Key Takeaways

-

A startup fundraising platform can help you raise capital faster by centralizing your investor pipeline, outreach, and follow-ups, so you spend less time wrangling spreadsheets and more time running a tight process.

-

Use this guide to quickly compare the main categories founders actually use: startup fundraising CRMs, crowdfunding platforms for startups, and free startup fundraising platforms, with clear notes on where each fits in the fundraising journey.

-

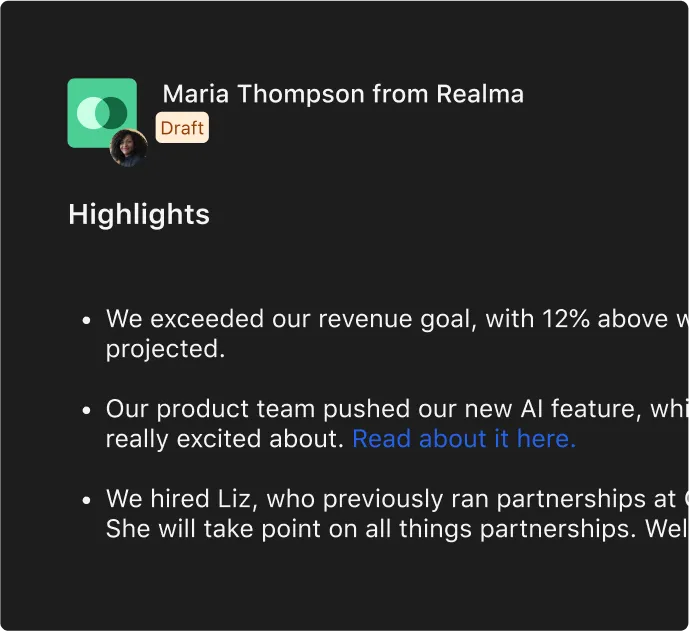

If you are targeting venture capital, the best fundraising CRM is the one that keeps investor communication consistent and measurable, making it easier to stay aligned on next steps and avoid deals slipping through the cracks.

-

Crowdfunding platforms for startups can unlock a larger pool of backers, but the outcomes depend on choosing the right model (including equity crowdfunding) and running a campaign that builds momentum beyond a single launch day.

-

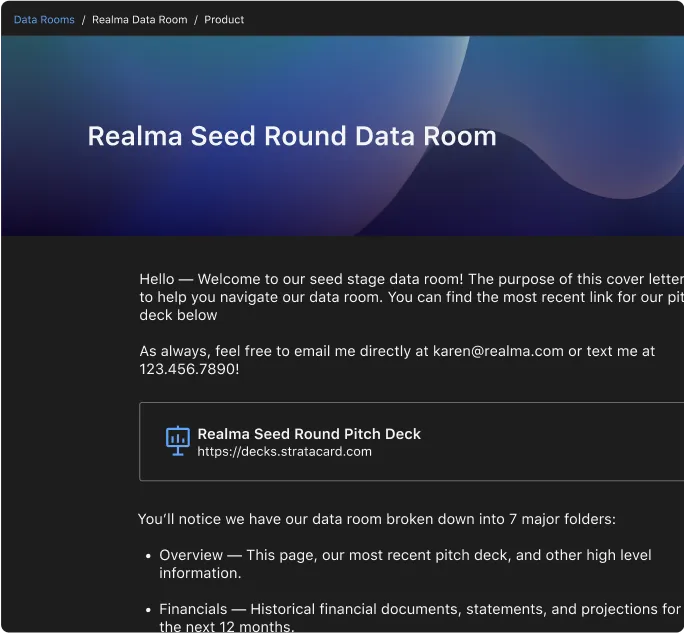

Cost matters, especially early. This article breaks down how to evaluate free fundraising tools alongside essentials like investor updates, pitch decks, data rooms, and dashboards, so you can build credibility with investors without overbuying software.

