Being a startup founder is difficult. On top of having to build a product or service, hiring top talent, managing the day-to-day, and more — founders have to fund their business. This can come in the business of equity financing, bootstrapping, debt, or other methods.

For founders looking to raise equity financing (via angel investors or venture capital), running a process is crucial to success. A strong process starts by finding the right investors to target and pitch during your raise.

For founders in New York, check out a few active angel investors in the area below.

Angel investors in New York

As we mentioned above, running a process is crucial to fundraising success. At Visible, we often compare a fundraise to a traditional B2B sales and marketing funnel.

At the top of your funnel, you add qualified investors to your pipeline (via cold and warm outreach). In the middle of the funnel, you nurture and pitch potential investors with email, updates, pitches, meetings, etc. At the bottom of the funnel, you are hopefully closing your new investors.

To help you filll the “top of your fundraising funnel,” check out a list of angel investors in New York below.

1) Roger Ehrenberg

Roger Ehrenberg is the Founding Partner of IA Ventures. In addition to founding IA Ventures, Roger is an active investor. In 2022, Roger has started Eberg Capital.

As put on it’s website, “Eberg Capital helps creators and their fans develop closer, more authentic relationships. Our work sits at the intersection of sports, gaming, the arts and web3.Eberg Capital helps creators and their fans develop closer, more authentic relationships. Our work sits at the intersection of sports, gaming, the arts and web3.”

Some of Eberg capitals most popular investments include:

- Alt

- Rally

- Cabin

Related Resource: 10 VC Firms Investing in Web3 Companies

2) Adam Rothenberg

Adam Rothenberg is a Partner at BoxGroup. Adam is primarily focused on seed stage companies. Learn more about some of the investment criteria for BoxGroup below:

Some popular investments include:

- Plaid

- Airtable

- Blue Apron

Related Resource: VCs Investing In Food & Bev Startups

3) Joanne Wilson

Joanne Wilson is synonymous with angel investing in New York City. As put on her website,

“Joanne Wilson is a prominent early-stage angel investor, entrepreneur, and philanthropist with a diverse background in retail, wholesale, media, real estate and technology. She has over 140 companies in her investment portfolio such as Food52, Eater, and Parachute Home, and has invested in several restaurants throughout downtown New York City.”

Some of Joanne’s most popular investments include:

- Houseplant

- Blue Bottle Coffee

- Parachute

4) Kal Vepuri

Kal Vepuri is the CEO of Hero. In addition to leading Hero, Kal makes angel investments via his personal investment vehicle, Brainchild Holdings.

As put on his LinkedIn, Kal (via Brainchild) has made “300+ direct investments in seed stage marketplaces, networks and saas in fintech, blockchain, healthcare services, enterprise/SMB and consumer.”

5) Gary Vaynerchuk

Gary Vaynerhcuk is a recognizable name in the angel investing world. Gary is a Partner at VaynerRSE.

At put on their website, “Through our partnership with leading entrepreneur Gary Vaynerchuk, Vayner/RSE invests in companies building tomorrow’s capabilities through unique consumer insight and relentless drive. Beyond capital, Vayner/RSE supports its community with access and insights derived across both our investment portfolio and the operating companies we oversee on a daily basis.”

Gary has made investments in some of the most popular tech companies of our era:

- Tumblr

- Uber

6) Fred Wilson

Fred Wilson is a Partner at Union Square Ventures. As put on his website, “Fred Wilson has been a venture capitalist since 1987. He currently is a Partner at Union Square Ventures and also founded Flatiron Partners.”

Some of his most popular investments include:

- Etsy

- Coinbase

7) Chris Dixon

As put on the a16z site, “Chris Dixon is a general partner and has been at Andreessen Horowitz since 2012. He founded and leads a16z crypto, which invests in web3 technologies through four dedicated funds with more than $7 billion under management.”

In addition to investing at Andreessen Horowitz, Chris writes angel checks in various technology companies.

Angel investor firms in New York

In addition to individual angel investors, there are firms dedicated to angel investors that write checks in startups across many stages and sectors. Check out a few of the popular angel investor firms in New York below:

8) New York Angels

As put on their website, “New York Angels is a membership based group of accredited investors who are professionals, entrepreneurs, operators, and industry experts.”

