The foundation of a great relationship between General Partners and their Limited Partners (LPs) is based on trust and transparency. A great way to foster this dynamic is by sending regular, insightful communications to your LPs.

While it can feel intimidating to go outside the box and share details about your fund performance in addition to the standard LP reporting requirements, this is a great way to stand out as a General Partner. With competition for funding being as intense as it is in today's climate, it's a smart move to go above and beyond to impress LPs and establish a trustworthy reputation as a GP.

A guide to LP reporting best practices for VCs

This guide was created in partnership with Aduro Advisors, a premier Fund Admin led by industry veterans. We partnered with Aduro for a webinar where we discussed the process of reporting to Limited Partners and best practices in-depth. This guide is a summary of that discussion.

The contents of this guide include:

- The importance of the LP reporting

- LP reporting best practices

- Sending LP updates as a fundraising strategy

- What to include in an LP Update

- A quarterly LP reporting update template

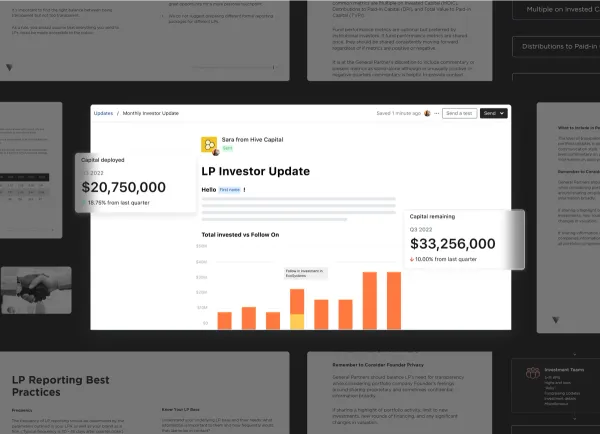

LP update templates for VCs

If you're not sure where to get started with your communication with LPs try checking out LP update templates for VCs or asking other GPs in your network for examples of what they're sharing with LPs.

Some basic LP communication rules to follow include:

1. Send your updates on a regular cadence

2. Go beyond just the basics

3. Be authentic with your communications

4. Don't share sensitive information about your companies

For more tips check out: Tips for Writing LP Updates for Emerging Managers (with Templates)

For more inspiration check out Visible's LP template library for inspiration.

Resources for reporting to LPs for venture capital investors

Check out these additional resources to inspire your next LP communication.