Investor Reporting Meaning & Definition

Put simply, the definition of investor reporting is the act of sharing key qualitative and quantitative data with your financial investors. Investor reporting can look different for different companies, depending on the company stage and vertical. A pre-revenue company may share a light, qualitative investor report, while a publicly traded company is obliged to share an in-depth report covering everything from executive compensation to granular financials. Whether a company is just 2 founders in a garage or 30000 employees spread across the globe, investor reporting is a vital part of running a successful business.

Investor reporting can also take place outside of a physical report. The function of investor reporting, or an investor relations team, also covers board meetings, press conferences, releasing financial data, etc. For a publicly traded company, the meaning of investor reporting involves more regulation and knowledge of government policy. Whereas a startup will communicate directly with their investors, an investor reporting team at a publicly held company primarily deals with analysts who are responsible for providing an opinion to the public on the potential of investment in said company.

At a startup, or privately held company, the meaning of investor reporting slightly changes. Instead of focusing on sharing financial and legal information for the public to make an investment decision, privately held companies often focus on engaging and leveraging their investors. Unlike a publicly held company, a privately held company is not legally obliged to report to their investors. However, the numbers show that companies who have taken on venture capital it is beneficial to practice investor reporting. According to our data, companies that regularly communicate to their current investors are twice as likely to raise follow-on funding.

Outside of the increasing the likelihood of raising follow on funding reporting to your private investors has other benefits. Chances are if you have accepted venture capital, the venture capitalist and partners at the firm can offer you a wealth of knowledge, experience, and introductions. By practicing investor reporting, founders can build a relationship with their investors and increase their chances of receiving help, time, and introductions from their investors.

Related Resource: How to Build a Strong Investor Relations Strategy

Investor Reporting Software

While most startup founders and leaders know they should be sending investor reports, it can often get lost in the shuffle of building a great product, repeatable sales process, and attracting top talent. To help combat this, there are several solutions and products that help relieve the stress of investor reporting and build a professional and repeatable investor reporting process.

The most common investor reporting solution is a simple email update template. These are generally sent on a monthly or quarterly basis and include a recap from the previous period, important company key performance indicators, big wins, losses, and asks for your investors.

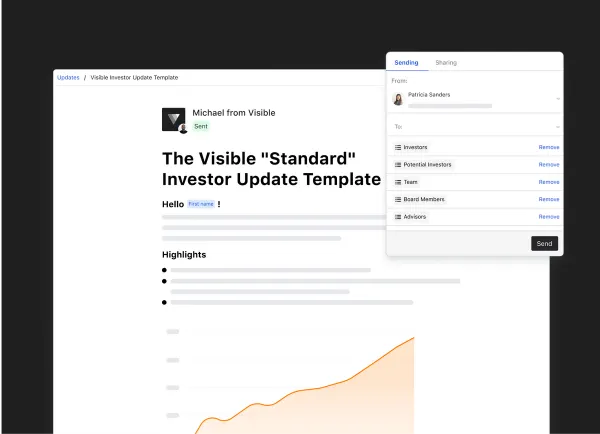

Visible Updates are a solution to bring a professional, beautiful, and engaging touch to your investor updates. Visible allows you to connect your key data, build beautiful charts, and add qualitative data to create beautiful investor updates. Send your Visible Investor Updates via email, slack, or PDF. In turn, we’ll provide engagement statistics to see how your investors are interacting with your Updates.

Visible also allows founders to segment different groups of investors and different stakeholders. For example, a founder may want to send a more in-depth investor report to their board members and maybe a liter version to their less engaged investors. Investor reports can also be used as a means to nurture potential investors. No matter how you define investor reporting, it can be a vital—and often overlooked—aspect of building a strong venture-backed business.

Investor Email Templates and Examples

Investor Relations Examples

As mentioned above, investor relations and reporting can take different forms. Investor relations examples vary greatly from public to private companies, and from early stage to growth stage companies. We’ve highlighted a few of our favorite investor relations examples below. For the examples, we’ll share they are generally intended to be sent on a monthly basis. We’ve also created a library of great investor relations examples.

