Key Takeaways

-

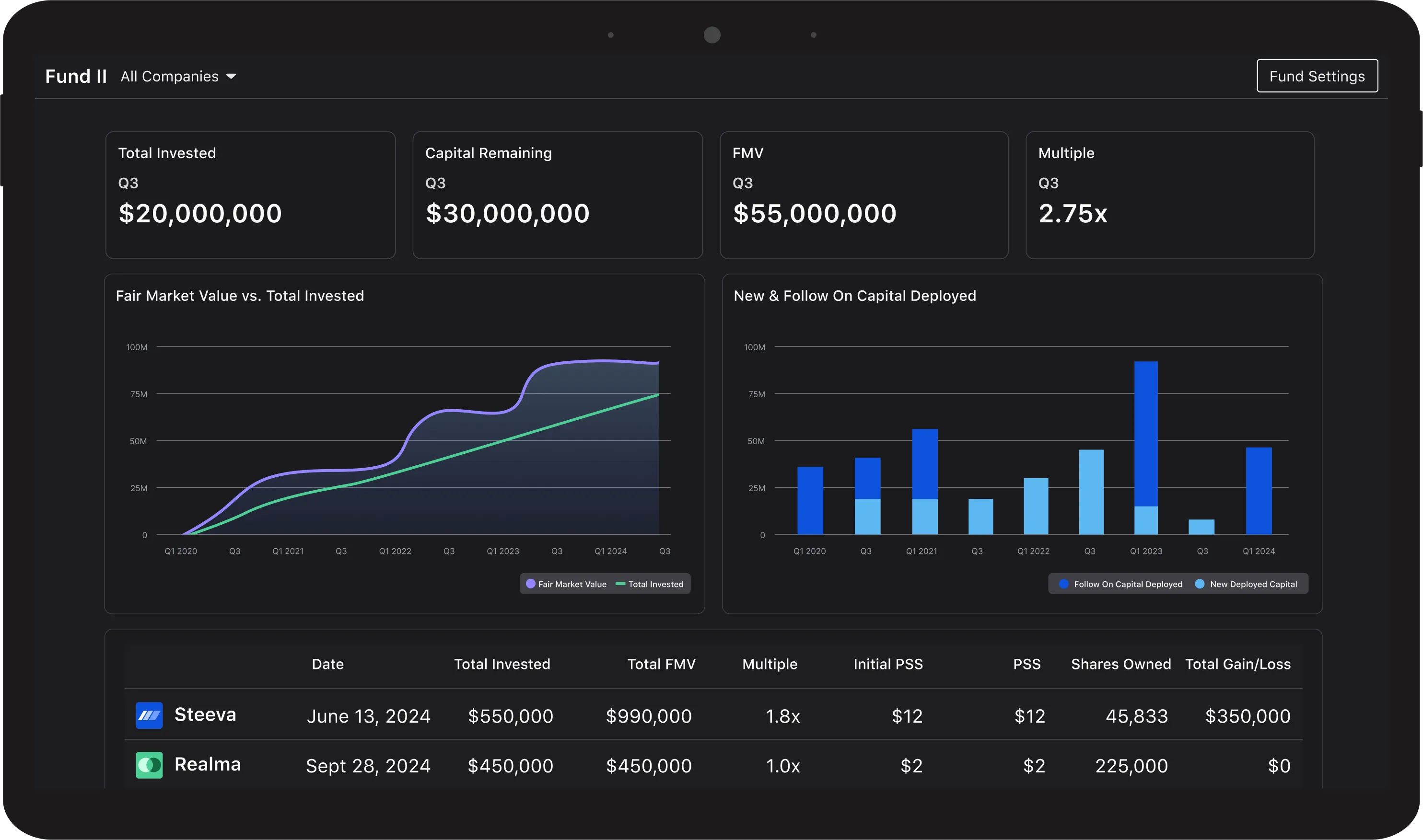

Portfolio monitoring tools give investors real-time visibility into performance, cash flow, and valuation changes, helping them act quickly on risks or opportunities.

-

Active monitoring improves returns by spotting underperforming assets early and identifying high-growth prospects for smarter capital allocation.

-

Top software centralizes data, automates alerts, and integrates with accounting and cap-table systems for streamlined, on-the-go tracking.

-

Free portfolio analysis options offer a low-risk way to test dashboards, reporting features, and data workflows before committing to a full platform.

-

Advanced capabilities like AI-driven analytics, stress testing, and visual dashboards turn raw data into actionable insights and clearer investor communications.

-

Strong security, collaboration tools, and mobile-first design ensure that modern portfolio monitoring remains both transparent and compliant as your fund scales.

