The Rise of Venture Capital in Utah: A Look at Utah’s Top 14 VC Firms

Utah has rapidly emerged as a thriving hub for startups and venture capital, offering a fertile ground for entrepreneurial innovation and investment. The state's robust tech ecosystem, often referred to as the "Silicon Slopes," is home to a dynamic community of founders and investors driving significant growth and innovation.

Venture capital in Utah has seen remarkable expansion, with a growing number of VC firms providing critical funding and support to early-stage companies. This vibrant startup scene is supported by a strong network of accelerators, incubators, and resources that make Utah an attractive destination for entrepreneurs seeking to launch and scale their ventures .

Venture Capital in Utah

At Visible, we often compare venture capital fundraise to a traditional B2B sales and marketing funnel.

- At the top of your fundraising funnel, you are bringing in qualified investors via warm and cold outreach.

- In the middle of your fundraising funnel, you are nurturing potential investors with pitch decks, meetings, and email updates.

- At the bottom of your fundraising funnel, you are hopefully closing new investors (and delighting them with regular updates).

Related Resource: How to Find Venture Capital to Fund Your Startup: 5 Methods

Just as a sales and marketing funnel starts with qualified leads, so should a fundraising funnel. For some companies, this might mean looking for local investors — for founders in Utah, check out a list of venture capitalists in the area below:

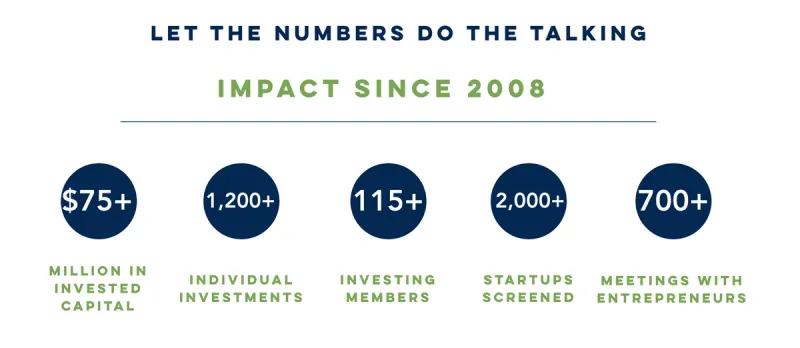

1. Park City Angels

As put by their team, “The Park City Angels are a group of 40+ accredited investors located in Park City, Utah. We look to invest in promising opportunities that can produce significant shareholder return. The active lifestyle of Park City has attracted many dynamic and successful business leaders that have deep experience in building world class businesses. We facilitate unique, high-caliber networking and development forums for angel investors and mentors involved in early-stage investment.”

Focus and industry: The Park City Angels team lays out their focus directly on their website, “We are most interested in companies that have valuations from $4MM to $6MM, have a reasonable likelihood of reaching $30MM in sales within 5 years, and can get to cash flow break-even within the next year or two.”

Funding stage: Park City Angels is focused on companies with valuations between $4M and $6M

The team at Park City Angels generally focuses on companies in Utah but is open to investing in companies across the country. Some of their most popular investments include:

- Lula

- High West Distillery

- Allgood Provisions

Location: Park City, UT

Related Resource: VCs Investing In Food & Bev Startups

2. EPIC Ventures

As put by their team, “EPIC Ventures is a premier early-stage software and Internet infrastructure venture firm whose mission is to back entrepreneurs and companies positioned to lead the information economy of tomorrow. We bring the collective operational and financial experience of our partnership, our world-class advisors, and our extensive network of technology industry contacts to engage and ensure our portfolio’s success.”

Focus and industry: The team at EPIC Ventures does not state an industry focus.

Funding stage: The team at EPIC Ventures is focused on early-stage investments.

EPIC Ventures invests in companies in Utah and the greater northwest in the United States. EPIC Ventures has invested across four funds. Some of their most popular investments include:

- Ancestory

- Manscaped

- Zenefits

Location: Salt Lake City, UT

Related Resource: A Quick Overview on VC Fund Structure

3. RenewableTech Ventures

As put by their team, “RenewableTech Ventures is committed to creating exceptional returns for both the entrepreneurs we invest in and our fund investors. These exceptional returns are achieved by investing in early-stage innovations in energy, clean technology, green materials, and other clean technologies. Our investment activity is focused in Canada and the United States, with a specific focus on regions that are underserved by venture capital.”

Focus and industry: The team at RenewableTech is focused on companies’ innovation in the energy, clean technology, and green technology space.

Funding stage: RenewableTech Ventures is focused on early-stage investments.