Related Resource: Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors

Monthly Update Email Templates

Our standard startup investor reporting example The standard investor reporting template by the team at Visible. What we have found to be best practices for investor reporting collected from our users and investor thought leaders.

Techstars Minimum Viable Investor Update Email Template In the “Minimum Viable Investor Update”, Jens Lapinski, Former Managing Director of Techstars METRO, lays out 3 items that he finds most useful in his portfolio company updates.

Founder Collective “Fill-in-the-blank” Investor Update Email Template An investor Update template for busy founders put together by the team at Founder Collective. Simply fill out the bolded sections and have your investor Updates out the door in no time.

Kima Ventures Investor Update Email Template A monthly update email template put together by Jean and the team at Kima. Quickly fill in the quantitative and qualitative data Kima finds most useful.

GitLab Investor Update Email Template A 6 part monthly update email template put together by the team at GitLab. Built for investors to quickly read and locate the information that is most relevant to them.

Shoelace: Investor Update Email Template A monthly update email template based off of Reza Khadjavi’s, Founder & CEO of Shoelace, investor update email used to wow investors.

Coding VC: Investor Update Email Template A monthly investor update email template from Leo Polovets, the general partner at Sosa Ventures, consisting of 5 sections that can be repeated on a monthly basis.

Y Combinator Investor Update TemplateA monthly investor update email template from Aaron Harris of Y Combinator focusing on major KPIs and asks for your investors.

Other Monthly Update Email Templates

Outside of regularly sending your investors monthly email templates, founders will also want to send other stakeholders email reports. This can include your team, individual business units, advisors, clients, etc. We’ve highlighted a few of our favorite stakeholder update email templates below:

The CEO Note Template An Update to share information across your company using different methods and styles used by leaders like Marc Benioff, Scott Dorsey, and Kyle Porter.

Fred Wilson: The Weekly Update Email A template based off of Fred Wilson’s Weekly Email intended for founders to share what’s on their mind, what happened the past week, and what’s on the schedule for the upcoming week.

All-Hands Team Update Email Template An Update template intended to share before your next All-Hands meeting or share after to summarize the meeting. Largely based off of Square’s Town Hall meetings and is broken into 3 major categories; The Team, Mission & Goals, and Agenda & Questions.

Pre-Board Meeting Update Email Template A Pre-Board Meeting Update Template that you can share with your board to help you make the most of your meeting time. By sending over a quick packet before your next meeting it will allow everyone to have time to prepare and come ready to discuss the topics that truly matter to the business.

V2MOM Monthly Update Email Template V2MOM is a management process and acronym standing for vision, values, mission, objectives, and measures.

Portfolio Management Software for Investors

While it falls on the shoulders of founders and company operators to report to their investors, it is also important for investors to engage their portfolio companies and transform their portfolio company data into valuable information. A quick reminder from investors to their portfolio companies can help increase the odds of receiving an investor report or data from portfolio companies. Staying on top of portfolio companies allows investors to lend a hand to help the company with their challenges, in turn increasing their portfolio companies’ value.

To help investors stay on top of their portfolio, and report to their own investors, there is portfolio management software for investors. At Visible, we have created our own portfolio management software for investors, Visible for Investors.

Using portfolio management software, investors can easily lend a hand to their companies and turn their data into actionable reports that can be shared and used across the portfolio. In turn, investors can use this to manage their own investors or limited partners. Investor software generally operates like a traditional customer relationship manager with the customer being their portfolio companies and founders.

Our Portfolio Management Software.

Visible for investors is investor software to help stay engaged with your founders right from your pocket. Using portfolio management software be the value-add investor that you want to be. Tap into your experience, network, and resources to jump in and help your investments when you see indicators that they may be struggling.

Managing an entire portfolio can be tough. Using our portfolio management software easily centralize all of your vital information in one place. From sentiment to investment memos, you’ll be able to customize your Visible instance to your needs.

Using automated update request, create your own unique investor report to your firm. Automatically send update requests to your portfolio companies, with scheduled follow-ups, to receive consistent data across your portfolio. Prompt for key metrics, files, operating information and qualitative updates.

Investor Management Software

Everything we build at Visible is focused on the founder. To help complete the investor Update request founder’s can take advantage of our existing investor management software to tap into our learnings and resources. Easily use our integrations and API to automatically fulfill any investor request.

