Blog

Metrics and data

Resources related to metrics and KPI's for startups and VC's.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

investors

Metrics and data

Multiple on Invested Capital (MOIC): What It Is and How to Calculate It

Venture capital firms need to have a system in place to track the performance of their different investments. Limited partners want to understand how a specific fund is performing — especially when a general partner is raising a new fund.

Multiple on Invested Capital (MOIC) stands out as a critical measure for investors aiming to track their portfolio performance . This article delves into the essence of MOIC, offering a clear guide on how to calculate it and its significance in the venture capital ecosystem.

Related resource: Venture Capital Metrics You Need to Know

What is Multiple on Invested Capital (MOIC)?

In venture capital, MOIC is a crucial metric that measures the return on investment by comparing the current or exit value of an investment to the initial capital invested. It offers a straightforward ratio indicating how many times the original investment has been returned, making it essential for evaluating the financial performance of an investment. MOIC's simplicity allows venture capitalists to assess value creation, compare performance across various investments, and make informed decisions on future investments or exits. As a universal metric, it facilitates direct comparison across diverse portfolios, highlighting the efficiency of startups in generating growth and guiding investors in maximizing their returns.

MOIC Formula

The formula for MOIC is:

MOIC = Current Value of Investment / Total Invested Capital

Each component plays a crucial role:

Current Value of Investment: The present market value or exit value of the investment.

Total Invested Capital: The initial amount invested.

Unrealized vs. Realized MOIC

Unrealized and realized MOIC are two states of the Multiple on Invested Capital that reflect different stages of an investment's lifecycle in venture capital:

Unrealized MOIC refers to the calculation of the multiple based on the current market value of an investment that has not yet been liquidated or exited. It represents a paper value, indicating the potential return on investment if the investment were to be sold at its current valuation. Unrealized MOIC is a snapshot of the investment's performance at a given point in time, offering investors a glimpse into the possible outcome of their venture, assuming the market conditions remain favorable until the actual sale or exit.

Realized MOIC, on the other hand, is determined when an investment is actually sold or exited. It calculates the multiple based on the final sale price or exit value, representing the actual return on investment received by the investor. Realized MOIC is concrete, reflecting the tangible outcome of an investment after it has been fully liquidated.

The key difference between these two measures lies in their timing and certainty: unrealized MOIC is speculative, based on current valuations that can fluctuate, while realized MOIC is definitive, based on actual returns received from an investment. Both metrics are valuable for investors to assess and monitor the performance and potential of their investments over time.

MOIC vs. IRR

MOIC and IRR are both used to evaluate investment performance, but they do so in fundamentally different ways:

MOIC measures the total return on an investment as a multiple of the original investment. It's calculated by dividing the current or exit value of an investment by the initial amount invested. MOIC provides a straightforward, time-independent snapshot of investment performance, showing how many times the invested capital has been returned.

IRR, on the other hand, calculates the annualized effective compounded return rate of an investment, considering the time value of money. IRR is the rate at which the net present value of all the cash flows (both positive and negative) from a project or investment equals zero. It provides a time-weighted annual return, making it especially useful for comparing investments with different durations.

The primary difference between MOIC and IRR is how they incorporate time:

MOIC is a simple multiple, useful for quickly assessing the magnitude of return without considering the investment period.

IRR provides a deeper analysis by considering the timing of cash flows, offering a rate of return that accounts for the duration of the investment, making it possible to compare investments on a more nuanced level.

While MOIC offers a clear, immediate measure of how much value an investment has generated, IRR gives insight into the efficiency and timing of returns, accommodating more complex scenarios where the timing of cash inflows and outflows is a crucial factor.

Why MOIC is Important in Venture Capital

MOIC plays a crucial role in evaluating investment performance by providing a clear, direct measure of the financial returns relative to the initial capital invested. It does this by expressing the return as a multiple, showing investors how many times their original investment has been returned in value. This simplicity and directness make MOIC an invaluable tool for quickly assessing the effectiveness of investments in generating financial growth.

MOIC helps investors understand the value generated from their investments by offering a straightforward metric that reflects the total increase in value of an investment, without the complexity of accounting for time or the pattern of cash flows. It enables investors to gauge the overall success and efficiency of their investments in turning the initial capital into a larger sum. By comparing the initial investment to the current or exit value, investors get a clear picture of the investment's performance and its contribution to their financial objectives.

Related resource: VC Fund Performance Metrics 101 (and why they matter to LPs)

Compares Returns Across Investments and Funds

By expressing performance as a multiple, MOIC standardizes the evaluation of investment returns across different startups and VC funds, making comparisons straightforward despite variations in initial investment sizes. This standardization is possible because MOIC calculates returns relative to the invested capital, providing a ratio or multiple that directly reflects how many times the investment value has increased. For instance, an MOIC of 3x indicates that the investment value has tripled, regardless of whether the initial investment was $100,000 or $10 million. This approach abstracts away the absolute dollar amounts and focuses on the proportional return, enabling investors to compare the performance of various investments on an equal footing. MOIC thus serves as a universal metric that simplifies the assessment of financial efficiency and success across the diverse landscape of startup investments and VC fund portfolios, facilitating more informed decision-making processes for investors.

Provides a Benchmark for Success

MOIC serves as a robust benchmark for success by offering a uniform metric that quantifies investment performance as a multiple of the initial capital. This simplicity allows stakeholders to assess and compare the absolute return on investments across various ventures, irrespective of their scale or the amount of capital deployed.

In the competitive landscape of venture capital, where the goal is to maximize returns on investment, MOIC distills the essence of financial success into a single, comprehensible figure. It enables investors to quickly identify high-performing investments and make informed decisions based on the capacity of startups to multiply the initial funds provided.

By setting a clear, quantifiable standard, MOIC helps define what constitutes a successful venture within the industry, guiding both investors and entrepreneurs in their pursuit of exceptional growth and value creation.

Tracks Progress Over Time

MOIC can be calculated at various stages throughout the lifecycle of an investment, offering investors timely insights into its performance and future potential. By comparing the current or exit value of an investment to the original capital invested at different points, investors can track the progression of their investment's value over time.

This dynamic application of MOIC allows stakeholders to monitor growth trends, evaluate the effectiveness of strategic decisions, and adjust their expectations for future returns based on real-time data. Such periodic assessments of MOIC provide a clear, ongoing picture of an investment's health and potential, empowering investors with the information needed to make informed decisions regarding additional investments, exits, or strategic shifts to maximize returns.

How to Calculate MOIC

Calculating MOIC involves a straightforward process, enabling investors to assess the performance of their investments at any point in time. Here’s a step-by-step guide to calculating MOIC, along with an example to clarify the process:

Identify the Total Invested Capital: Determine the total amount of money invested in the venture. This includes all capital contributions made towards the investment.

Determine the Current or Exit Value of the Investment: Assess the current market value of the investment if it has not been sold, or use the exit value if the investment has been liquidated.

Calculate MOIC: Divide the current or exit value of the investment by the total invested capital. The formula is:

MOIC = Current Value of Investment / Total Invested Capital

Example:

Let’s assume you invested $100,000 in a startup. After a few years, the current market value of your investment is $400,000.

Total Invested Capital: $100,000

Current Value of Investment: $400,000

Using the MOIC formula: MOIC = $400,000 / $100,000 = 4

This means your investment has generated a return four times the original amount invested, indicating a significant increase in value and showcasing the investment's performance.

By calculating MOIC at various points during the investment period, investors can monitor the progression and potential future returns of their investments. This continuous assessment helps in making informed decisions, whether it's about holding onto the investment, considering additional funding, or planning an exit strategy.

