Founders often struggle to keep fundraising materials organized and secure. Deal room software provides a centralized, encrypted hub for all your cap table files, term sheets, and investor questionnaires. Choosing the best data room for startups ensures your pitch materials are easy to find and share. If you’re bootstrapped or on a tight budget, consider a free data room for startups to test features before committing to a paid plan.

Key Benefits of Using a Deal Room

Implementing a secure investor deal room builds trust by giving backers real-time access to up-to-date documents. You’ll save hours otherwise spent emailing large files or chasing signatures. A sales deal room can also support pre-sales diligence, bridging fundraising and customer onboarding. For teams eyeing strategic exits, look for deal room software m&a features like virtual data locks and audit trails.

Organizations using a dealroom data room benefit from detailed audit logs that timestamp every view and download. That level of transparency can accelerate diligence by giving you metrics on how engaged potential investors truly are. Instead of guessing whether an investor has reviewed your financial model, you’ll see exactly when they opened those projections and for how long. Armed with that insight, you can follow up at the right moment with fresh context or answers to anticipated questions.

Choosing the Right Deal Room Solution

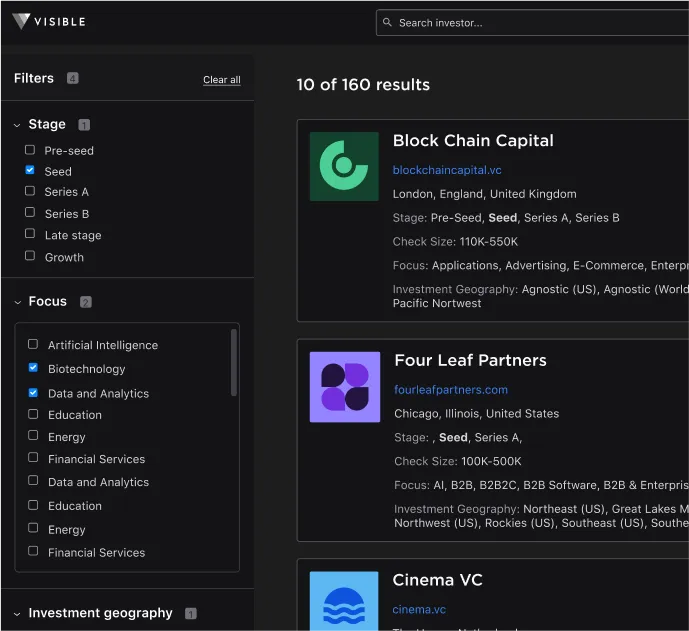

When evaluating platforms, compare legacy tools such as box data room and google data room against modern alternatives. If you want to try before you buy, search for deal room software free or download a trial via deal room software free download. Always weigh feature sets against dealroom pricing to find the best fit for your runway.

Consider the total cost of ownership, including onboarding services, customer support tiers, and API access for integrations. Some founders opt for tiered subscriptions that scale with dealroom revenue milestones, allowing them to unlock advanced capabilities only as their business demands grow. Others prioritize platforms with drag-and-drop simplicity to reduce training time for lean teams.

Advanced Features: AI, Analytics, and Beyond

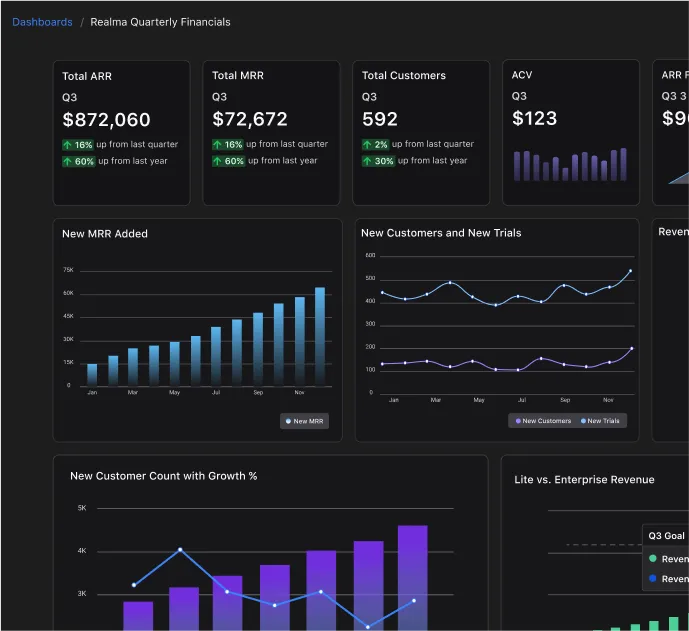

Some platforms embed dealroom ai to auto-tag and categorize documents, saving manual effort. Built-in analytics in a dealroom data room let you see who’s viewed which files and for how long. Whenever you need to refer generically, simply call it dealroom software for easy shorthand.

Beyond tagging and tracking, AI can surface gaps in your materials by comparing your package against best practices extracted from thousands of past fundraises. Advanced search capabilities powered by natural language processing allow you to locate specific clauses or investor questions in seconds. These smart features free you to focus on crafting compelling narratives instead of hunting for scattered files.

