“94% of business leaders surveyed say AI is critical to success.” Deloitte

In the dynamic landscape of the global marketplace, AI stands as a transformative force for startups, catalyzing growth, fostering innovation, and sharpening competitive edges. This technology is not just a tool; it's a game-changer, reshaping the way startups approach their business models, customer interactions, and market strategies.

AI is not just a technological advantage for startups; it's a strategic asset that propels them into new realms of possibilities, fostering a culture of continuous innovation and competitive prowess in the global market.

Related resource: How AI Tools are Reshaping Venture Capital: Tools to Know

The Impact of AI on Organizational Structure and Team Development

In this rapidly growing era of technological innovation, AI is reshaping the landscape of startups, indicating a new paradigm in organizational structure and team dynamics. AI is not merely a tool for operational efficiency but a transformative force that will redefine what it means to start and run a company. From changing how startups will hire to introducing flatter organizational hierarchies and fostering interdisciplinary collaborations, there will be many ways in which AI will influence startups to adapt, evolve, and thrive in the competitive global arena.

Startups are likely to experience significant changes in their work dynamics, organizational structure, and team compositions in the following ways:

- Embracing AI Expertise: The infusion of AI demands a workforce proficient in data science, machine learning, and AI ethics, steering recruitment towards specialized talent. This trend not only reshapes job roles but also fosters a culture of continuous learning and adaptation.

- Redefining Leadership and Management: AI-driven automation and decision-making tools are leading to leaner management layers. Decision-making becomes more data-driven and decentralized, empowering teams to operate with greater autonomy.

- Cultivating Interdisciplinary Collaboration: The complexity of AI applications necessitates collaboration across disciplines, blending AI expertise with industry-specific knowledge. This leads to diverse, cross-functional teams where innovation thrives at the intersection of technology and domain expertise.

- Adapting to Flexible Work Models: AI's facilitation of remote working tools and processes enables startups to adopt more flexible, global workforces, breaking geographical barriers and tapping into a wider talent pool.

- Prioritizing Ethical AI Integration: As AI becomes integral to business operations, the need for roles focusing on ethical AI usage and governance becomes crucial, ensuring responsible and fair use of technology.

Related resource: Top 15 Machine Learning Startups to Watch

How Can AI Best Support Startup Operations?

For startups, the key is to identify which areas are most crucial for their growth and how AI can be integrated to support those areas effectively. Proper implementation and ethical considerations are also essential to ensure that AI is used responsibly and efficiently.

Here are some key areas where AI can significantly support startups:

- Market Research and Analysis: AI can analyze vast amounts of data to identify market trends, customer preferences, and competitive landscapes. This helps startups in making data-driven decisions and understanding their market better.

- Customer Service and Support: AI-powered chatbots and virtual assistants can provide 24/7 customer service, answering queries, and solving basic problems. This improves customer experience and frees up human resources for more complex tasks.

- Product Development and Innovation: Startups can use AI for rapid prototyping, predictive analytics, and to gain insights into how users interact with their products or services. This can accelerate the development cycle and lead to more innovative solutions.

- Marketing and Personalization: AI can tailor marketing campaigns to individual consumer behaviors and preferences, leading to more effective and targeted marketing strategies.

- Operational Efficiency: AI can automate routine tasks, manage inventory, optimize logistics, and streamline operations, leading to cost savings and increased efficiency.

- Data Security and Fraud Detection: AI algorithms can monitor for unusual patterns indicating fraud or security breaches, providing an added layer of security to the company's data.

- Talent Acquisition and HR: AI can streamline the recruitment process by screening candidates, analyzing resumes, and even conducting preliminary interviews, helping startups find the right talent more efficiently.

- Customization and User Experience: By analyzing user data, AI can help customize user experiences, making products or services more appealing and user-friendly.

- Networking and Collaboration: AI can suggest potential partnerships, identify networking opportunities, and even assist in collaborative projects by managing and analyzing large datasets.

Below we’ll dive deeper into some of these areas and the existing solutions that can help assist your startup in streamlining these operations and delivering better outcomes.