What Is a Good MOIC?

A good MOIC (Multiple on Invested Capital) typically indicates that an investment has generated a substantial return relative to the initial capital invested. In venture capital, a MOIC of 3x or higher is often considered good, as it demonstrates that the investment has tripled the original amount invested, reflecting strong value creation and investment performance.

Example of a Good MOIC:

If an investor puts $1 million into a startup and later exits the investment for $4 million, the MOIC would be 4x. This is considered a strong performance, as the investor has quadrupled their initial investment.

Conversely, a bad MOIC falls below 1x, indicating that the investment has lost value and the investor receives back less capital than they originally invested.

Example of a Bad MOIC:

If an investor invests $1 million in a company, but the investment's value decreases, and they can only exit at $800,000, the MOIC would be 0.8x. This signifies a loss, as only 80% of the initial investment is recovered.

Track Your Fund Performance Data With Visible

By leveraging Visible, investors can track critical portfolio company and investment data all from one place. Learn how to get started with Visible to track your crucial investment data here.

Related resource: The Ultimate Guide to Startup Funding Stages

investors

Metrics and data

Operations

[Webinar] VC Portfolio Data Collection Best Practices

Collecting updates from portfolio companies on a regular basis is an important part of running smooth operations at a VC firm. Well-organized, accurate, up-to-date portfolio data helps investors provide better support, make data-informed investment decisions, and share more engaging insights with LPs.

However, collecting data from portfolio companies can also be a time-consuming and frustrating process if you’re not implementing best practices.

On Thursday, March 28th, Visible hosted a product webinar covering tips for streamlining the portfolio data collection process for VCs.

This webinar recording is not made publicly available. Reach out to our team to learn more about Visible.

Webinar Poll Results

Here are the results from the poll conducted during the webinar. The top three reasons VCs collect data from companies are:

Understand company performance in general

Send updates to current LPs

Provide better support to portfolio companies

Topics Discussed

Why VCs collect data from portfolio companies (poll)

Top 5 most common metrics to track

Founder-friendly data collection

What other investors are doing

How to set your firm up for data collection success

Advice from Visible customers

Demo of recent product updates

Time for questions

This webinar recording is not publicly available. Reach out to our team to learn more about VC portfolio data collection best practices.

Related Resources

Portfolio Data Collection Tips for VCs

The Best Practices for VC Portfolio Data Collection

Streamlining Portfolio Data Collection and Analysis Across the VC Firm

investors

Fundraising

Metrics and data

Customer Stories

[Webinar Recording] VC Fund Performance Metrics to Share When it’s ‘Early’ with Preface Ventures

It’s common for venture firms to start raising their next fund in the last year of capital deployment, typically years 3-4 of a fund’s life. This poses a sort of chicken-and-egg problem because many of the common fund performance metrics that Limited Partners use to drive allocation decisions only become reliable, and therefore more meaningful, around year six (Source: Cambridge Associates).

Farooq Abbasi, founder and General Partner of Preface Ventures, created a Seed Stage Enterprise VC Funding Napkin to help GPS think through alternative fund metrics that help communicate performance outside the traditional indicators that LPs use to measure success for more mature funds. The Seed Stage Enterprise VC Funding Napkin helps answer the question "What is good enough to raise a subsequent fund in the current market conditions".

Farooq from Preface Ventures joined us on Tuesday, February 27th for a discussion about the fund performance metrics GPs can use to benchmark and communicate fund performance when it's still 'early'.

View the recording below.

Webinar Topics

The issue with ‘typical’ fund performance metrics for ‘early’ funds

Overview of Preface Venture’s Seed Stage Enterprise VC Funding Napkin

Deep dive into alternative early performance benchmarks

How to keep track of alternative fund performance metrics

How to leverage alternative fund performance indicators into your fundraising narrative

Inside look into how Preface Ventures keeps LPs up to date

Q&A

Resources From the Webinar

Christoph Janz's What does it take to raise capital, in SaaS, in 2023?

Preface Ventures' A GP's View on VC Fund Performance When It's Early

Diversity VC

About Preface Ventures

Preface Ventures is a New York City-based firm started in 2020 led by Farooq Abbasi. Preface invests $500-$2M at the pre-seed and seed stage into startups who are building the Frontier Enterprise structure. Preface has 20 active positions in Fund II and 7 active positions in Fund III. (Learn more)

investors

Product Updates

Metrics and data

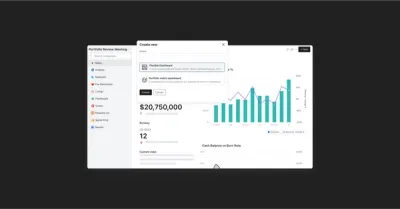

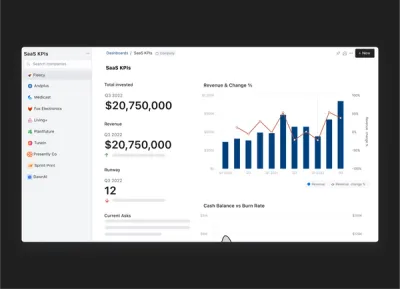

Product Update: Fund performance dashboard templates for VCs

Fund performance dashboard templates are here

Fund performance dashboard templates empower investors to build a best practice investment overview dashboard in 2-clicks and easily share it with stakeholders or team members.

How it works

Ensure your investment data is up to date in Visible and then select which fund data you want to visualize. Visible automatically creates a dashboard based on best practices. The dashboard includes key fund data and insights that help investors understand and communicate how their fund is performing. From there, the user can customize the dashboard by adding or removing widgets, changing the layout, changing colors, adding commentary and more.

The dashboard can then be duplicated and applied to different funds.

Fund metrics supported in Visible

Visible supports over 25 fund metrics and calculated insights including:

Total invested

Average investment amount

Total number of investments

Number of exits

Capital remaining

Follow on capital deployed

Gross IRR

Net IRR

Multiple

Total capital called

New capital deployed

% of fund called

Realized FMV

RVPI

TVPI

DPI

Management fees

Capital called

Escrow

Expenses

Carried interest

Distributions

and more

Learn more about the key fund metrics and calculated insights supported in Visible here.

founders

Metrics and data

[Webinar Recording] A Deep Dive of OpenView’s 2023 SaaS Benchmarks Survey

OpenView Ventures is back with its annual SaaS Benchmarks Survey & Report. Kyle Poyar of OpenView Ventures joined us to breakdown the report and what it means for founders. Check out the recording below:

Webinar Overview

Kyle Poyar of OpenView Ventures joined us on November 9th to take a deeper look at the 2023 OpenView Ventures SaaS Benchmark Survey with Kyle Poyar. Kyle is an Operating Partner where he helps portfolio companies fuel growth and become market leaders. He specializes in monetization, product-led growth (PLG), and SaaS metrics. A few topics you can expect us to hit on:

SaaS Pricing Models

Churn benchmarks

AI adoption

Financial performance

founders

Metrics and data

Market Penetration Strategy 101: How to Calculate & Best Strategies

Market penetration can elevate a business to new levels by tapping into existing products in current markets. This article will delve into what market penetration is, how it’s calculated, and the optimal strategies to achieve it. Whether you’re a startup or an established enterprise, understanding market penetration can help enhance market share and drive success.

What is Market Penetration?

Market penetration is a business growth strategy where companies aim to increase their market share of existing products or services in existing markets. Market penetration is crucial for businesses looking to solidify their presence in an industry and build a robust customer base.

