Building a venture-backed startup is difficult. On top of building a useful product, hiring a great team, and attracting qualified customers, founders need to be a 1 person finance team (in the early days).

When just starting and scaling a business, founders likely have no dedicated finance team in-house to lean on for insights. Founders need to rely on their own financial savviness (hopefully with the help of an accounting firm) to keep finances in check.

In order to efficiently grow your business, you need to have an understanding of your cash position. Learn more about calculating and tracking your startup runway below.

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

What is Startup Runway?

A startup runway is exactly what it sounds like — it is the amount of time (generally in months) a startup can operate before it runs out of money. For a profitable business, this metric likely means little. However, an early-stage startup that has yet to monetize its product or service will need to pay close attention to its runway.

Related Resource: The Understandable Guide to Startup Funding Stages

Your startup runway will inform how you hire, develop products, and finance your business in the coming months and years.

What is Startup Burn Rate?

The first component of your startup runway is your burn rate. According to Investopedia, “The burn rate is typically used to describe the rate at which a new company is spending its venture capital to finance overhead before generating positive cash flow from operations. It is a measure of negative cash flow.”

Related Resource: Startup Metrics You Need to Monitor

Simply put, the burn rate is the amount of money your business is “burning” every month. For example, if your business is spending $5,000 a month on salary, $1,000 on software, and $500 on office space but has yet to bring in any revenue your burn rate would be $6,500. Your burn rate is generally the input that you can dictate the most when it comes to extending your cash runway.

Related resource: Burn Rate: What It Is and How to Calculate It

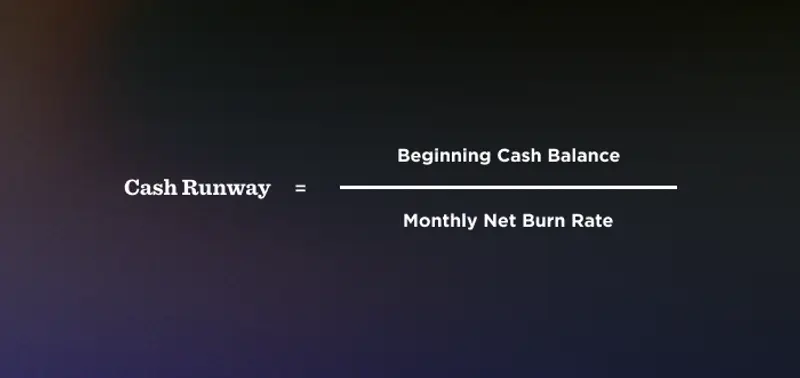

Formula for Startup Runway

Calculating your runway is simple and something that every startup founder should hone, especially in the early days. To calculate your runway, simply take your beginning cash balance and divide it by your monthly net burn rate as shown below:

Related Resource: 6 Metrics Every Startup Founder Should Track

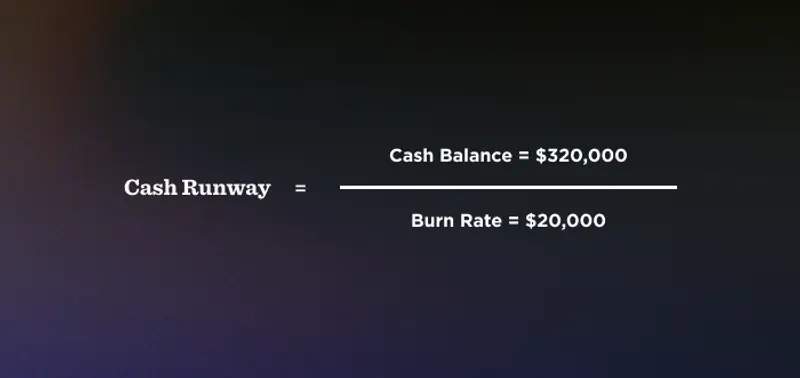

Real-Life Example of Startup Runway

For a real-life example of calculating a startup’s runway — let’s take an early-stage venture-backed company that raised a few million dollars in VC money and has been at it developing its product. At the beginning of the most recent period, their cash balance is $320,000 and their monthly burn rate is $20,000. You’d simply divide $320,000 by $20,000 to get a runway of 16 months.

How Much Startup Runway Should You Have?