Security and Compliance Considerations

Maintaining investor confidence means meeting strict security standards. Most deal room software solutions are SOC 2 Type II compliant and offer two-factor authentication to safeguard sensitive data. Some also support custom watermarking on downloads to deter unauthorized sharing. If you’re dealing with cross-border investors, verify that the platform adheres to international data-privacy regulations. This attention to security not only protects your documents but signals professionalism to potential backers.

Integrations and Workflow Automation

A deal room that plays well with your existing stack makes life easier. Popular deal room software integrates with your customer relationship management (CRM) system, accounting tools, and electronic signature platforms. That way, updates to your cap table or financial model can automatically sync to the deal room. Automated notifications inform investors of new uploads, reducing manual outreach. Think of your dealroom as the hub that ties together every tool you use to tell your company’s story.

Real-World Use Cases for Startups

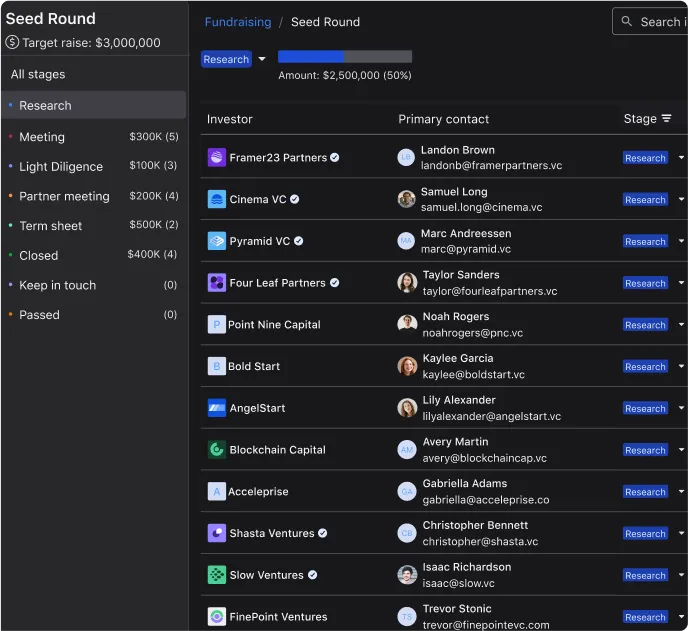

Early-stage founders can use dealroom startups tools to streamline seed rounds, sharing a clean data package with angel investors. Series A teams often tap dealroom m&a modules to prepare for strategic acquisitions. Tracking metrics in the same place also highlights dealroom revenue growth over time for more compelling pitches.

One venture-backed software startup reported closing its Series B a month earlier after switching from a generic platform to specialized deal room software. Investors praised the clear folder structure and timely notifications, reducing follow-up questions by forty percent. Another hardware founder used an investor deal room to coordinate a cross-border syndicate, ensuring all documents met local compliance requirements without manual back-and-forth.

Cost versus Return on Investment

While free data room for startups trials help you get started, premium subscriptions often pay for themselves. By reducing back-and-forth emails, avoiding compliance missteps, and accelerating due diligence, founders recoup subscription costs through faster closes. Estimate your ROI by comparing typical fundraising timelines before and after implementation. Many founders find that shaving even two weeks off due diligence justifies an annual subscription fee.