As put by their team, “RenewableTech Ventures provides capital, market intelligence, active board representation and an exceptional international network of industry contacts, technology leaders and co-investors.” They are focused on investing in the US/Canada, particularly in regions that are traditionally underserved by venture capital. Check out a few of their most popular investments below:

- Solid Carbon Products

- Consolidated Energy Systems

- Voila Mattress

Location: Salt Lake City – Vancouver

4. Kickstart Fund

Kickstart Fund is a seed-stage venture capital firm based in Salt Lake City, UT. Kickstart’s mission is to fuel the best companies in the Mountain West by providing smart capital, a connected community, and expert guidance. Since raising its first fund in 2008, Kickstart has invested in more than 150 companies.

Focus and industry: As put by their team, “We’re industry agnostic and have invested in SaaS, consumer, marketplace, and healthcare startups.”

Funding stage: Kickstart is focused on seed investing

The team at Kickstart has invested in 150+ companies and has become synonymous with seed investing in the western US. Kickstart traditionally writes checks between $250k and $2M. The team is largely focused on investing in companies located in Utah, Colorado, and the Mountain West. Check out a few of their most popular investments below:

- Stance

- CloudApp

- Cotopaxi

Location: Cottonwood Heights, Utah

5. Cross Creek

Cross Creek seeks to invest in later stage companies through its direct and fund investment strategy.

Funding Stage: Series C, Growth

Location: Salt Lake City, UT

6. Pelion

As put by their team, “Since 1986, Pelion Venture Partners has been helping entrepreneurs turn early-stage concepts into tomorrow’s industry-leading companies. The Pelion team has deep and diverse industry and investment experience. We are hands-on in our approach and work collaboratively on each portfolio company over the life of an investment.”

Focus and industry: Pelion is agnostic in their investment focus

Funding stage: Pelion is focused on early-stage investments

The team at Pelion has been investing since 1986 so it is fair to say that they know their way around the Utah venture capital space. Some of their most popular investments include:

- BigPanda

- Owlet

- Divvy

Location: Salt Lake City, UT

7. Mercato

As put by their team, “Mercato has built its success by providing entrepreneurs with the capital and resources they require to effectively scale their businesses. Over time, we have become expert growth investors with firsthand knowledge of what organizations really need to be successful.”

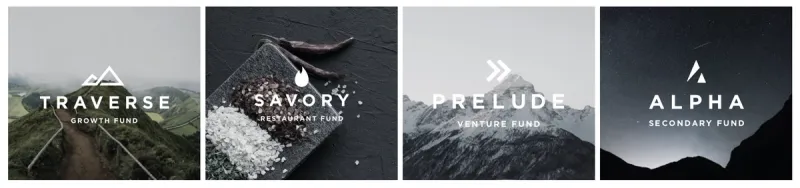

Focus and industry: The team at Mercato invests across 4 funds — each with a different focus and stage as shown below:

Funding stage: Mercato invests across many stages depending on the fund

As mentioned above, Mercato has 4 specific funds. Each fund gives them the opportunity to invest in different stages or markets. For the sake of this post we will take a look at their “Prelude Venture Fund.” As they put it, ‘Prelude companies have demonstrated product-market-fit and have deep customer relations obtained through product leadership and nimble execution.”

A few of Prelude’s most popular investments include:

- Cotopaxi

- Blip

- Bluematador

Location: Cottonwood Heights, UT

8. Zetta Venture Partners

As put by their team, “At Zetta Venture Partners, it’s our mission to help technical founders turn machine learning models into market-leading companies. We were the first VC firm exclusively focused on identifying and supporting AI-driven, B2B businesses.”

Focus and industry: Zetta Venture Partners is focused on AI-first startups

Related Resource: How AI Can Support Startups & Investors + VCs Investing in AI

Funding stage: The team at Zetta Venture Partners leads pre-seed and seed rounds.

Zetta Venture Partners launched their first fund in 2015 and has been hyper-focused on AI startups since. Zetta believes that AI startups are different than traditional software companies and are well-suited to help technical founders in the space. Some of their most popular investments include:

- Clearbit

- Domo

- Tractable

Location: New York – San Francisco – Utah

9. Signal Peak Ventures

As put by their team, “Signal Peak is a private equity and venture capital firm with more than $500 million of committed capital under management. The firm focuses on making equity investments in early-stage technology companies in emerging markets. Signal Peak is typically a SaaS investor targeting companies with differentiated and disruptive business models, exceptional management teams, and large addressable markets.”

Focus and industry: Signal Peak typically targets SaaS companies

Funding stage: Signal Peak is focused on early-stage companies

Signal Peak is focused on investing in technology companies across the United States. Some of their most popular investments include:

- Degreed

- Slate

- Hivewire

Location: Salt Lake City, UT

10. Peterson Ventures

As put by the team at Peterson Ventures, “We get it, building a business is hard. With us you get a dedicated partner you can trust, no matter what. And when you need it, we’re a counselor without a co-pay.

