Blog

Metrics and data

Resources related to metrics and KPI's for startups and VC's.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Metrics and data

Important Startup Financials to Win Investors

Accounting and finance are skills that every founder should hone. While you don’t need to be an expert, you should be comfortable with different financial statements and be able to answer questions from current and potential investors. Check out our quick breakdown of startup financials below:

What are startup financials?

Startup financials are the vitals behind how a company operates. Financials are the metrics and data that drive the different financial statements for a startup — income statement, balance sheet, cash flow, changes in equity, etc.

As we wrote in our post, Building A Startup Financial Model That Works, “The goal of a financial model is not to be exactly right with every projection. The more important focus is to show that you, as a founding or executive team, have a handle on the things that will directly impact the success or failure of your business and a cogent plan for executing successfully.”

Why are startup financials important for pitch decks?

An investor’s job is to generate returns for their investors (AKA limited partners or LPs). In order to invest in the best companies, investors need to leverage data and their own insights to fund companies they believe have the opportunity to generate returns for their investors.

Related Resource: How To Build a Pitch Deck, Step by Step

Part of this process involves collecting financials and data. Different investors might look for different things when it comes to a company’s financials and metrics — inevitably, an investor will need to take a look under the hood to see how a company operates.

Learn more about the financials that VCs look for in a pitch deck below:

Essential startup financials to include in pitch decks

As we previously mentioned, different investors will look for different metrics and data when it comes to a pitch deck. In order to best help you prepare the metrics and data you need, we laid out the following common metrics that VCs might look for in a pitch deck below (as always, we recommend sharing what you believe is best for your business):

Related Resource: Tips for Creating an Investor Pitch Deck

Gross revenue

Gross revenue is the sum of all money generated by a company. This is important for a pitch deck because investors will want to understand how much revenue a business is generating. For companies that are pre-revenue, make sure you are targeting investors that invest in pre-revenue companies.

Cost of goods sold

As put by the team at Investopedia, “Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the goods. It excludes indirect expenses, such as distribution costs and sales force costs.”

Gross profit

As put by the team at Investopedia, “Gross profit is the profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services.” This is important because investors want to understand how your business efficiently turns revenue into profit.

Operating expenses

Operating expenses are exactly what they sound like — the expenses a business incurs from normally operating. Operating expenses help investors understand how and where your business is spending money.

Net income

As put by the team at Investopedia, “Net income (NI), also called net earnings, is calculated as sales minus cost of goods sold, selling, general and administrative expenses, operating expenses, depreciation, interest, taxes, and other expenses.” Net income truly reflects the profitability of a company as it takes into account all of the expenses a business will face.

Related Resource: 18 Pitch Deck Examples for Any Startup

Understanding forecasting vs accounting

Over the course of building a startup, founders will inevitably have to understand different basic accounting, forecasting, and budgeting principles. Learn more about forecasting vs. accounting for your startup below:

Related Resource: 7 Essential Business Startup Resources

Financial forecasting

A financial forecast and financial model is a tool that founders can use to tell their startup’s story. As we wrote in our post, Building A Startup Financial Model That Works, “The goal of a financial model is not to be exactly right with every projection. The more important focus is to show that you, as a founding or executive team, have a handle on the things that will directly impact the success or failure of your business and a cogent plan for executing successfully.”

Accounting

Basic accounting is a skill that every founder should be familiar with. Accounting is a realistic look at the financial performance of your business. It’s critical to have a grasp on all elements of your company’s books to ensure your company can grow and scale in an effective way and avoid costly financial errors down the line.

Related Resource: A User-Friendly Guide to Startup Accounting

Financial statements: your startup’s report cards

Having a grasp on your financials is a surefire way to clearly articulate your needs for capital and how you plan to spend any additional funding. Learn more about common financial statements for startups below:

Related Resource: 4 Types of Financial Statements Founders Need to Understand

Income statement

As put by the team at Harvard Business School, “An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter.

Also known as profit and loss (P&L) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. Income statements are often shared as quarterly and annual reports, showing financial trends and comparisons over time.”

Balance sheet

As put by the team at ProjectionHub, “A startup balance sheet or projected balance sheet is a financial statement highlighting a business startup’s assets, liabilities, and owner’s equity. In other words, a balance sheet shows what a business owns, the amount that it owes, and the amount that the business owner may claim.”

Statement of cash flows

As put by the team at Accountancy Cloud, “A cash flow statement, or CFS, is a financial statement that accurately summarizes the total amount of cash that goes into and eventually leaves a startup business. Cash flow statements are designed to accurately measure if a startup is managing its cash wisely.”

Impress potential investors with Visible

With our suite of fundraising tools, you can easily find investors, share your pitch deck, and track your fundraising funnel. Learn more about our pitch deck sharing tool and give it a free try here.

Related resource: What is Internal Rate of Return (IRR) in Venture Capital

founders

Metrics and data

How to Calculate the Rule of 40 Using Visible

Since the start of 2022, there have been major macroeconomic changes taking the startup world by storm. Rising inflation, paired with the tumultuous public markets (especially in the technology sector), has made its way downstream to startup fundraising. As the team at OpenView Ventures put it, “For operators, this has led to whiplash from grow at all costs to cut at all costs.”

We partnered with OpenView Ventures for the 2022 SaaS Benchmarks Survey. The main takeaway? Nearly every company is cutting spend, regardless of how much cash they have in the bank.

Valuations are also changing. In 2021, valuations were largely based on growth rates for the next 12 months. However, there has been a transition to public valuations being based on the “Rule of 40.” Put simply, the rule of 40 means a company’s YoY revenue growth % + profit margin % should exceed 40.

As the team at OpenView points out, “For companies with ARR below $10M, Rule of 40 can vary widely from quarter to quarter. Achieving 40 each quarter is not required. But, it is required to have a grasp on what caused a drop or spike, and what can be done to get to 40 long term.”

Learn how you can calculate, and automate, the rule of 40 using Visible below:

1. Track Revenue

First things first, to calculate the rule of 40 you need to know your revenue for multiple years (or periods). You can enter this into Visible manually or using 1 of our integrations (likely Google Sheets, Xero, or QuickBooks).

Once you have your revenue # in Visible, we’ll automatically calculate your growth % (more on this in step 3).

2. Track or Calculate Profit Margin %

Next, you’ll want to make sure you have the necessary metrics in Visible to track your profit margin %. If you are using one of our accounting integrations (like Xero or QBO), or tracking this in a Google Sheet, you’ll be able to automatically bring this in. If you’re starting from scratch, you’ll simply need your revenue and COGs (or Gross Profit).

Once you have your Revenue + COGs metrics in Visible, you’ll be able to calculate it using our formula builder. The formula for Profit Margin % is =

Profit Margin % = ((Revenue – COGs)/Revenue) x 100

Which will look like the following in Visible:

3. Calculate Rule of 40

Now that we have Revenue and our Profit Margin %, we just need to add the two together. We’ll create a new formula shown below (Note: we’ll want to make sure we are using the annual change % insight for Revenue — this is automatically calculated):

4. Chart & Share

Once your formula is set up, it will automatically be calculated as new data enters Visible. From here, you can chart and share your Rule of 40 using Updates and Dashboards — check out an example below:

Track your key metrics, update investors, and raise capital all from one platform. Give Visible a free try for 14 days here.

