Virtual Data Rooms for VC-Backed Startups

How Founders Can Streamline Fundraising, Investor Relations, and M&A with the Right Virtual Data Room

Raising capital, managing investor relationships, and preparing for mergers and acquisitions (M&A) all require startups to securely share confidential information. A virtual data room (VDR) is a must-have tool for founders looking to streamline these processes while ensuring data security and transparency.

In this guide, we’ll explore the best virtual data room providers for startups, the key benefits of using a VDR, pricing considerations, and how to choose the right provider for fundraising and M&A. It is wise to compare the best virtual data room providers for M&A, best virtual data room providers for small businesses, and best virtual data room providers in the USA to help startups make an informed choice.

1. What is a Virtual Data Room (VDR)?

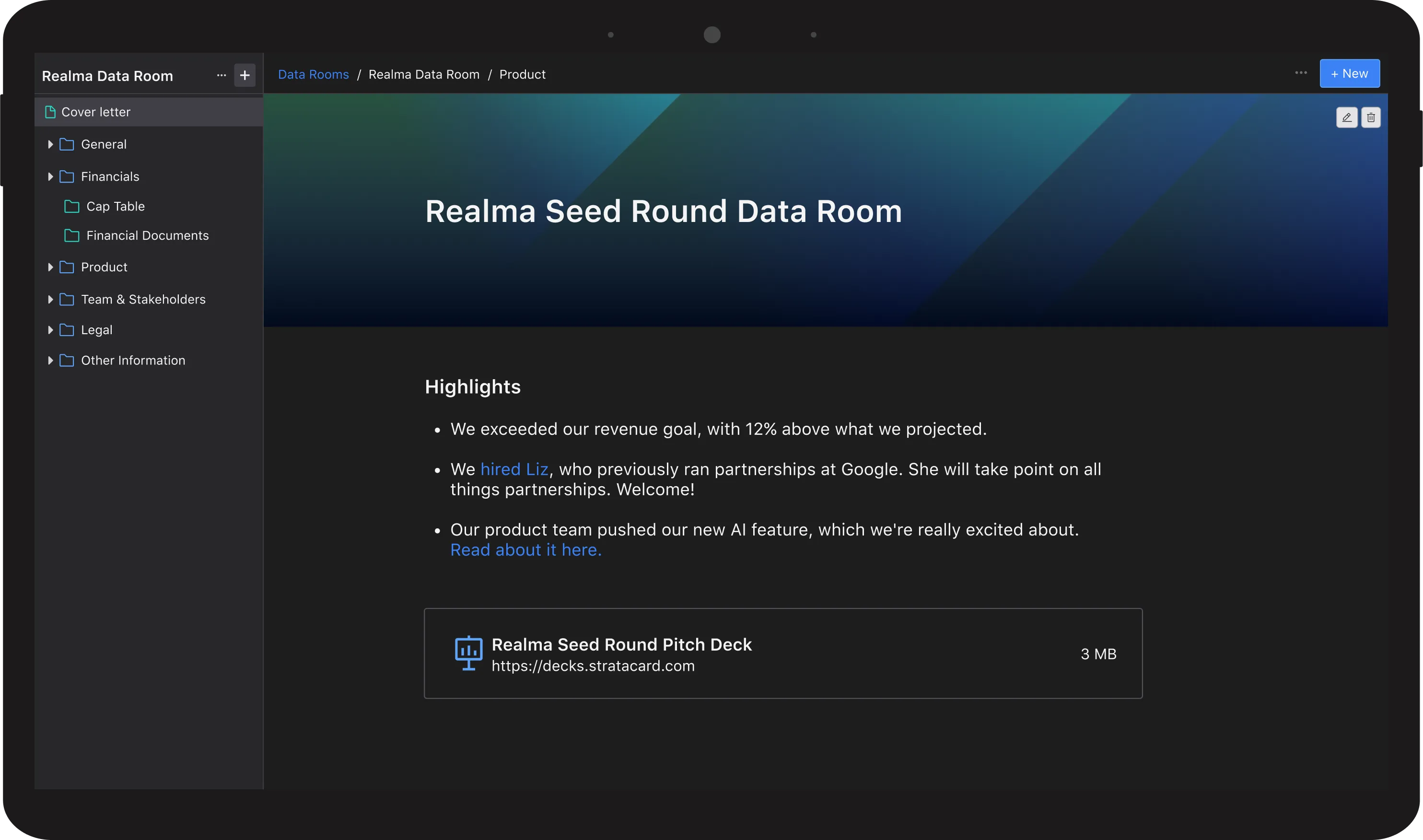

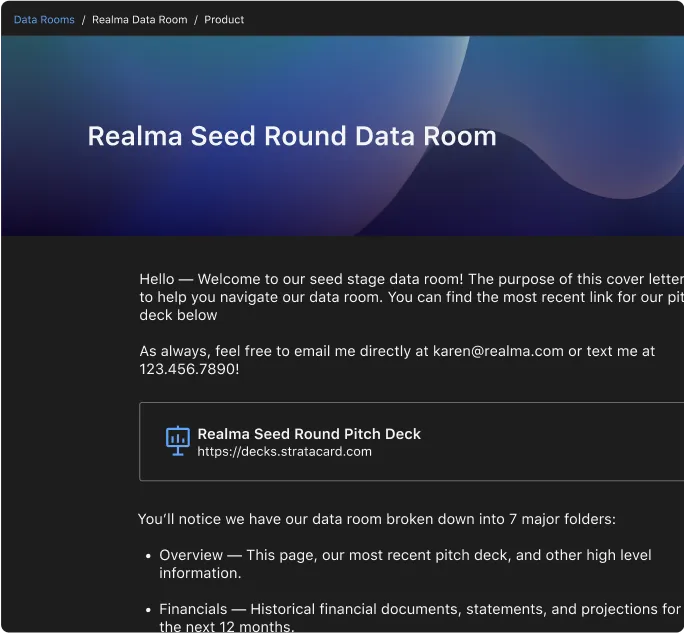

A virtual data room is a secure online repository that allows startups to store, organize, and share sensitive documents with investors, acquirers, and stakeholders. Unlike generic cloud storage solutions like Google Drive, a VDR provides enhanced security, permission controls, and tracking features, making it ideal for due diligence, fundraising, and acquisitions.

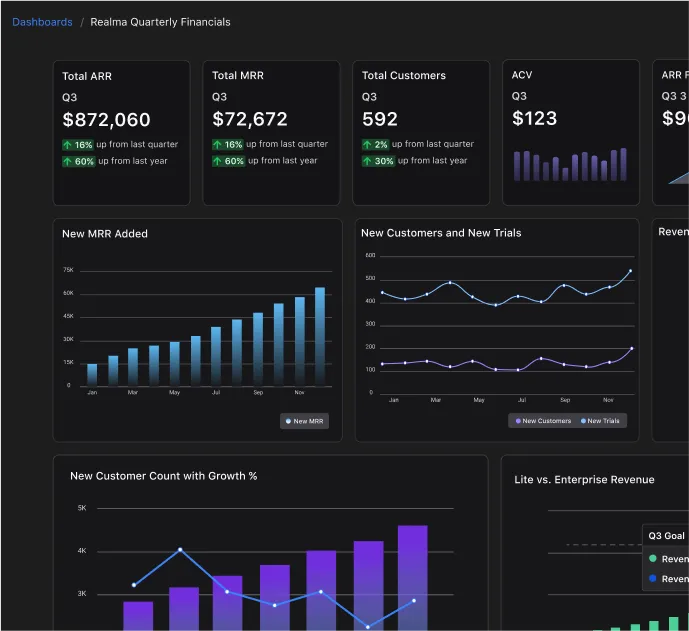

