Product Update: Analyze Your Portfolio Data with Segment Metrics

Visible recently released Segment Metrics, a premium portfolio insights tool for VCs. The solution empowers investors to answer key questions about their portfolio performance in seconds instead of hours.

How investors can unlock portfolio insights faster with Segment Metrics

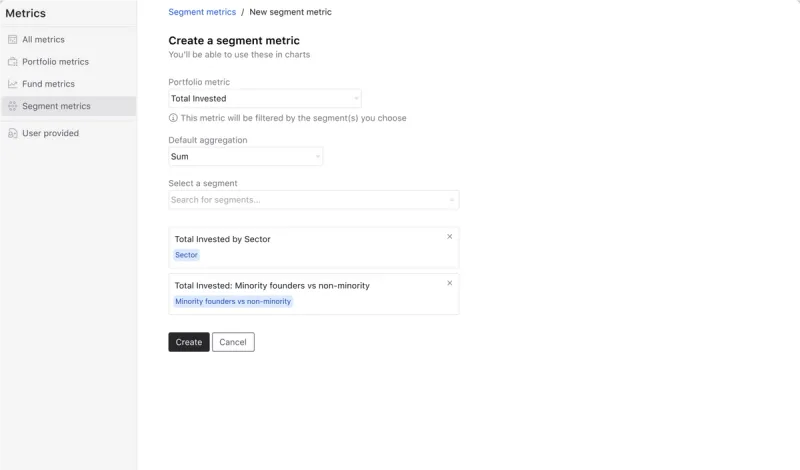

With Segment Metrics investors can find insights related to the sum, average, minimum, and maximum for any custom segment of their portfolio metric data and investment values.

Example Segment Insights

Examples of insights that can be uncovered with Segment Metrics include:

- The amount invested in female founders vs non-female founders

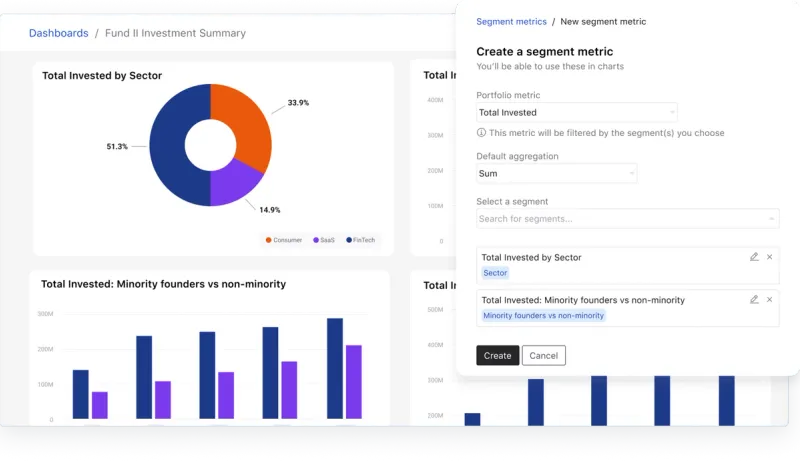

- The breakdown of investments based on sector, geography, and stage

- A comparison of revenue across seed-stage investments

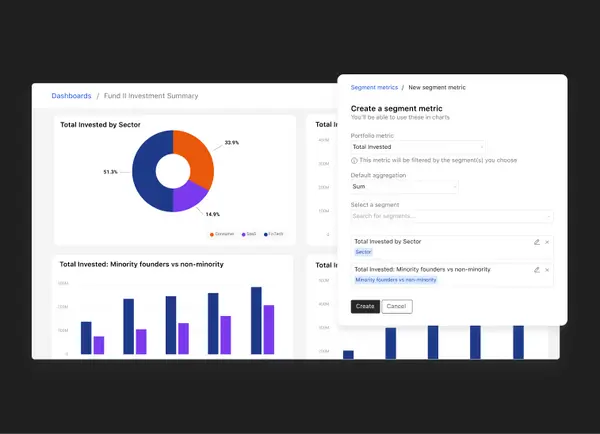

Investors can keep track of these insights by embedding the data visualizations on flexible, shareable dashboards in Visible as shown in the example below.

Learn more about setting up Segment metrics in our Knowledge Base.

Learn More About Visible

Visible has a suite of tools to help with portfolio data analysis including

- Robust, flexible dashboards that can be used for Internal Portfolio Review meetings

- Portfolio metric dashboards to help with cross-portfolio insights

Learn more about how 400+ Venture Capital investors use Visible to streamline their portfolio monitoring and reporting.