Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Metrics and data

The SaaS Business Model: How and Why it Works

What is the SaaS Business Model?

The typical business model for a SaaS business is a unique and exciting one to dive into. Software as a Service (SaaS) companies are not going away anytime soon and there is much more innovation that will continue to come from SaaS businesses. Looking at companies like Salesforce, Slack, and Zoom (just to name a few), it’s clear that the business model works. But how and why does it work? Read on for a complete breakdown and understanding of the SaaS business model.

SaaS or “Software as a Service” is a delivery model for software where a centrally located, cloud-based software is licensed to its customers via a subscription model. This might be annual, monthly, per user, or by package level but a company can be consider a SaaS company if they are hosting their software on the cloud and licensing it out.

At the core through all of these stages, the business model is based on a subscription payment set-up. This is core to the business and the building block of the model. A SaaS company may offer various types of subscriptions for different products or various end-users, but the subscription model is key to the foundation of the business. Due to the fact that SaaS companies are hosted on a centrally located cloud, they are in a unique position to constantly be updating the software and pushing those updates to users. This update and growth process for SaaS products is much quicker then in-house hardware that used to require very manual processes for the end-user. The subscription model combined with the consistent updates typically present with SaaS products leads to a higher customer retention than other business models. SaaS companies aid this by baking in very high-touch customer success teams to their sales cycle, continuing to work with and serve the customer even after an annual or monthly subscription is committed to.

A SaaS company follows a business model typically goes through 3 phases: early stage, growth stage, and mature stage. All stages involve different levels of funding. For a deeper dive on that specific component, read more here.

Related Resource: 20 Best SaaS Tools for Startups

The early stage of a SaaS company is focused on building out a product-market fit and securing some early, loyal customers. The team is typically bootstrapped or operating on a very small seed or friends and family round. The team typically stays small at this stage as well.

The growth stage in the SaaS business model is focused on scaling extremely quickly by taking on funding via Venture Capital or Angel investors and pushing the limits of your product’s success by taking some risks, scaling the team, entering into incubators, taking on more strategic advisors, and selling up-market. This stage is all about establishing metrics to track success and working to go above and beyond those in order to keep growing the business.

Related Resource: Who Funds SaaS Startups?

The mature stage kicks in when success is proven, the audience is present and hungry for the product, and the focus is now on growing and retaining customers vs. proving out the concept. The focus now can shift to continuing to fine-tune the business via pricing updates, continued product growth and development, and brand building.

Related resource: 11 Top Industry Events for SaaS Startups

Stages of a SaaS Business Model

As we mentioned in our Startup Funding Stages Guide, “There are multiple stages of startup funding: Seed, Series A, Series B, Series C, and so forth. Startups should be conscientious about the funding rounds that they will go through, which are generally based on the current maturity and development of the company.”

The same idea holds true with respects to a SaaS company. A SaaS business model is one of the most attractive to a venture capitalist. The lifecycle and funding stages likely look something like this:

Related Resource: 23 Top VC Investors Actively Funding SaaS Startups

Related Resource: How to Start and Operate a Successful SaaS Company

Seed Funding

Seed funding is a startup’s earliest funding stage. Often, seed funding comes from angel investors, friends and family members, and the original company founders.

Series A Funding

“When a company is first founded, stock options are generally sold to the company’s founders, those close to them, and angel investors. After this, a preferred stock can be sold to investors in the form of a Series A. Series A allows investors to get in early with a business that they truly believe in. It’s a mutually beneficial relationship for both the company and the future stock holders.”

Series B+ Funding

“Once a business has been launched and established, it may need to acquire Series B (and beyond) funding. A business will only acquire Series B funding after it has started its operations and proven its business model. Series B funding is generally less risky than Series A funding, and consequently there are usually more interested investors.”

Important SaaS Business Model Metrics

While diving deeper into the SaaS business model, it’s important to understand the key SaaS metrics that will inevitably pop-up along the way. These key SaaS Metrics are critical to track in order to understand the health of a SaaS business.

MRR (Monthly Recurring Revenue)

Not to be confused with ARR (Annual Recurring Revenue), MRR is how much money your company can be expected to bring in every month. Going beyond the basic meaning, MRR is a functional metric through which you can gauge your company’s income and success. MRR growth equals business growth – the same goes for shrinking MRR most likely equaling a negative impact on the business. MRR trends are incredibly important to subscription-based businesses, because they compound over time.

CAC (Customer Acquisition Cost)

The sum total it takes for your team to acquire a customer. This includes the time of the sales reps but also the marketing dollars spent. Tracking your customer acquisition cost tells you a lot about how your company is operating. If the dollars and time spent to acquire a single customer is higher than the MRR or ARR that customer brings in, that can be a huge red flag for the business. Over time, your customer acquisition cost will also tell you whether it’s getting more difficult or easier to acquire new customers. You’ll be able to look at trends to see when acquiring customers becomes more affordable, and if there are specific seasons during which customer acquisition is more expensive.

LTV (Lifetime Value)

Here at Visible, we consider LTV of a customer to be the most important metric you can track. LTV is the average customer revenue multiplied by the gross margin percentage divided by customer churn rate. Another way to think about it is MRR or ARR X Customer Lifetime. Understanding LTV is important in assessing the overall health of your company as well as justifying CAC costs to your investors. Some good news as you’re starting your business – you can track CAC and LTV right in Visible.

Churn

Essentially, churn is loss. You can have customer churn – the number of customers that cancel their subscription to your business annually or monthly. You can also have revenue churn – how much money is lost annually or monthly. Churn is expected in most businesses but maintaining an acceptable rate in comparison with the growth of your business is a key metric to understand, measure, and track. You can accept about three to five percent of your small to medium sized businesses portfolio every month or less than 10 percent annually. As enterprise level businesses go, aim for a churn rate less than one percent. Your churn rate should continue to decline in subsequent years until you reach negative churn.

Customer Retention

This SaaS metric refers to how long you are able to maintain a customer per your subscription model. This could be annually or monthly. Healthy retention can also be customer growth. If a software is user-based or has multiple product components, upsell and expansion can be possible leading to annual retention exceeding 100%. Healthy customer retention may not mean you maintain every customer every year, but you ultimately are seeing growth in the business through a balance of renewals, upsells, and contract expansions.

Successful SaaS Business Model Examples

There are thousands of SaaS businesses in the world today with more growing every year. Despite the model being a popular and growing business practice, 93% of SaaS startups fail within the first 3 years due to a lack of product market fit, run into cash flow problems, or experience more churn than growth. Diving into a few examples of successful SaaS businesses can be a helpful way to better understand the business model.

Salesforce is one of the most recognizable SaaS companies and was a true Trailblazer in the space. You can read a brief history of the business here. Salesforce has been so successful because it was one of the first companies to truly implement the SaaS Business Model successfully and has intelligently scaled by continuing to not only update it’s products, but by acquiring products where they see new opportunity effectively retaining customers and upselling them into new products as well as constantly expanding out into serving new industries. They are a mature company now with roughly 30,000 employees globally and a heavy focus on customer story-telling and partnership as a way to stay top of mind in the SaaS world.

An extension of the SaaS model that has emerged and has proven to be successful is the “Freemium” model. This pricing structure allows a portion of the product to be used for free by a user or team with full features being available through a subscription. This model works because it allows users and teams to get hooked on a product, have a positive experience with it, and share it internally and externally. This model is a good way to prove product-market fit and keep CAC down by having the product and its use take on a viral aspect with customers being bought in to a point that when the ask comes in to purchase the full software, the education that typically happens around a sale has a lot less friction associated with this.

