Key Takeaways

-

Early-stage investors are prioritizing seed and Series A, while later-stage startups are being supported through insider extensions and bridge rounds during macro uncertainty.

-

Founders should anticipate more outsider-led rounds with investor-driven valuations in the near term, including potential down or flat engineered rounds that align pricing with market conditions.

-

The sectors drawing healthcare VC include biotech, medical devices, healthcare IT, and healthcare services, with momentum in telehealth, AI in medical imaging, health data analytics, cybersecurity, home health, and mental health.

-

Venture firms offer more than capital by providing regulatory guidance, commercialization expertise, and partner networks that accelerate clinical development, go-to-market, and patient impact.

Healthcare venture capital is a specialized category of private equity designed to fund high-growth startups across biotechnology, medical devices, and health IT. In 2026, healthcare VCs focus on a fundamentals-first model, prioritizing clinical-grade evidence, regulatory clarity, and a proven path to profitability. According to recent data, while total global healthcare financing reached $60.4 billion in 2025, a 4% year-over-year increase, deal counts have become more concentrated among "winner-class" startups.

For founders, the bar for entry has risen: AI-enabled digital health companies now capture 54% of all sector funding, commanding a 19% premium on average deal size compared to non-AI peers. Seed rounds in this sector currently average $4.6 million due to intensive regulatory and development cycles, while Series B rounds have surged to a median of $38 million for companies with established customer bases.

This guide breaks down the active firms for 2026, the specific clinical benchmarks required to close a round, and how to navigate an increasingly discerning investor landscape.

6 Venture Capital Firms Investing in Healthcare

1. Felicis Ventures

Felicis Ventures is a boutique VC firm that backs iconic companies reinventing existing markets and creating frontier technologies. At Felicis Ventures we back the world’s iconic companies of today and tomorrow. We have a passion for products and out-of-the-box thinking.

Company Stage: Seed, Series A, Series B, Growth

Location: Menlo Park, California, United States

Portfolio Highlights

- Guild

- Predibase

- Operant

2. New Enterprise Associates

New Enterprise Associates is a global venture capital firm investing in technology and healthcare. NEA’s proven investment strategy spans all stages of a company’s growth, from seeding innovations in emerging markets to funding early-stage companies in high-growth markets to fueling the growth of market leaders. Any stage of growth is the right stage to partner with NEA. We can add value and offer expert guidance throughout your company’s lifecycle—whether your big idea is at its inception or has already progressed to be a viable reality.

Company Stage: Pre-Seed, Seed, Series A, Series B, Series C, Growth

Location: Menlo Park, California, United States

Portfolio Highlights

- PixieBrix

- Regression Games

- Timescale

3. BoxGroup

Investing in dreams at the earliest stage with companies like Plaid, Airtable, Ro, Ramp, and many more.

We support companies based on conviction in the team. We believe in “founder market fit” – the concept that certain teams are able to unlock specific markets. This is the first step to get to “product market fit.” Ideas tend not to be equal opportunity which means that it requires the right team to bring a vision to life.

Company Stage: Pre-Seed, Seed, Series A

Location: New York, United States

Portfolio Highlights

- Plaid

- Airtable

- Ramp

4. SV Health Investors

SV Health Investors, formerly SV Life Sciences, is a leading healthcare and life sciences venture capital and growth equity firm. Their goal is to transform healthcare – one investment at a time – by supporting the entrepreneurs who create and build breakthrough companies and treatments. In biotechnology, we are venture-focused. In healthcare services and digital health, we seek growth equity opportunities. In medical devices, we pursue a range of opportunities from early stage/venture-focused to early commercialization to growth equity.

Company Stage: Pre-Seed, Seed, Series A, Series B, Growth

Location: Boston, Massachusetts, United States

Portfolio Highlights

- Therini Bio

- Nimbus Therapeutics

- Quell Therapeutics

5. Elevate Capital

For some populations, there is a noticeable gap in gaining access to investment capital. These aspiring entrepreneurs are both underserved and overlooked, yet they have the courage and vision it takes to start and scale a business. At Elevate Capital, we believe there is a tremendous opportunity to invest early and offer mentorship to these entrepreneurs. We provide the venture capital and guidance they need to turn their startups into great companies.

