Blog

Operations

Resources to improve operations at your startup or VC fund.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Operations

V2MOM: Salesforce’s Secret & Why it Works

In 19 years, Salesforce has transformed from a “startup” to a publicly-traded company with over 30,000 employees. They’ve managed to sustain incredible growth while maintaining strong organizational alignment and communication. As Marc Benioff puts it, “While a company is growing fast, there is nothing more important than constant communication and complete alignment. We’ve been able to achieve both with the help of a secret management process that I developed a number of years ago”.

So what’s their “secret management process?” V2MOM.

What is V2MOM?

V2MOM is a management and communication process used by the team at Salesforce. It is an acronym that stands for vision, values, mission, objectives, and measures. It was implemented in the first few weeks of operation at Salesforce and has continued to ring true today. Benioff defines the different sections of the V2MOM below:

What Does the V2MOM Process Look Like?

The V2MOM process can be broken down by the individual inputs (or letters in the acronym). Learn more about each section below:

Vision

Claire Lew, Founder of KnowYourTeam, puts it, “A vision is a picture of a better place. You see this picture in your head: It’s what you want the world to look like because your product or team exists. In many ways, your team’s vision is your opinion on how you think the world ought to be. A vision answers the question, “What world do you want to create?” Or put even shorter by Marc Benioff, CEO of Salesforce,

“The vision helped us define what we wanted to do.”

The idea of a company vision can sound like a vague, ideal outlook to the world but it can help founders hire top talent, build a strong culture, and keep everyone aligned.

Values

Marc Benioff goes to describe values as,

“The values established what was most important about that vision; it set the principles and beliefs that guided it (in priority)”

The team at Lessonly takes a deeper dive and explains company values as, “Company values play a critical role in helping businesses to achieve their goals and objectives. These values shape the identity and principles of the organization, act as a guiding light for employees, and affect the way organizations conduct their business.”

Methods

Next comes methods. Benioff explains methods as,

“The methods illustrated how we would get the job done by outlining the actions and the steps that everyone needed to take.”

Methods can be used as a step by step roadmap of what needs to happen for you and your team to accomplish your organization’s larger vision. As an example, the Salesforce original V2MOM methods looked something like this:

Hire the team

Finalize product specification and technical architecture

Rapidly develop the product specification to beta and production stages

Build partnerships with big e-commerce, content, and hosting companies

Build a launch plan

Develop exit strategy: IPO/acquisition

Obstacles

If methods are the steps you need to take to accomplish the vision, obstacles are the things that might stand in the way of accomplishing your vision. As Benioff explains,

“The obstacles identified the challenges, problems, and issues we would have to overcome to achieve our vision.”

From the Salesforce example they lay out the following obstacles:

Developers

Product manager/business development person

Measures

Measures are the quantifiable results you’d like to achieve to achieve your vision. Generally speaking, this should be a number. As Benioff explains it,

“Finally, the measures specified the actual result we aimed to achieve; often this was defined as a numerical outcome.”

Continuing with the Salesforce example. They laid out the following metrics to measure and track:

Prototype is state-of-the-art

High-quality functional system

Partnerships are online and integrated

Salesforce.com is regarded as a leader and visionary

We are all rich

In order to help you track your vision, values, methods, obstacles, (and especially) measures, we created a V2MOM Update Template that can be used directly in Visible. Check it out here.

The Benefits of Using V2MOM

It is clear that V2MOM works well for Salesforce but the question is, "does it make sense to implement at my company?"

Check out a few of the benefits V2MOM below to help understand if V2MOM is right for your business.

Enhanced Clarity of Purpose

V2MOM is a great way to continue to focus on your clarity of purpose. By laying out the vision for a particular project or goal, you are forced to understand how individual work ties into the overall purpose of the business.

Seamless Alignment Across the Organization

V2MOM creates alignment across individuals and the entire organization. By laying out the vision and values, you are forced to see how your individual and team's work fits into the organization as a whole. A written document also offers other team members insight into other individuals' work to see how they can encourage and support one another.

Related Resource: How to Build Organizational Alignment Easily

Sharper Focus on Strategic Initiatives

Leveraging V2MOM is a great way to stay on top of strategic initiatives. It helps teams tie in their overarching strategic initiatives into documents that can be shared across the organization.

Why V2MOM worked for Salesforce

Many of the organizational decisions and directions at Salesforce are guided by their V2MOM. Since the inception of V2MOM, Salesforce has continued to use the management process for individuals and teams. As Salesforce continues to knock out their vision they go back to the drawing board and create a new vision the team can rally behind on an annual basis. You can check out the original V2MOM from April 12, 1999 below:

However, V2MOM can be expanded beyond company wide alignment and can be used for team alignment and individual objectives. After Marc and the entire company define a new V2MOM it is then passed down to teams and individuals. From here, each employee is responsible for creating their own V2MOM. While having the corporate V2MOM to guide their own it’s easy for everyone across the organization to see how their role, goals, and projects can fit into the overall company vision (read: alignment).

What types of businesses can use V2MOM

Any business can use a V2MOM. However, there are certain use cases and types of businesses that generally will benefit most from a V2MOM.

Early Stage Startups

Early stage startups, especially those with lofty growth goals, can greatly benefit from setting up a V2MOM. In the early days of a startup, staying aligned and focused while you search for product market fit, your first hires, and your first customers can be a major challenge. V2MOMs can especially help early stage startups with the following:

Hiring

A V2MOM can help build the base of a strong startup culture. With the company vision being a picture of what you want the world to look like, it can be a strong tool when hiring and recruiting top talent. If a potential candidate feels strongly about your vision, chances are they will fit into the culture and will have a desire to work with you to accomplish your vision.

Current employees will also be able to see the direct impact their work is making to the different components of a V2MOM. This will help give them the pride and ownership they want out of their work.

Alignment

Staying aligned while rapidly scaling headcount is a challenge. By having everyone hyper-focused on the vision, values, obstacles, methods, and measures, you’ll be able to keep everyone moving in the same direction.

Fundraising

V2MOM is a forcing function for leaders to lay out their vision and a rough road map of how they will get there. Even if you’re not pitching an exact V2MOM to a potential investor, it is a great backbone for different aspects of your pitch.

For example, the vision and values will help paint the picture of what the company will look like and where you are headed. The methods and obstacles will help demonstrate the roadmap to achieve your vision and a clear demonstration of your understanding of the market (and competitors). And measures are the metrics and projects you’ll track to move forward.

Related Resource: What do Investors Care About When it Comes to Culture?

Internal Teams

Salesforce expanded their V2MOM beyond as it is used for individuals and teams. Teams can lay out the vision they want to accomplish by using the company-wide V2MOM to guide them. From here, you can take it a step further and let individuals use the company-wise and team V2MOM to create their own individual plan to advance themselves forward.

When V2MOM May Not Work

Although we mentioned V2MOMs can work for all businesses — there are particular miscues, use cases, and businesses where it may not work as well.

Lack of Communication

Setting your V2MOM is only half the battle. To gauge your progress towards the company vision, you need to communicate and distribute your progress towards the vision (particularly the measures section). Companies that fail to communicate their V2MOM status properly, likely aren’t benefiting from the alignment that V2MOMs can offer.

Incorrect Data

When measuring any metric or goal, you must be measuring the correct thing. This stands true when tracking your measurables. For example, if you want to bring X # of people to your website but find out halfway through your Google Analytics data is wrong that can hurt your efforts over the previous months.

