What is Annual Run Rate?

Annual run rate is the rough estimate of a company’s annual revenue based on existing monthly or quarterly data.

Annual run rate has been around for a while, and is not to be confused with annual recurring revenue – an important metric for subscription business models. Both are sometimes abbreviated as ‘ARR,’ but you should know that annual recurring revenue only applies when you have monthly or annual subscriptions as a source of income.

While annual recurring revenue is obviously useful for companies who sell yearly subscriptions to large enterprises, it can also be used to project total ARR for companies that sell a product with monthly recurring revenue. You can calculate this by simply multiplying MRR x 12. You should also exclude one-time on-boarding or setup revenue, and factor in your anticipated churn rate when creating annual projections.

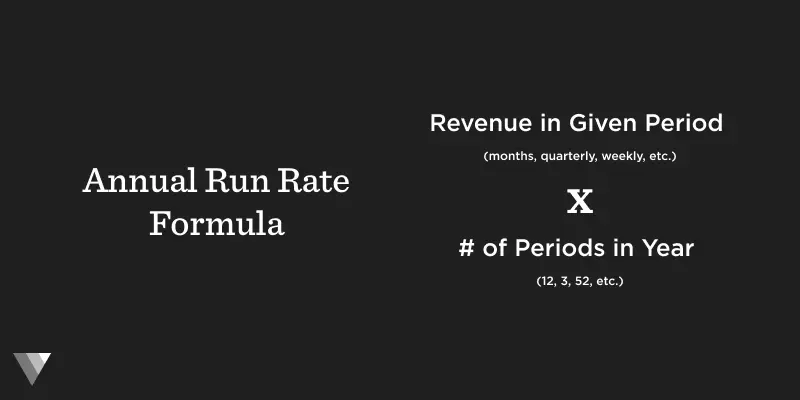

How to Calculate Annual Run Rate

Annual run rate on the other hand can be used to project the future performance of any business. A company could use run rates to help calculate annual burn rate and prepare for future demand. Annual run rates are calculated by using current or past performance to estimate what your business will do in the future. For example, if you’ve done $100k in Q1 revenue and $150k in Q2 revenue, you could predict that you’ll do an additional $250k in revenue for the rest of the year, bringing you to an annual revenue run rate of $500k.

Annual Run Rate Examples

To help you illustrate how to calculate your annual run rate, we’ve put together an example below:

For the example, we have $12,000 in monthly recurring revenue and 12 months in a year. So we take $12,000 x 12 months to equal an annual run rate of $144,000.

When Are Annual Run Rates Useful?

Tracking annual run rates tends to be more useful when you need to predict future demand, and also when calculating annual burn rates. Both of these situations require you to allocate resources properly for the health of your business. They can help you determine how much inventory you need to hold if you’re a DTC brand, or how many new sales reps you’ll need to hire if you’re an enterprise SaaS company. In addition to this, they can help you determine how much funding you’ll need to reach profitability.

Predict future demand

By keeping track of your annual run rate, you’ll be able to better predict future demand. This not only helps with hiring plans, go-to-market strategy, and operational metrics but will also help lay the groundwork for inventory and funding needs.

Determine inventory needs

An annual run rate is an easy way to project your inventory needs oven a given period of time. However, seasonal businesses or those with volatile growth should be cautious when using run rates. For example, Amazon should not use their performance during the holiday season to project annual revenue, just like you probably shouldn’t use your mid-pandemic April 2020 metrics to predict the rest of the year.

Determine funding needs

An annual run rate is also a great tool to help early-stage companies determine their funding needs and timeline. You’ll be able to keep a close eye on your cash efficiency. Or even better, you can demonstrate past and future success to entice potential investors with your ARR.

When Shouldn’t You Use Annual Run Rate?

As we briefly mentioned earlier, there are certainly a few downsides to ARR and reasons that companies should not track it.

Seasonality

Many industries face seasonality and changes in buying patterns throughout different seasons. For example, a D2C company that thrives during the holidays will not want to use their data from peak season as it will demonstrate unrealistic growth and revenue.

One-time sales and expiring contracts

Additionally, companies that have one-time sales or large onboarding fees should avoid using an annual run rate. One time sales will not correctly portray the actual go-to-market and sales figures to give you the data you need to make informed decisions.

How to Use Run Rates Effectively

At Visible, we recommend being conservative with your run rate calculations to maximize the quality of your decision-making. Be careful about annual run rates – they can lead to incorrect forecasting, as not every quarter is the same. Growth can be nonlinear and the past is not the future. Overly optimistic run rates can kill companies, so you should err on the side of overestimating your expenses, and underestimating revenue.

Share your run rate with investors and team members using email Updates and automated Dashboards using Visible. Try Visible free for 14 days.

Other Helpful Metric Resources:

- Our complete guide to SaaS metrics

- Another great primer on SaaS metrics with advice from NetSuite & HubSpot executives

- How to calculate your natural rate of growth

- Monthly Recurring Revenue (MRR) Explained: Definitions + Formulas

- Customer Acquisition Cost (CAC): A Critical Metrics for Founders