Blog

Fundraising

Resources related to raising capital from investors for startups and VC firms.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Fundraising

Emerging Fund Managers You Want on Your Cap Table

“Rolling funds, the rise of solo capitalists, crowd syndicates and team-based seed funds all scream one thing in unison: venture capital is growing and getting unbundled at the same time.” TechCrunch

Emerging Managers are Venture Capital Fund Managers whose assets under management (AUM) range from $25 – $100M and have typically raised less than three funds. These types of managers are playing an important role in the ‘growing and unbundling’ of the Venture Capital landscape as they oftentimes focus on previously overlooked founders and markets. Emerging managers bring unique perspectives and experiences to the world of Venture Capital which is why startups should have a solid understanding of this type of investor as they start their fundraising journey.

How are Emerging Managers Different Than More Established VCs

If we compare established fund managers to emerging fund managers, a known investment claimer holds very true, “past results are not an indicator of future success,”– According to Pitchbook research “Nearly 18% of first-time funds nab an internal rate of return (IRR) of 25% while later funds only exceed that number about 12% of the time”.

Many respected LPs have also reported that emerging managers tend to outperform more established funds that are larger scale.

Other distinguishing attributes of Emerging Managers include:

They generally write smaller checks

They’re more hands-on with their fewer number of investments

They’re focused on brand building

They’re agile and less organizationally bureaucratic

There has historically been a high-risk bias on emerging managers because of some constraints that they faced in the past with regards to limited partners, but as they “consistently outperform industry benchmarks” you can see that isn’t holding Emerging Managers back from growing rapidly year over year.

Why Would You Want Emerging Managers On Your Cap Table Instead

Emerging Managers usually come with years of experience from larger funds where they had the chance to learn and work with the big players. Since the IRR of their new funds are the key indicator of success for LPs, they are highly motivated to make their investments successful.

As they are also more agile, they are able to bring more innovation and ideas to the table which allows them to recognize and jump on new trends which takes more time for established VCs to react to.

The number of Micro VCs, which are also considered emerging managers, jumped 9x from 2012 to 2019, “The underpinning insight was that the “generalist” approach by legacy VC created an opportunity for bespoke firms that could better support founders at the early stage in their respective markets and that this would lead to improved outcomes.” Kaufman Fellows

Other benefits of emerging managers include:

They have more real-life experience that’s recent and relevant

They’re more engaged investors and are more motivated to help you out as they’re establishing their brand

“At the end of the day, LPs look for evidence that an emerging manager can, and will, identify the best companies in their area of focus, and be able to win those deals based on their approach, skills, and expertise. The best early-stage VCs bring tremendous value to their portfolio, creating a flywheel of entrepreneur referrals which in turn, fosters that GPs’ success, so they can build the next industry-leading franchise.” Crunchbase Ventures

They have more specialized knowledge pertaining to the focus of your startup.

“LPs typically look to avoid overfished ponds and overplayed deal channels, so you should make a compelling case for why they should follow you off the beaten path. The best EMs have a unique perspective within their area of focus. The prospective LPs you’re targeting need to agree that the approach and space you’re betting on is an exciting place to spend time.” Crunchbase Ventures

They serve as a pathway that enables more diversity in venture.

Emerging Managers include more women and racial minorities than in established VCs, which operate with “predominantly homogenous teams” that have been proven to yield poorer outcomes than in diverse teams.

“Emerging managers are grinders, hungry for success the way a young underdog is against a perennial winner in the sports world. This tightly aligns their goals with LPs – a strong return means both the manager and their partners win.” Gridline

How to Find Emerging Managers

Filter investors by AUM that are less than $100M and (pre) seed and Series A funding stage on our Connect Investor database

Emerging manager training programs (Recast Capital, Strut Consulting, Kauffman Fellows, and the VCI Fellowship for BIPOC First-Time Fund Managers)

Networking Events

Emerging manager communities (Transact Global, Raise Global)

VC Guide’s List of Emerging Managers

Emerging Managers to Check-out

Base Case Capital

Location: San Francisco, California, United States

About: base case capital is an early-stage venture capital firm focused on the next generation of enterprise software.

Investment Stages: Pre-Seed, Seed, Series A, Series B

Recent Investments:

Ashby

Supergrain

Fiberplane

Conscience

Location: Miami, Florida, United States

About: Conscience VC invests into early-stage, science-led consumer companies.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Aqua Cultured Foods

Last Gameboard

Wayfinder Biosciences

Atman

Location: New York, United States

About: We partner with inevitable people. We provide leverage, access, and acumen through aligned principles. We partner with founders at the pre-seed and seed stages. At Atman Capital, every founder in our egregore is a partner of the fund.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Chico.ai

Bamboo

Pipefy

NP-Hard Ventures

Location: Amsterdam, Netherlands

About: We support early teams in Europe and the US to build the infrastructure, tools, and decentralized platforms that simplify the way we work, by making technology more accessible and unlock creativity.

Investment Stages: Pre-Seed, Seed

Recent Investments:

tldraw

Universe Energy

eDRV

Empath Ventures

Location: Los Angeles, California, United States

About: Empath Ventures is a venture capital firm that mainly invests in psychedelic medicine companies.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Freedom Biosciences

MAPS Public Benefit Corporation

Pangea Botanica

Garuda Ventures

Location: San Francisco, Bay Area, California, United States

About: Garuda is an angel fund run by full-time operators Rishi Taparia and James Richards. We spend every day on the founder side of the table.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Paragon

ConductorOne

Arena

Lorimer Ventures

Location: Brooklyn, New York, United States

About: We’re a Brooklyn-based investment firm made up of founders, operators, and financial professionals with experience building and operating businesses from pre-revenue to post-IPO. We bring a founder-first perspective to each startup we back, and strive to be on a speed-dial basis with the founding teams we back.

Investment Stages: Pre-Seed, Seed, Series A

Recent Investments:

Tyba

Circuit Mind

OatFi

m]x[v

Location: New York, United States

About: m]x[v Capital is an up and coming early-stage venture fund building momentum for the next generation of cloud disruptors. We bring a founder and operator perspective to the cap table, helping our founders build their vision, product, and teams.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Epoch

Mailmodo

Postscript

Brickyard

Location: United States

About: Brickyard is an early-stage capital and founder outpost backing builders.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Krepling

Joon App

IRON

Acquired Wisdom Fund

About: Acquired Wisdom Fund helps seasoned professionals create scalable technology products. We invest in early stage tech startups.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Achievable

NOCAP Sports

Angler AI

True Wealth Ventures

Location: Austin, Texas, United States

About: We see value in the impact of women. True Wealth Ventures invests in smart female entrepreneurs, from health innovators to sustainable solution pioneers. Women-led companies have proven they deliver higher returns. It’s time to invest in new perspectives.

Thesis: Women-led companies improving either human health or environmental health

Investment Stages: Pre-Seed, Seed

Recent Investments:

De Oro Devices

Reharvest Provisions

Aeromutable

CapitalX

Location: San Francisco, California, United States

About: CapitalX.vc – enterprise focused generalist with $100k – $500k initial checks in preseed/seed.

Thesis: Women-led companies improving either human health or environmental health

Investment Stages: Seed, Pre-Seed, Series A

Recent Investments:

Simplifyber

Impossible Mining

Front Finance

Overlooked Ventures

About: We support founders who operate early-stage technology companies that are historically overlooked and provide them capital, resources, and connections to scale their business. We’ve been in your shoes. We’re tech founders with 10+ years of experience running companies and making deals. Now we’re authentically supporting entrepreneurs with capital and a founder-friendly focus.