This is done by selling more products or services to current customers or by finding new customers within existing markets. It can be achieved through various tactics like pricing strategies, advertising, sales promotions, and product improvements or innovations. The primary goal of this strategy is to increase market share, revenue, and customer loyalty within a market where the products or services are already available.

The degree of market penetration can be an indicator of the brand’s popularity, business growth, and the level of risk involved. It’s crucial for evaluating the success of products and services in the market and is also a critical factor in developing effective marketing strategies and plans.

Images source

How is Market Penetration Calculated?

Market Penetration is calculated to understand the existing sales or market share of a company in comparison to the total market potential. It provides insights into how much of the potential market a company has been able to capture.

Formula for Market Penetration Rate

Actual Market Size is the current market share or sales volume of the company.

Total Addressable Market (TAM) represents the total sales revenue opportunity available for all companies in a particular market.

Example:

Let’s say a company sells 500 units annually in a market where 10,000 units are sold in total by all competitors. The Market Penetration Rate would be:

This calculation implies that the company has captured 5% of the total market.

Additional resources:

Total Addressable Market Template– In order to help calculate your market share and your potential to build a large business, it helps to calculate and understand the total addressable market and sensitivity analysis. Check out our free total addressable market template below

When & How to Calculate Market Share (With Formulas)

Suggest Market Penetration Rate for Startups

Once you’ve calculated the market penetration rate, it’s essential to analyze it in context. A high rate may indicate a strong market presence but may also suggest market saturation, limiting growth. A lower rate can point to significant growth opportunities, but it could also reflect poor market fit or strong competition.

Companies often use market penetration metrics alongside other market analysis tools and industry benchmarks to develop effective market strategies and identify growth opportunities.

For startups, achieving a market penetration rate of 2-3% is often considered commendable, and it can serve as a strong foundation for further expansion and growth.

8 Best Market Penetration Strategies

To achieve greater market penetration, various strategies can be implemented. The selection depends on the business model, industry, and target audience. Below are eight effective market penetration strategies:

1) Dynamic Pricing

Dynamic Pricing can be a powerful tool for companies looking to penetrate existing markets more deeply. It is a strategy where companies adjust the prices of their products or services in real-time, or near real-time, in response to market demands, competitor prices, and other external factors.

This strategy can be pivotal in achieving higher market share in existing markets as it allows businesses to quickly adapt to market conditions and customer behaviors.

By adjusting prices to meet market conditions and consumer expectations, businesses can optimize their sales and profits, attract more customers, and enhance their market share. However, it’s crucial to manage this strategy carefully to maintain customer trust and satisfaction.

How It Works:

Dynamic Pricing leverages advanced technologies and algorithms to analyze multiple factors that influence demand, including seasonality, competitor prices, inventory levels, and consumer behavior. Based on this analysis, prices are adjusted to optimize sales, revenue, or margins.

Pros

Maximizes Revenue: Enables businesses to adjust prices to meet demand, maximizing revenue during high demand and possibly stimulating sales during low demand.

Competitive Advantage: Allows for real-time response to competitors’ pricing strategies, helping companies stay competitive in the market.

Optimizes Inventory: Helps in managing inventory more effectively by increasing prices when stock is low or decreasing prices to move surplus inventory.

Customer Segmentation: Offers the possibility to segment customers and offer different prices based on customer willingness to pay, optimizing revenue and customer satisfaction.

Market Responsiveness: Provides the flexibility to quickly respond to market conditions like changes in demand or supply, ensuring optimal pricing at all times.

Cons

Customer Dissatisfaction: Customers may perceive dynamic pricing as unfair, especially if they find out they paid more for the same product or service than others, potentially leading to loss of trust and customer churn.

Complex Implementation: Requires sophisticated software, algorithms, and expertise to analyze data and adjust prices accurately and effectively, which can be resource-intensive.

Brand Image Risk: Frequent price changes, especially upward revisions, can lead to a negative brand image and accusations of price gouging.

Price Wars: Can lead to destructive price wars with competitors, resulting in decreased profit margins for all market players.

Legal and Ethical Considerations: In some industries and jurisdictions, there may be legal restrictions and ethical considerations around dynamic pricing, and violating these can lead to fines and reputational damage.

2) Adding Distribution Channels

Adding distribution channels refers to the strategy of increasing the number of ways or locations through which customers can access and purchase a company’s products or services.

By making products or services available through a variety of channels, companies can reach a broader audience, adapt to customer purchasing preferences, and ultimately increase sales and market share within existing markets. This strategy requires careful planning and management to ensure consistency in brand image and customer experience across all channels.

Pros

Increased Sales: Access to more customers through varied channels can lead to higher sales and subsequently, increased market share.

Enhanced Market Coverage: More channels mean broader market coverage, enabling the business to reach different customer segments and geographic locations within the existing market.

Customer Convenience: Providing multiple purchasing options caters to diverse customer preferences, potentially improving customer satisfaction and loyalty.

Risk Diversification: Distributing through various channels reduces dependency on one, mitigating risks associated with the underperformance of a single channel.

Brand Visibility: Presence across multiple channels enhances brand visibility and awareness, contributing to brand equity.

Cons

Complex Management: Managing multiple channels can be logistically complex and administratively challenging, requiring additional resources and efforts.

Inconsistent Brand Image: Maintaining a consistent brand image and customer experience across varied channels can be challenging, potentially affecting brand perception.

Channel Conflict: Different channels might compete against each other for the same customers, leading to potential conflicts and affecting relationships with channel partners.

Reduced Profit Margins: Some channels might require price reductions or additional expenditures, such as commissions for third-party sellers, impacting profit margins.

Customer Confusion: Offering products through too many channels, especially with varied pricing or promotional offers, can confuse customers and dilute the brand value.

When adding distribution channels, companies need to strategically assess the potential impact on the brand, customer experience, and overall business operations. Proper integration, management, and consistent monitoring of all channels are crucial to addressing the challenges and reaping the benefits of this strategy. Balancing the added complexity with the potential advantages is key to successful implementation and sustainable growth in market penetration.

3) Geo-Targeting Specific Locations

Geo-targeting specific locations involves tailoring your marketing and sales efforts to target customers in a specific geographical area or region. This technique is often utilized by businesses to focus resources on areas where they are likely to gain the most traction, allowing them to reach and serve customers more effectively and efficiently.

Geo-targeting can be implemented using various tools and platforms like online advertising services, SEO, and social media, which allow businesses to specify the geographic locations they want to target. Additionally, analytics and data analysis can help in identifying the most lucrative regions to focus on.

Pros

Enhanced Personalization: Allows for more personalized and locally relevant marketing campaigns, improving engagement and conversion rates.

Resource Optimization: Focuses resources and efforts on high-potential or high-performing regions, ensuring better utilization and improved ROI.

Improved Customer Experience: Offering localized content, deals, and products caters to regional preferences and needs, leading to higher customer satisfaction and loyalty.

Market Insight: Provides valuable insights into regional market trends, consumer behavior, and preferences, aiding in better decision-making and strategy formulation.

Competitive Edge: Establishing a strong presence in specific locations can provide a competitive advantage, especially in areas with less competition.

Cons

Limited Reach: Focusing on specific locations might limit the overall reach of the business, potentially missing out on opportunities in other regions.

Resource Intensity: Developing localized strategies and content can be resource-intensive and might require significant investment in research and adaptation.

Market Variability: Different regions may exhibit varying demand patterns, requiring constant adjustments and refinements to the targeting strategy.

Cultural Sensitivity: There’s a risk of misunderstanding local cultures and preferences, which might lead to ineffective or even offensive campaigns.

Data Privacy Concerns: The use of location data can raise privacy concerns and regulatory issues, potentially leading to legal challenges and reputational damage.

