Customers are the lifeblood of a business. At the end of the day, a business needs customers and revenue to survive. In order to better help companies understand how customers are interacting and spending with your business, you need to have a set of metrics in place.

Customer lifetime value (CLV) (also referred to as the lifetime value of a customer) is a popular marketing metric to help you understand how much a single customer spends with your business of the lifetime of your relationship. As the team at Shopify puts it, “The lifetime value of a customer, or customer lifetime value (CLV), represents the total amount of money a customer is expected to spend in your business, or on your products, during their lifetime.”

Understanding your CLV is useful because it can help inform your acquisition and go-to-market efforts. It can help you answer questions like:

- What is the most money our company can spend on marketing/sales for customer acquisition

- What is the most we can spend on customer service to retain an existing customer

- Who are the most valuable customers and how can we better target them for future sales?

Related Reading: Startup Metrics You Need to Monitor

Related Resource: Customer Acquisition Cost: A Critical Metrics for Founders

How to Calculate Customer Lifetime Value For Startups

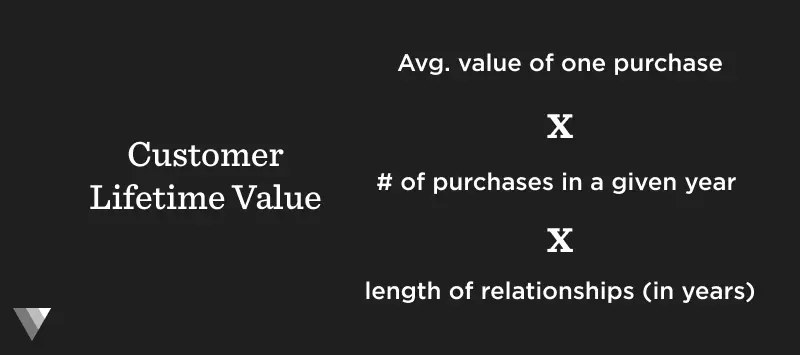

Determining your customer lifetime value is pretty straightforward but can vary depending on the business model and product. In the simplest form, a formula for customer lifetime value is:

CLV = Avg. value of one purchase X number of expected purchases in a given year X length of relationship (in years)

For example, let’s say you sell snowboards. It might look like:

CLV = $500 average order for a customer X 1 snowboard purchased by a customer in a year X 7 years = $500x1x7 = $3500 CLV

If you have a subscription-based or SaaS model, your CLV might look something like this (at a very simple level):

CLV = Avg. Revenue Per Account (ARPA) / Churn Rate

Let’s say you have $100,000 in ARR and 1,000 customers, your ARPA would be $100 a year.

And let’s say you have a churn rate of 5%. Your CLV would be $2,000 ($100/.05).

However, things can get a bit more complicated when you add in things like the expansion and contraction of different accounts.

Why Determining Your Customer Lifetime Value is Important

The formula for customer lifetime value might seem simple enough but you might want to understand why you should be tracking it for your business. Learn more about the advantages of tracking your CLV below:

Advantages of CLV

The biggest advantages of calculating and tracking your CLV are the insights you can uncover. These insights will help you understand your best acquisition channels (more on this below) and how to improve your customer retention rates.

By understanding the value of a customer over the lifetime of your relationship, you’ll be able to better allocate capital and headcount towards different initiatives, channels, and product development.

Historic CLV Vs Predictive CLV

When it comes to calculating and analyzing your CLV there are 2 further formulas and decisions to make. On one hand, you have historic CLV, which is based on existing data that you’ve already collected. On the other sid,e you have predictive CLV which is based on predictions (using data you already have) for how much a customer will spend over their lifetime.

How to calculate historic CLV

Calculating your historic CLV is often more difficult and can be a lagging indicator for success. Simply put, historic CLV calculates all of the transactions and is multiplied by gross margin % over the course of a relationship with a customer. So it looks like something like:

Historical CLV = (Transaction 1 + Transaction 2 + Transaction 3…) X Gross Margin %

How to calculate predictive CLV

Predictive CLV tends to be a better option for most businesses and can be a better interpretation of your CLV. Predictive CLV is more in line with the formulas we shared above and takes a holistic look a the business so you are multiplying your average customer spend by the amount of time they are a customer.

