The Complete Acquisition Due Diligence Checklist: A Step-by-Step Guide for Founders

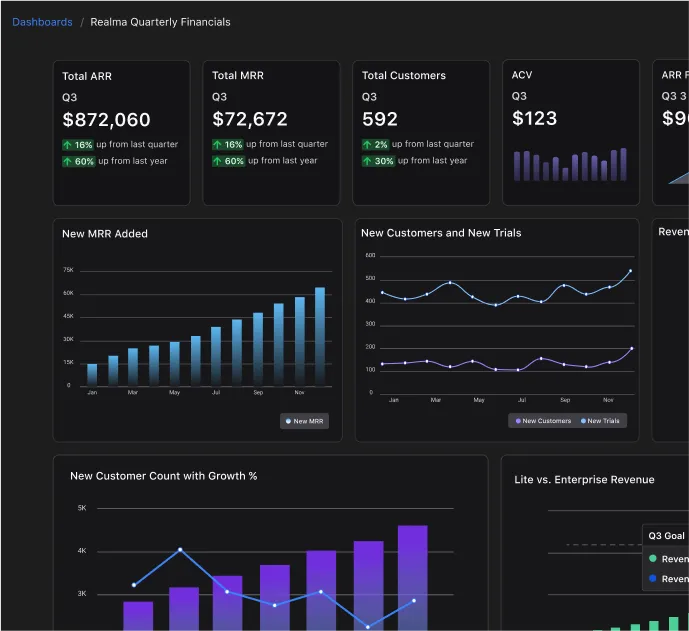

Discover the Power of Visible for Founders

Trusted by Thousands of Founders

What Is an Acquisition Due Diligence Checklist?

Acquisition due diligence is a critical process for founders considering mergers and acquisitions (M&A). A well-structured acquisition due diligence checklist helps evaluate financial, legal, and operational aspects of a target company before finalizing an acquisition. This ensures that risks are identified and mitigated early, preventing costly mistakes.

Many founders use an acquisition due diligence checklist template to streamline their evaluation. These templates come in various formats, such as an acquisition due diligence checklist PDF or acquisition due diligence checklist template Excel, allowing for easier documentation and organization.

Why Every Founder Needs an Acquisition Due Diligence Checklist

Founders pursuing acquisitions need a structured approach to assess risks and opportunities. A due diligence checklist for acquisition of a private company ensures that no critical details are overlooked during the evaluation process. Without due diligence, founders risk acquiring businesses with hidden liabilities, regulatory issues, or financial inconsistencies.

A due diligence checklist template free can help founders get started, offering a standardized framework to conduct assessments efficiently. For those involved in financial-sector acquisitions, a bank acquisition due diligence checklist is critical to ensure compliance with industry regulations.

Key Components of an Acquisition Due Diligence Checklist

A comprehensive M&A due diligence checklist includes the following key areas:

1. Financial Due Diligence

Financial due diligence involves analyzing revenue trends and projections, liabilities and outstanding debts, cash flow analysis, and valuation reports. Understanding these metrics allows founders to make informed decisions about whether an acquisition aligns with their business objectives. Using an M&A due diligence checklist PDF, founders can document financial findings efficiently. Additional considerations include historical financial statements, tax returns, and potential financial risks that may impact profitability. Understanding seasonal fluctuations, customer concentration risks, and revenue sustainability are also crucial factors to evaluate.

2. Legal Due Diligence

Legal due diligence covers corporate structure and governance, contracts and agreements, intellectual property rights, and pending or past legal disputes. Reviewing employment contracts, supplier agreements, and regulatory filings helps founders avoid unforeseen legal complications. A legal due diligence checklist for acquisition ensures all regulatory aspects are covered. Furthermore, conducting thorough research on compliance obligations and identifying any potential litigation risks is crucial before finalizing a deal. Due diligence should also involve a review of business licenses, regulatory filings, and non-compete agreements that may impact post-acquisition operations.

3. Operational Due Diligence

Operational due diligence assesses key team members and leadership, supply chain dependencies, customer contracts and retention rates, and technological infrastructure. Understanding how the target company operates on a day-to-day basis is essential for a seamless transition post-acquisition. An M&A acquisition due diligence checklist template helps organize operational evaluations effectively. Conducting site visits, assessing employee satisfaction, and evaluating company culture can also provide deeper insights into potential challenges post-merger. Additionally, understanding operational redundancies, transition risks, and key vendor relationships will help founders plan for integration.