Elevate Capital is the nation’s first institutional venture capital fund that specifically targets investments in underserved entrepreneurs—such as women and ethnic minorities, or those with limited access regionally to capital and opportunities. We support visionaries with disruptive ideas and products through two specialized investment vehicles.

Company Stage: Pre-Seed, Seed, Series A

Location: Portland, Oregon, United States

Portfolio Highlights

- TrovaTrip

- The Bacon

- HacWare

6. StandUp Ventures

StandUp Ventures is a Toronto-based, seed-stage venture capital fund focused on investing in high-growth ventures with at least one female founder in a key leadership role. We believe that women-led companies think outside the box, recruit great talent, and serve bigger markets. We invest in seed-stage, for-profit technology companies with at least one woman in a C-level leadership position within the company and an equitable amount of ownership.

We’re dedicated to curious, confident, and fearless entrepreneurs building ground-breaking technology companies. We partner with ambitious founders across Canada to break through from Seed to Series A.

Company Stage: Seed

Location: Toronto, Canada

Portfolio Highlights

- ODAIA

- Acerta Analytics

- TealBook

7. Civilization Ventures

Civilization Ventures is a venture capital firm focused on cutting edge innovations in exponential health tech and biology.

Company Stage: Seed, Series A, Series B

Location: San Francisco, California, United States

Portfolio Highlights

- Foresight Diagnostics

- Evonetix

- Infinimmune

2026 Market Intelligence: How to Raise Healthcare VC in a Fundamentals-First Market

The speculative era of the early 2020s has been replaced by a period of Industrial Maturity. Total global healthcare venture financing reached $60.4 billion in 2025, a significant recovery from 2024, marking the strongest annual capital deployment in years.

However, capital is now concentrated in fewer, larger deals. While funding is up, deal volume has stabilized as investors double down on winner-class startups. For founders, the bar has moved from innovation to commercial and regulatory de-risking.

What Metrics Do You Need to Raise a Healthcare Round in 2026?

Venture capital in 2026 is governed by Regulatory Darwinism. Investors are prioritizing companies that can prove profitable efficiency and clinical validation over theoretical platform potential.

1. The Clinical Evidence Benchmark

Investors no longer accept "pilot data" alone. To secure a Series A, you must demonstrate:

- Peer-Reviewed Validation: At least one peer-reviewed study or a white paper based on a closed-loop pilot.

- The 30% Efficiency Rule: Proof that your tool reduces administrative burden or improves outcomes by at least 30%.

2. Regulatory & Reimbursement Moats

A "clear regulatory path" is no longer a differentiator; it is a baseline requirement.

- FDA Status: A documented "Pre-Submission" status or clear 510(k)/De Novo strategy.

- CPT Code Alignment: Identify specific existing CPT/HCPCS codes or provide a 24-month roadmap for securing new reimbursement pathways Alpha Sophia, 2025.

3. Health Tech 2.0 Unit Economics

Investors now demand software-like margins even for tech-enabled services.

- Gross Margins: Aim for >70% for Health IT and >50% for MedTech/Services.

- The Rule of 40: Even at the early stage, VCs are calculating your combined growth rate and profit margin (FCF) to ensure long-term durability/

What Are the Biggest Healthcare Investment Trends for 2026?

Understanding where "Smart Capital" is flowing can help you position your pitch for the current economic climate.

- AI Moving from Chatbots to Agents: The focus has shifted from Generative AI pilots to Agentic AI, systems capable of autonomously navigating insurance rules, clinical workflows, and revenue cycle management.

- The Rebound of the Mega-Round: Mega-deals ($100M+) accounted for 42% of all digital health funding in late 2025, as VCs de-risk by backing established category leaders.

- The M&A Surge: M&A activity soared by 61% in 2025. With IPOs remaining selective, founders should build for strategic acquisition by large incumbents like Optum or CVS.

What Are The 3 Healthcare Sub-Sectors Attracting the Most Capital in 2026

The healthcare investment landscape has undergone a structural reset. In 2026, the "hype-to-reality" transition is complete, with capital flowing toward assets that demonstrate measurable productivity gains and clinical ROI. Global digital health funding rebounded to $14.2 billion in late 2025, driven by larger, more concentrated rounds for companies with a clear data moat.

