Blog

Metrics and data

Resources related to metrics and KPI's for startups and VC's.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Metrics and data

Calculating Your Quick Ratio

The Importance of Your Quick Ratio

Some investors refer to the quick ratio as a company’s acid test. Basically, the quick ratio indicates a company’s short-term liquidity and ability to pay current bills. The nickname and the quick ratio’s ability to demonstrate how well a company can operate in the near future should give you an idea of its importance.

You can easily calculate your quick ratio by adding up cash, short-term investments, immediate receivables, and cash equivalents. For the quick ratio, consider assets that you could transform into cash without losing value within 90 days. Then you divide this number by your current liabilities.

You can see this calculation’s formula below:

Cash + Short-Term Investments + Current Receivables + Cash Equivalents / Current Liabilities

For example, you might have $12,000 in cash and $8,000 in receivables. If you have $20,000 in debt, you would divide $20,000 by $20,000 to get a quick ratio of one.

What's a Good Quick Ratio?

If you have at least enough cash to meet your short-term obligations, that’s considered a positive sign for a new company. In other words, a good quick ratio would be at least one. A number over one might be even better, but any number less than one demonstrates that you could have to struggle to pay your immediate bills. On the other hand, too high of a value may mean that a company isn’t using their short-term assets to fund growth as well as they could.

SaaS Quick Ratio

Alternatively, there is a SaaS Quick Ratio. A SaaS Quick Ratio is similar to the standard quick ratio above but gives a SaaS company an overview of how efficiently their company can grow. The higher the SaaS quick ratio, the more efficiently a company can grow. In short, the formula divides any new MRR by any lost MRR. An example of a SaaS quick ratio can be found below:

SaaS Quick Ratio= (New MRR + Expansion MRR)/(Churned MRR + Contraction MRR)

While a higher new MRR growth rate can help fuel a good quick ratio, the best-in-class SaaS companies often have a lower churn rate which allow for a significantly higher quick ratio. With a lower churn rate, companies will have a much more reliable source for predicting future revenue and growth.

Your Quick Ratio in Visible

Tracking your quick ratio in Visible in incredibly easy thanks to our formula builder. To get started you’ll want to make sure you have all of your revenue metrics in Visible. We suggest creating a user provided metric or connecting Google Sheets, HubSpot, Salesforce, or ChartMogul to get started. From here, you’ll be able to create the quick ratio formula (as shown above) in the formula builder.

Once the quick ratio formula is created in Visible it will automatically update as your data sources refresh. We suggest sharing your quick ratio with management and executives so they have a quick view of how the company is performing and growing. Generally, we do not see founders share their quick ratio with their investors and rather share the underlying metrics.

Current Ratio

The current ratio refers to a number that indicates how well companies can pay bills that might crop up over the next year. To calculate the current ratio, you simply divide current assets by current liabilities like this:

Current Assets / Current Liabilities

If you company has $100,000 in current assets and $100,000 of debt, your current ratio would equal one.

What is a Good Current Ratio?

A good current ratio may need interpretation in light of averages for a specific industry or business. As with the quick ratio, a value of at least one indicates that a company has at least as many assets as liabilities. Some companies may consider using excess assets more productively as well. For instance, you can count inventory as an asset; however, you bring in revenue when you move inventory.

Quick Ratio Vs. Current Ratio

Quick ratio and current ratio sound similar but mean different things. To make sure you understand the difference, browse these comparisons of quick vs. current ratio:

Quick ratio: This formula only uses short-term debt and liquid assets that you can turn into cash within 120 days.

Current ratio: In contrast, the formula for the current ratio uses all assets and liabilities.

To understand the difference between the quick and current ratio, consider a simple example of a company with $100,000 in current liabilities:

Cash and cash equivalents: $10,000

Short-term marketable securities: $20,000

Accounts receivable: $50,000

Inventory: $112,000

Prepaid expense: $8,000

You get a current ratio of 2 by dividing total assets of $200,000 by liabilities of $100,000. In contrast, you would have a quick ratio of .8 when you divide $80,000 by $100,000. This difference between the numbers could mean that you should consider freeing up a bit more liquidity for short-term obligations. Again, you have to interpret the metrics in light of the unique situation.

That’s why you might include prepaid expenses in your current ratio. You can weigh prepaid expenses against your current liabilities; however, you might not include them in the quick ratio. For instance, you may have to purchase plane tickets for travel. In one sense, those could count as an asset, but they may not be easy to convert back into cash to satisfy an obligation.

Liquidity Ratios

Sometimes people use liquidity ratio to mean the same thing as the quick ratio. They may also refer to the quick ratio as the quick liquidity ratio. In a broader sense, liquidity ratios refer to various metrics that help investors and owners understand how well companies can meet their current debt obligations.

Related Resource: From IPOs to M&A: Navigating the Different Types of Liquidity Events

Besides the quick and current ratio, liquidity ratios could also include the operating cash flow ratio. You simply calculate this number by dividing liabilities by cash flow, but you don’t take other assets that you can quickly convert into cash into account. That means that this number will probably be a little lower than your quick ratio calculation. This number tells you how well a company can meet their obligations with the cash they have on hand and without having to collect receipts or liquidate cash equivalents or short-term investments.

Why are Liquidity Ratios Important?

Quick, current, and all liquidity ratios are important. Obviously, companies need to pay their typical operating expenses. They may also need funds for unexpected expenses and to take advantage of growth opportunities. All of these metrics give investors a quick way to judge the solvency of a company. That’s why they’re the kind of numbers that investors want to see. In addition, they are helpful guides for company owners and managers.

Related resource: Dry Powder: What is it, Types of Dry Powder, Impact it has in Trading

founders

Metrics and data

Product Updates

QuickBooks Integration Improvements

QuickBooks Chart of Accounts & More

Getting your key metrics, custom financials and business data out of QuickBooks Online just got a whole lot easier. Our product team (special thanks to Eugene) just released a stellar improvement to our existing QuickBooks integration.

Our improved integration will pull data from your Profit & Loss Statement, Balance Sheet and Statement of Cash Flows. We will sync any headers, sub-headers and specific accounts that are unique to your business.

Once connected, the headers will unfurl and you’ll be able to customize which metrics you’d like to pull in along with the headers themselves.

If you’re already using our QuickBooks integration, simply edit your current connection and we’ll display all of the new metrics that you can sync.

For new users, just connect to QuickBooks as a new integration.

We find that most customers love using our formula builder and variance reporting to mash up their QuickBooks data alongside forecasts, budgets, and data from other sources.

We hope you love our new QuickBooks functionality. If you have any questions, make sure to contact us or check out our knowledge base for any support-related items.

Up & to the right,

Mike & The Visible Team

founders

Metrics and data

How SaaS Companies Can Best Leverage a Product-led Growth Strategy

The importance of executing on the product side of the business has long been a primary focus for countless successful founders and notable startup advisers. So it may come as little surprise that one of the fastest growing trends in SaaS is a renewed focus on product—this time as the primary engine for growth.

What is product-led growth?

