Italy’s startup ecosystem is no longer flying under the radar. In 2025, Italian startups are smashing records, raising over €1.3 billion in 2024 and an impressive €504 million in Q1 2025 alone—outpacing much of Europe’s growth and drawing the eyes of global investors. From Milan’s fintech skyscrapers to Turin’s deeptech labs and Rome’s digital disruptors, Italy is now recognized as one of the continent’s fastest-growing innovation hubs.

What’s fueling this momentum? Here are some of the top factors:

- A new generation of ambitious founders building in sectors like fintech, healthtech, space, and sustainability

- Major government and EU incentives making it easier than ever to launch and scale

- A maturing venture capital scene—with both homegrown funds and international giants competing for the best deals

- A collaborative culture where over 60% of startups partner with universities, corporates, and research centers to accelerate growth.

This guide is for startup founders—whether you’re based in Italy or looking to expand from the United States—who are actively seeking funding in the region. Here, you’ll find an up-to-date list of the top venture capital firms investing in Italian startups, along with actionable insights on fundraising strategies, current ecosystem trends, essential networking opportunities, and local resources that can help you build and scale your business in Italy.

Top VCs in Italy

Innogest Capital

About: Italy’s startup ecosystem is evolving rapidly, offering both exciting opportunities and unique challenges for founders. In 2024, the country is seeing record investment, sectoral innovation, and a maturing support infrastructure—making it an increasingly attractive destination for entrepreneurs and investors alike.

Oltre Venture

About: Oltre Venture is the first Italian social venture capital company—an innovative financial tool supporting the social sector. Its goal is to finance and support the development of businesses capable of combining economic sustainability with social value. These businesses address the “grey area” of hidden hardship and socio-economic vulnerability, characterized by housing difficulties, job insecurity, loneliness, and social exclusion.

United Ventures

About: At United Ventures we look for daring entrepreneurs willing to develop innovative products and technologies, who acknowledge the challenges and risks of our times and still crave to come out on top in business. As entrepreneurs ourselves, our mission is to spot winners and drive them to achieve success and worldwide recognition through our mentorship, financial and business development support.

With a long-standing track record of both start-up and scale-up technological companies, we can boast the industry expertise, mentorship and business networking that it takes to create a success story.

Thesis: Thanks to our multistage strategy we can provide support and funding across all the stages of new ventures, by investing seed stage, early stage and growth capital, with both start-up companies and estabilished ones launching onto new markets.

Club Italia

About: Club Italia Investimenti 2 is an investment company based in Milan specializing in venture capital. The company was founded in 2013 by a group of entrepreneurs connected to the world of innovation and investments in promising young companies with high technological content.

CDP Venture Capital SGR

About: We are the largest venture capital manager in Italy and among the largest in Europe. We were established through a systemic approach to managing public and private resources, with the aim of creating a market operator capable of combining returns on invested capital with support for market development.

We operate in strategic sectors for the future by investing directly and indirectly in startups, innovative SMEs, and venture capital funds, in order to create a market infrastructure that can support the entire lifecycle of new businesses.

Club Digitale

About: Club Digitale, created by SiamoSoci, aims to contribute to the growth of the digital sector in Italy by providing the best startups in the country with the capital they need to develop their businesses. Club Digitale acquires equity stakes in a selection of startups that are completing an acceleration process at the project’s partner incubators.

The accelerators are run by successful entrepreneurs from the digital and technology sectors, and thanks to their experience, they now serve as centers of excellence for scouting, selecting, and supporting innovative, technology-driven startups. The mechanism we have built both simplifies access to venture capital for startups and allows Club Digitale members to benefit from an economic segment with a high growth rate.

P101 SGR

About: P101 SGR is one of the leading venture capital firms in Italy, investing in digital and technology-driven companies in Europe. Founded in 2013 by Andrea Di Camillo, it is supported by Azimut, Fondo Italiano di Investimento, European Investment Fund, Fondo Pensione BCC, Cassa Forense, Unicredit, as well as some of the main Italian entrepreneurial families.