For founders, these are the three high-conviction areas where VCs are currently deploying the most aggressive checks.

1. Vertical AI & Agentic Healthcare Operations

The most significant shift in 2026 is the move from simple task automation to Agentic AI, systems capable of autonomously navigating complex insurance rules and clinical policies.

- The Investment Thesis: VCs are prioritizing AI-first operations that solve the $1 trillion administrative waste problem. AI-enabled startups captured 54% of all digital health funding in 2025, commanding a 19% premium on deal size.

- Key Focus Areas: * Autonomous Revenue Cycle Management (RCM): Tools that self-correct claims and handle prior authorizations without human intervention.

- Ambient Clinical Intelligence: Platforms that convert physician-patient dialogue into structured EHR data, reducing burnout.

- Founder Benchmark: Expect to show a 2x to 3x increase in staff productivity (e.g., claims processed per FTE) to secure a Series A.

2. Next-Gen Biopharma & Pharma 5.0

Biotech funding grew by 70.9% in late 2025, signaling a massive re-entry of capital into R&D-heavy sectors.

- The Investment Thesis: Investors are backing Pharma 5.0 companies that blend AI drug discovery with physical manufacturing infrastructure. Large drugmakers are facing patent cliffs for over 200 drugs, driving a multi-billion-dollar hunt for late-stage pipelines.

- Key Focus Areas:

- Metabolic Diseases (GLP-1s): Next-gen oral obesity drugs and therapies for metabolic-associated steatohepatitis (MASH).

- Precision Oncology: In-vivo CAR-T therapies and radiopharmaceuticals that deliver payloads directly to tumors.

- Founder Benchmark: Clean Intellectual Property (IP) and regulatory clarity (e.g., a "plausible mechanism" pathway approval) are now non-negotiable for Seed+ rounds.

3. Integrated MedTech & Hospital-at-Home

The MedTech sector is pivoting toward connected ecosystems rather than standalone hardware. The U.S. digital health market is projected to grow at a 21.2% CAGR through 2026 as care shifts away from expensive hospital settings.

- The Investment Thesis: VCs are backing platforms that enable high-acuity care (e.g., post-surgical monitoring, dialysis) in a home setting.

- Key Focus Areas:

- Surgical Robotics: Systems optimized for outpatient Ambulatory Surgery Centers (ASCs).

- Remote Patient Monitoring (RPM): Device-agnostic platforms that integrate directly with payer-provider collaboration tools.

- Founder Benchmark: Must demonstrate immediate cost-savings for payers, such as a measurable reduction in 30-day hospital readmission rates.

The 2026 Healthcare VC Checklist

In 2026, the narrative raise is dead. Investors are looking for de-risked execution. Before opening a round, ensure your data room satisfies these four pillars of the Flight to Quality.

1. The "Evidence-First" Threshold

Investors no longer accept "vibe-based" clinical claims. You must demonstrate:

- Validated Proof of Concept (PoC): At least one peer-reviewed study or a white paper based on a closed-loop pilot with a major health system.

- The 30% Efficiency Metric: For Health IT, you must prove your tool reduces administrative burden or clinical burnout by at least 30%.

2. Regulatory & Reimbursement Moats

A "clear regulatory pathway" is no longer enough. You need a Reimbursement Strategy:

- CPT Code Mapping: Identify specific existing CPT codes your product falls under, or provide a 24-month roadmap for securing a new code.

- FDA Pre-Sub Status: For MedTech, having an active file or Pre-Submission interaction with the FDA is the baseline for Seed+ investment.

3. Unit Economics & "Default Alive" Metrics

With the middle market for Series B and C rounds narrowing, VCs want to see a bridge to self-sustainability

- Gross Margins: Aim for >70% for software and >50% for tech-enabled services.

- The Rule of 40: Even at the early stage, VCs are calculating your combined growth rate and profit margin to ensure long-term viability.

4. The "Agentic" Team Structure

The "Founder + Engineer" duo is insufficient for 2026. High-conviction teams now include:

- Regulatory/Compliance Lead: Someone who understands the Digital Personal Data Protection (DPDP) Rules and HIPAA implicitly.

- Implementation Specialists: Roles dedicated to shortening the infamously long hospital sales cycle from 18 months to 9 months.