Our friends at OpenView have been leading the charge in championing product-led growth as a go-to-market strategy. As defined in this helpful presentation, PLG occurs in “instances when product usage serves as the primary driver of user acquisition, expansion, and retention.” Growth becomes tied to the value of your company’s product.

Like most great startup trends, PLG has its massive success stories that have inspired its wider adoption. The rapid growth of Slack, Calendly and Dropbox have all been at least partially attributed to a product-led strategy to scale. In each case, a product has been offered that is easy-to-use, easy-to-share, and immediately valuable – so much so that it drives user acquisition at remarkable rates, slashes customer acquisition costs (CAC), and surges customer lifetime value (CLV). One of the most valuable upsides of a successful PLG strategy is the overwhelming strong unit economics that can accompany the user growth.

As OpenView often discusses, PLG often impacts every aspect of a SaaS business.

Product Led Growth Impact on Product

Considering PLG is based off of a company’s ability to distribute their product there is obviously a huge impact on the product. Everyone and every department in your business needs to have an intense focus on product. “It’s about product being the core DNA of your company,” Hiten Shah writes. “So much so that the default mode for solving problems—including growth challenges—is to figure out how to use the product to address whatever issue is at hand.”

So what exactly does this mean for your product? It needs to be simple and focused. You need to deeply understand your user pain points, strip out any unnecessary features, and have a product that delivers value in a quick and efficient manner. This is to enable other core tenants of product-led growth; freemium, self serve, product qualified leads, etc.

Product Led Growth Impact on Marketing

Product-led growth also has a major impact on your marketing efforts. In order to best leverage a PLG strategy, your product needs to act as its own marketing channel. The product needs to be inherently viral and allow for easy adaptation for other users.

The user experience should be the core of what a PLG marketing team does. The marketing team needs to be able to onboard new users, create a stellar experience, and use product data to improve marketing communication and nurturing later in the process. As the team at User Pilot writes, “Typically, this means that your product model includes a freemium or offers a free trial. This is a disruptive, bottom-up sales model…where employees of an organization can choose what products they want to use instead of being forced to use certain tools by IT or operations departments in a traditional top-down approach.”

Product Led Growth Impact on Sales

With an intense focus on product across a product led growth organization the way the sales team works and sells the product will also change. In the past, most software sales teams embraced a top down approach. A sales representative or account executive would find an executive (or executives) at an organization and do their best to sell a set number of seats for the organization. The traditional B2B sales funnel oftentimes looks like this:

With a product led growth strategy, sales teams almost act more like a customer success and inbound sales representative. For example, let’s assume a PLG company uses a free trial. The product and UI/UX need to be able to show the trialing user value as soon as possible. PLG sales goal here is to unlock and show the product’s value to the user on trial. Whereas a top-down approach would have required a sales member to tell a new user about the value now they are directly showing the value of the product.

As the team at ChartMogul put it, “The ultimate goal of PLG sales is to motivate your users to use your product, unleash the value as soon as possible, and convert your users to power-users.”

Product Led Growth Impact on Pricing

Product led growth has a drastic impact on the pricing of a product. PLG allows companies to land and expand their customer base. This often means a free or reduced price plan that scales with a company as they add usage, seats, etc. The 2 most common pricing strategies that have come out of PLG are freemium and free trials.

https://website-staging.visible.vc/wp-content/uploads/2019/05/mike-on-plg.mp4

Freemium Pricing

As Investopedia defines it, “Under a freemium model, a business gives away a service at no cost to the consumer as a way to establish the foundation for future transactions. By offering basic-level services for free, companies build relationships with customers, eventually offering them advanced services, add-ons, enhanced storage or usage limits, or an ad-free user experience for an extra cost.” The team at OpenView Labs goes on to explain a freemium model further by stating, “A freemium product, by contrast, gives users access to a limited set of features, functionalities, and use cases indefinitely and without charge. There is no time limit, but parts of the product remain off-limits to free users.”

This generally works best for a company that has a lower customer acquisition cost and a longer lifetime value (AKA a product led growth company). A freemium strategy opens up the top of funnel for a PLG company. This means that there may be more users coming into the product to give it a try but this generally means users are less likely to get activated (use the product) and may cause issues later in the sales and marketing funnel. Running parallel, and just as popular, is the free trial model.

Free Trial

Another common pricing and acquisition model is the free trial. As the team at OpenView Labs explains it, “Free trials typically allow users to experience a complete or nearly complete product for a limited time. This means granting free users access to all features, functionality, and use cases for the duration of their trial.”

This means that there may be more friction at the top of the funnel. A user inevitably knows that they will have to pay down the road and this may detract them from wanting to give your product a try. However, this means that when a user starts a free trial there is intent behind their decision and they are likely more qualified.

The main pro of a free trial method is the sense of urgency it creates. By having a “shot clock” on their trial time a user will inevitably have to make a decision to use the product.

Why is product led growth becoming so important?

OpenView Labs has coined product leg growth as “SaaS 2.0” and for very good reason. With recent failures of cash intensive/burning business there has been more focus than ever before on building a sustainable and profitable business. One of the most efficient ways to build a profitable business? You guessed it — product led growth.

In addition to the lean business becoming more attractive to venture capitalists and the public markets the ways people buy software is changing as well. In the past, software was traditionally a top-down purchase. A leader or executive at a company found a piece of software they liked, implemented it across their team or organization, and expected everyone to use it. Fast forward to today and more companies are embracing a bottoms-up approach.

As the team at Origin Ventures wrote, “As an influx of capital has increased competition amongst B2B SaaS companies, bottoms-up sales has become the low-cost, scalable method that provides a quick way for SaaS companies to engage users quickly. By selling directly to ground-floor product users (rather than executive teams), bottoms-up works best when the software is inexpensive or free to start, doesn’t need to be tailored to each customer, and has clear value propositions for small groups of employees.”

Benefits of a product led growth strategy

A product led growth strategy offers countless benefits.

Lower Acquisition Costs

One of the most attractive benefits of a PLG strategy is the decreased customer acquisition costs. While it is assuming that you’ll need to invest more in product development the cost of acquiring new customers will continue to lower. This is because the product should do the heavy lifting for your business.

By having a product that offers a free trial or freemium experience the top of your funnel will flourish and the product should enable users to upgrade and scale in turn lowering acquisition costs.

Upsells & Expansion

PLG enables your pricing and contract sizes to scale with your companies. While a set of users may be using a freemium version or are on a free trial, PLG should allow companies to slowly upgrade their plans. In turn this generates more upsell revenue and reduces the likelihood of churn as the price is created to scale and grow with a given customer and business.

Better User Experience

Ultimately a PLG strategy is a better experience for the end user. First off, in order to properly execute a PLG strategy the product needs to be best-in-class which is already a bonus for a user. On top of that the onboarding, resources, and UI/UX are built to be easy-to-understand and require minimal setup and intervention from a sales or customer success representative.

How to become a product led growth company

In order to become a product led growth company you need to have an extreme focus and buy in from everyone in the organization. While the benefits are clear there are a few things a SaaS company needs to do before they can fully embrace being a PLG company.

