At Visible, we oftentimes compare a venture fundraise to a traditional B2B sales and marketing funnel.

- At the top of the funnel, you are finding potential investors via cold outreach and warm introductions.

- In the middle of the funnel, you are nurturing potential investors with meetings, pitch decks, updates, and other communications.

- At the bottom of the funnel, you are working through due diligence and hopefully closing new investors.

Related Resource: All Encompassing Startup Fundraising Guide

A strong sales and marketing funnel starts by identifying the right leads for your business. The same idea is true for founders looking to find investors for their business — find the right investors for your business.

If you are a founder in Germany, check out our list of venture capital investors in your area below:

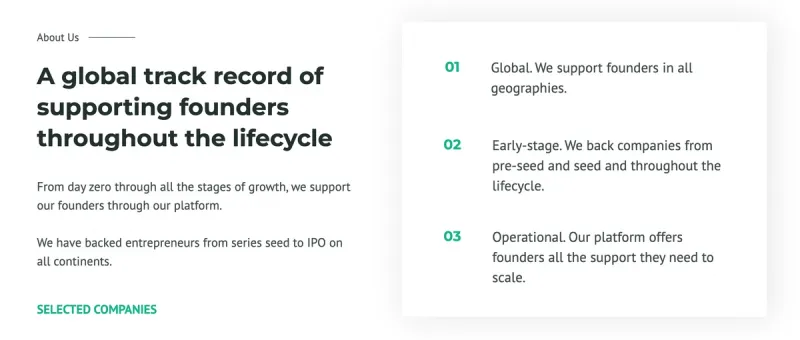

1. Global Founders Capital

As put by their team, “Global Founders Capital is a globally oriented, stage agnostic venture capital firm that empowers gifted entrepreneurs worldwide.

- Global. We support founders in all geographies.

- Stage agnostic. We back companies across all stages and throughout the lifecycle.

- Operational. Our platform offers founders all the support they need to scale.”

Learn more about Global Founders Capital by checking out their Visible Connect profile →

Location

Global Founders Capital is headquartered in Berlin but they invest in companies across the globe.

Related Resource: 8 Most Active Venture Capital Firms in Europe

Preferred industries

GFC is agnostic in its investment approach and will back companies across many industries.

Portfolio Highlights

Some of Global Founders Capital’s most popular investments include:

- Canva

- Slack

- Delivery Hero

Company Stage

GFC is stage agnostic and will invest in companies across all stages.

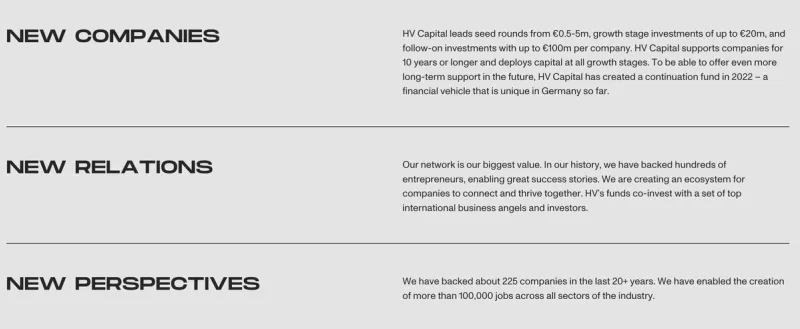

2. HV Capital

As put by the team at HV Capital, “Founded in 2000, HV Capital has a deep track record of spotting European winners at seed stage: HV Capital backed the first generation of German billion-dollar businesses. With over € 2.1bn under management, HV Capital has invested in about 225 disruptors from every industry, partnering with them for the long-term and sustained growth that has led to some of the most successful businesses in the German market.

From early stage to growth, HV Capital has the experience to know what makes a leader – which is why HV Capital is the leading all-stage investor in the German market, and one of the leading investors in Europe.”

Learn more about HV Capital by checking out their Visible Connect profile →

Location

HV Capital has offices in Berlin and Munich. HV Capital funds companies across Europe.

Related Resource: Berlin Venture Capital Investors and Accelerators to Know

Preferred industries

HV Capital is agnostic in its investment approach and backs companies across many sectors.

Portfolio Highlights

Some of HV Capital’s most popular investments include:

- Delivery Hero

- HelloFresh

- Tourlane

Company Stage

As put by their team, “HV Capital leads seed rounds from €0.5-5m, growth stage investments of up to €20m, and follow-on investments with up to €100m per company. HV Capital supports companies for 10 years or longer and deploys capital at all growth stages.”

