Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Reporting

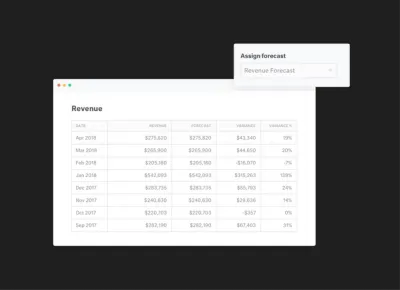

Quickbooks Update Template

QuickBooks Report Template

In the words of Tomasz Tunguz, Partner at Redpoint Ventures, “Financial statements are the Rosetta Stone for a business. They are the most succinct way of communicating how a business operates to management teams and boards, who weigh the trade-offs of different investments”. Distributing your financials to your team, investors, and board is vital to staying on top of your operations and uncovers insights for bringing a new product or service to market.

Using our Quickbooks data source, we put together an Update template that will allow you to easily visualize and distribute your key financial and operational data. Currently, our Quickbooks integration allows you to pull in the following metrics:

Cash

Customers

Employees

Expenses

Months Runway

Net Change in Cash

Net Income

Payables

Receivables

Revenue

Check Out the Template Here >>>

When sending a financial and operational Update it is important to make sure the information is understandable, relevant, reliable, and comparable. Many team members, investors, etc. are likely not concerned about granular data points but rather that they are moving in the right direction and are efficient as possible. Instead of overwhelming stakeholders with spreadsheets and complicated metrics, we’ve often found that it is most useful to send over a few charts with a quick narrative around what is working/not working/etc. For those looking to take it to the next level, it can be useful to include benchmarks and trends in the industry to show how certain metrics and financials are comparing to the industry as whole.

The template is broken down into 3 major components; Operational Overview, Expense Overview, and Other Notes. Keep in mind the financials you are tracking and sharing may change depending on the stage of your company; revenue is obviously not as important for a pre-revenue, early stage company. For our example, this includes revenue, cash position, and a high-level look at company expenses.

founders

Reporting

A Race to One Trillion: Microsoft’s 2017 Investor Letter

The Race to a Trillion Dollar Market Cap

Between the unofficial race to the first one trillion dollar company and the recent acquisition of GitHub we decided it would be an interesting time to look at Microsoft’s most recent shareholder letter. Recently passing Google’s market cap for the first time in 3 years their acquisitions and focus on “the cloud” (doesn’t hurt to purchase the company behind the largest repository of open source software) have proved to be a large factor in their push to $1T.

All of the charts, images, quotes, and emphasis below were added by us. Note: there may be removed sections of portions of the letter below. You can find the original 2017 Microsoft Shareholder Letter here.

PROGRESS AND OUR RESULTS

We delivered $90.0 billion in revenue and $22.3 billion in operating income this past fiscal year. Adjusting for Windows 10 revenue deferrals and restructuring expenses, revenue was $96.7 billion with $29.3 billion in operating income.

According to Morgan Stanley analyst, Microsoft will need to grow their revenue by 46% to $136B and net income to $46B to reach the trillion dollar threshold by 2020.

We continued to invest in innovation and expand our market opportunities, while maintaining our commitment to shareholder return, which included total cash return of $22.3 billion this year.

Our commercial cloud annualized revenue run rate ended the year exceeding $18.9 billion, up more than 56 percent year-over-year. Our cloud growth puts us squarely on track to reach the goal we set a little over two years ago of $20 billion in commercial cloud annualized revenue run rate in fiscal 2018.

“With Public Cloud adoption expected to grow from 21% of workloads today to 44% in the next three years, Microsoft looks poised to maintain a dominant position in a public cloud market we expect to more than double in size to (more than) $250 billion dollars.” – Morgan Stanley Analyst

Microsoft is doubling down on their cloud efforts and are expecting for strong growth with corporate usage for Office 365 and Azure.

The strength of our results across our reporting segments reflects our accelerating innovation as well as increased customer usage and engagement across our businesses

More than 100 million people use Office 365 commercial.

More than 27 million consumers use Office 365 Home & Personal across devices.

More than 53 million members are active on Xbox Live.

More than 500 million LinkedIn members use the LinkedIn network.

Windows 10 is active on more than 500 million devices around the world.

Dynamics 365 customers grew more than 40 percent year-over-year.

Azure compute usage more than doubled year-over-year.

As of June 14, 2018 the market cap for each company is…

Microsoft – $783B

Apple – $946B

Amazon – $832

Google – $806B

LOOKING FORWARD: OUR EXPANSIVE OPPORTUNITY

A new technology paradigm

As you can begin to see in the examples above, a new technology paradigm is emerging, one with an intelligent cloud and an intelligent edge. Microsoft will lead this new era. There are three characteristics that define this shift. The first is that the experience layer is becoming multidevice and multisense, where a person’s experience with technology will span a multitude of devices and become increasingly more natural and multisensory with voice, ink, gestures and gaze interactions. Second, artificial intelligence (AI) will be pervasive across devices, apps and infrastructure to drive insights and act on your behalf. Third, computing will be more distributed than ever before with compute power at the edge, whether it’s the connected car, the connected factory floor or any connected device. As developers write new applications for this paradigm, they need new mechanisms to manage the complexity of distributed, event-driven computing.