The Best Startup Fundraising Platforms & Tools to Raise Capital Faster

Raising capital is one of the most challenging yet crucial aspects of building a successful startup. Whether you are seeking venture capital (VC), equity crowdfunding, or other funding sources, having the right startup fundraising platform can streamline the process, helping you attract investors, manage relationships, and close deals efficiently.

With the growing number of platforms available, choosing the best one depends on your startup’s needs, fundraising stage, and capital strategy. In this guide, we’ll explore the best CRM for fundraising, startup crowdfunding platforms, and free fundraising platforms, ensuring that you can find the right tool to accelerate your fundraising efforts.

1. Understanding Startup Fundraising Platforms

Fundraising platforms fall into several categories, each designed for different stages of the fundraising journey. The three main types of startup fundraising platforms include:

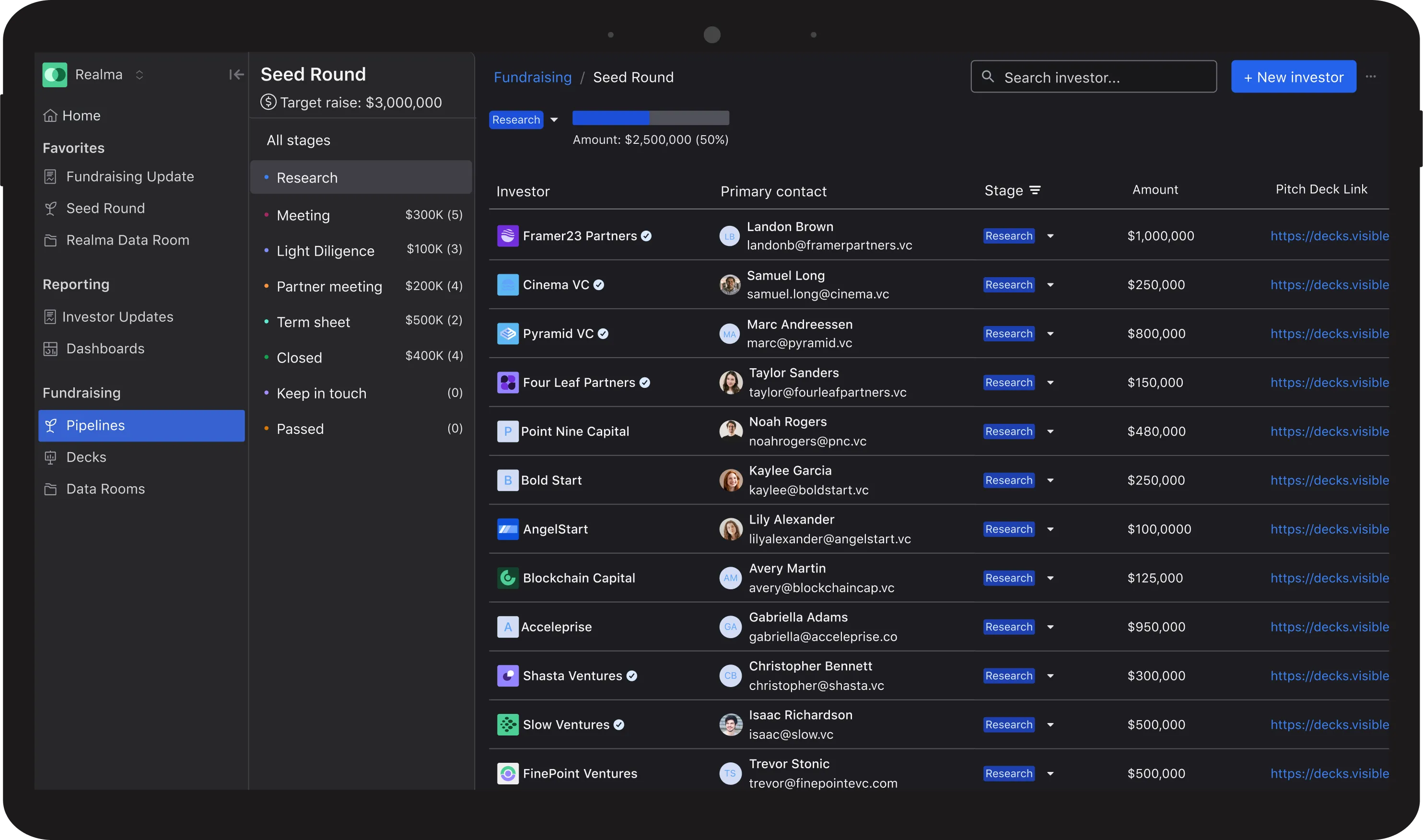

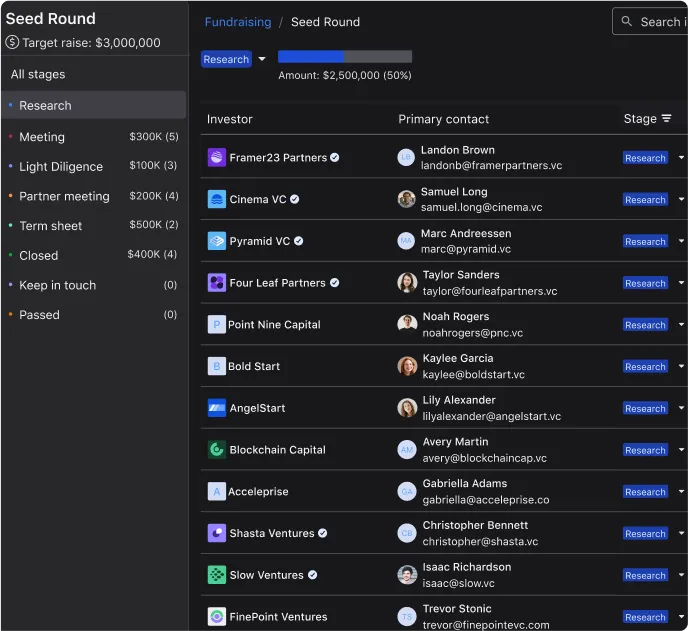