Related resource: Emerging Giants: An Overview of 20 Promising AI Startups

Market Research Using AI Tools

Startups using these solutions can gain deeper market insights, identify customer preferences and behaviors, understand competitive landscapes, and make informed, data-driven decisions for their business strategies.

- Poll the People: Utilizes OpenAI and Chat-GPT to combine human intelligence with AI, enabling data-driven decision-making through surveys and responses from over 500,000 panelists.

- SimilarWeb: Offers comprehensive insights into digital consumer behavior with advanced algorithms and machine learning. It helps in understanding website traffic, user demographics, engagement metrics, and competitive analysis for identifying industry trends and market opportunities.

- Latana: Specializes in brand performance tracking using AI and machine learning. It provides insights into brand awareness, perception, customer sentiment, and competitive positioning, using data from various sources including online surveys and social media.

- Tableau: An AI-powered data visualization and analytics tool, ideal for exploring, analyzing, and visualizing complex market research data. Its AI-driven features help uncover patterns, trends, and correlations in market data, with intuitive dashboards for effective communication of research findings

AI Customer Service and Support Tools

The tools can help with improved efficiency in handling customer queries, enhanced quality of customer interactions, faster resolution of issues, and overall better customer satisfaction. By leveraging these AI tools, startups can also reduce the workload on their human staff, allowing them to focus on more complex tasks.

- Uniphore: Provides a Conversational AI technology platform for delivering transformational customer service across various touchpoints. Startups can use this to improve customer interactions and automate responses.

- Gong.io: Utilizes natural language processing and machine learning to train and assist sales and customer service representatives, helping them in providing more effective customer service.

- Moveworks: Specializes in using AI to automatically resolve help desk tickets, which can significantly reduce response times and improve resolution rates.

- Observe.AI: Offers a Voice AI platform for call centers, enhancing customer calls with real-time feedback on customer sentiment and guidance for the best actions during calls.

- Amelia: Develops a Trusted AI platform that captures and transforms AI innovations, useful in creating more responsive and intelligent customer service experiences.

- Aisera: Provides an AI-driven service solution that automates operations and support for various domains like IT, HR, sales, and customer service, thus increasing efficiency and reducing manual effort.

- Dixa: Offers conversational customer engagement software, enabling real-time communication between brands and customers, enhancing the overall customer interaction experience.

- Glia: Creates digital-first platforms for companies to connect with customers using messaging, video, co-browsing, and AI, aiming to improve the digital customer service experience.

- Cresta: Develops an AI platform designed to improve the quality of customer services, by providing real-time assistance and information to customer service agents.

- Moogsoft: Delivers AI for IT Incident Management, automating operational tasks and helping teams become more effective in addressing customer issues.

Marketing and Personalization AI Tools

Using these tools, startups can aim for improved marketing efficiency, enhanced audience engagement, and better brand positioning.

- Jasper.ai: This AI tool, utilizing GPT-3, aids in creating high-quality ad copy, emails, landing pages, and social media posts. It provides customizable templates for various content frameworks, ensuring brand-appropriate and engaging copy. Desired outcomes include improved content quality, efficiency in content creation, and better engagement with target audiences.

- Beacons AI: Offers an AI Outreach Tool for generating personalized and compelling pitch emails to brands. This simplifies the task of brand outreach, making it an efficient process for startups aiming to establish partnerships or collaborations.

- Rapidely: Uses GPT-4 technology for social media content creation. It includes features like a Monthly Calendar Generator and Carousel Maker, enhancing social media management and engagement. Startups can expect to achieve streamlined content creation and improved social media presence.

- Flick: An AI Social Media Assistant that aids in brainstorming, writing, and scheduling social media content. It helps in generating on-brand captions and ideas, managing hashtags, and scheduling posts, leading to more effective social media marketing.

- DeepBrain AI: Specializes in AI video creation, allowing the conversion of text to video with photo-realistic AI avatars. This tool can significantly reduce video production time and costs, ideal for creating engaging video content for marketing purposes.