Established Businesses

V2MOMs can 100% work for established businesses, but it may not be the best use of time. If a shop or business knows exactly what they’re doing and have been operating in a certain manner for decades, there may not be a need for a V2MOM. If employees are happy and business is stable, there may be a better use of time for everyone involved then crafting an aspirational vision and roadmap.

V2MOM’s should be shared, changed, and discussed regularly. The introduction of V2MOMs for individuals should lead to conversations with their managers around priorities and decision-making processes. Ready to step up your company alignment as you continue to grow? We put together an V2MOM Update Template you can check out here.

How Do You Write a V2MOM? Tips to Follow

If V2MOM sounds like a could be a good fit for your business. Check out tips to get started with V2MOM below:

1. Respect the Structured Order of the Elements

First things first, you need to stick to the structured order of the elements. This means staying true to vision, values, methods, obstacles, and measures.

2. Use the SMART Framework

The SMART framework is used when setting goals. This will help when it comes to setting the measurables for a V2MOM. As the team at TechTarget puts it, "SMART is a best practice framework for setting goals. A SMART goal should be specific, measurable, achievable, realistic and time-bound. By setting a goal, an individual is making a roadmap for a specific target."

3. Keep it Concise

Keep your V2MOM short and sweet. Make it easy to understand for everyone in the organization. By adding too much information, it will likely add confusion and further questions.

4. Prioritize and Be Specific

Prioritizing the methods you will use will help lead to the desired outcomes. By listing too many methods you are likely diluting the focus and hurting your chances of a desired outcome.

5. Regularly Review and Update

A V2MOM is a living document. It should be regularly reviewed by managers and peers so you can regularly update what is working and adapt to the changing environments.

Use Visible's V2MOM Template as a Roadmap to Success

Having a way to share and iterate on your V2MOM is crucial to success. Check out the template from our team that can be easily shared via email, Slack, and link. Try the template and get started on your V2MOM document here.

investors

Reporting

Operations

An Essential Guide on VC Fund Administration

What is fund administration?

Fund administration is a third-party service that handles the accounting, cash-flow movement, and LP reporting for Venture Capital funds. Hustle Fund argues that fund admins are the most important part of a VC’s back-office operations.

Key fundamentals of funds administration in Venture Capital

Fund Admins play an essential role in ensuring critical fund operations run smoothly and also can help VC firms maintain credibility with Limited Partners (LPs). Below we outline the key fundamentals of Fund Administration.

Cash flow management and capital allocation

Fund administrators are responsible for wiring money directly to founders. The main reason fund administrators handle this process and not the GP is to protect against fraud and ensure accuracy.

Fund administrators also handle the capital transactions between LPs and the fund. This includes managing the call-down process, determining how much to request from each LP, and sending letters to each LP with wire instructions. After an exit event, the fund administrators are also responsible for figuring out how much to distribute back to each LP.

That’s a lot of separate transactions to manage which is why this can be an extremely time-consuming process. It’s also a high-stakes process with no room for mistakes. An error in the numbers can even result in a lawsuit based on gross incompetence.

Limited Partner management

Since Fund Administrators are responsible for sending communications related to capital transactions and reporting to Limited Partners, it’s critical that fund administrators keep an up-to-date list of Limited Partner contact information. The fund should share updated contact information with fund administrators as changes occur.

Reporting

Fund administration also handles the formal LP reporting process as outlined in a fund’s Limited Partnership Agreement. This typically includes putting together quarterly reports of each company’s latest valuation on a quarterly basis but the reporting requirements can vary from fund to fund based on LP requirements. To put together this reporting, fund administrators will source the latest investment information from the VC fund which is why it’s important for firms to keep investment data and fair market value changes up to date and accessible. Preparing these quarterly reports helps streamline the annual audit at the end of the year.

Visible provides investors with an easy way to maintain accurate investment records that can easily be shared with fund administrators and auditors.

Compliance assistance

An important role of a fund administrator is making sure funds are maintaining compliance with the terms outlined in their Limited Partnership Agreement (LPA). This can include terms related to the timing of distributions, what can be considered a fund expense, and the deadlines for reporting.

Audit and tax

A fund administrator will work closely with other fund service providers such as auditors and tax-related providers to ensure the fund is performing in accordance with regulations.

Related resource –> Venture Capital Audit Process: What it is and how Visible can help

Modern technology and software solutions

There are a variety of fund administrators dedicated to serving the VC industry. As discussed, VC fund administrators play a key role in VC firm operations so it’s worth taking the time to select the provider that is going to be the best fit for your firm. A great way to start is by asking your community for referrals. From there, it’s wise to interview the administrators and actually speak with the representative who will be assigned to work with your fund.

Fund administrators differentiate themselves by variables such as the level of sophistication of their tech stack, whether they offer an LP portal, and also by the quality of the service they provide. It’s important to note that the quality of service can be dependent on the representative you work with at the organization. This is why it’s a great idea to meet with the rep in advance of signing a contract.

The benefits of working with fund administrators

Working with the right fund administrator can mean fewer headaches and more time to spend finding and supporting the best investment opportunities. Below we outline the top benefits of working with fund administrators regardless of your fund structure.

Saves your firm time and resources

Working with a fund administrator instead of trying to manage accounting in-house can save a firm time and money. This is because fund administrators are laser-focused on all the back-office functions and can be less costly than adding a full-time finance expert to your team.

Provides expertise and experience

A great fund administrator can provide funds with expertise based on working with dozens or even hundreds of VC firms. This can save less experienced GPs from costly accounting, legal, or capital transaction mistakes.

Assists with investor relations management

A fund administrator should provide timely and accurate communication to LPs. When fund administrators are executing well it should make the lives of the LPs easier which reflects positively on the fund.

Provides compliance and regulatory support

Since fund administrators have worked with hundreds and potentially even thousands of VC funds of varying stages, they’ve been exposed to many of the edge cases that could cause an inexperienced fund to make costly mistakes that could hurt their reputation. Fund administrators are well-versed in Venture Capital regulation and compliance which means GPs can leverage their fund administrators’ expertise when questions arise.

When is the optimal time to start working with a fund administrator

While not always required, it’s a good idea to start working with a fund administrator before even closing your first fund. This ensures your back office operations are set up for success right from the beginning. Many fund administrators have special pricing for emerging fund managers that makes it more affordable to get started.

Looking to improve your portfolio monitoring processes at your fund?

Visible streamlines the way you keep your companies’ financial KPI’s and investment data up to date and organized so sharing key information with service providers like your fund admin becomes even easier.

founders

Operations

What Is Form 3921, and How Does It Affect Your Employees?

Equity compensation, such as Incentive Stock Options (ISOs), has become a cornerstone of the compensation strategy for many startups. While these options offer a range of benefits for both employers and employees, they also come with specific tax obligations and reporting requirements. Enter IRS Form 3921—a critical form that serves as the linchpin for reporting ISO exercises to the Internal Revenue Service.

This form not only aids the IRS in ensuring tax compliance but also helps employees keep track of essential information required for their own tax returns.

What Is the Purpose of IRS Form 3921?

The purpose of IRS Form 3921 is to inform the IRS of the exercise of an incentive stock option (ISO). ISOs are a type of equity compensation that allows employees to purchase company stock at a predetermined price, typically below the fair market value of the stock. When an employee exercises an ISO, they are essentially buying stock from their employer.

