Key Takeaways

-

Investor update software helps VC-backed founders streamline investor communications, build trust, and stay top of mind with current and prospective investors, which can directly support smoother follow-on fundraising.

-

Regular, structured investor updates make it easier to show traction, clarify milestones and challenges, and align with common investor expectations around metrics like MRR, growth, and runway.

-

Look for investor update tools with automated email templates and scheduling so your startup can deliver consistent investor updates without last-minute scrambles or manual copy-paste work.

-

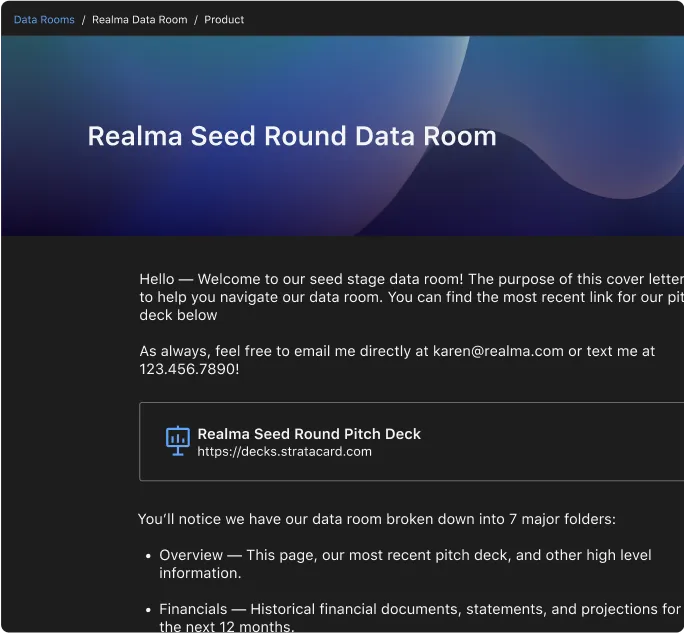

Prioritize platforms that combine an investor CRM with fundraising tracking so you can manage relationships, follow-ups, and pipeline progress in one place instead of scattered docs and spreadsheets.

-

A built-in investor database plus customizable update templates and export options (PDF, PPT, or Word) can help you personalize outreach, share updates in the right format, and run a more efficient fundraising process end to end.

Investor Update Software for VC-Backed Founders

How to streamline investor communications, build trust, and secure future funding

Investor updates are a crucial part of running a VC-backed startup. Regular, well-structured updates keep investors engaged, increase follow-on investment opportunities, and help founders build long-term relationships. Yet, many founders struggle with manual updates, disorganized investor relations, and inefficient tracking.

The right investor update software simplifies the process, automates key tasks, and ensures investors receive the information they need to remain confident in your company’s progress. In this guide, we’ll explore the best investor update software, what features to look for, how to find investors online, and how to choose the right solution for your startup.

1. Why Investor Updates Matter for VC-Backed Startups

Building Strong Investor Relationships

Investors want to hear from the startups they back. Regular updates show transparency, keep investors engaged, and position your company for future fundraising rounds. By keeping investors informed about company progress, founders can foster trust and establish themselves as reliable entrepreneurs. This transparency not only reassures investors but also increases the likelihood of securing additional capital when it's needed. Using a structured investor update email template ensures consistency and clarity in your messaging.

Staying Top of Mind for Future Funding

When your startup is raising its next round, investors who’ve been receiving updates are more likely to participate or introduce you to new investors. Investor updates can serve as a soft touchpoint, reminding investors of your startup’s progress. A well-crafted investor update keeps investors excited about your company's growth, helping you leverage warm connections rather than starting from scratch when it’s time to fundraise. Many founders look for the best investor update software free solutions to streamline this process and maintain engagement without incurring high costs.

Streamlining Investor Relations

Managing investor updates manually is time-consuming. Software tools automate the process, provide structured templates, and ensure consistency in communication. A strong investor relations strategy relies on tools that make managing updates effortless and efficient. Instead of spending hours compiling emails and tracking down performance data, founders can use investor relationship management software to automate the process, ensuring timely, informative, and structured investor communication.

