The SaaS Quick Ratio is a simple formula used to measure the efficiency of your SaaS company’s growth. A quick ratio gives a company a reliable source to predict how they can grow revenue with churn in mind. In short, the quick ratio formula is new MRR by lost MRR over a period of time. The higher your quick ratio the stronger the growth. The quick ratio formula can be found below:

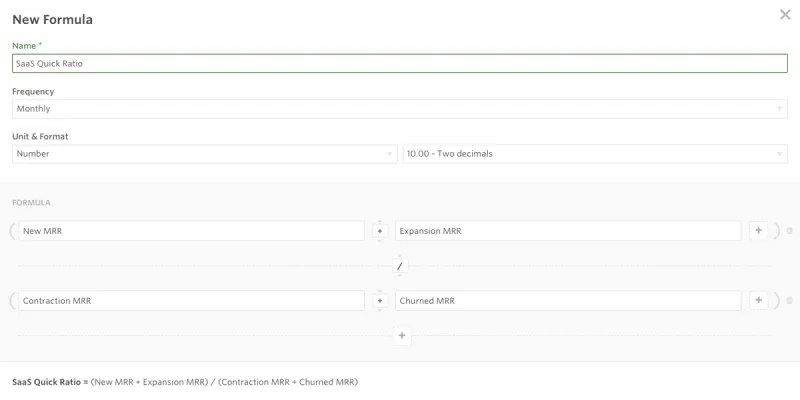

Quick Ratio Formula = (New MRR + Expansion MRR) / (Contraction MRR + Churned MRR)

A low churn rate is often the most efficient way to grow your SaaS business. While new MRR is vital to a company’s success as well, a high churn rate will make it virtually impossible to have a sustainable growth rate. As Tomasz Tunguz puts it, “If the churn number is unsustainably high, we know from previous churn analyses that high churn implies lower growth rates and dramatically less efficient growth.”

While a high MRR growth rate can mask a high churn rate, the best-in-class companies always have a low growth rate, creating a much higher quick ratio.

Quick Ratio Formula in Visible

Creating a quick ratio formula in Visible is incredibly easy with our formula builder. First, you’ll want to make sure you have your recurring revenue metrics in Visible. We would suggest using user provided metrics or using Google Sheets, Salesforce, HubSpot or ChartMogul to automatically get your recurring revenue metrics in Visible.

Once your metrics are in Visible, you’ll want to start building your quick ratio formula. To start, add any new and expansion MRR metrics in the top line. For our quick ratio formula we only mention MRR and Expansion MRR but this could include reactivated, multiple product, etc. On the bottom row, you’ll want to add any “loss” MRR metrics, like contraction and churned MRR.

After the quick ratio formula is setup, it will automatically be calculated as any new data comes in from your integrations. Next, you’ll want to visualize, distribute, and act on your quick ratio. We suggest sharing your quick ratio with managers and executives on your team so everyone has an easy way to understand the growth of your company at a quick glance. Generally, we do not see companies share their quick ratio with their investors as if you have a down month or period it may display poorly and generate unnecessary concerns.

Tracking your quick ratio is a great way for SaaS companies to get a quick idea of how efficiently they are growing. The easiest way to strengthen your SaaS quick ratio is by shrinking your monthly churn rate. Learn more about your quick ratio here.