Form 3921 provides the IRS with information about the ISO exercise, such as the date the option was exercised, the exercise price, and the fair market value of the stock. This information helps the IRS track the number of ISOs that are exercised and the amount of compensation that is received by employees.

The IRS uses this information to ensure that employees pay the correct amount of taxes on the appreciation in the value of the stock. If an employee sells the stock within one year of the exercise date, they will owe ordinary income taxes on the entire amount of the appreciation. However, if they hold the stock for at least one year from the date the option was granted and two years from the date the option was exercised, they will only owe capital gains taxes on the appreciation.

In addition to informing the IRS of the exercise of an ISO, Form 3921 also serves as a record for the employee. The employee should keep a copy of Form 3921 for their own records so that they can properly report the income on their tax return.

Related resource: IRS- About Form 3921, Exercise of an Incentive Stock Option Under Section 422(b)

The Difference Between Form 1099B and Form 3921

The main difference between the two forms is that Form 1099-B reports on the sale of stock, while Form 3921 reports on the exercise of an ISO. Form 1099-B is typically filed by the brokerage firm that sold the stock, while Form 3921 is typically filed by the startup that issued the ISO.

Form 1099-B is an information return that must be filed by brokers and other financial institutions to report the proceeds of sales and other taxable transactions in securities, such as stocks, bonds, and mutual funds. The form provides the IRS with information about the sale, such as the date of the sale, the sale price, and the cost basis.

Form 3921 is an information return that must be filed by startups with the IRS when an employee exercises an incentive stock option (ISO). The form provides the IRS with information about the ISO exercise, such as the date the option was exercised, the exercise price, and the fair market value of the stock.

“If you sold stock, bonds or other securities through a broker or had a barter exchange transaction (exchanged property or services rather than paying cash), you will likely receive a Form 1099-B. Regardless of whether you had a gain, loss, or broke even, you must report these transactions on your tax return.” HRBlock

Related resource: What is a Schedule K-1: A Comprehensive Guide

How Does Form 3921 Impact Employees Who Exercise an Incentive Stock Option (ISO)?

It provides the IRS with information about the ISO exercise, which the IRS uses to ensure that employees pay the correct amount of taxes on the appreciation in the value of the stock.

It serves as a record for the employee, which they can use to properly report the income on their tax return.

If an employee sells the stock within one year of the exercise date, they will owe ordinary income taxes on the entire amount of the appreciation. However, if they hold the stock for at least one year from the date the option was granted and two years from the date the option was exercised, they will only owe capital gains taxes on the appreciation.

The employee should keep a copy of Form 3921 for their own records so that they can properly report the income on their tax return.

When Should a Startup Owner Receive a Form 3921?

For startup owners, Form 3921 is their responsibility. Whenever an employee exercises ISOs granted by the startup, the owner must provide them with Form 3921.

To ensure timely filing of Form 3921, keep in mind these three crucial deadlines:

January 31: The final date to distribute copy B to all employees who exercised their ISOs during the preceding year.

February 28: The cut-off for submitting copy A to the IRS via paper forms.

March 31: The last date to send copy A to the IRS through electronic submission.

What Information Do You Need to Complete the Form?

Filling out Form 3921 requires particular attention to details and collecting specific data. It’s crucial to identify the necessary information for startup owners and employees.

You can find more information about Form 3921 on the IRS website.

For Startup Owners

Startup owners provide Form 3921’s data set so they must provide:

The name, address, and taxpayer identification number (TIN) of the employee who exercised the ISO.

The date the ISO was granted.

The exercise price of the ISO.

The fair market value of the stock on the date the ISO was exercised.

The number of shares of stock that were acquired through the exercise of the ISO.

The name and TIN of the company that issued the ISO.

The transmitter control code (TCC), if filing electronically.

The employee’s email address, if filing electronically.

The fair market value of the stock on the date of exercise, if the employee did not hold the stock for at least one year from the date the option was granted and two years from the date the option was exercised.

The company’s EIN (Employer Identification Number)

The company can obtain the employee’s TIN from the employee’s W-4 form. The company can obtain the fair market value of the stock from the stockbroker or transfer agent. The company can obtain the transmitter control code from the IRS website.

The company must file Form 3921 by March 31 of the year following the year in which the ISO was exercised. The company can file Form 3921 electronically or by mail.

For Startup Employees

Employees do not need to complete Form 3921. This form is filed by the company that issued the incentive stock option (ISO). However, the employee may need to provide some information to the company, such as their taxpayer identification number (TIN).

The employee’s TIN can be found on their W-4 form. The company can use this information to complete Form 3921.

The employee should also keep a copy of Form 3921 for their own records. This could be helpful if they ever need to file an amended tax return or if the IRS audits them.

Do Startups or Employees Owe Taxes on Form 3921?

The employee will owe taxes on the difference between the fair market value of the stock on the date the option was exercised and the exercise price when they sell the stock, unless they hold the stock for at least one year from the date the option was granted and two years from the date the option was exercised. In that case, the employee will not owe any taxes on the appreciation in the value of the stock.

The startup does not owe any taxes on the exercise of an ISO. However, if the startup later sells the stock that was acquired through the exercise of the ISO, it may owe capital gains taxes on the appreciation in the value of the stock.

How to File IRS Form 3921 as a Startup Owner

Yearly tax reporting is a ritual, and for those with ISO dealings, Form 3921 is a significant part of this process. Here’s a breakdown:

1. File Copy A Through the IRS

Form 3921 can be submitted to the IRS electronically or via traditional mail. Online methods are often more efficient and can offer faster confirmations of receipt. Regardless of your choice, ensure you’re ahead of the filing deadline, which typically aligns with other wage and tax statements.

2. Give Copy B to the Employee

This isn’t just a courtesy; it’s a requirement. Distributing Copy B of Form 3921 ensures that employees have the essential data they need to file their taxes correctly. The timeline is tight, with the document typically due to the employee by January 31st of the year following the ISO exercise.

3. Keep Copy C for Startup Records

In the world of business, documentation is king. Keeping Copy C of Form 3921 is not just good practice but vital for tax compliance. If the IRS ever comes knocking with an audit in tow, you’ll be grateful you retained these records.

What Happens if You Miss the Filing Deadline?

Oversights happen, but missing the Form 3921 deadline can be costly. Penalties can accrue, and these, over time, can become substantial financial burdens. If you realize you’ve missed the deadline, it’s crucial to act promptly: submit the form as soon as possible and consult a tax professional regarding any penalties and potential relief.

The amount of the penalty will depend on how late you file the form and whether you have a history of filing late.

The IRS may impose a penalty of up to $25 per day for each day that Form 3921 is late, up to a maximum of $15,000. The penalty will be reduced if you can show that the late filing was due to reasonable cause.

In addition to the penalty, the IRS may also assess interest on any taxes that are due as a result of the late filing of Form 3921. The interest rate is currently 6% per year.

To avoid the penalties for late filing of Form 3921, it is important to file the form on time. If you are unable to file the form on time, you should contact the IRS as soon as possible to request an extension.

Resources

Understand the difference between ISOs and NSOs here.

IRS- About Form 3921, Exercise of an Incentive Stock Option Under Section 422(b)

Copy of Form 3921

Instructions for Forms 3921 and 3922

Learn everything you need to know about accounting for your startup here.

Dive into valuable business startup resources here.