Customer Empathy

First order of business to become a product led growth company is to deeply understand your customer and the job they are trying to accomplish. A great product is best informed by deeply understanding your customers.

You also need to have empathy when it comes to how a customer buys your product. On one hand you may have customers that enjoy speaking to someone when making a decision. On the other hand you may have customers that want to be left along and make a buying decision on their own. Both customers in this instance are correct. It is a PLG companies duty to be able to empathize with and sell to both customer sets.

Great Product

It probably goes without saying that a PLG company needs a great product. If your product is clunky and requires a hands on setup it is probably not a great option for PLG. If it is intuitive and easy to get started a PLG strategy may sound like a better idea. It is the namesake of the strategy so having your product dialed in a 100% must.

Intuitive Onboarding

In part of having a great product is having great onboarding. If users are coming to your product via free trial or a freemium experience they need to be able to get setup and understand the product on their own. There is likely an overlap of the product doing the work, resources to help, and a customer success team to help accomplish this. It is imperative that the product is easy to get started. For a freemium experience, it will not scale well to have customer success or support team members helping users in the product. The goal is to allow users uncover the value on their own.

Company Culture & Team Focus

If you’ve built a great product, chances are your culture—knowingly or not—is centered around putting the product first. As Liz Cain of OpenView puts it, “You live to serve your customer, to make a product that delights and excites… You don’t want your company aligned around a boiler room, ‘always be closing’ sales culture.”

While product-led growth might not be for every business, there are learnings that can translate across all businesses.

Key product led growth metrics you must know

Product Qualified Leads

When a potential customer is already using a version of your product—whether that be a trial participant or user in a freemium model—they can qualify as a PQL. With a PQL, the customer has hit a designated trigger that lets the sales team know they are ready for a follow up call. As Christopher O’Donnell notes, by using the product to educate the customer first, you’ve given your sales team a huge advantage. “If we flip the traditional model 180 degrees and start instead with product adoption, we find ourselves selling the product to folks who understand the offering and are potentially already happy with it, before they even pay,” O’Donnell writes.

PQLs rely on the product selling itself. With this approach, you’re providing the best possible introduction to demonstrate how the product can be a long-term solution. That’s an easy process to replicate too. “[PQLs] are scalable because they require no human touch and they are high-quality leads,” Tomasz Tunguz writes. “When the sales team calls PQLs, customers typically convert at about 25 to 30%.”

If you have a freemium offering of your product, you can gain the benefits of the potential velocity of incoming leads while also earning the financial rewards of an inside sales price point.

Furthermore, a focus on PQLs can improve your product roadmap as well. Tunguz notes that PQLs actually serve as a management tool as well because the focus on customer action gets everyone onboard with revenue as the key performance indicator. are a “Typically, the product and engineering teams don’t have goals tied to revenue which bisects a team into revenue generating components (sales and marketing) and cost centers (eng and product).”

That can create a lack of effectiveness when it comes to creating a product that sells itself and providing the best ammo for a sales team to finish the job if needed. Of course, your product and engineering teams will have longer-term features that will not be revenue significant in the short-run. However, a mix of both can help get everyone on the same page and quickly end potential arguments. That’s a great addition to any company culture. “PQLs provide a rigorous framework for prioritizing development,” Tunguz writes. “Each feature can be benchmarked to determine the net impact to PQL which is ultimately funnel optimization.”

Churn

Churn is important in every SaaS business but especially important in a product led growth business. As we wrote in our SaaS Metrics Guide, there are 2 core types of churn that a PLG/SaaS business need to track:

“Customer churn rate: This simply refers to customers lost within specific time periods. Hopefully, you can also enhance these SaaS metrics with information about why the churn rate may have either spiked or declined under various circumstances.

Revenue churn rate: A SaaS business model may include various prices, based upon the number of unique accounts or levels of features or services. Hopefully, customers upgrade over time; however, if they’re not, SaaS companies should find out why.”

Keeping your churn low will not only allow for efficient growth but allow for a greater customer lifetime value so you can bump customer acquisition costs when needed.

Customer Lifetime Value

Another metric to keep tabs on when evaluating a PLG strategy is customer lifetime value. Simply put, customer lifetime value is the estimated amount that a customer will bring in over the course of their relationship with your business. As we wrote in our SaaS Metrics Guide:

“You can estimate the lifetime value of your customers by following these steps:

Estimate your customer lifetime rate with this formula: 1/average churn rate. With an average churn rate of one percent, for example, your CLR would be 100.

Divide monthly revenue by the number of customers to calculate your average revenue per account, or ARPA. For example, 100 customers and a monthly revenue of $100,000 would work out to an ARPA of $1,000.

Finally, calculate the customer lifetime value, or CLV, by multiplying the ARPA by the CLR. In the example above, your CLV would be 1,000 X 100 = $100,000.

You can use the CLV to help you estimate the lifetime value of each customer. Companies can also use this handy metric to illustrate their value to investors.”

A PLG company should allow for a higher customer lifetime value as the model and pricing is built to scale with a business. For example, a company bringing in $0 in revenue should be paying $0 for their subscription. As they continue to grow their revenue so will their contract size. In theory this should decrease the likelihood of them churning and increase their likelihood of staying on board and increasing their contract/lifetime value.

Time to value

One of the key aspects to selling a PLG subscription is the amount of time it takes a new user to get to value. If you can measure and continue to improve your time to value, the likelihood of a new customer closing or an existing customer upgrading their plan will greatly increase. Users have essentially limitless options in today’s SaaS world and need to be able to quickly evaluate and make a decision on your product. If a long setup or manual work is required you’ll likely lose the attention of a new user and they will look elsewhere.

The team at OpenView labs shares how HubSpot uses TTV with their website grader:

“Trials are good to do, but trials are often too long. At HubSpot we had a tool called Website Grader… Its entire existence was about creating time to value. It’s free. You put in a URL – your site or your competitor’s – and we analyze the site using our marketing methodology.“

Upsells/Expansion

As we mentioned earlier the likelihood of a customer upselling or expanding their account is a major plus of product led growth. As we described in our Monthly Recurring Revenue Guide, “Expansion monthly recurring revenue is MRR from gained from existing customers when they upgrade their subscriptions”

Because users will have the option of a free trial or freemium plan the ability for them to quickly upgrade plans is very likely. While it may only be small jumps from plan-to-plan in you enable a customer to achieve their job, they will continue to upgrade plans as their team and business continues to scale.

Examples of businesses with a product led growth strategy

While there are countless businesses that run a product led growth strategy, the three below are some of our favorites.

Slack

Slack is one of our all time favorite examples of product led growth at Visible. Slack has had a freemium plan since day 1 and has become the poster child of freemium. Slack pricing is built to scale with usage and a user’s growth. WIth the Slack PLG strategy, new users get to use the full Slack product for free up until they hit 10,000 messages. This means that once you’ve hit the limit, you fully understand the value of Slack and probably can’t function as a business without it.