Microsoft made a big splash with their recent $7.5B acquisition of GitHub. The acquisition stays in line with Satya Nadella’s focus on the cloud and open source projects. GitHub has already had a large presence in enterprise sales with GitHub enterprise and will be able to tap into Microsoft’s massive enterprise customer base. With the continued growth of public cloud usage Microsoft is looking to grow their strong position in the space.

With this new paradigm comes new opportunity. Every customer is looking for both innovative technology to drive new growth and a strategic partner that can help them build their own digital capability. Customers are looking to change how they use digital technology and to reimagine how they empower their employees, engage customers, optimize their operations, and change the very core of their products and services. They are building their own digital systems of intelligence to drive growth. Microsoft is uniquely positioned to capitalize on this opportunity with the combination of our technology, partner ecosystem and culture of growth mindset.

As we look ahead to fiscal 2018 and beyond, we will focus on bringing our technology and products together into experiences and solutions that deliver new value for our customers. Going forward, we will focus our innovation and investments in areas where we see the greatest opportunity for growth.

The modern workplace

The workplace itself is transforming — from changing employee expectations, a widening skills gap, more diverse and globally distributed teams, to an increasingly complex threat environment. The productivity experiences and tools we deliver will unlock the creator in all of us and enable seamless teamwork not just in the workplace, but also at school and at home across all the devices people use — from the phone to the laptop to mixed-reality headsets to the whiteboard. The Microsoft Graph, which provides the underlying data model of the user’s experience, and the LinkedIn network, will make it possible for every professional in any business or functional role to be much more productive in getting things done.

Enter Office 365, Windows 10, and LinkedIn. Office 365 currently has 100 million users and is expected to double to 200 million by 2020 on top of LinkedIns already 500m users.

Applications and infrastructure

Cloud computing is foundational to enabling digital transformation for any organization. Beyond being a trusted, global, hyper-scale cloud, what makes Azure unique is our hybrid consistency, developer productivity and SaaS application integration. Our hybrid infrastructure consistency spans identity, data, compute, management and security, helping to support the real-world needs and evolving regulatory requirements of commercial customers and enterprise-focused SaaS ISVs. Azure Stack is an extension of Azure that enables developers to build and deploy applications the same way whether they run on the intelligent cloud or the intelligent edge. With Visual Studio and Azure Services, we provide the toolchain and application platform for modern DevOps that helps organizations with their agility and productivity — and enable them to use the best of the Windows ecosystem and the best of the Linux ecosystem together. Azure enables SaaS ISV developers to reach 100 million plus enterprise users through the integration of Azure Active Directory and Office 365, and by embedding Power BI, Power Apps and Flow as part of their applications, enables customers to have consistent identity, developer extensibility and security across their application portfolio spanning their own custom applications and SaaS applications.

Microsoft has doubled down on their cloud investment and are going after Amazon and Google’s cloud services as the market continues to grow.

While AWS still has a commanding percentage of the enterprise cloud market Azure has been rapidly chipping away at Amazon’s lead. Azure went from 34% to 45% of the market while AWS still grew from 57% to 64%. The data above comes from a survey by TechRepublic of 1000 technical professionals.

Gaming

The $100 billion plus gaming industry is experiencing massive growth and transformation, and we have an expansive opportunity as we think about gaming end-to-end — from the way games are created and distributed to how they are played and viewed. We will build on our strong foundation of connected gaming assets across PC, console, mobile and work to grow and engage the 53 million strong Xbox Live member network more deeply and frequently — from great game experiences to streaming to social to mixed reality. We will be the company for gamers to play the games they want, with the people they want, on the devices they want. I’m excited about our opportunity to accelerate our growth opportunity, innovate boldly and earn new fans.

Microsoft has been on an acquisition spree in the gaming market. On June 10, Microsoft announced the acquisition of 4 game studios as they continue to innovate and grow their gaming business. Microsoft’s continued investment in Xbox, AI, and live streaming video games have the opportunity to be a large part of their Azure Cloud business.

founders

Hiring & Talent

Metrics and data

An Update Template for Sharing Your HubSpot Funnel Metrics

What campaigns are working? What content is performing best? Where can we improve inefficiencies? Where should we double down? Continuing to review, analyze, and “duct-tape” your funnel is key to executing an agile marketing playbook.

“Data doesn’t do you any good unless you act on it. Each of these metrics clearly tells you how you’re doing. Right away, you’ll know where you need to spend your time.” – Andrew Chen, a16z

General Funnel Metrics

Automatically bring in general funnel metrics using our HubSpot integration. Bring in basic lead counts or use filters to bring in granular funnel metrics to dig into where you can improve the most. You can check out examples for bringing in different pipeline stages below:

Different Lead Stages; subscribers, MQLs, SQLs, PQLs, etc. – Start with “Contacts” as your HubSpot Object. Anchor the date to any field you or HubSpot are automatically tracking; create date, became an XYZ date, etc. From here, you can filter your different contacts however you’d like. For this example, we our simply using our “Lifecycle Stage” but can easily break that down by different sources, personas, sales reps, etc.