Visible Can Help Your Startup Stay In-the-Know

Understanding and managing the intricacies of Form 3921 can be overwhelming, but Visible is happy to help navigate this and more! Leveraging tools and platforms, like Visible, can streamline processes, and let startups focus on what they do best: innovating and growing.

See all the ways we help founders with free access to Visible for 14 days: https://app.visible.vc/create-account

investors

Operations

Customer Stories

[Webinar Recording] Best Practices for Onboarding Portfolio Companies to Your VC Firm with M13 and Forum Ventures

We can all agree that first impressions matter. Onboarding a new investment into your VC firm’s community is a key step in setting up the investor <> company relationship for success.

Join us Tuesday, August 29th for a discussion with two leaders in VC Operations, Steph Jones from Forum Ventures and Amelia Zack from M13, on how to set up effective portfolio company onboarding processes at your VC firm.

This webinar is designed for people working in VC operations who want to improve the way they engage with their portfolio companies post-investment.

Discussion topics:

Defining the company onboarding process for your firm and why it matters

Welcoming companies into your community

Connecting companies to resources

Setting expectations about portfolio data collection

Q&A

investors

Reporting

Operations

A Simple Breakdown of the VC Audit Process

VC Audit Definition

Before we address best practices it's important to define what the VC audit entails. A VC audit is when a Venture Capital firm enlists a third-party auditor to evaluate its financial compliance. The auditor will review key fund documentation alongside recent portfolio performance to ensure the firm's valuations are accurate.

Which VC Firms Require an Audit

On August 23, 2023 the SEC approved new rules for private fund advisers. The changes will require all SEC-registered private fund advisers to have an annual audit regardless of size. Prior to this change, some funds were considered exempt but it was still common for VCs to conduct an audit to help better position the firm for future fundraising from potential LPs who want to see audited financials.

Purpose of an Audit

The purpose of a VC audit can be summarized in three parts:

Ensure the fund’s General Partner(s) are operating in accordance with the fund’s LPA and that the financials reflect compliance

Confirm the fund’s valuations of portfolio companies and the fund’s ownership position in them

Give LPs confidence that a neutral third party validates the fund’s financial statements and assessment of its own success

General VC Audit Timeline

Audits are typically conducted on an annual basis using end-of-year figures. The audit process typically starts in the final month of the calendar year and wraps up during the first quarter of the calendar year.

Although audits only happen once per year, it’s important to maintain clean records of things like company valuations, company financial metrics, fund expenses, capital calls, and other transactions throughout the year. Continual hygiene of fund records translates into a smoother audit process at the end of the year.

Here's a general timeline for the VC audit process:

Q1 - Q4 - Collect portfolio company KPI's and monitor valuation changes

Q4 - Establish audit timeline with fund admin and auditor. Additionally, the pre-audit process should kick off so auditors have a chance to understand a firm's operations.

Q1 - In January, firms should be doing year-end valuations and closing their books. During this month fund managers should also be reviewing the books before sending the final figures to an auditor. During January or February, the audit process officially begins.

Q2 - April 30 is the official audit deadline but extensions to the deadline can be requested.

For more audit best practices check this webinar co-hosted with Visible and Weaver -- How to Prepare for Your Fund Audit.

How to Prepare for a VC Audit

Choosing an Audit Firm

This is an important step in setting yourself up for audit success. When choosing an auditor it's important to choose a service provider who specializes and understands the nuances of Venture Capital. Otherwise, you risk spending time during the audit process having to teach your auditor about your industry. You can do this by checking out their website and if they have published resources on Venture Capital then this is a great indication that they have knowledge of your industry. You should also ask the team you'll be directly working with whether they have experience in the VC industry.

If you're an emerging manager and expect to need hand-holding during the audit process, make sure you choose an auditor who is open for ad-hoc questions. During the diligence process, you should ask the auditor about their policy for asking questions and if there is an additional charge.

Related Resource: Five Simple Steps Key Venture Capital Staff Can Take to Support a Successful Audit

Establishing a Valuation Policy

It's a great idea to establish a valuation policy before your first audit. This policy outlines how your firm will justify its portfolio company valuations under different circumstances.

Related resource: Establishing a Valuation Policy

Preparing the Required Documents and Information

While not a comprehensive list, here are some of the items that funds will likely be asked to provide to auditors:

Limited Partnership Agreement

Financial statements

Fully signed deal documentation

Invoices to prove the firm is charging LPs for permitted expenses

Transaction records (capital calls, distributions, bank balances)

Updated ownership positions in each company (cap tables)

Proof of valuation calculations/policies

Portfolio company contacts (name and email address)

Portfolio company financials (year-end)

Portfolio company financing documents from most recent rounds

Portfolio company balance sheets

Portfolio company revenue reports

An established valuation policy

Pro Tip: Ensure you are sending your auditor the fully executed (signed) version of the documents. Doing this will help cut down time during the audit process and help firms save money.

Hustle Fund reminds investors in this article Fund Audit 101 – Everything You Need To Know that it’s the job of the VC to provide this information to auditors and that the required documentation can change from year to year. It can be helpful to ask your auditor to provide quarterly updates about what they will be asking for during the annual audit.

Related Resource: 8 Questions to Ask Before Auditing Your First Venture Capital Fund

Monitoring Portfolio Companies Using Visible

One of the most time-consuming parts of the audit process is the back and forth that can occur when auditors need more evidence on how the VC firm arrived at company valuation figures. To justify valuations, it's important to have key information from your portfolio companies at the ready. Check out the list below to see what you need to have on file.

Portfolio monitoring audit checklist:

Revenue budget vs actual

Cash on hand

Burn rate

Company performance vs business plan

Details about the last round of financing

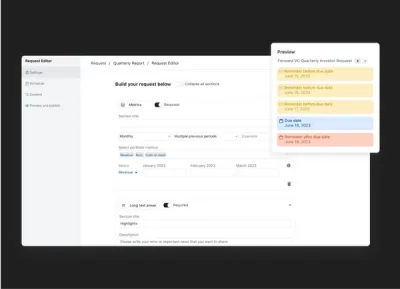

Visible equips investors with a founder-friendly way to ask for key audit information from portfolio companies. Visible's Request feature allows for any custom metric, qualitative question, files, properties, and more. This streamlined approach to data collection helps VC firms keep up-to-date and accurate records about their portfolio companies throughout the year — leading to a smoother audit process.

Check out an Example Request in Visible.

More than 400+ VCs use Visible to streamline their portfolio monitoring and reporting.

founders

Hiring & Talent

Operations

Advisory Shares Explained: Empowering Entrepreneurs and Investors

Managing company equity is a crucial part of a founder’s job duty. In the early days of building a business, chances are there will be countless advisors, investors, peers, etc. that help a business. However, most early stage businesses do not have the cashflow to compensate every advisor along the way. Founders need to get crafty with how they compensate their earliest advisors and experts — enter: advisory shares.

We always recommend consulting a lawyer before taking further action on advisory shares. Learn more about advisory shares and how you can leverage them for your business below:

What Are Advisory Shares?

As put by the team at Investopedia, “One common class of stock is advisory shares. Also known as advisor shares, this type of stock is given to business advisors in exchange for their insight and expertise. Often, the advisors who receive this type of stock options reward are company founders or high-level executives. Advisor shares typically vest monthly over a 1-2 year period on a schedule with no cliff and 100% single-trigger acceleration.”