- Brandwatch Consumer Intelligence: Provides AI-powered consumer intelligence and social media management solutions. It generates actionable insights for understanding consumer behaviors and trends, assisting startups in making data-driven marketing decisions.

- Brand24: An AI social media monitoring tool that tracks real-time feedback about a company. It helps in managing brand reputation and analyzing marketing campaign effectiveness, crucial for maintaining a positive brand image.

- GrowthBar: Utilizes GPT-3 AI for content generation, especially useful for SEO, blogging, and meta descriptions. This tool assists in creating optimized content, enhancing a startup's online visibility and search engine ranking.

The Future AI Plays in How VCs Invest

“We found that the best performance, nearly 3.5 times the industry average, would result from integrating the recommendations of the humans on our investment team and the machine-learning model. This shows what I strongly believe—that decision-making augmented by machine learning represents a major advancement for venture-capital investing.” – Veronica Wu

VCs are already using AI in a variety of ways but say it’s still necessary to use human judgment when it comes to decision-making. In an interview with McKinsey Veronica Wu says, “we combined machine learning, which produces insights we would otherwise miss, with our human intuition and judgment. We have to learn to trust the data model more, but not rely on it completely. It’s really about a combination of people and tools.”.

In the fast-evolving landscape of venture capital, the integration of AI and platforms like Visible is creating a synergy that significantly enhances investment strategies and operational efficiencies. This combination presents a powerful toolset for VCs, enabling smarter, data-driven decisions and streamlined processes. Here's how VCs can leverage AI, both generally and specifically in conjunction with Visible:

- Enhanced Due Diligence and Data Analysis: AI's ability to sift through and analyze extensive data sets enables VCs to conduct more thorough due diligence. This deep data analysis covers market trends, startup performance metrics, and competitor analysis, providing a comprehensive investment picture.

- Predictive Analytics for Identifying Opportunities: AI's predictive capabilities are pivotal in forecasting market trends and identifying burgeoning sectors. This foresight allows VCs to stay ahead, investing in startups with high growth potential before they become obvious choices.

- Optimized Portfolio Management: AI algorithms continually assess market conditions and offer insights for portfolio rebalancing. This dynamic management approach ensures that VC portfolios are aligned with changing market realities, optimizing returns.

- Streamlining Deal Flow Management: AI streamlines the deal flow process, efficiently sorting through potential investments. This not only saves time but also ensures that VCs focus on the most promising opportunities.

- Accurate Risk Assessment: AI provides sophisticated risk assessment models, evaluating potential investments against various market and economic indicators. This results in a more nuanced understanding of investment risks and potential returns.

Additional Resources

- CBInsights: Generative AI Bible

- 13 Generative AI Startups to Look out for

- AI Meets Your Investor Updates

- Using AI Prompts to Write Your Next Investor Update

Top VCs Investing in AI Startups

Alpha Intelligence Capital

Locations: San Francisco, Paris, Hong Kong, Singapore, Dubai

About: Alpha Intelligence Capital (AIC) is an entrepreneurs-led, entrepreneurs-invested, family of global venture capital funds. AIC invests in deep Artificial Intelligence/Machine Learning (AI/ML) technology-based companies. To us, AI is the science of self-learning software algorithms that execute tasks otherwise typically performed by humans, or that substantially augment human intelligence.

Thesis: AIC invests in deep Artificial Intelligence/Machine Learning (AI/ML) technology-based companies

Investment Stages: Series A, Series B, Series C

Recent Investments:

- Aidoc

- Proscia

- ZeroEyes

Air Street Capital

About: Air Street Capital is a venture capital firm investing in AI-first technology and life science companies. We invest as early as possible and enjoy iterating through product, market and technology strategy from day 1.

Thesis: AI-first technology and life science companies.

Investment Stages: Pre-Seed, Seed

Recent Investments:

- Athenian

- Valence Discovery

- V7 Labs

Two Sigma Ventures

Location: New York, United States

About: Two Sigma Ventures invests in companies run by highly driven people with potentially world-changing ideas.