Startup fundraising CRMs help startups track investor relationships, manage capital raises, and streamline investor communications. They are essential for VC-backed founders who need to organize outreach, follow-ups, and reporting. A CRM for fundraising free of excessive complexity can be valuable for startups looking to streamline investor tracking while keeping costs low. Understanding the fundraising CRM meaning and its impact on startup fundraising software selection can help startups maximize their capital-raising potential. A startup VC fundraising platform provides features specifically designed for venture-backed businesses to track and manage their fundraising pipeline.

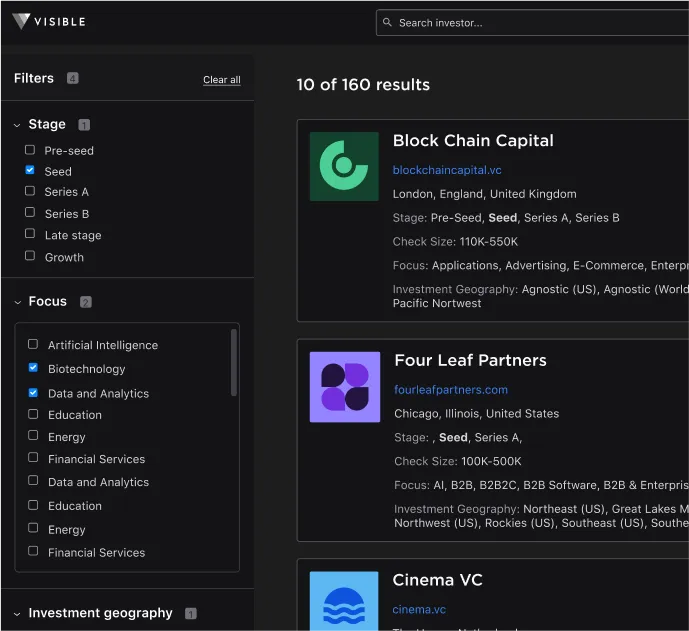

Crowdfunding platforms for startups allow businesses to raise capital from a large number of investors, either through reward-based crowdfunding, equity crowdfunding, or debt-based crowdfunding. The best crowdfunding for business startup initiatives enables founders to attract early adopters and build market validation. Many founders look for the best crowdfunding for small business options to raise funds for their ventures. The best crowdfunding for startups provides tools to engage potential investors and create compelling fundraising campaigns. Founders looking for the best crowdfunding sites for investors should evaluate platforms that offer a diverse pool of backers interested in startup investments.

