“The future of work” is a broad and evolving topic, for this article we will cover it in the context of how founders are creating and solving for our rapidly changing working world as well as where and how VCs are investing in it.

At its core, the future of work revolves around how technological advancements, socio-economic shifts, cultural changes, and evolving business models are transforming the nature, location, and experience of work. For founders, this signifies a wide array of potential opportunities to innovate within, and for VCs, there lies huge investment opportunities.

Predictions for the Future of Work: Where VCs see the biggest opportunities

The “Future of Work” is expected to be more flexible, decentralized, sustainable, and human-centric, all underpinned by advanced technology. For founders, aligning with these predicted trends could prove beneficial in securing VC interest and investment.

AI and automation will transform many jobs. AI is already widely being used to automate tasks and will grow as new use cases and technology evolve, this could lead to some job displacement. However, AI is also creating new jobs, such as AI developers and engineers. VCs are investing in companies that are developing AI-powered tools to automate tasks, improve productivity, and make work more efficient.

- Expert Opinion: McKinsey & Company, among others, has highlighted the accelerating adoption of automation and AI across industries, from manufacturing to services.

- Opportunities: Startups developing intuitive AI interfaces, low-code/no-code automation platforms, and solutions for job displacement caused by automation (like re-skilling platforms).

Democratization of Entrepreneurship. This refers to the leveling of the playing field, enabling more people from diverse backgrounds to start and scale businesses thanks to recent developments in technology, such as AI. The “Future of Work” isn’t just about how we work, but also about how we create, innovate, and bring ideas to market. What once required a substantial capital investment or technical expertise is now accessible to anyone with an idea and internet access. No longer do entrepreneurs need to understand coding to build a digital presence.

- Expert Opinion: Lower barriers to entry in business, thanks to digital tools, will lead to a rise in micro-entrepreneurs and niche businesses. This viewpoint is supported by platforms like Shopify and their growth trajectory.

- VC Opportunity: Tools supporting small-scale e-commerce, localized marketing platforms, and solutions catering to niche digital businesses.

Skills development and education will be essential for success. As the world of work changes rapidly, it is increasingly important for people to have the skills they need to succeed. VCs are investing in companies that provide skills development and education programs to help people learn new skills and stay ahead of the curve.

- Expert Opinion: With the pace of technological advancement, lifelong learning is becoming essential. Leaders like Thomas Friedman have emphasized the importance of adaptable and continuous learning.

- Opportunities: Micro-credentialing platforms, industry-specific upskilling courses, and experiential learning tools leveraging AR and VR.

The gig economy will continue to grow. The gig economy is growing rapidly, and VCs are investing in companies that are making it easier for people to find and book freelance work. This includes companies that provide freelance marketplaces, job boards, and payment platforms.

- Expert Opinion: The gig economy is expected to grow but evolve to offer more security and benefits to freelancers. Experts like Diane Mulcahy have discussed the shift from the traditional 9-to-5 to more flexible work structures.

- Opportunities: Platforms providing benefits and insurance for freelancers, gig work management tools, and specialized marketplaces for niche skills.

Investment Landscape: Capital Flowing into the Future of Work

As of Q3 2023, the future of work 100 has collectively raised $30 billion in capital from VCs, with a total valuation of over $211 billion, according to Future of Work 100 Report.

Top Investors

Top Categories (starting with the largest)

- Recruiting

- HR

- Learning

- Collaboration

- Wellness

Notable Deals

- $500 million Series E in Q1 2023

- Total Funding Amount: $1.2 Billion

Rippling is a human resource management company that offers an overall platform to help manage HR and IT operations.

- $264.7 million Series G Q2 2022

- Total Funding Amount: $643.2 Million

Guild is a learning platform that offers classes, programs, and degrees for working adults.

These fundraises suggest that VCs are still very bullish on the future of work sector, even in the face of a challenging economic environment.

Future of Work Categories

The “future of work” is dynamic, and the areas of focus will evolve as new technologies emerge and societal needs change. VC investments will continuously shift to adapt to these changes, seeking out innovative solutions that address the most pressing challenges and opportunities in the world of work.

As of now, these are the categories we found to be of most interest to VCs and Founders alike, as they solve for and support the way we work today and in the future.

Remote and Distributed Work

With the proliferation of digital tools and the effects of the pandemic, remote and hybrid work models have become more prevalent.

- Virtual collaboration tools (e.g., video conferencing, project management software).

- Virtual office environments and platforms.

- Remote team-building and culture-enhancing solutions.

- Digital security tools tailored for remote work setups.

Human Resources and Talent Management

- AI-driven recruitment platforms that ensure a better fit between candidates and companies.

- Employee engagement and performance tracking tools.

- Solutions for remote onboarding, training, and continuous learning.

Automation and AI

The rise of automation and AI has the potential to transform many job roles and industries.