Note: Use the value field to tie a monetary value to your metrics. For example, using “Deal Amount” to bring in the value of all of the contacts in a certain stage. From here, you can use formulas to calculate the weighted value of different pipeline stages.

New Customers – Start by connecting the object where you are tracking new customers and their value; likely companies or deals. Just as you would for lead stages, you’ll want to anchor the object to the field that denotes a new customer; lifecycle stage, etc. Use the value field to bring in a simple count or the total dollar amount for won deals. Easily take a look at the row level data to see where customers are coming from, renewal dates, and more.

Top of Funnel: Lead Source Breakdown

Marketing attribution is tough. Staying on top of your lead sources and continuing to tweak and improve inefficiencies is a quick way to keep your growth metrics moving in the right direction. Keep tabs on where your leads are coming from by filtering different leads by their lead source.Use “Filters” when connecting HubSpot to Visible to break down new leads by different sources, campaigns, and events. Drill down using row level data to see what specific leads are coming from what sources.

You can check out an Update example for sharing your funnel metrics and lead sources here.

founders

Reporting

“Our Coffee & Our People”: The Starbucks 1992 Investor Letter

Howard Schultz recently announced that he will be stepping down as executive chairman of Starbucks; exactly 26 years after their initial public offering. In 26 years as a public company, Howard helped transform Starbucks from a small coffee chain into a global brand with over 27,000 locations.

In our newest investor letter, we can take a look at the 1992 Starbucks Shareholder Letter; their first as a publicly traded company. With no mentions of mobile ordering, international expansion, or Unicorn Frappuccinos it is remarkable to see the growth that Starbucks experienced with Howard Schultz at the helm. Expanding from 154 to 27,000+ locations two things have stayed true throughout; Starbuck’s commitment to their people and their coffee.

All of the charts, images, quotes, and emphasis below were added by us. You can find the original 1992 Starbucks Shareholder Letter here.

The 1992 Starbucks Shareholder Letter

TO OUR SHAREHOLDERS:

Every successful business has its competitive advantage. At Starbucks we have two: Our coffee and our people. Since our inception in 1971, Starbucks has been based on an unrelenting (some would say fanatical) devotion to providing its customers with the best possible cup of coffee.

In Howard’s last shareholder letter (2016) this still rings true. Starbucks has continued to double down on enhancing the lives of their “partners” and the communities where they live and work.

One indicator of this passionate commitment is the question we ask ourselves whenever we assess our efforts: are they as good as the coffee? Our retail stores are intended to be environments worthy of housing the finest coffees which nature and skilled human labor can provide. Dedication to quality, in the cup, is what Starbucks is all about.

At the time of their IPO Starbucks was doing ~100,000 transactions at their retail stores a week. As of 2016? 85M+ transactions a week across their retail stores. In addition to their focus on people, Starbucks has scaled their transactions while staying true to their focus on quality coffee. Below is an excerpt from Howard’s letter to partners announcing his departure:

“Sourcing and roasting the highest quality arabica coffee will always be our heritage. Never stop reaffirming Starbucks leadership position in all things coffee. I can think of no better expression of this than our Reserve stores.”

A look inside the experimental Starbucks Reserve in Chicago.

Many of the specifics that make our company seem unique to others are, to our way of thinking, simply natural, even inevitable, consequences of this core attitude and aspiration. Quality coffees are grown, roasted, brewed, by quality people, and the welfare of the people, the planet and product are inextricably linked. Our “employees” are called partners, and this is literally true, since every individual is offered stock options.

We seek to seamlessly interweave variables that ensure quality for the customer with literal ownership in the company. We want to be the employer of choice in each market in which we do business. In order to achieve this goal we pay fairly, provide benefits to all whether part-time or full-time, and encourage individuality and open communication. Our environmental commitment begins with recycling and conserving wherever possible.

We donate coffee locally in every market, providing homeless shelters and hospices better coffee for free than many of our competitors offer at full price. We are also entering our second year as the West Coast’s largest corporate donor to CARE, the international aid and development organization. Starbucks, together with its customers, funds CARE programs in the coffee producing countries of Indonesia, Kenya and Guatemala, with an emphasis on disease prevention and increased literacy for children. This year has been an exceptionally rewarding one.

We achieved sales of $93,078,000 which were up 61.5% from 1991. We opened 53 new stores, including ones in our newest markets of San Diego, San Francisco and Denver.

To no surprise, Starbucks has not been able to sustain their growth rate after raising $25M+ from their IPO but have continued to grow store locations at a steady rate. In 2017 more brick-and-mortar stores closed since the start of the “Great Recession” (2007), yet Starbucks added 2,250 net new store locations over the course of the year. The commitment to their people, coffee, and culture has continued to resonate with customers around the world.

Also, we earned $4,104,000 after tax which represented a 70.4% increases versus a year ago. Lastly, Starbucks’ entrance into the world of publicly-owned companies this June was profoundly significant, both within the company and for the specialty coffee industry as a whole. It is an affirmation of our leadership position, but it is first and foremost a powerful demonstration of what can result from the joining together of great people and great coffee.