4) Continuous Improvements of Products

Continuous improvements of products refer to the ongoing effort to refine and enhance products based on customer feedback, market demands, technological advancements, or competitive dynamics. This strategy is crucial in market penetration as it helps in maintaining and enhancing the appeal of the products, addressing evolving customer needs, and staying competitive in the market.

Pros

Increased Customer Satisfaction: Addressing customer needs and resolving issues lead to higher satisfaction and loyalty.

Enhanced Market Position: Ongoing improvements help in maintaining a competitive edge and solidifying market presence.

Revenue Growth: Enhanced features and quality can justify higher pricing, leading to increased revenue.

Brand Strengthening: Demonstrating commitment to excellence and innovation enhances brand reputation and equity.

Cons

High Costs: Constant refinement and development can be resource-intensive and costly.

Overcomplication: Adding too many features or making too many changes can complicate the product, potentially alienating users.

Customer Overwhelm: Frequent changes and updates can overwhelm and frustrate customers, especially if they are not well-communicated.

Market Misalignment: Without proper market research, improvements may not align with actual customer needs, leading to wasted resources and missed opportunities.

5) Launch a New Product or Rebrand

Launching a new product or rebranding refers to the introduction of a novel product or a significant transformation of existing brand elements, respectively, to appeal to the current market. This can be a pivotal market penetration strategy, aiming to renew consumer interest and address evolving market demands, preferences, and competition.

Pros

Increased Market Share: New or revitalized offerings can attract a wider audience and capture additional market segments.

Enhanced Brand Image: A successful rebrand can modernize and elevate the brand’s image, improving perceptions and attractiveness.

Revenue Growth: New products and improved brand image can drive sales and potentially allow for premium pricing.

Adaptation to Market Changes: Enables the business to stay relevant and responsive to evolving market trends, demands, and consumer expectations.

Cons

High Risk and Uncertainty: The success of a new product or a rebrand is not guaranteed and may not resonate with consumers, leading to financial losses.

Substantial Investment: Development, launch, and rebranding processes can be costly, involving substantial investment in research, marketing, and implementation.

Potential Customer Alienation: Existing customers may react negatively to significant changes in products or brand identity, potentially leading to loss of loyalty.

Implementation Challenges: Executing a rebrand or launching a new product involves logistical, operational, and strategic challenges, requiring meticulous planning and coordination.

6) Build Relationships With Business Partners

Building relationships with business partners involves creating and nurturing mutually beneficial connections with other businesses, suppliers, distributors, or stakeholders in your industry. This strategy is crucial in market penetration as it can open up new avenues for growth, co-development, and expansion, allowing businesses to leverage collective resources, networks, and expertise to enhance market presence.

Pros

Expanded Reach: Access to partners’ networks and resources can significantly extend market reach and presence.

Increased Innovation: Collaborative efforts can lead to innovative solutions and offerings, enhancing competitive advantage.

Cost Efficiency: Sharing resources and responsibilities can lead to reduced operational costs and increased efficiency.

Enhanced Learning: Exposure to partners’ expertise and insights can lead to valuable learning and growth opportunities.

Cons

Potential Conflicts: Divergent goals, values, or management styles can lead to conflicts and strains in partnerships.

Dependence Risks: Reliance on partners can pose risks in case of disagreements, underperformance, or termination of partnerships.

Loss of Control: Collaborations may require concessions and shared decision-making, potentially leading to loss of control over certain aspects of the business.

Resource Diversion: Managing partnerships can be resource-intensive and might divert focus and resources from core activities.

7) Buy a Smaller Competitor in Your Industry

Buying a smaller competitor, also known as acquisition, refers to purchasing another company to control its assets and operations. This market penetration strategy can be powerful, as it allows a company to quickly increase its market share, expand its product or service offerings, and eliminate competition.

When considering acquiring a smaller competitor, thorough due diligence is paramount to assess the compatibility, valuation, and potential synergies accurately. A well-planned integration strategy, clear communication, and cultural alignment are crucial for realizing the full benefits of the acquisition and ensuring smooth transition and consolidation, thus enhancing market penetration and long-term success.

Pros

Rapid Market Expansion: Provides immediate access to new market segments, geographic areas, and customer groups.

Enhanced Resources and Technologies: Acquisition brings in additional resources, technologies, and intellectual properties, enhancing overall capabilities.

Cost and Revenue Synergies: Merging operations can lead to cost savings and additional revenue opportunities, increasing profitability.

Strategic Positioning: Reducing competition and leveraging combined strengths can strengthen market positioning and dominance.

Cons

Integration Challenges: Merging different corporate cultures, systems, and operations can be complex and challenging.

High Costs and Risks: Acquisition involves significant financial investment and carries risks of overvaluation and unanticipated complications.

Potential Culture Clash: Differences in organizational cultures and management styles can lead to conflicts and employee dissatisfaction.

Regulatory Hurdles: Acquisitions may be subject to stringent regulatory scrutiny and approval, potentially impacting the feasibility and timelines.

8) Provide a Rewards Program or Promotional Program

Providing a Rewards or Promotional Program refers to offering incentives like discounts, points, or special offers to customers to encourage loyalty, repeat business, and attract new customers. These programs are instrumental in market penetration as they help in increasing product or service usage among existing customers and drawing in new clientele.

When implementing rewards or promotional programs, it is important to balance the incentives with the overall business strategy and ensure that the programs are sustainable, beneficial, and aligned with brand values. A well-crafted and managed rewards program can be a powerful tool for market penetration, building long-lasting relationships with customers, and creating a competitive advantage in the market.

Pros

Increased Sales: By incentivizing purchases, such programs can drive up sales volumes and revenues.

Customer Data Collection: These programs often involve collecting customer data, which can be analyzed to gain insights into consumer behavior and preferences.

Enhanced Customer Satisfaction: Customers receiving rewards or benefits are likely to be more satisfied and have a positive perception of the brand.

Effective Word-of-Mouth Marketing: Satisfied customers, especially those benefiting from rewards, are more likely to recommend the brand to others.

Cons

Cost Implications: Implementing and maintaining rewards programs can be costly, impacting profit margins.

Customer Expectation Management: Customers may come to expect regular promotions, potentially impacting perceived value and full-price sales.

Complexity in Management: Designing, managing, and optimizing rewards or promotional programs can be complex and resource-intensive.

Risk of Decreased Perceived Value: Regular and extensive promotions can lead to a devaluation of the product or service in the eyes of consumers.

Raise Funds and Penetrate Your Market With Visible

Market penetration is a pivotal strategy for businesses aiming to enhance their market share in existing markets with existing or innovative products. Whether it’s through employing dynamic pricing, adding distribution channels, geo-targeting, continually improving products, launching new products or rebranding, forging business partnerships, acquiring smaller competitors, or providing compelling rewards or promotional programs, each strategy carries its unique set of advantages and challenges.

The key is to meticulously analyze and integrate these strategies, aligning them with the overarching business objectives, customer needs, and market dynamics, to drive sustainable growth and success. Leveraging such multifaceted approaches can aid in navigating the competitive landscape, fostering customer loyalty, and achieving a robust market presence, propelling your business to new heights. And, to successfully penetrate the market, raising funds effectively is crucial—discover how Visible can assist in making your fundraising journey seamless and successful.

Related resource: What is Internal Rate of Return (IRR) in Venture Capital

investors

Metrics and data

TVPI for VCs — Definition and Why It Matters

What is TVPI

In simple terms, ‘Total Value to Paid In’, also known as TVPI, communicates how much a VC fund is worth on paper compared to how much money Limited Partners (LPs) have put into the fund.