Two companies with extremely successful Freemium models are Slack and Zoom. Both tools can be used for free by individuals, teams, and even larger organizations but have limits on things like storage, meeting times, and seat #s that are only available when an enterprise package is purchased.

Pros & Cons of a SaaS Business Model

Like any business model, there are of course pros and cons to diving down any particular path.

Pros of a SaaS Model

Rapid growth – if you find product-market fit early and are able to secure funding, the possibility of growing your company to a Billion dollar valuation is very real and can happen extremely quickly.

Ease of deployment – because SaaS lives in the cloud, it can be easy to make quick fixes to your product and sell to and serve customers from virtually anywhere.

Predictable revenue – the subscription model affords you the ability to fairly consistently understand how much money you can expect to make. There is no seasonality in a subscription model and annual or monthly contracts provide security that many other business models cannot guarantee.

Cons of a SaaS Model

Upfront costs – If you aren’t able to secure funding right away, it can be tough to maintain the capital and manpower needed to grow your company quickly enough to be successful. It’s common to not see profitability in the first few years, so it can be a hard business model to follow by truly bootstrapping. Specifically the cost of a team, CAC, and cost to build out the infrastructure to host your cloud software are major factors to consider.

High risk – growing fast also means you can fail fast. Taking on a lot of capital and scaling quickly can bring reward but if something changes in the market, your business could crash and burn overnight.

Churn – although revenue may be predictable, if the wrong combination of events takes place in a year (major competitor comes to market, market needs change, economic changes occur), you may see a huge bout of churn in a renewal cycle. This extreme shift could be almost impossible to bounce back from.

SaaS Business Model Growth Strategies

In addition to the “Freemium” model shared above, there are many other growth strategies that can be implemented in a SaaS Business model. A few popular ones include:

Customer Stories and Referrals

If your SaaS is integral to the way a company does business, you may be lucky enough to have customers who are super fans and love advocating for the value you bring to their day, their work, and their business. Capitalizing on these success stories through marketing content, speaking events, or even referrals can be a smart way to grow your business in an authentic way. These customer stories are good proof points to why you work. Referrals can often lead to better conversations earlier on with prospective customers or even help your sales team break into accounts that have been historically tricky to sell to. Here is an example from one of our customers:

Thought Leadership

If your company is selling into a specific space, a common strategy is to try and become the “expert” in that space. If your company blog or community group can provide value to your end-user outside of your product, that credibility will spread. Lattice does a great job of this. They have built a free 10k plus HR community group for any HR leader. They keep this space completely focused on their ultimate end-user but never focus on the product, simply provide a space for that community to meet. From there they are able to source content and ideas on what to write about in their blog and share on their podcast, effectively providing value to their end-user before even attempting to make the sale. This name recognition and “expert” status makes the use-case for the product feel more in-line with what the user group is actually interested in.

3rd Party Resources

Companies that actively spend time building up great customer reviews on sites like G2.com or work to be analyzed for trusted reports like Forrester, can use that credibility as an outside proof-point for why their product is valuable when selling into new customers.

Social Media and Influencer Marketing

This strategy is all about going where your end-user is. Build a brand and a voice via social media sites that are popular with your customer. Showcasing your companies voice and personality as well as commenting and sharing insight into trending topics can be an easy way to grow your awareness in an industry. Influencers, or well-known folks in a specific space, can be valuable on social media as well. If a top marketing influencer endorses your marketing SaaS software, folks may come inbound based on that person’s recommendation. Connecting with and offering trials to influencers can be a great way to get this started. Additionally, identifying an exec at your company with a strong following can be a great way to build your company brand via that individual. Folks on LinkedIn, for example, are much more likely to engage with what a person has to say then what a branded company page does.

Tools to Help You Optimize Your SaaS Business Model

We recommend a few tools to start when jumping into a SaaS business model. Free or premium versions are great, but it’s important to invest in tools that allow you to measure the key metrics listed above and track overall business health.

CRM – A customer relationship management tool is key to maintaining an accurate and complete data-base of all of the accounts your team is actively selling to, are active customers, or who have churned. A complete picture of the relationships your company works with will allow you to measure growth and track CAC, MRR and churn. Salesforce, Hubspot, and Oracle all offer quality options but starting out you can build a basic CRM via spreadsheet tools – it will just be a lot more manual.

Analytics Tool – Invest in a tool that will allow you to accurately measure all the metrics for your company. We recommend google analytics or manually tracking your metrics via a spreadsheet tool if you don’t have the budget to invest right away. Looker and Tableau are great options once you have budget to spend.

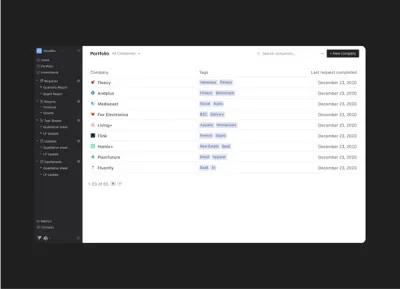

Visible – We of course have to share how we can help with growing our SaaS business model, too. Once you take on funding, we are the most complete tool for sharing updates with your entire team and managing existing and potential relationships with investors. You can learn more and check out a free trial of us here.

founders

Product Updates

Visible has a new look

Over the past twelve months, Visible has evolved from a tool to help founders write great investor updates to a platform to help founders Raise capital, Track key metrics, and Update investors.

We felt it was only fitting to evolve our brand just as we have evolved our product. We’re excited to share our new brand identity with you that pays homage to our past while letting us grow into our future.

Our mission hasn’t changed, we are still here to give founders a better chance of success.

We’ve updated our logo, wordmark, typeface, colors, and imagery across our marketing assets and app. Below we’ll get into why we ultimately made the change and how we went about accomplishing the overhaul this summer.

Why change?

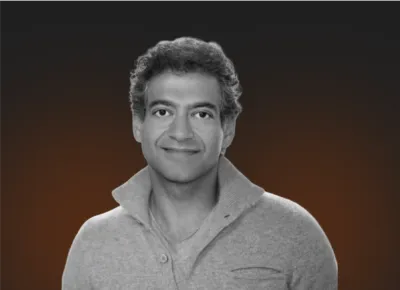

Simply put, we love founders. We really started to feel this over the past two years after getting to work with over 4,300 founders across the globe. In our new brand identity, you’ll see that founders will be at the forefront of everything we do.

Why do we love founders? Because the odds are perpetually stacked against them but they always find a way to keep going. Being a founder is the toughest and oftentimes the loneliest job there is. Founders are forging new paths with future obstacles they can’t see paired with an environment that is ever-evolving.

So how does a founder navigate all of this? Withtrusted guides. Maybe that guide is a founder who has forged their own path or an investor who has seen others succeed (or fail) through similar obstacles. The guide could also be a significant other, an independent board member, or a close mentor.

One thing became clear to us, scaling a startup is a people and relationship driven endeavor. We hope thatVisible can act as a trusted guide and resource to founders. We also want Visible to act as a catalyst to help founders build relationships with other trusted guides to help take them on their journey. This is why we are updating our brand, to reflect our drive to serve founders first and the guides who support them.

Here are some of the tools & resources we’ve recently launched for founders to help them on their journey:

Visible Connect – A free investor database so founders can quickly find which potential investors they should be building relationships with.