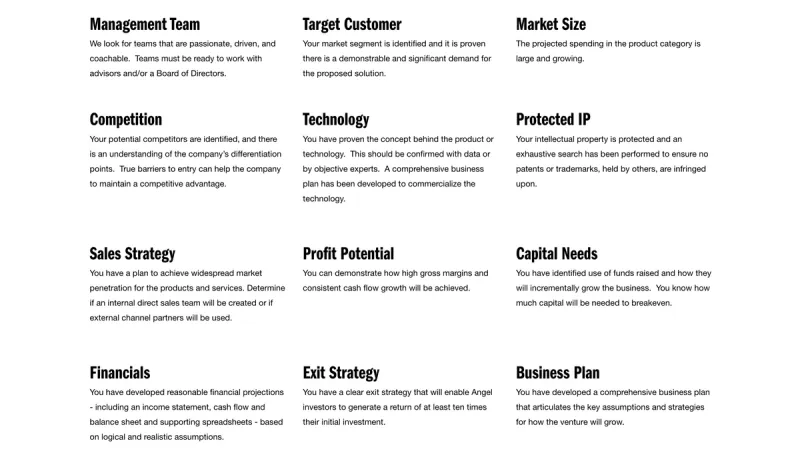

In addition, they share their investment criteria, “In the aggregate, the members of New York Angels invest between $100,000 to $1,500,000 per round in early stage companies. Our members are looking for companies that have an established proof of concept and are poised for growth.”

Some of their most popular investments include:

- Bombas

- Gust

9) 37 Angels

As put on their website, “At 37 Angels, we are committed to:

- Education: Our goal is to shed light on the black box of startup investing for investors and founders through education.

- Transparency: 37 Angels has a process that’s built around clear and open communication for both founders and funders.

- Empathy: Many of our members are former entrepreneurs who understand the highs and lows of business-building.”

10) Pipeline Angels

As put on their website, “Pipeline Angels is changing the face of angel investing and venture capital, as well as creating funding for trans women, cis women, nonbinary, two-spirit, agender, and gender-nonconforming founders.”

Some of their most popular investments include:

- Apothecarry

- Cocomama

- GoldBean

11) Golden Seeds

As put on their website, “We are a discerning group of investors, seeking and funding high-potential, women-led businesses. And creating lasting impact… Golden Seeds accepts applications from women-led companies domiciled in the U.S.

These companies must have at least one woman in an operating role at the C-suite level. Frequently, companies have a female founder or CEO, but we also consider companies with women in other C-level positions.”

12) Empire Angels

As put on their website, “Empire Angels is a diverse group of Millennials investing in early stage ventures with a focus on supporting young entrepreneurs.”

Some of Empire Angels most popular investments include:

- The Infatuation

- Popsy App

- Socure

Connect with investors for your startup with Visible

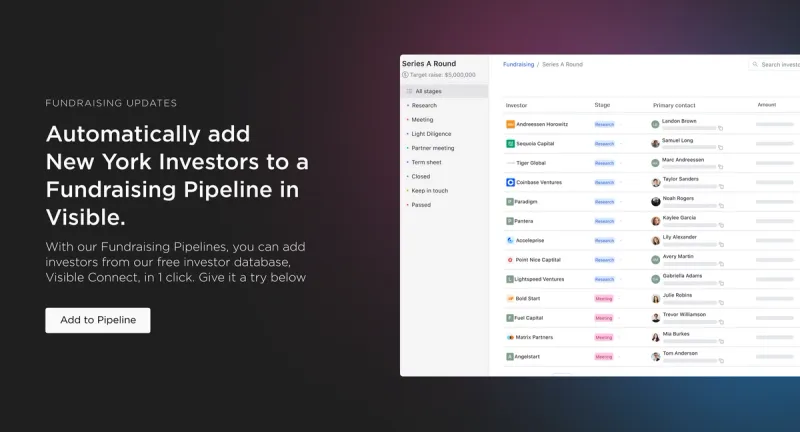

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

Related Resource: A Quick Overview on VC Fund Structure

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

Related Resource: The Top 10 VC Firms for Startups in the Greater New York Area