Recent Investments:

Pipe

Stagger

West Tenth

Chingona Ventures

Location: Chicago, Illinois, United States

About: Chingona Ventures invests in founders from backgrounds and industries that are not well understood by the traditional investor.

Thesis: Focus on industries that are massively changing and founders whose backgrounds uniquely position them to create businesses in growth markets that are often overlooked. Focus areas are in financial technology, female technology, food technology, health/wellness, and future of learning.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Cartwheel

Sigo Seguros

Encantos

Forum Ventures

Location: New York City, San Francisco, and Toronto, United States

Thesis: B2B SaaS; Future of Work, E-commerce enablement, Supply Chain & Logistics, Marketplace, Fintech, Healthcare

Investment Stages: Pre-Seed, Seed

Recent Investments:

Sandbox Banking

Tusk Logistics

Vergo

Check out Forum Ventures profile on our Connect Investor Database

Dream Machine

Location: Palo Alto, California, United States

About: Dream Machine is an opportunistic seed fund interested in consumer and frontier tech. It is founded by Alexia Bonatsos, the former co-editor-in-chief of Techcrunch and one of the earliest reporters to write about WhatsApp, Uber, Instagram, Airbnb and Pinterest. With Dream Machine, she hopes to help exceptional founders make science fiction non-fiction.

Investment Stages: Pre-Seed, Seed

Recent Investments:

TTYL

BlockParty

Powder

VamosVentures

Location: Los Angeles, California, United States

Investment Stages: Pre-Seed, Seed, Series A

Recent Investments:

Miga Health

Form Energy

Zócalo Health

Revent

Location: Berlin, Germany

Investment Stages: Series A, Series B, Series C

Recent Investments:

Resourcify

Noscendo GmbH

Sylvera

Spark Growth Ventures

Location: San Diego, California, United States

About: Spark Growth Ventures is a community driven, early & mid stage, vertical-agnostic, technology venture capital firm. Our mission is to support gritty and exceptional founders in their missions by bringing forth the combined value of our strong community. We are fortunate to have a global network of entrepreneurs, C-level relationships, subject matter experts, world-class talent, institutional investors, high net worth individuals and family offices, many of who are investors in our platform. Our team has several decades of global experience in venture capital, entrepreneurship, innovation, executive & board management, functional leadership and advisory work.

Thesis: Capital efficient and scalable business model rooted in tech enabled products and services solving real and large problems. Mission oriented and gritty founders are a must.

Investment Stages: Series A, Series B, Series C

Recent Investments:

Redcliffe Labs

Tab32

Placer.ai

Nomad Ventures

Location: Los Angeles, California, United States

About: Nomad Ventures is an LA-based Venture Fund focused on Early-Stage Marketplace businesses. The GPs (Chris Taylor and James Mumma) are entrepreneurs who have helped build some of the fastest growing startups in recent history (Uber, Uber Eats, Opendoor) and they support founders by providing both expertise and capital to build the next big tech businesses. ???? ???? ????

Investment Stages: Pre-Seed, Seed

Recent Investments:

Intro

Minoan

Lunch

Climentum Capital

About: Climentum Capital is a Venture Capital firm based out of Copenhagen, Berlin and Stockholm. We invest in European startups that can cut down megatons of CO2 emissions in a concrete and measurable way. The fund targets late Seed and Series A investments into the six sectors that demonstrate the largest CO2 reduction potential: – Industry & Manufacturing – NextGen Renewables – Food & Agriculture – Buildings & Architecture – Transportation & Mobility – Waste & Materials As one of the first Venture Capital funds with a double carry structure (with both financial and impact targets), Climentum is dedicated from day one to evaluate and only invest in companies that hold true carbon reduction potential.

Investment Stages: Seed, Series A

Recent Investments:

Entocycle

Qvantum

Continuum

Seed Club Ventures

About: Seed Club Ventures is a Venture DAO backing early-stage founders building at the intersection of web3 and community. With a membership of 60+ leading innovators and investors in crypto, we are diverse in our ability to support projects throughout their life cycle. Launched in partnership with Seed Club, the leading network for DAO builders, our mission is to build a community-owned internet.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Guild

Stability AI

Molecule

Capchase

Location: New York, New York, United States

About:Capchase is the growth partner for ambitious software-as-a-service (SaaS) and comparable recurring-revenue companies. They help founders and CFOs grow their businesses faster through non-dilutive capital, market insights, and community support. Founded in 2020 and headquartered in New York City, Capchase provides financing by bringing future expected cash flows to the present day – thereby securing funding that is fast, flexible, and doesn’t dilute their ownership.

Investment Stages: Series B

Recent Investments:

Fondo

Enerex

BlogTec

Gold House Ventures

About: Gold House Ventures is the definitive fund investing in Asian/Pacific Islander-founded companies. We back founders building industry-changing, culturally-compelling businesses by providing a singular suite of services that includes our accelerator, Gold Rush (whose alumni have collectively raised $500 million+); our talent placement vehicle, the Multicultural Leadership Coalition, which partners with leading multicultural funds to increase diversity in Board and Advisory pipelines; media marketing with every major film studio and streaming platform, and access to Gold House’s network of top Asian Pacific leaders across venture capital, media, entertainment, and tech.

Investment Stages: Pre-Seed, Seed, Series A, Series B

Recent Investments:

CreatorDAO

Xiao Chi Jie

Blossom.team

The Fintech Fund

About: An early-stage venture fund supporting the best fintech and defi teams.

Thesis: The Fintech Fund is a $25M venture fund investing in the top 1% of fintech and decentralized finance startups globally. Our focus is split between more established fintech markets in the US and Europe – for which picks-and-shovels SaaS and infrastructure builders will sell into a growing market of buyers – and emerging markets, where opportunities exist for consumer fintechs to dominate winner-take-all markets.

Investment Stages: Pre-Seed, Seed

Recent Investments:

TrueBiz

GuruHotel

Yave

Vibe Capital

About: Vibe Capital is a $10m Fund that invests in the Web3, AI, and Deep Science sectors at the Pre-Seed and Seed stage. We seek venture-scale returns by leaning in to the volatility caused by the exponential growth of the Web3, AI, and Deep Science sectors intertwining with demographic shifts and climate change.

Thesis: Vibe Capital is a $10m Fund that invests in the Web3, AI, and Deep Science sectors at the Pre-Seed and Seed stage. We seek venture-scale returns by leaning in to the volatility caused by the exponential growth of the Web3, AI, and Deep Science sectors intertwining with demographic shifts and climate change.

More here -> https://vibecap.co/thesis/

Investment Stages: Pre-Seed

Recent Investments:

Pipedream Labs

Circle Labs

Fauna Bio

Origins

About: We’re a new type of VC firm backing legendary consumer founders with an unfair advantage from pre-seed to seriesA. We invest $100k to $500k in consumer tech startups and also come with the power of influence of our LP’s and their 160,000,000 followers. You can reach us at hello@origins.fund

Investment Stages: Pre-Seed, Seed, Series A

Recent Investments:

Matchday

Stadium Live

Upway

Portfolio Ventures

About: The PV Angel Fund is backed by a great mix of investors leading UK angels, successful founders, C-level execs, and corporate NEDs who co-invest alongside the fund and provide strategic support to our portfolio companies.