Put Your CLV Calculations to Work

If you’re going to take the time to calculate and track your customer lifetime value, you want to make sure you are getting the most out of it as possible. Check out some of our favorite ways to leverage CLV for growth below:

Prioritize your marketing spend

Arguably the biggest benefit of tracking your CLV is understanding how to better acquire new customers. A higher CLV means you can spend more to acquire new customers. A lower CLV obviously means you can spend less.

This means different channels might be more fruitful or economical for different models. If you have a low CLV, you will need to find more organic and cheaper acquisition channels. If you have a huge CLV, you can use more robust and hands-on channels.

As a general rule of thumb in the SaaS world you want to make sure your CLV:CAC (customer acquisition cost) ratio is at least 3:1. This means that your customer lifetime value is 3x what you are spending to acquire them.

Related Reading: Customer Acquisition Cost (CAC): A Critical Metrics for Founders

Reduce customer churn and hammer loyalty

One of the highest leverage activities to increase CLV is by lowering churn. If you take our example from the beginning — a SaaS company with CLV of $2,000 ($100 ARPA / 5% churn rate) — and change their churn to 1% you’ll see their CLV goes to $10,000 ($100 ARPRA / 1% churn rate).

By tracking CLV you’ll be able to better understand how you can properly service your current customers to decrease churn and increase loyalty. You might find that if they spend $10,000 over the course of a few years, you can run additional campaigns or offer them a dedicated account manager so they stick around.

Related Reading: What’s an Acceptable Churn Rate?

Design new enterprises that grow the business

If you find a certain segment of your customers or particular product has a particularly high CLV, you can double down. You can find and design new enterprises that could have a higher CLV.

Tips for Enhancing CLV

Tracking your CLV is a small part of the battle. Constantly drawing insights and enhancing your CLV is where the real fun begins. There are a few key areas where you can focus to improve your CLV. Learn more below:

Make Improvements to the onboarding process

A surefire way to increase your CLV is by improving your onboarding process for new customers. This helps in a few different ways.

- An improved onboarding process helps to make sure your customers are engaged with your product. In turn, this reduces churn and increases your CLV.

- A more engaging onboarding experience is a great way to build a relationship with customers. This can help you expand their account size in the future as they are familiar with your product and team.

Provide high-quality content to your customers

Another great way to increase your CLV is by focusing on high-end content for your customers. This is especially true for SaaS businesses that might rely on a customer to use the product themselves.

By having great and engaging content for your customers they will understand how to use and leverage your product best and will be less likely to churn. A couple of examples:

- A knowledge base or support articles that are well written and easy to understand for users.

- Videos and tutorials that demonstrate exactly how things can be accomplished in the product.

- Stories and insights from other customers that show how the best customers and companies are using your product.

Offer the best high-end customer services

Going hand-in-hand with the points above is offering a superior customer experience. Offering incredible customer service will assure customers they want to stick with your business and will churn at a lower rate.

Build relationships with customers

You might be noticing a trend here — the best way to improve your CLV is by having an incredible customer experience that reduces churn. Building relationships takes a series of approaches. It doesn’t happen overnight but by implementing a few of the ideas from above you’ll be able to strengthen your relationship and build trust with customers — the key to reducing churn and increasing your average revenue per customer.

Track your CLV with Visible

Customer lifetime value (CLV) is an important metric for any business to track. Having a calculated approach to your acquisition and customer support efforts is a surefire way to grow your business and bring in new capital from investors when needed.

Need a place to track your CLV (and other key metrics) and share it with your key stakeholders (like team members, investors, board members, etc.)? Check out Visible. Track key metrics, raise capital, send updates and engage your team from a single platform. Try Visible free for 14 days.