Advisor Shares vs. Regular Shares (or Equity)

Advisor shares come in different shapes and sizes. There is not a technical definition of advisor shares but is rather any form of equity in a business. Learn more about the characteristics of advisory shares below:

Characteristics of Advisory Shares

As mentioned above, advisor shares typically vest monthly over a 1-2 year period with no cliff. Advisory shares are typically granted as stock options but not every company grants their shares in the same way. This generally comes in the form of Non-Qualified Stock Options (NSOs).

Related Read: The Main Difference Between ISOs and NSOs

How Do Advisory Shares Work?

While advisory shares can take on different forms, they typically can be boiled down to a few similarities. Of course, these can change depending on your business.

Exchanged for advice or expertise

Typically offered as NSO stock options

Follow a shorter vesting schedule

Learn more about how advisory shares typically work below:

Implement a Startup Advisor Agreement

As put by the team at HubSpot, “A startup advisor agreement is a contract between a startup and its advisor. This agreement outlines the terms of the relationship, including the responsibilities of each party and the compensation the advisor will receive.”

There are countless advisor agreement templates online to get you started. The Founder Institute offers a free template called the FAST Agreement.

Determine the Vesting Schedule

As advisor shares are for advisors that offered their expertise, they are typically granted on a shorter vesting schedule because their value is given over a shorter amount of time.

This is typically a 1 or 2 year vesting schedule (as opposed to the 4 year vesting schedule traditionally used for startup employees).

Benefits of Advisory Shares

Advisory shares come with their own set of pros and cons. Properly maintaining and distributing equity is a critical role of a startup founder so understand the benefits, and drawbacks, of offering advisory shares is a must.

Related Resource: 7 Essential Business Startup Resources

Learn more about the benefits of offering startup advisory shares below:

Access to Real Experts

When setting out to build a business, chances are most founders lack expertise in certain areas when it comes to building a business or in their market. However, most early-stage companies are typically strapped for cash and are unable to afford the defacto experts in the space.

With advisor shares, startup founders can attract real experts to get guidance and strategic support in the early days in return for shares in the business.

Related Resource: Seed Funding for Startups 101: A Complete Guide

Better Network Credibility

If hiring the right advisor, chances are they will be able to help beyond strategic advice or their expertise. They will be able to expose your business to their network and will be able to make introductions to new business opportunities, partnerships, investors, and potential hires.

Cost-Effective Compensation

As we previously mentioned, most businesses that benefit most from advisors are unable to offer them a salary or cash compensation. With advisor shares, startup founders are able to offer shares as compensation and conserve thei cash to help with scaling their business and headcount.

Drawbacks of Advisory Shares

Of course, offering advisor shares is not for everyone. While there are benefits to offering advisor shares, there are certainly drawbacks as well. Weighing the pros and cons and determining what is right for your business is ultimately up to you.

We always recommend consulting with a lawyer or counsel when determining how to compensate advisors.

Diluted Ownership

The biggest drawback for most founders will be the diluted ownership. By offering shares to advisors, you will be diluting the ownership of yourself and existing shareholders.

As advisors are fully vested in 1-2 years, they will potentially not be invested in future success as other stakeholders and could be costly when taking into account the diluted ownership.

Potential Conflicts of Interest

Advisors might not have the same motivators and incentives as your employees and other shareholders. As their ownership is generally a smaller % and their shares vest early, they are potentially not as incentivized for the growth of your company as employees and larger % owners will be.

Getting in front of these conversations and making sure you have a good read on any potential advisors before bringing them onboard is a good first step to mitigate potential conflicts.

Extra Stakeholder to Manage

Chances are most advisors are helping other companies as well. This means that their attention is divided and you will need to ensure you are getting enough value to warrant dilution.

This also means that you are responsible for managing a relationship and communication with another stakeholder in your business — what can be burdensome on some founders.

The 2 Variations of Advisory Shares

Advisory shares are generally offered in 2 variations — restricted stock awards and stock options. Learn more about each option and what they mean below:

Restricted Stock Awards

As put by the team at Investopedia, “A restricted stock award is similar to an RSU in a number of ways, except for the fact that the award also comes with voting rights. This is because the employee owns the stock immediately once it is awarded. Generally, an RSU represents stock, but in some cases, an employee can elect to receive the cash value of the RSU in lieu of a stock award. This is not the case for restricted stock awards, which cannot be redeemed for cash.”

Stock Options

As we mentioned, NSOs (Non-Qualified Stock Options) are commonly used for advisor shares. As put by the team at Investopedia, “A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option… Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option.”

Who Gets to Issue Advisory Shares?

Issuing advisory shares is typically reserved for the founder or CEO of a company. Having a decision-making process and gameplan when issuing advisory shares is important. This might mean offering no shares at all, having an allocated amount of advisor shares from the get go, or something inbetween.

Making sure your board of directors and other key stakeholders are on board is crucial to make sure that interest and strategy stays aligned for all stakeholders.

How Many Shares Should You Give a Startup Advisor?

Managing the balance between sufficient incentives and managing equity dilution is crucial for any business. Determining the number of shares to offer an advisor is subjective to the founder and advisor. When determining the number, a couple of things to keep in mind include:

Advisor’s experience

Time commitment

Expected contribution

As put by the team at Silicon Valley Bank, “An advisor may receive between 0.25% and 1% of shares, depending on the stage of the startup and the nature of the advice provided. There are ways to structure such compensation that ensures founders get value for those shares and still retain the flexibility to replace advisors, all without losing equity.”

Let Visible Help You Streamline the Investment Management Process

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.

Related resource: Navigating the World of QSBS: Tax Benefits and Eligibility Criteria Explained

investors

Operations

Metrics and data

Portfolio Management: What it is and How to Scale it at Your VC Firm

What is VC Portfolio Management?

Portfolio Management in Venture Capital is a process used by VC investors with the ultimate goal of protecting and increasing the value of their investments. Proper portfolio management is a cumulation of intelligent decision-making, information analysis, and resource commitment all aimed at achieving the value increase and stability in a range of investments.

Portfolio Management within the VC context generally consists of the following:

Market Research and Oversight

Venture capitalists need to be extremely savvy and up-to-date with the most relevant and real-time information about the industries they investment in. Typically, VC firms specialize in a particular type of investment (pre-seed, seed, later stage, etc) and sometimes they are industry specific (B2B Saas, B2C, EnviroTech, FemTech). Therefore, the portfolio that a VC is managing may encompass many different industries. Investors should aim to understand the most up-to-date research on how each industry and market is growing and changing. This helps investors make smart initial investment decisions, inform follow-up funding decisions, and appropriately advise on timely exit strategies.

Risk Profiling

VC investing is a risky business. However, a clear understanding of how long it will take to gain a return on an investment is critical for investors and goes hand in hand with market research when setting up a portfolio management strategy. VCs need to profile the level of risk of each investment with an informed understanding how long it will likely take to get their initial investment back (typically 3-7 years) and how likely they are to 10x their investment. The balance of quick return with high potential is critical to consider when managing new investments in a VC portfolio.

Exit Strategies

As a VC is first making an investment, they typically write into their investment strategy how they hope to exit the business. This plan includes identifying exit targets and appropriate negotiation engagements in best and worst-case scenarios for the business. Strategies might be mergers, acquisitions, buyouts, or public offerings. An ideal exit strategy is important to outline as a part of a portfolio management strategy. This helps investors better mitigate risk and understand the potential outcomes and value of a portfolio.