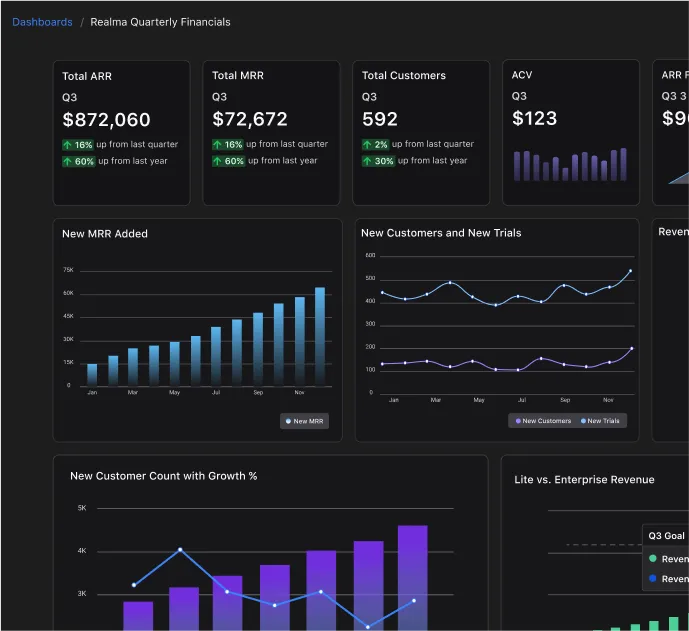

Investor Expectations for Updates

Most VCs expect structured investor updates that include key insights into company performance. They typically look for financial metrics like MRR (monthly recurring revenue), growth rate, and runway to assess business health. Additionally, updates should cover recent milestones and challenges, hiring updates, and any requests for help—whether it’s introductions to other investors, hiring needs, or strategic advice. Many founders use an investor update template free download to ensure they include all the necessary details and maintain a professional format.

2. Key Features to Look for in Investor Update Software

Automated Email Templates & Scheduling

Look for tools offering pre-built investor update templates (e.g., Y Combinator investor update template) with scheduling features to keep investors consistently informed. Automated investor updates ensure timely and structured communication. Scheduling tools help founders set up updates in advance, preventing delays due to last-minute preparation. Some platforms also provide investor update template Word and PDF formats, making it easier to share updates in different formats.

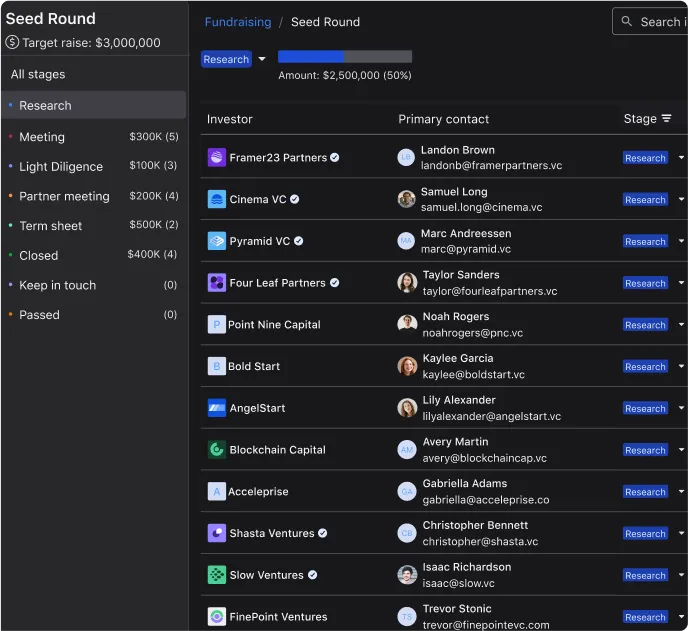

CRM for Investor Relations

Investor CRM functionality helps track investor interactions, manage fundraising pipelines, and segment investors based on engagement. A robust investor relations CRM consolidates all investor communication into a single platform, ensuring that no interaction is overlooked. This makes it easier to keep track of investor preferences, past conversations, and follow-ups, allowing for a more personalized engagement strategy. Many founders look for the best CRM for investor relations to streamline their investor outreach and fundraising efforts.