Investor reporting has never been easier with the combination of our investor engagement software and portfolio management software for investors.

What is Investor Relations?

According to the National Investor Relations Institute, “Investor Relations is a strategic management responsibility that is capable of integrating finance, communication, marketing and securities law compliance to enable the most effective two-way communication between a company, the financial community, and other constituencies, which ultimately contributes to a company’s securities achieving fair valuation.”

As we discussed earlier, investor relations can take different forms depending on the owners of the business. Investor relations for a publicly held company will greatly vary than the investor relations for a privately held, venture-backed business. While not required, the benefits of investor relations for a privately held company are instrumental in the growth and health of the company. Sending a simple email update, or creating an investor relations website, allows privately held companies to tap into their investors’ network, experience, knowledge, and ultimately additional capital.

At a publicly traded company investor relations is legally obliged to have an internal investor relations team, meet certain requirements, and have the information audited. Often a larger team, the investor relations department is responsible for hosting an investor relations website for the public to access their key information to gather as much information as possible before investing. According to Investopedia, “IR teams are typically tasked with coordinating shareholder meetings and press conferences, releasing financial data, leading financial analyst briefings, publishing reports to the Securities and Exchange Commission (SEC), and handling the public side of any financial crisis.”

Benefits & Importance of Investor Relations

On the public side, the importance of investor relations is pretty clear. The role is to provide the analyst with vital and required information who in turn who provide public opinion on the company as an investment opportunity. By creating internal audits and becoming the source of truth between all business units. IR can manage an analyst’ expectations in turn influences the overall investment community showing the importance of investor relations in a big way.

On the flip side, we have investor relations for privately held companies. In the total opposite fashion, privately held companies are in no way obliged to release their financials and meet any requirements from their investors. However, the benefits and importance of investor relations for a startup can be monumental in the company’s growth and health. The biggest benefit of investor relations is the likelihood of raising additional capital. Venture-backed businesses who send their investors monthly reports are twice as likely to raise follow on funding. As Jason Calacanis, famous angel investor, puts it; “There is another really awesome reason to keep investors updated: they didn’t give you all of their money — they have more! They want to give you more!”

Another benefit of investor relations? The investors have likely been in the same situation or encountered it with other investments. At the end of the day, an investors job is to make investments that generate returns for their investors. By using investor relations to share bad news, your investors can step in and help get your company back on track with their depth of knowledge, experience, networks, and capital. All in all, the importance of investors relations at a venture-backed company is vital when it comes to attracting additional capital and talent.

Investor Relations Salary and Jobs

Since the Public Company Accounting Reform and Investor Protection Act, was passed in 2002 the marketplace for investor relations jobs has greatly increased. An investor relations manager job can cover different facets of a business, but generally involve supporting the release of financial information, investor reports, and legal diligence.

Investor relations responsibilities are vital to the life of a business from both the legal and operational standpoint. Investor relations jobs are often found as a subset of the companies public relations or finance department. From a legal standpoint, an investor relations manager is responsible for fulfilling legal requirements and financial documentation. Investor relations managers take company financials and data to turn them into compelling data stories that can be shared with analysts and eventually the public. Investor relations managers need to determine what data will affect the public shareholders and present that in an understandable and compelling way. From an internal standpoint, an investor relations manager is responsible for managing crisis and collecting feedback and passing that along to upper management. As CFI puts it, “Communication is also a two-way street; the IR department is also responsible for forwarding input from significant stakeholders of the company to management. During times of crisis (financial or otherwise), the IR department will advise management with a goal to preserve the company’s relationship with its investors, as well as to mitigate any damage to share prices.”

According to Salary.com, an investor relations managers salary typically falls between $100,000 and $140,000. Of course, investor relations salary fluctuates depending on experience, education, certifications, etc. On the flip side, there are also investor relations firms that publicly traded companies can use to take on their investor relations responsibilities. The investor relations salary at a company or at an investor relations firm tend to be in the same range. A couple of popular investor relations firm include, KCSA Strategies, Liolis, and Al Petrie Advisors.

Related resource: Discounted Cash Flow (DCF) Analysis: The Purpose, Formula, and How it Works