Thesis: 1. Startups across all industries need to be data driven and getting really good at deriving value from data will continue to be critical 2. VCs can be way more supportive of founders. Our model is to utilize the 1700 mostly technical employees of Two Sigma Investments to assist companies with data science, engineering, recruiting, BD, etc.

Investment Stages: Seed, Series A, Series B, Series C, Growth

Recent Investments:

- Cajal Neuroscience

- Xilis

- Remote

DCVC (Data Collective VC)

Location: Palo Alto, California, United States

About: Data Collective is a venture fund with a unique team of experienced venture capitalists, technology entrepreneurs and practicing engineers, investing together in seed and early stage Big Data and IT infrastructure companies.

Investment Stages: Seed, Series A, Series B

Recent Investments:

- Smartex

- Samsara Eco

- ZwitterCo

1984 Ventures

Location: San Francisco , California, United States

About: 1984 Ventures is an early-stage venture capital firm proptech, fintech, healthcare, marketplace, SaaS, e-commerce, and consumer.

Thesis: Looking for companies from pre-revenue to 100k+ in MRR

Investment Stages: Pre-Seed, Seed

Recent Investments:

- Relevize

- Collaborative Robotics

- SyIndr

Wing VC

Location: Palo Alto, California, United States

About: Wing is a purpose-built venture capital firm founded by two industry veterans with a different perspective on what it takes to create enduring companies.

Thesis: Invest before it’s obvious, Partner for the long term, Focus on business

Investment Stages: Pre-Seed, Seed, Series A

Recent Investments:

- Deepgram

- Supernova

- HeadsUp

Zetta Venture Partners

Location: San Francisco , California, United States

About: Zetta Venture Partners is the first focused fund committed to delivering exceptional returns from the high-growth analytics market.

Thesis: AI & Infrastructure (B2B only)

Investment Stages: Pre-Seed, Seed

Recent Investments:

- EnsoData

- VideaHealth

- Pimloc

M12

Location: Redmond, Washington, United States

About: Is the new name for Microsoft Ventures; it invests in AI & machine learning, big data & analytics, business SAAS, cloud infrastructure, emerging technologies, productivity & communications, security. M12 ran a $2m competition for female founders (applications closed in September 2018)

Investment Stages: Series A, Series B, Growth

Recent Investments:

- Valence Security

- RapidSOS

- Insite AI

True Ventures

Location: Seed, Series A, Series B

About: True Ventures is a Silicon Valley-based venture capital firm that invests in early-stage technology startups.

Investment Stages: Seed, Series A, Series B

Recent Investments:

- Almond

- Avidbots

- Chameleon.io

AME Cloud Ventures

Location: California, United States

About: AME Cloud Ventures invests in seed to later-stage tech companies that build infrastructure and value chains around data.

Investment Stages: Seed, Series A, Series B

Recent Investments:

- Meez

- Haven

- Kojo

Greycroft

Location: New York, United States

About: Greycroft is a venture capital firm that focuses on technology start-ups and investments in the Internet and mobile markets.

Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

Recent Investments:

- Ostro

- Frame AI

- FrankieOne

Hyperplane Venture Capital

Location: Boston, Massachusetts, United States

About: Hyperplane Venture Capital is an investment firm focused on exceptional founders building machine intelligence and data companies. The company was founded by Brendan Kohler and Vivjan Myrto in 2015; and is headquartered in Boston, Massachusetts.

Investment Stages: Seed, Series A, Series B

Recent Investments:

- Relevize

- Givebutter

- Nurse-1-1

Morado Ventures

Location: Palo Alto, California, United States

About: Morado Ventures is focused on high-growth, seed-stage technology companies, with particular emphasis on “Data-fueled” businesses.

Thesis: At Morado we invest in Passionate Entrepreneurs with unique expertise working on hard technological problems with software and hardware.