3. High-Tech Grunderfonds

As put by their team, “HTGF is a venture capital investor for innovative technologies and business models. We successfully support the best founders whose ideas can revolutionise entire industries and improve people’s lives – from seed to exit.

As a seed investor, we have financed 700 start-ups in the industrial tech, digital tech, life sciences and chemicals sectors. We have overseen more than 160 exits, including IPOs. When founding your company together with us, you benefit from an experienced partner at your side.”

Learn more about High-Tech Grunderfonds by checking out their Visible Connect profile →

Location

HTGF has offices in Bonn and Berlin and invests in companies that are headquartered in Germany.

Preferred industries

HTGF traditionally invests in companies in the following industries:

- Digital tech

- Industrial tech

- Life sciences

- Chemicals

Portfolio Highlights

Some of High-Tech Grunderfonds’ most popular investments include:

- 4GENE

- Anybill

- Covalo

Company Stage

HTGF is focused on seed-stage investments

Related Resource: Seed Funding for Startups 101: A Complete Guide

4. Earlybird Venture Capital

As put by their team, “Founded in 1997, Earlybird invests in all development and growth phases of technology companies. Among the most experienced venture investors in Europe, Earlybird offers its portfolio companies not only financial resources but also strategic support plus access to an international network and capital markets.

The Digital West Fund focuses primarily on early stage digital technology opportunities in GSA, Nordics, UK, Benelux, France and Southern Europe, while the Digital East Fund is focused on early stage ICT investment opportunities in Eastern Europe and Turkey, being the leading tech VC in this region. The Health Fund focuses on early and later stage opportunities in digital health, medical devices, diagnostics, enabling technologies and biopharma across Europe. Earlybird-X backs deep tech innovation, including robotics, AI, and mobility, at the earliest stages – tapping into a network of leading European universities.”

Learn more about Earlybird by checking out their Visible Connect profile →

Location

Earlybird has offices in Berlin and Munich and invests in companies across all of Europe.

Preferred industries

Earlybird invests in companies across many sectors and industries depending on the fund.

Related Resource: 10 VC Firms Investing in Web3 Companies

Portfolio Highlights

Some of Earlybird’s most popular investments include:

- Hive

- ShapeShift

- Aiven

Company Stage

Earlybird invests across many stages but is focused on early-stage companies.

5. Point Nine Capital

As put by the team at Point Nine Capital,

“What we do:

- We invest mostly at seed (AKA the v0.9 stage). Occasionally we make pre-seed, “Seed II”, or “early Series A” investments.

- Our initial ticket size is €0.5-5 million. If you raise a seed round from us,

we commit to participating in your Series A. - We’re geo-agnostic. Europe is our home market, but 20-30% of our investments are in the US, Canada, and other countries.

We obsess about helping you win, and it shows in the numbers: More than 65% of the companies that we back at the seed stage raise a Series A, and more than ten are already at $100M+ ARR (and counting).”

Learn more about Point Nine Capital by checking our their Visible Connect profile →

Location

As put by their team, “We’re geo-agnostic. Europe is our home market, but 20-30% of our investments are in the US, Canada, and other countries.”

Preferred industries

Point Nine Capital is focused on B2B SaaS and Marketplace companies.

Portfolio Highlights

Some of Point Nine Capital’s most popular investments include:

- Algolia

- Delivery Hero

- Loom

Company Stage

As put by their team, “We invest mostly at seed. Occasionally we make pre-seed, “Seed II”, or “early Series A” investments. Our initial ticket size is €0.5-5 million. If you raise a seed round from us, we commit to participating in your Series A.”

6. Cherry Ventures

As put by their team, “Cherry Ventures is an early-stage venture capital firm led by a team of entrepreneurs with experience building fast-scaling companies such as Zalando and Spotify. The firm backs Europe’s boldest founders, usually as their first institutional investor, and supports them in everything from their go-to-market strategy and the scaling of their businesses.”

Learn more about Cherry Ventures by checking out their Visible Connect profile →

Location

Cherry Ventures has an office in Berlin and typically invests in companies across Europe.

Preferred industries

Cherry Ventures invests across all sectors and industries.

Portfolio Highlights

Some of Cherry Ventures’ most popular investments include:

- FlixBus

- Infarm

- Forto

Company Stage

As put by their team, “We invest throughout Europe and in pre-seed and seed-stage startups.”