Founders use VDRs to securely share pitch decks, financial statements, and legal documents with investors. A well-structured data room maintains transparency, ensuring that VCs and stakeholders can easily access the necessary materials without delays. Additionally, a VDR significantly speeds up the due diligence process by providing a single, organized location for all required documentation. Startups often evaluate the virtual data room cost per month and the virtual data room cost for M&A to determine the best option for their needs.

2. Key Benefits of Virtual Data Rooms for Startups

Build Trust with Investors

Investors expect startups to be organized and transparent. A well-prepared data room for investors includes key documents such as financial statements, cap tables, and business plans, helping to build credibility. When investors see a properly structured data room, they can quickly assess the startup’s health and potential, making them more likely to move forward in the funding process. Many startups look for a free data room for startups initially, but later transition to premium solutions as they scale.

Fundraising Efficiency & Due Diligence Readiness

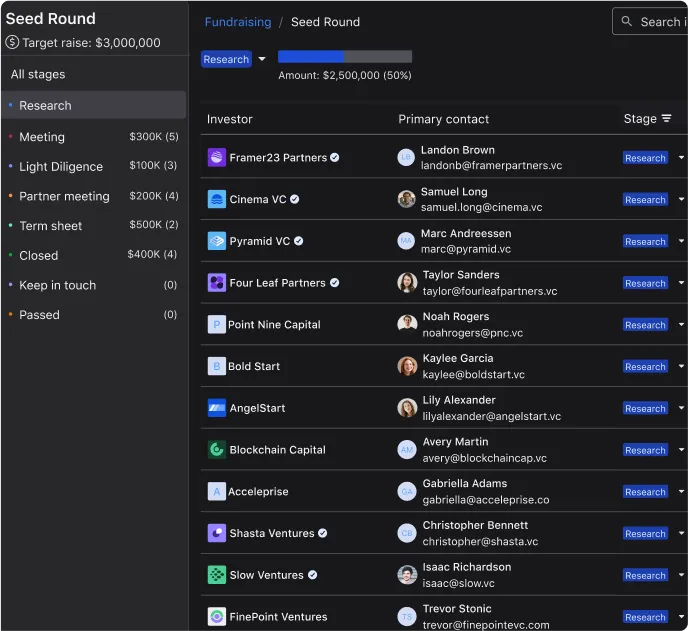

A Series A data room checklist ensures that all critical information is ready before investor meetings. Rather than scrambling to compile documents after an investor request, startups with a VDR can provide immediate access, reducing back-and-forth emails and expediting the due diligence process.

