10+ Venture Capital Firms in Canada Funding Startups in 2024

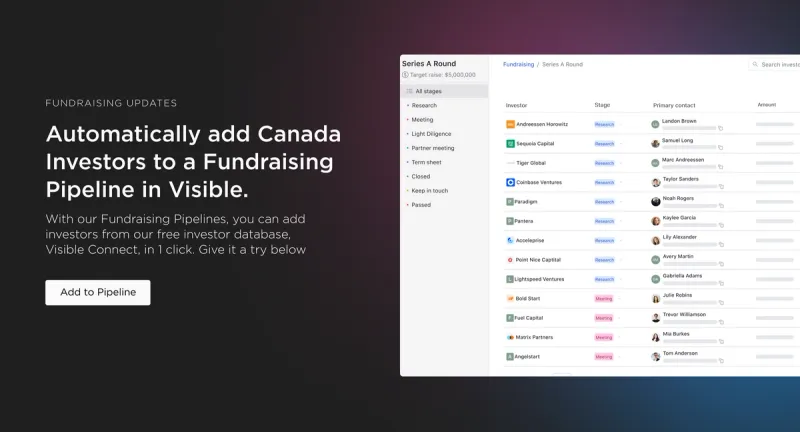

At Visible, we typically compare a venture fundraise to a traditional B2B sales and marketing funnel.

- At the top of the funnel, you find potential investors via cold outreach and warm introductions.

- In the middle of the funnel, you nurture potential investors with meetings, pitch decks, updates, and other communications.

- At the bottom of the funnel, you are working through due diligence and hopefully closing new investors.

Like sales, a healthy fundraising funnel starts by finding the right investors. This can be based on geography, check size, focus areas, etc. For founders looking for investors in Canada, check out our list below:

1. BDC Ventures

As put by the team at BDC Ventures, “Our venture capital funds present diverse opportunities for entrepreneurs to innovate in new and existing markets. The breadth of our funds across industries, technologies and company stage is unique in Canada’s venture capital space. Each fund is managed by a dedicated team with decades of experience bringing groundbreaking Canadian companies to the world stage.”

Location

BDC Ventures is focused on growing the venture capital ecosystem in Canada.

Company Stage

BDC Ventures invests in companies from early to late stages.

Preferred industries

The team at BDC Ventures is currently operating 6 funds that invest across multiple industries including:

- Sustainability Venture Fund

- Climate Tech Fund II

- Thrive Venture Fund and Lab for Women

- Deep Tech Venture Fund

- Industrial Innovation Venture Fund

- Growth Venture Co-Investment Fund

Related Resource: 10+ VCs & Accelerators Investing in Underrepresented Founders

Portfolio Highlights

Some of BDC Ventures’ most popular investments include:

- Hopper

- Unsplash

- Shoelace

2. Golden Ventures

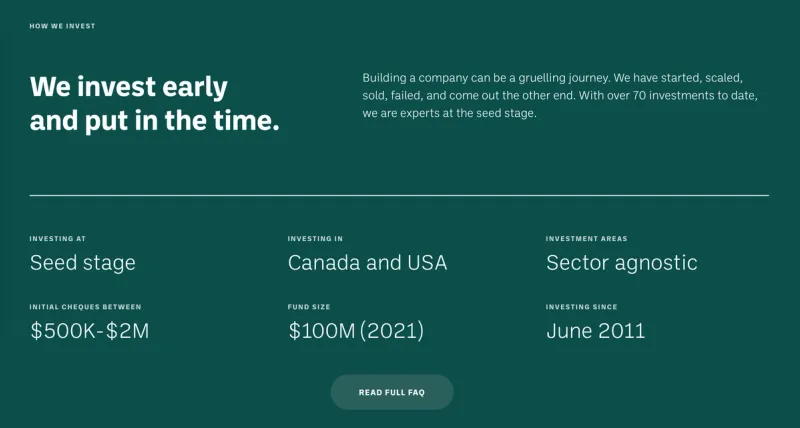

As put by the team at Golden Ventures, “We have a deep sense of empathy to founders and their craft. We challenge our portfolio and team to build remarkable companies. We are authentic and rational in our decision-making and apply the same honesty to our relationships.”

Location

Golden Ventures is headquartered in Toronto and invest in companies throughout North America.

Company Stage

Golden Ventures is focused on seed-stage companies. As put by their team, “We target initial commitments of $500K – $2M for between 7-15% of a company, and we reserve capital to follow on into companies based on progress.”