4. Regulatory Due Diligence

Regulatory due diligence ensures that industry-specific compliance standards, data protection and privacy laws, tax obligations, and environmental impact assessments are met. For bank acquisitions, a bank acquisition due diligence checklist template is critical to meet strict regulatory requirements. Founders should also assess international regulatory considerations if the acquisition involves global operations, ensuring compliance with data privacy laws and anti-corruption policies. Understanding industry-specific licensing requirements, potential compliance violations, and ongoing regulatory changes can prevent costly legal issues down the road.

5. Technology and Intellectual Property Due Diligence

Beyond financial, legal, and operational concerns, founders must assess the technological landscape of the company they are acquiring. This includes evaluating proprietary software, patents, trademarks, cybersecurity risks, and IT infrastructure. Ensuring that all intellectual property rights are properly documented and protected is vital for long-term success. A due diligence checklist for acquisition of a private company template should include an in-depth review of technology licensing agreements and any potential security vulnerabilities. Also, founders should assess software scalability, third-party software dependencies, and pending intellectual property disputes.

6. Human Resources and Cultural Due Diligence

One often overlooked but crucial aspect of due diligence is assessing the target company's human capital and workplace culture. This includes reviewing employee contracts, benefits, retention rates, leadership structure, and overall organizational fit. A due diligence checklist for acquisition of a private company sample should include an evaluation of how well the target company’s culture aligns with the acquiring business. Companies with strong cultural alignment will likely experience smooth post-acquisition integration and long-term success. Additionally, evaluating training programs, diversity initiatives, and employee sentiment surveys can provide further insights into cultural challenges.

7. Customer and Market Due Diligence

Understanding the target company's customer base and market positioning is critical in evaluating the long-term sustainability of an acquisition. Founders should analyze customer demographics, retention rates, revenue per customer, and any potential churn risks. Reviewing the competitive landscape and assessing how the acquisition fits within the broader industry trends can help founders make data-driven decisions. Additionally, assessing customer feedback, brand reputation, and past marketing effectiveness provides further insights into growth potential.

8. Post-Acquisition Integration Strategy

While due diligence focuses on assessing a target company before an acquisition, planning for post-acquisition integration is just as important. A well-structured integration plan ensures a smooth transition, maintaining productivity and preventing major disruptions. Key integration considerations include aligning company cultures, merging operational processes, restructuring teams, and maintaining customer confidence throughout the transition. Developing a roadmap for short-term and long-term integration and clear communication strategies helps minimize resistance and improves overall success.

How to Use an Acquisition Due Diligence Checklist Template

To effectively use a due diligence checklist for acquisition of a private company template, founders should customize the checklist based on the type of acquisition, such as a due diligence checklist for acquisition of a private company sample for smaller deals. Different teams should own specific checklist sections, including finance, legal, and operations. Documenting findings and maintaining records using an M&A due diligence checklist Excel file for easy tracking is essential. Finally, founders should analyze risks and opportunities using their findings to make informed decisions before finalizing the acquisition.

Additionally, conducting a phased approach to due diligence can help manage the complexity of large transactions. Dividing the process into pre-due diligence, core due diligence, and post-due diligence phases ensures thorough examination and smoother execution.

Download Your Free Acquisition Due Diligence Checklist (PDF & Excel)

To streamline the due diligence process, founders can download a due diligence checklist template free in various formats. The acquisition due diligence checklist template PDF is printable for easy reference. The M&A due diligence checklist Excel is editable for tracking key metrics. The bank acquisition due diligence checklist template is designed for financial-sector acquisitions.

Final Thoughts: Mastering Due Diligence for a Successful Acquisition

A thorough M&A acquisition due diligence checklist is essential for founders navigating acquisitions. By leveraging an acquisition due diligence checklist template PDF or M&A due diligence checklist template, founders can mitigate risks, uncover hidden opportunities, and ensure a successful transaction. Using a structured approach makes the acquisition process more efficient and increases the likelihood of long-term success.

Founders should also consider post-acquisition integration strategies when conducting due diligence. Understanding how the acquired company will transition into the existing business structure, setting up a clear integration roadmap, and ensuring transparent communication with stakeholders are all crucial components of a successful acquisition.

By carefully following a due diligence checklist and addressing potential risks early, founders can secure acquisitions that drive growth, enhance market positioning, and deliver long-term value for their business.