Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

Customer Stories

Building Trust and Vulnerability in Business with Max Yoder

On the fourth episode of the Thrive Through Connection Podcast, we welcome Max Yoder, the Founder of Lessonly and author of Do Better Work. Lessonly was an Indianapolis-based company that grew to over 300 employees and $30 million in annual recurring revenue before being acquired by Seismic in 2021. Max joins us to share the lessons he learned from scaling Lessonly and writing Do Better Work.

About Max

In addition to growing Lessonly to 300+ employees and leading it through a successful exit, Max became known for his thoughtful approach to leadership, insights he captured in his book, Do Better Work. He’s had a front-row seat to the highs, lows, and daily challenges that startup founders and leaders face. In this episode, Max breaks down the countless relationships that shaped both Lessonly and Do Better Work.

Mike, the CEO and Founder of Visible, had an opportunity to sit down and chat with Max. You can give the full episode a listen below:

Spotify Link

Apple Link

What You Can Expect to Learn from Max

How the mission and vision for Lessonly came to life

How mentors helped shape decision-making and strategy in the early days

The advantages of having a strong network

What it means to lead with vulnerability

The importance of aligning with investors and partners

Stay up to date with the Thrive Through Connection Podcast by subscribing wherever you listen to your podcast. You can find links to your favorite podcast hosts below:

YouTube

Spotify

Apple

Fundraising

Finding the Right Investors with Laurel Hess

Reporting

Navigating Investor Relationships with Brett Brohl

Fundraising

Going From Operator to Funder with Leo Polovets

Fundraising

View all

founders

Unlock Capital in Italy: Top VCs, Trends, and Resources for Startup Success

Italy’s startup ecosystem is no longer flying under the radar. In 2025, Italian startups are smashing records, raising over €1.3 billion in 2024 and an impressive €504 million in Q1 2025 alone—outpacing much of Europe’s growth and drawing the eyes of global investors. From Milan’s fintech skyscrapers to Turin’s deeptech labs and Rome’s digital disruptors, Italy is now recognized as one of the continent’s fastest-growing innovation hubs.

What’s fueling this momentum? Here are some of the top factors:

A new generation of ambitious founders building in sectors like fintech, healthtech, space, and sustainability

Major government and EU incentives making it easier than ever to launch and scale

A maturing venture capital scene—with both homegrown funds and international giants competing for the best deals

A collaborative culture where over 60% of startups partner with universities, corporates, and research centers to accelerate growth.

This guide is for startup founders—whether you’re based in Italy or looking to expand from the United States—who are actively seeking funding in the region. Here, you’ll find an up-to-date list of the top venture capital firms investing in Italian startups, along with actionable insights on fundraising strategies, current ecosystem trends, essential networking opportunities, and local resources that can help you build and scale your business in Italy.

Top VCs in Italy

Innogest Capital

About: Italy’s startup ecosystem is evolving rapidly, offering both exciting opportunities and unique challenges for founders. In 2024, the country is seeing record investment, sectoral innovation, and a maturing support infrastructure—making it an increasingly attractive destination for entrepreneurs and investors alike.

Oltre Venture

About: Oltre Venture is the first Italian social venture capital company—an innovative financial tool supporting the social sector. Its goal is to finance and support the development of businesses capable of combining economic sustainability with social value. These businesses address the “grey area” of hidden hardship and socio-economic vulnerability, characterized by housing difficulties, job insecurity, loneliness, and social exclusion.

United Ventures

About: At United Ventures we look for daring entrepreneurs willing to develop innovative products and technologies, who acknowledge the challenges and risks of our times and still crave to come out on top in business. As entrepreneurs ourselves, our mission is to spot winners and drive them to achieve success and worldwide recognition through our mentorship, financial and business development support.

With a long-standing track record of both start-up and scale-up technological companies, we can boast the industry expertise, mentorship and business networking that it takes to create a success story.

Thesis: Thanks to our multistage strategy we can provide support and funding across all the stages of new ventures, by investing seed stage, early stage and growth capital, with both start-up companies and estabilished ones launching onto new markets.

Club Italia

About: Club Italia Investimenti 2 is an investment company based in Milan specializing in venture capital. The company was founded in 2013 by a group of entrepreneurs connected to the world of innovation and investments in promising young companies with high technological content.

CDP Venture Capital SGR

About: We are the largest venture capital manager in Italy and among the largest in Europe. We were established through a systemic approach to managing public and private resources, with the aim of creating a market operator capable of combining returns on invested capital with support for market development.

We operate in strategic sectors for the future by investing directly and indirectly in startups, innovative SMEs, and venture capital funds, in order to create a market infrastructure that can support the entire lifecycle of new businesses.

Club Digitale

About: Club Digitale, created by SiamoSoci, aims to contribute to the growth of the digital sector in Italy by providing the best startups in the country with the capital they need to develop their businesses. Club Digitale acquires equity stakes in a selection of startups that are completing an acceleration process at the project’s partner incubators.

The accelerators are run by successful entrepreneurs from the digital and technology sectors, and thanks to their experience, they now serve as centers of excellence for scouting, selecting, and supporting innovative, technology-driven startups. The mechanism we have built both simplifies access to venture capital for startups and allows Club Digitale members to benefit from an economic segment with a high growth rate.

Key Trends and Opportunities in the Italian Startup Ecosystem

Italy’s startup ecosystem in 2025 is demonstrating remarkable resilience and dynamism, with new records in investment, sectoral innovation, and internationalization. For founders, the landscape is more promising—and competitive—than ever.

Strong Investment Momentum and Sector Growth

Italian startups raised over €1.3 billion in 2024, and the momentum has continued into 2025, with €504 million raised in Q1 alone. This stability is notable, especially as other major European markets have seen declines. The Italian ecosystem is now recognized as one of the fastest-growing in Europe, with a 28% year-on-year increase in startup investments (StartupBusiness, 2025).

Key sectors driving this growth include:

Fintech: Startups like Satispay and Nexi are leading digital payments, neobanking, and blockchain innovation, supported by a favorable regulatory environment.

Space and Deeptech: Companies such as D-Orbit (raised €150M in 2024) are putting Italy on the map for space logistics and advanced tech.

Healthtech: Telemedicine, AI diagnostics, and digital health management are transforming healthcare access and efficiency.

FoodTech & Agritech: Startups like xFarm (raised €36M) are innovating in sustainable agriculture and food supply chains.

Sustainability & Circular Economy: There’s a surge in startups focused on renewable energy, waste management, and sustainable consumption, often with EU and government backing.

Notable recent deals (2024–2025):

D-Orbit (space logistics): €150M

Bending Spoons (mobile apps): €144.4M

Alps Blockchain (blockchain infrastructure): €105M

Satispay (fintech): €60M

xFarm (agritech): €36M

BizAway (corporate travel): €35M

LimoLane (mobility): €35M

Cyber Guru (cybersecurity):$25M

Hui (SaaS):$25M

Casavo (proptech): €20M

Government and EU Support: Incentives and Programs

The Italian government continues to roll out new incentives, grants, and regulatory reforms to support innovation. The DdL Concorrenza and ongoing EU programs like Horizon Europe are providing significant resources for R&D, internationalization, and digital transformation. Programs like Smart&Start Italia and CDP Venture Capital SGR are also key sources of funding and support for early-stage startups.

Collaboration and Ecosystem Maturity

Corporate Partnerships: Over 60% of Italian startups now collaborate with universities, research centers, and large corporates, gaining access to capital, expertise, and new markets. These partnerships are crucial for scaling and credibility, though founders should be prepared for cultural and operational differences.

Incubators and Accelerators: Nearly half of startups leverage incubators, accelerators, and innovation hubs for technical support, mentorship, and investor access. Milan, Rome, and Turin are home to many of these resources.