Related Resource: Seed Funding for Startups 101: A Complete Guide

Preferred industries

Golden Ventures is industry agnostic in its investment approach.

Portfolio Highlights

Some of Golden Ventures’ most popular investments include:

- ApplyBoard

- Yesware

- Stacked

3. Inovia Capital

As put by their team, “Inovia Capital is a venture capital firm partnering with founders to build impactful and enduring global companies.

With four active venture funds, two growth funds, a continuation fund and an expanding team of investors, operators and advisors, we are fully equipped to support founders with capital, insights and mentorship throughout their journey.”

Location

Inovia Capital is headquartered in Canada and invests in companies across the globe.

Company Stage

Inovia Capital invests in companies across all stages.

Preferred industries

As put by their team, “We focus on B2B and B2C SaaS companies and marketplaces.”

Related Resource: 32 Top VC Investors Actively Funding SaaS Startups

Portfolio Highlights

Some of Inovia’s most popular investments include:

- Bench

- Hopper

- Darwin AI

4. BlueSky Equities

As put by their team, “Bluesky Equities is a privately-owned, absolute-return focused, investment management company.

We are unconstrained in our approach, investing in public and private markets with a focus on alternative assets including venture capital, private equity, hedge funds, and real estate.”

Location

Bluesky Equities is headquartered in Calgary and invest in companies across Canada.

Company Stage

Bluesky Equities is focused on early-stage investments.

Preferred industries

Bluesky Equities is focused on B2B SaaS companies.

Related Resource: 15+ VCs Investing in the Future of Work

Portfolio Highlights

Some of Bluesky Equities’ most popular investments include:

- Ownly

- Active Door

- Spocket

5. ArcTern Ventures

As put by the team at ArcTern Ventures, “Since 2012, we’ve been investing in entrepreneurs obsessed with solving humanity’s greatest challenges—climate change and sustainability. We’re former startup founders ourselves, we get it, and like you, we believe technology can save our planet.”

Location

ArcTern has office locations in Toronto, San Francisco, and Oslo and invests in companies across the globe.

Related Resource: The 11 Best Venture Capitals in San Francisco

Company Stage

Explain the company stage this firm invests in.

Preferred industries

As put by their team, “We invest broadly in technology companies that have a positive impact on climate change and sustainability.” Some specific sectors include:

- Clean Energy

- Energy Efficieny and Storage

- Circular Economy

- Advanced Manufacturing and Materials

- Mobility

- Food Systems

Related Resource: VCs Investing In Food & Bev Startups

Portfolio Highlights

Some of ArcTern’s most popular investments include:

- Palmetto

- Span

- Flashfood

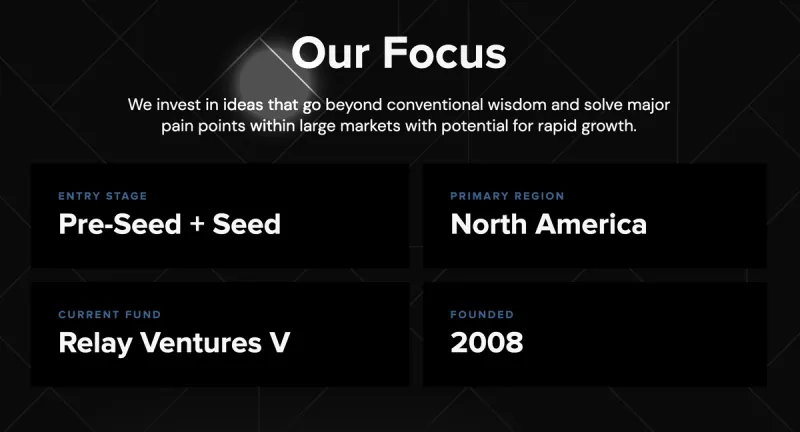

6. Relay Ventures

As put by the team at Relay Ventures, “We don’t fund companies. We fund founders. From the beginning, we have had a simple philosophy. We view founders as partners. We bring capital, networks, and experience, and our founders bring expertise, teams, and dreams. Together we build transformational businesses based on teamwork, trust, and aspiration. Because being a founder depends on it. Our track record speaks for itself.”

Location

Relay Ventures is headquartered in Toronto and invests in companies across North America.

Company Stage

Relay Ventures is focused on seed and pre-seed stage companies.

Preferred industries

Relay Ventures is industry agnostic and focuses on companies operating in large markets.