Security & Compliance

Unlike traditional cloud storage, virtual data rooms can offer bank-grade encryption, audit logs, and access controls to prevent unauthorized access. This is especially important when sharing sensitive legal agreements, financial data, and intellectual property, all of which require strict security measures to prevent leaks or breaches.

M&A & Exit Readiness

For startups considering an acquisition, M&A data room providers help organize and securely share due diligence materials, streamlining the M&A process. Acquirers can review financials, legal agreements, and other key information in a controlled, trackable environment, ensuring a smooth transaction. Evaluating virtual data room providers for M&A ensures startups choose the right platform.

3. What Should a Startup Include in Its Data Room?

A startup data room should include corporate documents such as incorporation papers, bylaws, and shareholder agreements. Financial statements, including profit and loss reports, balance sheets, and financial projections, are also critical for investors assessing the startup’s financial health. An up-to-date cap table and records of SAFE or convertible note agreements provide transparency regarding ownership and equity distribution.

Legal documents such as contracts, NDAs, and intellectual property agreements should also be included to demonstrate compliance and protect the startup’s assets. Additionally, key business and growth metrics, such as market analysis and revenue trends, help investors understand the company’s trajectory and potential. A well-organized Series A data room checklist ensures that all of these components are readily available when investors conduct their due diligence. Startups may also compare virtual data room price comparisons to find cost-effective solutions.

4. How to Choose the Best Virtual Data Room for Startups

When selecting the best data room for startups, several factors should be considered. Security may be the top priority, so the platform should offer end-to-end encryption, role-based access control, and detailed audit logs to track who accesses which files. The interface should be user-friendly, allowing both founders and investors to navigate the data room with ease.

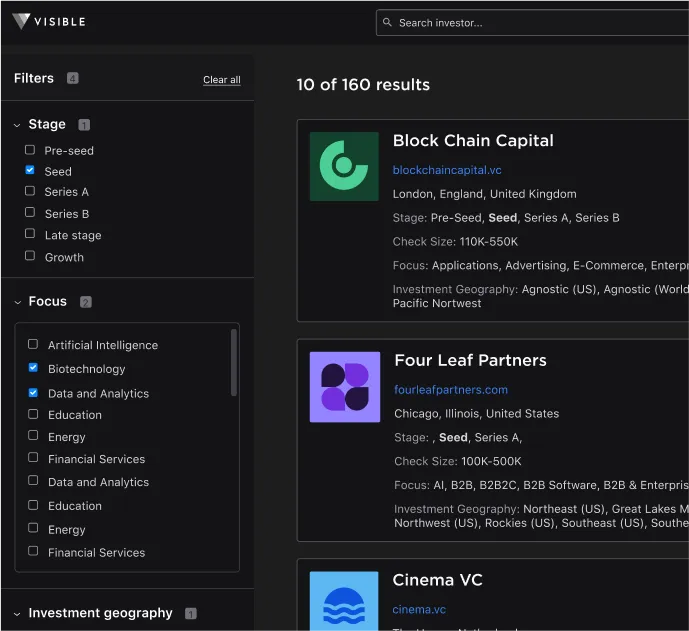

Integration capabilities are also important, as a VDR should seamlessly connect with other essential tools such as CRM software, email platforms, and analytics dashboards. Finally, pricing transparency matters—founders should understand the virtual data room cost per month to ensure the tool fits within their budget. Startups can choose between free virtual data room providers for basic needs or opt for premium solutions with advanced security and compliance features. Many founders also evaluate virtual data room providers in the USA to ensure compliance with local regulations.

5. Best Virtual Data Room Providers for Startups & M&A

Several providers cater specifically to startups. Some of the best options for venture-backed startups managing investor relations offer a combination of security and ease of use. For M&A transactions, the most trusted M&A data room providers offer advanced compliance and due diligence tools. Some startups initially turn to free virtual data room providers, such as Google Drive or GitHub, but these platforms lack the security features necessary for serious fundraising or acquisition discussions. Exploring virtual data room free GitHub or virtual data room free app solutions can be useful for early-stage startups testing their needs.

Selecting the Virtual Data Room for Your Startup

A virtual data room for startups is an essential tool for raising capital, managing investor relations, and preparing for M&A. A well-structured startup data room checklist ensures that fundraising efforts run smoothly, reducing friction and building investor confidence. The best virtual data room providers offer security, efficiency, and transparency, helping startups stay organized and investor-ready.

Founders should start by selecting a virtual data room for startups with a free trial to evaluate the platform's features. Organizing a data room for investors checklist before engaging with VCs can significantly streamline the fundraising process. For startups anticipating high-stakes deals, investing in a premium VDR with robust security and compliance features is a wise decision.