Howard Schultz

chairman, president, and chief executive officer

founders

Metrics and data

Use Sheetgo To Consolidate Your Google Sheets Reporting

Hate them or love them, spreadsheets are here to stay. Everyone has been a part of the confusion that comes with tracking and sharing your spreadsheets. A few metrics here, a few metrics there, it can become a days work to find and surface the right sheets. Thanks to our friends at Sheetgo you can easily centralize and consolidate all of your online spreadsheet data across multiple Google Sheets and CSV files.

Centralize Your Data

No need to chase managers and colleagues for their spreadsheets and data on a regular basis. Using Sheetgo you can easily connect multiple Google Sheets to feed into a master sheet to have your key data at your fingertips. SheetGo is a powerful tool to build, maintain, and scale an internal data distribution system.

When connecting multiple sheets you likely won’t need all of the data points in each. SheetGo can be as powerful or simple as you would like. Use their filters to determine what data you will be bringing in from each sheet or use personal queries to customize the process to your needs.

Outside of centralizing your team’s data help your clients, board, and investors stay on top of key data with consolidated sheets. Running ad campaigns on multiple platforms for a client? Easily take the data exports and centralize all of their vital data into one sheet.

Visualize & Distribute

Once you have your Sheetgo connections in place connect a single sheet to Visible to visualize and distribute your data. As you continue to update the individual sheets fueling your “master sheet” your charts, dashboards, and Updates will automatically refresh in Visible as well. Using a combination of Visible & Sheetgo it has never been easier to stay on top of your spreadsheets and avoid the frustration that comes with hunting down your data.

Ready to simplify your teams spreadsheets and data? Check out Sheetgo and let us know what you think.

founders

Reporting

Netflix IPO: A Lesson in Investor Relations from Reed Hastings

Just a few days away from the 16th anniversary of the Netflix IPO we decided to take a look at the initial investor letter and market sentiment from May 2002. Merely a DVD rental subscription at the time Reed Hastings briefly mentions online streaming and fails to mention creating original content. At the time a “niche business“, Netflix has transformed into a media giant and one of the more intriguing technology companies of our era.

Fast forward to 2018 and the only way I know how to watch a DVD is in a friend’s 2003 Honda Odyssey. Or better yet, I can just pull up the Netflix app on my phone and start streaming Stranger Things, Narcos, or one of their other original productions.

All of the charts, images, quotes, and emphasis below were added by us. You can find the original 2002 letter from Netflix CEO, Reed Hastings, using this link.

The 2002 Netflix IPO Letter to Investors

I’m pleased to report to you that 2002 was a truly remarkable year for Netflix. In this, our first year as a public company, we met or exceeded all of the financial and operational goals we had set for ourselves 12 months earlier. During a time of continuing uncertainty in the technology and financial markets, we were one of only eight technology companies to successfully complete an initial public offering in 2002. And in each of our three subsequent reporting periods as a public company, we outperformed investor expectations for key financial metrics, including revenues, expenses, EBITDA, and free cash flow.

In this climate, the strength of our business model has been resoundingly validated by consumers who, in ever increasing numbers, have found significant enjoyment and value in our online movie rental service. In this letter, I will explain to you how this model works, why it is working so well, and why we believe it will ultimately change the way people experience and enjoy watching movies at home.

First, I’d like to share with you a few highlights from our past year.

THE PERFORMANCE OF THE YEAR.

During 2002, we experienced the kind of rapid growth that many technology companies promised just a few short years ago but few delivered.

In 2002, we doubled our revenue to $152.8 million, from $75.9 million in 2001. We ended the year with approximately 857,000 total subscribers (more than 1 million as of this writing), up 88 percent over the previous year. With positive free cash flow of $15.8 million for 2002 and $104 million of cash and short term investments, we have, and intend to maintain, an extremely strong balance sheet.

Clearly, we are pleased with the results of the past 12 months. In addition to our strong financial performance, our accomplishments also included surpassing, in our first major metropolitan target market of San Francisco, our nationwide goal of 5 percent household penetration.

Since 2002, Netflix has thwarted their expectations of 5% household penetration. As of January 2018, Netflix has made its way into 50%+ of U.S. households with broadband access.

We remain opportunistic in looking for ways to improve our service and our operations. In 2002, we invested in 12 new distribution centers around the U.S., increasing the number of our subscribers who receive their DVDs with next-day service through the U.S. mail. Our marketing initiatives to acquire new subscribers through various channels including banner advertising, direct merchandising, and word-of-mouth remain highly successful. We will continue to evaluate the cost-effectiveness of new channels such as broadcast television as the number of DVD households continues to grow.

Remarkably, Netflix still operates 17 distribution centers. A low from their 50+ they had in 2016. Netflix has continued to own marketing. Transitioning from banner ads and direct merchandising to impressive product (e.g. original content, personalized content, etc.), multi-channel, and email marketing.

BUSINESS BASICS.

Investors are right to ask why a company, regardless of how well it may be doing at present, believes its success will endure. At Netflix, we are encouraged by a number of market trends that indicate strong demand for our service in both the immediate and long-term future.