Portfolio Highlights

Some of Relay Ventures’ most popular investments include:

- Ecobee

- Bird

- Swift

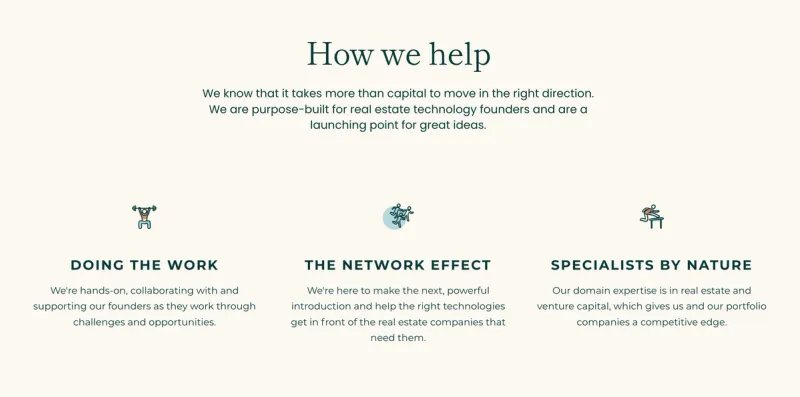

7. Alate Partners

As put by the team at Alate Partners, “We invest in courageous founders and transformational technology that will change the built world for the better. Founded as a partnership between Relay Ventures and Dream, our team has decades of experience in venture capital, operations, and real estate. In addition to providing capital, Alate has unique access to expertise and customers through our network of influential real estate partners, investors, and founders.”

Location

Alate Partners is headquartered in Toronto.

Company Stage

Alate Partners invest in companies around the Seed and Series A stages.

Preferred industries

As put by their team, “We exclusively invest in real estate and construction technology, so you can skip explaining the basics and focus on what matters most. Our knowledge and network are here to accelerate your growth.”

Portfolio Highlights

Some of Alate’s most popular investments include:

- Bird

- Altrio

- PadSplit

8. Real Ventures

As put by their team, “Real Ventures is an early-stage venture firm focused on serving daring entrepreneurs with the ambition to create successful, global companies. Since 2007, Real Ventures has dedicated itself to building the Canadian startup ecosystem on the belief that people, not money, build game-changing companies.

Real Ventures provides stage-specific guidance, mentorship, and access to networks and resources to fast-track founders’ personal and company growth. Real Ventures manages $325 million across five funds and its active portfolio of 100+ companies is currently valued at $10 billion.”

Location

Real Ventures is headquartered in Toronto and has an office in Montreal. They primarily invest in companies in Canada.

Company Stage

Real Ventures is focused on early-stage investments.

Preferred industries

As put by their team, “There is no standard answer, but there are three main things that we look for: a great team with unique insight on a market opening that has massive scaling potential. We like to hear bold ideas that have the potential to disrupt unconventional industries.”

Portfolio Highlights

Some of Real Ventures most popular investments include:

- Mejuri

- Integrate AI

- Unbounce

9. Georgian

As put by the team at Georgian, “We believe that entrepreneurs deserve an experience of growth capital that matches any other best-in-class technology partner. We’re focused on your experience as a growth-stage CEO, using data-driven insights to improve how our team supports you and your team.”

Location

Georgian is headquartered in Toronto and invests in companies across the globe.

Company Stage

Georgian is focused on companies that are generating $500k+ in MRR and are raising between $25M and $75M.

Preferred industries

Georgian is focused on B2B SaaS companies.

Related Resource: FinTech Venture Capital Investors to Know

Portfolio Highlights

Some of Georgian’s most popular investments include:

- Beam

- Shopify

- Ritual

10. Panache Ventures

As put by the team at Panache Ventures, “We invest in the most promising founders — those who are automating, decentralizing, democratizing, and expanding human capabilities.

We want to be the first to invest in your potential, and to support your leadership.”

Location

Panache is headquartered in Montreal and invests in primarily invests in companies in Montreal.

Company Stage

Panache invests in early-stage companies and tries to write the first check into their companies.

Preferred industries

Panache is industry agnostic in their approach.

Related Resource: 10 VC Firms Investing in Web3 Companies

Portfolio Highlights

Some of Panache Ventures most popular investments include:

- Altrio

- Dwelling

- Relay

Maximize your fundraising impact with Visible

As we mentioned at the beginning of this post, a venture fundraise often mirrors a traditional B2B sales and marketing funnel.

Just as a sales and marketing team has dedicated tools, shouldn’t a founder that is managing their investors and fundraising efforts? Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.