Regional Hubs and Internationalization

Regional Hubs: Milan remains the epicenter, but Turin (mobility, aerospace) and Rome (digital, public sector) are rapidly growing as innovation hubs. Northern Italy still attracts the majority of investment, but opportunities are emerging in the South and other regions as local ecosystems develop.

Internationalization: Italian startups are increasingly expanding abroad and attracting foreign investment. Participation in global events and partnerships with international corporates are now common strategies for growth.

Talent, Education, and Community

Italy’s talent pool is deepening, thanks to universities offering innovation-focused programs and a growing number of professionals with technical and entrepreneurial skills. Community events, meetups, and industry associations (like Italian Tech Alliance) provide valuable networking and learning opportunities.

Challenges: What Founders Should Watch For

Late-Stage Funding Gaps: While early-stage capital is abundant, late-stage and growth funding remain limited. Founders may need to look abroad for larger rounds.

Bureaucracy and Regulation: Navigating Italian bureaucracy can be complex. Engaging local advisors and leveraging government programs can help.

Cultural Nuances: Building trust and relationships is essential. Expect longer sales cycles and negotiation periods, especially with large corporates.

Actionable Opportunities for Founders

Leverage government and EU incentives for R&D, hiring, and internationalization.

Engage with local incubators, accelerators, and industry associations for mentorship and investor access.

Build strategic partnerships with corporates and universities to accelerate growth and credibility.

Focus on high-growth sectors like fintech, healthtech, sustainability, and foodtech.

Consider international expansion early, especially if targeting larger funding rounds or global markets.

Networking Opportunities and Local Resources for Founders in Italy

Building a successful startup in Italy goes beyond securing funding; it requires immersing yourself in the local ecosystem, leveraging key networks, and tapping into available resources. For founders, especially those new to the Italian scene, understanding where to connect and what support is available can be a game-changer.

Key Networking Opportunities

Networking is paramount in Italy, where relationships often open doors to investors, partners, and talent.

Industry Events and Conferences:

Italian Tech Week: A major annual event in Milan that brings together founders, investors, and industry leaders. It's an excellent opportunity for high-level networking and staying abreast of ecosystem trends.

StartupItalia Open Summit: Another significant event that showcases Italian innovation, connecting startups with investors and corporate partners.

International Events with Italian Presence: Events like Slush, Web Summit, and VivaTech often have dedicated Italian delegations or pavilions, offering opportunities to connect with Italian VCs and founders on a global stage.

Business Angels Networks:

Italian Business Angels Network (IBAN): The oldest and largest association of business angels in Italy, facilitating connections between angel investors and startups seeking early-stage capital. While IBAN doesn't invest directly, its events and network are invaluable.

Club degli Investitori: An angel network of over 300 entrepreneurs and professionals who invest in startups and scaleups, providing both capital and mentorship.

Italian Angels for Growth (IAG): A prominent network of business angels, entrepreneurs, and firms that pool resources and expertise to foster innovation. They offer access to experienced investors and their business networks.

Local Resources and Support Systems

Accelerators and Incubators:

LVenture Group: A leading accelerator based in Rome, providing pre-seed and seed-stage startups with funding, mentorship, and access to a vast network.

Startupbootcamp: Has programs in Italy, offering sector-specific acceleration for fintech, IoT, and other areas.

Polihub (Politecnico di Milano): The university incubator of Politecnico di Milano, supporting deep tech and research-intensive startups.

Other Regional Hubs: Explore local incubators and accelerators in cities like Turin (I3P at Politecnico di Torino) and Bologna (G-Factor).

Government and Public Initiatives:

CDP Venture Capital SGR – Fondo Nazionale Innovazione: As the largest institutional investor, CDP Venture Capital plays a crucial role in developing the Italian VC ecosystem. They manage various funds and initiatives to support startups across all stages.

Invitalia: The National Agency for Inward Investment and Economic Development, offering incentives, grants, and support programs for new businesses and innovative startups.

Smart&Start Italia: A program managed by Invitalia that provides non-repayable grants and subsidized loans for innovative startups, particularly those focused on digital economy, sustainable development, and social innovation.

Industry Associations and Ecosystem Builders:

Italian Tech Alliance: The national association representing venture capitalists, innovation investors, and startups. They are a key voice for the ecosystem and provide valuable reports and networking opportunities.

StartupItalia: A leading media platform and community hub for Italian startups, offering news, insights, and event listings.

Connect With Investors in Italy Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of Italy's investors here.

Track your conversations and move them through your funnel with our Fundraising CRM

Share your pitch deck and monthly updates with potential investors

Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

founders

Fundraising in Birmingham: VCs, Accelerators, and Startup Resources

Imagine launching your startup in a city where the cost of living is low, the talent pool is deep, and the community is genuinely invested in your success. Welcome to Birmingham, Alabama—a city that’s quietly but confidently becoming one of the Southeast’s most exciting destinations for founders and venture capital.

Once known for its steel and smokestacks, Birmingham is now forging a new identity as a magnet for innovation. The city’s startup scene is buzzing with energy, fueled by a new generation of ambitious founders, supportive investors, and a network of accelerators and incubators that rival those in much larger markets. Whether you’re building in healthtech, fintech, SaaS, or beyond, Birmingham offers the resources, connections, and grit to help you scale.

This guide is a resource for founders seeking venture capital in Birmingham. We’ll highlight the top VC firms currently funding startups in the city, actionable insights on fundraising in Birmingham, current ecosystem trends, key networking opportunities, and local resources to help you build and scale your company.

Top VCs and Incubators in Birmingham

New Capital Partners

About: New Capital Partners is an Alabama-based private equity firm that manages private equity and economic development funds.

Sweetspot check size: $ 15M

Thesis: We are a group of former operators that now partner with founders and management teams of growth stage businesses to help accelerate the growth through our experience building great companies, industry relationships, access to capital, and investment expertise.

Alabama Futures Fund

About: Our Fund seeks to be the first significant investment in an early-stage venture that can reach attainable milestones leading to series A financing within 12-24 months. Our sweet spot is companies that have adaptable and coachable founding teams who have identified a significant customer problem and are working towards product market fit. This includes companies at the minimum viable product, pre-revenue and early revenue stages. Because of the risks involved in investing this early, our preference is to stage capital relative to milestones achieved. Therefore, we reserve significant capital for follow-on investments in our most promising companies.

AIM Group

About: Collective Capital Ventures is a unique self-directed venture capital model that enables you to build an automatically diversified portfolio while gaining access to 30+ vetted investment opportunities in high-growth technology companies. We provide the venture capital experience with flexibility for the individual investor.

Alabama Launchpad

About: Alabama Launchpad helps high growth companies start, stay and grow in Alabama while supporting, advocating, and recognizing entrepreneurship statewide. Alabama Launchpad is a program of the Economic Development Partnership of Alabama.

Innovation Depot

About: Our vision is for Innovation Depot to be recognized as one of the best incubators in the country, where entrepreneurs pursue their startup dreams, build dynamic teams, and contribute to the growth of Birmingham. We aim to be the go-to destination for every tech enthusiast in the city, fostering a vibrant community of founders, startup employees, investors, and supporters. We want our building to feel like home, a place where countless hours are spent turning ideas into reality, and where everyone feels welcomed and valued. This is the place to be for innovation, collaboration, and success.

Why Birmingham Is a Growing Startup Hub: Key Advantages for Founders

Affordable Cost of Living and Quality of Life

One of Birmingham’s standout features is its affordability. The cost of living is significantly lower than in major tech hubs like San Francisco, New York, or even Atlanta, allowing founders to stretch their runway further and attract top talent without the high salary demands of larger cities. This affordability extends to office space, housing, and everyday expenses, making it easier for startups to operate lean and invest more in growth.

