TL;DR — We are excited to announce Visible Connect, our investor database. Visible Connect uses first hand data and directly integrates to our Fundraising CRM. You can give Visible Connect a try here.

Fundraising is a challenging, time consuming process for startups. One of those challenges is finding the right investors. Founders spend countless hours trying to understand:

- Is this investor active? What deals have they done recently?

- Will they lead? Take a board seat?

- What geographies do they invest in? What stages? What verticals?

- What size checks do they typically write?

- Have they raised a new fund recently?

- Do they have certain traction metrics or growth rates they like to see?

The current patchwork of data sources & resources lack the founder first mentality, can be cost prohibitive and lack insightful data for founders who are fundraising.

This isn’t a novel idea. Founder-friendly individuals who know the pain of fundraising consistently try to solve aspects of this problem with lists like Joe Floyd’s Emergence Enterprise CRM and Shai Goldman’s Sub $200M fund list. We believe these efforts should be coordinated and data aggregated for the benefit of founders everywhere.

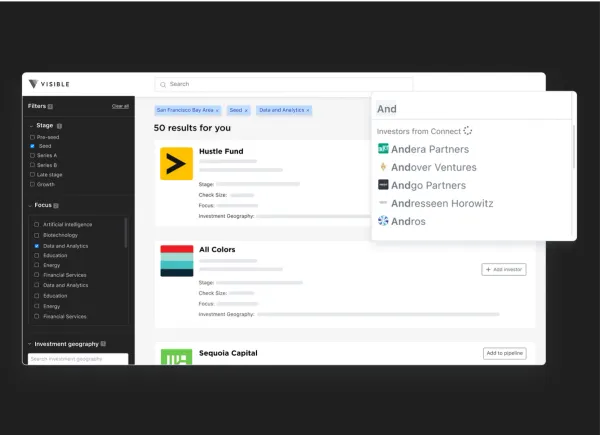

Introducing Visible Connect

In the spirit of the Techstars #givefirst mentality, we are thrilled to announce Visible Connect. Our attempt at curating the best investor information in the world and opening it up as a resource for founders to derive investor insights and run more efficient fundraising processes.

Visible Connect allows founders to find active investors using the fields we have found most valuable, including:

- Check size — minimum, max, and sweet spot

- Investment Geography — where a firm generally invests

- Board Seat — Determines the chances that an investment firm will take a board of directors seat in your startup/company.

- Traction Metrics — Show what metrics the Investing firm looks for when deciding whether or not to invest in the given startup/company.

- Verified — Shows whether or not the Investment Firm information was entered first-handed by a member of the firm or confirmed the data.

- And more!

Visible Connect + Fundraising Pipelines

Once you filter and find investors for your startup, simply add them to your Fundraising Pipeline in Visible to track and manage your progress (You can learn more about our Fundraising CRM here).

We believe great outcomes happen when founders forge relationships with investors and potential investors. One of the benefits of the current system is that founders with options are forced to be thoughtful about who they reach out to. However, not all founders feel they have options. They need to know that they do.

We believe Connect is not a tool for founders to ‘spray and pray’ or spam investors with template cold emails. There will be no contact emails provided on the database for this reason.

We believe founders waste precious time trying to figure out investor fit and profile for their given stage when they could be spending that time building potentially fruitful relationships with the right investors. It should not be a core competency of a founder to understand all of the investment thesis for venture investors.

Connect Data Sources

We collect data in three principal ways:

- Primary information – Direct attestations from venture capitalists, accelerators and other investment firms about their business

- Secondary information – investor lists provided to us by venture capitalists (co-investors) or startup founders aggregated in the course of a fundraise or the ordinary course of business

- Public information – third party data sources that are not labeled as proprietary or have terms of use associated. These sources may include: deal flow newsletters, public lists and databases, social media posts, journalistic articles, and more

We’d like to give special thanks to all the individuals who gave their time to build data sources used in the compilation of this ongoing project.

- The AllRaise Airtable of investors. All Raise is on a mission to accelerate the success of female founders and funders to build a more prosperous, equitable future.

- Data from the team at Diversity VC

- The Southeast Capital Landscape built by Embarc Collective, Modern Capital, Launch Tennessee, and HQ1

- Joe Floyd and the Enterprise Fundraising CRM

- Shai Goldman and the Sub $200M VC fund list

- Crunchbase Open Data Map API

- NVCA’s membership database

- The Fundery’s Essential VC Database for Women Entrepreneurs

- Venturebeat’s NYC lead investor roster

- This public airtable aggregating investors who invest in underrepresented founders (anyone know who we can give credit to?)

- David Teten’s list of Revenue-based Investors (and Chris Harvey’s tweet about it)

- Tech In Chicago’s list of Chicago VCs

- Clay and Milk’s list of Midwestern VCs

- Brian Folmer of XRC Labs

- Nick Potts of Scriptdrop

- Ideagist’s list of accelerators and incubators in California

- Jason Corsello’s Future of Work Investors

- Dan Primack’s Pro Rata Newsletter (We manually enter this data daily)

- Evan Lonergan’s Excoastal (We manually enter this data weekly)

- Austin Wood’s Tech Between the Coasts (We manually enter this data weekly)

We’re always looking to bring on more data sources, contributors and maintainers of the project. If you want to submit a data source or help contribute you can fill out this Airtable form.