For starters, consumers are becoming increasingly comfortable with the Internet. The widespread adoption of broadband technologies means a smoother web experience for more people across the U.S. In particular, people are coming to appreciate the more personalized recommendations that are enabled by software (compared to, for example, recommendations from video store clerks who may know nothing about their customers’ movie tastes) as well as the ease and security with which purchases may now be made online.

Netflix has stayed true to this idea and continues to dominate competitors in algorithmic based content curation (more below).

Second, as hardware improves and costs come down, the growth of DVD as the medium of choice for at-home movie entertainment is accelerating. We expect that household penetration of DVD, already the fastest-growing consumer electronics product in history, will climb from its approximately 40 million TV households currently to over 100 million in the next three years.

As DVD ownership has become more mainstream, so has our subscriber base. In 1998 the demographic profile of our initial target subscriber was a classic early adopter: predominantly affluent, technologically-savvy, and male. Today, women make up more than half of our subscribers, while the household income of members joining today is roughly half that of subscribers who joined two years ago.

MERCHANDISING MAGIC.

The result of these trends is a market that we currently dominate with a highly visible brand presence. It is also a market that we believe will continue to mature, along with our Company. To ensure that we take advantage of this momentum, we are continually developing our understanding of how people browse and select movies.

The key to our phenomenal consumer acceptance and business success is the sophisticated software that powers our website. Here, our subscribers are able to browse through 14,500 film titles—virtually every movie available on DVD, including both the latest and most popular TV series as well as hard-to-find documentaries—and place the ones they want to receive on a rental list that they continually replenish with new choices.

In the past year we have significantly improved our ability to merchandise our titles to match the tastes of our subscribers. Beyond the richness of our inventory and the robustness of our distribution software lies what we believe is the true strength of the Netflix model: a proprietary system for personalizing movie recommendations for each subscriber via a remarkably powerful and innovative rating system. Instead of using someone else’s tastes to guide a subscriber’s choices, Netflix builds a profile of each person’s movie likes and dislikes to truly personalize a DVD recommendation.

Evolution of the Netflix personalization approach

“We want our recommendations to be accurate in that they are relevant to the tastes of our members, but they also need to be diverse so that we can address the spectrum of a member’s interests versus only focusing on one. We want to be able to highlight the depth in the catalog we have in those interests and also the breadth we have across other areas to help our members explore and even find new interests. We want our recommendations to be fresh and responsive to the actions a member takes, such as watching a show, adding to their list, or rating; but we also want some stability so that people are familiar with their homepage and can easily find videos they’ve been recommended in the recent past.” – From a 2015 Netflix Technology Blog Post

The result is more often than not the movie-lover’s discovery of a personal “gem”: a movie that a subscriber has perhaps never even heard of and which may turn out to be a genuine favorite. This kind of match expands the audience for both acclaimed and lesser-known films—award winners that made their debut on DVD through Netflix and have gone on to find broad distribution, as well as smaller, low-profile movies from independent filmmakers and distributors.

Subscribers rented fully 97 percent of the movie titles we carried in the fourth quarter of 2002. To help achieve such remarkably broad inventory utilization, we’ve added new areas on our website, such as the Critic’s Pick page and the Netflix Top 100 page, that make it easier for subscribers to discover interesting content. For customers who know what they want to watch, we’ve made the search function more intuitive, with better ranking of search results and more obvious results listings. And we’ve made it easier for subscribers to answer their questions and resolve problems online, which has reduced our service costs.

LOOKING AHEAD.

Our vision is to change the way people access and view the movies they love. To accomplish that, on a large scale, we have set a long-term goal to acquire 5 million subscribers in the U.S., or 5 percent of U.S. TV households over the next four to seven years. By then, we expect to generate $1 billion in revenue and $100 to $200 million in free cash flow.

In the shorter term, a year from now, I expect to be able to report to you that we ended the year 2003 with 25 operational U.S. distribution hubs, initiated international expansion into Canada, and generated total revenue of more than $235 million.

We are fortunate to have in place an extremely strong management team that has both the experience and the vision to propel the Company forward in what we believe will be a dynamic new market. As we continue to roll out and improve our service, we are optimistic that we have the potential for even greater gains ahead.

The coming year promises to be an exciting one for Netflix, and we hope that you’ll be with us to enjoy the show. On behalf of the management team and dedicated staff at Netflix, I would like to thank you for your continued support over the past year, and I look forward to your continued participation as a member of the Netflix family.

Sincerely,

Reed Hastings – Chief Executive Officer, President, and Co-Founder

founders

Hiring & Talent

Operations

Metrics and data

Operations

Startups: Why Send Management Reports?

Successful companies share a few key traits… so do unsuccessful ones. Investors, executives, team members, potential hires, etc. understand this. Regular management reports show the CEO/CFO/etc. are key in keeping business decisions agile while showing you value what your management team brings to the table.

How Can You Get Started with Successful Management Reports?

It’s a lot easier than you might think. Good management reports don’t have to be long and they don’t have to be time consuming. If you’ve already got metrics, KPIs, etc. in place with your teams it is a matter of extracting the key data and turning it into something easily replicable, actionable, and digestible. Sharing financials, metrics, and dashboards can certainly be useful to managers but suffocating at the same time.