176 editions of theFounders Forward – Our curated weekly newsletter that has gone out rain or shine every Thursday.

Visible for Investors – The most founder friendly tool an investor can use to engage with their portfolio.

We wrote 3,800 words in ourall encompassing startup fundraising guide to help founders who are fundraising for the first time.

The Visible Founder Community – This is currently in alpha with some of our customers. We just made a hire to take this to the next level. Stay tuned!

If you like getting into the details of how we went about deciding on the new brand and what it entails. Keep reading!

The Process

After we decided that we wanted to update our brand identity we dug into our design values & process, looked at the competitive landscape, talked to our customers, and even reviewed conversion data of our marketing funnel. To give an inside peek at some of our research and process:

Design Values

Empowerment – We want to make complex tasks simple, while also providing customers with all the valuable information they can get to improve their investor relationships.

Reliability – We want customers to trust Visible. They should not only trust that every investor update email is going to be sent but that our team is here when you need us.

Consistency – We need to be consistent in our communication and in our user experience. When we launch something new customers should feel like they know it by heart.

Competitors

We took a look at our customers and their brand identities. We wanted to make sure we could differentiate and stand out. We saw a lot of blue.

Mood Board

After we pulled all of our research together, we got started on a mood board. We knew that if we wanted to be a trusted guide for founders we need to convey trust, fearlessness, and experience. Here are some early mood boards:

Two ideas started to emerge that we liked:

The editorial feel our marketing site could have. Our articles and resources were read by more than 175k people in 2020. Let’s elevate the content with a more editorial and educational look.

Triangles vibed well with where we wanted to go. The glyphs above have a lot of parallel meanings to building a startup, it plays nicely with the V in Visible and also has elements of climbing a mountain.

Of course, we reviewed many iterations of our logo, typeface, and marketing site before landing on the final product.

The Logo

It is made of 3 overlapping, equilateral triangles. Each triangle is slightly transparent, allowing the mark to interact with other design elements.

The triangles represent human relationships, both the connection between each of us and the ever-shifting overlap across myriad networks. There’s also a resonance with the strength of triadic relationships in management and the value created between customers, founders, and VCs, as well as founders, VCs, and LPs.

The logomark also pays a nice tribute to our current logo which has an overlapping pie chart. The logo also makes your eyes go “up and to the right”, a common salutation for our content and represents the never ending journey for growth.

Typography

We found the need to have both serif and sans-serif typefaces in our updated brand style guide. With software interfaces at the core of our products, we found that sans-serif fonts offer the right combination of efficiency and legibility at all sizes.

We’re also introducing a beautiful new serif typeface that helps us express the quality and trustworthiness of the content we create and curate for founders. The serifs look great for headers and big and bold for things like inspiring quotes.

Imagery

We really wanted to bring our customers, founders, community – people! – to the forefront of our brand. Illustrations are trendy but can feel very abstract and lack relatable humanness. We found beauty and inspiration in seeing a diverse group of people doing incredible work.

We enjoy the stark contrast of a black and white photo but also how it plays nicely with vibrant headshots. Our logomark really pops across different media types from photos to videos.

Founders Forward –> The Visible Weekly

The Founders Forward is now The Visible Weekly and will also get a bit of a facelift. We decided it was better to support fewer brands and sunsetted the yellow branding and logo. If we want to better serve founders we felt that Visible should be the core focal point across all of our content.

Don’t worry… the newsletter isn’t going anywhere! It will still be curated by our team and produced once a week. If you haven’t subscribed you can do so here -> visible.vc/subscribe

Our App

In the immediate, our app will have the new logo, color palette, and showcase some of the new brand elements. Over time we’ll introduce more changes that further blend our brand identity into the product.

Thanks

Most importantly we’d like to thank you, our community, for your encouragement, feedback, and support to get us to this point. We are energized for the years to come and can’t wait to give you a better chance of success.

I personally want to thank the entire Visible team for their drive to better serve founders and our customers. The new brand was a total team effort and none of this would be possible without a team who isn’t scared to do the difficult.

Up & to the right,

Mike Preuss

Visible CEO & Co-founder

founders

Fundraising

10 Blockchain Investors Founders Should Know

The world is becoming aware of the potential in blockchain technology. The rise of Bitcoin, Ethereum, and other blockchain protocols have created a new class of startup working to innovate on a new frontier. From alternative cryptocurrencies to companies who support the crypto ecosystem, we are witnessing the infrastructure-building phase of a new wave of technology.

At Visible, we talk to founders every day who are looking for investors. Our new Connect platform allows you to search our database of nearly 11,000 investors to do your own research, but in this post, we will be highlighting some of those investors in the blockchain space.

2020 Ventures

Stage: All Stages

Investment Geography: United States, Southeast Asia

Key person: David Williams

Blockchain investments: Bitpay, Polysign, Kava Networks, Ripple Labs, tokens like BTC, ETH, LINK, & more.

Thesis: 2020 Ventures doesn’t only invest in blockchain & crypto, but when they do invest in the space they make bets on both coins and companies in the space. They spend time primarily on payments & stores of Value, but also invest in DeFi, exchanges, and other projects.

Notation

Stage: Pre Seed

Investment Geography: New York, Agnostic

Key Person: Alex Lines and Nicholas Chirls

Blockchain Investments: Filecoin, Zepplin, Livepeer

Thesis: Notation capital explicitly says on their site that they are not thesis driven. Instead, they focus on writing the earliest checks into big ideas that are of interest to them. With deeply technical backgrounds, Notation is placing bets across many different sectors – blockchain being one of them. They’ve invested directly in protocols like Filecoin and in crypto-focused companies such as Bison Trails and Livepeer. You can read their operating principles on Github here.

Blockchain Valley Ventures

Stage: All stages

Investment Geography: Global

Blockchain Investments: Algotrader, Coinfirm, Keyless

Key People: Heinrich Zetlmayer

Thesis: Another hybrid advisory/investment firm, Blockchain Valley Ventures brings expertise to the blockchain space by helping projects of all kinds come to fruition. From corporate blockchain projects to startup ventures in the space, BVV is there to help with both capital and expertise.

Pillar VC

Stage: All stages

Investment Geography: United States, Northeast

Key People: Jamie Goldstein, Russ Wilcox, Sarah Hodges

Blockchain Investments: Algorand, Circle, LBRY

Thesis: Pillar is a highly founder focused VC fund that differentiates itself by investing in good founding teams. They invest across many categories, but found themselves as one of the first investors in new blockchain Algorand and several other crypto companies.

Boost VC

Stage: Accelerator/Seed

Investment Geography: Global

Key People: Adam Draper, Brayton Williams, Maddie Callander

Blockchain investments: Abra, Aragon, Filecoin, Ethereum, and many more

Thesis: Boost.vc invests in what they call ‘Sci-Fi Founders’ primarily via their accelerator. They have dozens of investments across many different frontier industries, primarily focusing on VR/AR, Crypto, and what they call ‘sci-fi’ investments.

Castle Island Ventures

Stage: All stages

Investment Geography: Global

Key People: Matthew Walsh, Nic Carter

Blockchain Investments: BlockFi, Zabo, Talos, and more

Thesis: Castle Island Ventures invests almost exclusively in public blockchain projects. They have conviction that public, permissionless blockchains will form a new economic infrastructure, and deploy capital using their past financial and crypto expertise in projects that support public blockchains.