Access to Skilled Talent

Birmingham is home to several respected universities and research institutions, including the University of Alabama at Birmingham (UAB), and Samford University. These institutions produce a steady pipeline of skilled graduates in fields like engineering, computer science, healthcare, and business. UAB, in particular, is a nationally recognized leader in medical research and innovation, fueling the city’s strength in healthtech and biotech startups.

Supportive Startup Infrastructure

The city’s startup infrastructure has grown significantly in recent years. Organizations like Innovation Depot—one of the largest tech incubators in the Southeast—provide founders with affordable workspace, mentorship, and access to a vibrant community of entrepreneurs. Other resources, such as the Birmingham Business Alliance and Techstars Alabama Power EnergyTech Accelerator, offer programs, funding, and networking opportunities tailored to early-stage companies.

Notable Startup Success Stories

Birmingham’s ecosystem is gaining national attention thanks to high-profile exits and funding rounds. Companies like Shipt (acquired by Target for$550 million), Ensora Health, and Fleetio have demonstrated that Birmingham startups can scale and succeed on a national stage.

Networking Opportunities and Startup Events in Birmingham

Networking is the lifeblood of Birmingham’s startup ecosystem. For founders, building relationships with investors, mentors, and fellow entrepreneurs can open doors to funding, partnerships, and invaluable advice. Birmingham offers a range of high-impact events and organizations that make it easy for founders to plug into the local community and accelerate their growth.

Major Recurring Events and Conferences

Sloss Tech is the city’s premier technology conference, attracting national speakers and hundreds of attendees each year. It’s a must-attend for founders looking to connect with the broader tech community and stay on top of industry trends.

Innovation Depot Event Calendar from demo days to workshops and networking sessions you can find multiple events to connect and learn.

Birmingham Venture Club Events provide a platform for founders to meet investors and learn from successful entrepreneurs through luncheons, panels, and pitch events.

Pitch Competitions and Accelerator Demo Days

Participating in pitch competitions and accelerator demo days is a proven way to gain exposure and feedback.

Velocity Accelerator Demo Day is a highlight for early-stage startups, offering a chance to present to a room full of investors and community leaders.

Alabama Launchpad is a statewide competition that awards non-dilutive funding to promising startups and provides valuable pitch experience.

Key Organizations and Community Hubs

Innovation Depot serves as the central hub for Birmingham’s startup activity, offering coworking space, mentorship, and a packed events calendar.

Birmingham Venture Club is a go-to for founders seeking to build relationships with local investors and business leaders.

Local Resources and Support for Birmingham Startup Founders

Building a successful startup takes more than just a great idea—it requires access to the right resources, support systems, and community connections. Birmingham, Alabama, offers a wealth of local resources designed to help founders at every stage of their entrepreneurial journey. Leveraging these assets can accelerate growth, reduce risk, and connect you with the expertise and capital you need to thrive.

Incubators, Accelerators, and Coworking Spaces

Innovation Depot is the region’s flagship tech incubator, offering affordable office space, mentorship, and access to a vibrant community of entrepreneurs. Its programs include the Velocity Accelerator, which provides seed funding, intensive mentorship, and a structured curriculum for early-stage startups.

Forge is a modern coworking space in downtown Birmingham that caters to startups, freelancers, and remote teams. Forge hosts regular networking events and workshops, making it a great place to build connections and find collaborators (Forge).

Local Government and Economic Development Initiatives

Birmingham Business Alliance (BBA) supports startups through advocacy, business development programs, and connections to local investors and partners.

Alabama Launchpad is a statewide startup competition that awards non-dilutive funding and provides valuable exposure to investors and mentors.

City of Birmingham Office of Innovation and Economic Opportunity offers resources and programs to help startups navigate permitting, incentives, and local business regulations.

Connect With Investors in Birmingham Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of Birmingham's investors here.

Track your conversations and move them through your funnel with our Fundraising CRM

Share your pitch deck and monthly updates with potential investors

Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

founders

Unlocking Capital in Memphis: Top VCs and Startup Support

Memphis, Tennessee, is rapidly redefining its reputation—emerging not only as a city rich in culture and history but also as a strategic hub for innovation and entrepreneurial growth in the Southeast. Today, Memphis offers a compelling environment for ambitious founders: a unique combination of affordability, industry expertise, and a collaborative business community attracting both emerging startups and established investors.

For founders seeking to secure venture capital and scale their businesses, understanding the nuances of the Memphis ecosystem is essential. The city’s venture capital landscape is evolving quickly, with increased investor interest in healthcare, logistics, AgTech, and B2B technology sectors. At the same time, Memphis’s supportive infrastructure—ranging from accelerators and research institutions to government-backed incentives—provides founders with the resources and networks needed to thrive.

This guide is designed to help founders navigate the Memphis VC scene. We'll delve into the top venture capital firms actively investing in the region, current ecosystem trends, key networking opportunities, and point you toward invaluable local resources tailored to founders building and scaling startups in Memphis.

Top VCs in Memphis

Innova Memphis

About: Innova Memphis is a venture capital & private equity company and invests in early stage businesses related to biosciences, healthcare, technology, and AgTech.

ZeroTo510

About: We’re a Memphis-based medical technology program that supports early-stage founders looking to accelerate toward commercialization. ZeroTo510 is a unique, entrepreneurial accelerator program focusing on medical devices.

MB Venture Partners

About: MB Venture Partners is a Memphis-based venture capital firm that provides capital and strategic direction to life science companies. MBVP was founded by Gary Stevenson and Joseph R. “Pitt” Hyde III. The Firm invests in primarily in medical device start-ups at all stages of development. We are especially interested in funding product solutions for musculoskeletal disease. Johnson and Johnson, Medtronic, Smith + Nephew, Zimmer Biomet, and Wright Medical (now part of Stryker) have each acquired MBVP-funded start-ups. MBVP has been the largest sponsor and Conference Host of the Musculoskeletal New Ventures Conference for more than 20 years.

EPIcenter

About: Epicenter’s mission is to drive innovation and support high-growth entrepreneurship in Memphis. We believe that fostering these ideas and businesses is crucial for the city's thriving economy.

SSM Partners

About: SSM invests in rapidly-growing software and tech-enabled services companies across B2B and healthcare. The firm has been partnering with talented entrepreneurs and management teams for more than 20 years to help them scale by building a trusted relationship and offering a thorough understanding of the growth company lifecycle and a collaborative approach to building great businesses. SSM makes minority and majority equity investments of $8 to $30 million per opportunity.

Sparkgap

About: Our 115-day accelerator program provides logistics tech founders with crucial early-stage funding, as well as mentoring from some of the top figures in the industry. But more importantly, Sparkgap enables you to test and hone real ideas using real corporate assets — all in the real-life laboratory of America’s logistics capital.

Fundraising in Memphis: Insights, Trends, and Local Resources for Startup Founders

Current Fundraising Trends in Memphis

The Memphis startup ecosystem is seeing increased interest from local and regional investors, especially in healthcare, logistics, AgTech, and B2B SaaS sectors. Investors seek founders who demonstrate strong market understanding, scalable business models, and a commitment to the Memphis community. Early-stage funding is available through local VCs and angel networks, while growth-stage capital often comes from a mix of Memphis-based and national firms.

How to Approach Memphis VCs

Memphis VCs value authentic relationships and a clear understanding of how your startup fits into the local and regional economy. Warm introductions through local accelerators, founder networks, or university programs can be especially effective. Tailor your pitch to highlight not just your business model, but also your commitment to growing in Memphis and contributing to the local ecosystem. Attend local events and leverage platforms like Epicenter Memphis to connect with investors and mentors.

