Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

As the saying goes, “you can’t improve what you don’t measure.” The most successful startups have a system to track and improve the metrics and financials that are most vital to their business.

Before you can set up a system to track your key metrics, you don’t need to understand what specific metrics and financials you should be tracking. At the end of the day, revenue metrics are what makes a business tick. In order to best track your revenue metrics, you need to understand the nuances between different financials and metrics.

Related Resource: Startup Metrics You Need to Monitor

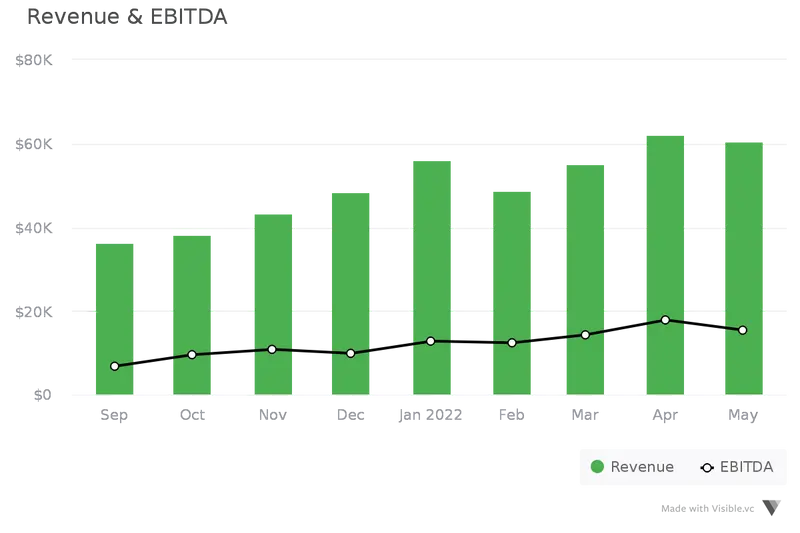

Learn more about the differences between revenue and EBITDA below.

What is the difference between EBITDA and revenue?

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and revenue are two financial metrics that all startup founders should be familiar with.

Simply put, revenue is the topline income a company is bringing in over a period of time. On the other hand, EBITDA is a financial metric used to help measure profitability. Learn more about the intricacies of both EBITDA and revenue below:

What is EBITDA?

As put by Investopedia, “EBITDA, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of profitability to net income. By stripping out the non-cash depreciation and amortization expense as well as taxes and debt costs dependent on the capital structure, EBITDA attempts to represent cash profit generated by the company’s operations.”

Related resource: What is a Schedule K-1: A Comprehensive Guide

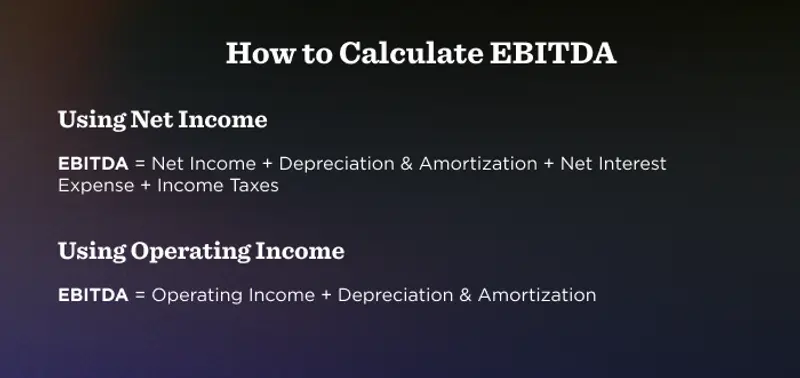

How to calculate EBITDA

There are 2 common ways to calculate EBITDA. Both will generally use a combination of an income statement and a cash flow statement to pull the relevant metrics.

