Raising venture capital is a numbers game.

The Fundraising Funnel

At the top of your funnel, you are identifying potential investors through research, direct outreach, and intros from your peers. In the middle of the funnel, you are sharing your pitch deck, meeting with GPs, and perhaps the entire partnership. At the end of the funnel, there are (hopefully) multiple term sheets and negotiations ahead of closing.

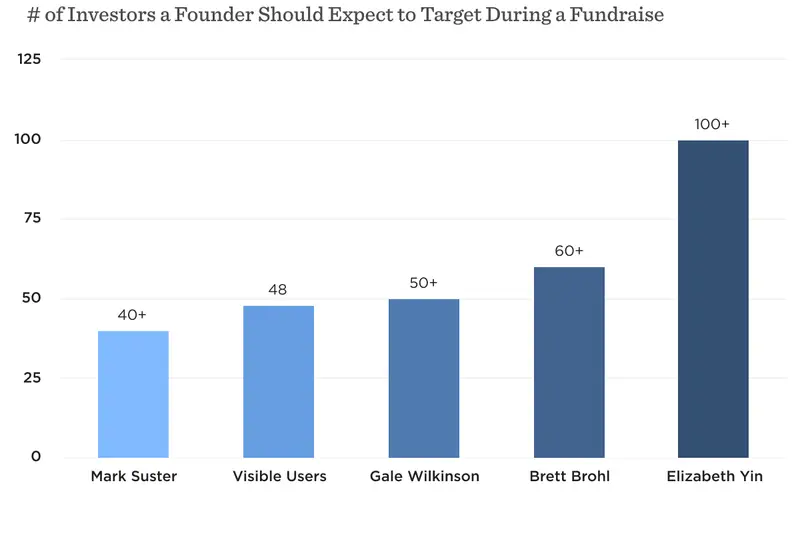

This process is full of “nos”, “maybes”, and “ghosts.” Inevitably, different investors will pass for different reasons so it is important to have a thorough list to keep the momentum going. Between our own product, the Founders Forward Podcast, and online resources, we’ve found the following benchmarks for how many investors you need in your funnel:

How Many Investors Should You Expect to Target

- 40+ — Mark Suster of Upfront Ventures, “Ideally, you want to have 40–50 qualified and interested investors in your funnel.” Learn more here.

- 48 — The average # of investors a Visible user has in a Fundraising Pipeline. Learn more about our Fundraising tools here.

- 50+ — Gale Wilkinson of Vitalize Ventures, “If you don’t have a list and you’re raising now, don’t worry. Spend a weekend and write down who are your top, you know, 50 to 75 that you want to target?” Learn more here.

- 60+ — Brett Brohl of Bread & Butter Ventures, “You’re going to have to reach out to probably about 60 funds and have about that many meetings to close a round.” Learn more here.

- 100+ — Elizabeth Yin of Hustle Fund, “I made up a rule of thumb: 5-100-500. Over 5 weeks, meet with 100 investors to close $500k in your seed round. If you want to close $1m, double all of these numbers.” Learn more here.

Before building your list of investors it is important to understand your ideal investor. Once you have an understanding of your ideal investor, check out free databases, like Visible Connect, to find investors for your startup. Give it a try and filter through our 5,000+ early-stage investors below:

P.S. If you filter by “Verified” that means these investors have personally verified the data in their profile is correct.

Related Reads

How to Build an Investor List with Gale Wilkinson of Vitalize

On the Founders Forward Podcast, Gale Wilkinson of Vitalize Ventures offers countless takeaways to help early-stage founders fundraise — covering everything from list building to ownership benchmarks. Listen now

The Fundraising Wisdom That Helped Our Founders Raise $18B in Follow-On Capital

The team at First Round Review shares an in-depth guide for running a fundraising process using best practices from their portfolio companies. Read more

Building Your Ideal Investor Persona

On the Visible Blog, we break down the attributes that a founder should consider when identifying their ideal investor. Read more