Investment Stages: Pre-Seed, Seed, Series A

Recent Investments:

- Metrist

- Everest Labs

- Headroom

Gradient Ventures

Location: Mountain View, California, United States

About: We help founders build transformational companies. Specialties include;

Artificial Intelligence, Deep Learning, Neural Nets, Machine Learning, Data Science, Virtual Reality, Augmented Reality, Venture Capital, Startups, and Community

Investment Stages: Pre-Seed, Seed, Series A

Recent Investments:

- Payload

- Butter

- The Coterie

Wing

Location: Menlo Park, California, United States

About: Wing is a purpose-built venture capital firm founded by two industry veterans with a different perspective on what it takes to create enduring companies.

Thesis: Invest before it’s obvious, Partner for the long term, Focus on business

Investment Stages: Seed, Series A, Series B

Recent Investments:

- Deepgram

- HeadsUp

- Supernova

BootstrapLabs

Location: San Francisco, California, United States

About: BootstrapLabs, a leading Silicon Valley based venture capital firm focused on Applied Artificial Intelligence, and the first VC firm to focus solely on AI since 2015 – with over 30 investments in AI-first companies and today investing from the 3rd AI-focused seed fund ($115M).

Investment Stages: Seed

Recent Investments:

- Southie Autonomy

- Rabot

- Pryon

East Ventures

Location: Tokyo, Japan

About: Founded in 2009, East Ventures is an early-stage sector-agnostic venture capital firm. The firm has supported more than 170 companies in the Southeast Asian region that are present across Indonesia, Singapore, Japan, Malaysia, Thailand, and Vietnam.

Investment Stages: Early Stage, Growth

Recent Investments:

- Klar Smile

- The Parentinc

- Wagely

Hyperplane

Location: Boston, Massachusetts, United States

About: Hyperplane Venture Capital is an investment firm focused on exceptional founders building machine intelligence and data companies. The company was founded by Brendan Kohler and Vivjan Myrto in 2015; and is headquartered in Boston, Massachusetts.

Investment Stages: Pre-Seed, Seed

Recent Investments:

- Relevize

- Nurse-1-1

- Butlr Technologies

Streamlined Ventures

Location: Palo Alto, California, United States

About: We are a seed-stage investment firm rooted in the belief that the founders of companies are the true heroes of entrepreneurial value creation in our society. We are passionate about working with visionary founders to help them create exceptional companies and help them capture as much of that value for themselves as possible – they deserve it! If we stay true to our beliefs and we are good at what we do, then we will benefit too. Our style of engagement with all our stakeholders focuses on low ego behavior, mutual respect and clarity of thought. We seed invest in visionary founders who are building the next generation of transformational technology companies.

Investment Stages: Seed, Series A

Recent Investments:

- Hoken

- Fursure

- Ratio

Looking for Funding? We can help

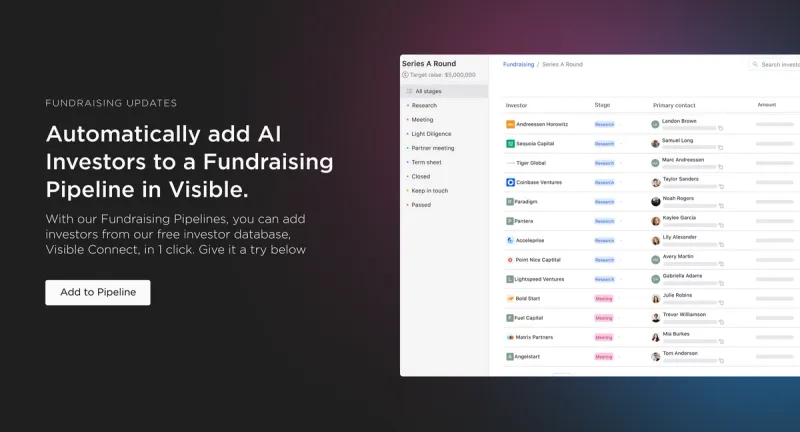

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VCs and accelerators who are looking to invest in companies like yours. Check out all our investors here and filter as needed. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

Related Resource: All-Encompassing Startup Fundraising Guide

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

* The author generated this text in part with GPT-3, OpenAI’s large-scale language-generation model. Upon generating draft language, the author reviewed, edited, and revised the language to their own liking and takes ultimate responsibility for the content of this publication