Thesis: Co-investing tax-efficient capital in the best UK tech startups alongside lead investors.

Investment Stages: Pre-Seed, Seed, Series A

Punch Capital

About: Punch Capital backs early-stage founders who break new ground.

Thesis: Punch Capital backs courageous immigrants at the earliest stages. We are honored to be among Weekend Fund’s Emerging 50: signatureblock.co/emerging-50.

Investment Stages: Angel, Pre-Seed, Seed

Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VCs and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

founders

Fundraising

Operations

Business Startup Advice: 15 Helpful Tips for Startup Growth

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Building a startup is difficult. Being a founder can almost feel impossible. There are very few people that have been in the shoes of a startup founder. This means that there are very few people that know the difficulties that come along with building and leading a startup.

As a startup founder, you are responsible for hiring and retaining employees, securing capital, developing a product, building culture, and more. Chances are you haven’t lead all of those things in the past. Because of this it is important for you to look to the founders and leaders that have been there before to uncover advice.

Related Resource: 7 Essential Business Startup Resources

Check out our 15 helpful tips for startup success below:

1) Be Persistent

Leading a startup is full of ups and downs. Inevitably, things will not go as planned and will feel like everything is headed in the wrong direction. Paul Graham, Founder of YC, coined the term “trough of sorrow” to explain when your startup loses momentum and feels like things are all headed in the wrong direction.

In order to navigate troughs of sorrow and down periods, startup founders need to stay persistent. You’ll need to focus on what truly matters to your business and stay the course.

Related Resource: The 23 Best Books for Startup Founders at Any Stage

2) Always Be Solution Focused

As we’ve alluded to earlier, founders are pulled in a hundred different directions. — whether it be with hiring, fundraising, or developing a product. It is easy to get distracted and spend your time (and your team’s time) working on projects or initiatives that are not core to your business.

As a startup founder, it is important to stay focused on your solution and the problem you are solving. As Kyle Wong, the CEO of Pixlee, puts it,

“Having a product that does a lot of things but doesn’t do anything well is useless. Your goal should be to definitively say that your product is the best at doing X for market Y. You should ask yourself, “Which customers do I care most about, and what can I do to make their experience better?”

Determine what your company is uniquely good at and stay focused on that solution.

3) Invest in Yourself

When managing a team, it can be difficult to put yourself aside and continue to invest in the team members around you. As a startup founder, it is important that you take the time and resources necessary to invest in yourself. This will differ from founder to founder depending on they do this. For some it might be setting time off from work to hone other skills, attending leadership conferences, etc.

4) Execution, Execution, Execution

Forecasting growth and building a product roadmap is a task in itself. Executing those plans and roadmaps is vital, and difficult. In order for a startup to succeed, the leadership team needs to be focused on execution from day to day to make sure everyone is headed in the same direction.

As the team at Basis Set Ventures puts it, “Execution is the only aspect that is consistently correlated with startup success. Across all archetypes, day-to-day effectiveness and whether the founder learns and adapts quickly are most correlated with success.” Check out the image from their Founder Superpowers report below:

5) Focus on Results

Going hand in hand with execution is the ability to focus on results. It can be easy to get consumed by the inputs, but if the results are not there it is important to quickly pivot and try inputs and strategies that show real results.

Because most startups have a limited runway (cash) it is important to move quickly and stay rallied behind results. If you find a marketing or acquisition channel is not moving the needle, it is important to quickly cut that channel and focus on what is driving results.

6) Build a Reliable Network

The startup world is a tight-knit community. Different VC funds and corporations have made it incredibly easy for founders and startup employees to network and help one another.

Having a reliable network is a great way to help in all aspects of business building. Connections will be able to make introductions to potential investors, ideal customers, and job candidates. It is important to be thoughtful about the relationships you are building and focus on building trust before pursuing business interests.

As the team at Hustle Fund wrote, “Networking wasn’t about going to a bunch of conferences and exchanging business cards. Networking is simply about making friends.”

7) Protect Your Equity

Equity is the most expensive asset a startup founder has. It is important to protect and manage your equity accordingly. At Visible, we believe that startup leaders should have dedicated tools for managing their equity — just as sales and marketing teams have dedicated tools to manage their day-to-day.

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

8) Become a Storyteller

Storytelling is a crucial part of building a successful startup. Sure there are more important aspects of business building but being a great storyteller will help immensely with fundraising, hiring, and messaging. As Steve Jobs puts it,

“The most powerful person in the world is the storyteller. The storyteller sets the vision, values, and agenda of an entire generation to come.”

Kristian Andersen of High Alpha joined us to discuss how founders can leverage storytelling to craft their pitch deck for successful fundraise. Learn more here or check out a snippet below:

9) Embrace the Journey

Building a startup is a journey. As we mentioned previously, there are many ups and downs when it comes to building a startup. While it can be easy to stay focused on the day-to-day it is important to take a step back and look at the journey. It is easy to focus on the lows but is rewarding to allow yourself and your team to celebrate the wins.

10) Don’t Let Yourself Get Burned Out

Building a successful startup requires solving a lot of difficult problems. At times it might feel like you are banging your head against the wall. It is easy to get consumed by a problem and put everything you have into solving it day after day. However, this can lead to burnout and cost you, and your team, in the long run.

In order to avoid burnout, it is important to make yourself, especially your physical and mental health, a priority. Learn more below.

11) Make Physical and Mental Health a Priority

Launching a startup is an exhausting job and can take a toll on a founder’s physical and mental health. As the team at Starting Line VC puts it,

“Building a startup is an exhausting process. It is terrifying, stressful, and confusing. It can also be exhilarating. The highs are higher than any other feeling; the lows depress similarly. As a founder remarked to us recently, “my mood is dictated daily by the performance of our Shopify revenue. If not managed and balanced, these volatile emotions can become unhealthy. Worse, they can affect performance.”

Learn more about managing your physical and mental health with Ezra Galston of Starting Line Ventures here.

12) Strategically Plan Out Every Work Day

If you’ve been following along, you have probably noticed that focus is a core aspect of startup success. Focus in everything from product development to your daily routine can help a company succeed. By having a strategic plan for each workday, you’ll be able to maintain that focus on the big problems you are solving. Of course, there is no one size fits all strategy to planning out a work day. Find what works best for you and stick to it.

13) Make Different Mistakes

Things never go as planned when building a startup. Mistakes are inevitable. The only thing you can do is learn from your previous mistakes and do your best to make them again. Mistakes are a great way to learn, especially as an early stage startup. You can’t let the mistakes weigh you down and have to be viewed as a learning opportunity that won’t happen again.

14) Progress Not Perfection

Many times it can be intimidating to put a product, pitch deck, email, blog post, etc. out before it is perfect. However, most startups are strapped for cash and need to balance speed with perfection. Of course, it would be ideal to have every aspect of your product be perfect, but that is not realistic. One of the differentiators of a startup is the ability to move quickly. In order to do so, you need to focus on the progress. Finding the right balance of progress and perfection is key to moving efficiently.

15) Know Your Customers

Without customers, a business fails to exist. Having a voice of your customers and a true understanding of their needs is a surefire way to make sure you are building the right product, sending the right message, and hiring the right team members. In order to know your customers, you need to take the time to understand their needs and build relationships with individuals.