Bringing clarity and simplicity to management reporting is a strong start to avoid “the activity trap” and keep managers, teams, and individuals focused on their original purpose. It is easy for team members to get lost in their day to day and ultimately forget why they joined your company to grow the company and themselves. In working with countless CEOs, CFOs, and managers, we have a few things to keep in mind while building your management reporting and data distribution system:

Replicable – Keep metrics and objectives comparable from report to report. Chances are you’ve got an objective in place so be sure to highlight that in every report to keep focus where it matters most.

Actionable – Be sure that the report leaves room for questions, discussions, and a game plan until your next meeting, report, etc.

Digestible – Make the report light and to the point. Be sure to include only the 2-6 most vital metrics as full dashboards and spreadsheets can become suffocating and distract from your manager’s main objectives.

An Example Management Report

You can check out an example of a Visible Management Report Here.

As always, feel free to sign-up for a free trial here and email support@visible.vc if you’d like the template dropped into your account.

founders

Metrics and data

Product Updates

Using Variance Reporting in Visible

Use Variance Reports to Determine How You’re Tracking to Your Projections

How are we doing? Are things going to plan? Are we overspending? Underspending? Where should we double-down? Cutback?

These are all questions that you’ve likely encountered in a management meeting or recent board meeting.

Today we are excited to announce new Variance Report module that will be part of our insights layer. Variance reporting will let our customers quickly assign any of their KPIs to a forecasted or budgeted value and with one-click get back a full Variance Report.

We’ll calculate the following in your Variance Report:

MTD Variance

MTD Variance %

YTD Actual

YTD Variance

YTD Variance %

YTD Actual

prior yr YTD Actual

prior yr YTD Variance

prior yr YTD Variance %

Our budget vs actual and variance reporting will give you instant insights and reporting capabilities for any of your metrics in Visible. Being able to make timely decisions based on your forecasts and budget will help accelerate growth, manage your bottom line and hit goals across your organization. Utilizing the variance report in Visible is great for:

Weekly team updates showing progess towards your Monthly and Annual Goals

Crafting monthly management reports to your leadership teams providing feedback on where you under/over performed

Creating pre-board meeting reports that give a health check on where you are compared to board approved budgets.

We hope you enjoy! Sign in to Visible to get started to or sign up! Feel free to email support@visible.vc with any questions, comments and feedback.

Up & to the right, The Visible Team

founders

Metrics and data

Top Down vs Bottoms Up Projections

Financial projections are essential for any business, even if it’s not yet generating revenue. A variety of specific methods exist for performing this task, but they can generally be classified into top-down and bottom-up approaches. Financial analysts often use both methods as checks upon each other.

Top Down Projections

A top-down method of estimating future financial performance uses general parameters to develop specific projection numbers. You’ll often use a top-down approach to determine the market share that your new business can expect to receive. You might start with the market value of your product, narrowing it down to a particular location as much as possible. You would then assume that your business will receive a specific portion of that market and use that estimate to generate a sales forecast.

A top-down approach is comparatively easy since the only parameters it really requires is the total market value for your area and the market share you expect to receive. This method is most useful for checking the reasonableness of the projections resulting from a bottom-up approach. However, top down projections aren’t recommended for preparing detailed forecasts.

Example

Assume for this example you plan to open a business in an area where the total annual sale value of your product is $2 billion. You believe that your business might get 0.01 percent of that market, resulting in annual sales of $200,000. Note that your financial projection is entirely dependent upon the accuracy of your estimate on the product’s market value and your market share. Furthermore, the top-down approach doesn’t you to ask “what if” type questions.

Bottoms Up Projections

The bottom-up approach uses specific parameters to develop a general forecast of a business’s performance. This method might start the number people you expect to pass by your business each day, also known as footfall. You would then estimate the percentage of footfall that will enter your store and make a purchase. The next step is to estimate the average value of each purchase to project your annual sales. Bottoms up projections are based on a set of individual assumptions, allowing you to determine the impact of changing a particular parameter with relative ease.

You may use a bottom-up approach to select a location for a new business. You can obtain an accurate estimate of the footfall by direct observation. You can also observe similar stores in that area to estimate the percentage of footfall that are likely to enter your store. The prices that your competitors charge will give you a good idea of the price you can expect to charge.

Example

Assume for this example that an average of 10,000 people pass by a particular location each day. About one percent of this traffic in this area enters a store and makes a purchase, and the average total of each sale is about $5. The expected annual sales revenue in this example is therefore 10,000 x 0.01 x 5 x 365 = $182,500. You can then refine this estimate by considering additional factors such as price changes, closing on weekends and seasonal fluctuations.

founders

Hiring & Talent

What Does a Bad Sales Hire Really Cost Your Startup?

How to Avoid a Bad Sales Hire

It’s a dilemma for any company: your growing startup begins to face increasingly aggressive quarterly goals and the pressure is on to scale your sales team to meet the growing needs. Why is growth a challenge? It increases your chances of making the wrong hire.

