Key Takeaways

-

VC portfolio monitoring providers give venture capital firms the real-time data and analytics needed to track investments, identify risks, and make faster, more informed decisions.

-

Modern tools replace manual spreadsheets with automated workflows, visual dashboards, and integrated financial data, enabling proactive oversight and stronger fund performance.

-

Essential features include customizable reporting, KPI tracking, scenario analysis, and robust security to protect sensitive investor and portfolio company information.

-

Scalable platforms help firms maintain transparency with limited partners, delivering accurate, timely updates that strengthen investor relationships and support future fundraising.

-

Comparing providers involves evaluating usability, integrations, and analytics depth, ensuring the chosen solution aligns with a firm’s investment strategy and growth plans.

-

Adopting advanced portfolio management software positions venture capital funds to outperform competitors by turning data into actionable insights and enhancing operational efficiency.

Venture capital firms operate in a dynamic landscape where data, timing, and insights shape outcomes. Effective portfolio monitoring is not just a back-office function, it’s a strategic capability. VC portfolio monitoring providers play a pivotal role in equipping investors with tools that allow them to track performance, identify risks, and drive decision-making across their investments. As competition intensifies and limited partners demand greater transparency, portfolio monitoring becomes indispensable to the venture investment process.

What Is Portfolio Monitoring? Meaning and Use Cases for VCs

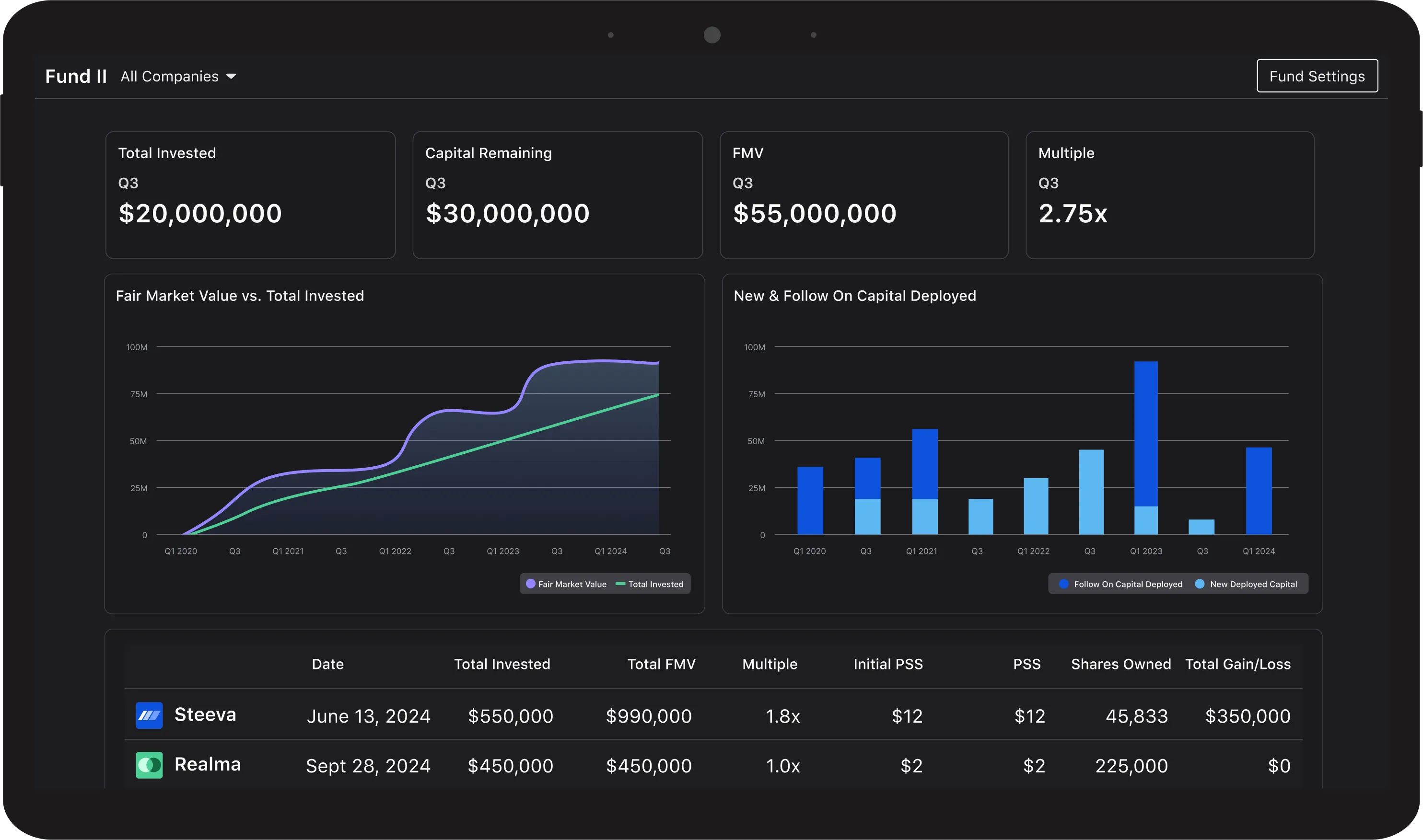

At its core, portfolio monitoring refers to the continuous oversight and analysis of a fund’s investments. It enables investors to track key metrics, monitor financial and operational performance, and respond proactively to portfolio company developments. The portfolio monitoring meaning extends beyond spreadsheets, it involves structured data aggregation, visual dashboards, and scenario modeling.

A simple portfolio monitoring meaning example could be a fund manager using real-time data from their monitoring software to spot a drop in a company’s ARR, prompting a strategic intervention. Such proactive oversight helps investors avoid surprises and manage outcomes more effectively.

Portfolio monitoring also facilitates consistency across teams. As funds scale and invest across multiple sectors or geographies, centralized visibility ensures alignment between deal teams, operating partners, and finance staff.

The Importance of Portfolio Management in Venture Capital

The importance of portfolio management in venture capital cannot be overstated. It helps firms allocate resources efficiently, report accurately to LPs, and identify both risks and opportunities within their portfolio. In a high-stakes environment, understanding what’s working, and what isn’t, is vital.

For institutional investors, how VCs manage their portfolio involves a mix of financial tracking, performance reviews, and operational updates. These activities were traditionally manual but are now powered by digital platforms, enabling faster responses and greater insight. Modern portfolio management also strengthens the relationship between GPs and LPs by delivering structured, timely updates and clearer narratives about fund performance.

Strong portfolio management practices can also impact a firm’s ability to raise future funds. Investors that can demonstrate a clear understanding of their current performance, and articulate how it maps to their investment strategy, tend to stand out in competitive fundraising cycles.