Key Networking Opportunities

Networking is essential in Memphis, where the startup community is close-knit and collaborative. Some of the most valuable opportunities include:

Epicenter Events: Regular workshops, meetups, and demo days for entrepreneurs.

Start Co. Programs: Accelerator cohorts and alumni events that connect founders with investors and advisors.

ZeroTo510 Demo Day: A showcase for medical device startups, attracting investors from across the region.

Local Accelerator and Incubator Programs

Memphis is home to several accelerators and incubators that provide funding, mentorship, and community:

Start Co.: Focuses on B2B, logistics, women-led, and social impact startups.

ZeroTo510: Specializes in medical device startups, offering seed funding and regulatory guidance.

Epicenter: Offers a range of programs for founders at every stage, including capital access and business support.

University and Research Institution Resources

The University of Memphis and other local institutions are active in supporting startups through research partnerships, talent pipelines, and commercialization programs. Founders can access student interns, faculty expertise, and technology transfer offices to accelerate product development and innovation.

Government and Nonprofit Support

Memphis startups can tap into a variety of grants, tax incentives, and support programs from the city, state, and nonprofit organizations. The Tennessee Department of Economic and Community Development offers incentives for job creation and innovation, while local nonprofits like Epicenter provide grants and business development resources.

Memphis Startup Ecosystem in 2025: Key Trends, Opportunities, and Challenges for Founders

Emerging Industry Trends

Memphis continues to build on its legacy as a logistics powerhouse, with FedEx’s global headquarters anchoring a robust supply chain and transportation sector. In recent years, the city has also seen a surge in healthcare innovation, driven by the presence of world-class institutions like St. Jude Children’s Research Hospital and a growing number of healthtech startups. AgTech is another rising star, leveraging the region’s agricultural roots and new technologies to address food production and sustainability. Fintech and social impact ventures are also gaining traction, supported by local investors and accelerators focused on mission-driven founders.

Opportunities Unique to Memphis

Memphis offers several advantages that set it apart from other startup hubs. Its central location makes it a natural logistics and distribution center, providing startups with access to national and international markets. Strong partnerships between universities, research institutions, and industry create a fertile ground for innovation and commercialization.

Memphis offers a cost of living about 11% lower than the national average, with housing and office space costs significantly below those in major U.S. cities. This affordability extends to labor and operational expenses, giving startups a longer runway and making Memphis especially attractive for founders looking to maximize their capital efficiency. Tennessee’s lack of state income tax and local business tax incentives further enhance the city’s appeal for entrepreneurs.

Challenges Facing Memphis Startups

While Memphis offers many advantages, founders should be prepared for certain challenges. Access to late-stage capital can be more limited compared to larger markets, making it important to build relationships with both local and national investors early on. Talent retention is another hurdle, as some skilled professionals may be drawn to larger tech hubs. Scaling beyond the Memphis market requires strategic planning and often, partnerships outside the region. Founders must also navigate a business environment that, while supportive, is still developing the infrastructure and density of more established startup cities.

Ecosystem Growth Initiatives

To address these challenges and fuel continued growth, Memphis is investing in a range of ecosystem initiatives. Public and private organizations are expanding accelerator programs, increasing access to early-stage capital, and launching diversity and inclusion efforts to ensure all founders have a seat at the table. Infrastructure improvements, such as new coworking spaces and innovation districts, are making it easier for startups to collaborate and scale. Cross-regional partnerships with other Southeastern cities are also opening new doors for Memphis founders.

Connect With Investors in Memphis Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of Memphis' investors here.

Track your conversations and move them through your funnel with our Fundraising CRM

Share your pitch deck and monthly updates with potential investors

Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

Metrics and data

View all

investors

Proactively Monitor Your Portfolio With Metric Alerts

When monitoring a portfolio, having the right insights at the right time is crucial. Whether it is a sudden dip in cash runway or a surge in MRR, knowing exactly when portfolio company key metrics shift can mean the difference between proactive support and missed opportunity.

Our recent updates to Metric Alerts make it easier to stay connected to your portfolio’s performance.

Support Companies With Smarter Alerts

We have redesigned Metric Alerts to help you monitor your entire portfolio with ease, spot red flags faster, and stay connected to each company’s performance.

A New Home for Alerts

Metric Alerts now live in a dedicated section of your sidebar under Monitoring. Here you will find:

A New Alert button for fast setup

A Log View showing every triggered alert with icons, timestamps, and direct links to your portfolio metrics

Easy edit access. Click the metric name or the icon button to quickly update alerts in a side panel

Now you can manage all alerts in one place without any hassle.

Portfolio-Wide Metric Selection

You no longer need to set up alerts company by company. With the Metric Alerts, you can:

Select any Portfolio Metric, such as Revenue or Runway, and apply the alert across all companies

Receive notifications when a company’s metric meets a specific criteria

Creating alerts across your portfolio ensures that you will never miss any shifts across your portfolio.

Proactive Support

Metric Alerts equip you with actionable information to stay on top of material changes.

Use the Log View to track historical alerts and identify patterns

Drill down to the Metric page from the alert to conduct further analysis

Edit alert criteria instantly using the side-panel form

Founders rely on you to be proactive, responsive, and informed. With Metric Alerts, you can stay connected to the numbers and the people behind them.

Put Metric Alerts to Work

The new and improved Metric Alerts are now available to all Visible customers.

Whether you are looking to monitor key metrics across your entire portfolio, catch red flags sooner, or strengthen your relationships with founders through proactive insights, Metric Alerts are designed to keep you connected and in control.

To explore how Metric Alerts can streamline your portfolio monitoring and support your investment strategy, head here.

investors

Case Study: Airtree Venture's Transformation with Visible

About Airtree Ventures

Airtree is a Sydney-based venture capital firm backing founders based in Australia and New Zealand building the iconic companies of tomorrow. The firm was founded in 2014 and is now deploying out of its 4th fund with $1.3 billion in assets under management. Their portfolio includes over 105+ portfolio companies and 250+ founders who have helped create over 17,000 jobs.

Airtree’s portfolio includes the region’s breakout technology companies, such as Canva, Go1, Employment Hero, Pet Circle, Immutable, and Linktree.

For this case study, we spoke to Dan Lombard who is the Data Lead at Airtree Ventures.

Related article: Airtree Ventures already returned its first fund thanks to Canva while maintaining the majority of its stake

Fragmented Systems and Processes Prior to Visible

Prior to the integration of Visible, Airtree relied heavily on a fragmented system of spreadsheets to manage their portfolio of 105+ companies. Each quarter, four employees were tasked with managing the relationships with the points of contact at 15 to 20 portfolio companies through manual outreach and communications. This reliance on spreadsheets resulted in inefficiencies and potential data loss, as spreadsheets are prone to break when modified.

Challenges With Data Accuracy and Scaling Manual Outreach to a Growing Portfolio

Before Visible, 80% of Airtree’s portfolio monitoring problem was having clean data and scaling outreach to their portfolio companies. They faced two primary challenges with their former system:

Operational Efficiency: Four team members spent significant time manually collecting data from over 100 companies every quarter. The Airtree team members were sending one-off email communications to each company and manually keeping track of who needed to be followed up with at each company which diverted resources from other critical projects they could be working on.

Data Integrity and Scalability: Frequent changes to the data in spreadsheets resulted in errors in the sheets and data loss, which caused frustration as there was no way of understanding which changes were made to the sheet and when. This process made it difficult to scale portfolio monitoring operations as Airtree grew.

Why Airtree Chose Visible as their Portfolio Monitoring Platform

Airtree chose Visible for its robust, scalable, and user-friendly platform. Key factors influencing their choice included:

Ease of Use and Customization: Visible's platform offered unparalleled customization and ease of use.