To calculate TVPI you take the total distributions paid back to the LPs (realized gains) and add it to the residual value of the investments in the fund (unrealized gains) and then divide the value by how much Limited Partners have contributed to a fund.

It’s important to remember that LPs do not contribute all their committed capital to a fund all at once but rather over time it is ‘called’ by the General Partner for specific reasons such as a new investment.

Related Resource: Fund Performance Metrics 101 (and why they matter to LPs)

Why does TVPI matter in VC

TVPI is one of the earliest indicators current and prospective LP’s will use to measure the performance of a VC fund. It’s essentially communicating whether the fund’s performance is heading in the right direction. In other words, it demonstrates whether the value of investments have increased or decreased.

Any TVPI value greater than 1x means that the fund’s value has grown over time.

LPs use TVPI to compare the performance of funds against each other. The greater the TVPI, the greater the increase in the value of the fund.

To better understand TVPI benchmarks check out Pitchbook’s Benchmark Report as of Q4 2022.

Visible empowers investors to visualize, share, and communicate their most important fund metrics in flexible dashboards.

TVPI within the current market context

According to Hustle Fund, TVPI is the metric that investors are currently feeling squeamish about reporting to potential Limited Partners in today’s tough market conditions. The reason TVPI is low for many funds right now is because their portfolio companies are having a hard time fundraising. If portfolio companies are raising priced rounds at all, the increase in company valuations are marginal or even lower than before (when this occurs it’s called a Down Round).

This means investors are not likely to be marking up any of their investments, causing TVPI to remain the same or even decrease with down rounds.

Whether your TVPI has gone up or down in the last quarter, it’s important to maintain transparent communication with LPs in both good times and the bad.

Check out Visible’s LP Update Template Library to inspire better communication with your LPs this quarter.

Using Visible to track and visualize fund metrics

With Visible investors can keep track of over 30+ fund metrics including:

TVPI

RVPI

DPI

IRR

Multiple

And more

Fund metrics can be visualized in Visible's flexible dashboards alongside text, properties, variance charts, and portfolio metric data.

Over 400+ VCs use Visible to streamline their portfolio monitoring and reporting.

investors

Metrics and data

Reporting

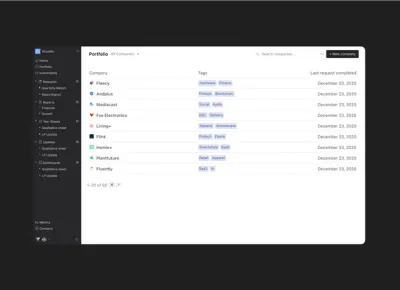

Streamlining Portfolio Data Collection and Analysis Across the VC Firm

Many Venture Capital firms struggle to efficiently collect updates from their portfolio companies and turn the data into meaningful insights for their firm and Limited Partners. It’s usually a painful process consisting of messy Google Sheets or Excel file templates being sent to companies. Then, someone at the VC firm is responsible for the painful task of tracking down companies and convincing them to send the metric template back to the investor. The end result is typically an unreliable master sheet that isn’t accessible or easy to digest for the rest of the firm.

Visible has helped over 350+ VC firms streamline the way they collect, analyze, and report on their portfolio and fund performance. Keep reading to learn how.

Streamlining Portfolio Data Collection

To set up a more efficient portfolio data collection process at your firm make sure you:

Don't require companies to manage another login

Visible’s data Requests are delivered directly to your companies’ email inboxes and the secure-linked base form ensures there is no friction in the data-sharing process.

Maintain founder privacy

Visible supports over 3.5k founders on our platform and the consistent feedback we hear is founders do not want their investors to have direct access to their data sources. Founders prefer to have control over what and when their data is shared with investors.

Customize which information you request from companies

Visible allows investors to create any custom metric, qualitative question, yes/no response, multiple choice, and more. This provides investors with the flexibility to use Visible for more than just financial reporting but also impact or diversity reporting and end-of-year audit preparation.

Related resource: Portfolio Monitoring Tips for Venture Capital Investors

Related resource: Which Metrics Should I Collect from My Portfolio Companies

Easy Ways to Analyze VC Portfolio Data

While having up-to-date, accurate investment data is important, being able to extract and communicate insights about your portfolio data is when it really becomes valuable. Visible supports three different types of dashboards to help you analyze your portfolio data more easily.

Flexible portfolio company dashboards — Visualize KPI’s by choosing from 9 different chart types and combine with rich text and company properties. These dashboards are a great fit to help facilitate more robust internal portfolio review meetings.

Portfolio metric dashboards — This dashboard allows you to compare performance across your entire portfolio and easily identify your top performers and the companies who may need additional support.

Fund analytics dashboards — This flexible dashboard lets investors control how they want to visualize and analyze their fund performance metrics. Choose from over 30+ fund metrics and auto calculated insights and easily add them to your shareable dashboard.

View an example of all three types of dashboards by downloading the resource below.

Sharing Portfolio Updates with Limited Partners

It’s important to remember that while Limited Partners are primarily focused on financial returns they also care about insights. VC firms who empower their Limited Partners with updates about sector trends and high-level insight into portfolio company performance are setting themselves up to be both trusted and valuable long-term partners to their investors.

LP Update Template Library — Visible makes it easy for firms to make engaging communication with Limited Partners a habit by providing free and open-source Update templates. Want to feature your LP Update template in out library? Get in touch!

Tear Sheets — Tear Sheets or One Pagers can be a great way to provide high-level updates about portfolio companies to your LPs. Visible’s tear sheet template solution helps VC firms create reporting with ease by merging information and data into beautiful charts that are automatically kept up to date.

View Tear Sheet examples to inspire your next reporting.

Related resource: Tear Sheets 101 (and how to build one in Visible)

Visible supports 400+ funds around the world streamline the portfolio data collection, analysis, and reporting process.

investors

Operations

Metrics and data

Portfolio Management: What it is and How to Scale it at Your VC Firm

What is VC Portfolio Management?

Portfolio Management in Venture Capital is a process used by VC investors with the ultimate goal of protecting and increasing the value of their investments. Proper portfolio management is a cumulation of intelligent decision-making, information analysis, and resource commitment all aimed at achieving the value increase and stability in a range of investments.

Portfolio Management within the VC context generally consists of the following:

Market Research and Oversight

Venture capitalists need to be extremely savvy and up-to-date with the most relevant and real-time information about the industries they investment in. Typically, VC firms specialize in a particular type of investment (pre-seed, seed, later stage, etc) and sometimes they are industry specific (B2B Saas, B2C, EnviroTech, FemTech). Therefore, the portfolio that a VC is managing may encompass many different industries. Investors should aim to understand the most up-to-date research on how each industry and market is growing and changing. This helps investors make smart initial investment decisions, inform follow-up funding decisions, and appropriately advise on timely exit strategies.

Risk Profiling

VC investing is a risky business. However, a clear understanding of how long it will take to gain a return on an investment is critical for investors and goes hand in hand with market research when setting up a portfolio management strategy. VCs need to profile the level of risk of each investment with an informed understanding how long it will likely take to get their initial investment back (typically 3-7 years) and how likely they are to 10x their investment. The balance of quick return with high potential is critical to consider when managing new investments in a VC portfolio.

Exit Strategies

As a VC is first making an investment, they typically write into their investment strategy how they hope to exit the business. This plan includes identifying exit targets and appropriate negotiation engagements in best and worst-case scenarios for the business. Strategies might be mergers, acquisitions, buyouts, or public offerings. An ideal exit strategy is important to outline as a part of a portfolio management strategy. This helps investors better mitigate risk and understand the potential outcomes and value of a portfolio.