Blockchers

Stage: Accelerator, Seed, Grants

Investment Geography: Europe

Blockchain Investments: Volvero, Blocksquare, and more

Thesis: Blockchers provides grants and occasional investments through their accelerator in the European Union. They are smaller than some of the other players on this list, but they’re a great option to explore if you’re building a blockchain based startup in Europe.

Kenetic Trading

Stage: Series A/Series B

Investment Geography: Global, but focusing on Asia

Key People: Jehan Chu, Daniel Weinberg

Blockchain Investments: BlockFi, Handshake, Alchemy, and many others

Thesis: Kenetic Capital is involved in a few different areas of crypto and blockchain markets. They invest in Series A and later blockchain companies like BlockFi and Handshake, and also are involved in cryptocurrency trading. They offer many sophisticated trading products and executes on advanced trading strategies with a team of experience software engineers and quantitative traders. Jehan Chu, the fund’s CEO, has played a major role in the building the blockchain community in Hong Kong and hosts meetups throughout Asia.

ConsenSys Ventures

Stage: Accelerator, All Stages

Investment Geography: Global

Key People: Min Teo, Joseph Lubin

Blockchain Investments: Compound, Gitcoin, Juno, and many others

Thesis: ConsenSys is a highly successful Ethereum software development company. They’ve built multiple hit products such as MetaMask, Codefi and Quorum. They’ve used their expertise to spin out an investment arm that has made investments to projects like Compound, Gitcoin, and many other protocols and infrastructure builders in the space. Just starting out? You can consider their hackathon or accelerator programs.

Placeholder VC

Stage: All Stages

Investment Geography: Global

Key People: Joel Monegro, Chris Burniske

Blockchain Investments: Magic, Nexus Mutual, 0x, Aragon, and many others

Thesis: Placeholder invests in new projects in the space that seek to build around cryptonetworks. Their thesis is that the advent of blockchains and their open-sourced nature will lead to a slow decline of the current tech monopolies of the day. The key reason: blockchains undermine the key advantage of tech giants: data monopolization. ‘crypto collapses the cost of building and scaling information networks by replacing centralized coordination with universal financial incentives.’ You can read their full investment thesis here.

Use Visible Connect to browser our investor database of hand curated investors. Find investors and add them directly to your Fundraising Pipeline in Visible. Give it a try here.

founders

Metrics and data

How to Easily Achieve Product-Market Fit

What does product-market fit really mean?

The first goal of every startup is to find product market fit. But what is product market fit in the first place? How do you know when you have it? The most famous and widely accepted definition of product market fit is one that Marc Andreessen coined in 2007, “Product-market fit means being in a good market with a product that can satisfy that market.” Andy Rachleff has expanded on this definition, adding that product market fit means identifying who you’re trying to serve (the market), what you’re going to offer (your product), and how you’re going to deliver upon that offering in a way that allows you to capture the value created by the product (your business model).

How do you achieve/find product-market fit?

Achieving product-market fit is about identifying needs in the marketplace and testing different ways of satisfying them. You must be thoughtful about how you can serve customers, and iterate quickly with your product based on their reaction to your offering. It’s also critical to understand your potential business model and how that relates to the market you’re trying to serve.

Learn how Yaw Aning, Founder of Malomo, found their first customers when searching for PMF below:

Defining Your Target Customer

The process of defining your target customer is the first step in finding product market fit. This step is about choosing your market. If you don’t know who you want to serve, you’ll have no idea what to build, and instead spend time and money on building a product that no one needs. It is key here to identify a sufficiently promising market. As this post by Andreessen Horowitz explains, a great product in a lousy market has no chance of succeeding, while a decent product in a great market has a much greater chance of finding product-market fit.

Identifying Your Value Proposition

Once you’ve identified a market and customer you’d like to serve, you’ll need to develop a value proposition to test in the marketplace. This value proposition does not have to be perfect. In fact, you should expect to iterate upon it and potentially decide to change it altogether. After all, the Twitter team started by building an app for podcasting, and Slack started off as a video game. If you assemble a talented team that works well together and don’t stop iterating, you can eventually identify the value proposition that makes sense for your market.

Building Your MVP

The MVP is designed to be your first entry into the market. Popularized by Eric Ries and his Lean Startup Playbook, an MVP is meant to help you test your value proposition. Today, many companies are using no-code or low-code platforms like WebFlow and Bubble to create basic versions of products and testing them in the market. These tools enable non-technical founders to test their ideas in the marketplace before building a full-fledged product with a team of engineers.

You often won’t know for sure if customers value your product until you put it into the market. This is why it pays to move quickly and release your product before you feel ready. This is especially true if your product is a mobile or web application that is easy iterate on (medical device or biotech founders should tread more carefully). Reid Hoffman, the founder of LinkedIn, has often said that ‘if you aren’t embarrassed by the first version of your product, you launched too late.’

Find Product-Market Fit Before Scaling

You should work to solve for product market fit before you worry about finding the perfect growth strategy. Andy Rachleff has said that you should work on solving for your value hypothesis before solving for your growth hypothesis. A 2011 study by Startup Genome found that 70% of the 3200 startups they studied scaled prematurely. To avoid being one of the 70%, focus on finding product market fit before you focus on growing your business. It’s tempting to raise giant sums of money and shoot for the moon – you just first need to make sure that you’ve built something in the right market that people really want.

Indicators of Product Market Fit

Once you’ve released your MVP into the wild and started iterating, you’ll likely wonder how to gauge whether you’re making progress toward product market fit. In fact, Facebook executive Alex Schultz has said that a major cause of startup problems happens when founders think they have product market fit, when they really don’t.

It’s easy to get caught up in vanity metrics that don’t indicate whether or not your product is succeeding. You should identify what metrics are real determinants of progress in the market – things like new revenue, customer retention, and NPS can be good examples of metrics to focus on. Perhaps the greatest measure of product market fit is your ability to grow without much investment in sales or marketing. Word of mouth growth is an outstanding sign that you’re on the right track. But, at the end of the day, product market fit is often clear. “As Eric Reis says, if you need to ask whether or not you have product-market fit, you don’t.”

Word of Mouth Growth

‘Word of mouth’ is a vague term that marketers use to describe the phenomena that happens when your product grows organically based on positive reviews from users. It’s difficult to measure, but many agree that it is one of the most powerful forces in the marketing universe. If your product grows through word of mouth, without significant spending on advertising, it can be a great sign that you’re on the path to product-market fit. Keith Rabois recounts an excellent story about Square growing exponentially with every new hardware device that was sold. Other potential users were seeing the Square point of sale device in person and becoming customers. To Keith and Jack Dorsey, this was a clear sign that they were finding product market fit. In their case, they had found a clear path to viral growth as well.

Keep Testing to Find Product Market Fit

One of the best ways to find product market fit is by looking at the process through the lens of the scientific method. You can develop a hypothesis around what users will want and then test it in the market. By viewing it in this way, finding product market fit can become a game. This frees you to overcome the fear of shipping. Rather than trying to build the perfect product at the start, you can continue building as you gain more clarity based on market feedback.

When people like Reid Hoffman talk about the importance of shipping early, they don’t mean that you should intentionally create something terrible. Rather, you should err on the side of releasing your product into the market because the feedback you’ll receive in return will provide information that can either support or falsify your hypothesis. Sometimes, the feedback you get can take you down a new road altogether. Startups are cash constrained, and need to find product market fit before they run out of money. It’s often better to release too early and get this critical feedback before you blow through half of your cash on what you believe to be the perfect idea, only for it to backfire.