Building relationships with customers will also reduce the likelihood of churn. Chances are your customers are working through the same things as you and will understand what you are going through. Scott Dorsey of High Alpha stresses that founders should be close to their customers than ever before when working through tough times. From our post, 4 Takeaways From Our Webinar with Scott Dorsey,

“During uncertain times, it is more important than ever to be close to your customers. Your customers are going through the same things that you are going through. Establish and preserve your relationship so you can grow together on the other side of the downturn.”

Learn Everything You Need to Know About Funding With Visible

Boiling down what it takes to build a successful startup into 15 tips is unrealistic. Some things may work for one company and not the other. The only way to truly understand what works for you and your business is by getting out there and doing it. At Visible, we want to be there along the way to help you with all things related to fundraising, investor relations, and metric tracking. Learn more about how we can help with your fundraising efforts here.

Related resource: Strategic Pivots in Startups: Deciding When, Understanding Why, and Executing How

founders

Fundraising

[Webinar Recording] Raising a Founder-Led SPV With Nik Talreja of Sydecar

Nik Talreja is the CEO and Founder of Sydecar. Sydecar helps you start and run your fund or SPV — so you can focus on making deals, not spreadsheets. Nik is joining us to break down the structure, mechanics, and considerations for founder-led SPVs. Check out the recording below:

Webinar Recap

Nik joined us on July 12th to break down all things related to SPVs. We’ll cover the ins and outs of raising your first SPV. In this webinar, you can expect to learn:

What an SPV is

Why founders should consider using an SPV

Considerations for a founder-led SPV

The mechanics behind an SPV

Watch Recording

Check out the recording of our webinar with Nik below:

founders

Fundraising

The 12 Best VC Funds You Should Know About

What is a VC Fund?

A venture fund is capital that is ready to be deployed by the venture capital firm (or the management company). It’s a funding option that allows VC funds to buy equity in a startup. In turn, a startup gives up a percentage of their ownership with the hopes of growing their valuation and creating a successful exit for everyone on the cap table.

The Structure of a VC Fund

Capital for a venture fund comes from limited partners, which are generally much larger funds, and are looking to diversity their investing via venture capital funds.

Limited partners tend to be either university endowments, sovereign funds, family offices, pension funds, or insurance companies.

Then there’s a management company which is responsible for prospecting investments, collecting fees and expenses, branding, and more.

AngelList describes it as, “A management company is a business entity created by a venture firm’s general partners (GPs). It’s responsible for managing a venture firm’s operations across its funds.”

A general partner is someone who manages a venture fund and likely the management company. GPs oftentimes invest their own money so they have skin in the game.

Read the full article on VC Fund Structure here.

Types of Venture Capital Funding:

Seed Capital

Seed funding, which oftentimes includes “pre-seed” funding, is generally the first round of financing for a startup. There typically tend to be funds that specialize in pre-seed/seed-stage financings.

Early Stage Capital (Often Series A or Series B)

Early-stage capital is often when a company might have some traction and promise that it can grow into a massive company that is worthy of an exit.

Expansion Capital

Venture funds at this stage are likely huge funds that make fewer investments with larger check sizes. At the point of investment, most companies will have proven success to in turn will raise at higher valuations.

Late Stage Capital

This might be a final injection before a company sets to go public or to fund expansion into a totally new market.

Rolling Funds

While they are not typically dedicated to a specific stage (like the examples above) the way they raise financing and treat the general partner to limited partners relationship differs.

Startup Fundraising Checklist:

Step 1: Determine if VC is Right for Your Business

Step 2: Prepare Your Deck, Docs, and Metrics

Step 3: Find Investors (Check out our Connect Investor Database)

Step 4: Pitch Investors and Take Meetings

Step 5: Due Diligence

Step 6: The Term Sheet

Related Resource: Miami’s Venture Capital Scene: The 10 Best Firms

Tiger Global Management

Tiger Global Management is an investment firm that deploys capital globally in both public and private markets and beats out all other VC’s in the world with the highest count of unicorn portfolio companies. They are based in New York with a focus in global Internet, software, consumer, and payments industries

Some of their recent investments include:

Amogy

SleekFlow

CloudQuery

Number of Unicorns in Portfolio

Tiger Global Management has 209 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 440 rounds within the last year.

SV Angel

SV Angel is a San Francisco-based angel firm that helps startups with business development, financing, M&A, and other strategic advice.

Some of their recent investments include:

Graft

Bubblehouse

Gilde

Number of Unicorns in Portfolio

SV Angel has 23 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 57 rounds within the last year.

Related Resource: The 11 Best Venture Capitals in San Francisco

LocalGlobe

LocalGlobe is a venture capital firm that focuses on seed and impact investments. They are located in London, England and their investment geography is usually within Europe.

Some of their recent investments include:

Cloudwall Capital

&Open

Shellworks

Related Resource: 15 Venture Capital Firms in London Fueling Startup Growth

Number of Unicorns in Portfolio

LocalGlobe has 18 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 52 rounds within the last year.

Greycroft

Greycroft is a venture capital firm located in New York that focuses on technology start-ups and investments in the internet and mobile markets.

Some of their recent investments include:

Narmi

Boulder Care

Branch

Number of Unicorns in Portfolio

Greycroft has 9 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 80 rounds within the last year.

Bain Capital Venutre

Bain Capital Ventures is a global private equity firm located in Boston, with over $17 billion of assets under management. Since 1984, the firm has invested in over 200 companies, with such notable successes as Aspect Development, DoubleClick, Gartner Group, and Netfish Technologies. Bain Capital Ventures manages a $250 million fund. Bain Capital Ventures partners with exceptional management teams to help early stage companies become long-term leaders in their markets.

Some of their recent investments include:

Auxilius

Magical

JupiterOne

Number of Rounds Participated in the last 12 Months

Bain Capital Venutre have participated in 66 rounds within the last year.

Andersson Horowitz

Andreessen Horowitz was established in June 2009 in Menlo Park, California by entrepreneurs and engineers Marc Andreessen and Ben Horowitz, based on their vision for a new, modern VC firm designed to support today’s entrepreneurs. Andreessen and Horowitz have a track record of investing in, building and scaling highly successful businesses.

Some of their recent investments include:

Entropy

SCiFi Foods

Adim

Number of Unicorns in Portfolio

Andersson Horowitz has 98 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 241 rounds within the last year.

Canaan Partners

Canaan Partners invests more than money in a company—they invest their time, experience, knowledge, connections and team-oriented approach. They place tremendous value on creating working partnerships with entrepreneurs and management teams who have the character and the drive to succeed. Prominent among Canaan’s resources is the breadth of operating, managerial and financial experience.

Some of their recent investments include:

WorkMotion

Appsmith

Marvin

Number of Unicorns in Portfolio

Canaan Partners has 6 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 43 rounds within the last year.

Anthemis

Anthemis Group is a global platform that cultivates change in the financial system by investing in, growing, and sustaining businesses. They are located in New York and London and thein investment thesis is to focus on startups that leverage technology to significantly impact the financial system.

Some of their recent investments include:

Hokodo

Kasheesh

Kinly

Number of Unicorns in Portfolio

Anthemis has 5 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 51 rounds within the last year.

General Catalyst

General Catalyst is a venture capital firm located in Cambridge, Massachusetts, that makes early-stage and growth equity investments with a focus in Consumer, Enterprise, Mobile, and Applications.