Related resource: What is Acquihiring? A Comprehensive Guide for Founders

How Exactly Does Portfolio Management Work?

More experienced venture capitalists will use their past experiences to determine patterns in investment strategies and the most effective way to interpret different potential investment outcome scenarios. Ultimately, portfolio management in Venture Capital comes down to understanding the delicate balance of qualitative and quantitative information about the investments in a portfolio.

Portfolio management internally within a VC fund consists of market research and oversight, risk profiling, and formulating numerous potential exit strategies. In order to work through these steps, a VC will need updated information from their portfolio companies on a regular basis. VCs are looking for a mix of metrics and qualitative data from their portfolio.

If you’re a VC looking to streamline the way you collect data from your portfolio companies, check out What Metrics Should I Be Collecting from my Portfolio Companies.

Collecting Portfolio Data in Visible

70% of the 350+ funds using Visible are requesting data from companies on a quarterly basis. Learn more about portfolio monitoring in Visible.

Check out an Example Request in Visible.

Portfolio Management Metrics

Of course, there are metrics that are commonly tracked amongst VC portfolio companies to help VCs stay on top of their portfolio performance. A couple of the key metrics and areas we generally see VCs focused on:

Financials and cash position

A VC wants the honest truth about how their companies are positioned financially. They will want to know metrics such as Cash Balance, Burn Rate, Runway, and Gross Profit. Investors may also ask for the forecast for these metrics. This information helps a VC determine whether they’re likely to reserve cash for a follow-up investment in a company and what a potential exit strategy might be.

Related Resources: Which Metrics Should I Collect from My Portfolio Companies?

True North KPIs

Depending on the type of business a company is operating, their ‘True North’ KPIs will differ. A company’s true north KPIs should be the key performance indicators that are guiding the business every single day. Beyond revenue goals, examples of other KPIs could be active users, a customer net promoter score, active customers, or average contract value. These KPIs will help a VC determine how the company is performing versus sector benchmarks.

Related Resources: Startup Metrics You Need to Monitor

Ownership and Cap Table Data

If a VC is looking to make a new investment, an important component they will consider for their portfolio management is how much ownership they will have in the company. A founder seeking investment should be transparent about what percent of the company is available in exchange for investment (if any) and how much is already taken. In addition to a clear ownership breakdown, a company should share information about its securities (stock options etc..). This information will be extremely relevant as the VC determines how to structure a potential investment deal.

Portfolio Management Qualitative Information

Collecting the metrics and quantitative data is only part of the portfolio management process. We also see investors collect a number of different qualitative fields to help them better understand how a company is performing. A couple of examples below:

Wins from the Previous Period

Founders shouldn’t be shy. Companies should be sure to highlight their most recent, and impressive wins as a company. This will energize and excite a VC who is determining which of their current companies they may want to make a follow-on investment into. Investors will also likely use this information when deciding whether to introduce a company to a potential follow-on investor. When investors make intros to other investors, they’re putting their social capital on the line. Companies who have instilled confidence in their current investors are more likely to get intros to follow on funders.

The VC Advantage

Venture capitalists take portfolio management so seriously because they of course want to see their portfolio investments succeed and make money. Therefore, outside of putting down the initial investment, venture capitalists usually incorporate many other touchpoints and opportunities to help their investments succeed. Outside of the fiscal advantage VC investments provide, a close relationship with investors and VCs can be a competitive advantage that makes or breaks a company.

Ultimately, VCs want to help their portfolio companies because it helps them. In addition to actively monitoring the metric performance of their portfolio, VCs want to offer assistance in any way that they can to give their investments a competitive advantage. These competitive advantage points are also a part of a successful portfolio management strategy. VCs help their portfolio companies in a variety of ways:

Taking action on metrics – As mentioned above, VCs are continuously monitoring their portfolio investments. VCs analyze their companies’ profits, customer churn, average deal size, and more. An informed VC can provide insights and advice to companies to help them improve their performance metrics. Drawing form experience managing other investments, they will have insight into what works and what to avoid or change in order to succeed.

Hiring decisions – VC partners are often ex-founders who have successfully built and exited one ore more companies. They are experienced in hiring founding teams and can help advise what roles are the most critical to higher first. Additionally, VCs networks are deep and wide. A founder may have the chance to hire a seasoned CFO or CMO through an intro from a VC. Hiring the right people is critical to the success of early stage companies and leaning on a VC partner to do so may allow a founder to access talent that wouldn’t have otherwise been interested in their company. (Relevant resource: 5 Ways to Help Your Portfolio Companies Find Talent)

Fundraising assistance – Fundraising is exhausting but necessary as companies aim to quickly scale their business. After partnering with a VC for an early round, investors want to ensure the right investment partners come onboard for later rounds. If a company is on track to succeed, leaning on existing VC relationships to find additional investors is a smart idea. An existing VC will want to work with other firms or angels they get along with or align with ideologically and will often go above and beyond to help you make new connections and raise a new round of funding. (Relevant resource: How to share your fundraising pipeline with your current investors)

Strategic product decisions – With a close eye on the market, a VC can be a good sounding board for what pivots or iterations to make to a company’s product. It’s easy for founders to get stuck in a silo, only focusing on the details of their product. A VC can provide helpful advice on what decisions to make that better keep in mind the market and competitors, even providing tough love on what product decisions might not be right.

Related Resources: How to Lead a Portfolio Review Meeting for VC’s

How Visible Can Help

Investors of all stages are using Visible to streamline their portfolio monitoring and reporting processes. Visible helps investors streamline the way they collect data from their founders on a regular basis and provides data visualization and reporting tools.

Over 400+ Venture Capital investors are using Visible to streamline their portfolio monitoring and reporting. Learn more.

investors

Metrics and data

Operations

Portfolio Monitoring Tips for Venture Capital Investors

What is Portfolio Monitoring

Portfolio monitoring in the context of Venture Capital is the process of tracking the performance of investments in a venture fund. The primary focus of portfolio monitoring is tracking the financial metrics of a company but it also includes monitoring key operational changes, fluctuations in companies’ valuations, and trends in the respective company’s market or industry.

We recently asked 50+ investors to choose their top three reasons for collecting structured data as a part of their portfolio monitoring processes.

You can find a summary of the results below —

Top three reasons investors take portfolio monitoring seriously:

Investors want to better understand how their companies are performing in general

Investors want to provide better support to companies

Investors need to provide updates to Limited Partners

How to Monitor Venture Capital Portfolio Companies

Investors struggle to monitor their portfolio companies effectively because if they hear from companies at all, it’s in a format that is unstructured and in a frequency that is unpredictable. This makes it extremely difficult for investors to have an accurate data set from which they can draw meaningful insights or share updates with their Limited Partners.

Investors who effectively monitor their portfolio companies have a process in place to collect structured updates from their companies on a regular basis — from day one. In the early days of a fund when there are typically less than 10 companies, this can look like sending an Excel file or Google Sheet template to portfolio companies via email and asking them to complete it and send it back.

It’s important to have a reporting process in place from day one because the more time that passes, the harder it can be to change portfolio company behavior when it comes to reporting.

As a fund’s portfolio grows, this process becomes cumbersome and investors often find they are wasting time chasing companies, trying to keep track of which companies have responded and which haven’t, and collating numerous templates into a master portfolio data file.

Visible helps over 400+ investors streamline the way they collect, analyze, and report on their portfolio data.