Calculate using operating income

The first way to calculate EBITDA is by using operating income. For this way, you can simply take operating income and add depreciation & amortization. It will look like this:

EBITDA = Operating Income + Depreciation & Amortization

Calculate using net income

The other common way to calculate EBITDA is by using net income. For this method, you’ll need a few more financials. Net income takes operating income and subtracts non-operating expenses (like interest and taxes) so you’ll need to add those back into EBITDA. It will look like this:

EBITDA = Net Income + Depreciation & Amortization + Net Interest Expense + Income Taxes

Why is EBITDA an important metric?

Oftentimes, EBITDA is considered one of the most important financial metrics that a company can track. This is because it removes any external forces that are impacting a business’s financials and is solely on its profitability trends. This helps companies determine their true valuation and can be easily used to benchmark against similar companies.

A more clear understanding of valuation, also means that the company can be properly priced to potential acquisition partners.

Related Resource: Startup Metrics You Need to Monitor

Pros and cons of EBITDA

Like any startup metric, EBITDA comes with its pros and cons. As we laid out above, EBITDA is important because it removes external forces and demonstrates the true financials of a business. When it comes to cons, EBITDA can sometimes lead to confusion.

A typical con is that EBITDA gives an unclear look at cash flow and can lead to a misleading understanding of how much cash is truly coming into the business.

What is revenue?

As put by the team at Investopedia, “Revenue is the money generated from normal business operations, calculated as the average sales price times the number of units sold. It is the top-line (or gross income) figure from which costs are subtracted to determine net income. Revenue is also known as sales on the income statement.”

At the end of the day, revenue is the lifeblood of a business. If a business is not bringing in new customers or expanding existing revenue, its livelihood will be short-lived.

Most projections and financials will start with revenue as it determines where the money can be allocated across the business.

Related Resource: 6 Metrics Every Startup Founder Should Track

Net revenue vs. gross revenue

Gross revenue is the total income a business brings in over a certain period of time. For example, if you should $5,000 worth of merchandise over the course of a month, your gross revenue would be $5,000.

On the flip side, is net revenue. This starts with gross revenue and subtracts your expenses. For example, in the example above your gross revenue is $5,000 and if you incur $2,000 in expenses over the same period – your net revenue would be $3,000.

How to calculate total revenue

Calculating revenue is very straightforward. To calculate your total revenue simply take the # of units sold and multiply it by the average price.

Why is revenue an important metric

As we mentioned above, revenue is the lifeblood of a business. At the end of the day, a business needs to generate revenue to fuel growth and sustain salaries, and develop new product. At the end of the day, without revenue, a business will cease to exist.

Related Resource: 6 Metrics Every Startup Founder Should Track

EBITDA vs. revenue comparison

As we laid out above, EBITDA and revenue are both important financial metrics for every business. However, making sure you are properly tracking and understanding your financial metrics is a must.

Learn more about the key differences and similarities between EBITDA and revenue below:

Key differences between EBITDA and revenue

EBITDA and revenue differ mostly in their purpose. On one hand, you have revenue. This is a true measure of sales and marketing activity and is simply based on the performance of your sales efforts.

On the other hand, you have EBITDA. EBITDA uses revenue as one of its functions and tailors it to measure your business’s profitability. This takes into account the performance of your business as a whole, not just your ability to add new revenue.

Key similarities between EBITDA and revenue

While the 2 metrics differ in what they track and measure, they are similar in the fact that they are valuable metrics that every startup should track. Because of their ability to measure how different aspects of your business, it is important to keep tabs on both.

Both metrics hold merit and should be used to evaluate different aspects of your business.

Which metric do investors prefer?

Like most things in the venture capital world, different investors will have different opinions when it comes to EBITDA. Revenue should be a given when it comes to what investors want to see. Investors, especially early stage and growth stage investors, expect to see solid revenue growth to grow into a massive company.

On the other hand, there are instances where investors will want to see EBITDA. As we’ve previously mentioned, EBITDA shows a company’s profitability and can be used when setting valuations so investors can have a better understanding of your company’s financial health.

Track and share your metrics effectively with Visible

Determining what metrics to track for your business is only half the battle. Having the right systems in place to track and share your key metrics is vital to growth.

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.