Implementation Best Practices

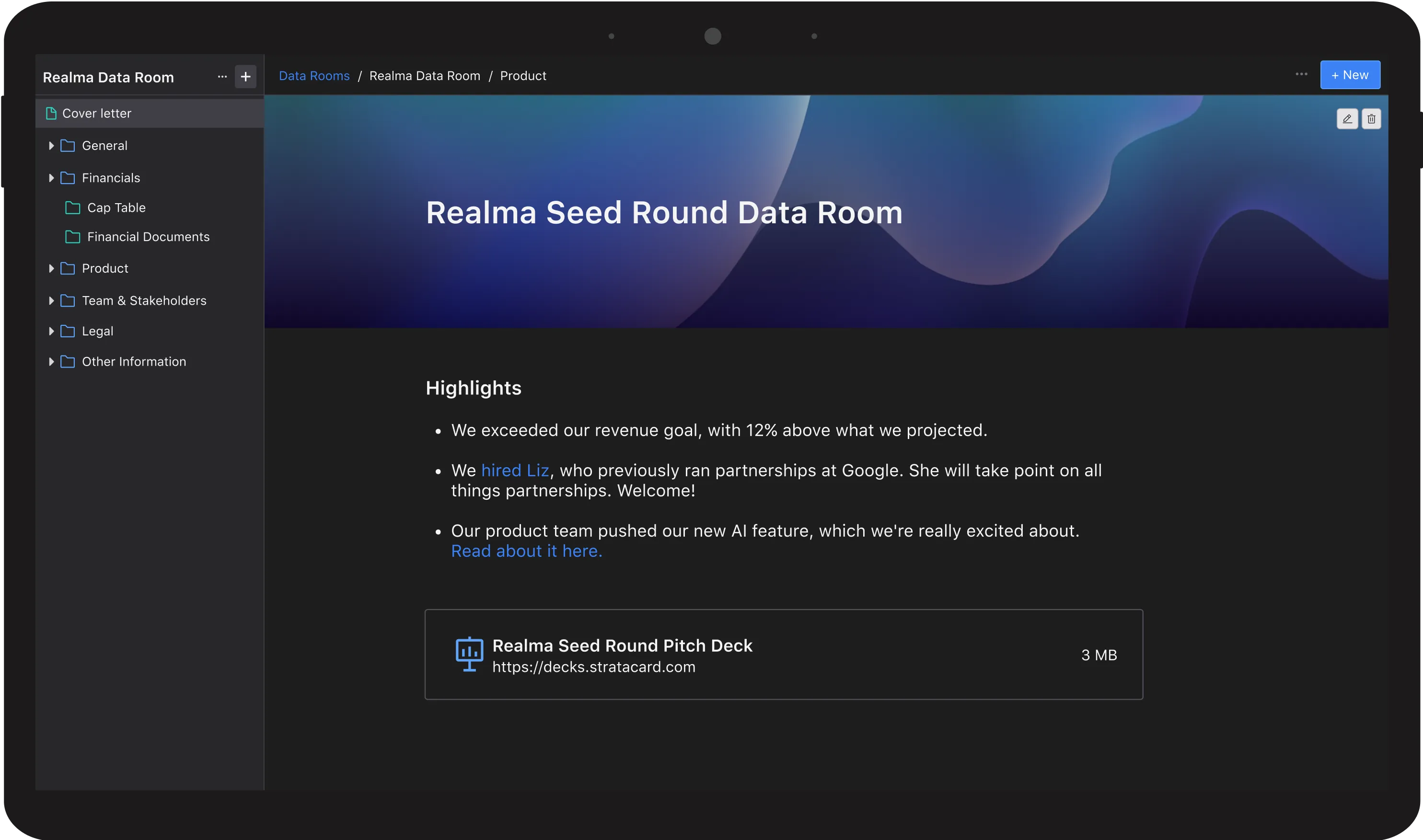

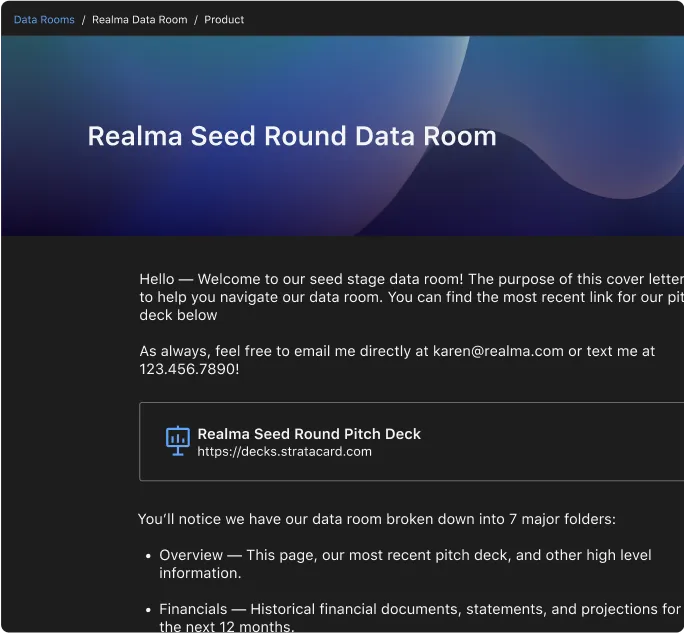

Start by mapping your fundraising process and uploading documents in phases. Use a consistent folder structure and naming convention within dealroom to minimize confusion. Grant permissions carefully—only the right investors see sensitive term sheets. Schedule weekly check-ins to ensure your data remains fresh and accurate.

To streamline collaboration, integrate your deal room with tools you already use, such as your customer relationship management system or accounting software. Mobile access ensures founders can share documents on the go, whether they’re meeting a mentor at a coffee shop or dialing into a late-night conference call with overseas backers. Assign a “deal room champion” to own ongoing maintenance and act as the main point of contact for any investor questions.

Common Pitfalls and How to Avoid Them

Avoid dumping every file into one folder; it makes diligence a chore and frustrates investors. Don’t leave default permissions in place—review access after each funding milestone. Finally, resist the urge to treat your deal room as a file archive; update it continuously as you hit new traction milestones.

In addition, watch out for hidden fees in some tiered plans, such as per-user costs or charges for exceeding storage limits. Clarify whether analytics dashboards are included or require an extra premium. Transparent pricing discussions upfront help you avoid unwelcome surprises and keep your focus on fundraising.

Next Steps: Launch Your Deal Room Today

Compile your initial data package, run a free trial to validate the user experience, and gather feedback from a trusted mentor or advisor. Once you confirm your chosen platform meets your needs, formalize your subscription and invite your first wave of investors. With a well-structured deal room, you’ll streamline due diligence and close rounds faster than ever.

To maintain momentum, schedule quarterly reviews to reassess your setup, incorporate new documents, and ensure the platform continues to align with your evolving fundraising goals. By treating your deal room as a dynamic, integrated part of your fundraising workflow, you position your startup for long-term success.