Tools like Slackbot and their suite of integrations make onboarding and getting setup on Slack easier than ever. The pricing as Slack is built to grow with a business as well. With per seat pricing of around $7/mo it is often times a no-brainer to add on more licenses when needed.

Dropbox

Another one of our favorite examples of a proper product leg growth strategy is from Dropbox. Dropbox fully supports the bottoms up approach and has mastered it on their march to over $1B in revenue.

The Dropbox product is remarkably easy to use. It has a very friendly and simple UI that makes usage an ease. Oftentimes it is considered the best tool for sharing files. On top of that it is inherently viral. There are shared files that make other people intrigued by Dropbox and may sign up for their own use. They also have a powerful referral program that gives free data to new users and the referring user.

Dropbox has truly nailed the bottoms up approach and have been a SaaS case study for companies looking to embrace a product led growth strategy.

What’s a good product-led growth strategy?

In his review of Blake Bartlett’s PLG talk at SaaStr 2017, Drew Beechler outlines the five traits of PLG success: virality, easy sign-up, quick to demonstrate value, slow to hit users with paywalls, and “a focus on making all customers successful across the sales-to-support continuum.”

A successful PLG strategy gets your product in the hands of your customers as fast as possible and starts solving their problems right away. “Growth in [PLG] companies has a significant viral component.” Jon Falker of GLIDR writes, “Users can get unique value from the product or service right away and can benefit from helping to attract other new users.” This is why freemium models are remarkably effective in a PLG environment. By providing the user with a valuable experience upfront, you can inspire more frequent use, greater shareability, and focus on the premium aspects of your product that will drive purchasing decisions and ultimately retain these customers.

Is product-led growth the right strategy for your company?

Your company’s unique financial, growth, and talent considerations will need to be assessed before you can determine the right investment to make into a PLG strategy. As the OpenView PLG Market Map shows, this strategy continues to be adopted across the globe and among an increasingly wide swath of product categories. Still in order to succeed at the five traits of strong PLG companies listed above, you actually have to be a business positioned to offer these benefits. If a freemium model isn’t on the table at the moment or if your product doesn’t currently offer clear network effects, a more gradual approach to achieving PLG success may be the right course of action. For instance, as Shah notes, a company might hire or retain sales talent to attract large customers early on while product-led growth continues to develop at scale. A focus on product can occur simultaneously in an organization that still needs to execute more traditional SaaS sales to achieve a healthy growth rate. On the marketing side, a gradual approach to PLG may include an increased focus on conversion rates on core landing pages to drive faster user acquisition across all customer types.

But even in a more incremental approach to PLG, you will refocus your entire team on what matters most. “Everyone in the company should be focused on growth. Everyone should be responsible for revenue,” Shah writes. “Exactly what this looks like will vary from company to company based on which teams have the most say on what ends up getting built and shipped.”

Successful PLG companies develop cross-functional teams, demonstrate effective information sharing within their organization, and attach greater significance to shared KPIs to accomplish to inspire a greater focus on growth and accountability to revenue.

To learn more about product led growth and best practices for growing and scaling your company, check out the Visible Weekly. Curated resources and insights delivered every Thursday.

founders

Metrics and data

The Ultimate Customer Retention Cohort Analysis

What is a Cohort Analysis?

A cohort analysis is a study of activities for a certain segment of customers or users. In this template, we are looking at the customer cohorts for the quarter or month they were acquired, and what % of those customers were retained for subsequent quarters/months.

As summarized in Lean Analytics (via Wikipedia), “Cohort analysis is a kind of behavioral analytics that breaks the data in a data set into related groups before analysis. These groups, or cohorts, usually share common characteristics or experiences within a defined time span. Cohort analysis allows a company to “see patterns clearly across the life-cycle of a customer (or user), rather than slicing across all customers blindly without accounting for the natural cycle that a customer undergoes.”

Why Cohorts are Effective for Analyzing Data

With cohort analysis, you can start to correlate initiatives in your own business to see how they may affect the customer lifecycle. As your company scales, iterates, innovates and creates processes, you would hope to not only acquire customers at a faster pace but also retain them longer, correct? One would assume as product/market fit is found, domain experts are hired and new campaigns are launched that customer retention gets better… but how do you know?

New Product Features

In order to best understand how new product features are impacting customer retention and other metrics you will want to look at a certain cohort of customers/users. Perhaps cohort retention improved as you started to introduce features in your product to engage customers through a daily digest. By understanding how customers interacted with the new daily digest you’ll be able to use data to determine where development time and resources should be placed in the future.

New Marketing Campaigns

Startups are constantly testing new marketing channels and go-to-market efforts. Without the proper data behind a new campaign, it can be difficult to determine what cohorts and campaigns are performing best. For example, maybe you introduce paid search as a marketing strategy, then realize retention drops because customers acquired through paid were not the ideal customer type. This should be a clear indicator that you either need to (1) improve different aspects of your paid funnel or (2) focus the time and energy on paid channels on different channels.

New Customer Onboarding

For SaaS companies and service providers, onboarding new customers is vital to their retention and growth with the product and your organization. Onboarding flows are constantly being tested and tweaked to convert your customers as best as possible. For example, let’s say you add 3 questions during the signup process to better tailor a new user/customers onboarding experience and it is shown in the data that this cohort is 2x as likely to take a key action in your application, you will want to implement and improve this even further.

The 2 Types of Cohort Analysis

Cohort analysis can be a powerful tool to interpret and understand your user data. While you can slice and dice your cohort data in a wide variety of ways, it ultimately comes down to 2 main types of cohort analysis:

Related Resource: Startup Metrics You Need to Monitor

Acquisition Cohorts

One of the main types of cohort analysis is by acquisition type. As we mentioned in the previous section, cohorts can be valuable when analyzing marketing campaigns and efforts. By breaking down cohorts by acquisition channels, you’ll be able to better understand the specific channels that are performing best or campaigns that need to be tweaked.

Behavioral Cohorts

The other main type of cohort analysis is by behavior. This can generally be used in regard to steps taken in a product. For example, you can create a cohort of users that have taken a specific action in your product. This can be used to inform and dictate product development and strategy.

How to Build a Cohort Analysis in 4 Steps

Building a cohort analysis can be time-consuming and tricky. That is why we created a template with just a few steps to help get you started (more on using our template later). At the end of the day, if you are creating a cohort analysis from scratch or plan on using our template there are a few steps you’ll need to take before you can get started

1) Start with a Goal and Questions

When building a cohort analysis you first need to figure out what the goal of the analysis is. At the end of the day the goal of a cohort analysis is to better inform your team to make decisions around product, marketing, customer experience, etc. If you’re not setting expectations and questions you want to answer, you can miss the point and impact of a cohort analysis.

2) Define the Metrics & Data Needed

Once you’ve determined the goal and questions you’d like to answer you need to understand what data and metrics you will need to measure and compile to execute your analysis. If you are measuring customer retention, you will want to start with clean data around your customer base. For example, you will want to have a grasp on contract size, sign up dates, churn dates, etc.