Related resource: The Only Financial Ratios Cheat Sheet You’ll Ever Need

founders

Hiring & Talent

Metrics and data

Developing a Successful SaaS Sales Strategy

Founders are tasked with hundreds of responsibilities when starting a business. On top of hiring, financing, and building their product, early-stage founders are generally responsible for developing initial strategies — this includes the earliest sales and market strategies.

In this article, we will look to help you craft a successful SaaS sales strategy. We’ll highlight the elements you will want to think of when you start to build your sales motion. This will help your team to understand how to measure the number of potential customers in your pipeline and the growth potential you might see in your revenue numbers.

How are SaaS sales different from other types of sales?

Like any sales strategy, it is important to start with the basics when looking at a SaaS sales strategy. At the top of your funnel, you have marketing leads that likely find your brand via content, word of mouth, paid ads, your own product, etc.

From here, leads are moved through the funnel. In the middle, SaaS companies can leverage email campaigns, events, product demos, etc. to move leads to the bottom of their funnel. However, as the SaaS buying experience takes place fully online — sales and marketing organizations can be creative with their approach. The online experience allows companies to track more robust data than ever before. Additionally, SaaS products have turned into their own growth levers as well — the ability to manipulate pricing and plans has led to the ability for companies to leverage their own product for growth.

Related Resource: How SaaS Companies Can Best Leverage a Product-led Growth Strategy

The online presence and emergence of product-led growth have led to new sales strategies unique to SaaS companies. Learn more below:

3 Popular SaaS sales models

There are countless ways to structure your Saas sales strategy. For the sake of this post, we’ll focus on 3 of the most popular strategies. Learn more about the self-service model, transactional model, and enterprise sales model below:

Related Resource: The SaaS Business Model: How and Why it Works

Self-service model

The self-service model allows prospects to become customers without communicating with your team. As put by the team at ProductLed, “A SaaS self-serve model is exactly what it sounds like. Rather than rely on a dedicated Sales team to prospect, educate, and close sales, you design a system that allows customers to serve themselves. The quality of the product itself does all the selling.” This strategy is typically best for a strong and simple product that typically has a lower contract size.

Transactional sales model

The transactional model allows you to create income-generating actions where prospects have to become a customer at that point in time. This requires transactional sales models to have high-volume sales that can be supported by a strong sales and customer support team.

Enterprise sales model

The enterprise model is a strategy to sell more robust software packages to corporations – you will need baked-in features in a prepackaged manner to sell to a fellow business. Enterprise sales is the model that shares the most similarities with a traditional B2B sales funnel.

Inbound vs outbound sales

In a Saas sales funnel, you are constantly looking to consistently fill your sales funnel with fresh prospects. Once you have prospects you will look to find which prospects are worthy of being qualified and have a high likelihood of converting so you can spend your time communicating with those high-quality prospects.

There are two popular strategies for creating fresh prospects that would be defined as inbound and outbound sales strategies. Inbound sales is when you invest in marketing to create prospects reaching out to you – fresh prospects reaching out to your business to ask about your software product. As put by the team at HubSpot:

“Inbound sales organizations use a sales process that is personalized, helpful, and directly focused on prospects’ pain points throughout their buyer’s journey. During inbound sales, buyers move through three key phases: awareness, consideration, and decision (which we’ll discuss further below). While buyers go through these three phases, sales teams go through four different actions that will help them support qualified leads into becoming opportunities and eventually customers: identify, connect, explore, and advise.”

An inbound strategy typically works best for SaaS companies that need a greater volume of customers and can nurture them and move them through their funnel at scale (e.g. self-service model)

Outbound sales on the other hand are having members of your organization reach out to potential prospects to see if they would be interested in using your service. Outbound sales require highly targeted and proactive pushing of your messaging to customers.

Generally, outbound sales require dedicated team members to manually prospect and reach out to potential customers. This means that outbound sales organizations do not naturally scale as well as an inbound sales organizations and will likely require a higher contract value. An enterprise model would rely heavily on Outbound sales, while a self-service business model will rely heavily on Inbound sales.

The SaaS Sales Process

The best Saas sales strategy will be a hybrid of inbound and outbound sales, but all of them should include a sales funnel. This funnel should have stages that help to qualify your prospects. These stages should be:

Step 1: Lead generation

This activity is often times a marketing activity that gives you contact or business information to explore the fit further

Step 2: Prospecting

This is where you develop the bio of who is the contact you are reaching out to within the organization. It is always helpful to prospect for someone who can make a buying decision

Step 3: Qualifying

In this step, you need to understand whether the prospect has the resources to pay for your product and the problem that your product can solve. This step is often the time for you to ask questions of your prospects

Step 4: Demos and presenting

This is when you will share the features and capabilities of your product with the qualified prospect. You want to show them the different features and where they can get the most value.

Step 5: Closing the deal

After your demo or a presenting call, the prospect should be pushed to a point where they need to make a decision on whether to buy your product.

Step 6: Nurturing

Once someone becomes a customer, you need to make sure to nurture them and grow your product offering with their business. This is the most difficult stage. Make sure to share your new product releases, stay in tune with how they are using your product, and build relationships with your customers.

Cultivating a robust sales team

To create a sustaining sales team, it is important to hire talented and tenacious people to own your sales funnel. They will need to track conversion numbers, stay organized with their outreach to prospects, and grow your funnel over time.

There are three key roles within a Saas sales funnel. Those positions within your organization are:

Sales development representatives

(also known as business development representatives) These members of your team own lead generation, prospecting, and qualifying potential customers on your sales team. They get paid 40-60k/year depending on geographical location and experience. They should be tasked with outreach and drumming up new business.

Account executives

Account executives should focus on giving product demos, closing deals, and nurturing existing customers. They should be a bit more buttoned up in their approach and have a commission incentive associated with the # of accounts they manage.

Sales managers/VPs

Sales managers and Vice presidents of sales should take ownership of the data within your sales pipelines. Numbers like # of new leads, # of new qualified leads, # of new customers, # of churned customers, amount of new revenue, and lead to customer conversion %. Growing these sales numbers each quarter. Measuring these numbers weekly, monthly, and quarterly. Making them visible to the rest of the company regularly.

8 Key Elements of a successful SaaS sales strategy

One of the most important elements of building a successful business is having a like-minded team around you to support and work with you. Make sure to align with all your team members and hire people with good work ethics and similar values of your company. A good sales team should be competitive, goal-oriented, and metric-driven. The sales managers and VPs will be really crucial in shaping the team dynamics and culture of your business. Hire great people and the numbers will take care of themselves!

We’ve identified 8 elements of a successful sales strategy that every Saas sales strategy should include

1. Solidify your value proposition

It is so important to understand thoroughly and communicate your product’s core value proposition. If someone decides to buy your product, they should know how to use the product and how to get the most out of it.

2. Superb communication with prospects

Communication is of the utmost importance. Make sure your prospects understand your product and how it will help their business. Inform them of new product updates

3. Strategic trial periods

An effective strategy is to give potential customers a free trial of your product to understand your value proposition. You want to make sure not to make this trial period too short or too long. Make it strategic so the prospect will understand the value prop but also be encouraged to make a buying decision.