- Robotic Process Automation (RPA) for automating repetitive tasks.

- AI-driven solutions for data analysis, customer service, and other business functions.

- Job re-skilling and up-skilling platforms, recognizing the need for workers to adapt.

Gig Economy and Flexible Employment

As more people pursue freelance, contract, and part-time work, there’s a growing demand for platforms that facilitate this kind of employment. This includes:

- Freelancer marketplaces.

- Tools for gig workers, such as invoicing, insurance, and benefits platforms.

- Platforms for micro-tasks or crowd-sourced work.

Employee Well-being and Productivity

The emphasis on work-life balance and employee well-being is growing.

- Mental health and well-being platforms tailored for professionals.

- Productivity-enhancing tools, including time management and focus-enhancing software.

- Physical wellness platforms, including virtual fitness and ergonomics solutions.

Lifelong Learning and Continuous Education

The rapid pace of change means workers need to continually update their skills.

- Online learning platforms, both general and industry-specific.

- Corporate training and development tools.

- Credentialing and certification platforms.

Decentralized Work Platforms

With the rise of blockchain and decentralized technologies, there are new models for work and value creation, such as:

- Decentralized autonomous organizations (DAOs) where members collaborate without a traditional hierarchical structure.

- Platforms that allow for tokenized incentives or compensation.

Diverse and Inclusive Work Environments

Recognizing the value of diverse workforces, there’s a push for tools and platforms that promote diversity and inclusion, such as:

- Recruitment software that mitigates biases.

- Platforms that connect businesses with diverse talent pools.

- Tools that foster inclusive communication and understanding within teams.

Culture and Engagement in Distributed Teams

- Platforms for virtual team-building activities.

- Tools that help maintain and communicate company culture in a remote setting.

VCs Investing in the Future of Work

Khosla Ventures

- Location: Menlo Park, California, United States

- About: At KV, we fundamentally like large problems that are amenable to technology solutions. We seek out unfair advantages: proprietary and protected technological advances, business model innovations, unique approaches to markets, different partnerships, and teams who are passionate about a vision.

- Investment Stages: Seed, Series A

- Recent Investments:

- Volta Labs

- WorkWhile

- Emi

To learn more about Khosla Ventures, check out their Visible Connect Profile.

Menlo Ventures

- Location: Menlo Park, California, United States

- About: We are investors and company builders—we know what it takes to turn a budding idea into a scalable business. We work with early-stage founders to find product-market fit, develop go-to-market strategies, scale their organizations, and support them as they grow.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Recent Investments:

- TruEra

- OpenSpace

- Siteline

To learn more about Menlo Ventures, check out their Visible Connect Profile.

Social Capital

- Location: Palo Alto, California, United States

- About: Social Capital’s mission is to build the future. We do this by identifying emerging technology trends, partnering with entrepreneurs that are trying to solve some of the world’s hardest problems and help them build substantial commercial and economic outcomes. Our returns have placed us among the top technology investors in the world and act as a signal that we have generally been on the right track.

- Investment Stages: Seed, Series A, Series B, Growth

- Recent Investments:

- Palmetto

- WorkStep

- Asaak

To learn more about Social Capital, check out their Visible Connect Profile.

Hexa

- Location: Paris, France

- About: Hexa is home to startup studios eFounders (SaaS), Logic Founders (fintech) and 3founders (web3). It all started in 2011 with startup studio eFounders, which pioneered a new way of entrepreneurship, became a reference in the B2B SaaS world, and launched over 30 companies including 3 unicorns (Front, Aircall, Spendesk). Now, eFounders is part of Hexa, alongside its sister startup studios Logic Founders (fintech) and 3founders (web3).

- Investment Stages: Pre-seed, Seed, Series A, Series B, Series C

- Recent Investments:

- Kairn

- Crew

- Collective

To learn more about Hexa, check out their Visible Connect Profile.

s28 Capital

- Location: San Francisco, California, United States

- About: S28 Capital is an early-stage venture fund with $170M under management. We’re a team of founders and early startup employees.

- Investment Stages: Seed, Series A

- Recent Investments:

- OpsLevel

- Rudderstack

- CaptivateIQ

To learn more about s28 Capital, check out their Visible Connect Profile.

WorkLife

- Location: San Francisco, United States

- About: The first fund designed for builders, creators & individual contributors We’re operators with a deep network of creators, developer evangelists, product designers and engineers. We’re backed by the founders of Cameo, Spotify, Twitch, Zoom and platforms built for builders, creators, and individual contributors. Our advisors include Arianna Huffington, Michael Ovitz, Sophia Amoruso, Eric Yuan and other disruptors across all industries.

- Investment Stages: Pre-seed, Seed, Growth

- Recent Investments:

- Accord

- Tandem

- ChartHop

To learn more about WorkLife, check out their Visible Connect Profile.