Some of their recent investments include:

Guild

Vibrant Planet

Sanas

Number of Unicorns in Portfolio

General Catalyst has 72 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 115 rounds within the last year.

Related Resource: 11 Top Venture Capital Firms in Boston

TCV

TCV is a leading provider of capital to growth-stage private and public companies in the technology industry. They are located in Menlo Park, California but invest globally.

Some of their recent investments include:

Trulioo

FlixMobility

FarEye

Number of Unicorns in Portfolio

TCV has 32 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 23 rounds within the last year.

Balderton Capital

Balderton Capital is an early-stage venture firm that’s based on the principles of teamwork and an intense dedication to building companies of lasting value. They provide superior service to entrepreneurs through a unique, team-oriented partnership. This team approach not only makes it more fun for them to come to work everyday, but more importantly, it benefits their portfolio companies. Instead of competing for resources, they share ideas, contacts and resources. They are located in London, England and primarily invest in European companies.

Some of their recent investments include:

TestGorilla

Request Finance

Avi Medical

Number of Unicorns in Portfolio

Balderton Capital has 13 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 38 rounds within the last year.

Forum Ventures

Location: New York City, San Francisco, and Toronto, United States

Thesis: B2B SaaS; Future of Work, E-commerce enablement, Supply Chain & Logistics, Marketplace, Fintech, Healthcare

Investment Stages: Pre-Seed, Seed

Recent Investments:

Sandbox Banking

Tusk Logistics

Vergo

Check out Forum Ventures profile on our Connect Investor Database

RRE Ventures

RRE Ventures is a New York-based venture capital firm that offers early-stage funding to software, internet, and communications companies.

Some of their recent investments include:

Haystacks.ai

Domain Money

Palm NFT Studio

Number of Unicorns in Portfolio

RRE Ventures has 13 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 17 rounds within the last year.

Related Resource: Exploring the Top 10 Venture Capital Firms in New York City

Related Resource: Chicago’s Best Venture Capital Firms: A List of the Top 10 Firm

Related Resource: Atlanta’s Hottest Venture Capital Firms: Our Top 9 Picks

Looking for Funding? Visible Can Help- Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here and check out Visibles Fundraising page: https://visible.vc/fundraising

founders

Fundraising

Investor CRM: Seamlessly Manage Relationships and Finances

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

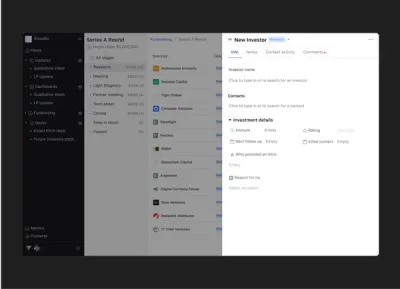

At Visible, we compare a venture fundraise to a traditional B2B sales and marketing funnel. At the top of your “fundraising funnel” you are bringing in qualified investors (leads), moving them through the middle of your funnel with meetings, pitches, monthly updates, etc., and hopefully closing them at the bottom of the funnel as a new investor. Ideally, once you close a new investor you’ll delight them with regular communication.

Related Reading: An Essential Guide on Capital Raising Software

Just as a sales and marketing team have dedicated tools, shouldnt a fundraise? By implementing an investor CRM or a dedicated CRM for fundraising, you will be able to stay on top of your communication and relationships with both current and potential investors.

What is an Investor CRM?

As put by the originator of the CRM, Salesforce, “Customer relationship management (CRM) is a technology for managing all your company’s relationships and interactions with customers and potential customers. The goal is simple: Improve business relationships to grow your business. A CRM system helps companies stay connected to customers, streamline processes, and improve profitability.”

However, an investor CRM is slightly different. Whereas a traditional CRM is focused on current and potential customer, an investor CRM stays focused on your current and potential investors.

Related Resource: Why a CRM is Essential for Investor Relations

This means tools to send updates, share pitch decks, monitor conversations, track status, etc. Learn more about the benefits of using a CRM for your investor relations below:

Benefits of a CRM Tool for Startups

Fundraising is a difficult. Implementing an investor CRM will not be a silver bullet that will close a round of funding for your business. It will help you build a system and organization into your process to improve your odds of success and allow you to focus on what truly matters, building your business.

Learn more about the benefits of using an investor CRM for your investor relations below:

1) CRM Gives Real-Time Insight on Your Pipeline

Any sales team wants to know the status of their pipeline. The same is true for a founder and a fundraise. Over the course of a venture fundraise, you will likely talk to anywhere between 50 and 100 investors.

To give you an accurate idea of the status of your round, founders should have a CRM in place to give you an idea of your current pipeline. For example, for new “leads” a sales & marketing team might give them a 10% chance to become a customer. You can set up the same idea for a fundraise. A new investor might be a 10% chance, an investor after a successful meeting might be 25%, etc.

2) All Investor Interactions and Conversations are Tracked

The sheer number of conversations during a fundraise should not be overlooked. As we mentioned, you will likely be talking to 50-100 investors. An investor CRM, will allow you to stay on top of your conversations.

Inevitably during the course of a fundraise, investors will pass for different reasons, request you follow up later, etc. A CRM is a surefire way to stay on top of these conversations and notes that will arise during a raise.

3) CRM Ensures You’ll Never Miss a Follow-Up

Follow ups and communication are vital to a successful sales & marketing process. The same can be said for a fundraise. Of course, there are companies that be so intriguing to investors that they’ll be ready to write a check after 1 meeting. However, for the majority of companies they will need to run a process for following up with investors.

At the end of the day, your job is to create FOMO with your potential investors so they are motivated to move quickly.

4) Seamlessly Monitors Fundraising

As we’ve alluded to throughout the post, an investor CRM is the best way to monitor the overall status of your fundraise. Using different stages and properties, you’ll be able to closely monitor the status of your raise.

This is not only beneficial to yourself but also your stakeholders. You can share the status of your fundraise with existing investors and advisors so they can help make introductions to potential investors and move you closer to a successful round.

5) Improves Relationships With Investors

One of the best benefits of using an investor CRM is that it strengthens your relationships with current investors. We have found that companies that regularly communicate with your investors are 300% more likely to raise follow on funding.

By having a system in place to communicate with your current investors you will not only improve your odds of raising follow on funding but you’ll be able to leverage their network, experience, and resources.

As a starting point, we recommend founders send a monthly update to their investors. To get the ball rolling, check out a few of our favorite monthly update templates here.

Related Resource: Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors

Features to Look for in an Investor CRM

Most CRMs are tailored to sales and marketing teams. When seeking out an investor specific CRM, look for some of the following details:

Seamless Collaboration and Data Sharing

Typically, investor relations relies solely on the founder and maybe a handful of other leaders. However, there are opportunities for collaboration when communicating and working with investors.

By having a CRM that allows for collaboration and data sharing, you’ll be able to quickly uncover insights about your fundraise and the state of your fundraise.

Ability to Integrate with Other Tools

A major benefit of using a CRM is that it helps automate tedious aspects of investor relations. Look for a tool that will allow you to connect with other tools and help create more efficient investor relations.

At Visible, our CRM directly integrates with a few tools:

Our free investor database, Visible Connect

Our investor updates tool

Our pitch deck sharing tool

Zapier

Easily Customizable

Every fundraise is different. Stage, geography, check sizes, etc. will all dictate how you wan to set up your investor CRM.

Look for a tool that allows you to easily customize your fundraise so it is molded to the specifics of your fundraise.