Key Trends and Opportunities in the Italian Startup Ecosystem

Italy’s startup ecosystem in 2025 is demonstrating remarkable resilience and dynamism, with new records in investment, sectoral innovation, and internationalization. For founders, the landscape is more promising—and competitive—than ever.

Strong Investment Momentum and Sector Growth

Italian startups raised over €1.3 billion in 2024, and the momentum has continued into 2025, with €504 million raised in Q1 alone. This stability is notable, especially as other major European markets have seen declines. The Italian ecosystem is now recognized as one of the fastest-growing in Europe, with a 28% year-on-year increase in startup investments (StartupBusiness, 2025).

Key sectors driving this growth include:

- Fintech: Startups like Satispay and Nexi are leading digital payments, neobanking, and blockchain innovation, supported by a favorable regulatory environment.

- Space and Deeptech: Companies such as D-Orbit (raised €150M in 2024) are putting Italy on the map for space logistics and advanced tech.

- Healthtech: Telemedicine, AI diagnostics, and digital health management are transforming healthcare access and efficiency.

- FoodTech & Agritech: Startups like xFarm (raised €36M) are innovating in sustainable agriculture and food supply chains.

- Sustainability & Circular Economy: There’s a surge in startups focused on renewable energy, waste management, and sustainable consumption, often with EU and government backing.

Notable recent deals (2024–2025):

- D-Orbit (space logistics): €150M

- Bending Spoons (mobile apps): €144.4M

- Alps Blockchain (blockchain infrastructure): €105M

- Satispay (fintech): €60M

- xFarm (agritech): €36M

- BizAway (corporate travel): €35M

- LimoLane (mobility): €35M

- Cyber Guru (cybersecurity):$25M

- Casavo (proptech): €20M

Government and EU Support: Incentives and Programs

The Italian government continues to roll out new incentives, grants, and regulatory reforms to support innovation. The DdL Concorrenza and ongoing EU programs like Horizon Europe are providing significant resources for R&D, internationalization, and digital transformation. Programs like Smart&Start Italia and CDP Venture Capital SGR are also key sources of funding and support for early-stage startups.

Collaboration and Ecosystem Maturity

- Corporate Partnerships: Over 60% of Italian startups now collaborate with universities, research centers, and large corporates, gaining access to capital, expertise, and new markets. These partnerships are crucial for scaling and credibility, though founders should be prepared for cultural and operational differences.

- Incubators and Accelerators: Nearly half of startups leverage incubators, accelerators, and innovation hubs for technical support, mentorship, and investor access. Milan, Rome, and Turin are home to many of these resources.

Regional Hubs and Internationalization

- Regional Hubs: Milan remains the epicenter, but Turin (mobility, aerospace) and Rome (digital, public sector) are rapidly growing as innovation hubs. Northern Italy still attracts the majority of investment, but opportunities are emerging in the South and other regions as local ecosystems develop.

- Internationalization: Italian startups are increasingly expanding abroad and attracting foreign investment. Participation in global events and partnerships with international corporates are now common strategies for growth.

Talent, Education, and Community

Italy’s talent pool is deepening, thanks to universities offering innovation-focused programs and a growing number of professionals with technical and entrepreneurial skills. Community events, meetups, and industry associations (like Italian Tech Alliance) provide valuable networking and learning opportunities.

Challenges: What Founders Should Watch For

- Late-Stage Funding Gaps: While early-stage capital is abundant, late-stage and growth funding remain limited. Founders may need to look abroad for larger rounds.

- Bureaucracy and Regulation: Navigating Italian bureaucracy can be complex. Engaging local advisors and leveraging government programs can help.

- Cultural Nuances: Building trust and relationships is essential. Expect longer sales cycles and negotiation periods, especially with large corporates.

Actionable Opportunities for Founders

- Leverage government and EU incentives for R&D, hiring, and internationalization.

- Engage with local incubators, accelerators, and industry associations for mentorship and investor access.

- Build strategic partnerships with corporates and universities to accelerate growth and credibility.

- Focus on high-growth sectors like fintech, healthtech, sustainability, and foodtech.

- Consider international expansion early, especially if targeting larger funding rounds or global markets.