4. Track the right SaaS metrics

Tracking your core metrics is vital to success. See a few of those below:

Customer Acquisition Cost – the amount of money it takes to acquire a new customer

Customer Lifetime Value – the amount of value a customer provides your company over the course of their relationship with you as a customer.

Lead velocity rate – the growth percentage of qualified leads month over month. This will help you understand how quickly you are qualifying your leads

Related Resources: Our Ultimate Guide to SaaS Metrics & How To Calculate and Interpret Your SaaS Magic Number

5. Develop a sales playbook

Every successful sales management team should develop a playbook on how to deploy their resources and where each team member should spend their time. Playbooks are often thought of in sports terms, but they also work wonders in the business world. They will help you do things efficiently and effectively.

6. Set effective sales goals

How many new customers does your business hope to bring in next month? This is an important question and one your whole sales team should understand and work towards!

7. Utilize the right tools to enhance the process

Your team should have all the resources at their disposal to communicate effectively and track their metrics. As you build out your strategy and team, be sure to give them all possible resources at their disposal. There are tons of great tools out there for teams to make the most out of their time and have direct methods of communication with customers and one another.

8. Establish an effective customer support program

A huge part of an effective sales strategy is welcoming potential customers and making sure your existing customers are not forgotten about. When customers reach out, it is important to talk and listen to their issues. Understand what they are needing so your product can continue to evolve.

Make sure anyone getting introduced to your product will also have the information they need to use your product successfully. It might be helpful to include this member of your team in your sales meetings and keep them informed as to messaging and efforts for growth!

Generate support for your startup with Visible

Developing a successful SaaS sales strategy is not an easy task. It will take a hybrid approach of many of the elements listed in this article and will need attentive members of your team to nurture it and test new things. We created Visible to help founders have a better chance for success. Stay in the loop with the best resources to build and scale your startup with our newsletter, the Visible Weekly — subscribe here.

Related resource: Lead Velocity Rate: A Key Metric in the Startup Landscape

investors

Metrics and data

Operations

How to Establish ESG Monitoring and Reporting Practices at Your VC Firm

As we invest in rapidly changing technologies that impact people and the planet, it’s of the utmost importance to consider the unintended consequences—even at the early stage. As the world felt the effects of several major crises in recent times, Environmental, Social, and Governance (ESG) principles have rightfully risen to the spotlight in the venture capital industry and now play a critical role in investment decision-making.

Investors hold a responsibility to guide their portfolio companies in ESG practices, not just because the world is watching—but because companies that are as concerned with their impact as they are with building their products are proven to perform better in the long run.

Visible recently hosted an ESG for Venture Capital webinar with Tracy Barba, Head of ESG at 500 Startups and Director at ESG4VC, where she answered the common questions about establishing ESG reporting practices at VC firms. We’ve shared answers to some of those questions below as well as guidance on using Visible for ESG portfolio monitoring.

What is ESG for Venture Capital?

ESG policies and practices help investors and companies manage their environmental, social, and governance risk and identify opportunities for value creation. VCs—including 500 Startups—are widely embracing the shift. In the 2020 ESG Annual Report spearheaded by Tracy Barba, 500 Startups said their policies include:

Environmental criteria to examine how a company performs as a steward of nature.

Social criteria to consider a company’s relationship with its employees, suppliers, customers, and communities where it operates.

Governance criteria to review a company’s leadership, shareholder rights, executive pay, audits, and internal controls.

VC firms can and should provide an ESG framework as startup companies grow. It’s never too early to care—as we’ve seen in the news, large tech companies have found themselves in legal and ethical trouble over issues that could have been resolved in the earlier stages.

In How Venture Capital Can Join the ESG Revolution, Stanford’s Social Innovation Review pointed out that eventually, ESG should not be understood as an “add-on” but a core value in a VC leading to better investments and companies. Ethical and legal considerations should not be ignored in the service of achieving rapid growth and swift time to market. As a VC firm, there is a risk in your ownership percentage if a portfolio company were to face legal battles, public scrutiny, and other risks that could have been prevented if they were identified earlier.

ESG as a term is often used interchangeably with impact investing. As Tracy Barba points out, impact investing is thinking about the end goal and the impact of the companies you’re investing in. Having a strategy around water or climate is an example of an impact strategy, so you’re filtering deals based on that. ESG is a screening for every company, regardless of the type, measuring their environmental, social, and governance criteria.

It’s hard for an early-stage company to know their impact, such as environmental waste, if they don’t have a product yet. That’s why it’s important to map ESG to relevant stages of a company’s development. At an early stage, the goal is to start to have a conversation. It’s much easier to think about how a company affects the environment from the beginning and address any issues upfront rather than fix or replace already-established processes in the future. At later stages, more detailed discussions will be appropriate.

Founders overwhelmingly do care and want to consider ESG, but many don’t know when or how to get started. As an investor, you can help them start to think through ESG by adding it as an agenda item on your monthly or quarterly check-ins. An example question is: “Are you tracking your carbon footprint?” Their answer might simply be “Yes”, or it might be, “No we aren’t, but we’d like to. How can we get started?”

Why is ESG Becoming More Common in Venture Capital?

There is a growing understanding that ESG policies help with customer loyalty, retaining talent, and attracting more investors. It’s beneficial if a company directs time and energy towards making sure they’re operating responsibly.

In venture capital, some topics are gaining momentum:

Diversity – there are demonstrated benefits to having culturally diverse teams and boards.

Gender equality – supporting more women and as founders and funders.

Data protection & privacy of users – startups are not exempt from laws such as the GDPR and CCPA which protect the personal data privacy of consumers.

Environmental impact trends – caring about carbon emissions, ethical sourcing of materials, waste management, etc.

It’s important to be mindful of regulations and how they can change over time. The Sustainable Finance Disclosure Regulation (SFDR) in Europe aims to prevent greenwashing and to increase transparency around sustainability claims (source: Eurosif). While the SEC currently only recommends ESG disclosure, it may also create firm rules in the future. Companies may start measuring and reporting their ESG progress in preparation for new regulations.

More than ever, founders care about being backed by VCs they align with. VCs can drive a positive shift by integrating ESG into their own operations. Showing that you care as an investor is integral in instilling ESG policies into your portfolio.

How To Monitor ESG Metrics Across your VC Portfolio

You can start tracking ESG metrics across your portfolio by sending them an annual questionnaire. 500 Startups, for example, collects their founder diversity info on a quarterly basis, measuring their progress over time and benchmarking to the VC industry.

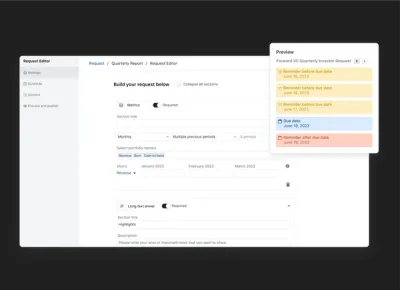

Founders already get asked for a lot of information, so to encourage their participation in your ESG questionnaires, ask fewer questions and use simple yes/no answers whenever possible. With Visible, you can fully customize your ESG reporting questions using Requests.

