

What Are Non-Qualified Stock Options or NSOs

On the flip side are non-qualified stock options (NSOs). As put by the team at Investopedia, “A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.” NSOs are generally more common than ISOs.

While they might not have the tax benefits of ISOs, NSOs are generally more common than ISOs and offer their own benefits. It is worth noting that NSOs can be granted to non-employees as well (board members, advisors, mentors, customers, etc.) Learn more about NSOs and their tax structure below:

How Are NSOs Taxed?

The main difference between NSOs and ISOs comes down to how they are taxed. If you recall, ISOs are only taxed at the capital gains tax when they are sold. NSOs can potentially be taxed on two occasions.

To start, NSOs are taxed when the stock options are initially exercised. If/when someone decides to exercise their NSOs they will pay a tax on the difference between the fair market value and the strike price.

Next, NSOs are taxed when someone sells the actual stock — similar to ISOs. Depending on how long someone holds their stock between the time they exercise it and sell it, will determine if they pay short term or long term capital gains tax.

The Impact AMT has on NSOs

As we mentioned earlier, an alternative tax minimum (AMT) is a potential downside of ISOs. Unlike their counterpart, NSOs are not subject to AMT.

ISO vs NSO Which One is Right For You?

Now that we understand the difference between qualified incentive stock options (ISOs) and non-qualified incentive stock options (NSOs) it is time to understand how and when you should be using both. Both have expected use cases and their own set of pros and cons depending on the use.

Related Reading: How to Fairly Split Startup Equity with Founders

When to Choose an ISO

Of course, most employees will likely want an ISO plan as it offers tax benefits. However, it is lesser used and should be reserved for high-value employees. As the team at Investopedia writes, “This type of employee stock purchase plan is intended to retain key employees or managers.” A few times for when you should choose a qualified incentive stock option for your employees:

- When offering stock options for an employee (ISOs are not eligible with individuals who are not employees)

- When trying to incentivize and retain a high-value employee — this might be a manager or executive that is closely aligned with your companies success.

- When your company is in a financial position to offer ISOs instead of NSOs

When to Choose an NSO

While they do not necessarily have the tax benefits of ISOs, NSOs are widely used and are more common than ISOs. Below are a few examples and pros of choosing an NSO instead of an ISO:

- When issuing stock options to non-employees. This could be consultants, board members, mentors, and more.

- From the team at Pasquesi Partners, “With NSO, companies are able to take tax deductions when the employee chooses to exercise their option in the stock. Because of the way they are structured, NSO earnings are viewed as income for the employee, hence the tax deductions.”

- When looking for a more simple option and straightforward stock option to offer employees

Share Stock Option Information With Your Investors with Visible

No matter how you structure your cap table and share equity with investors, employees, and more, it is important to be straightforward and transparent the entire time.

Want to improve your investor reporting and communication? Let us help. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.