Track Communication

A key aspect of building trust with current and potential investors is with regular communication. A CRM should be a place where you can keep an eye on how your investors are engaging with your emails, updates, pitch decks, etc.

Manage Your Investor Relationships With Visible

Find investors, share your pitch deck, send investors updates, and track your investor conversations all from one place. Try Visible for free for 14 days here.

founders

Fundraising

Why a CRM is Essential for Investor Relations

At Visible, we believe that fundraising oftentimes mirrors a traditional B2B sales and marketing funnel.

At the top of your “fundraising funnel” you are adding qualified investors (leads), moving them through the middle of your funnel with meetings, coffee chats, monthly updates, etc. with the goal of closing them as a new investor at the bottom of the ideal. From here, you are ideally delighting them with consistent communication.

Related Resource: An Essential Guide on Capital Raising Software

Just as a sales and marketing team has dedicated tools shouldn’t a founder have tools to manage their most expensive asset, equity? Learn more about how founders can use a CRM to improve and manage their investor relations below.

What is the Definition of a CRM?

As put by Salesforce, the original pioneer of CRMs, “Customer relationship management (CRM) is a technology for managing all your company’s relationships and interactions with customers and potential customers. The goal is simple: Improve business relationships to grow your business. A CRM system helps companies stay connected to customers, streamline processes, and improve profitability.”

However, this definition slightly changes when it comes to investor CRM or a dedicated CRM for fundraising. Whereas a traditional CRM is used to further your relationship with customers, an investor CRM is used to strengthen relationships with both current and potential investors.

Why is Customer Relationship Management (CRM) Important for Investor Relations?

As we previously mentioned, equity is the most expensive asset a startup founder has. Having a system in place to communicate and build relationships with the stakeholders on your cap table is a surefire way to improve your odds of raising capital in the future.

Investors are typically investing thousands to millions of dollars into businesses and they want to know their relationship is being taken seriously. Founders have the ability to stand out from their peers by having a strong system for communicating and building relationships with investors.

At Visible, we have found that companies that regularly communicate with their investors are 300% more likely to raise follow on funding down the road. On top of helping with follow on funding, founders can also leverage their investor’s network, experience, and resources.

Related Resource: Investor CRM: Seamlessly Manage Relationships and Finances

CRM Helps Startups Learn About Their Investors

Fundraising is relationship-based. On top of having a fundable business, investors will turn to founders to see how they communicate and lead their organization. By having a system and CRM in place, investors will be able to strengthen their relationships with portfolio companies.

This might not seem important when it comes to fundraising, it pays dividends down the road. At the end of the day, investors are human and will value a relationship and predictable communication.

CRM Encourages Organization

An investor CRM can also be a forcing function to have a fundraising strategy and game plan in place. A CRM will require you to be diligent about the investors are you adding to the top of your funnel and will help you best allocate your time (e.g. taking meetings with the right investors). Additionally, it will require you to have the right assets in place for when an investor inevitably asks for your pitch deck, metrics, references, etc.

Related Resource: All-Encompassing Startup Fundraising Guide

CRM Software Is Designed to Optimize Investor Interactions

Fundraising oftentimes turns into a full-time job for founders. By leveraging CRM and other tools, founders will be able to organize their process and spend more time on what truly matters, building their business. By having a CRM in place, founders will be able to focus their time on efforts on the right investors are the right time.

At Visible, we allow founders to share monthly Updates with different lists of investors. This is not only great for current investors but can also be used to nurture investors that might be at different stages of a fundraise.

For example, if an investor says your business is too early, you might want to send them a light monthly Update to keep them in the loop on the status of your business. This way when you are ready to seek future funding they will already be familiar with your business and will be eager to write a check.

How to Utilize CRM Software for Investor Relations

Raising capital for a business is extremely difficult. CRM software will not be a silver bullet to raising capital. You still need to have a fundable business and game plan in place to pitch and close potential investors. Having a CRM in place is a great way to help you spend more time on what truly matters, building your business.

Related Resource: Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors

Setting up an investor CRM can be highly tailored to your business and can be customized by your stage, geography, market, etc. Check out an example of a Fundraising CRM in Visible here.

Manage Your Investor Relationships With Visible

Fundraising is a relationship-based game. By having the tools, game plan, and assets in place you’ll increase your odds of a speedy and successful fundraise. Find investors, share your pitch deck, send investor updates, and track your interactions in our investor CRM all from one platform. Try Visible for free for 14 days here.

founders

Fundraising

An Essential Guide on Capital Raising Software

Fundraising is difficult. We’ve helped thousands of founders raise capital and engage with their investors. Over time, we’ve learned that a traditional B2B sales & marketing process mirrors a venture capital fundraising process.

At the top of your “fundraising funnel” you are adding qualified investors (leads), nurturing them through the middle of your funnel with meetings, updates, coffee chats, etc., and ideally closing them as new investors at the bottom of your funnel.

Related Resource: All Encompassing Startup Fundraising Guide

Just as sales and marketing processes have dedicated tools, shouldn’t a fundraise? Learn more about fundraising software and how it can help you raise capital below:

What is Capital Raising Software?

First things first, what is capital-raising software? Capital raising software, or simply fundraising software, is a platform or tool that can help founders navigate a fundraise. This means having the tools to find investors, share assets during their raise, and a place to manage and track their ongoing conversations and relationships.

Related Resource: The Understandable Guide to Startup Funding Stages

Generally speaking, when a founder seeks funding it turns into their full-time job. By utilizing a software stack dedicated to their fundraise, founders will be able to speed up their fundraising process and spend more time on what truly matters — building their business. Learn more about capital raising software and what features to look for below:

Features to Look for in a Capital Raising Tool

There are few tools that are truly dedicated to the capital-raising process. In the past, founders might just use a hodgepodge of software and tools dedicated to other use cases. This can create a headache as it gets intermingled with day-to-day tasks (e.g. using your sales & marketing CRM for tracking a fundraise).

To help you find the tool that is right for you, we’ve laid out a couple of considerations and features to keep an eye out for below:

Easy-to-Use Connect With Potential Investor Portal

First things first, when seeking out a capital-raising tool, you will want to make sure that the ability to connect and engage with potential investors is there. At Visible, we find that companies that regularly send investor updates are 300% more likely to raise follow-on funding from their existing investors. One of the core ways to engage with potential and current investors is by sharing monthly Updates.

At Visible, we have a tool entirely dedicated to sending Updates to your investors. From here you can see how they are engaging with Updates and add potential investors to your lists along the way. Check out some of our most popular Update templates in our library here.

Personalized Investor Database

Just like any sales and marketing process starts by finding qualified leads and customers, so should a fundraise. Traditional venture capital funds invest in all sorts of geographies, markets, company sizes, etc. so it is important to make sure you are talking to the right people.

By having an investor database, you’ll be able to filter and find the right investors for your business.

Related Resource: Building Your Ideal Investor Persona

At Visible, we have a free investor database, Visible Connect, that allows you to filter investors by the properties we find most important to find potential investors

Related Resource: Debt vs Equity Financing

Monitors Investor Interactions

Any sales and marketing team will have a place to monitor their interactions with current and potential customers (typically a CRM like HubSpot or Salesforce). Having a place to monitor interactions with current and potential investors is a surefire way to improve your odds of funding success. It will also help in other areas where investors can lend a hand as well (e.g. hiring, strategy, promotion, etc.)