Preview of an ESG Request in Visible below —

View best practices for collecting metrics with Visible below:

You can track answers and hold founders accountable for how they are going to implement best practices, how they are going to hire, etc.

ESG questionnaires are not meant to penalize startups, but to get a sense of where they currently are—they may only just be starting to think about tracking and monitoring their water usage or diversity, for example. Once they gain customers, the questions you ask them will grow more detailed.

If an early-stage company feels they do not have the resources or bandwidth to manage ESG concerns, you can help them get started by simply putting an employee manual or non-discrimination policy on the agenda for your next check-in. Remember, it’s going to be more expensive if they wait longer to implement those practices.

Tips for ESG Fund Reporting

External consultants can help VC firms evaluate their policies and processes across recruitment, HR, and deal flow, and recommend ways to improve. Since external consultants collect data across venture capital firms, they can educate them about best practices and compare how they are doing relative to the entire industry.

Tracy Barba, Head of ESG at 500 Startups, reported that working with external consultants like Diversity VC was helpful in providing them with an external validation point. This type of industry benchmarking is now growing as a field and becoming more common practice.

Resource: How to increase Diversity at your VC Fund

How to Incorporate ESG Into Your Portfolio Support

Now that you’ve gathered ESG data from your portfolio companies and identified opportunities for improvement, what’s next? VC firms can take the initiative to provide education, tools, training, and resources for their companies—whether in-house or through outside service providers and consultants.

500 Startups provides a vast array of ESG resources for their founders and the public, including webinars, which are available on their website: ESG for Early-Stage.

Resource: Portfolio Support Best Practices for Venture Capital Investors

Tracy Barba’s nonprofit ESG4VC aims to provide education, office hours, and research for venture capital firms to help establish standards and encourage movement in a positive direction across the industry.

It’s been said that we can’t fix what we can’t measure. When it comes to improving the impact business has on the environment, workers, and communities, investors can be proactive in incorporating ESG policies at the very early stages so that everyone can benefit.

View Examples of How to Request Metrics in Visible below:

founders

Metrics and data

7 Startup Growth Strategies

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Whether a venture-backed startup looking to attack a massive market or a bootstrapped business, startups are generally in pursuit of growth. One of the main competitive advantages of a startup is the ability to test new growth strategies and move quickly compared to its predecessors.

Related Resource: The Understandable Guide to Startup Funding Stages

Finding a growth strategy or channel can make or break a company. In order to best help you find and develop the growth channels that work best for your business, we’ve laid out a few key strategies below:

1. Develop a strong value proposition

First things first, you need to develop a strong value proposition. As put by the team at Investopedia, “A value proposition refers to the value a company promises to deliver to customers should they choose to buy their product. A value proposition is part of a company’s overall marketing strategy. The value proposition provides a declaration of intent or a statement that introduces a company’s brand to consumers by telling them what the company stands for, how it operates, and why it deserves their business.”

This should be used at the backbone of your growth strategies and can be used to define your channels, messaging, and overall growth strategy. It is important to be thoughtful when laying out your value proposition — talk to customers, potential customers, and other stakeholders to help construct your value proposition.

Related Resource: How to Easily Achieve Product-Market Fit

2. Understand and embrace your target audience

After you’ve laid out your value proposition, you need to define the market and audience you would like to target. This is similar to creating your ideal customer profile.

As put by the team at Gartner, “The ideal customer profile (ICP) defines the firmographic, environmental and behavioral attributes of accounts that are expected to become a company’s most valuable customers. It is developed through both qualitative and quantitative analyses, and may optionally be informed by predictive analytics software.”

Related Resource: How to Write a Business Plan For Your Startup

Identify why a customer wants your product or service

If you’ve properly laid out your value proposition, this should be fairly easy. If you understand the value you are offering your customer, it should be straightforward why they would want to purchase your product or service.

Segment your overall market

For modeling purposes, you will likely start with your market as a whole. From here, it is important to narrow down your target and hone in on your specific segment in a market.

For example, if you are selling snowboards your total addressable market might be every outdoors person but you’d likely want to hone in your market to just anyone that has snowboarded in the last X years.

Related Resource: Total Addressable Market vs Serviceable Addressable Market

Research the market

Once you’ve honed in on your market, you need to make sure you are an expert in all things related to the market. When reaching out to potential customers, chances are they will turn to you for best practices on the market and space. To go above and beyond, come equipped with the right knowledge.

Choose the segmented market

After researching and analyzing the different markets, make the choice. Pick your segmented market and make sure you have the messaging and product in place to win the market.

3. Research and analyze your top competitors

Inevitably, when speaking and targeting potential customers you will be compared to your competitors. In order to best combat any pushback, you need to come prepared. In order to best grow you need to understand how your product or service compares to competitors.

If you can understand your strong points (and weak points) in comparison to competitors you’ll be able to better tailor your messaging and campaigns.

4. Establish smart key performance indicators

As the old adage goes, “you can’t improve what you don’t measure.” When testing and finding growth strategies, it is important to have the right KPIs in place to track your performance.

Related Resource: Startup Metrics You Need to Monitor

Depending on the growth strategy or campaign will dictate what metric you should track. Check out a few examples below:

Return on investment (ROI)

One of the most common KPIs to track in relation to a growth strategy is return on investment. In order to continue investing in a growth strategy, you need to make sure it is generating returns.

As put by the team at Investopedia, “Return on investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment’s cost.”

Churn rate

On the flip side, growth can be fueled by improving your churn rate. If you’d like to grow your current customer base, focusing on churn rate is a surefire way. Learn more about tracking and improving your churn rate below:

Related Resource: Our Ultimate Guide to SaaS Metrics

Customer acquisition cost

As we wrote in our post, “Customer Acquisition Cost: A Critical Metrics for Founders,” customer acquisition cost is “The sum of the amount that it takes your business to acquire a customer, including time from your sales representatives and marketing and advertising expenses.”

By monitoring your customer acquisition costs, you’ll be able to determine what channels make the most sense for your business. A surefire way to fuel growth is by improving your CAC. For example, if you are running ads at a high cost that do not convert to customers, chances are you’d be better suited to reallocate those costs to a better converting channel with lower acquisition costs.

Customer lifetime value

As put by the team at NetSuite, “Customer lifetime value (CLV) is a measure of the total income a business can expect to bring in from a typical customer for as long as that person or account remains a client.”

By monitoring your customer lifetime value, you’ll be able to boost margins and warrant spending more on acquisition costs. Learn more about customer lifetime value below:

Related Resource: Defining Customer Lifetime Value for Startups: A Critical Metric

5. Scale wisely and effectively

In the early days of building a business, the old adage goes, “do things that don’t scale.” However, as you find your rhythm and have a valuable product with growth strategies that work, it is time to scale. During uncertain times, it is especially important to scale efficiently to work towards profitability.

Scaling involves taking your existing channels and growing them at scale (and ideally improving margins). This means making smart hires that will take certain areas of your business to the next level.

Related Resource: Scaling != Growth

6. Continuously review your business model

As you find the growth strategies and channels that work best, it is important to be consistently evaluating your business model. Markets and customer needs change quickly so it is important to make sure you are staying ahead of them.

This means that you are likely evaluating your different acquisition channels, your product, and your hiring plans. If you find your business is most capable of executing in a certain area (for example, product-led growth), you might want to consider hiring and building your product around product-led growth.