Depending on what you are tracking, it may require a deeper layer of data. For example, if you are looking at a specific marketing channel, you will likely want to include this data as well. Having cleaning and correct data is essential to making sure your analysis is effective as possible.

3) Perform the Analysis

There are countless tools and resources available to help performt the actual analysis. For example, Google Analytics has a builtin tool to perform cohort analysis but that requires your Google Analytics data to be 100% clean. To help we’ve created a tool to help automatically perform the analysis in a few quick steps.

4) Study the Data

The most important part of a cohort analysis is finding actionable insights to help better inform your business and product decisions. When studying your data, it is important to keep in mind the original goal and questions you set out with. See how different cohorts can help answer these questions and make better business and product decisions in the future. Check out more about specific things you should analyze and look for in the next section:

Applications of Customer Cohort Analysis

Cohort analysis can be applied to all business models. Depending on your model, acquisition strategy, and product or service will determine how to apply a cohort analysis.

Customer Cohort Analysis in Ecommerce

In order to best understand your eCommerce efforts, you need to understand how customers are engaging with your brand, website, and product. For example, you can use a cohort analysis to see if customers from certain marketing campaigns are making repeat purchases.

Related Resource: Key Metrics to Track and Measure In the eCommerce World

Customer Cohort Analysis in Mobile App Development

In order to best develop mobile apps, you need to understand what marketing strategy and product are impacting your key usage metrics. For example, you can use a cohort analysis to see how customers going through a certain onboarding flow are engaging with your mobile app.

Customer Cohort Analysis in Digital Marketing

In order to best build a digital marketing business, you need to understand what campaigns are performing best. For example, you can use a cohort analysis to see how customers are engaging through different marketing channels and campaigns.

Customer Cohort Analysis in Online Gaming

In order to best build an online gaming business, you need to understand what strategies are getting gamers to engage with your product the most. For example, you can use a cohort analysis to see how customers who play in specific tournaments engage with your game at later dates.

Related Resource: 10 Gaming and Esports Investors You Should Know

Customer Cohort Analysis in Cybersecurity

In order to best build a cybersecurity business, you need to understand what strategies are working best to retain customers. For example, you can use a cohort analysis to see how likely it is for customers to renew and expand their contracts that come from certain campaigns.

Related Resource: 10 Cybersecurity VCs You Should Know About

How to Build a Cohort Analysis for Customer Success

As we mentioned above a cohort analysis can be extremely useful for making better business and product decisions. One of the key aspects of this is how it can impact customer success and your retention efforts. Our template has a deep focus on customer retention and allows you to look back at different cohorts to see how you can improve retention efforts.

Revenue Retention

In our SaaS Metrics Guide we discuss the importance of retention. As we put it, “Poor customer retention isn’t just bad for finances; it’s an indicator that there could be a core issue with the solution itself. Customer retention rates are always a major feature of revenue development.”

At its core, a cohort analysis is best for measuring customer and revenue retention. While it could be an array of factors, understanding what cohorts are most likely to stay customers and have the highest lifetime value is essential. This may start with a top of funnel problem or may it is a product problem.

By taking aim at improving your net and gross revenue retention, a cohort analysis can be a valuable tool.

Customer Lifetime Value

As defined in our Customer Acquisition Costs Guide, “Customer lifetime value quantifies the value of what the customer acquisition actually brought into the business. Without customer lifetime value, you know how much every customer cost to bring in, but you don’t know how much those customers were worth.”

This idea goes hand-in-hand with gross and net revenue retention. If a cohort of customers has a higher customer lifetime value, why is that? Was there a particular onboarding process or channel that was prevalent that led to a higher LTV? If a cohort of customers has a lower lifetime value, why is that? Was a certain channel performing poorly? Did you remove a step from onboarding that may have reduced activation and in turn forced customers to churn sooner?

Measuring customer lifetime value is an incredibly valuable aspect of a cohort analysis. By finding the customers that are more likely to stick around, you can focus on what is working and apply it across your customer base and product moving forward.

Onboarding and Engagement

When analyzing different cohorts of customers you can look at things like onboarding and engagement campaigns during their lifecycle. Whether a software company or service provider, customer onboarding is constantly always changing. It could be a new questionnaire during onboarding or more touch points from a customer success representative. Oftentimes onboarding can be an integral part of how quickly a customer finds value and sets the tone moving forward. If there is a radical change to onboarding and customer engagement, it has the opportunity to impact their lifetime value and likelihood of churn.

New Products and Services

Startups are constantly testing different product and service offerings. Use a customer cohort analysis to determine how they impacted your revenue retention months later. If customers that activated a new feature or product are more likely to stay onboard, see how you can fit this into your customer success messaging and onboarding.

Discounts and Promotions

What good is offering a discount if you cannot see how it ultimately affects your revenue. If you offer customers a discount at the end of a quarter or month, see how likely they are to stay onboard once the promotion or discount expires. If you find customers that activated a promotion or discount ultimately churn sooner, it may be worth putting that time and energy into cohorts of customers who you know have a higher lifetime value.

What are the Benefits of Customer Cohort Analysis?

As we’ve alluded to throughout this post, there are countless benefits to building and analyzing different customer cohorts. Learn more about a few key benefits below:

Inform Product Development

Cohort analysis can be used to break down segments of customers based on their product usage. Because of this, you can understand what product features lead to your best customers. This can be used to inform product development and strategy down the road.

Related Resource: How SaaS Companies Can Best Leverage a Product-led Growth Strategy

Focus on Acquisition Channels

Another major benefit of analyzing different customer cohorts is by breaking down different acquisition channels and strategies. By evaluating cohorts based on their source channel, you’ll be able to better understand what strategies and channels you should be investing in further.

Improve Customer Success & Onboarding

Looking at the bottom of your funnel, you can analyze your customers by the customer success and onboarding strategies used. For example, if you are testing a dedicated customer success representative for a certain set of customers you’ll be able to determine if it is worth rolling out this strategy across all of your customers.

Our Customer Retention Cohort Analysis Google Sheet Template

Building a customer retention cohort analysis can be a time suck which is why we are open sourcing our template with you today. Our template provides entry of customer data in two different ways, in addition to supporting tracking over quarters and months.

Everything you need can be found in the instructions tab of the template. This template will allow you to get data from the previous eight quarters and is completely automated. A quick explainer:

Decide if you want to enter row level data of your customers, simply head to the “Customer Data” tab, remove all of the fake data we’ve entered, and enter in your own data. This will automatically fuel the other tabs and be the start of your cohort analysis.

If you’d prefer to enter simple counts of your customers at the start and end of different time periods, head to the “Customers Retained Count” tab. From here, you can enter the total customers acquired and churned during a period.

Get The Ultimate Customer Retention Cohort Analysis Template for SaaS

Use our template to correlate key business decisions to your customer acquisition and retention efforts. As your company scales, iterates, innovates and creates processes, you would hope to not only acquire customers at a faster pace, but also retain them longer, correct? One would assume as product/market fit is found, domain experts are hired and new campaigns are launched that customer retention gets better… but how do you know?