According to Mindflash, 38 percent of all bad hires come from companies looking to fill a position quickly. Another 21 percent blamed an inability to test or research the employee’s skills well enough while another 11 percent pinned the bad hire on the company’s failure to check out references. Each scenario screams out a company pulling the trigger too quickly to fill a spot. This can be an especially deadly concern when it comes to your sales team.

There’s no doubting that filling sales positions is hard. When surveying companies from 2006 to 2012 on the hardest jobs to fill, the ManpowerGroup consistently named sales as the annual winner for the toughest department.

For every company, it’s a large opportunity cost to miss out on the next great closer and land a dud instead. But for a cash-conscious growing business, a bad sales hire can be especially devastating. Many businesses have considered the costs of a bad hire to equal the amount it takes to recruit, onboard and train a salesperson. But a bad sales hire isn’t simply limited to the hiring costs. Your business will incur more than a fixed set of initial costs.

Chris Young believes you can expect to calculate the total costs by adding up these two categories:

The cost to recruit, onboard, and train a salesperson.

The average sales of your Top 20%, Average, and Bottom 20% salespeople.

You can expect a bad sales hire to cost your business well into a six-figure sum. A 2012 report by the DePaul University Centre for Sales Leadership estimated an $114,957 price tag on the cost to hire, train, and replace a salesperson alone. The same report claimed a 28 percent turnover rate for salespeople.

Then there’s the toll it takes on your team. The amount of administration and management time that will be sucked from your staff when you make the wrong hire can be staggering. Bad sales hires require special attention and additional training when employed. Studies have shown that an average sales manager wastes 13 percent of their time focused on poor performers. Then, when the inevitable need to terminate arrives, administrators will need to spend valuable time following the proper protocols to justify and oversee the employee’s dismissal. Finally, your HR department will spend additional time with exit interviews and you might be on the hook for severance costs.

In their 2006 book Never Hire A Bad Salesperson Again, Dr. Christopher Croner and Richard Abraham also argued a business will face soft costs with any sales hire like losing value from the customers your rep is handling through neglect or poor behavior. Croner and Abraham estimated the cost at 10 percent of a rep’s quota.

Despite whatever short-term needs your business may face, it’s essential to the long-term health of your organization to avoid bad hires at all costs. If that means slowing down headcount and even missing a quarterly goal as a result, it’s likely worth it. Make sure to communicate with your investors when you are facing a lack of qualified candidates. Lean on their expertise and network to better your chances at making good hires if you’re truly in need. Talk honestly about your hesitation to hire if you show up at monthly or quarterly meetings having failed to scale headcount according to plan. Keep your position consistent: you’d rather lose little now than pay a lot more later for a bad sales rep.

Related resource: 9 Signs It’s Time To Hire in a Startup

founders

Metrics and data

Making Changes to Your Cash Flow Projections

No founder has ever created a financial plan and cash flow projections they didn’t like. But what happens when the countless hours spent sifting through data, building models, and pitching your projections don’t go as planned?

There is endless content on putting together accurate financial projections and cash flow analysis but the reality is companies are still going to have down quarters, overly optimistic forecasts, and miss your projections one way or another. However, it is something that can be handled immediately with a few quick readjustments.

When to Readjust your Cash Flow Projections

As we mentioned above, no founder has created a forecast they did not like. There is a fine line between an optimistic and delusional projection. If you’re continuing to miss your forecast, have limited resources, etc. it is probably time to readjust your forecasts. For earlier stage companies, start with your life-blood; cash flow.

“Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. Cash flow is the life-blood of all businesses—particularly start-ups and small enterprises.”

Cash flow can be extremely delicate in the early stages of a company’s life. Being off by just a few weeks or months can make or break moral, investor interest, and the life of the business.

As Jason Lemkin puts it after a missed quarter, “If your cash is now going to stretch 12 months instead of 15, you may need to take action now. If you wait — it will be too late to make a difference. Do not wait a quarter here. Do this now.”

If revenue is down, chances are you are closer to your zero cash date and need to make sure this is accounted for. You will likely need to re-forecast your cash and financial projections for the year as well.

How to Readjust – A Dynamic Forecast

A quick and easy way to keep your projection in check? A last three to six month rolling projection simply using your growth rate and burn rate. What exactly is a “Last Three Month” model? You’ll just need to take the average of your last three (to six) month growth rate and roll it forward 12 months. While it may not be as appealing as a forecast you put together on your own it is generally a great indicator of where your business is heading.

Example from SaaStr.com

As you can see in the example above from SaaStr, the average growth rate over the last 4 months is 14.7% so they use that as their growth rate moving forward. As your new revenue and growth rates continue to change so will your rolling average and forecasts.

Chances are this will be the most realistic forward looking growth rates as well. However, you can still pair a “Last Three Month” model with your original forecasts so you have a more realistic and a “stretch” forecast to keep an eye on.

Start automating your cash flow projections using our business intelligence layer by signing up for a trial at Visible.vc

founders

Fundraising

Metrics and data

Debt vs Equity Financing

What is debt financing?

Startups are in a constant competition for 2 resources; capital and talent. When it comes to raising capital for your startup there are quite a few options. Outside of bootstrapping, debt and equity financing are 2 of the most popular options.