Related resource: What is Acquihiring? A Comprehensive Guide for Founders

How Exactly Does Portfolio Management Work?

More experienced venture capitalists will use their past experiences to determine patterns in investment strategies and the most effective way to interpret different potential investment outcome scenarios. Ultimately, portfolio management in Venture Capital comes down to understanding the delicate balance of qualitative and quantitative information about the investments in a portfolio.

Portfolio management internally within a VC fund consists of market research and oversight, risk profiling, and formulating numerous potential exit strategies. In order to work through these steps, a VC will need updated information from their portfolio companies on a regular basis. VCs are looking for a mix of metrics and qualitative data from their portfolio.

If you’re a VC looking to streamline the way you collect data from your portfolio companies, check out What Metrics Should I Be Collecting from my Portfolio Companies.

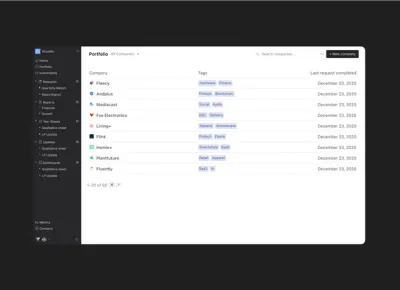

Collecting Portfolio Data in Visible

70% of the 350+ funds using Visible are requesting data from companies on a quarterly basis. Learn more about portfolio monitoring in Visible.

Check out an Example Request in Visible.

Portfolio Management Metrics

Of course, there are metrics that are commonly tracked amongst VC portfolio companies to help VCs stay on top of their portfolio performance. A couple of the key metrics and areas we generally see VCs focused on:

Financials and cash position

A VC wants the honest truth about how their companies are positioned financially. They will want to know metrics such as Cash Balance, Burn Rate, Runway, and Gross Profit. Investors may also ask for the forecast for these metrics. This information helps a VC determine whether they’re likely to reserve cash for a follow-up investment in a company and what a potential exit strategy might be.

Related Resources: Which Metrics Should I Collect from My Portfolio Companies?

True North KPIs

Depending on the type of business a company is operating, their ‘True North’ KPIs will differ. A company’s true north KPIs should be the key performance indicators that are guiding the business every single day. Beyond revenue goals, examples of other KPIs could be active users, a customer net promoter score, active customers, or average contract value. These KPIs will help a VC determine how the company is performing versus sector benchmarks.

Related Resources: Startup Metrics You Need to Monitor

Ownership and Cap Table Data

If a VC is looking to make a new investment, an important component they will consider for their portfolio management is how much ownership they will have in the company. A founder seeking investment should be transparent about what percent of the company is available in exchange for investment (if any) and how much is already taken. In addition to a clear ownership breakdown, a company should share information about its securities (stock options etc..). This information will be extremely relevant as the VC determines how to structure a potential investment deal.

Portfolio Management Qualitative Information

Collecting the metrics and quantitative data is only part of the portfolio management process. We also see investors collect a number of different qualitative fields to help them better understand how a company is performing. A couple of examples below:

Wins from the Previous Period

Founders shouldn’t be shy. Companies should be sure to highlight their most recent, and impressive wins as a company. This will energize and excite a VC who is determining which of their current companies they may want to make a follow-on investment into. Investors will also likely use this information when deciding whether to introduce a company to a potential follow-on investor. When investors make intros to other investors, they’re putting their social capital on the line. Companies who have instilled confidence in their current investors are more likely to get intros to follow on funders.

The VC Advantage

Venture capitalists take portfolio management so seriously because they of course want to see their portfolio investments succeed and make money. Therefore, outside of putting down the initial investment, venture capitalists usually incorporate many other touchpoints and opportunities to help their investments succeed. Outside of the fiscal advantage VC investments provide, a close relationship with investors and VCs can be a competitive advantage that makes or breaks a company.

Ultimately, VCs want to help their portfolio companies because it helps them. In addition to actively monitoring the metric performance of their portfolio, VCs want to offer assistance in any way that they can to give their investments a competitive advantage. These competitive advantage points are also a part of a successful portfolio management strategy. VCs help their portfolio companies in a variety of ways:

Taking action on metrics – As mentioned above, VCs are continuously monitoring their portfolio investments. VCs analyze their companies’ profits, customer churn, average deal size, and more. An informed VC can provide insights and advice to companies to help them improve their performance metrics. Drawing form experience managing other investments, they will have insight into what works and what to avoid or change in order to succeed.

Hiring decisions – VC partners are often ex-founders who have successfully built and exited one ore more companies. They are experienced in hiring founding teams and can help advise what roles are the most critical to higher first. Additionally, VCs networks are deep and wide. A founder may have the chance to hire a seasoned CFO or CMO through an intro from a VC. Hiring the right people is critical to the success of early stage companies and leaning on a VC partner to do so may allow a founder to access talent that wouldn’t have otherwise been interested in their company. (Relevant resource: 5 Ways to Help Your Portfolio Companies Find Talent)

Fundraising assistance – Fundraising is exhausting but necessary as companies aim to quickly scale their business. After partnering with a VC for an early round, investors want to ensure the right investment partners come onboard for later rounds. If a company is on track to succeed, leaning on existing VC relationships to find additional investors is a smart idea. An existing VC will want to work with other firms or angels they get along with or align with ideologically and will often go above and beyond to help you make new connections and raise a new round of funding. (Relevant resource: How to share your fundraising pipeline with your current investors)

Strategic product decisions – With a close eye on the market, a VC can be a good sounding board for what pivots or iterations to make to a company’s product. It’s easy for founders to get stuck in a silo, only focusing on the details of their product. A VC can provide helpful advice on what decisions to make that better keep in mind the market and competitors, even providing tough love on what product decisions might not be right.

Related Resources: How to Lead a Portfolio Review Meeting for VC’s

How Visible Can Help

Investors of all stages are using Visible to streamline their portfolio monitoring and reporting processes. Visible helps investors streamline the way they collect data from their founders on a regular basis and provides data visualization and reporting tools.

Over 400+ Venture Capital investors are using Visible to streamline their portfolio monitoring and reporting. Learn more.

investors

Metrics and data

Operations

Portfolio Monitoring Tips for Venture Capital Investors

What is Portfolio Monitoring

Portfolio monitoring in the context of Venture Capital is the process of tracking the performance of investments in a venture fund. The primary focus of portfolio monitoring is tracking the financial metrics of a company but it also includes monitoring key operational changes, fluctuations in companies’ valuations, and trends in the respective company’s market or industry.

We recently asked 50+ investors to choose their top three reasons for collecting structured data as a part of their portfolio monitoring processes.

You can find a summary of the results below —

Top three reasons investors take portfolio monitoring seriously:

Investors want to better understand how their companies are performing in general

Investors want to provide better support to companies

Investors need to provide updates to Limited Partners

How to Monitor Venture Capital Portfolio Companies

Investors struggle to monitor their portfolio companies effectively because if they hear from companies at all, it’s in a format that is unstructured and in a frequency that is unpredictable. This makes it extremely difficult for investors to have an accurate data set from which they can draw meaningful insights or share updates with their Limited Partners.

Investors who effectively monitor their portfolio companies have a process in place to collect structured updates from their companies on a regular basis — from day one. In the early days of a fund when there are typically less than 10 companies, this can look like sending an Excel file or Google Sheet template to portfolio companies via email and asking them to complete it and send it back.