With our free template you’ll be able to:

Easily enter customer lifetime information in a pre-formatted section.

Generate a monthly and quarterly cohort analysis of your customer retention efforts.

Compare your cohort analysis against company milestones to understand what is generating the highest-quality customers for your business.

Download our template below:

founders

Metrics and data

Product Updates

Salesforce Updates – Contacts & Accounts

Contact and Account Objects in Salesforce

The Visible product team just updated our Salesforce Integration. We now support the Contacts and Accounts objects in addition to the already existing Leads and Opportunities objects.

If you need a refresher on Salesforce, you can read more in our knowledge base. Contact us to send us any feedback or questions.

Up & to the right,

-Mike & The Visible Team.

founders

Metrics and data

How We Used Product Qualified Leads to Get Started with Product-Led Growth

Why Product-Led Growth?

According to OpenView Labs, Product-Led Growth is “a go-to-market strategy where the product is central to how these companies acquire, convert, expand and retain users. This allows companies to forgo spending large sums on traditional marketing and sales activities. Instead, they rely on the products themselves to supply a pipeline of satisfied users to convert to paying customers.”

Implementing a Product-Led Growth strategy offers companies unique financial and operating advantages that allow quick scalability, economic efficiency, and ultimately more efficient growth. Dropbox is a great example of a company that does this well. They generate double the revenue of their closest competitor, but spend a lower share of that revenue on sales and marketing. This can largely be attributed to their product-led growth strategy.

At Visible, we’ve centered our growth around our product for a few years now and were able to implement the strategy on our business side by using Product Qualified Leads.

What are Product Qualified Leads?

If you’ve built a great product, chances are your culture—knowingly or not—is centered around putting the product first. As Liz Cain of OpenView puts it, “You live to serve your customer, to make a product that delights and excites… You don’t want your company aligned around a boiler room, ‘always be closing’ sales culture.”

At Visible, we started to implement a product-led approach with our sales and marketing efforts by using Product Qualified Leads. Product Qualified Leads are prospects using some version of your current product who take some sort of qualifying action. Typically this happens during a trial or freemium experience.

The exact definition of a PQL will vary greatly from product to product. For example, Slack knows a customer is more likely to close when they hit 2,000+ messages. We have our own product actions we keep our eye on. Outside of standard demographic and sales information, we use a point system to weigh the following product actions:

Connect a data source

Create a chart

Invite other users

Create an Update

We know once someone on a trial sends an Update, they are more likely to become a paying customer, so we weigh that above all other actions. This leads us to take an “Update-centered” approach to our product and messaging during a user trial.

Once someone on a trial has reached a point threshold based on our product criteria, we’ll change their status and try to move them toward conversion. For example, if they’ve connected a data source and created a chart, how do we get them to distribute that chart using Updates?

The PQL framework has continued to be fluid for us since we implemented it roughly 2 years ago. Testing and iterating the approach is crucial and something we continue to do. Not only has a PQL approach led to more efficient growth, but also to improvements in the product, sales, marketing, and customer success aspects of our business.

While product-led growth might not be for every business, there are learnings that can translate across all businesses. Using PQLs is a great way to start and evaluate what your users and customers truly value about your product. Ready to learn more about product-led growth? Check out the 2018 SaaS Expansion Benchmarks report we created in partnership with OpenView Labs.

founders

Metrics and data

SaaS Metrics Benchmarks

The SaaS industry has experienced rapid growth in recent years. With industry expansion comes expansion in all facets of the market. More data, resources, blog posts, thought leaders, ideas, than ever before. While there are great resources being shared on a daily basis there are also equally poor resources being shared on a daily basis. So do how you filter the signal from the noise? Why do SaaS Metrics matter and what should you be tracking?

SaaS companies are inherently driven by data and metrics so common SaaS metrics benchmarks and metrics are starting to become more common across the industry. With hundreds of venture firms focusing in SaaS, many have started to share their findings to continue to spur growth in the industry and increase the quality of early stage SaaS companies.

SaaS Metrics Benchmarks

Comparing your company to the others around you is one of the best ways to ensure that you are on the right track with your SaaS metrics. Being a SaaS startup founder can often feel like you’re alone in the journey so being able to stack up against other using SaaS metrics benchmarks is a must.

One of our favorite SaaS metrics benchmarks is the annual metrics benchmark from the team at OpenView ventures. We’ve partnered with OpenView to send their survey to 400+ SaaS companies on an annual basis. From here, the team takes a look at the data and uncovers underlying trends and directions in the market. We specifically love this SaaS benchmark because it shows vital SaaS metrics broken down by company size. It can be intimidating comparing your data to powerhouses like Slack or Salesforce so the OpenView SaaS metrics benchmarks allows you to compare yourself to companies at a similar stage.

Another great SaaS metrics benchmark is from Christoph Janz of Point Nine Capital. Every year, Christoph puts together a SaaS funding napkin. The napkin is a breakdown of SaaS metrics and benchmarks the data a company needs to hit to raise a seed, series A, series B, etc. Generally, Chrisoph uses revenue, team, product/market, sales/marketing, and the companies’ moat to benchmark what it takes to raise at different stages of a company lifecycle.

No matter what source you use, finding a quality SaaS metric benchmark will greatly help in your journey to scale the company. While no company or founder is the exact same, having a benchmark to turn to will help shine a light at the end of the tunnel.

founders

Metrics and data

Marketing Scores: Measuring Your Marketing Efficiency

The job of a marketer is to assist a sales team in generating new leads and in turn generating new customers. In order to measure the effectiveness in closing new customers teams have to implement marketing scores across the organization to measure and iterate on their efforts.

Marketing scores can be used across your sales and marketing funnel to improve conversions across the board and spur growth with small tweaks. Especially for a SaaS business, measuring your SaaS metrics and marketing scores can be easily replicated across the funnel and shared throughout your organization. You can check out the 3 marketing scores we suggest starting to track below:

Qualified Marketing Traffic

In its simplest form marketing traffic is anyone who has visited your website. The greater number of people who visit your website and are aware of your business the greater number of opportunities you have to produce customers. However, not all marketing traffic is created equal. Depending on where your traffic is coming from it may have a varying level of qualification.

Qualified Marketing Traffic is anyone that would be considered qualified to buy your product or service. For example, if you’re selling grass seed, someone who is googling where to buy grass seed would be more qualified than someone that found your site googling what kind of grass is used at a golf course.

Qualified Marketing & Sales Leads

The next step in the sales funnel is generating qualified leads. Once we have found what qualified marketing traffic looks like it is time to qualify them a step further and turn them into a lead that can be turned over to sales. The more qualified the marketing traffic the easier it is to turn them into a lead. Depending on what your product or service offers, generating leads may be a varying degree of importance. If you have a longer sales cycle with more touch points it may be more important to create a lead and establish a relationship than a company with a shorter sales cycle that is a quick and easy purchase.

