Your Ultimate Report: Sharing Operational Metrics

Welcome to part 2 of 4 of our Ultimate Report series. When we talk to our customers and potential customers we love to get an understanding of their “ultimate report”. It’s the report that stakeholders can quickly rally behind and understand how the business is performing, usually to a goal or target.

This week we want to touch on two key parts of the reporting process every company should be doing.

- Operational Metrics

- Developing a cadence for stakeholder reporting

The below chart is a common one that most VCs love & one that you’ll see in just about every “Investor Update” template post online.

The goal here is to quickly see:

- How fast is your top line growing?

- How much cash is in the bank?

- Is burn under control?

- What does headcount look like?

With Visible, this is incredibly easy to visualize and automate through our different data integrations. Putting this together should take no more than a couple minutes.

The other key to great reporting is not doing it just once but building a repeatable cadence that is timely.

According to Peter Drucker, the key to building a successful company is about how well you attract and retain both talent and capital. Attracting capital (read: investors) is one thing; but how do you handle the added pressure of putting someone else’s capital to work? Regular communication.

While we spend most of our day talking with founders and operators we also spend a good amount of time speaking with stakeholders and those “consuming” reports. The one component they look for more than certain metrics, wins, losses, or other sections? Regular communication. With some back of the envelope math we have found companies that regularly communicate with their investors are twice as likely to raise follow on funding.

Consistent communication builds trust and helps keep you top of mind for your investors. It also creates accountability on both sides of the table. When an investor comes across a great designer looking to join a startup, who do you think she will recommend? The company she hasn’t heard from since wiring the money, or the one that comes to her each month with a quick overview on how things are going and how she can help?

But what is “regular communication”? That is something that should be answered by your, your team, and your stakeholders. Find a cadence that works best for both you and your stakeholders. One of our favorite cadences we see companies use is similar to the one below:

- Weekly – Short, data heavy Updates sent to the entire team. Highlight big wins, losses, and your “North Stars” for individual departments

- Monthly – A more qualitative focused Update sent to all Investors and stakeholders highlighting all important wins, losses, and questions from the month.

- Quarterly – the “friends and family” Update. Send to any of your stakeholders that have interest in the business with a quick update on the state of the business while keeping potential investors in the loop.

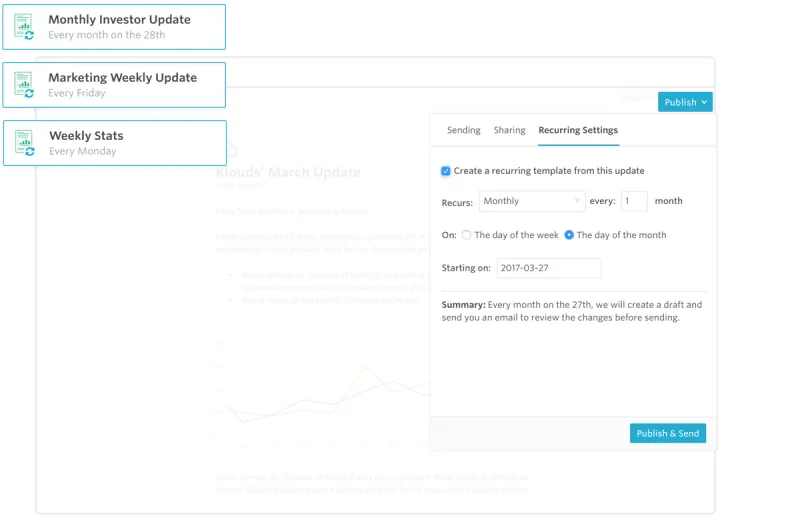

Make sure to check our recurring templates in Visible to help automate your cadence.