Equity crowdfunding platforms enable startups to offer investors an equity stake in exchange for capital, making them a viable alternative to venture capital. A startup fundraising platform for profit offers access to investors looking to participate in revenue-generating opportunities. The best startup fundraising platforms for profit in the USA ensures compliance with regional regulations while providing strong investor outreach capabilities.

2. Best CRM for Startup Fundraising

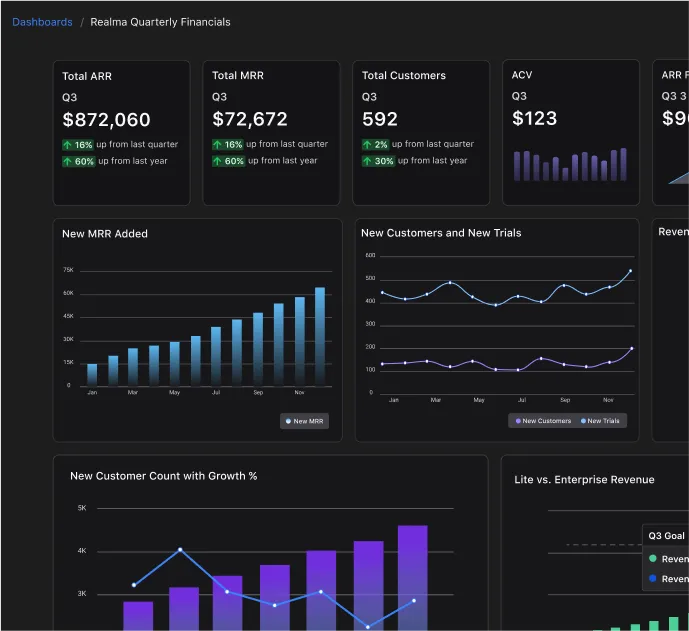

A fundraising CRM (customer relationship management tool) is designed to help founders manage investor interactions, track deal progress, and maintain a structured fundraising process. These platforms offer tools for tracking investor engagement, managing deal flow, and streamlining communication.

Startups often seek a CRM for fundraising free of unnecessary complexity but equipped with features that support long-term relationship management. Understanding the fundraising CRM meaning can help founders choose a solution that aligns with their fundraising goals. Startup fundraising software enables founders to automate investor outreach, monitor funding commitments, and generate reports for stakeholder communication. A startup VC fundraising platform offers tailored solutions for managing relationships with venture capital firms, streamlining the process of securing funding.

3. Best Crowdfunding Platforms for Startups

Crowdfunding has become an increasingly popular way for startups to raise capital, allowing founders to tap into large investor networks. The best crowdfunding for business startup efforts connects founders with early supporters and potential customers. Many entrepreneurs look for the best crowdfunding for small business initiatives to secure funding while building brand awareness. The best crowdfunding for startups provides tools to effectively engage investors and market their funding campaign.

Founders exploring crowdfunding platforms for startups should consider equity crowdfunding options that allow them to exchange equity for investment. The best crowdfunding sites for investors attract a broad network of backers interested in startup ventures. Choosing the right startup crowdfunding platforms can help founders maximize their fundraising success. Many crowdfunding platforms for startups also provide additional resources such as marketing tools, financial tracking, and investor management features. A startup fundraising platform for profit ensures that businesses can raise funds while focusing on long-term revenue generation.