Understanding Portfolio Monitoring Meaning

Portfolio monitoring meaning refers to the ongoing process of tracking the health and performance of your investments through both quantitative and qualitative indicators. It moves beyond periodic reviews by providing real-time visibility into valuation shifts, cash-flow variances, and milestone achievements. With defined thresholds and customizable alerts, you can detect emerging risks or opportunities the moment they arise. This proactive approach helps you stay informed and aligned with your fund’s overall strategy.

Why Active Monitoring Improves Portfolio Performance

Active monitoring boosts portfolio performance by letting you spot underperforming assets before they erode returns and by highlighting high-growth opportunities early. By leveraging a portfolio performance tool, you can generate automated scorecards that measure metrics such as internal rate of return and cash-on-cash multiple. These insights support timely capital reallocations, ensuring you invest more in winners and cut exposure to laggards. Regular performance reviews driven by data also strengthen your discussions with limited partners.

“Research shows that investors using comprehensive monitoring tools demonstrate 23% better adherence to their target allocations and 18% less emotional decision-making during market volatility.”

Key Software Features for Insight and Control

Top-tier portfolio monitoring software centralizes data aggregation, automated alerts, and customizable reporting within a single interface. Look for platforms that integrate seamlessly with accounting systems, cap-table management, and market data feeds via application programming interfaces. Mobile access and cloud-based dashboards ensure you can review key indicators on the go, whether you are at a board meeting or traveling. Combining scenario-analysis modules with stress-testing helps you model potential outcomes and refine your investment thesis.

Core Portfolio Management Tools and Techniques

Effective portfolio management tools and techniques include benchmarking fund returns against relevant industry indices and conducting rolling-return analyses to smooth out short-term volatility. Stress-testing under different exit scenarios, from acquisition multiples to initial public offering timelines, lets you assess downside resilience. Regular reconciliation of actual cash flows against projections uncovers gaps in your forecasting model. These repeatable practices create a consistent framework for evaluating every new deal.

Comparing Fund Management Software and Investment Portfolio Management Software

Fund management software typically focuses on fund-level accounting, compliance, capital calls, and distribution waterfalls, while investment portfolio management software centers on deal-level analytics, valuation tracking, and exit-modeling tools. Although both categories can overlap, your choice depends on workflow priorities: whether you need robust audit trails and fund-level reporting or deep-dive capabilities into individual company metrics. A clear understanding of these differences guides you to the right solution for your team.

Examining Free Options for Portfolio Monitoring

A free portfolio analysis tool provides a no-cost entry point to test core dashboard features, data import workflows, and basic analytics. Many providers offer portfolio monitoring tools free for up to a set number of assets or limited reporting features. You can often find portfolio monitoring tools free download options for desktop evaluations, allowing you to gauge user experience before upgrading. While free tiers lack advanced modules, they serve well for small portfolios or pilot programs.

Specialized Tools for Venture Capital and Private Equity

Venture capital firms evaluating the best VC portfolio management software should look for deal-pipeline tracking, fundraising-round integrations, and limited partner communication portals. VC fund software often automates capital call notices and distribution waterfall calculations, reducing manual effort and error. Larger firms in private equity require private equity portfolio monitoring software with advanced valuation modules, audit trails, and compliance reporting. Choosing a solution designed for your firm’s size and fund structure streamlines operations and enhances transparency.

Harnessing Visual Insights with Portfolio Visualizer

A portfolio visualizer turns spreadsheets of figures into interactive heat maps, performance-attribution charts, and scenario-simulation graphs. These visuals help you distill complex data into clear narratives for limited partners and internal stakeholders. By layering metrics like net asset value, internal rate of return, and cash-on-cash multiple, you can create presentations that drive informed discussions. Visual dashboards also accelerate decision cycles by making trends immediately apparent.

Best Practices for Implementation

When rolling out new tools, start with a clear governance framework that defines roles, data ownership, and update cadences. Train your team on the chosen portfolio monitoring software to ensure consistent data entry and reduce resistance to change. Establish a pilot group to test features and gather feedback before a full-scale launch, adjusting configurations based on real-world use. Regularly revisit your setup to incorporate new features or data sources as your fund’s needs evolve.

Common Pitfalls to Avoid

Avoid relying on spreadsheets alone, as manual processes introduce errors and limit scalability. Do not purchase every available module; instead, select features that align directly with your fund’s priorities, whether compliance reporting or scenario modeling. Beware of data silos and ensure integrations connect all relevant systems, from cap tables to accounting platforms. Finally, guard against over-customization, which can complicate upgrades and support.

Selecting the Best Portfolio Monitoring Tools

To identify the best portfolio monitoring tools, evaluate potential solutions on usability, integration capabilities, security certifications, and scalability. If budget is a concern, explore the best portfolio monitoring tools free offerings to find a platform that grows with your fund. Prioritize software with strong API support, reliable uptime service-level agreements, and active user communities. A structured evaluation matrix that weights features against cost prevents surprises and accelerates consensus.

Adopting a Philosophy of Visible Portfolio Management

Visible portfolio management emphasizes transparent, consistent communication with all stakeholders through shared dashboards, executive summaries, and standardized key performance indicators. By committing to regular updates on a monthly or quarterly basis, you maintain alignment and build trust with investors, founders, and advisors. Shared access to live dashboards reduces ad-hoc reporting requests and streamlines decision-making. Ultimately, a visible approach fosters accountability and strengthens long-term relationships.

Leveraging AI and Automation for Smarter Monitoring

Advances in artificial intelligence and machine learning are transforming how you monitor your portfolio. Automated data ingestion minimizes manual entry by pulling financial statements, market updates, and valuation revisions into a single dashboard. Machine learning models can flag anomalies such as an unexpected cash-burn spike more quickly than human review. Natural language processing engines even summarize news articles and regulatory filings, helping you stay on top of developments without sifting through dozens of reports. By adopting AI-driven features, you free up your team to focus on strategic decision making rather than routine data gathering.

Ensuring Data Security and Compliance

As you centralize sensitive fund and portfolio data, robust security measures are essential. Look for tools that offer end-to-end encryption, multi-factor authentication, and role-based access controls. Compliance modules should track audit logs and simplify reporting for investors and regulators. Regular third-party security audits and SOC 2 or ISO 27001 certifications provide added assurance. Investing in a secure platform protects your firm’s reputation and reduces the risk of data breaches or non-compliance penalties.

Integrating Social and Collaboration Features

Collaboration is key for small teams and remote stakeholders. Modern portfolio monitoring tools now include built-in comment streams, shared notes, and tagging functionality. You can assign action items directly within a deal’s profile and track follow-through in real time. Some platforms integrate with team-messaging apps, enabling notifications when key milestones are reached and keeping everyone aligned.

Future Trends in Portfolio Monitoring

Expect more real-time market data feeds and predictive analytics that anticipate sector shifts before they happen. Blockchain-based solutions may introduce immutable transaction records and streamline cap-table management with digital securities. Mobile-first dashboards will become the norm, granting on-the-go access to performance snapshots and alerts. Staying informed about emerging trends ensures your monitoring strategy remains cutting-edge.

Conclusion: Elevating Your Monitoring Practice

Adding AI-powered automation, stringent security, and collaborative workflows to your toolkit elevates portfolio monitoring from a back-office task to a strategic advantage. Continued investment in the right combination of tools and techniques fortifies decision making, drives stronger portfolio performance, and delivers greater transparency for all stakeholders. As monitoring technology evolves, your firm will be primed to respond swiftly to market changes, capitalize on new opportunities, and maintain investor confidence.

Frequently Asked Questions

What makes portfolio monitoring tools valuable for investors?

Modern portfolio monitoring tools provide real-time performance tracking, automated alerts, and seamless integrations with cap tables and accounting systems. Cloud-based dashboards and mobile access let you review key metrics anywhere, helping you stay proactive and make informed investment decisions.

Are there free portfolio monitoring features available?

Yes. Many platforms offer a free tier that allows tracking a limited number of portfolio companies, importing data, and creating basic reports. This option is ideal for smaller portfolios or for testing core functionality before expanding to advanced features as your needs grow.

How can portfolio monitoring tools support private equity needs?

Portfolio monitoring software designed for private equity includes advanced valuation tracking, audit logs, and compliance-ready reporting. Automated capital call tracking and detailed performance analytics streamline operations while maintaining transparency with investors and other stakeholders.

What is a free portfolio analysis tool and when should it be used?

A free portfolio analysis tool provides essential performance metrics, visual dashboards, and simple data imports at no cost. It’s best for early-stage funds or small teams looking to validate workflows and evaluate data integrations before scaling to a more comprehensive setup.

How do portfolio visualizers improve investment decisions?

Portfolio visualizers transform complex portfolio data into interactive charts, heat maps, and scenario models. By layering key indicators such as net asset value and internal rate of return, they help clearly present trends to investors and quickly identify growth opportunities or potential risks.

What key features should be prioritized in portfolio monitoring software?

Look for automated data ingestion, customizable reporting, and robust security with role-based access. Strong API integrations and mobile-friendly dashboards ensure accurate, real-time insights while maintaining compliance and simplifying team collaboration.

How do AI and automation enhance portfolio monitoring?

AI and automation pull financial statements, detect anomalies, and highlight performance trends. These tools reduce manual work, speed up risk detection, and free teams to focus on strategic decision-making and portfolio growth rather than routine data entry.