Evolution of Venture Capital Portfolio Tracking Solutions

Historically, VC firms used Excel sheets, email updates, and static reports to manage their portfolios. As data volumes and complexity grew, these methods became unsustainable. Today, venture capital portfolio tracking solutions provide automated workflows, real-time dashboards, and integration with data sources like accounting software and CRMs.

Automated VC portfolio tracking allows firms to sync financial metrics, benchmark growth, and spot trends without manual input. For example, an investor can receive automated alerts when a company’s burn rate exceeds thresholds or when quarterly financials deviate from forecasts. These real-time insights turn passive oversight into active engagement.

Using portfolio management examples, many firms have transitioned from reactive monitoring to strategic, forward-looking analysis. These examples highlight how automation and integration create efficiency and clarity, even across diverse portfolios.

Another major shift is the ability to access data at the partner, fund, or firm level, all within the same platform. This nested view gives partners quick access to both macro fund performance and micro company activity, saving time and reducing friction in portfolio reviews.

“Nearly 65% of data-driven VC firms report using at least one internally built tool, spanning functions from portfolio monitoring to back-office operations.” - Data-Driven VC Landscape

This highlights how portfolio monitoring technology is no longer optional, showing that leading venture firms are actively adopting dedicated systems to gain real-time insight and stay competitive with investor expectations.

Features to Look for in VC Portfolio Management Software

Choosing the right VC portfolio management software starts with identifying core needs. For many firms, essential features include centralized data capture, customizable reporting, KPI tracking, and scenario analysis tools. These features support day-to-day operations and high-level strategic planning.

Some platforms offer VC portfolio management software free trials, giving investors a way to explore their interface, data handling, and flexibility before committing. However, scalability, security, and analytics depth often distinguish paid versions from entry-level tools.

Modern tools also provide performance benchmarks, fund-level analytics, and automated data requests, capabilities that improve both internal team efficiency and external LP communication.

Security is another key consideration. With sensitive financial and operational data flowing through the platform, robust permission controls, encryption, and audit logs are essential. The best VC portfolio monitoring providers prioritize both functionality and data protection.

Top VC Portfolio Monitoring Providers in the Market

The market for VC portfolio monitoring providers has expanded rapidly. Choosing the best VC portfolio monitoring providers requires evaluating product capabilities, customer support, customization options, and integration with other tech stacks.

The best VC portfolio management software combines ease of use with deep analytical power. Whether a firm needs high-level overviews or granular company-specific insights, top providers deliver dashboards, exportable reports, and collaborative features.

As firms increasingly rely on portfolio monitoring tools for VCs, the demand for seamless user experiences, secure data environments, and reliable automation grows. Among the top venture capital portfolio tools, differentiation often lies in customization, reporting automation, and how intuitively teams can access insights.