Lead-to-Customer Rate

The last of the marketing scores that we have is the lead-to-customer rate. Simply, this is the rate at which you turn leads into customers. This marketing score is touched by both sales and marketing teams. If marketing is turning over low quality leads the lead-to-customer rate will likely be low. If sales is not speaking to the same message that the marketing team is using this could also lead to a low lead-to-customer rate. The good news, while many aspects have an impact on the LTC it is easy to make small tweaks to increase the rate.

founders

Metrics and data

Current Ratio and Liquidity Ratio

As we’ve discussed before calculating your quick ratio is an easy formula to understand how efficiently your company can grow. The higher the quick ratio the more efficient a company can grow. An example quick ratio formula can be found below:

Quick Ratio Formula = (New MRR + Expansion MRR) / (Contraction MRR + Churned MRR)

In addition to the quick formula, we see many startups track two other financial ratios: current ratio and liquidity ratio. Tracking different financial ratios can be an integral part of a companies’ success as they offer a quick and easily digestible way to understand where your company stands. Where a quick ratio observes your short term financials, the current ratio and liquidity ratio observe all of your assets and long term obligations.

Liquidity Ratio

Liquidity ratio or liquidity ratios are often seen in a similar sense as a quick ratio and can be used as an umbrella term. Both quick ratios and current ratios are a different form of liquidity ratios. According to Investopedia, “Liquidity ratios are an important class of financial metrics used to determine a debtor’s ability to pay off current debt obligations without raising external capital. Liquidity ratios measure a company’s ability to pay debt obligations and its margin of safety through the calculation of metrics including the current ratio, quick ratio, and operating cash flow ratio.”

Related Resource: From IPOs to M&A: Navigating the Different Types of Liquidity Events

Liquidity ratios are important to startups and their investors because it helps determine if a startup can meet their current debt obligations.

Current Ratio

As mentioned above, a current ratio is a form of a liquidity ratio. A current ratio is a longer term look at a companies’ debts and assets. The current ratio formula is very simple and can be found below:

Current Ratio Formula = Current Assets / Current Liabilities

While different companies may interpret what counts as an asset differently, a current ratio of 1 is generally accepted as a good current ratio value. Whereas a quick ratio often observes just your recent revenue, a current ratio takes a holistic view at all of your assets and liabilities which causes a bit more variance from company to company.

All in all, tracking your liquidity ratios (current ratio and quick ratio) can offer both startup leaders and investors a high level view of the companies ability to grow and cover their debt obligations.

founders

Metrics and data

Quick Ratio Formula

The SaaS Quick Ratio is a simple formula used to measure the efficiency of your SaaS company’s growth. A quick ratio gives a company a reliable source to predict how they can grow revenue with churn in mind. In short, the quick ratio formula is new MRR by lost MRR over a period of time. The higher your quick ratio the stronger the growth. The quick ratio formula can be found below:

Quick Ratio Formula = (New MRR + Expansion MRR) / (Contraction MRR + Churned MRR)

A low churn rate is often the most efficient way to grow your SaaS business. While new MRR is vital to a company’s success as well, a high churn rate will make it virtually impossible to have a sustainable growth rate. As Tomasz Tunguz puts it, “If the churn number is unsustainably high, we know from previous churn analyses that high churn implies lower growth rates and dramatically less efficient growth.”

While a high MRR growth rate can mask a high churn rate, the best-in-class companies always have a low growth rate, creating a much higher quick ratio.

Quick Ratio Formula in Visible

Creating a quick ratio formula in Visible is incredibly easy with our formula builder. First, you’ll want to make sure you have your recurring revenue metrics in Visible. We would suggest using user provided metrics or using Google Sheets, Salesforce, HubSpot or ChartMogul to automatically get your recurring revenue metrics in Visible.

Once your metrics are in Visible, you’ll want to start building your quick ratio formula. To start, add any new and expansion MRR metrics in the top line. For our quick ratio formula we only mention MRR and Expansion MRR but this could include reactivated, multiple product, etc. On the bottom row, you’ll want to add any “loss” MRR metrics, like contraction and churned MRR.

After the quick ratio formula is setup, it will automatically be calculated as any new data comes in from your integrations. Next, you’ll want to visualize, distribute, and act on your quick ratio. We suggest sharing your quick ratio with managers and executives on your team so everyone has an easy way to understand the growth of your company at a quick glance. Generally, we do not see companies share their quick ratio with their investors as if you have a down month or period it may display poorly and generate unnecessary concerns.

Tracking your quick ratio is a great way for SaaS companies to get a quick idea of how efficiently they are growing. The easiest way to strengthen your SaaS quick ratio is by shrinking your monthly churn rate. Learn more about your quick ratio here.

founders

Hiring & Talent

Metrics and data

An Update Template for Sharing Your HubSpot Funnel Metrics

What campaigns are working? What content is performing best? Where can we improve inefficiencies? Where should we double down? Continuing to review, analyze, and “duct-tape” your funnel is key to executing an agile marketing playbook.

“Data doesn’t do you any good unless you act on it. Each of these metrics clearly tells you how you’re doing. Right away, you’ll know where you need to spend your time.” – Andrew Chen, a16z

General Funnel Metrics

Automatically bring in general funnel metrics using our HubSpot integration. Bring in basic lead counts or use filters to bring in granular funnel metrics to dig into where you can improve the most. You can check out examples for bringing in different pipeline stages below:

Different Lead Stages; subscribers, MQLs, SQLs, PQLs, etc. – Start with “Contacts” as your HubSpot Object. Anchor the date to any field you or HubSpot are automatically tracking; create date, became an XYZ date, etc. From here, you can filter your different contacts however you’d like. For this example, we our simply using our “Lifecycle Stage” but can easily break that down by different sources, personas, sales reps, etc.

Note: Use the value field to tie a monetary value to your metrics. For example, using “Deal Amount” to bring in the value of all of the contacts in a certain stage. From here, you can use formulas to calculate the weighted value of different pipeline stages.

New Customers – Start by connecting the object where you are tracking new customers and their value; likely companies or deals. Just as you would for lead stages, you’ll want to anchor the object to the field that denotes a new customer; lifecycle stage, etc. Use the value field to bring in a simple count or the total dollar amount for won deals. Easily take a look at the row level data to see where customers are coming from, renewal dates, and more.

Top of Funnel: Lead Source Breakdown

Marketing attribution is tough. Staying on top of your lead sources and continuing to tweak and improve inefficiencies is a quick way to keep your growth metrics moving in the right direction. Keep tabs on where your leads are coming from by filtering different leads by their lead source.Use “Filters” when connecting HubSpot to Visible to break down new leads by different sources, campaigns, and events. Drill down using row level data to see what specific leads are coming from what sources.

You can check out an Update example for sharing your funnel metrics and lead sources here.

founders

Metrics and data

Use Sheetgo To Consolidate Your Google Sheets Reporting

Hate them or love them, spreadsheets are here to stay. Everyone has been a part of the confusion that comes with tracking and sharing your spreadsheets. A few metrics here, a few metrics there, it can become a days work to find and surface the right sheets. Thanks to our friends at Sheetgo you can easily centralize and consolidate all of your online spreadsheet data across multiple Google Sheets and CSV files.