Related Resource: 7 Startup Growth Strategies

How can you tell when you've achieved product-market fit?

When product market fit happens, it sometimes feels magical. Other times, it’s less obvious. In a consumer application that is built on viral marketing, it may be glaringly obvious when you hit product market fit – growth rates might explode and you could have a quick hit on your hands. In other areas, the process might take longer. If you run an enterprise SaaS business with a 6+ month sales cycle, it will take longer to see the fruits of your labor. Tyler Tringas of Earnest Capital calls this “the long, slow, SaaS grind.” If product market fit isn’t always obvious, how do we know when we’re on the right track?

In the case of the SaaS app, it may be realizing that you’re gaining new customers via word of mouth, or churn rates are very low. In other cases, an incredibly well received MVP (minimum viable product) could be an indicator of potential product market fit. Finding product market fit can be more of an art than science, but there are some things you can watch out for.

How do you measure product-market fit?

At its core, product market fit means that you’ve built something that solves a real problem for people or businesses in a large enough market. When you have it, potential customers will often start seeking out you to use your product without the need of marketing spend. If you believe that you’ve found product market fit, and can reliably predict your customer lifetime value, it could make sense to step on the gas with sales & marketing spend as a part of your growth strategy. Paypal after all was burning $10M/month at one point in their journey as their customer acquisition strategy revolved around giving users a free $10 to use their product. If your customers are loving your product and it has a high lifetime value, then a Paypal-esque strategy may make sense. Regardless of your strategy for finding product market fit, here are 2 things to observe when measuring your progress:

Know Your Customer Lifetime Value

When measuring product/market fit, you’ll need to make sure that you’re in a market & selling a product that makes your customer lifetime value high enough to pursue for the long term. If you sell a SaaS product that costs $10/month on average, but costs $10/month to support due to its complex nature, then you probably don’t have product market fit. On the other hand, if you have a product that sells for $1000/month and costs $5000 to build up front, you could have an excellent win on your hands (provided that churn is sufficiently low). Pricing is one of the toughest things to figure out in startups, but it’s critical to be aware of your customer lifetime value & the potential size of your market when making early decisions.

What’s Your NPS?

NPS (net promoter score) is a way to evaluate how likely your customers are to recommend your product to other people in their network. It’s been heralded as a key metric to track in recent years to evaluate customer satisfaction and gauge how effectively their company will grow via word of mouth. While it’s not perfect (qualitative metrics are notorious for having variance), it’s still a good thing to measure to determine how well your product is resonating. You should also look at other indicators related to NPS. How excited are your customers about your product? Are they posting about it on social media, or telling you about how it’s changed their lives? What about churn rates? A high NPS with a high churn rate usually means that you’re missing the mark.

Improving product-market fit requires you to iterate

Iterating on product market fit, as we mentioned earlier, requires you to take action and evaluate the results of that action. This process mirrors the scientific method – you start with an insight, do background research to observe what’s already been done, and formulate a hypothesis in the form of an initial product that you release into the market. Even if you receive a lackluster response, you formulate a new hypothesis & iterate on your product, repeating this process.

Sometimes, you’ll find that you were totally off in your initial product, or that your product was used in unexpected ways. If everyone knew how the market would react to new product offerings, there would be no point in building and developing new products! This is why it’s critical to get your product into the hands of users early to test your offering.

Most software businesses are perfect for this model – it helps to produce products that can be iterated upon immediately. Companies that produce hardware or more security-intensive products can also benefit from demonstrating prototypes to early adopters and getting early feedback on your concept, or offering pre-orders. The worst thing you can do is spend months or years building a new product that you realize nobody wanted. You’re better suited releasing an early version and building along with market feedback. Another great option is releasing an MVP and then launching a kickstarter campaign or offering pre-orders. Madelin Woods, a founder in our community, is a great example of this. She created prototypes of her burrito-eating tool ‘Burrito-Pop’ that generated buzz amongst friends & acquaintances. Her Burrito Pop Kickstarter fundraise generated enough funding to get version 1 to market.

Collect Data Consistently to Shorten Feedback Loops

Setting up short feedback loops is also critical. The more quickly you can get feedback from the market on your idea, the better, as compound interest applies to the iteration of products. You’re better off iterating 100 times on your offering, than spending 100s of hours on developing one version. It’s beneficial to keep an eye on metrics that are key indicators of growth & usage. At Visible, we measure key indicators of product engagement and conduct regular customer development calls when we build new product offerings. Mike, our CEO, will take demos and sit in on calls as we build. You can adopt the same mentality as you work to find product/market fit.

Build Quickly to Iterate Quickly

You can only iterate as fast as you can build. Using best practices for product development, we at Visible work in 6 week cycles where we choose key initiatives and ship product quickly. It’s key to have your product team working well together to ensure that your team is free to ship product on a consistent basis. Ryan Singer of Basecamp’s Shape Up provides an outstanding framework to help you ship product more quickly with less stress and headaches. The Visible product team endorses this process of development as it has helped us ship consistently on big projects every 6 weeks.

Be Ok With Changing Your Mind

As Winston Churchill said: “To improve is to change; to be perfect is to change often.” It’s critical to avoid the ‘sunk cost fallacy’ – continuing to invest in products just because you’ve already spent time or money on them. You must be willing to abandon projects or initiatives that no longer make sense for your business. Before you have product market fit, you cannot be too stubborn about the route you want your company travel. If Stewart Butterfield at Slack would have insisted on developing a video game, he could never have built the workplace app that runs thousands of companies around the world. This is challenging to do as a founder, as you and your team may need to abandon things you’ve worked hard on in exchange for something different. One of the greatest skills an early stage founder can have is inspiring their team to change directions when it’s needed.

Finding product market fit is the first challenge of building a company. If you stay focused on users, operate in a large enough market, and keep iterating, you’ll always have a chance. Once you have it, it’s time to pour more talent and capital onto the fire to grow your business – but that’s a topic for another day.

founders

Fundraising

How Rolling Funds Will Impact Fundraising

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Relatively speaking, venture capital is a fairly new asset class. Innovations have been consistent since Y Combinator came to market in the early 2000s. Since then there have been countless innovations that are creating more funding options for startup founders. The most recent innovation has been rolling funds. Learn more about rolling funds and what they means for startup founders below:

What are Rolling Funds?

Pioneered by Angelist, a rolling fund is a new VC fund structure that allows funds to raise money on a continuous basis – creating a new fund structure as quickly as every quarter. These funds can also be publicly marketed under Rule 506(c). While rolling funds are still relatively new, there have been early benefits and signs of more innovation to come. To learn more about rolling funds and their impact on startup founders and investors, read more below:

What are the benefits of Rolling Funds

Rolling funds have the opportunity to transform the venture capital space. As we begin to scratch the surface on rolling funds and how they fit into the space, there have been some clear benefits so far.

1. Attract New Types of Investors

These funds also lower the barrier of entry into VC for aspiring investors by allowing them to get started with less up front capital. Angelist can manage most of the legal and administrative aspects of rolling funds too, further lowering the overall amount of knowledge and capital needed to get started. Because of this, rolling funds may create many new types of investors.

2. Provides More Funding Options for Founders

More investors means more funding options for startup founders. As we mentioned above, rolling funds will lower the barrier to entry for emerging VCs, in turn creating more funding options for startups. As more competition pops up in the space, the more competitive it will become to get on a startup’s cap table. Because of this, funds will have to create more resources and terms for startups.

Related Resource: The Understandable Guide to Startup Funding Stages

3. Continual Limited Partner Fundraising

Rolling funds allow VC’s to continue to raise money from limited partners on a regular basis, essentially turning the process of LP investing into a quarterly subscription-based model. If an LP decides that they don’t want to continue backing an investor, they can stop allocating resources to them immediately. On the other hand, if they see that a given investor is making good bets, they can invest more money in them very quickly. This is especially useful for VC’s who would like to fundraise opportunistically in the case of portfolio markups.

4. Shortened Feedback Loops

This new structure will shorten feedback loops for venture capitalists. Startups take a long time to reach full maturity, but they still have clear milestones throughout their journey. If an investor has several companies in their portfolio that succeed in securing future funding or obtaining product market fit, they can be rewarded instantly by raising more money during the next quarter. This is good for LP’s too, as they can make small, periodic investments in rolling funds based on the real time performance of the investor. This is quite different from having to write very large checks every 10 years. It opens up LP investing to smaller funds and individuals – rather than just institutions.

How are Rolling Funds Structured?

As we mentioned, rolling funds will allow more people to become VC’s. Because companies like Angelist will allow these small investors to outsource many fund management responsibilities, more people with A+ networks and good judgment can get into the game.

For example, a star employee at Stripe or AirBnB might have access to many startup deals and the judgment needed to allocate capital effectively. Traditionally, if they wanted to get into VC, they would have needed to slowly work their way into an established fund or quit their job to start their own. If they didn’t want to do this, then they could angel invest, but then may not have hit the threshold needed to be an accredited investor (and even then they were confined to only investing their own money). Rolling funds allow them to start investing part time, and without needing to hit accredited investor requirements (although LP’s do need to be accredited). These new operator investors will be able to attract LP investment from many different sources, such as their managers, successful friends, and others who are impressed by their network and experience.

Maybe you, a current founder, have always thought that you’d be a good VC and wish you could allocate capital into your other founder friends’ deals. With rolling funds, you can start a fund as a side hustle. This enables you to capitalize on your access and judgement by investing in other founders.

506(c) Funds

Rolling funds are structured as a 506(c) offering. According to the SEC:

“Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that:

all purchasers in the offering are accredited investors

the issuer takes reasonable steps to verify purchasers’ accredited investor status and

certain other conditions in Regulation D are satisfied”

Put simply, a 506(c) requires that all LPs are accredited investors. As Investopedia puts it, “An accredited investor is an individual or a business entity that is allowed to trade securities that may not be registered with financial authorities. They are entitled to this privileged access by satisfying at least one requirement regarding their income, net worth, asset size, governance status, or professional experience.”

LP Subscriptions

Accredited LPs, limited partners, are the investors behind a rolling fund. As the name implies, rolling funds are raised on a rolling basis.

Quarterly Funds

As the team at Rolling Fund News puts it, ‘A rolling fund is structured as a series of limited partnerships: at the end of each quarterly investment period, a new fund is offered on substantially the same terms, for as long as the rolling fund continues to operate. With this fund structure, rolling funds are publicly marketable and remain open to new investors.”

Contributions

The fund managers are responsible for deciding what the contribution minimum or maximums are for LPs. Currently on the AngelList rolling fund marketplace the quarterly minimums range anywhere from $2,500 to $50,000.

Fee Structure

Like any venture capital fund, there are fees associated with a rolling fund.

Admin Fee

For all rolling funds on AngelList there is a 0.15% admin fee. The fee is similar to more traditional funds and syndicates offered through AngelList.

Management Fees

There are also management fees associated with rolling funds. Most management fees are 2% but can generally range anywhere from 0% to 3%. As defined by AngelList, “Each fund will pay the fund manager a customary management fee. Management fees generally accrue over the first ten years of each fund’s life and are typically payable in advance over four years. Like a traditional fund, GPs can waive fees on an LP-by-LP basis.”

Check out an example from AngelList below:

How to Get Involved with Rolling Funds?

The rolling fund structure opens up VC investing to many people who would have otherwise had a difficult time getting started. For example, imagine a fund built entirely around an independent media creator with a strong brand. High quality tech bloggers or university professors with a deep understanding of startups and a large audience can raise funding quickly on top of their brand and expertise. It could create an additional income stream for these individuals and allow them to build wealth through venture investing.

Networking

A common thread is that rolling funds will open up the opportunity to create a VC fund to anyone with a great network, access to deals, and good judgement around startups. Whether it’s an elite tech blogger, current founder looking to invest on the side, or startup executives who wants to benefit from their understanding and access to early stage companies – there will be new players in the VC game that might be different than the typical venture investor.

Exploring

Since launching rolling funds, AngelList has launched a marketplace where anyone can peruse and check out different funds that are currently raising. You’ll be able to check out the different funds (and their managers) to get an idea of who is in the space. Check it out here.

Invest

With lower investment minimums and more availability, rolling funds are becoming a feasible investment for non-traditional investors. Founders particularly are beginning to invest in rolling funds to invest in other founders. Of course this is an incredibly risky investment and should seek advice before investing.

How Rolling Funds Could Impact Fundraising

As we previously discussed, rolling funds have created more funding options for startups. Because of this it has the opportunity to impact the current VC fundraising process.

Related Resource: All Encompassing Startup Fundraising Guide

Increase in Total Number of VCs

Rolling funds will lead to an increase in the total number of VC’s. More entrants into the VC business will lead to pressure on the traditional players in the ecosystem and more competition for deals. This competition will lead to better prices for founders raising capital. Would you rather take money from your long time friend’s rolling fund or a Sand Hill Road VC during your Seed round? These options may be real in the next 5-10 years.

Rise in Early Stage Investing

At first, rolling funds will primarily impact early stage investing. Most of these new funds have raised relatively modest amounts of money compared to large VC’s. Due to the large amounts of capital needed to play at later stage investing, rolling funds might not have an impact there just yet. However, due to the nature of compounding, some rolling funds might grow much larger than expected. VC is dominated by power laws, and the most successful rolling funds might find themselves with LP’s begging to get into future rounds. A rolling fund with a few smash hit successes can instantly raise additional LP capital. Traditional VC’s would have to wait longer to do so. One can even expect large VC’s to adopt the rolling fund model in the future.

Easing Exit Pressure

A final way that rolling funds will help founders is by easing exit pressure. All VC investors (including those who run rolling funds), will want your company to swing for the fences and seek to be a massive outlier. Traditional VC funds, however, need to show returns to LP’s on a roughly 10 year time horizon so that they have the momentum necessary to raise additional funding. This sometimes gives VC’s an incentive to push your company to exit or IPO within a specific time frame. LP’s want to see returns on set schedules. If your company’s exit would help show better returns, your VC’s might pressure you into selling your company prematurely. With rolling funds, this is not as much of an issue, as they can raise funding from LP’s on a continuous basis, vs having to raise a giant new fund every 10 years.

Rolling Fund FAQs

Because rolling funds are fairly new to most founders and investors – check out a few common questions below:

Can You Market a Rolling Fund?

One of the unique factors of a rolling fund are that the general partners behind them are allowed to market them to the general public. As AngelList writes, “Unlike most traditional venture funds, managers of Rolling Funds (known as general partners or “GPs”) can publicly advertise their offerings to grow their investor network and raise money.”