4. Best Free Startup Fundraising Platforms

Some founders look for free fundraising platforms to avoid upfront costs. While most fundraising platforms charge fees, a few offer free plans or success-based fees. Startups searching for the best free fundraising platforms should consider options that provide essential fundraising tools without expensive subscriptions. The best free startup fundraising platform helps founders organize their fundraising process while keeping costs manageable. Entrepreneurs looking for the best free startup fundraising platform for profit can explore tools that provide investor engagement features at no cost. The best startup fundraising platform for profit in the USA offers startups an opportunity to raise capital while ensuring compliance with local regulations. Free crowdfunding for business startup efforts allows founders to test the market before committing to a paid fundraising strategy.

5. How to Choose the Right Startup Fundraising Platform

Choosing the best startup fundraising platform depends on several factors. Early-stage startups may benefit from crowdfunding, while later-stage startups often need a CRM to manage investor relationships. If equity financing is needed, an equity crowdfunding platform could be the best choice. If a startup wants to maintain ownership, debt crowdfunding or startup fundraising CRMs may be better options.

A startup fundraising platform for profit ensures that founders can generate revenue while securing funding. Startup fundraising software provides an integrated approach to tracking investor outreach, financial projections, and funding commitments. A startup VC fundraising platform simplifies investor relations by centralizing communications and funding activities. By considering a startup’s specific fundraising goals, available resources, and long-term growth plans, founders can identify the best fundraising platform for their needs.

The Fundraising Platform for Your Startup

Startup fundraising is challenging, but the right platform can make a significant difference. A fundraising CRM is essential for tracking investors and managing relationships. Crowdfunding platforms allow startups to raise capital from a broad pool of investors. For those seeking free startup fundraising platforms, there are options available with no upfront costs. By carefully selecting the right startup fundraising platform, founders can streamline their capital-raising process and maximize their chances of success. Understanding the best crowdfunding for business startup opportunities, evaluating the best crowdfunding for small business platforms, and choosing the best crowdfunding for startups can significantly improve fundraising outcomes. Exploring the best crowdfunding sites for investors ensures access to a diverse network of backers. For cost-conscious founders, the best free fundraising platforms provide an opportunity to raise funds with minimal financial risk. Selecting a CRM for fundraising free of complexity while understanding the fundraising CRM meaning ensures an effective investor management strategy. Implementing the right startup fundraising software and startup VC fundraising platform can optimize the fundraising process for long-term success.

Frequently Asked Questions

What is a startup fundraising platform?

A startup fundraising platform is software that helps founders plan, run, and track a capital raise. It centralizes your investor list, outreach, follow-ups, meetings, and status updates in one place. The best platforms make it easier to stay organized, communicate consistently, and report progress to your team.

What is the difference between a startup fundraising platform and a fundraising CRM?

A fundraising CRM is typically focused on relationship management, like tracking investor conversations, emails, and next steps. A startup fundraising platform often includes CRM functionality plus fundraising-specific workflows, templates, reporting, and collaboration features. In practice, many founders use the terms interchangeably, but “platform” implies broader capabilities.

How do I choose the best startup fundraising platform for my stage?

The best startup fundraising platform depends on your fundraising motion and volume. Pre-seed and seed founders usually need fast pipeline setup, lightweight tracking, and clean follow-up workflows. Later-stage teams often prioritize collaboration, advanced reporting, permissions, and integrations. Match the tool to your outreach cadence and team size.

Can a free startup fundraising platform work for raising venture capital?

A free startup fundraising platform can work early if your investor list is small and your process is simple. The risk is missed follow-ups, messy data, and inconsistent reporting as volume ramps. If you are emailing dozens of investors weekly, a dedicated fundraising platform or CRM is often worth it.

Do startup fundraising platforms help with crowdfunding for startups?

Some startup fundraising platforms support crowdfunding for startups indirectly by helping you manage outreach, messaging, and leads, but crowdfunding often requires a dedicated equity crowdfunding platform. Crowdfunding has different workflows, like campaign pages, compliance steps, and updates to many backers. Choose a platform built for your fundraising path.

What features matter most in a startup fundraising platform?

Prioritize features that reduce operational drag: a reliable investor pipeline, reminders and follow-up automation, clean notes and tagging, collaboration for co-founders, and reporting you can share with stakeholders. A strong startup fundraising platform should also help you maintain momentum and avoid losing track of next steps.