Support and Development: Visible’s team actively listened to feedback, offered best practices, and continuously invested in their product, ensuring a partnership that catered to Airtree’s evolving needs.

Automation and Integration: Visible excelled in automating portfolio monitoring and offered a frictionless experience for founders. Airtree leveraged the Visible API to seamlessly integrate data into their existing data warehouse system.

Airtree’s historical data collection process, previously led by four Airtree team members, is now a streamlined process led only by Dan, who leverages Visible Requests to collect data from their portfolio of 105+ companies. Visible Requests empowers Dan to send customized link-based data requests to each company, automate the email reminder process, and easily keep track of where companies are in the reporting process.

View an example Visible Request below.

Onboarded to Visible within 24 Hours

Visible provided Airtree with an efficient and supported onboarding. When asked about Airtree's onboarding with Visible Dan Lombard shared the following:

Visible stood out by enabling a swift and seamless transition that was operational in less than 24 hours, a stark contrast to other providers who estimated a quarter for full implementation. This rapid integration was facilitated by a comprehensive onboarding template provided by Visible.

Visible API & Airtree’s Data Infrastructure

With the implementation of Visible, Airtree wanted to take a more sophisticated approach to the way they handle their portfolio data with the goal of driving more valuable insights for their team. The approach needed to be automated, integrate with other data sources, and have a singular view accessible for the whole team. This was not possible when their data lived in disparate systems, files, and spreadsheets.

Dan Lombard has led the improvement of Airtree's data infrastructure. Now, data sources like Visible and Affinity are piped into Snowflake via recurring AWS Lambda jobs. Airtree leverages the Visible API daily. Dan mentioned that while Airtree collects data quarterly, a daily sync of the data is crucial because Airtree is always onboarding new companies, communicating with their founders, and uploading historical data.

“The Visible API gives us this level of daily fidelity and only takes the AWS Lambda job 5 minutes to populate an entire data architecture.”

- Dan Lombard, Data Lead at Airtree Ventures

Once the data is in their database, Snowflake handles the ETL and entity matching. Airtree then has Streamlit sit on top of Snowflake to query data, provision access, and build out new insights.

Advice for Other VC Firms Building Out Their Data Infrastructure

Don’t overcomplicate things to start. It is easy to get caught up in the bells and whistles. Dan recommends a bias towards simplicity. Start small and use it as a stepping stone as you build things out.

Conclusion

Airtree’s adoption of Visible transformed their portfolio management by automating key processes and centralizing data, thus enabling more strategic decision-making and efficient operations. The case of Airtree is a testament to how the right technological partnerships can profoundly impact business efficiency and data management.

investors

The Standard Metrics to Collect for VC Portfolio Monitoring

Visible supports hundreds of investors around the world to streamline their portfolio monitoring. One of the most common questions we receive is — what metrics should I be collecting from my portfolio companies?

Everyone from Emerging Managers writing their first checks to established VC firms ask this question because they want to make sure they're monitoring their portfolio companies in the most effective way possible.

The Standard Metrics Value-Add Investors Should be Monitoring

It’s important to know which metrics are the best to collect from portfolio companies so that investors can extract the maximum amount of insight from the least number of metrics. This streamlined approach is easiest for founders and allows investors to get what they need to provide better support to their companies, inform future investment decisions, and have good records in place for LP reporting or fundraising.

Below we outline the six most common metrics investors collect from portfolio companies.

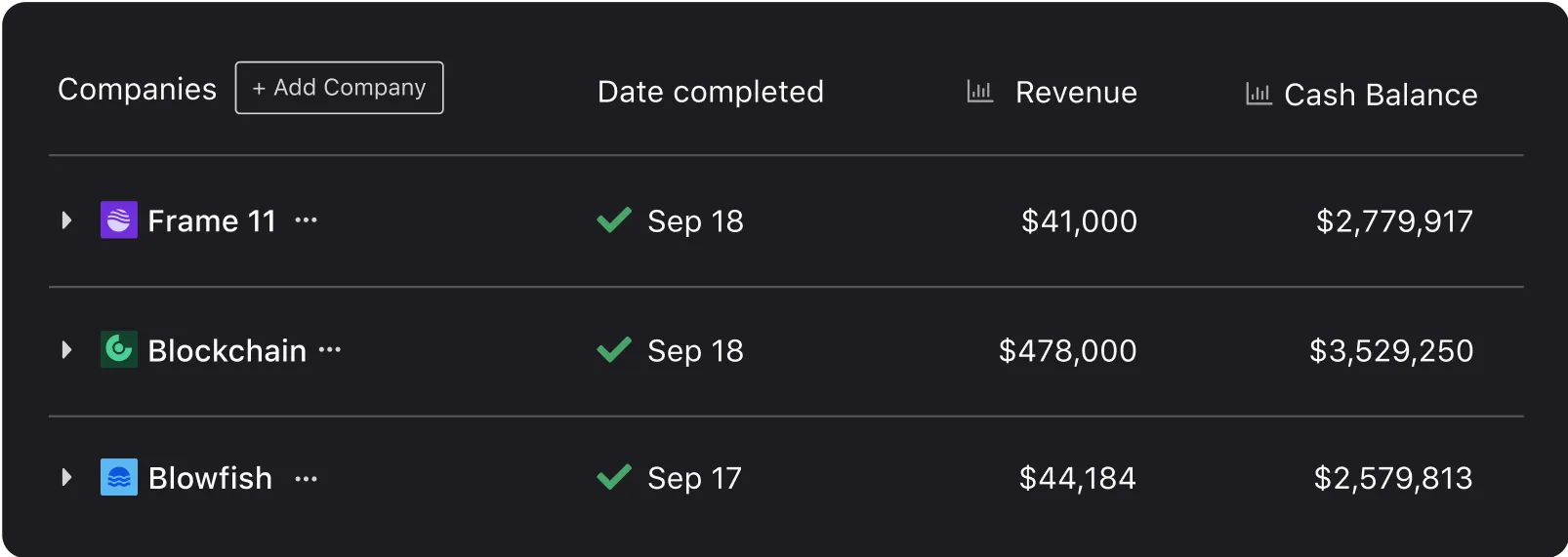

1) Revenue

Definition: Money generated from normal business operations for the reporting period; also known as ‘net sales’. We recommend excluding ‘other revenue’ from secondary activities and excluding cash from fundraising.

Revenue tells you how a company’s sales are performing.

This metric is a key indicator for how a business is doing. It can be analyzed to understand if new marketing strategies are working, how a change in pricing might affect the demand for a good or service, and the pace of growth in a market.

By asking for revenue from just ‘normal business operations’ you’re excluding money a company could also be making from secondary activities that are non-integral to their business. This helps keep the revenue data more precise, allows you to compare the metric more accurately across the portfolio, and will allow you to use it more accurately in other metric formulas such as Net Income.

Visible helps over 400+ VCs streamline the way they collect data from companies with Requests. Check out a Request example below.

2) Cash Balance

Definition: The amount of cash a company has in the bank at the end of a reporting period.

Cash Balance is an important indicator of ‘life expectancy’.

This metric is essential to track because it tells you about the financial stability and risk level of the company. There’s no bluffing with this Cash Balance metric. A company either has a healthy amount of cash in the bank at the end of its reporting or they don’t. Cash balance also gives you an idea of how soon a company will need to kick off its next round of financing.

3) Monthly Net Burn

Definition: The rate at which a company uses money taking income into account. The monthly burn rate will be positive for companies that are not yet profitable and negative for companies that are considered profitable. Net burn is usually reported as monthly and calculated by subtracting a company’s ending cash balance from its starting cash balance and dividing that by the number of months for the period. We recommend collecting this metric from companies on a quarterly basis but still asking for the monthly rate — this helps rule out any one-off variability.