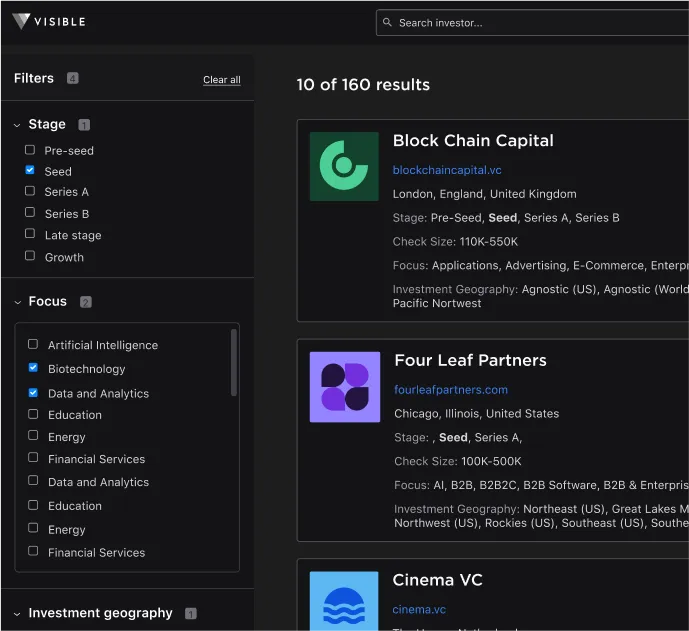

Investor Database Access

Some investor update tools include built-in databases, allowing founders to find investors online and access a free investor database for prospecting. A strong investor search platform can connect founders with potential investors actively looking for startups. By leveraging these databases, founders can identify relevant investors based on industry, investment stage, and geography, improving the efficiency of fundraising efforts. Some platforms even offer investor database Excel templates if there is a need to export the data.

Customizable Update Templates

The best investor update software provides options to export updates in PDF, PPT, or Word formats for investor presentations. A well-structured investor update template PDF or investor update template PPT ensures updates are digestible and visually appealing, but a software-based update is even better. Customizing templates to highlight the most critical information helps investors quickly grasp company performance and areas where they can provide support. Founders who need flexibility often search for investor update template free options to tailor updates to their needs.

Fundraising Tracking

Managing investor outreach efficiently is key to a smooth fundraising process. The best tools track investor interest, responses, and commitments. Many startup fundraising platforms integrate these features to help founders optimize their fundraising process. This eliminates the guesswork from investor relations by providing clear insights into which investors are engaged and which require additional follow-up. Some founders use startup fundraising software free options to test different platforms before committing to a paid solution.

3. Choosing the Investor Update Software for Your Startup

Choosing the right investor update software makes VC-backed fundraising easier, strengthens investor relationships, and ensures founders stay organized. Managing investor relations efficiently not only saves time but also increases the likelihood of securing follow-on funding. Many founders begin by searching for where to find investors for startup funding before realizing that structured investor updates play a critical role in ongoing investor engagement.