Related Resource: How to Write a Business Plan For Your Startup

7. Engage your investors to build relationships

Once you have found the growth strategies that work best for your business, you’ll need to make sure you have the resources in place to grow and scale. This is capital and talent.

One of the most common ways to source capital for a startup growth strategy is by raising venture capital. You’ll want to make sure that you are engaging with current and potential investors along the way to improve your odds of raising venture capital.

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Related Resource: Top VCs Investing in the $100 Billion Creator Economy

Grow your startup with Visible

Finding the right growth strategies for your business is only half the battle. Having the resources in place to track your key growth metrics will help you make informed decisions along the way.

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

investors

Metrics and data

The Standard Metrics to Collect for VC Portfolio Monitoring

Visible supports hundreds of investors around the world to streamline their portfolio monitoring. One of the most common questions we receive is — what metrics should I be collecting from my portfolio companies?

Everyone from Emerging Managers writing their first checks to established VC firms ask this question because they want to make sure they're monitoring their portfolio companies in the most effective way possible.

The Standard Metrics Value-Add Investors Should be Monitoring

It’s important to know which metrics are the best to collect from portfolio companies so that investors can extract the maximum amount of insight from the least number of metrics. This streamlined approach is easiest for founders and allows investors to get what they need to provide better support to their companies, inform future investment decisions, and have good records in place for LP reporting or fundraising.

Below we outline the six most common metrics investors collect from portfolio companies.

1) Revenue

Definition: Money generated from normal business operations for the reporting period; also known as ‘net sales’. We recommend excluding ‘other revenue’ from secondary activities and excluding cash from fundraising.

Revenue tells you how a company’s sales are performing.

This metric is a key indicator for how a business is doing. It can be analyzed to understand if new marketing strategies are working, how a change in pricing might affect the demand for a good or service, and the pace of growth in a market.

By asking for revenue from just ‘normal business operations’ you’re excluding money a company could also be making from secondary activities that are non-integral to their business. This helps keep the revenue data more precise, allows you to compare the metric more accurately across the portfolio, and will allow you to use it more accurately in other metric formulas such as Net Income.

Visible helps over 400+ VCs streamline the way they collect data from companies with Requests. Check out a Request example below.

2) Cash Balance

Definition: The amount of cash a company has in the bank at the end of a reporting period.

Cash Balance is an important indicator of ‘life expectancy’.

This metric is essential to track because it tells you about the financial stability and risk level of the company. There’s no bluffing with this Cash Balance metric. A company either has a healthy amount of cash in the bank at the end of its reporting or they don’t. Cash balance also gives you an idea of how soon a company will need to kick off its next round of financing.

3) Monthly Net Burn

Definition: The rate at which a company uses money taking income into account. The monthly burn rate will be positive for companies that are not yet profitable and negative for companies that are considered profitable. Net burn is usually reported as monthly and calculated by subtracting a company’s ending cash balance from its starting cash balance and dividing that by the number of months for the period. We recommend collecting this metric from companies on a quarterly basis but still asking for the monthly rate — this helps rule out any one-off variability.

Monthly Net Burn = (Starting cash balance – ending cash balance) / months

Monthly Net Burn is an indicator of operational efficiency.

This metric becomes even more relevant during market downturns when the focus shifts from growth at all costs to growth with operational efficiency. This is a good metric to benchmark and compare across all companies in your portfolio.

You can also use this metric to calculate a key metric, Cash Runway.

Related resource: Burn Rate: What It Is and How to Calculate It

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

4) Cash Runway

Definition: Cash runway is the number of months a business can survive before it runs out of cash. It can be calculated as:

Runway = Cash Balance / Monthly Net Burn

Cash runway tells you when a company will run out of cash.

This metric is essential because it determines when a company needs to kick off their next fundraising process, usually, it’s when they have 6-8 months of runway left. If you see one of your companies hit a cash runway of six months or less, you should be reaching out to see if they need support or guidance on their fundraising efforts.

While Runway is definitely considered a key metric, you don’t need to ask your companies for it since it can be calculated easily with other data you should already have on hand (Cash Balance & Monthly Net Burn Rate).

5) Net Income

Definition: Net income is a company’s total earnings (or profit) after all expenses have been subtracted. It is calculated by taking a company’s revenue and subtracting all expenses, including operational expenses, interest expenses, income taxes, and depreciation and amortization.

Net Income = Revenue – Total Expenses

Net Income is an indicator of profitability.

If net income is positive, meaning revenue is greater than a company’s total expenses, it is considered profitable. This is a metric that startups should have readily available since it’s the ‘bottom line’ of an Income Statement, making it very easy to report.

This metric can also be used in a formula to calculate Net Profit Margin, total expenses, and cash runway.

6) Total Headcount

This is the total number of full-time equivalent employees excluding contractors. Contractors are excluded because of the variability of the nature of contract work — a contractor may only work a few hours a month or they could work 20 hours per week. This variability will cause back-and-forth clarification between you and your companies which wastes time.

This metric gives you insight into company growth and operational changes.

This metric is important to track because it’s a reflection of decisions made by the leadership team. If there’s an increase in headcount, the leadership is investing in future growth, on the other side, if there’s a major decrease in total headcount it could be because the leadership team has decided to reduce burn by letting people go or employees are churning. All are post-signs of operational changes worth paying attention to.

Check out an Example Request in Visible.

Suggested Qualitative Questions to Ask Your Companies

While metrics are the best way to aggregate and compare insights across your portfolio, you may also be wondering which qualitative questions you should ask portfolio companies as well. Qualitative prompts can be a concise and valuable way for startups to share more narrative updates on company performance with their investors.

Below we outline the two most common qualitative questions investors ask portfolio companies as well as suggested descriptions.

1) Recent Updates & Wins

Description: Please use bullet points and share updates related to Sales, Product, Team, and Fundraising. This will be used for internal reporting and may also be shared with our Limited Partners.

We suggest asking companies for bullet points on these four categories because it’s a focused way for investors to understand the narrative context behind a company’s metrics.

With your companies’ permission, this narrative update can also serve as the foundation for your tear sheets for your LP reporting and your internal reporting.

2) Asks

Description: How can we best support you this quarter?

You can make your reporting processes more valuable for your portfolio companies by asking your companies if there are specific ways you can provide support to them in the next quarter.

Once you have responses from your portfolio companies, you can take action on their requests and you’ll be able to extract support themes to inform the way you provide scalable portfolio support.

Monitor Your Portfolio Companies Seamlessly With Visible

It’s important to know which are the most important metrics to collect to ensure your portfolio data collection processes are streamlined and valuable both for you and your companies. In this article, we highlighted Revenue, Net Income, Cash Balance, Runway, Net Burn Rate, and Total Headcount as the top metrics to collect from all your portfolio companies. With Visible, its also easy to ask for any custom metric and assign it just to specific companies.

Investors of all stages are using Visible to streamline their portfolio monitoring and reporting processes. Book some time with our team to learn how Visible can automate your portfolio monitoring processes.

