What's new

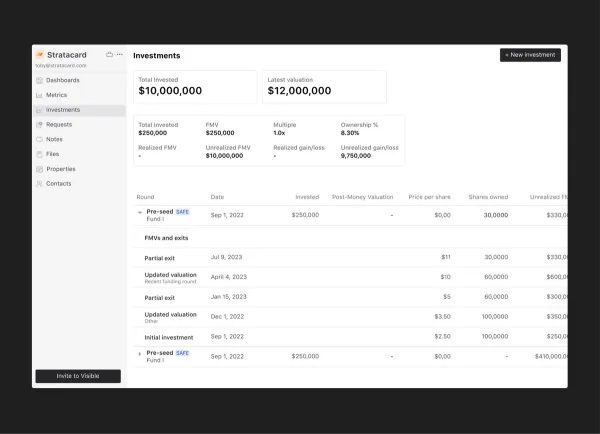

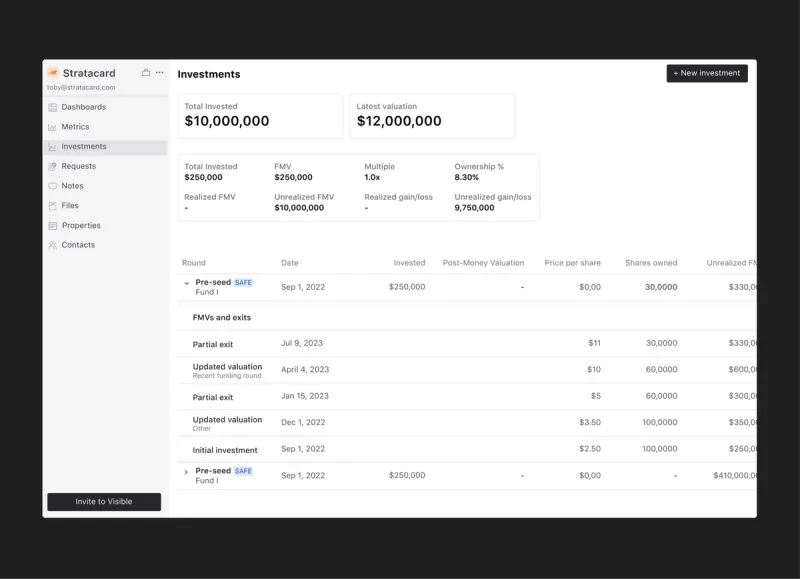

The investment overview table on portfolio company profiles is now more comprehensive.

In addition to portfolio data collection tools, Visible also empowers VC firms with a source of truth for their portfolio investment records. Visible's investment data solution is more accessible and easy to digest than the status quo Excel file master sheet that many firms rely on... but don't really trust.

With this recent update to our investment data tracking solution, we've made the overview table on companies' profiles more comprehensive so you can see the history of changes to fair market values and exits all in one view. Previously changes to fair market value were handled in a separate window which required users to take additional steps to make edits.

What's included in a portfolio companies investment table overview

The following details are included in a companies investment table overview:

- Direct investment details

- Visible supports the following investment types Equity, SAFE, Convertible Note, Debt, Token, and other

- Follow on investment details

- Visible lets investors track rounds even if they do not participate

- Changes to fair market value

- Visible lets users document the FMV justification, notes, and who it was approved by

- Exits

- Visible empowers investors to keep track of exit details which keeps their fund metrics up-to-date and accurate

Related resource: VC Fund Performance Metrics 101 (and why they matter to LPs)

Learn more about Visible's investment data tracking capabilities by meeting with our team.