Challenges You Need to Solve

- The Valuation Reset: Series A multiples have compressed. Prepare to justify your valuation based on Invoiced Revenue rather than Booked ACV.

- The Pilot Purgatory: Health systems are over-piloted. VCs will look for conversion rates from pilot to enterprise-wide contract as your primary KPI.

- Data Sovereignty: With increasing AI regulation, you must prove you own, or have perpetual rights to, the data used to train your clinical models.

Resource: The Top VCs Investing in BioTech.

Partner With VCs Investing In The Future of Healthcare with Visible

Venture capital has emerged as a powerful catalyst for progress in the healthcare industry. By bridging the funding gap, providing expertise, and fostering innovation, VCs enable healthcare startups to thrive and create transformative solutions.

Funding not only drives financial success but also cultivates a future where patient care is enhanced, medical outcomes are improved, and the boundaries of what is possible in healthcare are continually pushed.

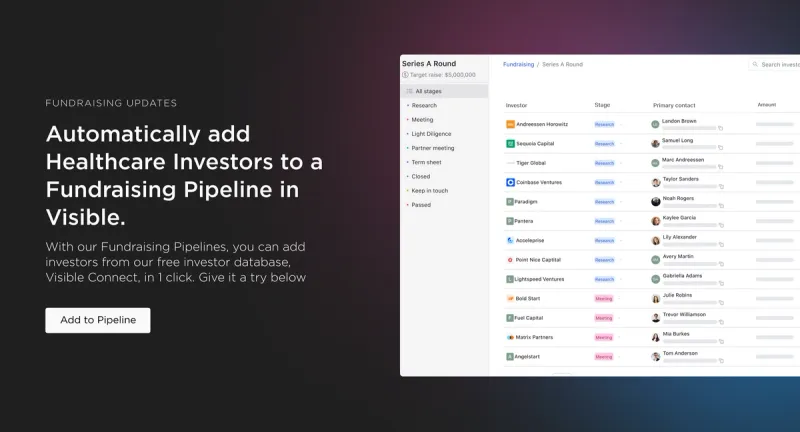

Check out Visible’s investor database, Connect, to find VCs investing specifically within the healthcare space.

Also here are two more of our list articles,

- 10+ Founder Friendly Venture Capital Firms Investing in Startups

- The 12 Best VC Funds You Should Know About

Companies should leverage VCs expertise and resources to accelerate their growth, navigate regulatory challenges, and scale their impact.

Also, get access to Visible for free for 14 days.

Frequently Asked Questions

What do healthcare VCs look for in a startup?

Healthcare VCs seek strong teams, scalable technology, and clear regulatory pathways. They favor startups with differentiated products, clinical validation, and a large addressable market. Founders who show traction through early partnerships or pilot programs often stand out to healthcare investors.

How do healthcare VCs support companies beyond funding?

Healthcare VCs provide strategic guidance, regulatory expertise, and access to industry networks. They connect founders with healthcare providers, pharmaceutical companies, and potential partners, while offering mentorship and operational support. This hands-on involvement helps startups navigate complex compliance and accelerate commercialization.

Which sectors attract the most healthcare VC investment?

Healthcare VCs focus on biotech, medical devices, healthcare IT, and healthcare services. High-growth areas include telehealth, AI-driven diagnostics, precision medicine, digital health platforms, and mental health technology. These sectors offer strong market potential and opportunities to improve patient outcomes.

What is the current trend in healthcare VC funding?

Despite economic headwinds, healthcare VCs continue to deploy significant capital. Early-stage investments remain strong, with many funds prioritizing seed and Series A rounds. Later-stage deals are seeing adjusted valuations, but investor interest in innovative healthcare solutions remains high.

How can founders connect with top healthcare VCs?

Founders can research active healthcare investors through venture databases, industry events, and targeted outreach. Platforms like Visible’s investor database make it easier to identify relevant healthcare VCs, track engagement, and manage updates, helping startups build relationships with the right funding partners.

What are the main benefits of working with healthcare VCs?

Partnering with healthcare VCs gives startups access to essential capital, industry expertise, and long-term support. These investors help navigate regulatory requirements, refine go-to-market strategies, and provide follow-on funding, ensuring companies have the resources to scale and innovate effectively.