It’s important to have a reporting process in place from day one because the more time that passes, the harder it can be to change portfolio company behavior when it comes to reporting.

As a fund’s portfolio grows, this process becomes cumbersome and investors often find they are wasting time chasing companies, trying to keep track of which companies have responded and which haven’t, and collating numerous templates into a master portfolio data file.

Visible helps over 400+ investors streamline the way they collect, analyze, and report on their portfolio data.

What Metrics to Track for VC Portfolio Companies

To monitor the performance of portfolio companies it’s crucial to track the right metrics across all your companies. The most common metrics to track include:

Revenue

Cash Balance

Monthly Net Burn Rate

Runway

Net Income

Headcount

Read more about which metrics to collect from portfolio companies and why.

Based on data from the 400+ funds using Visible, most investors are asking for their companies to report 8 metrics and 1-2 qualitative questions on a quarterly basis.

Learn more about VC Portfolio Data Collection Best Practices in our guide.

VC Portfolio Monitoring Template

Visible provides investors with a streamlined, founder-friendly way to collect structured data from portfolio companies on a regular basis. The solution in Visible that empowers investors to easily collect KPIs is called a Request.

Visible allows investors to build custom data Requests that support:

Automated email reminders to reduce chasing companies

Assigning custom metrics to certain companies

Sending a Request to multiple points of contact

Asking for budget vs actuals

Secure linked-based forms for companies

Portfolio companies reporting in multiple currencies

Check out an Example Request in Visible.

Portfolio Monitoring Tips for Venture Capital Investors

Set expectations early on.

Consider outlining your reporting requirements in a side letter

Have a process in place to collect data from day one — it’s harder to change reporting behavior change later on

Incorporate reporting expectations into your onboarding process

Check out this Guide to Onboarding New Companies into Your VC Portfolio.

Communicate the why to portfolio companies.

Explain how responses will help inform portfolio support

Explain which data will be shared with LPs and which is just for internal processing

Explain how it will be used to inform follow on investment decisions

Make your data Requests founder-friendly.

Don’t ask for more than 5-8 metrics

Use metric definitions to reduce back-and-forth

Send your Request at the same time every period

Make sure you have the right points of contact at the company

Don’t make your companies create an account if they don’t want to

Turning Your Portfolio Data into Meaningful Insights

After going through the effort to collect structured data from portfolio companies the next important step is turning into important insights that can be shared with your team and eventually your Limited Partners.

Visible has a suite of tools to help with portfolio data analysis including

Robust, flexible dashboards that can be used for Internal Portfolio Review meetings

Portfolio metric dashboards to help with cross-portfolio insights

Tools to slice and dice your portfolio data by custom segments

Over 400+ Venture Capital investors are using Visible to streamline their portfolio monitoring and reporting.

investors

Operations

Up-and-Coming Platform Managers Working in VC

Why It’s Important to Have a Platform Manager in VC

Platform managers are instrumental in the success of startups, which is why the role of platform managers within VC firms has become increasingly important and there has been a surge in hiring for this position. By providing guidance and support to portfolio companies, Platform Managers help founders navigate the challenges of building and scaling a startup. They offer advice and support on everything from product development and fundraising to talent acquisition and marketing. Platform managers act as a liaison between portfolio companies and the VC firm, helping founders access the resources and expertise they need to succeed.

Hiring a platform manager can also help VCs enhance their value proposition and differentiate themselves in an increasingly crowded market. Some other ways in which they can also add value to VC firms and their portfolio companies are:

Strategic Focus: A platform manager can help VCs develop a strategic focus for their investments by identifying areas where they can add value beyond just providing capital. The platform manager can work with portfolio companies to help them leverage the VC’s network, resources, and expertise to scale their businesses.

Portfolio Optimization: A platform manager can help VCs optimize their portfolio by identifying areas of overlap or synergy between portfolio companies. They can also help VCs identify potential acquisition targets and facilitate mergers and acquisitions.

Value Creation: A platform manager can help create value for portfolio companies by providing access to resources such as talent, capital, and strategic partnerships. This can help portfolio companies grow faster and more efficiently.

Brand Building: A platform manager can help VCs build their brand by creating and promoting events, content, and other initiatives that showcase the VC’s expertise and thought leadership in their respective domains.

Investor Relations: A platform manager can help VCs manage their relationships with investors by creating reports, organizing events, and providing regular updates on the performance of portfolio companies.

How to Succeed as a Platform Manager in VC

To succeed as a platform manager in VC, individuals must have a deep understanding of the startup ecosystem and the challenges that founders face. They must be able to build relationships with portfolio companies and act as a trusted advisor to founders.

Additionally, they must have strong analytical skills, as well as the ability to manage complex projects and navigate volatile market conditions. They must be able to analyze financial data and market trends to identify opportunities and make informed decisions. They must also have the ability to manage complex projects and navigate volatile market conditions.

To get into venture capital as a platform manager, individuals should focus on building a strong network in the startup ecosystem. They should attend industry events, participate in startup accelerators, and connect with successful founders and investors. It’s also important to gain relevant experience in areas such as product development, marketing, and finance.

It also helps to read industry blogs and publications to stay up to date on the latest trends and funding rounds.

Best Practices for Platform Management

Some best practices include, how to identify potential portfolio companies, how to add value to portfolio companies, and how to optimize the firm’s portfolio.

Identifying Potential Portfolio Companies

The first step in effective platform management is identifying potential portfolio companies that align with the VC firm’s investment focus and criteria. To do this, platform managers should:

Develop a deep understanding of the VC firm’s investment focus and criteria, including industry sectors, geographies, and stages of investment.

Network and stay up-to-date on industry trends and emerging technologies to identify potential investment opportunities.

Leverage the VC firm’s network to source and evaluate potential portfolio companies.

Conduct thorough due diligence on potential portfolio companies to ensure they meet the firm’s investment criteria and have strong growth potential.

Adding Value to Portfolio Companies

Once a portfolio company has been identified and invested in, platform managers can help add value to the company by providing access to resources and expertise that can help the company scale and succeed. To do this, platform managers should:

Work closely with portfolio company management teams to identify areas where the VC firm can provide value beyond just capital.

Provide access to the VC firm’s network of industry experts, potential customers, and strategic partners.

Help portfolio companies recruit top talent by providing access to the VC firm’s talent network and offering guidance on hiring best practices.

Help portfolio companies develop and execute growth strategies, including marketing and sales strategies, product development, and international expansion.

Optimizing the Firm’s Portfolio

Finally, platform managers should focus on optimizing the VC firm’s portfolio by identifying potential areas of overlap or synergy between portfolio companies and helping to facilitate mergers and acquisitions. To do this, platform managers should:

Conduct regular portfolio reviews to assess the performance of each portfolio company and identify areas where the VC firm can add value.

Identify potential acquisition targets that can help strengthen the VC firm’s portfolio and create synergies across portfolio companies.

Help facilitate mergers and acquisitions by providing guidance on deal structuring and negotiation.

Work closely with portfolio company management teams to identify opportunities for cross-collaboration and knowledge-sharing across the portfolio.

Resources for Platform Managers

VC Platform Jobs

VC Platform Global Community

Let’s Talk Ops

OpenLP resources across the venture ecosystem

Resources From the Visible Blog

How to Hire for Your First VC Platform Role

Defining Your VC Platform Approach Using the TOPSCAN Method

Guide: VC Portfolio Support Best Practices

How to Plan a Top-Tier CEO Summit

How to help your portfolio companies find talent

Up-and-Coming Platform Managers in VC

Meryl Breidbart | Director of Investment Operations | At One Ventures

How did you get into platform?