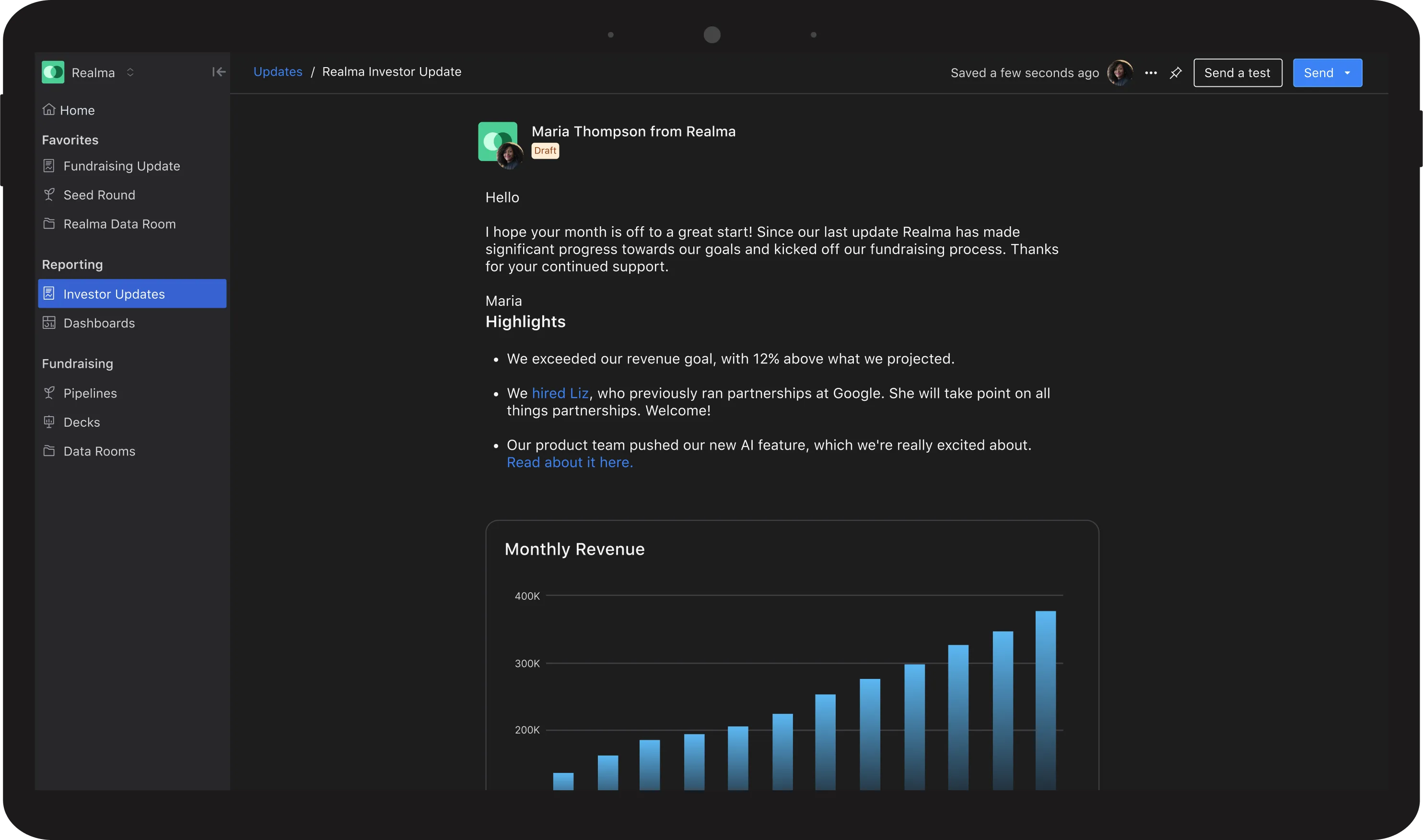

Founders looking to automate investor updates, manage investor relationships, and optimize fundraising should consider Visible as their go-to solution. With a robust feature set designed for startups, Visible makes investor communication seamless and effective. Whether you need an investor CRM template or a full-scale investor search platform free solution, the right tool will help you stay ahead.

If you're still deciding on a solution, this breakdown of key investor reporting software features can help you evaluate tools based on automation, branding, analytics, and integration capabilities.

Frequently Asked Questions

What is investor update software?

Investor update software helps founders create, send, and track regular investor updates in one place. It typically includes update templates, email sending, and performance tracking, plus investor contact management. The goal is to share progress, metrics, and asks consistently while saving time and keeping investor communication organized.

Why should startups use investor update software instead of email and spreadsheets?

Investor update software reduces manual work and missed follow-ups by centralizing contacts, templates, and sending history. Instead of copying metrics into endless threads, founders can standardize updates, track opens and replies, and keep a clear record of investor conversations. This consistency helps build trust and supports future fundraising.

What should a founder include in an investor update using investor update software?

A strong investor update includes a quick summary, key metrics (revenue, growth, burn, runway), product and go-to-market progress, wins and risks, and clear asks. Investor update software makes it easier to maintain this structure each month and ensures stakeholders receive the same decision-ready information.

How often should you send investor updates using investor update software?

Most VC-backed startups send investor updates monthly, while earlier-stage teams sometimes send them every 4 to 6 weeks. Investor update software helps you maintain a reliable cadence with reminders and repeatable formatting. The best frequency is the one you can sustain while reporting meaningful progress and upcoming needs.

What features should you look for in investor update software?

Look for investor update software with templates, scheduling, and easy export options, plus an investor CRM to manage contacts and segmentation. Useful additions include engagement tracking, collaboration, and a place to store key fundraising and reporting materials. Choose tools that reduce friction so updates stay consistent during busy periods.

Can investor update software help with fundraising?

Yes. Investor update software supports fundraising by keeping investors informed, documenting progress, and making it easier to share traction over time. Consistent updates can warm up potential future backers and prompt introductions when you have a specific ask. Centralized history also helps you prepare for diligence and follow-up outreach.