At Visible, we allow founders to use our Fundraising CRM to track interactions (Deck views, Update engagements, etc.) so they can properly follow up with the right investors at the right time. Learn more about our Fundraising CRM here.

Related Resource: Why a CRM is Essential for Investor Relations

Related Resource: Investor CRM: Seamlessly Manage Relationships and Finances

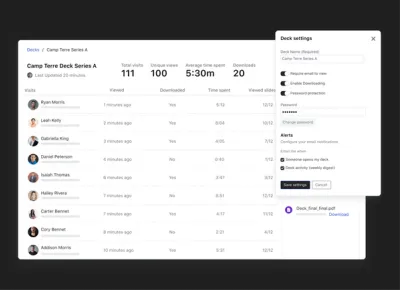

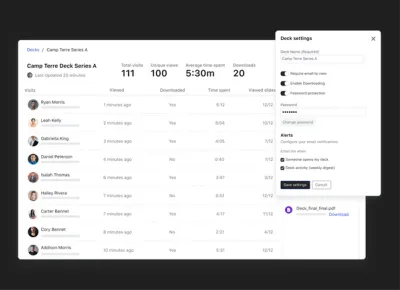

Host and Share Pitch Decks to Investors

While different investors have different preferences when it comes to how, when, and where to share a pitch deck, they will inevitably want to see some form of a pitch deck throughout the process.

Having a tool where you can share your pitch deck via link will help you understand how investors are engaging with your deck. Tie this in with the tools mentioned above and you have a platform that can help with every step of your fundraise.

Related Resource: Tips for Creating an Investor Pitch Deck

At Visible, we offer a tool to help founders share their pitch deck with your own domain and brand settings so you truly own every step of your funding journey. Learn more about sharing Decks with Visible here.

How to Utilize Capital Raising Software to Get Funding for Your Startup

Of course, software won’t be a silver bullet that magically makes your business fundable. You need to have a fundable business and a gameplan in place to go out and raise capital. Capital raising software is simply a tool that will make the job easier on you as a founder.

By finding a tool to help with your fundraise, you’ll be able to spend more time having meaningful conversations with investors, hiring top talent, and building your business.

Related Resource: How to Raise Capital Using RUVs

Find Investors and Build Relationships With Visible’s Capital Raising Software

At Visible, our mission is to help founders succeed. We’ve helped thousands of founders communicate with their current and potential investors. Find investors, share your pitch deck, update your investors, and track your relationships all from one place. Give Visible a free try for 14 days here.

founders

Fundraising

Startup Fundraising Checklist

Startups are in constant competition for 2 resources — capital and talent. One of the most common ways to secure capital for a startup is by raising venture capital. However, raising capital for a startup, especially an early-stage startup, is no easy feat. In order to best improve your odds of raising capital, you need to have a game plan and system in place to kick off your raise.

At Visible, we often compare a fundraise to a traditional B2B sales process. You are adding investors (leads) to the top of your funnel, nurturing them with Updates and meetings in the middle, and ideally closing them as a new investors at the bottom of the funnel.

Related Resource: All Encompassing Startup Fundraising Guide

Just as a sales and marketing team has a process for acquiring customers, so should a founder when setting out to raise capital. Learn more below:

1) Display Growth and Traction

First things first, you need to make sure that your company is in a position to raise venture capital. Investors are generally taking a major risk by funding startups so it is important to demonstrate that you have the ability to generate outsized returns. One of the main things investors will look to is your company’s growth and traction.

In order to do so, it is important to have a system in place to track and monitor your key metrics. A few of our favorite resources to get started:

6 Metrics Every Startup Founder Should Track

Our Ultimate Guide to SaaS Metrics

Key Metrics to Track and Measure In the eCommerce World

Why This Item Is Important

As we previously mentioned, investors are taking on risk so they want to see that your startup has the ability to grow into a large company. The easiest way to do this is by showing consistent and rapid growth from one period to the next.

2) Define Your Startups Milestones and Fundraising Goals

If you’ve determined that your business is in a good place to raise venture capital, it is time to put together milestones and goals for your fundraise. A couple of questions you’ll want to ask yourself and think through before raising:

How much capital do I want to raise?

When do we need new capital by?

What valuation should we raise at?

What will we do with capital once it is in the bank?

Related Resource: The Investor Due Diligence Checklist: How to Treat New VCs Like Business Partners

Why This Item Is Important

Before setting out to launch a new acquisition campaign, you likely have goals and milestones in place. The same can be said for a fundraise. By having a list of milestones and goals in place, you will be able to field any questions from investors as you’ve done the legwork upfront and will come off as prepared and calculated with your raise.

3) Make Sure You Have a Compelling Pitch Deck

At the end of the day, fundraising is storytelling. You will want to hook your investors and help them build conviction for why they should invest. One of the most popular tools for telling your story is a pitch deck. Check out a few of our favorite resources to help you build your next pitch deck below:

Tips for Creating an Investor Pitch Deck

18 Pitch Deck Examples for Any Startup

Our Teaser Pitch Deck Template

How To Build a Pitch Deck, Step by Step

Why This Item Is Important

Investors generally have little to no context about your business and your market. In order to help them build conviction around your business you need to arm them with the right information and assets to move as quickly as possible to invest in your company. A pitch deck is a great tool to distribute to potential investors and use as a guiding tool in your raise.

4) Prove Your Product/Service Is Scalable

As we previously mentioned, investors want to fund companies that have the ability to turn into large businesses and exits. One of the aspects they will focus on most is your ability to build your customer base and revenue at scale. During the course of your raise investors may ask to see a few of the following things:

Metric growth as it relates to your acquisition efforts

How your current acquisition strategy works

Stories from customers that show you have happy customers

Why This Item Is Important

Without a clear path to scale your revenue, investors will likely have no interest in funding your business. You need to demonstrate that you have had success in the past or have a gameplan to scale revenue in the future. If you have an acquisition strategy that is already working well, investors will feel more inclined to invest as you should be able to demonstrate how their capital will directly grow the business using your existing channels.

5) Build a List of Investors

Just how a sales process starts by identifying your ICP and potential customers, the same is a true for a venture fundraise. VC funds invest in all sorts of companies – ranging from early stage to late, new markets to old, small teams and big, etc.

We suggest starting by building a list of 50-100 investors that you believe are a strong fit for your company and staying focused on them during your fundraise. A couple of traits that are important to pay attention to (from our post, Building Your Ideal Investor Persona):

Location – Where are you located? Do you need local investors? Or maybe you are looking for connections and networks in strategic geographies.

Industry Focus – What type of company are you? Where should your future investors/partners be focused? e.g. If you’re a B2B SaaS company don’t waste your time with marketplace focused investors. Mark Suster suggest that it is best to prioritize investors with companies in your space.

Stage Focus – What size check/round are you raising? e.g. If you’re raising a $1M seed round avoid a firm with $2B AUM. If you’re raising a $30M round avoid a firm with $75M AUM.

Current Portfolio – What type of companies should be a signal to you that they’re a good fit? Is there a high likelihood they’ve invested in one of your competitors? If so, best to avoid as they likely won’t double down their bet with a competitor to a portfolio co.

Motivators – What do want to get out of your investors and what do they want to get out of you? Do they need to match your values and culture?

Deal Velocity – Are you in need of capital as soon as possible? Or are you taking your time and looking for strategic investors? Varying investor’s have different philosophies for the velocity they’re making deals. Point Nine Capital and Kima ventures are both regarded as top firms in Europe. However, Point Nine makes ~10 investments a year whereas Kima makes 1-2 investments a week.

Why This Item Is Important

Randomly reaching out to any investor is a poor strategy when it comes to pitching investors. You want to make sure you are spending your time on the most relevant investors for your business. By starting with a list, you’ll be able to customize your outreach and make sure you are spending time on the right investors for your business.

Check out our free investor database, Visible Connect, to filter and find the right investors for your business.

6) Tell a Story About Your Company

As we mentioned earlier, storytelling is a component of a successful fundraise. While metrics, data, traction, etc. will certainly grab the attention of investors, that will likely not be the sole reason they write a check. As a founder it is your duty to build a compelling narrative around your business that will help investors build an emotional understanding of your business. This could be things like your background, founding story, customer stories, etc.

Why This Item Is Important

While the duty of a VC is to generate returns for their limited partners, there is still a human element to investing. Investors, especially at the early stage, are generally investing in the founder. In order to help them build conviction in you and your business, you need to present stories that will help them gain a new understanding of your business.

7) Introduce Your Team and Stakeholders

Of course, founders are not the only people behind a business. You might have co-founders or early teammates that have helped get your business to where it is today. Be sure to prep your current teammates and inform them on the status of the raise. Investors will want to hear about your teammates and earliest hires to understand why your business is positioned to execute on the problem you are solving.

Why This Item Is Important

At the early stages, investors are generally placing a bet on the team and the vision of the company. They will look to your early hires and executives to help them decide if your team is right for building the business. They will likely want to see relevant experience, roles, and traits that make your team stand out from your competitors.

8) Include a Cap Table

One of the benefits of investing in private companies is the ownership and equity that comes with it. Because of this, investors will want to see the ownership breakdown of your company. This is generally best served via a cap table. There are countless tools (we suggest Pulley) that can help you quickly share your most up-to-date cap table.

Why This Item Is Important

Cap tables are another tool that help VCs understand the structure of your business. It will help them understand their potential ownership position and the investors they will be working alongside. While you might not need to share a cap table from the start with investors you should make sure it is up-to-date and ready for later stages of your fundraising process.

9) Signup For a Fundraising Relationship Platform

Just how a sales and marketing team have dedicated tools, so should your fundraise. By finding a tool to track and manage your fundraise you’ll be able to spend more time on what actual matters, building your business.

Find investors, manage your raise, share your pitch deck, and update your investors all from one place. Try Visible for free for 14 days here.

Why This Item Is Important

Having a dedicated place to keep tabs on your fundraise and investor relations will not only help you speed up your fundraise but will allow you to focus on building your business.

Visible Is Here to Help You WIth Your Fundraising

Fundraising is difficult. Our mission at Visible is to help more startups succeed. We’ve built a set of tools that will help you with every step of your fundraising journey.

Find investors, manage your raise, share your pitch deck, and update your investors all from one place. Try Visible for free for 14 days here.

Related resources:

Navigating the Valley of Death: Essential Survival Strategies for Startups

Top 18 Revolutionary EdTech Startups Redefining Education

investors

Operations

Fundraising

[Webinar Recording] The Benefits of a Hybrid SPV + Fund Strategy with Kingsley Advani of Allocations

Kingsley Advani is a British investor who started investing in 2013 and turned $34k in savings into ~$100m in private investments. Since then he’s co-founded an angel group with 1,000+ investors and founded a private markets platform, Allocations. Kingsley is joining Visible.vc to discuss the benefits of creating a hybrid SPV + fund strategy.

Kingsley Advani, Founder and CEO of Allocations joined us to discuss trends in SPV investing and the benefits of raising SPV’s for VC fund managers.

In this webinar recording, you can expect to learn:

SPV Overview (what are they, how did they become popular)

Kingsley’s perspective on the ‘Why Now’ for SPV’s

5 Benefits of Creating a Hybrid SPV + Fund Strategy

Demo of Creating an SPV in Allocations

Using Visible for SPV + Fund Reporting

founders

Fundraising

Startup Syndicate Funding: Here’s How it Works

Equity financing comes in different shapes and sizes for startups. The most common form is a traditional venture capital firm. However, there are other instruments and organizations that will fund startups in exchange for equity.

Related Resource: All Encompassing Startup Fundraising Guide

One of the more common alternatives to venture capital is a syndicate. Learn more about startup syndicates and how your company can raise funding from a syndicate below:

What Is Syndicate in Startup Terms?

An investment syndicate is an investment vehicle that allows a group of individual investors to pool their money and make an investment in a single company led by a lead investor. Syndicate investing is used in multiple asset classes including startups, private equity, real estate, and others.

Syndicates have risen in popularity due to the ease created by tools like AngelList. As the team at AngelList puts it, “A syndicate allows investors to participate in a lead investor’s deals. In exchange, investors pay the lead carry.”

Related Resource: The Understandable Guide to Startup Funding Stages

What is a Syndicate Lead?

A syndicate lead is generally a well-established investor that has a pulse on the market. They are the individual dedicated to deploying the capital and investing in individual startups. This allows the lead, who may not have enough capital to keep up with their deal flow, to pool money from other individuals and ideally generate returns for the group.

How Does Syndicate Funding Work?

Syndicates function differently than a traditional venture capital firm. It is important that you understand how they work as a founder to improve your pitch and odds of closing a syndicate plus to make sure they are a fit for your business.

Check out a quick overview of how syndicates work below:

1) The Lead Investor Chooses a Startup

As we mentioned earlier, a lead investor is generally someone with strong dealflow or a presence in a particular industry. They might be a venture capitalist themselves or closely associated with the market.

To kick things off, a lead will find a startup they would like to invest in via their syndicate.

2) An Investment Vehicle is Created

Next the lead investor pools money from a series of backers to help fund the company via their syndicate. This can be created in tools like AngelList or StartupXplore. Backers, or individual investors, can serach through and find the syndicates that they are most interested in and invest within the syndicates parameters.

The lead investor they will need to help distribute materials and data that show why LPs or backers should join their syndicate and make an investment. This is typically done within one of the tools mentioned above. Once the syndicate is fulfilled they can move on to make the actual investment into a company.

3) Monitor Investments

Naturally, everyone invested in a syndicate will want to understand how their investment is performing. Generally, it is on the startup founder to inform the lead investor who will distribute the necessary information with the investors within the syndicate.

4) Liquidation or Exit

Of course, syndicate investors are partaking in a round because they believe there is an opportunity for upside from the investment. Eventually the investment will be faced with a successful exit or a liquidation event. For an example from StartupXplore,

“If the investment does not go well, the vehicle will disolve. If there are benefits (dividends, buyback or partial or total acquisition of the startup), all the investors will receive the amount they invested and 89% of the capital gains generated. Of the remaining part, the leader will receive 10% and Startupxlore 1%.”

Related Resource: Down Round: Understanding Down Round Funding and How to Avoid It

On the flipside, AngelList lays out a successful exit that looks something like this:

“Here’s an example: Sara, a notable angel investor, decides to lead a syndicate. The syndicate investors agree to invest $200K total in each of her future deals and pay her 15% carry.

When Sara makes her next investment, she offers to invest $250K in the company. She personally invests $50K and offers the remaining $200K to her syndicate.