Monthly Net Burn = (Starting cash balance – ending cash balance) / months

Monthly Net Burn is an indicator of operational efficiency.

This metric becomes even more relevant during market downturns when the focus shifts from growth at all costs to growth with operational efficiency. This is a good metric to benchmark and compare across all companies in your portfolio.

You can also use this metric to calculate a key metric, Cash Runway.

Related resource: Burn Rate: What It Is and How to Calculate It

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

4) Cash Runway

Definition: Cash runway is the number of months a business can survive before it runs out of cash. It can be calculated as:

Runway = Cash Balance / Monthly Net Burn

Cash runway tells you when a company will run out of cash.

This metric is essential because it determines when a company needs to kick off their next fundraising process, usually, it’s when they have 6-8 months of runway left. If you see one of your companies hit a cash runway of six months or less, you should be reaching out to see if they need support or guidance on their fundraising efforts.

While Runway is definitely considered a key metric, you don’t need to ask your companies for it since it can be calculated easily with other data you should already have on hand (Cash Balance & Monthly Net Burn Rate).

5) Net Income

Definition: Net income is a company’s total earnings (or profit) after all expenses have been subtracted. It is calculated by taking a company’s revenue and subtracting all expenses, including operational expenses, interest expenses, income taxes, and depreciation and amortization.

Net Income = Revenue – Total Expenses

Net Income is an indicator of profitability.

If net income is positive, meaning revenue is greater than a company’s total expenses, it is considered profitable. This is a metric that startups should have readily available since it’s the ‘bottom line’ of an Income Statement, making it very easy to report.

This metric can also be used in a formula to calculate Net Profit Margin, total expenses, and cash runway.

6) Total Headcount

This is the total number of full-time equivalent employees excluding contractors. Contractors are excluded because of the variability of the nature of contract work — a contractor may only work a few hours a month or they could work 20 hours per week. This variability will cause back-and-forth clarification between you and your companies which wastes time.

This metric gives you insight into company growth and operational changes.

This metric is important to track because it’s a reflection of decisions made by the leadership team. If there’s an increase in headcount, the leadership is investing in future growth, on the other side, if there’s a major decrease in total headcount it could be because the leadership team has decided to reduce burn by letting people go or employees are churning. All are post-signs of operational changes worth paying attention to.

Check out an Example Request in Visible.

Suggested Qualitative Questions to Ask Your Companies

While metrics are the best way to aggregate and compare insights across your portfolio, you may also be wondering which qualitative questions you should ask portfolio companies as well. Qualitative prompts can be a concise and valuable way for startups to share more narrative updates on company performance with their investors.

Below we outline the two most common qualitative questions investors ask portfolio companies as well as suggested descriptions.

1) Recent Updates & Wins

Description: Please use bullet points and share updates related to Sales, Product, Team, and Fundraising. This will be used for internal reporting and may also be shared with our Limited Partners.

We suggest asking companies for bullet points on these four categories because it’s a focused way for investors to understand the narrative context behind a company’s metrics.

With your companies’ permission, this narrative update can also serve as the foundation for your tear sheets for your LP reporting and your internal reporting.

2) Asks

Description: How can we best support you this quarter?

You can make your reporting processes more valuable for your portfolio companies by asking your companies if there are specific ways you can provide support to them in the next quarter.

Once you have responses from your portfolio companies, you can take action on their requests and you’ll be able to extract support themes to inform the way you provide scalable portfolio support.

Monitor Your Portfolio Companies Seamlessly With Visible

It’s important to know which are the most important metrics to collect to ensure your portfolio data collection processes are streamlined and valuable both for you and your companies. In this article, we highlighted Revenue, Net Income, Cash Balance, Runway, Net Burn Rate, and Total Headcount as the top metrics to collect from all your portfolio companies. With Visible, its also easy to ask for any custom metric and assign it just to specific companies.

Investors of all stages are using Visible to streamline their portfolio monitoring and reporting processes. Book some time with our team to learn how Visible can automate your portfolio monitoring processes.

Visible for Investors is a founder-friendly portfolio monitoring and reporting platform used by over 400+ VCs.

Product Updates

View allOperations

View all

founders

Building Trust and Vulnerability in Business with Max Yoder

On the fourth episode of the Thrive Through Connection Podcast, we welcome Max Yoder, the Founder of Lessonly and author of Do Better Work. Lessonly was an Indianapolis-based company that grew to over 300 employees and $30 million in annual recurring revenue before being acquired by Seismic in 2021. Max joins us to share the lessons he learned from scaling Lessonly and writing Do Better Work.

About Max

In addition to growing Lessonly to 300+ employees and leading it through a successful exit, Max became known for his thoughtful approach to leadership, insights he captured in his book, Do Better Work. He’s had a front-row seat to the highs, lows, and daily challenges that startup founders and leaders face. In this episode, Max breaks down the countless relationships that shaped both Lessonly and Do Better Work.

Mike, the CEO and Founder of Visible, had an opportunity to sit down and chat with Max. You can give the full episode a listen below:

Spotify Link

Apple Link

What You Can Expect to Learn from Max

How the mission and vision for Lessonly came to life

How mentors helped shape decision-making and strategy in the early days

The advantages of having a strong network

What it means to lead with vulnerability

The importance of aligning with investors and partners

Stay up to date with the Thrive Through Connection Podcast by subscribing wherever you listen to your podcast. You can find links to your favorite podcast hosts below:

YouTube

Spotify

Apple

founders

Top 15 Climate Tech Startups Revolutionizing Sustainability in 2025

In an era where the effects of climate change are being felt more acutely every day, the need for bold, innovative solutions has never been greater. Climate tech startups are at the forefront of this revolution, creating technologies that address some of the world’s most pressing environmental challenges. These leading climate startups are not only pushing the boundaries of sustainable innovation but also reshaping industries by offering practical, scalable solutions to reduce carbon footprints and foster environmental resilience.

From carbon capture technology to renewable energy storage and sustainable agriculture, these companies are addressing critical issues head-on. This article highlights 15 innovative climate tech companies that are making significant strides in combating climate change. Whether they are developing groundbreaking technologies for cleaner energy or devising new ways to sequester carbon, these startups represent the future of green innovation.

Related Resource: Leveraging Innovation and Sustainability: A Guide for Clean Tech and Climate Tech Founders

Emerging Climate Tech Trends Impacting Startups in 2024

As climate tech evolves, several trends are directly shaping the trajectory of climate tech companies and their ability to address environmental challenges. These trends reflect not just advancements in technology but also the shifting demands within the industry, influencing how startups scale, secure funding, and innovate. Below are the key trends influencing climate tech companies in 2024.

Carbon Capture and Sequestration Technologies

Carbon capture and sequestration (CCS) is rapidly becoming a core focus for many climate tech startups, particularly those aiming to reduce industrial carbon footprints. Startups working on direct air capture (DAC) technologies are gaining significant traction as industries and governments seek scalable solutions to meet global emissions reduction goals. As funding for CCS increases, companies within this space are seeing more opportunities for partnerships with heavy industries like oil and gas, cement, and steel. However, the cost of these technologies remains a challenge, pushing climate tech companies to innovate in ways that make CCS more affordable and efficient for widespread adoption.

Long-Duration Energy Storage

The transition to renewable energy is pushing climate tech companies to develop long-duration energy storage solutions that go beyond traditional battery technology. Energy storage startups are now at the forefront of enabling a renewable energy grid that can handle fluctuations in solar and wind energy. This trend is driving significant investment into companies creating vanadium redox flow batteries, iron-air batteries, and other next-gen storage solutions. For these startups, the ability to secure contracts with energy utilities and prove the scalability of their technology will be key to future success. The demand for reliable energy storage is expected to grow exponentially as more countries mandate higher percentages of renewable energy in their grids.

Sustainable Agriculture and Food Tech

Climate tech companies focused on sustainable agriculture are seeing rising interest from both investors and governments as the agriculture sector faces mounting pressure to reduce emissions. Startups developing technologies like vertical farming, precision agriculture, and agroforestry are helping traditional farms and food producers become more resilient to climate risks. For example, companies offering precision agriculture solutions can optimize water usage and reduce chemical inputs, making farming more sustainable. This trend is particularly relevant for climate tech startups targeting regions prone to droughts and extreme weather, as their solutions offer tangible ways to mitigate the effects of climate change on food production.

AI-Driven Environmental Insights

The integration of AI into climate tech is transforming how companies gather and leverage environmental data, offering them a competitive edge in developing smarter, more targeted solutions. Startups providing AI-driven platforms that analyze climate risks, predict environmental shifts, and optimize resource use are seeing increased demand from sectors like renewable energy, real estate, and agriculture. For climate tech companies, this trend offers a unique opportunity to position themselves as data-driven innovators, capable of helping businesses and governments adapt to changing environmental conditions. Companies specializing in geospatial AI are especially well-positioned to attract funding as they provide essential insights for industries looking to mitigate environmental risks.

Key Challenges Facing Climate Tech Startups

While the climate tech sector is thriving, climate tech startups face several significant challenges that can hinder growth and scalability. From securing adequate funding to navigating complex regulatory landscapes, these barriers are unique to companies striving to create sustainable solutions. Below are some of the climate startup challenges that founders need to consider as they work toward building impactful, scalable businesses.

High Research and Development (R&D) Costs

One of the primary barriers for climate tech companies is the high cost of research and development. Unlike many software startups that can iterate quickly and cost-effectively, climate tech solutions often require significant investment in hardware, materials, and testing facilities. Whether developing new carbon capture technologies or refining energy storage systems, climate startups need extensive capital to move from concept to commercialization. This financial hurdle can slow down progress, particularly for startups without access to substantial early-stage funding or grant support.

Navigating Regulatory Challenges

Regulatory hurdles are another critical challenge for climate tech startups. Governments and regulatory bodies are increasingly enacting policies aimed at reducing carbon emissions, but the path to compliance can be complex. Startups must navigate a patchwork of regulations, often varying by region and industry. For example, renewable energy companies may face permitting delays, while those in carbon capture or waste management might contend with strict environmental standards. This regulatory uncertainty can deter investors and slow down the deployment of new technologies, making it a significant barrier to success.

Scaling Across Sectors

Climate tech solutions often require cross-sector partnerships to scale effectively. A company developing energy storage technology, for example, may need to partner with both energy utilities and hardware manufacturers to bring its product to market. Likewise, startups focusing on sustainable agriculture might need collaborations with large-scale farming operations or governments to deploy their technologies at scale. Establishing these partnerships can be difficult for early-stage startups, especially those without a proven track record or established industry relationships. The need for coordination across sectors and industries is a major challenge that climate startups must overcome to ensure long-term success.

Related resource: Top 10 VCs Fueling Innovation in Transportation

Securing Sufficient Funding

While investor interest in climate tech is growing, many climate startups still struggle to secure sufficient funding, particularly during the early stages. Venture capital firms often look for quick returns, but many climate tech solutions require long timelines before reaching commercialization. Startups in this space may also face competition from other sectors for investor attention. The need to demonstrate both environmental and financial impact adds another layer of complexity when raising capital. As a result, climate tech startups often need to explore alternative funding sources such as government grants, impact investors, and green bonds to bridge the gap.

15 Climate Tech Startups to Watch in 2024

1. CarbonCapture

CarbonCapture stands out in the climate tech sector with its innovative approach to direct air capture (DAC) technology. The company's systems, which use molecular sieves and renewable energy sources, are designed for adaptability. These machines not only remove CO2 from the atmosphere but also capture clean water distilled from the air, a dual functionality that enhances both environmental and practical value. The potential impact of this technology is substantial, offering a scalable and efficient solution to reduce atmospheric CO2 levels. This approach is particularly promising in the fight against global warming and climate change.

Year founded: 2019

Location: Pasadena, California

Funding amount/type: The company has raised a total of $35 million over three funding rounds.

Funding series: The most recent, a Series A round completed in September 2023.

Major investors: Climate Pledge Fund, Ethos Family Office, Rio Tinto, Idealab Studio, Idealab X, and Marc Benioff’s TIME Ventures.

2. Astraea

Astraea is a significant player in the climate tech sector, particularly with its innovative use of data analytics for environmental insights. The company has developed an AI platform for geospatial data, which includes products like EarthAI Site and EarthAI Enterprise. These tools offer vital insights using imagery, analytics, and dashboards, catering to a variety of industries such as real estate, renewable energy, conservation finance, and agriculture. Astraea's EarthAI platform is particularly notable for its ability to aid in understanding climate patterns and their impacts, leveraging AI and geospatial data to provide actionable insights.

Year Founded: 2016

Location: Charlottesville, Virginia, USA

Funding Amount/Type: Astraea has raised a total of $16.5 million over four funding rounds. In a recent development, the company raised $6.5 million in Series A funding.

Funding Series: The latest funding, completed on July 21, 2022, was a Series A round.

Major Investors: The Series A funding was co-led by Aligned Climate Capital and Carbon Drawdown Collective, with other participants including CAV Angels, Tydall Investment Partners, and the University of Virginia Seed Fund.

Astraea's role in climate tech is particularly exciting due to its innovative use of AI and satellite data to provide critical environmental insights. This approach is essential for addressing complex climate challenges, enabling better decision-making and strategy formulation in various sectors. The support and funding received from notable investors reflect confidence in Astraea's potential to make a meaningful impact in the field of climate technology.

3. CellCube

CellCube, known for its innovative energy storage solutions, is making significant strides in the field of climate tech with its focus on vanadium redox flow batteries (VRFBs). As a leader in sustainable, future-proof, and durable energy storage infrastructure, CellCube has emerged as one of the first and largest developers, manufacturers, and sellers of VRFBs globally. Their modular CellCube batteries are designed to store large electricity capacities efficiently for 4 to 24 hours, meeting the highest safety standards and boasting a lifecycle of 20 to 30 years. This technology is crucial for enabling the storage of energy from intermittent renewable sources like solar and wind, thus facilitating their integration into the energy grid and enhancing the sustainability of energy systems.

CellCube, initially known as Enerox, has evolved over the last ten years from a specialized product developer to a leading provider of comprehensive energy storage solutions. With more than 140 systems installed worldwide, they have established themselves as a key player in the industry.

Year Founded: Not explicitly stated, but with 20 years of research and development, it suggests a founding date around 2002-2003.

Location: Denver, Colorado, USA.

Funding Amount/Type: The company arranged a non-brokered private placement financing for gross proceeds of CDN $10 million.

Major Investors: Bushveld Minerals increased its investment in CellCube to 27.6%, as part of its energy storage business strategy.

CellCube's significance in the climate tech field is highlighted by its role in enhancing renewable energy integration. Their VRFBs provide a reliable and scalable solution for energy storage, addressing one of the most significant challenges in the shift towards renewable energy sources. By enabling more efficient storage and use of renewable energy, CellCube contributes significantly to reducing reliance on fossil fuels and combating climate change. Their progress and the growing investor interest underscore the critical role of energy storage technologies in achieving a sustainable future.

4. Jackery

Jackery, a leader in the field of portable solar power solutions, was founded in 2012 in California, USA, by a former Apple battery engineer. The company is recognized for its innovative approach in developing portable solar power generators, solar panels, and other related products. Jackery's mission is to provide green energy solutions that are accessible to everyone, everywhere, particularly focusing on outdoor and emergency use scenarios. Their products, known for their efficiency and accessibility, cater to the needs of those requiring mobile power sources, whether off-grid or during power outages.