Visible for Investors is a founder-friendly portfolio monitoring and reporting platform used by over 400+ VCs.

founders

Metrics and data

How to Calculate Runway & Burn Rate

Building a venture-backed startup is difficult. On top of building a useful product, hiring a great team, and attracting qualified customers, founders need to be a 1 person finance team (in the early days).

When just starting and scaling a business, founders likely have no dedicated finance team in-house to lean on for insights. Founders need to rely on their own financial savviness (hopefully with the help of an accounting firm) to keep finances in check.

In order to efficiently grow your business, you need to have an understanding of your cash position. Learn more about calculating and tracking your startup runway below.

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

What is Startup Runway?

A startup runway is exactly what it sounds like — it is the amount of time (generally in months) a startup can operate before it runs out of money. For a profitable business, this metric likely means little. However, an early-stage startup that has yet to monetize its product or service will need to pay close attention to its runway.

Related Resource: The Understandable Guide to Startup Funding Stages

Your startup runway will inform how you hire, develop products, and finance your business in the coming months and years.

What is Startup Burn Rate?

The first component of your startup runway is your burn rate. According to Investopedia, “The burn rate is typically used to describe the rate at which a new company is spending its venture capital to finance overhead before generating positive cash flow from operations. It is a measure of negative cash flow.”

Related Resource: Startup Metrics You Need to Monitor

Simply put, the burn rate is the amount of money your business is “burning” every month. For example, if your business is spending $5,000 a month on salary, $1,000 on software, and $500 on office space but has yet to bring in any revenue your burn rate would be $6,500. Your burn rate is generally the input that you can dictate the most when it comes to extending your cash runway.

Related resource: Burn Rate: What It Is and How to Calculate It

Formula for Startup Runway

Calculating your runway is simple and something that every startup founder should hone, especially in the early days. To calculate your runway, simply take your beginning cash balance and divide it by your monthly net burn rate as shown below:

Related Resource: 6 Metrics Every Startup Founder Should Track

Real-Life Example of Startup Runway

For a real-life example of calculating a startup’s runway — let’s take an early-stage venture-backed company that raised a few million dollars in VC money and has been at it developing its product. At the beginning of the most recent period, their cash balance is $320,000 and their monthly burn rate is $20,000. You’d simply divide $320,000 by $20,000 to get a runway of 16 months.

How Much Startup Runway Should You Have?

There is no right or wrong answer when it comes to determining how long your cash runway should be. Your company’s stage, current market, and business model might impact how long your runway should be. As a general rule of thumb, it is suggested that seed and series A companies have a runway of 12-18 months

Formula for Burn Rate

Like startup runway, burn rate is a straightforward formula — especially for founders who have their cash statements and metrics in place. To calculate your burn rate, simply take your beginning cash balance, subtract your ending cash balance and divide that by the # of months over the given period. Typically it is better to calculate your burn rate over a longer period of time as a single month could be lumpy as expenses vary from month to month.

Related Resource: What is a Startup’s Annual Run Rate? (Definition + Formula)

Real-Life Example of Startup Burn Rate

For a real-life example of calculating a startup, let’s take a startup that raised $3M and already had $200k in the bank bringing its cash balance to $3.2M. Fast forward 6 months and their cash balance is now $2.6M. Using the burn rate formula that would mean their monthly burn rate is $100K ($3.2M – $2.6M = $600K / 6 months = $100K) as shown below:

Ways to Extend Startup Runway and Reduce Burn Rate

As we mentioned earlier, the easiest way to manipulate your runway and extend your runway is by controlling your monthly burn rate. Learn more about how to extend your runway below:

Drive More Sales

First and foremost, the best way to extend your runway is by driving more sales. Of course, this is likely already a goal of your business (unless your business is not ready to monetize your product or service). By driving more sales you’ll be able to increase your cash balance and in turn, extend your startup’s runway.

Cut Non-Essential Expenses

The most straightforward way to extend your startup’s runway is by cutting non-essential expenses. This can feel difficult as it can impact your team’s day-to-day operations — however, this can be done in a thoughtful manner that extends your runway. For example, consolidating software or removing marketing channels that might not be performing well is a good way to extend the runway.

Related resource: The Only Financial Ratios Cheat Sheet You’ll Ever Need

Utilize Corporate Credit Cards and other Funding Sources

You can also get creative with the financing options that your business leverages. While venture financing might take months to get cash into your bank account, new funding options could be of interest. Learn more about alternative ways to fund your business below:

Related Resource: Checking Out Venture Capital Funding Alternatives

Track Runway With Visible

Runway is a vital metric for early-stage startups. Every startup founder should be in tune with their runway and use it to inform spending decisions and strategy for the coming months and years.

Tools and software are a great way to keep tabs on your finances. Track key metrics, send investor Updates, and track the status of your next fundraise with Visible. Give it a free try for 14 days here.

Related resource: What is Internal Rate of Return (IRR) in Venture Capital

investors

Metrics and data

Portfolio Data Collection Tips for VCs

Getting regular, high-quality, and actionable data from portfolio companies is important. It allows investors to make better investment decisions, provide better support to companies, and share meaningful insights internally across the firm and with LPs.

This practice should also be highly valuable for founders. They should be able to share wins and challenges and seek support from their investors. The reporting process should only take companies 3 minutes to complete (if not, something may be wrong with how the investor is asking for structured data or the reporting company may not be as familiar with their key metrics as they should be).

Below are some best practices to make sure you get:

High response rates from companies

Structured data (comparing apples to apples)

Actionable insights

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

Set Reporting Expectations Early On

✔️ Tip: Set expectations during the onboarding process (if not sooner)

It’s way easier to set reporting expectations with companies early on (and with fewer companies) rather than changing your reporting requirements a few years into your relationship with portfolio companies.

Some investors choose to outline their reporting expectations in a side letter as a part of the investment documents.

It's recommended that investors also have a dedicated conversation around reporting expectations during the onboarding process.

Related Resource: A Guide to Onboarding New Companies to Your VC Firm

When and How Often to Collect Portfolio Data

✔️ Tip: Collect data at a predictable frequency

Set the expectation that you will be sending a Request for company data the same time every reporting cycle. Visible has data that shows that Mondays are great due dates and if you’re sending out quarterly Requests for data, we suggest giving your companies 2-4 weeks after quarter close to get their information back to you.

Don’t randomly switch between the 10th, the 30th, etc. This makes it difficult for founders to prioritize your reporting requirements and gives the impression that your due dates don’t really matter.

Visible makes scheduling data Requests and subsequent reminders a breeze for investors. Investors can select the due date, email notification dates, and customize the messages that will get sent out to portfolio companies.

✔️ Tip: Collect data at an appropriate frequency

We recommend the following cadences. This is 100% customizable as every fund is different.

Weekly – Companies in an accelerator program

Monthly – Pre-seed investments

Quarterly – Pre-seed, Seed, Series A, Series B + investments

What Data to Collect from Portfolio Companies

✔️ Tip: Less is more

Don’t send a Request asking for ‘nice to have’ metrics. Only ask for the information you really need and are going to use. We suggest starting small, getting a rhythm, and expanding the data as needed.

Metrics

✔️ Tip: Ask for only 5-15 metrics

Depending on how closely you work with companies, ask for 5-15 metrics and no more. If you’re not taking actionable next steps based on a metric (ex: reporting to LP’s, providing more hands-on support, informing investment decisions) then it's likely you don't need to be asking for it.