We help you go from Seed to Series A by investing in your seed round, introducing you to our network of CEO’s and advisors, improving your metrics, focusing your strategy when the time is right, introducing you to some of the best investors around for your next round of funding.”

Focus and industry: Peterson Ventures is focused on companies in digital commerce and SaaS

Funding stage: Peterson Ventures is focused on seed and early-stage startups

The team at Peterson invests in the people behind a business. They believe in building long-lasting relationships with their entrepreneurs. A few of their most popular investments include:

- Allbirds

- Bonobos

- Cotopaxi

Location: Salt Lake City, UT

11. Album VC

Album VC, originally known as Peak Ventures, is a well-regarded venture capital firm based in Utah that focuses on investing in early-stage technology companies. Established by seasoned entrepreneurs John Mayfield and Curt Roberts, Album VC rebranded in 2019 to better reflect its mission of amplifying the stories of the companies they back. The firm is known for its founder-friendly approach, providing not only capital but also extensive mentorship and strategic support. Album VC has a strong track record of helping startups achieve significant growth and success, making it a valuable partner for entrepreneurs looking to scale their businesses.

Focus and industry:

The primarily focus is on early-stage investments across a wide range of industries. They have a particular interest in sectors such as software, consumer internet, and enterprise technology. Their portfolio includes companies that are pushing the boundaries of innovation and transforming their respective industries. Founders in these sectors can expect Album VC to bring not only capital but also strategic guidance and valuable industry connections.

Funding stage:

Album VC typically invests in Seed and Series A rounds, offering initial checks ranging from $500,000 to $5 million. They aim to support startups from their earliest stages of development, providing the necessary resources to scale and succeed. Album VC’s investment strategy is tailored to help companies navigate the critical phases of growth, ensuring they have the support needed to achieve their milestones.

Location:

Lehi, Utah

12. Tamarak Capital

Tamarak Capital is a dynamic venture capital firm dedicated to nurturing early-stage startups with high growth potential. With a mission to accelerate the development of innovative companies, Tamarak Capital combines financial investment with strategic mentorship to help founders build successful businesses. The firm prides itself on its collaborative approach, working closely with entrepreneurs to provide the guidance and resources needed to achieve their goals.

Focus and industry:

Tamarak Capital primarily focuses on investing in technology-driven industries. Their areas of interest include software, hardware, consumer products, and healthcare technology.

Funding stage:

Tamarak typically invests in Seed and Series A rounds, with initial investments ranging from $500,000 to $2 million. Their goal is to support startups at the early stages of their development, providing the capital and expertise necessary to help them scale.

Location:

Springville, Utah

13. StartStudio

StartStudio is an innovative venture capital firm based in Utah, dedicated to transforming early-stage startups into successful, scalable businesses. With a unique approach that blends investment with hands-on incubation, StartStudio works closely with founders to develop their ideas and bring them to market. Their team of experienced entrepreneurs and investors provides comprehensive support, including mentorship, strategic guidance, and operational assistance, making StartStudio a valuable partner for ambitious startups looking to accelerate their growth.

Focus and industry:

StartStudio primarily focuses on technology-driven industries, with a strong emphasis on software, mobile applications, and digital platforms.

Funding stage:

StartStudio typically invests in pre-seed and seed-stage companies, with an initial investment of $100,000. Their investment strategy is designed to provide early-stage startups with the critical funding they need to develop their products, validate their business models, and prepare for subsequent funding rounds.

Location:

Provo, Utah

14. Royal Street Ventures

Royal Street Ventures' philosophy is centered on collaboration and long-term partnership. It offers both financial backing and strategic mentorship to early-stage companies. The team comprises seasoned investors and industry experts who work closely with founders to provide the resources and guidance necessary for scaling their businesses and achieving market success.

Focus and industry:

They invest in companies focused on creating scalable, tech-enabled solutions to real-world problems from the Midwest to the Pacific U.S.

Funding stage:

Typically, they invest in early-stage and seed rounds, with initial investments ranging from $250,000 to $2 million.

Location:

Park City, Utah

Find investors in Utah with Visible

As we mentioned at the start of this post, we often compare a venture capital fundraise to a traditional sales and marketing funnel. Just as a sales and marketing team has dedicated tools, shouldn’t a founder manage their investors?

With Visible you can manage every part of your fundraising funnel:

- Find investors with Visible Connect, our free investor database, at the top of your funnel

- Track your conversations with our Fundraising CRM

- Nurture them with our Pitch Deck sharing tool

- Work through due diligence with our Data Room tool

- Delight them with regular investor Updates

Give Visible a free try for 14 days here →