What Metrics to Track for VC Portfolio Companies

To monitor the performance of portfolio companies it’s crucial to track the right metrics across all your companies. The most common metrics to track include:

Revenue

Cash Balance

Monthly Net Burn Rate

Runway

Net Income

Headcount

Read more about which metrics to collect from portfolio companies and why.

Based on data from the 400+ funds using Visible, most investors are asking for their companies to report 8 metrics and 1-2 qualitative questions on a quarterly basis.

Learn more about VC Portfolio Data Collection Best Practices in our guide.

VC Portfolio Monitoring Template

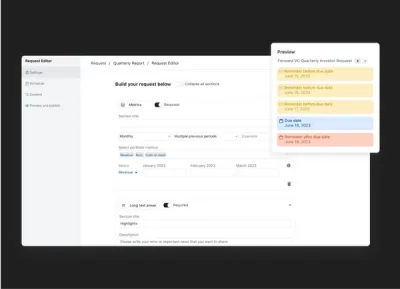

Visible provides investors with a streamlined, founder-friendly way to collect structured data from portfolio companies on a regular basis. The solution in Visible that empowers investors to easily collect KPIs is called a Request.

Visible allows investors to build custom data Requests that support:

Automated email reminders to reduce chasing companies

Assigning custom metrics to certain companies

Sending a Request to multiple points of contact

Asking for budget vs actuals

Secure linked-based forms for companies

Portfolio companies reporting in multiple currencies

Check out an Example Request in Visible.

Portfolio Monitoring Tips for Venture Capital Investors

Set expectations early on.

Consider outlining your reporting requirements in a side letter

Have a process in place to collect data from day one — it’s harder to change reporting behavior change later on

Incorporate reporting expectations into your onboarding process

Check out this Guide to Onboarding New Companies into Your VC Portfolio.

Communicate the why to portfolio companies.

Explain how responses will help inform portfolio support

Explain which data will be shared with LPs and which is just for internal processing

Explain how it will be used to inform follow on investment decisions

Make your data Requests founder-friendly.

Don’t ask for more than 5-8 metrics

Use metric definitions to reduce back-and-forth

Send your Request at the same time every period

Make sure you have the right points of contact at the company

Don’t make your companies create an account if they don’t want to

Turning Your Portfolio Data into Meaningful Insights

After going through the effort to collect structured data from portfolio companies the next important step is turning into important insights that can be shared with your team and eventually your Limited Partners.

Visible has a suite of tools to help with portfolio data analysis including

Robust, flexible dashboards that can be used for Internal Portfolio Review meetings

Portfolio metric dashboards to help with cross-portfolio insights

Tools to slice and dice your portfolio data by custom segments

Over 400+ Venture Capital investors are using Visible to streamline their portfolio monitoring and reporting.

investors

Metrics and data

Customer Stories

Case Study: How The Artemis Fund Uses Visible to Create Annual Impact Reports

About The Artemis Fund

The Artemis Fund is on a mission to diversify the face of wealth. Founded in 2019 in Houston Texas, the firm is led by General Partners Diana Murakhovskaya, Leslie Goldman, and Stephanie Campbell. Their team of five invests at the seed stage and leverages their conviction that the future of financial services and commerce will be written by diverse entrepreneurs. The Artemis Fund has invested in 20 disruptive fintech, e-commerce tech, and care-tech companies founded and led by women.

The Artemis Fund joined Visible in April 2021 with the primary objective of streamlining the way they collect both core financial metrics and impact metrics from their growing portfolio. For two years in a row now, The Artemis Fund has turned their metrics into a data-driven impact report using Visible’s portfolio monitoring tools.

Unexpected Benefits of Creating Impact Reports

Juliette Richert from The Artemis Fund shared the objective of their impact reports has broadened over time — reaping more benefits than they originally intended.

Impact is integral to The Artemis Fund’s investment thesis so there was always a desire to measure their impact; however, the primary objective of publishing their first impact report in 2021 was for fundraising from future LPs. Needing data to back up the narrative of your portfolio’s performance to LP’s is something we commonly hear from investors using Visible.

Over time, the team at Artemis realized the companies they were investing in were having an outsized impact on the communities they are serving. Juliette shared their “portfolio companies are very focused on their end users.” The Artemis team worked with their founders to identify which impact metrics are most integral to their businesses and then Artemis began tracking them using Visible’s portfolio monitoring tools. This larger ripple effect is a major driver behind Artemis’ work and so the team was excited to have actual metrics to back up their investment strategy.

The Artemis Fund’s 2022 impact report clearly communciates their thesis and the narrative behind their portfolio companies’ performance, both of which are made more compelling because they’re backed up by data.

This year they distributed their impact report to their wider network. The unexpected result was that it has become a valuable marketing tool for their fund for not just potential investors but it’s helped attract more founders to their deal pipeline as well. Artemis’ report clearly demonstrates that they’re not just paying lip service to investing and supporting female founders — they’re actually executing against their values and have the data to prove it.

“Using Visible streamlines the way we collect and digest metrics, helping us understand the health of our portfolio and address potential issues proactively.”

— Juliette Richert, The Artemis Fund

Choosing Which Impact Metrics to Track

The first step of creating Artemis’ Impact Report was choosing which metrics to track from their portfolio companies and setting up a data Request in Visible.

Check out an Example Portfolio Data Request in Visible.

The Artemis Fund created 35+ custom metrics in Visible, some of which were collected from all companies, and the rest were assigned to specific companies based on the business model or sector.

Headcount Metrics

Artemis collects these metrics from all companies on an annual basis.

FTE Headcount

PTE/Contractor Headcount

Diverse Headcount #

Female Headcount #

Custom Impact Metrics

Artemis assigns these metrics to specific companies in VIsible and collects them on an annual basis. The list below is not comprehensive.

CO2 Saved (Assigned to portfolio company DressX)

Families Served (Assigned to portfolio company Hello Divorce)

Musicians Served (Assigned to portfolio company Green Room)

Financial Metrics

Artemis collects these metrics on a monthly basis from all companies. The list below is not comprehensive.

Cash Burn

Cash Balance

Revenue

Expected Runway

Total Funding

The Artemis Fund Collected Annual Impact Metrics with a 94% Response Rate Using Visible

Aggregating Impact Data into a Report

Next, The Artemis Fund aggregated their portfolio data within Visible using the Portfolio Metric Dashboard which provides quick insights such as the total, minimum, maximum, median for any metric.

The portfolio-wide metrics Artemis included in their report are Revenue & Capital for SMBs, Number of Families Served, and Number of Jobs created.

This year, instead of providing an overview of each company they chose to highlight specific companies in the form of a case study in their impact report. The result is a more digestible yet compelling report that certainly helps LPs and founders understand the type of companies Artemis’ chooses to back.

The entire compiled report is 17 slides. The Artemis Fund’s deck is hosted on Visible’s deck feature which allows them to distribute the deck via a shareable link and gives them control over their branding, email gating, password protection and more.

View the full impact report here.

Visible helps 350+ funds streamline the way they collect and analyze portfolio data.

investors

Metrics and data

Venture Capital Metrics You Need to Know

The world of Venture Capital is full of jargon and acronyms that can make the industry seem intimidating. When it comes to Venture Capital metrics, it’s important to have at least a high-level understanding of what they mean so that you can contribute meaningfully to team discussions and evaluate investment performance accurately. This post breaks down common VC investment metrics that you’ll likely come across in venture.

Related resource: The Only Financial Ratios Cheat Sheet You’ll Ever Need

VC Fund Performance Metrics

Multiple on Invested Capital (MOIC): The current value of the fund as it relates to how much has been invested.