There is no right or wrong answer when it comes to determining how long your cash runway should be. Your company’s stage, current market, and business model might impact how long your runway should be. As a general rule of thumb, it is suggested that seed and series A companies have a runway of 12-18 months

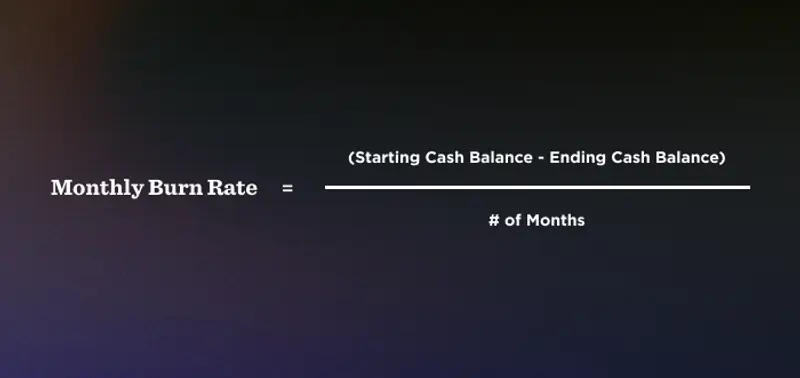

Formula for Burn Rate

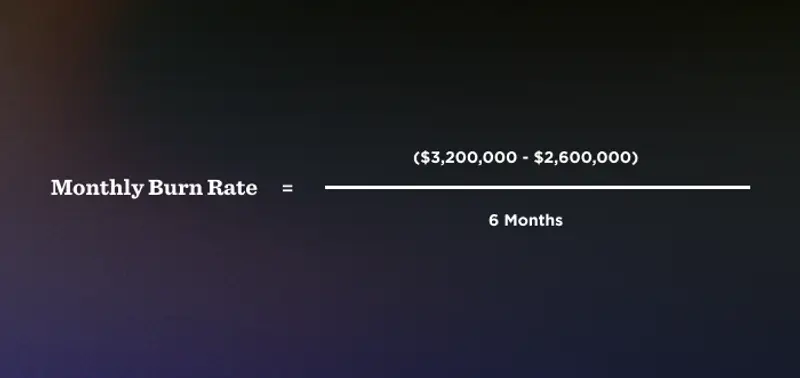

Like startup runway, burn rate is a straightforward formula — especially for founders who have their cash statements and metrics in place. To calculate your burn rate, simply take your beginning cash balance, subtract your ending cash balance and divide that by the # of months over the given period. Typically it is better to calculate your burn rate over a longer period of time as a single month could be lumpy as expenses vary from month to month.

Related Resource: What is a Startup’s Annual Run Rate? (Definition + Formula)

Real-Life Example of Startup Burn Rate

For a real-life example of calculating a startup, let’s take a startup that raised $3M and already had $200k in the bank bringing its cash balance to $3.2M. Fast forward 6 months and their cash balance is now $2.6M. Using the burn rate formula that would mean their monthly burn rate is $100K ($3.2M – $2.6M = $600K / 6 months = $100K) as shown below:

Ways to Extend Startup Runway and Reduce Burn Rate

As we mentioned earlier, the easiest way to manipulate your runway and extend your runway is by controlling your monthly burn rate. Learn more about how to extend your runway below:

Drive More Sales

First and foremost, the best way to extend your runway is by driving more sales. Of course, this is likely already a goal of your business (unless your business is not ready to monetize your product or service). By driving more sales you’ll be able to increase your cash balance and in turn, extend your startup’s runway.

Cut Non-Essential Expenses

The most straightforward way to extend your startup’s runway is by cutting non-essential expenses. This can feel difficult as it can impact your team’s day-to-day operations — however, this can be done in a thoughtful manner that extends your runway. For example, consolidating software or removing marketing channels that might not be performing well is a good way to extend the runway.

Related resource: The Only Financial Ratios Cheat Sheet You’ll Ever Need

Utilize Corporate Credit Cards and other Funding Sources

You can also get creative with the financing options that your business leverages. While venture financing might take months to get cash into your bank account, new funding options could be of interest. Learn more about alternative ways to fund your business below:

Related Resource: Checking Out Venture Capital Funding Alternatives

Track Runway With Visible

Runway is a vital metric for early-stage startups. Every startup founder should be in tune with their runway and use it to inform spending decisions and strategy for the coming months and years.

Tools and software are a great way to keep tabs on your finances. Track key metrics, send investor Updates, and track the status of your next fundraise with Visible. Give it a free try for 14 days here.

Related resource: What is Internal Rate of Return (IRR) in Venture Capital