Year Founded: 2012

Location: Fremont, California, USA

Funding information isn’t given for Jackery

Jackery's innovation in portable solar power solutions is particularly exciting for the field of climate tech due to its contribution to sustainable energy accessibility. By providing efficient, portable solar generators and panels, Jackery plays a crucial role in enhancing the adoption of renewable energy sources. This is especially important in remote or disaster-prone areas where traditional power sources are unavailable or unreliable. Jackery's commitment to developing green energy solutions aligns with global efforts to reduce carbon emissions and mitigate the impacts of climate change. Their growth and the success of their products in the market underscore the increasing demand for portable and sustainable energy solutions.

5. CarbonCure

CarbonCure, a pioneer in carbon sequestration within the concrete industry, has garnered significant attention for its innovative approach to reducing carbon footprints. Founded in 2011 by Robert Niven and headquartered in Halifax, Nova Scotia, CarbonCure's technology revolves around the injection of captured carbon dioxide into concrete, where it is permanently stored. This process not only utilizes CO2 but also enhances the strength of the concrete, presenting a dual benefit.

The implications of CarbonCure's technology for the construction industry are profound. As concrete is one of the most widely used materials in construction, its production is also one of the largest sources of CO2 emissions globally. By integrating CarbonCure's technology, the construction industry can significantly reduce its carbon footprint, contributing to the global efforts against climate change. This technology offers a practical and scalable solution for carbon sequestration, aligning with the industry's growing focus on sustainability.

Year Founded: 2011

Location: Halifax, Nova Scotia, Canada

Funding Amount/Type: CarbonCure Technologies has raised a total of $97.36 million over 12 funding rounds, with the latest being a Series F round for $80 million on July 11, 2023.

Major Investors: The company's investors include Sustainable Development Technology Canada, Innovacorp, GreenSoil Investments, Pangaea Ventures, Breakthrough Energy Ventures, Microsoft Climate Innovation Fund, BDC Capital, 2150, Mitsubishi Corporation, Carbon Direct, Taronga Ventures, and Amazon's Climate Pledge Fund.

CarbonCure's technology is particularly exciting in the climate tech field due to its practical application in a widespread and traditionally high-emission industry. The ability to reduce the carbon footprint of concrete production and use while improving the material's quality represents a significant advancement in green construction practices. The company's successful funding rounds and the backing of major investors underscore the industry's recognition of the importance of sustainable solutions like CarbonCure's, indicating a promising future for this technology in global efforts to combat climate change.

6. Form Energy

Form Energy, a Massachusetts-based technology company founded in 2017, is revolutionizing the field of climate tech with its advancements in long-duration energy storage systems. These systems are designed to enable a reliable and fully renewable electric grid year-round, addressing one of the major challenges in the transition to renewable energy. Form Energy's technology is crucial for maintaining grid stability and integrating renewable energy sources, as it allows for the storage and release of energy over extended periods, thus balancing supply and demand even when renewable sources are intermittent.

Year Founded: 2017

Location: Boston, Massachusetts, US

Funding Amount/Type: Form Energy has raised a significant amount of funding, with a $450 million Series E financing round announced in October 2022. This adds to their total funding, which had previously exceeded $350 million, reaching a valuation of $1.2 billion in mid-2021.

Funding Series: The latest funding round was a Series E round.

Major Investors: The Series E round was led by TPG’s global impact investing platform, TPG Rise, and included major investors such as GIC, Canada Pension Plan Investment Board (CPP Investments), ArcelorMittal, Bill Gates’ Breakthrough Energy Ventures, and others.

Form Energy's long-duration energy storage technology is particularly exciting in the climate tech sector for its potential to transform how energy grids operate. By allowing for the storage of energy for days, rather than hours, this technology enables a more seamless integration of renewable energy sources like solar and wind, which are often variable in nature. This capability is crucial for reducing reliance on fossil fuels and achieving a more sustainable and resilient energy infrastructure.

The company's focus on developing cost-effective and scalable energy storage solutions aligns with the growing global need for innovations that can support a fully renewable energy grid. The significant investment and support from major investors underscore the industry's recognition of the importance of long-duration energy storage and Form Energy's role in driving forward the transition to a cleaner, more sustainable energy future.

7. Klima

Klima, a mobile application developed by Climate Labs GmbH, is revolutionizing the field of climate tech with its unique approach to personal carbon offsetting. Founded in 2019 by serial entrepreneurs Markus Gilles, Andreas Pursian-Ehrlich, and Jonas Brandau, Klima is headquartered in Berlin, Germany. The app's mission is to turn carbon neutrality into a mass movement, unleashing the power of individual action at scale. Klima allows users to measure, reduce, and offset their carbon footprint directly through the app, empowering individuals to contribute actively to climate change mitigation efforts.

Year Founded: 2019

Location: Berlin, Germany

Funding Amount/Type: Klima has raised a total of €15.8 million over three funding rounds, with the latest funding being raised on April 21, 2022, from a Series A round. The total funding amount is also reported as $18 million in another source, with a Series A round of $11 million raised on April 1, 2022.

Funding Series: The latest funding round was a Series A round.

Major Investors: Klima's investors include Christian Reber (co-founder and CEO of Pitch), Jens Begemann, Niklas Jansen (co-founder and managing director of Blinkist), e.ventures, HV Holtzbrinck Ventures, 468 Capital, HV Capital, Keen Venture Partners, Headline, and Blue Impact Ventures.

Klima’s approach to climate change mitigation is particularly exciting in the field of climate tech because it emphasizes the impact of individual actions. By enabling users to track and offset their carbon footprint through everyday activities, Klima is making climate action accessible and actionable for the broader public. This approach not only raises awareness about personal environmental impacts but also provides a tangible way for individuals to contribute to global carbon reduction efforts.

The startup's success in raising significant funding and attracting major investors reflects the growing interest in solutions that empower individuals to participate in climate action. Klima's innovative use of technology to facilitate personal carbon offsetting marks a significant step forward in engaging the public in climate change mitigation and underscores the potential for technology to play a transformative role in addressing environmental challenges.

8. Polarium

Polarium, founded in 2014, is a Swedish company that has established itself as a key player in the lithium battery technology sector. The company focuses on providing smart lithium batteries designed to address power backup challenges in various sectors, including telecom, commercial, and industrial. Polarium's mission is to empower a sustainable world with innovative solutions for energy storage and energy optimization built on lithium-ion technology.

Year Founded: 2014

Location: Sweden

Funding Amount/Type: Polarium has raised a total of $273.9 million over 7 funding rounds. Another source reports the total funding as $250.19 million over 8 rounds.

Funding Series: The latest funding was a Venture - Series Unknown round raised on September 4, 2023.

Major Investors: The Swedish pension company Alecta, Formica Capital, Absolute Unlisted (part of the investment manager Coeli), AMF, Vargas, Roosgruppen, and Beijer Invest are among the key investors in Polarium.

Polarium's innovations in lithium battery technology are significant for various reasons. First, these batteries offer a sustainable and efficient solution for energy storage and management, vital in sectors ranging from telecommunications to industrial applications. Second, Polarium's technology plays a critical role in the integration and optimization of renewable energy sources, contributing to the transition towards more sustainable energy systems.

The startup is particularly exciting in the field of climate tech due to its focus on lithium-ion technology, which is crucial for the development of more efficient and sustainable energy storage solutions. This technology is essential for the scalability and effectiveness of renewable energy systems, as it allows for more efficient storage and distribution of energy generated from renewable sources.