Because of this, GPs of a rolling fund can attract LPs from different walks of life. More individuals are beginning to invest in rolling funds which means that startup founders will have a more diverse network of investors with more resources and connections available.

What is the Difference Between a Syndicate and a Fund?

As put by the team at AbstractOps, “A startup syndicate – or an investment syndicate – is a special purpose vehicle (SPV) created for the sole purpose of making one investment. Although syndicate investors are typically high-risk (high-reward) investors, through syndicates, they can invest in more deals with small amounts of capital, as little as $1,000 per syndicate. ” This means that a syndicate is only investing in a single company. On the flip side, a fund is dedicated to making investments across many companies.

Related Resource: Accredited Investor vs Qualified Purchaser

Is There a Minimum Investment for a Rolling Fund?

The minimum investment for a rolling fund varies from fund to fund. The list of Rolling Funds currently raising on AngelList varies anywhere from a minimum of $2.5K a quarter to $167K a quarter.

Checkout Visible’s Investor Database To Find the Perfect Investor

Early signs show that rolling funds are here to stay and can be transformational for both venture capitalists and startup founders. If you’re a founder looking to raise capital, check out Visible Connect, our investor database, here. We maintain the database with firsthand data and will continue to add new funds and data as it becomes available.

founders

Fundraising

5 Insurance Policies You Should Understand Before Securing Your Next Funding Round

While you’re busy launching your startup and talking with investors, insurance might not be high on your priority list. But as you start planning to raise your next round, keep in mind that commercial insurance will most likely be a requirement of securing venture funding. Not having insurance can even slow down funding, so it’s wise to get the coverage you need ahead of time to avoid closing new rounds.

Venture capital firms often require certain policies to help mitigate the risk associated with investing in your startup. Here we’ll explain five key policies you should understand to help make your next funding round as smooth and seamless as possible.

Directors & Officers (D&O) Insurance

D&O insurance will likely be the first policy you need to have in place to secure if you’re raising money from investors. D&O covers you, the company, and your board of directors from a broad array of claims associated with wrongdoing that results from managing the company. Some examples include:

Theft of trade secrets

Misrepresentation that results in a loss for investors

Breach of fiduciary duty

D&O has three main coverage areas:

Side A: Covers individual insureds not indemnified by the corporation

Side B: Covers reimbursing the corporation for indemnifying individuals

Side C: Covers the corporation itself against securities claims, such as company mismanagement

It’s important to note that D&O will not cover any instances of intentional illegal acts, such as fraud or illegal remuneration.

Tech Errors & Omissions (E&O)

Tech E&O is a type of professional liability policy that is specifically designed for the needs of tech startups and can cover liability associated with technology products or services you provide, media content, and network failures. Essentially, this policy covers claims where your products, services, or professional advice results in a financial loss for your clients. As your startup grows this policy will be essential to mitigating these risks. Keep in mind, tech E&O will not cover claims associated with a deliberate breach of contract.

Cyber Liability Insurance

While tech E&O will cover errors or omissions, it will not cover cases of cyberattacks. For that, you’ll need Cyber Liability. This is the only type of commercial policy that will help cover the damages associated with data breaches. You can often add this coverage to your Technology Errors & Omissions policy.

Startups rely on technology to keep their operations going and this leaves them vulnerable to hackers. In fact, a report by Verizon found that almost a third of all cyberattacks involved small companies and the average cost associated with data breaches, like notification and legal fees, will set you back thousands of dollars.

To help cover this risk, it’s important for startups to have Cyber Liability in place. This policy covers liability that originates both internally from employees and externally from hackers, and can cover the following areas:

Loss of digital assets

Business interruption expenses

Cyber extortion

Non-employee and employee privacy liability

Digital media liability

It’s important to note that Cyber Liability will not cover risk mitigation costs or loss of first-party intellectual property.

Employment Practices Liability insurance (EPLI)

As startups secure more funding and hire new talent, the risk for employee-related claims goes up. Since many startups often lack the HR and legal resources that large corporations have, disgruntled employees could easily sue for allegations of discrimination, wrongful termination, or harassment. Not only are these claims costly, but they can also damage a startup’s reputation.

EPLI insurance will cover the startup and employees against allegations of:

Discrimination

Wrongful termination

Sexual harassment

Retaliation

Workplace harassment

Breach of employer contract

Keep in mind, EPLI does not cover claims of bodily injury to employees. That’s what Workers Compensation is for.

Key Man Insurance

Key Man insurance is simply a corporate-owned life insurance policy, typically on the founder or CEO. With startups, the sudden or unexpected death of someone as important as the CEO or founder could sink the company. With Key Man insurance, if this were to happen, the company would receive the life insurance payout.

The Key Takeaway

As you start planning your next funding round, make sure you keep insurance top-of-mind. You’ve worked long and hard to get here, so it’s important your company is adequately protected. VC firms know they’re taking a big risk by investing in your company, so they’ll need reassurances their liability is covered. Don’t wait until the last minute to provide proof of insurance, you should make sure you’re getting the right coverage that fits your budget.

Some startups might find it difficult to secure commercial insurance due to their limited financial history. Make sure you use a broker that specializes in helping startups with broad management liability coverage.

With these policies in mind, you’ll be ready to sign on the dotted line to secure your next funding round in no time.

Related Resource: Down Round: Understanding Down Round Funding and How to Avoid It

By Emily Lazration, CoverWallet

Emily is the Content Marketing Specialist at CoverWallet, a tech company that makes it easy for businesses to understand, buy, and manage commercial insurance online. She has written for several outlets including Inc., Ooma, and Fundera covering small business news and advice.

founders

Fundraising

What Are Convertible Notes and Why Are They Used?

What is a Convertible Note?

A convertible note is a type of short term debt that converts into equity. Convertible note holders essentially get paid interest in the form of discounted equity shares, rather than regularly scheduled payments. They are often used by early stage startups when closing a seed round, and later stage companies looking for more cash in a ‘bridge’ round before their next planned fundraise. Convertible notes have a few key components:

Conversion Discount — The discount at which the investor will receive shares at the date of maturity or the next ‘qualified financing’ (i.e. the next round of funding).

Valuation Cap — The cap on the valuation (i.e. price) that the investors will pay for their equity during the company’s next fundraise.

Interest Rate — This interest rate will be added to the principal amount invested when the debt converts into equity. Most convertible notes in 2020 have a low rate to keep the value primarily on the equity conversion & reflect the current interest rate environment.

Maturity Date — Like some other forms of debt, convertible notes have a maturity date at which the investor can request full payment back from the company. This date is mostly designed to set expectations for the date of the next round of funding.

It depends. They have some clear advantages in that they tend to allow deals to get done faster. However, many in the VC community have been critical, citing that they come with more complexity and hidden risk down the road if both sides are not careful.

Related resource: Liquidation Preference: Types of Liquidation Events & How it Works

Are Convertible Notes Good or Bad?

When Convertible Notes Are Good

Convertible notes are good for quickly closing a Seed round. They’re great for getting buy in from your first investors, especially when you have a tough time pricing your company. Paul Graham wrote a post in 2010 called ‘High Resolution Fundraising’ in which he argued that innovation in convertible securities allows for more accurate & personalized pricing in early stage funding. If you need the cash to get you to a Series A that will attract a solid lead investor at a fair price, a convertible note can help.