Centralize Your Data

No need to chase managers and colleagues for their spreadsheets and data on a regular basis. Using Sheetgo you can easily connect multiple Google Sheets to feed into a master sheet to have your key data at your fingertips. SheetGo is a powerful tool to build, maintain, and scale an internal data distribution system.

When connecting multiple sheets you likely won’t need all of the data points in each. SheetGo can be as powerful or simple as you would like. Use their filters to determine what data you will be bringing in from each sheet or use personal queries to customize the process to your needs.

Outside of centralizing your team’s data help your clients, board, and investors stay on top of key data with consolidated sheets. Running ad campaigns on multiple platforms for a client? Easily take the data exports and centralize all of their vital data into one sheet.

Visualize & Distribute

Once you have your Sheetgo connections in place connect a single sheet to Visible to visualize and distribute your data. As you continue to update the individual sheets fueling your “master sheet” your charts, dashboards, and Updates will automatically refresh in Visible as well. Using a combination of Visible & Sheetgo it has never been easier to stay on top of your spreadsheets and avoid the frustration that comes with hunting down your data.

Ready to simplify your teams spreadsheets and data? Check out Sheetgo and let us know what you think.

founders

Hiring & Talent

Operations

Metrics and data

Operations

Startups: Why Send Management Reports?

Successful companies share a few key traits… so do unsuccessful ones. Investors, executives, team members, potential hires, etc. understand this. Regular management reports show the CEO/CFO/etc. are key in keeping business decisions agile while showing you value what your management team brings to the table.

How Can You Get Started with Successful Management Reports?

It’s a lot easier than you might think. Good management reports don’t have to be long and they don’t have to be time consuming. If you’ve already got metrics, KPIs, etc. in place with your teams it is a matter of extracting the key data and turning it into something easily replicable, actionable, and digestible. Sharing financials, metrics, and dashboards can certainly be useful to managers but suffocating at the same time.

Bringing clarity and simplicity to management reporting is a strong start to avoid “the activity trap” and keep managers, teams, and individuals focused on their original purpose. It is easy for team members to get lost in their day to day and ultimately forget why they joined your company to grow the company and themselves. In working with countless CEOs, CFOs, and managers, we have a few things to keep in mind while building your management reporting and data distribution system:

Replicable – Keep metrics and objectives comparable from report to report. Chances are you’ve got an objective in place so be sure to highlight that in every report to keep focus where it matters most.

Actionable – Be sure that the report leaves room for questions, discussions, and a game plan until your next meeting, report, etc.

Digestible – Make the report light and to the point. Be sure to include only the 2-6 most vital metrics as full dashboards and spreadsheets can become suffocating and distract from your manager’s main objectives.

An Example Management Report

You can check out an example of a Visible Management Report Here.

As always, feel free to sign-up for a free trial here and email support@visible.vc if you’d like the template dropped into your account.

founders

Metrics and data

Product Updates

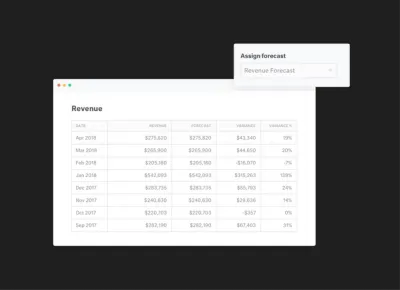

Using Variance Reporting in Visible

Use Variance Reports to Determine How You’re Tracking to Your Projections

How are we doing? Are things going to plan? Are we overspending? Underspending? Where should we double-down? Cutback?

These are all questions that you’ve likely encountered in a management meeting or recent board meeting.

Today we are excited to announce new Variance Report module that will be part of our insights layer. Variance reporting will let our customers quickly assign any of their KPIs to a forecasted or budgeted value and with one-click get back a full Variance Report.

We’ll calculate the following in your Variance Report:

MTD Variance

MTD Variance %

YTD Actual

YTD Variance

YTD Variance %

YTD Actual

prior yr YTD Actual

prior yr YTD Variance

prior yr YTD Variance %

Our budget vs actual and variance reporting will give you instant insights and reporting capabilities for any of your metrics in Visible. Being able to make timely decisions based on your forecasts and budget will help accelerate growth, manage your bottom line and hit goals across your organization. Utilizing the variance report in Visible is great for:

Weekly team updates showing progess towards your Monthly and Annual Goals

Crafting monthly management reports to your leadership teams providing feedback on where you under/over performed

Creating pre-board meeting reports that give a health check on where you are compared to board approved budgets.

We hope you enjoy! Sign in to Visible to get started to or sign up! Feel free to email support@visible.vc with any questions, comments and feedback.

Up & to the right, The Visible Team

founders

Metrics and data

Top Down vs Bottoms Up Projections

Financial projections are essential for any business, even if it’s not yet generating revenue. A variety of specific methods exist for performing this task, but they can generally be classified into top-down and bottom-up approaches. Financial analysts often use both methods as checks upon each other.

Top Down Projections

A top-down method of estimating future financial performance uses general parameters to develop specific projection numbers. You’ll often use a top-down approach to determine the market share that your new business can expect to receive. You might start with the market value of your product, narrowing it down to a particular location as much as possible. You would then assume that your business will receive a specific portion of that market and use that estimate to generate a sales forecast.

A top-down approach is comparatively easy since the only parameters it really requires is the total market value for your area and the market share you expect to receive. This method is most useful for checking the reasonableness of the projections resulting from a bottom-up approach. However, top down projections aren’t recommended for preparing detailed forecasts.

Example

Assume for this example you plan to open a business in an area where the total annual sale value of your product is $2 billion. You believe that your business might get 0.01 percent of that market, resulting in annual sales of $200,000. Note that your financial projection is entirely dependent upon the accuracy of your estimate on the product’s market value and your market share. Furthermore, the top-down approach doesn’t you to ask “what if” type questions.

Bottoms Up Projections

The bottom-up approach uses specific parameters to develop a general forecast of a business’s performance. This method might start the number people you expect to pass by your business each day, also known as footfall. You would then estimate the percentage of footfall that will enter your store and make a purchase. The next step is to estimate the average value of each purchase to project your annual sales. Bottoms up projections are based on a set of individual assumptions, allowing you to determine the impact of changing a particular parameter with relative ease.

You may use a bottom-up approach to select a location for a new business. You can obtain an accurate estimate of the footfall by direct observation. You can also observe similar stores in that area to estimate the percentage of footfall that are likely to enter your store. The prices that your competitors charge will give you a good idea of the price you can expect to charge.

Example

Assume for this example that an average of 10,000 people pass by a particular location each day. About one percent of this traffic in this area enters a store and makes a purchase, and the average total of each sale is about $5. The expected annual sales revenue in this example is therefore 10,000 x 0.01 x 5 x 365 = $182,500. You can then refine this estimate by considering additional factors such as price changes, closing on weekends and seasonal fluctuations.

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial