Key Takeaways

-

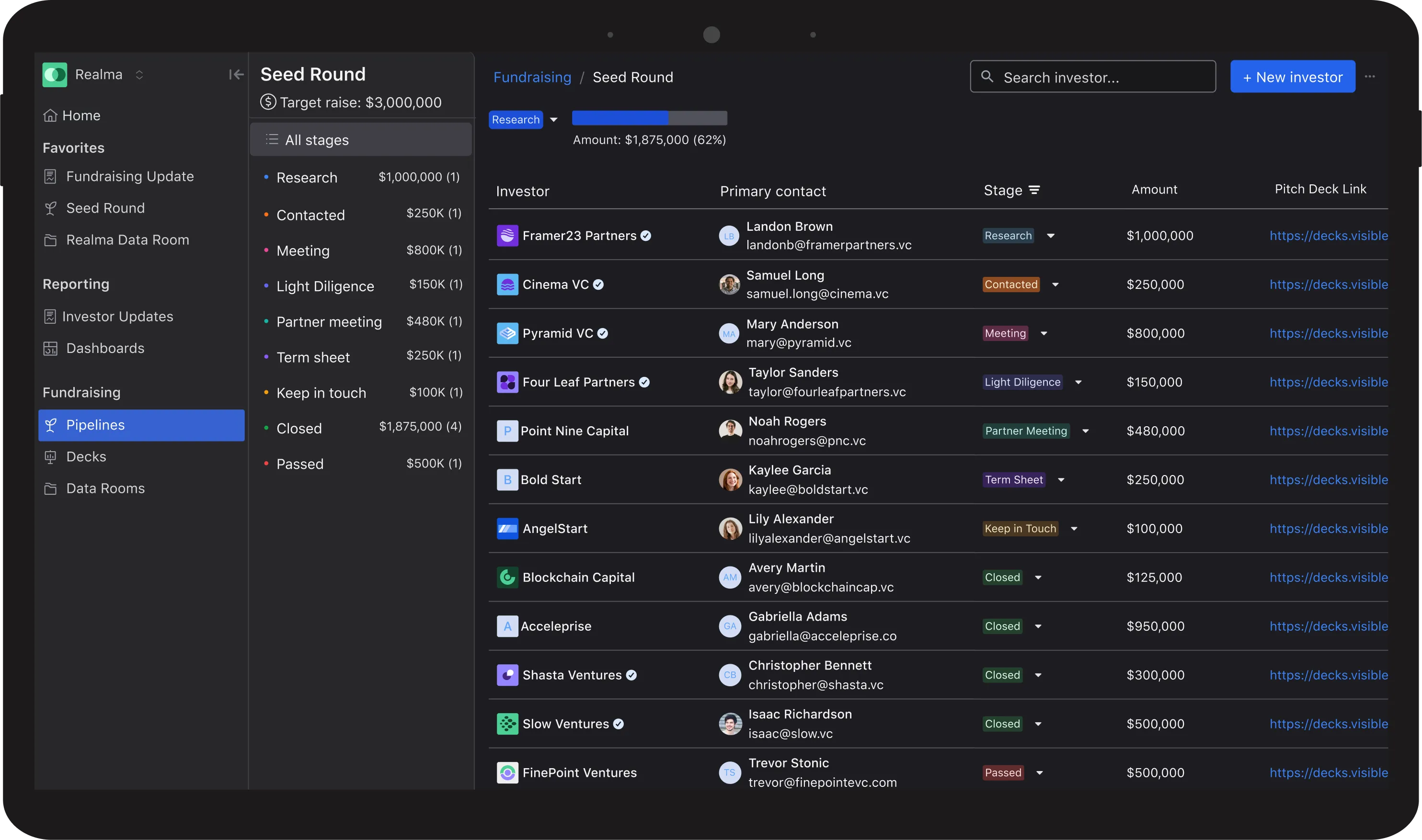

Learn how venture capital deal flow software streamlines sourcing, tracking, and evaluating every investment, replacing scattered spreadsheets with one efficient system.

-

Discover the must-have features, secure deal rooms, portfolio dashboards, accounting integrations, and custom reporting that keep VC teams organized and investor-ready.

-

See how unified tools simplify fund operations, from capital call reconciliation to KPI tracking, while supporting clean data and strong security practices.

-

Explore best practices for implementation, including pilot projects, training, and standardized workflows to ensure a smooth rollout and long-term success.

-

Understand how a flexible VC tech stack scales from seed stage to growth funds, adapting to new portfolio needs and reporting requirements over time.

Founders and investors need a clear path from sourcing opportunities to closing deals. Venture capital (VC) deal flow software automates the sourcing, tracking, and evaluation of every investment. This guide shows how the right tools can boost efficiency and insights for teams new to social media marketing tactics and small business workflows.

Understanding Venture Capital Deal Flow Software

Deal flow management software helps you capture and organize every prospective investment. By centralizing your data and processes, you eliminate scattered spreadsheets and missed follow-ups. Many teams simply call this “dealflow” in conversation, but the formal term is venture capital deal flow software. For early-stage firms, having a unified system reduces ramp-up time for new team members and makes it easier to train assistants on pipeline hygiene.

Top Features of Efficient Deal Flow Management Software

Efficient platforms share several core capabilities that support small VC-backed teams. Secure collaboration through deal room software lets you share term sheets and due diligence documents safely. Personal dashboards from the best portfolio management software for individuals offer custom views of your active and prospective deals. Financial modeling capabilities from fund modeling software and fund management software modules make forecasting and scenario planning straightforward. Activity tracking with a venture capital investment tracker records every email, call, and meeting in one timeline. Many modern solutions also include mobile apps for on-the-go review, AI-powered deal sourcing to surface promising startups, and automated reminders that ensure no opportunity slips through the cracks.

“Nearly all respondents (97%) said their organizations have begun incorporating generative AI or advanced data analytics into their dealmaking processes; digitization has risen significantly in target identification (80%) and target screening (79%).” -Deloitte, 2025 M&A Trends Survey: A time to pivot

Comparing the Best Venture Capital Deal Flow Software Solutions

When evaluating options, focus on feature depth, ease of use, and pricing transparency. For pipeline analytics, look for the best venture capital deal flow software that surfaces stage-by-stage conversion rates. For fund operations, consider solutions labeled best VC fund software or vc fund software offering support for capital calls, distributions, and waterfall calculations. For portfolio oversight, explore platforms known as the best VC portfolio management software or vc portfolio management software that excel at roll-up reporting and key performance indicators. Trial periods matter, so check whether the vendor lets you import sample data, connect to your CRM, and export PDF summaries for investor updates.

Free and PDF Tools for Early-Stage Firms

Budget-conscious teams should test free tiers and templates before committing. Search for the best venture capital deal flow software free or venture capital deal flow software free in app marketplaces and download a venture capital deal flow software PDF to start manually tracking opportunities on day one. Free options often limit the number of active deals you can manage, but they still deliver core deal sourcing and status tracking. PDF templates are ideal for one-off fundraises or proof-of-concepts before you invest in a full-featured platform.

Integrating Accounting and Portfolio Management

A unified back office accelerates reporting and reduces manual errors by linking bookkeeping sync with venture capital accounting software directly to your general ledger and consolidating dashboards via visible portfolio management that brings deal-level and fund-level data into one comprehensive view. Reconciliation features automatically match fund calls and distributions against bank statements, and some platforms generate audit-ready reports, saving hours during quarterly reviews and tax filings.

Building Your VC Stack for Maximum Efficiency

No tool exists in isolation, so your ideal vc stack should weave together CRM platforms for contact management, analytics suites for performance insights, reporting tools for investor updates, and social dashboards for market intelligence to ensure your deal flow software integrates smoothly with the rest of your toolkit. Look for open APIs or integrations via Zapier to connect your dealflow system to email, calendar, and file-storage tools. Standardized data schemas help you roll portfolio metrics into BI dashboards without custom coding, preventing data silos and supporting real-time decision-making.

Crafting a Winning VC Fund Pitch Deck

A strong deck highlights your pipeline health and KPI trends and should include an overview of your sourcing strategy and dealflow volume. Pipeline metrics visualized from your deal flow management software, fund-level performance projections drawn from your fund modeling software, and case studies tracked via your venture capital investment tracker all reinforce your narrative. Use charts and tables exported as high-resolution PDF assets to keep slide decks crisp and tailor your story to show how deal room security checks and due-diligence workflows support robust risk management. A clear call to action that leverages system data builds credibility with investors.

Implementation Best Practices

When you select a venture capital deal flow software, plan your rollout to minimize disruption. Begin by mapping your existing processes to the features you need most. Conduct a pilot with a small team and a subset of active deals to validate data migrations from spreadsheets or your CRM. Schedule training sessions that cover core workflows such as creating new deal records, assigning stages, and running reports. Designate a super user who can field questions and guide colleagues on using the fund modeling software and vc portfolio management software modules effectively. Document standard operating procedures so new team members can ramp up quickly without reinventing each step.

Data Hygiene and Security Considerations

Maintaining clean data ensures your venture capital investment tracker and deal room software deliver reliable insights. Establish naming conventions for companies, contacts, and deal stages before importing historical records. Regularly archive stale opportunities to keep dashboards focused on active pipelines. Evaluate the platform’s permission controls to ensure sensitive term sheets remain accessible only to authorized users. Confirm that your chosen solution meets industry standards for encryption, access logging, and audit trails so investor-grade data privacy is never compromised. By baking these practices into your visible portfolio management approach, you safeguard both compliance and team efficiency.

Custom Reporting and KPI Tracking

Once your deal flow management software is live, define the key performance indicators that matter most to your fund. Common metrics include deal volume by source, average time in each pipeline stage, and conversion rates from initial outreach to term sheet. Use built-in report builders to automate weekly summaries for your investment committee or quarterly investor updates. If you need greater flexibility, export raw data into your analytics suite or business intelligence dashboards. Tie fund-level results back to individual dealroom activity, linking to your fund management software and fund modeling software outputs so every stakeholder sees how sourcing efforts translate into returns.

Scaling From Seed to Series A and Beyond

As funds grow, your vc stack should evolve with your needs. Early-stage teams often prioritize deal origination features such as AI-driven startup recommendations. Later-stage funds may shift focus toward portfolio oversight and risk management, requiring deeper integrations with venture capital accounting software. Reassess your toolset at each fundraising milestone to ensure you’re not overpaying for unused features or missing new automation that streamlines investor reporting. The best vc fund software adapts to changing team sizes and strategy pivots without forcing expensive system overhauls.

Leveraging Community and Support Resources

Many deal flow platforms foster active user communities where you can exchange tips on customizing dashboards, writing effective CRM automations, or troubleshooting integrations with social media monitoring tools. Attend vendor-hosted webinars or quarterly user summits to learn best practices for social media marketing within VC contexts. Leverage knowledge bases to discover hidden features like bulk data imports or webhook triggers that connect your dealflow system to messaging apps. Engaging with both official support channels and peer networks accelerates your mastery of the software and helps you uncover opportunities to optimize your processes.

Measuring Success and ROI

To justify the investment in dedicated deal flow software, track improvements against your previous manual processes. Compare time spent per deal in old spreadsheets versus the new system. Survey your team on user satisfaction, focusing on ease of data entry and clarity of pipeline insights. Monitor the impact on fundraising cycles by measuring the reduction in time from first meeting request to term sheet execution. When you tie these productivity gains back to fund performance, you can demonstrate how visible portfolio management directly contributed to winning more high-quality deals.

Frequently Asked Questions

What is venture capital deal flow software and why is it important?

Venture capital deal flow software centralizes the sourcing, tracking, and evaluation of potential investments. A unified platform helps funds manage their entire pipeline, from first contact through portfolio monitoring, while also providing investor reporting and analytics, all in one secure system.

What key features should the best venture capital deal flow software include?

The most effective solutions combine secure data rooms, customizable dashboards, KPI tracking, and integrated portfolio management. They also offer seamless integrations with accounting and CRM tools, easy data imports, and flexible reporting so teams can collaborate and make investment decisions confidently.

How does deal flow management software differ from a standard CRM?

Unlike a general CRM, deal flow management software is designed specifically for venture capital. It captures pipeline stages, manages investor updates, and links performance data with portfolio metrics. This specialization gives funds real-time visibility into both active deals and existing investments.

Are there free or trial options for early-stage funds?

Yes. Many platforms provide free trials or starter plans that include core features such as pipeline management, investor updates, and portfolio dashboards. These options let emerging funds start tracking deals and reporting to investors without committing to a full subscription upfront. Visible offers a free starter plan that includes these essential features.

How can VC fund software integrate with accounting and portfolio tools?

Modern VC fund platforms connect directly to popular accounting systems and analytics tools. This integration automates capital call reconciliation, streamlines performance reporting, and ensures that fund-level financials and portfolio KPIs stay accurate and up to date.

What metrics should investors track with venture capital deal flow software?

Essential metrics include deal volume, conversion rates across pipeline stages, time from introduction to investment, and portfolio company performance indicators. Built-in dashboards and reports help funds monitor these KPIs continuously and share clear updates with investors.

How does venture capital deal flow software scale as a fund grows?

A flexible platform expands from early investments to larger portfolios without major reconfiguration. Teams can add new users, automate reporting, and deepen integrations with accounting and analytics tools as their fund size and complexity increase.

What best practices ensure a smooth implementation of deal flow software?

Begin with a pilot project, import clean data, and document your core workflows. Provide training sessions for your team and establish naming conventions and access permissions. A well-planned rollout ensures everyone can quickly manage deals, track performance, and share investor updates from day one.