The most common metrics investors ask for include:

Revenue

Cash Balance

Cash Burn

Headcount

Runway

Related resource: Which Metrics Should I Be Collecting from Portfolio Companies

View examples of data Requests in Visible.

✔️ Tip: Use a metric description to reduce back-and-forth

If you are asking for Burn and don’t provide context, you might get 15 different variations. Should it be negative? Should it be trailing 3 months or the current month? Should it include financing? Be descriptive about what you want.

Qualitative Questions to Ask Portfolio Companies

✔️ Tip: Define what type of information you're looking for

As an investor, it's a great idea to give companies the opportunity to share support requests on a regular basis. Consider including a description to clarify what type of support your firm can provide companies.

Additionally, most investors also ask for companies to report narrative highlights and lowlights from the question. It's important to clarify what type of information you're actually looking for so companies are not wasting time sharing information an investor is not actually going to use.

Implementing a Portfolio Monitoring Platform

✔️ Tip: Notify your companies two weeks in advance

Introducing Your Companies to Visible

As the most founder-friendly solution on the market, we ensure that requesting data is a frictionless process for founders. This means founders don’t need to create an account in order for Investors to get value out of the platform (ie: No log-in required!).

Still, it's a great idea to give your companies notice about the adoption of Visible so they can keep an eye out for the first Request that will land in their inbox.

Feel free to use our Intro Copy Template to notify your companies about the adoption of Visible two weeks in advance of your first Request deadline.

Customize Your Domain

Investors can white-label the automatic emails that are sent from Visible so that the emails use their firm's domain. You can also customize the sender address to anyone at your firm.

Visible's Customer Support

All Visible customers get world-class support and a dedicated Investor Success Manager. We provide an efficient, hands-on onboarding experience, training for new team members, and support on an ongoing basis.

Visible is trusted by over 350+ VC funds around the world to help streamline their portfolio monitoring and reporting.

founders

Operations

Metrics and data

Customer Stories

Kickstarting a Marketplace with Trey Closson, CEO of Amplio

About Trey

Trey Closson is the CEO and Founder of Amplio — a platform for proactively identifying the risks of tomorrow’s supply chain. Prior to starting Amplio, Trey spent time at Flexport and Georgia Pacific. Trey joins us to break down his first year as a founder and what he has learned from transitioning from operator to founder.

Episode Takeaways

A couple of key topics we hit on:

The current state of the global supply chain issues

How Amplio found their first customers

How Amplio is using pilot programs to scale their customer base

The importance of relentless focus

Why founders should invest in community

Why building a startup is a marathon, not a sprint

Watch the Episode

Give episode 6 a listen below (or give it a listen on Spotify, Apple Podcasts, or wherever you normally consume podcasts)

founders

Metrics and data

6 Metrics Every Startup Founder Should Track

One thing that is important, as a startup founder, is to track your financial metrics each month to measure the health of your business.

At Visible, we help you curate and send investor updates. We recommend you send these monthly. With our mission being to improve a founder’s chance of success, monthly updates are a huge part of staying on that path to success. Monthly investor updates help you keep your investors in the loop. They help to keep investors engaged and provide you a time to reflect on what work was done over the course of the month. Monthly updates are a great tool for accountability and gaining perspective on whether your startup is growing or not

We strongly recommend you send monthly updates. Especially once you have raised venture capital

Part of these updates should be an inclusion of charts/metrics that help you measure the health of your business. Your investors will enjoy getting updates and seeing your core metrics grow over time. You should also allow metrics to help you to understand what to prioritize within your startup.

Your investors will care about seeing these because it shows how fast you are spending their money, but will also give you insights into a few different things. It will give you insight as to when you might need to raise money again. It will give you insight as to how much time you have to run the business while keeping your current expenses constant. It might signal you to hire more to get over key humps in the business, like developing your product or spending more resources on sales. It might show you need to be more efficient when allocating your marketing dollars. It might be the case that you should ignore these metrics altogether and just focus on what’s in front of you each day. Every startup is unique and we understand it’s not a one size fits all approach.

Related Resource: What Should be in an Investor Data Room?

The financial metrics we recommend tracking are:

Cash on hand

Burn Rate

Run rate

Revenue

Revenue Growth

Engagement metrics (churn, user growth, retention, this one varies)

Cash on Hand

Cash on hand is the amount of cash you had at the end of the month last month. This can be found on your Balance Sheet.

How to track in Visible:

Connect accounting integration (Quickbooks, Xero, etc.)

Create chart with Total Bank Accounts as Metric

Chart Period → Custom period:

Custom period: Last 6 months & Previous Period

Monthly Cash Burn

Monthly burn rate is defined as the cash on hand at the end of this month minus the cash on hand at the end of the previous month. This will give you the difference of cash between the two amounts. Allowing you to know how much cash exited your account!

How to track in Visible:

Add an insight to chart

Previous period change

Chart on Separate Y-Axis

Months of Runway

Run Rate is a bit more complicated. Run rate calculates the amount of months you have left to run the company given your current cash on hand and monthly burn. This number depends on your burn rate staying constant. More than likely your burn rate will not remain constant (it will increase. Run rate is calculated by taking Cash on hand/(Monthly Burn Rate). This will yield you the number of months you have left to operate your business with expenses staying constant.

How to track in Visible:

Export Monthly Balance Sheets from accounting software into google sheets

Manually calculate Monthly Burn (ex. Feb Cash – Jan Cash)

Calculate Months of Runway

Cash on hand/ Monthly Burn Rate

Integrate sheet into Visible

Add Months of runway to Total Bank Accounts Chart

Save Chart

Related resource: Strategic Pivots in Startups: Deciding When, Understanding Why, and Executing How

Revenue

Revenue is the amount of cash that you received in payments from your customers (over the course of the past month).

How to track in Visible:

Pull Revenue from your accounting integration

Revenue is the top line of your income statement

Create a chart

Measure previous 6 months

Related Resource: EBITDA vs Revenue: Understanding the Difference

Revenue Growth

Revenue growth is a true barometer for success for your startup. It shows how much your revenue has increased over the prior period. If you have revenue growth, it should signal to you that you are on the right track and continue to execute at a high level.

How to track in Visible:

Add an insight to chart

Previous period change %

Chart on Separate Y-Axis

Engagement Metrics

An engagement metric is something that is unique to your individual business. The manner of it would relate to the type of business your run (marketplace app, Saas product, or physical product). It should directly relate to your revenue growth. Things like churn/retention could be your engagement metric. For Airbnb, it could be the number of nights booked. For Uber, it could be # of rides completed per week. Having healthy engagement metrics should drive your revenue and allow you to feel good that you are building something people love.

Tracking is Visible will vary based on your metric. Early on, just track it manually! Cash on hand, burn rate, and runway are very much metrics for your own sanity. These relate to the lifeblood of the business and how long you can be certain your company will be in existence. We recommend maintaining a conservative level of spend for the first few months after raising a seed round. It is much easier to increase spend than it is to decrease. By starting conservatively, you will have good context as to how much you can increase your burn rate to find the sweet spot for growth and trimming your runway.