Some platforms cater to generalist investors, while others are purpose-built for sector-specific portfolios or thematic strategies. Understanding the nuances of your own investment thesis can help guide the selection process.

Portfolio Management Software for Investors: A Strategic Advantage

For investors, portfolio management software for investors is no longer optional, it’s a strategic necessity. These platforms don’t just track numbers; they contextualize performance, show sector exposure, and support thesis-driven investing.

Using VC portfolio performance analytics tools, investors can assess metrics like cash burn, revenue run rate, and valuation trends. These tools also help model exit scenarios, assess follow-on potential, and evaluate performance against peer benchmarks. Ultimately, this enables more informed capital deployment and LP engagement.

Analytics also play a key role during fundraising and due diligence. When LPs request fund performance data, having a centralized, well-documented system in place helps ensure quick turnaround and confident communication.

Evaluating Providers: From Visible Portfolio Management to Custom Solutions

When selecting a monitoring provider, investors often explore platforms like Visible portfolio management due to its intuitive dashboards and LP reporting features. Reviews, such as Visible portfolio management reviews, can help highlight common user experiences and platform strengths. Additionally, the ability to track ownership or liquidity events, such as those related to Visible portfolio management stock, can add depth to decision-making.

Yet, some investors may opt for custom-built platforms tailored to their workflows. The choice between ready-made solutions and bespoke tools depends on the firm’s size, portfolio complexity, and internal resourcing.

Customization can be particularly useful for firms with proprietary frameworks or performance methodologies. However, the trade-off often involves higher upfront costs and ongoing maintenance responsibilities.

Accessing Portfolio Management Resources: PDFs, Demos, and Guides

Investors beginning their search often turn to downloadable materials like a portfolio management PDF, which outlines key terms, workflows, and evaluation criteria. These resources offer a structured starting point for assessing internal needs and comparing vendor offerings.

Many providers also offer demos and live walkthroughs to illustrate how their systems handle real-world data. These guides, coupled with firsthand exploration, empower firms to make informed decisions grounded in both product functionality and strategic alignment.

Webinars and knowledge bases are also helpful resources when assessing vendor support and onboarding processes. For teams with varied levels of technical expertise, user training and product documentation can greatly influence adoption success.

Final Thoughts: Investing in Scalable, Insight-Driven Portfolio Management

Selecting the right VC portfolio monitoring providers can transform how investors manage risk, uncover opportunities, and communicate with LPs. As venture capital becomes increasingly data-driven, firms need tools that go beyond static tracking.

Whether adopting automated VC portfolio tracking, diving into VC portfolio performance analytics tools, or evaluating Visible portfolio management, the goal remains the same: better decisions through better visibility. By investing in scalable, insight-driven portfolio management systems, investors position themselves to navigate complexity with confidence, and outperform over time.

Frequently Asked Questions

What do VC portfolio monitoring providers offer to venture capital firms?

They provide secure platforms that centralize portfolio data, track performance metrics, and display real-time dashboards. This visibility helps investors measure company progress, identify risks early, and share clear updates with limited partners, turning oversight into a strategic advantage.

How does VC portfolio management software improve investor decision-making?

Modern solutions aggregate financial and operational data across all investments. By surfacing trends and benchmarks, they enable fund managers to spot opportunities, anticipate challenges, and allocate capital with confidence from a single, organized system.

What key features should firms look for in the best VC portfolio monitoring providers?

Essential capabilities include automated data capture, customizable reporting, KPI tracking, and scenario analysis. Strong security with encryption, granular permissions, and detailed audit logs ensures sensitive information stays protected while teams access insights through an intuitive interface.

Are there free VC portfolio management software options?

Some entry-level tools and trials can handle basic reporting and KPI tracking, but they often lack the scalability and integrations that established platforms provide. Growing firms benefit from professional solutions that support complex portfolios and automate data requests as needs expand.

How do VC portfolio performance analytics tools support fundraising?

Centralized analytics give instant access to fund-level metrics, cash burn rates, and valuation trends. When limited partners request updates, automated reporting provides accurate, on-demand insights that build trust and streamline due diligence.

Why is portfolio monitoring important for limited partner relations?

Consistent, timely monitoring strengthens investor relationships by offering transparent performance updates. Automated reports and real-time dashboards demonstrate disciplined fund management and reinforce confidence in the firm’s strategy.

What factors help firms compare VC portfolio monitoring providers?

Key considerations include ease of use, scalability, data security, and integration with existing financial and CRM systems. Many investors specifically look for the depth and clarity offered by tools such as Visible portfolio management when assessing how well a platform can meet both current requirements and future growth.