Related resource: Multiple on Invested Capital (MOIC): What It Is and How to Calculate It

Distributions per Paid-in-Capital (DPI): The amount of money returned to Limited Partners, relative to how much capital Limited Partners have given the fund.

Residual Value per Paid-in-Capital (RVPI): The ratio of the current value of all remaining (non-exited) investments compared to the total capital contributed by Limited Partners to date.

Gross Total Value to Paid-in-Capital (TVPI): The overall value of the fund relative to the total amount of capital paid into the fund to date.

Internal Rate of Return (IRR): The expected annualized return a fund will generate based on a series of cash flows taking into consideration the time value of money. (Read more about IRR for VC’s)

Visible lets investors track and visualize over 30+ investment metrics in custom dashboards.

You may also like → Venture Capital Metrics 101 (and why they matter to LP’s)

Fund Operations Metrics

Management Fees: A fee commonly paid annually by the fund to cover things like General Partner compensation, insurance, and travel. This is typically 2% of committed capital.

Escrow: Capital temporarily held by a third party until a particular condition has been met. Typically occurs as a part of paying distributions to Limited Partners.

Expenses: Money used to complete investments by the fund, such as legal costs, and other ongoing operational expenses of the fund, such as an annual audit.

Carried Interest: The amount of money returned to the General Partners of a fund after a liquidity event such as when a portfolio company gets acquired. Carried interest is typically 20% of profits, although it can vary depending on a GP’s track record and management fee.

Distributions: The transfer of cash or securities from a venture capital fund to its investors, called Limited Partners, after the fund exits its position in one of the companies. Typically 80% of distributions are returned to LPs. The timing of fund distributions varies from fund to fund.

You may also like → Venture Capital Fee Economics

Valuation Metrics

Fair Market Value (FMV): The value of an investment at a certain point in time. The most common trigger for a change in the FMV is when there is a company raises a subsequent priced round and a new company valuation is established.

Realized FMV: The value of an investment that has actually been realized through a liquidity event such as an acquisition.

Unrealized FMV: The perceived value of an investment that has not yet been realized through a liquidity event.

You may also like → 25 Limited Partners Backing Venture Capital Funds + What They Look For

Capital Metrics

Total Invested: The total amount of capital invested in portfolio companies. This includes initial capital and follow-on capital.

Committed Capital: The amount of money a Limited Partner promises to a venture capital fund.

Capital Called: The capital called from Limited Partners. Typically capital is called on an as needed basis before making a new investment.

Capital Remaining: Capital remaining in a fund that is yet to be invested into companies. Also referred to as ‘dry powder’ and unspent cash.

Uncalled Capital: Capital that has been committed by Limited Partners but not yet called by the fund.

Track & Visualize Your Fund Metrics in Visible

Visible lets investors track and visualize over 30+ investment metrics in custom dashboards.

Additional VC Metrics Supported in Visible

Visible auto-calculates common investment calculations so investors can more easily understand and communicate their fund performance.

Total Number of Investments: A sum total of investments made into individual companies.

Average Investment Amount: The average check size for all investments out of a fund.

Total Number of Exits: The number of companies that have exited the portfolio.

% of Fund Deployed: The ratio of capital deployed compared to the total committed fund size.

% of Fund Called: The ratio of capital called compared to the fund size.

Follow On Capital Deployed: The amount of capital deployed into existing companies in the portfolio.

Total Portfolio Company Capital Raised: The total amount a portfolio company has raised.

Follow on Capital Raised: The combined amount all companies in the fund have raised.

Visible supports over 30+ investment metrics and unlimited custom KPI’s for portfolio monitoring.

investors

Reporting

Metrics and data

Flexible Dashboards for Venture Capital Investors (with examples)

As a venture capital investor, it’s critical to maintain accurate, up-to-date information about your portfolio companies and investment data. This helps investors make data-informed investment decisions, provide better portfolio support, fulfill audit requirements with relative ease, and not to mention, impress LPs.

What’s even better than just having your data well-organized and easy to find, is when investors can seamlessly turn that data into meaningful insights that are easy to share with internal team members and stakeholders.

Below we describe three different dashboard types supported in Visible that help investors surface and communicate important updates about their portfolio.

Flexible Dashboards for Internal Portfolio Reviews

Flexible dashboards in Visible allow investors to integrate metric data, investment data, and properties directly into a dashboard. The flexible grid layout means investors have control over how they want to visualize and communicate updates to their team.

Investors commonly use these dashboards to facilitate internal portfolio review meetings which keeps their team up to date and engaged about important updates across the portfolio.

View flexible dashboard examples in the guide below.

Fund Performance Dashboards for Communicating with LPs

Visible allows investors to track, visualize, and share key fund performance metrics. Investors can choose from 14+ different chart types and use custom colors to incorporate their branding into their dashboards.

The fund metrics supported in Visible include:

TVPI

DPI

RVPI

MOIC

IRR

Unrealized and realized FMV

Total Invested

Capital Called

and more.

Learn about the 30+ fund metrics supported in Visible.

Related resource: VC Fund Performance Metrics 101

View a Fund Performance Dashboard example in the guide below.

Portfolio Metric Dashboards for Cross-Portfolio Analysis

As a venture capital portfolio grows, it’s helpful for investors to be able to pull quick insights across all their companies. Visible’s Portfolio Metric Dashboards let investors compare performance across the entire portfolio for a single metric. This view can be filtered by a custom segment and time period. Visible also automatically calculates quick insights such as:

Total

Min

Max

Median

Quartiles

View a Portfolio Metric Dashboard in the guide below.

Visible’s dashboards give investors control over how they want to track and visualize their portfolio KPIs and investment data. Learn more about Visible.

founders

Fundraising

Metrics and data

[Webinar Recording] Using SaaS Metrics to Build Your Fundraising Narrative with Forum Ventures

Webinar Recap

Throughout a fundraise, founders are expected to share the data and financials that fuel their business. Jonah Midanik of Forum Ventures joined us on March 21st to discuss all things SaaS metrics and fundraising.

Watch Recording

A few things you can expect us to cover:

The SaaS metrics every founder should know

What metrics a founder should expect to share with potential investors

What metrics and financials a founder should expect to have prepared for due diligence

How early-stage founders should think about more “advanced” SaaS metrics

About Jonah

Jonah has spent the last twenty years at the intersection of marketing and technology as a serial entrepreneur in Canada. He has experienced several different lenses on the founder’s journey from bootstrapping his own startup, to launching new corporate divisions, and raising 8 figures of venture capital.

At Forum, in supporting hundreds of founders’ growth, Jonah has carved out a niche in the market of teaching founders how to build and deliver pitch decks and which metrics to include to convey traction to raise capital successfully.

investors

Metrics and data

Portfolio Monitoring for Corporate Venture Capital Investors

This article includes insights from a webinar Visible co-hosted with the corporate venture firm JLL Spark Global Ventures and Counter Club, a network of corporate venture capitalists brought together by common challenges and opportunities to share best practices. To learn more about Counter Club and watch the full webinar recording head to Counter Club’s registration page.

Corporate Venture Capital Overview

Corporate Venture Capital (CVC) is the practice of large firms investing in small early-stage startups and offering strategic value. They differ from traditional VC’s because they are not only motivated to make impressive returns for Limited Partners (LPs), but are also focused on protecting their corporate strategy and gaining a competitive advantage.

The Limited Partner for a CVC is usually the singular firm which means the capital source is highly concentrated. The parent corporation is often heavily involved in the day-to-day of a corporate venture. CVC teams are expected to know what’s going on in their portfolio at all times and be ready to share insights and regular reporting with their corporate partner.

What is Portfolio Monitoring?