Revenue, revenue growth, and engagement metrics are really ways for you to measure how well you have done in the latest period. It is really important to decide as a team what your North star metric is and work towards that goal together. These sort of standard metrics will help align your team and work to accomplish your goals together. The goal with Visible as a product is to help you as a founder measure these metrics and update your investors. That way you can measure these core financial metrics (Cash on hand, Burn Rate, Runway) right off the bat when starting your trial with Visible. Setting you up for success after raising a Seed round. you will be set up for success to measure the proper metrics and keep your investors filled in. This way you can spend the majority of your time building a great product that people love.

Related Resource: A Guide to Building Successful OKRs for Startups

In conclusion, measuring the core financials of your startup (or business) is really good practice. It will help you maintain accountability and measure growth. We recommend you track the core 6 metrics each month of Cash on hand, Burn Rate, Run rate, Revenue, Revenue Growth, and market-specific Engagement metrics. These will help you to get the most out of your fundraising dollars and to maximize growth!

founders

Hiring & Talent

Metrics and data

A User-Friendly Guide to Startup Accounting

In a startup, there are a million things going on at all times. The last thing on a founder’s mind is most likely not balancing the books and managing the daily ins and outs of company finance – other than ensuring there is a cash runway to work with. But as your business grows, it’s critical to have a grasp on all elements of your company’s books to ensure your company can grow and scale in an effective way and avoid costly financial errors down the line.

Why Does Accounting Matter to Startups?

In a startup, typically cash is always tight and you’re operating on a short runway. This makes accounting even more critical for your business. Measuring, processing, and communicating the source and destination of every dollar is crucial to ensure smart business decisions can be made. After your startup raises a round of funding and takes on outside investors, accurate accounting is, even more, a crucial element to have under control in your startup. With outside eyes monitoring every way, you’re spending their investment, ensuring you have a tight grip on and understanding of your company’s accounting will make or break your business.

Related Resource: Building A Startup Financial Model That Works

What is Your Business Structure?

What is Your Business Structure?

Depending on how your organization is formally classified, the accounting required will be slightly different. All formal, for-profit businesses are classified as 1 of 5 different business entity types. The 5 different business entities are:

Business Entities Types

Sole Proprietorship is an enterprise that is owned and run by a single person. Specifically, there is no legal distinction between the owner of the business and the business entity. A sole proprietorship does not always work alone as it is possible for the sole proprietorship to employ other people. Sole proprietorships are also known as sole tradership, individual entrepreneurship, or simply as a proprietorship.

Partnership – When two or more individuals operate a business based on an oral or written agreement, that is legally considered a partnership. An agreement on the protocols and terms of the partnership is not required to consider a business entity to be considered a formal partnership, it’s best practice for one to be in place. Similar to a sole proprietorship, a partnership entity business has no legal distinction between the owners of said business.

C Corporation – in the United States, under federal income tax law, a C Corporation is any business entity or enterprise corporation that is taxed separately from its owners. Unless the corporate elects otherwise, most for-profit corporate businesses in the United States are automatically considered a C Corporation.

S Corporation – An S Corporation is a privately held company that makes the decision to be taxed under the Subchapter S of Chapter 1 of the Internal Revenue Code, or IRS, federal income tax law. By making a valid election, the S-corporation’s income and losses are divided among and passed through its shareholders. The individual shareholders must then report the income or loss on their own individual income tax returns.

Limited Liability Company (LLC) – An LLC is a business that’s structure is allowed and dictated by individual state statutes. Each state can adjust and use different regulations to structure an LLC so it’s critical for business entities to check what different regulations are allowed for an LLC state to state. Owners of an LLC are referred to as members and typically, most states do not restrict ownership. So members could be individual owners, corporations, other LLCs, or in some cases even foreign entities. Most states also do not have a maximum number of members restriction in place on LLCs and most also permit “single-member” or sole owner LLCs. The main restriction on LLCs comes into play when considering the types of private businesses that do not qualify to be LLCs such as banks and insurance companies.

Understanding the Two Methods of Accounting

Now that the 5 primary business entities have been defined, the two methods of accounting need to be understood. Depending on the type of business entity, a different method may be used.

Accrual Basis Accounting

This specific accounting method allows a company to record its revenue before receiving the physical payment for the product or service that has been sold. Public companies are required to use accrual basis accounting. Most companies making above $5M a year in revenue use accrual basis accounting. This is typically the preferred method of accounting for private companies as it is generally more reflective of a company’s actual revenue.

Cash Basis Accounting

On the opposite end of the spectrum to accrual basis accounting, cash basis accounting only records the revenue in a company’s book of business when the cash transaction has physically occurred for the product or services sold. C Corporations and Partnerships are not allowed to use cash basis accounting unless they total under 5M a year in revenue for 3 tax years in a row.

Related resource: What is a Schedule K-1: A Comprehensive Guide

What Types of Financial Records Should Your Startup Keep?

Once you’ve determined the type of accounting most appropriate for your startup, it’s critical to have a clear understanding of the broad types of financial materials you should be keeping track of and recording for said accounting practice. A good rule of thumb is to keep everything related to the financial arm of your business, and when possible, make multiple copies as backups for key financial items and hold onto these items for at least 3 to 7 years after their existing date. An overview of the items that your startup should be holding onto and keeping in their financial records includes:

Receipts from business expenses

Bank statements

Bills

Tax Forms for both your business and employees

Contracts that outline the services or products you are selling

Contracts with vendors you are purchasing services from

Receipts from any tax-deductible donations or contributions made by your business entity

Overall, it’s critical to establish a system early on for maintaining detailed records of every documented transaction or financial movement that occurs within or in relation to your business.

Related Resource: How to Calculate Runway & Burn Rate

The Relationship Between Recordkeeping and Accounting

A big part of the practice of measuring, processing, and communicating about financial information, aka accounting, is the process of recordkeeping. Recordkeeping is the process of keeping track of the history of an organization’s activities, or in some cases a person’s activities, by creating and storing these as consistent formal records.

What is Record-Keeping or Bookkeeping?

Recordkeeping relates to accounting as a form of recordkeeping specifically for financial activities. A clear recordkeeping process is the backbone and foundation of a good accounting process. Without it, accurate processing and measurement simply cannot occur.

Knowing recordkeeping, or bookkeeping as it’s sometimes known, is the backbone of the accounting process, it’s important to establish weekly and monthly recordkeeping tasks to ensure your process is rock solid from the early days of your business. We’ve got some recommendations to get you started.

Recommended Weekly Recordkeeping Tasks

1. Record all transactions into your books

Decide on a single source of truth to maintain ongoing documentation of your financial records. This single source of truth is often referred to as a “book”. We recommend a digital source of truth as well as a written source of truth or physical copies of each record as a backup barring any issue with the digital book. Set time for yourself every week at the same time to record all financial transactions from that week in your book and ensure the records are saved, backed up, and filed in an organized manner. Doing this on a weekly basis will prevent missed recordings of financial records as they get backed up week over week.

2. Segment Your Transactions

In addition to recording each transaction in your books on a weekly basis, take it a step further and segment your transactions into categories. This will provide an additional layer of organization and allow for extra audit and thoroughness on how your finances are flowing into and out of your business. Segments could include items like revenue, bills paid, taxes, etc.

3. Digitize Your Receipts