Bonfire Ventures

- Location: Los Angeles, California, United States

- About: We bring experience and empathy to our founder’s journeys.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- SKAEL

- Spekit

- Atrium

To learn more about Bonfire Ventures, check out their Visible Connect Profile.

Related Resource: 10 Angel Investors to Know in Los Angeles

iNovia Capital

- Location: Montreal, Quebec, Canada

- About: Inovia Capital is a full-stack venture firm that invests in tech founders.

- Investment Stages: Seed, Series A, Series B, Series C, Growth

- Recent Investments:

- Talent.com

- Calico

- RouteThis

To learn more about iNovia Capital, check out their Visible Connect Profile.

Related Resource: 10 Venture Capital Firms in Canada Leading the Future of Innovation

Bloomberg Beta

- Location: San Fransisco & New York City, California, United States

- About: Invests in powerful ideas that bring transparency to markets, achieve global scale, with strong, open cultures that embrace technology.

- Thesis: We believe work must be more productive, fulfilling, inclusive, and available to as many people as possible. Our waking hours must engage the best in us and provide for our needs and wants — and the world we live in too often fails to offer that. We believe technology startups play an essential role in delivering a better future. We can speed the arrival of that future by investing in the best startups that share these intentions.

- Investment Stages: Pre-seed, Seed, Series A, Series B, Series C

- Recent Investments:

- CloudApp

- StrongDM

- Tonic.ai

To learn more about Bloomberg Beta, check out their Visible Connect Profile.

SOSV

- Location: Princeton, New Jersey, United States

- About: SOSV is a venture capital firm providing multi-stage investment to develop and scale their founders’ big ideas for positive change.

- Investment Stages: Accelerator, Pre-Seed, Seed, Series A, Series B

- Recent Investments:

- MarketForce

- Novoloop

- TabTrader

To learn more about SOSV, check out their Visible Connect Profile.

Lerer Hippeau

- Location: New York, New York, United States

- About: Lerer Hippeau is a seed and early-stage venture capital fund based in New York City.

- Investment Stages: Seed, Series A, Series B, Series C

- Recent Investments:

- Palmetto

- Sardine

- Blockdaemon

To learn more about Lerer Hippeau, check out their Visible Connect Profile.

White Star Capital

- Location: New York, New York, United States

- About: White Star Capital is an international venture and early growth-stage investment platform in technology.

- Investment Stages: Series A, Series B

- Recent Investments:

- Swing

- Wrk

- RareCircles

To learn more about White Star Capital, check out their Visible Connect Profile.

General Catalyst

- Location: Cambridge, Massachusetts, United States

- About: General Catalyst is a venture capital firm that makes early-stage and growth equity investments.

- Investment Stages: Seed, Series A, Series B, Growth

- Recent Investments:

- Ponto

- Socotra

- Homeward

To learn more about General Catalyst, check out their Visible Connect Profile.

Tuesday Capital

- Location: Burlingame, California, United States

- About: Tuesday Capital (formerly known as CrunchFund) is a seed stage focused venture firm

- Investment Stages: Seed, Series A, Growth

- Recent Investments:

- Kueski

- NeuraLight

- Crabi

To learn more about Tuesday Capital, check out their Visible Connect Profile.

Forum Ventures

- Location: New York City, San Francisco, and Toronto, United States

- Thesis: B2B SaaS; Future of Work, E-commerce enablement, Supply Chain & Logistics, Marketplace, Fintech, Healthcare

- Investment Stages: Pre-Seed, Seed

- Recent Investments:

- Sandbox Banking

- Tusk Logistics

- Vergo

Check out Forum Ventures profile on our Connect Investor Database

Start Your Next Round with Visible

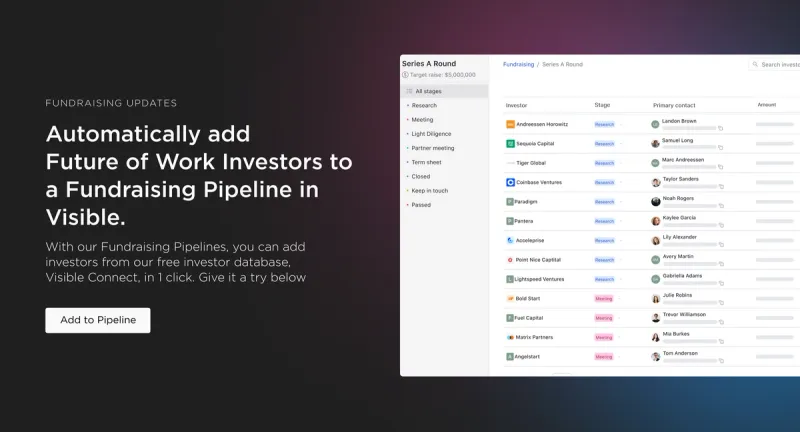

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our investors here.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.