7. b2venture

As put by their team, “b2venture is an early-stage venture capital firm supported by an unparalleled community of angel investors, bringing unique expertise, entrepreneurial experience, and hands-on support to our portfolio companies.

We draw on the collective power of our angel investor community to help us find and foster unique entrepreneurs, maverick ideas, and outlier companies from all over Europe.

We invest in the pre-seed, seed and across later stages as well.”

Location

b2ventures has offices across Europe and invests in companies across Europe.

Preferred industries

b2ventures is industry agnostic and invests across many sectors and industries.

Related Resource: 17 Travel & Tourism VC Investors that can Fund Your Startup

Portfolio Highlights

Some of b2ventures most popular investments include:

- Raisin

- Sumup

- Ledgy

Company Stage

As put by their team, “b2venture is an early-stage venture capital firm. We invest in companies in the Pre-Seed, Seed, and Series A financing rounds with tickets from EUR 250’000 to EUR 5’000’000. Our average ticket size amounts to EUR 1’000’000. We are prepared to invest significantly in follow-on financing rounds in later stages of your company.”

8. Project A Ventures

As put by their team, “Project A invests in digital companies that challenge the status quo of their industries. With over $1 billion of assets under management, we start with investments of $1 million to $10 million and reserve up to $30 million for future rounds, from pre-seed to Series A and beyond.

In addition to capital, we provide our portfolio companies with exclusive operational support by our team of 120 in-house experts including all areas across product, growth, data and people. Since 2012 Project A has invested in more than 100 companies.”

Learn more about Project A Ventures by checking out their Visible Connect profile →

Location

Project A Ventures has offices in Berlin and London and invests in companies across Europe.

Preferred industries

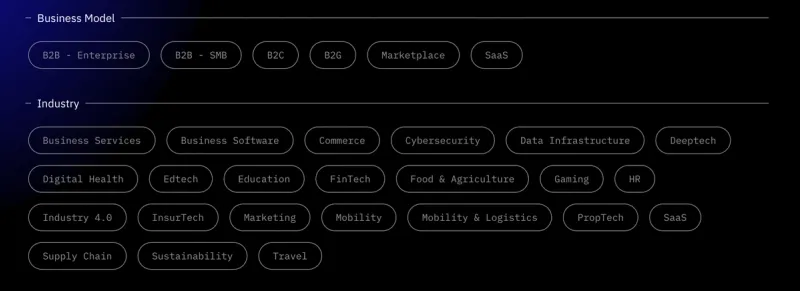

Project A fund’s digital companies — these can span many industries and business models as shown below:

Portfolio Highlights

Some of Project A’s most popular investments include:

- Trade Republic

- Kry

- Sennder

Company Stage

As put by their team, “We start with investments of $1 million to $10 million and reserve up to $30 million for future rounds, from pre-seed to Series A and beyond.”

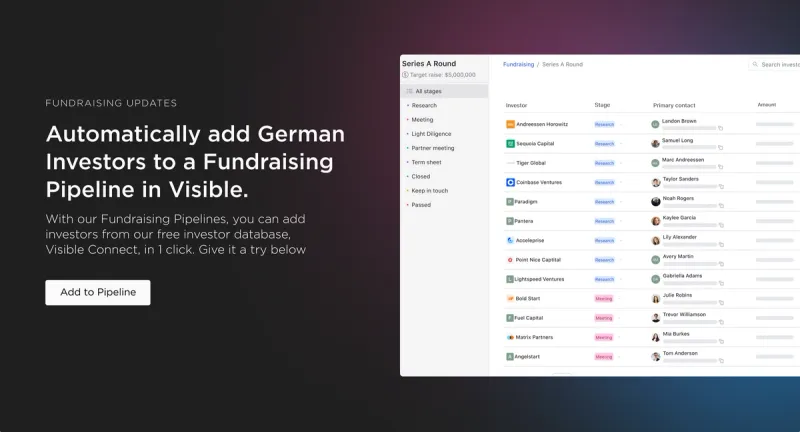

Take your fundraising efforts to the next level with Visible

As we mentioned at the beginning of this post, a venture fundraise often mirrors a traditional B2B sales and marketing funnel.

Just as a sales and marketing team has dedicated tools, shouldn’t a founder that is managing their investors and fundraising efforts? Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.