When Convertible Notes Are Bad

Convertible notes are destructive when used carelessly. Having too many notes or poorly structured notes outstanding can put your company and later negotiations at risk by complicating your cap table. You should partner with a lawyer who understands the ins and outs of convertible notes, and educate yourself prior to closing a round with this type of funding. Convertible notes are great for speed in Seed rounds, but they must be well thought out to avoid problems later on.

What Happens When a Convertible Note Matures?

When a convertible note is issued, both the investor and founders are expecting the debt to ‘mature’ by converting to equity during a financing round within the next 1 to 2 years. However, notes also come with maturity dates, enabling the investor to get their money back (with some interest added to the principal) if that financing round does not happen on time.

There have been instances in which companies are either acquired before their initial equity round or choose to not raise any equity funding. These are both rare occurrences, but they create tough situations. See investors are not making an exceptionally high risk investment just to get their principal back plus a small interest rate. VC’s and angels win by having huge outliers in their portfolio – if they don’t get equity and you become a unicorn, they lose. It’s best for founders to add language into their convertible notes that state what investors can expect to get in these situations.

Do You Have to Pay Back a Convertible Note?

Convertible notes are just like any other form of debt – you’ll need to pay back the principal plus interest. In an ideal world, a startup would never pay back a convertible note in cash. However, if the maturity date hits prior to a Series A financing, investors can choose to demand their money back. This could effectively bankrupt the company. After all, the startup raised the money because they didn’t have the cash in the first place. If a company raises money using multiple convertible notes, this risk is even greater. Because of this, neither side of the table wants a convertible note to reach its maturity date prior to the next round of funding.

Is a Convertible Note Debt or Equity?

Convertible notes begin as short term debt, but convert into equity during a later round of financing by allowing the investor to receive a discount on shares at a future date. The investor technically has downside protection in the event that the company goes out of business until the note converts. They are entitled to their principal in a liquidity event prior to the conversion date, or if the note reaches maturity prior to a qualified financing.

Related Resource: A User-Friendly Guide on Convertible Debt

How Does a Convertible Note Convert?

A convertible note converts at the next ‘qualified financing round.’ In most cases, convertible notes are issued during a seed round, with the Series A round being the expected conversion event. However, it’s critical to understand the terms at which the note will convert because it will have a huge impact on dilution (this article goes into depth on convertible instruments and dilution). There are three options, all of which are explained in great detail in this post from CooleyGo and this one from Alexander Jarvis

Pre Money Method

In this instance, the convertible note converts based on the pre-money Series A valuation of the company. The dilution in this case will be passed from the founders on to the note holders and new Series A investors.

Percent Ownership Method

With this method, the note will convert based the percent ownership that the incoming Series A investor expects to receive. Founders bear the brunt of all of the dilution, which benefits the convertible note holder in addition to the new investor.

Dollars Invested Method

This method is unique in that it includes the value of the convertible note in the post money valuation of the company. In the Pre Money Method, the founder is favored at the expense of investors, while in the Percent Ownership Method, the founder gets diluted more than they expect. The Dollars Invested Method serves as a middle ground between the two, and allows the dilution to be shared amongst the Seed investors, Series A investors, and founders.

Why Are Convertible Notes Used By Startups?

Convertible debt has obvious advantages in that it can allow you to get deals done faster. By giving your first investor(s) a good deal, you compensate them for taking a risk on your team by allowing them the option to take a future stake in your company at a discount, while protecting their downside risk. However, you should be warned that these early benefits can come with nasty long-term consequences if you are careless with convertible notes. It’s best to be careful, do your research, and understand the terms so that you’re protected for future rounds.

When Should Convertible Notes Be Used?

When they can help you close your seed round faster:

If a company is trying to raise a seed round, one of the biggest challenges they’ll face is getting the first investor to say yes. There is an old saying in the startup world that the most common question investors ask is ‘who else is investing?’ There is a ‘herd mentality’ stereotype that is often applied to VC’s.

Even though it drives founders crazy, investors have a point. Startups almost always need cash to succeed, and if they’re not fundable, they’ll fail. For an investor to see a return, the company will need many other investors to see the same value.

No investor takes more risk in this regard than angels or early stage VC’s. They need to take the first chance on a company, typically long before it has any substantial financial or user data to make a convincing funding argument that’s based on fundamentals. Angels are making high risk bets on an idea, a team, and a market. Convertible notes allow founders to provide better deals to investors who take this risk, and ultimately give you a chance to scale your company.

To give you more time to determine a valuation:

One of the most difficult problems when getting an early stage deal done is agreeing on a valuation. Seed stage founders don’t have much data to help price their company, and every investor wants to wait until someone else agrees on a given valuation to get on board. Investors keep the company arms length, waiting for another fund or angel to take the first step.

With convertible notes, founders can offer better terms to an investor who writes the first check, and delay having to put a firm price on their company. Notes also enable companies to avoid extra legal fees associated with negotiations that take place during equity financing . This allows them to save cash and get deals done faster (although there are now templates like Series Seed documents that make this easier).

When Should Convertible Notes NOT Be Used?

When they can overcomplicate your cap table:

If a company raises money with multiple convertible notes, the cap table can get complex and the founders may place themselves in an uncomfortable position. This is especially the case if they don’t hit the next qualified financing on time. Convertible notes are still debt prior to their conversion. You may be liable to pay back cash that you don’t have if your future round doesn’t go as planned. This also gets awkward if founders don’t raise another round of funding at all (i.e. if the company gets acquired, hits profitability, or goes out of business). The key is to remove the complexity by trying to include these scenarios in your thinking prior to closing the seed financing. We suggest reading more about this from Jose Ancer on his insightful blog: Silicon Hills Lawyer.

When they come with extra dilution and liquidation multiples:

We touched on dilution in convertible note conversion earlier in this post, but they can also pose another challenge: liquidation multiples. Here’s a quick example on how a hidden liquidation multiple can surface with a convertible note:

Let’s say an investor who gives us a convertible note worth $1M at a $10M valuation cap (more math to come later). If we raise a $20M seed round, this investor ends up owning roughly 10% of a company that is now worth $20M. They only paid $1M, but now are entitled to $2M in the event of a liquidation. This investor will now receive 2x what they paid in the event of an early liquidation that is worth less than the initial valuation. This is quite disadvantageous for the founder (and potentially other investors). You can avoid this situation by adding some additional language to your convertible notes – similar to this this paragraph suggested by Mark Suster (but consult your lawyer first).

Related Resource: Everything You Should Know About Diluting Shares

What the pros say:

Many investors, such as Jason Lemkin, Fred Wilson, and many others have been critical of convertible notes. They would rather put a price on the company and believe that, due to their experience, they can negotiate a fair price quickly. They also argue that the valuation cap essentially puts a price on the company by default. If you’re willing to price your company, why not just raise the equity and avoid the headache that can come with the conversion? Jason Lemkin also argues that investors who invest with convertible debt are less incentivized to be involved early on. After all, they don’t yet have any control or stake in the company. To some investors, the complexity of convertible notes is not worth the time saved – it’s simply pushing important conversations down the road while exposing both sides of the table to unnecessary risk.

Convertible Note Examples

Let’s say you’re a founder of a seed stage company who just raised $1M via convertible note. The valuation cap is $10M and the discount rate is 20%. Then, you raise a Series A round 18 months later at a $20M valuation. If there are 1M shares outstanding, then new investors will pay $20 per share, while the investor who issued the convertible note will receive equity based on either a valuation cap or the discount – typically whichever is most advantageous for the investor on a price per share basis.