I started my career as a designer and founder of Chirps, so when I began at At One Ventures as an investor, I naturally gravitated to filling our platform holes. I started by organizing our first AGM and building some fund partnerships and from there, helped launch our platform and operations team, which now includes a VP of Talent, a VP of Marketing, and a Venture Partner with extensive commercialization experience.

What’s the focus of your firm’s post-investment support; what’s your specialty?

We know we can’t be excellent at everything, so we have decided to double down on a few areas: talent, marketing, fundraising support, and commercialization. I specifically focus on fundraising. I build pitch decks, run pitch practice sessions, and make introductions for our founders to our vast network of follow-on investors. In addition to this work, I also support our firm with internal operations – assisting with our fundraising efforts and making sure we run a tight ship.

What’s your favorite part of the role?

Working directly with our founders! I am an extrovert and get energy from talking to lots of different people. I enjoy reducing the amount of work our founders have to do and providing them with best practices and processes so that they can learn quickly.

Advice for first-time platform managers?

You can’t be all things to all people. Figure out 1-2 strategic goals for the first year of the role and make sure to prioritize those. Otherwise, you will find yourself being a recruiter for company A and a PR firm for company B, which will not scale and will not help you deepen expertise.

Mal Filipowska |Portfolio & Platform Manager | Seedstars

How did you get into platform?

For the first five years of my Venture Capital career, I was always on the investment side of the fund: sourcing deals, preparing investment memos etc. I executed over 30 transactions across Europe, MENA, and India. A big part of my role was building relationships with other VCs and sharing investment opportunities: that’s how I met Seedstars. I instantly fell in love with their investment thesis and commitment to empowering start-ups in emerging markets globally.It was mutual, and the Partners of Seedstars International Ventures invited me to join the team. The platform role was an obvious fit: it was 100% global (opposite to our Investment Managers, divided by regions). It allowed me to continue working with founders from diverse backgrounds from over 100+ start-ups in almost 40 different countries, be hands-on in supporting them in solving their most urgent challenges and have a tangible impact on their journey to success.

What’s the focus of your firm’s post-investment support; what’s your specialty?

As a global fund, we decided to focus on the most urgent and universal aspect of every start-up: growth. As we can read in the famous Paul Graham essay: “if you get growth, everything else tends to fall into place”.After we invest, our portfolio companies get lifetime access to the “Growth Track” – a tailored consultancy program for start-up teams. It is delivered by growth experts and helps our portfolio companies to develop a long-lasting and sustainable growth strategy. We host such a program twice a year, so portfolio companies can always bring their new employees for us to teach them the growth mindset & methodologies.

What’s your favorite part of the role?

My favorite part of the Platform role is how it fosters my professional growth within the Venture Capital industry. In the platform role, I am more exposed to the everyday challenges faced by founders, which enables me to actively participate in solving them together. There is no space for beautiful pitch decks or listening to what the VC wants to hear – we’re in the same boat now, so my entire focus is working towards a common goal. Personally, I find it very developing and satisfying.

Advice for first-time platform managers?

Take your time: Spend some time to dive deep into the role and understand the needs of your portfolio companies. By doing so, you’ll be better equipped to help them succeed.Find your niche: Focus on common challenges your portfolio companies face and become an expert in addressing them. This approach allows you to add “scalability” to your support and significantly impact the board.Stay connected to the investment side: Don’t lose touch with the investment aspect of venture capital. Participate in investment committees and the investment process to maintain a well-rounded perspective and contribute more effectively to your portfolio’s growth.Collaborate with the VC community: Each player contributes uniquely to the world of venture capital. Instead of competing, work alongside your co-investors, join forces with your co-investors, complement each other and build on each other’s strengths.Connect with founders personally: Meeting your founders in person and getting to know them as individuals will help build stronger relationships and foster a deeper understanding of their needs and motivations

Regan Gore | Community & Operations Associate | Eniac Ventures

How did you get into platform?

Prior to joining Eniac, I was in consulting and executive search, and then I taught first grade during COVID. I have honestly found so many overlaps between teaching and platform, and I think that experience helped me hit the ground running when I joined the VC world. I was really lucky to have a wonderful resource in Sam Gelt (a16z) who reached out to me after connecting in a Slack group and helped guide me in my VC job process. Through her and a few other mentors (huge shoutout to Mariana Consuegra (previously BCGDV), Kenyon Cory (Petal), and the Aspire to Her team), I was able to learn more about community and different roles that were community-focused, ultimately finding a path to VC. I have found that platform is a great way to connect with founders and be part of their journeys, especially at a seed firm where we can really provide help and value right away.

What’s your favorite part of the role?

My absolute favorite part of the role is getting to speak to so many interesting founders as well as connecting with phenomenal partners who can be great resources to our founders. Deepening those relationships every day drives so much of my work, and I love that each day is a little different!

Advice for first-time platform managers?

My best advice for first-time platform managers is to create your own cohort of founders in your portfolio who you trust + they trust you. I have found this small group has been a helpful sounding board to many ideas, they’ve given me very honest feedback on our platform offerings and have tested out ideas before I’ve brought them to the larger group, and they are great cheerleaders at events and in our slack group! I think a lot of first-time platform managers think that you have to have a “perfect” facade when talking to founders, but they are in the same boat as you, and the relationship is so much better when everyone is open and honest about where they are, what they are working on, and where they can use help.

Rachel Hodes | Director of Platform | NextView Ventures

How did you get into platform?

When I was a senior in college, I decided to take an internship at this relatively new, female-founded, D2C brand that had just closed its Series A. Taking the 1 train down to their chic Chinatown office, which one day became their flagship store, was always the highlight of my week. I remember feeling impressed and inspired by the creativity, collaboration, and community-building that went down in that millennial-pink wonderland, and I knew that this experience was the beginning of my addiction to all things startups. I spent the rest of my early to mid-twenties operating at various early-stage consumer and B2B companies. The “throw spaghetti at the wall to see what sticks” kind of days… *sigh* memories. But like most people, the pandemic forced me to pause, reevaluate my path forward, and be incredibly intentional about what I wanted to do next. I knew I was outgrowing those early-stage operating days but I also knew I wasn’t quite ready to quit startups cold turkey. During this transitional time, I learned about platform from a friend who was actually trying to hire me for a role at his boutique recruitment firm: “Your role here would be similar to that of a platform person’s role at a VC firm.” Oh really? Bet. I started doing my research and realized that platform encompasses all the things I love to do (content, community, operations, marketing, events, etc.) PLUS it directly supports startups and founders in a MAJOR way?! Sign me up. By some kind of kismet, stars aligning chance, my now mentor, Stephanie Manning Cohen (Operating Partner at Lerer Hippeau) had just messaged me on LinkedIn and was interested in chatting about an open platform role on her team. This particular position didn’t end up being the right fit, but Stephanie connected me to the partners at NextView, and it’s been a match made in seed-stage heaven ever since ❤️

What’s the focus of your firm’s post-investment support; what’s your specialty?

We focus on the four things that matter most at the seed stage: building a great product, getting great customers, hiring a great team, and not running out of money. I would say my specialty is bringing people together in a meaningful way, and I’m excited to explore that more with NextView’s founder initiatives this year. Stay tuned!

What’s your favorite part of the role?