Networking Opportunities and Local Resources for Founders in Italy

Building a successful startup in Italy goes beyond securing funding; it requires immersing yourself in the local ecosystem, leveraging key networks, and tapping into available resources. For founders, especially those new to the Italian scene, understanding where to connect and what support is available can be a game-changer.

Key Networking Opportunities

Networking is paramount in Italy, where relationships often open doors to investors, partners, and talent.

- Industry Events and Conferences:

- Italian Tech Week: A major annual event in Milan that brings together founders, investors, and industry leaders. It's an excellent opportunity for high-level networking and staying abreast of ecosystem trends.

- StartupItalia Open Summit: Another significant event that showcases Italian innovation, connecting startups with investors and corporate partners.

- International Events with Italian Presence: Events like Slush, Web Summit, and VivaTech often have dedicated Italian delegations or pavilions, offering opportunities to connect with Italian VCs and founders on a global stage.

- Business Angels Networks:

- Italian Business Angels Network (IBAN): The oldest and largest association of business angels in Italy, facilitating connections between angel investors and startups seeking early-stage capital. While IBAN doesn't invest directly, its events and network are invaluable.

- Club degli Investitori: An angel network of over 300 entrepreneurs and professionals who invest in startups and scaleups, providing both capital and mentorship.

- Italian Angels for Growth (IAG): A prominent network of business angels, entrepreneurs, and firms that pool resources and expertise to foster innovation. They offer access to experienced investors and their business networks.

Local Resources and Support Systems

- Accelerators and Incubators:

- LVenture Group: A leading accelerator based in Rome, providing pre-seed and seed-stage startups with funding, mentorship, and access to a vast network.

- Startupbootcamp: Has programs in Italy, offering sector-specific acceleration for fintech, IoT, and other areas.

- Polihub (Politecnico di Milano): The university incubator of Politecnico di Milano, supporting deep tech and research-intensive startups.

- Other Regional Hubs: Explore local incubators and accelerators in cities like Turin (I3P at Politecnico di Torino) and Bologna (G-Factor).

- Government and Public Initiatives:

- CDP Venture Capital SGR – Fondo Nazionale Innovazione: As the largest institutional investor, CDP Venture Capital plays a crucial role in developing the Italian VC ecosystem. They manage various funds and initiatives to support startups across all stages.

- Invitalia: The National Agency for Inward Investment and Economic Development, offering incentives, grants, and support programs for new businesses and innovative startups.

- Smart&Start Italia: A program managed by Invitalia that provides non-repayable grants and subsidized loans for innovative startups, particularly those focused on digital economy, sustainable development, and social innovation.

- Industry Associations and Ecosystem Builders:

- Italian Tech Alliance: The national association representing venture capitalists, innovation investors, and startups. They are a key voice for the ecosystem and provide valuable reports and networking opportunities.

- StartupItalia: A leading media platform and community hub for Italian startups, offering news, insights, and event listings.

Connect With Investors in Italy Using Visible

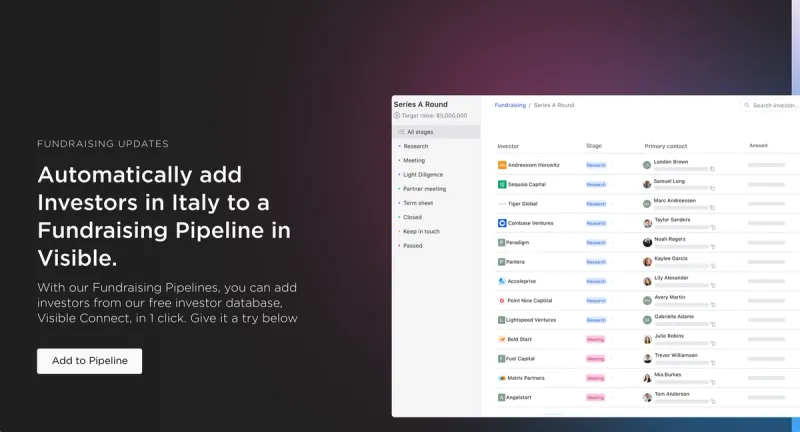

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of Italy's investors here.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.