According to Investopedia, “Debt financing occurs when a firm raises money for working capital or capital expenditures by selling debt instruments to individuals and/or institutional investors. In return for lending the money, the individuals or institutions become creditors and receive a promise that the principal and interest on the debt will be repaid.”

On the other hand, there is equity financing.

How does debt financing work?

A lender is generally evaluating if and when a business can be repaid. A team of lenders will generally evaluate a few things, this generally starts with past performance and future projections. A few keys to understand when approaching a lender or bank for debt financing:

Complete financial statements and documents. Poor or incomplete financial statements can put doubt in the mind of a debt-provider. Most debt-providers will look as far back as 2-3 years. For example, Lighter Capital will occasionally make investments with ~6 months of solid financials.

Understand your business. Have a deep understanding of where your customers, how you’re acquiring them, and why they are churning.

Revenue Growth. You don’t have to be a profitable company to receive funding from Lighter Capital but should have a clear plan and pathway to profitability.

Downside Scenarios. As mentioned above, debt-providers are focused on repayment as opposed to extreme upside. Make sure you lay out downside scenarios to show you can navigate down periods.

High Gross Margins. Going hand in hand with “downside scenarios” show debt-providers you have high gross margins and can limit the downside as much as possible.

Story matches the numbers. If you’re telling a great narrative and the data/financials are not matching up with the story chances are that will cause doubt in the mind of the providers.

Plan for New Capital. Show you have a plan in place for how you will allocate your new capital. Allen of Lighter Capital has seen a clear connection between a company coming to them with a solid plan and their future growth.

Pros of debt financing

Every financing option will come with its own set of pros and cons. Check out a few of the key pros of debt financing below:

Maintain ownership — debt financing does not require founders to give up equity or ownership in their business

Efficient growth — taking on debt can allow companies to buy the resources and hire the talent they need to fuel growth

Tax benefits — As the team at Lightspeed put it, “A strong advantage of debt financing is the tax deductions. Classified as a business expense, the principal and interest payment on that debt may be deducted from your business income taxes.”

Cons of debt financing

On the flip side, there are cons to debt financing. Check out a few examples below:

Repayment — of course, you’ll need to repay the debt. This requires a predictable business model.

Collateral — debt also requires collateral. This can be limited to early-stage companies.

Types of debt financing

There are different types of debt financing that startups can leverage. Check out a few types of debt financing below:

Bank Lending — The most traditional form of debt financing requires taking a loan from a traditional bank or institution.

Recurring Revenue — There are specific lenders dedicated to recurring revenue business models (SaaS).

Family or Friend Lending — Startup founders can also take on debt or loans from family members or friends.

What is equity financing?

According to Investopedia, “Equity financing is the process of raising capital through the sale of shares. Companies raise money because they might have a short-term need to pay bills or they might have a long-term goal and require funds to invest in their growth. By selling shares, they sell ownership in their company in return for cash, like stock financing.”

When thinking of equity financing in terms of startups we generally think of venture capital and angel investors. When a startup goes out to raise a funding round, they are selling shares (AKA equity in the company) for a set amount of capital.

How does equity financing work

When raising equity financing or venture capital it often follows a process. This involves the founder focusing on the fundraise.

Finding the Right Investors

To start a fundraise, you first need to understand what investors you should be talking to. A venture fundraise is time intensive so it is important to make sure you’re spending your time with the right people. Check out our investor database to find the right investors for your business here.

Related Resource: An Essential Guide on Capital Raising Software

Pitching Your Company

Once you land a meeting with a potential investor you will need to pitch your business and make it a point for them to invest. As we wrote in our Fundraising Guide, “If you’ve done your research and asked the right questions, you’ll be armed with the information you need to effectively pitch your company. At the end of the day, pitching is storytelling and it is your job to figure out how each potential investor fits into the narrative. If done correctly, you’ll be able to control the conversation and better your chances of setting future meetings.”

Due Diligence

If you are fortunate enough to gain interest from a venture capitalist they will perform due diligence to confirm what you’ve been pitching is true. This means they will be calling on customers, other investors, and combing through historical data to confirm they’d like to make the investment.

Pros of equity financing

Like debt financing, equity financing comes with its own set of pros and cons. Check out a few of the pros of equity financing below:

No Loan Repayment — With equity financing, the burden of repayment does not fall on the shoulders of a founder. In turn for giving up ownership, they are giving up the burden of repaying debt.

Resources — Many equity financers, like venture capitalists, come with resources to help startups grow and scale their operations.

Cons of equity financing

On the flip side, there are also cons that come with equity financing. Check out a couple of examples of the cons of raising equity financing below:

Loss of ownership — Giving up equity means that founders are giving up ownership and potentially decision-making powers.

Expectations — When adding on new shareholders, chances are they will have requirements and expectations that may not align with your own.

Types of equity financing

Equity financing, and the individuals/firms that support it, come in different shapes and sizes. Check out a few examples of equity financing below:

Venture Capital — dedicated firms built to invest in high-growth startups

Angel Investors — high net worth individuals that use startup investing as a way to diversify their investment portfolio

Private Equity — Professional investment firms dedicated to helping operate and scale large startups.

Related Resources:

How to Find Investors

How to Effectively Find + Secure Angel Investors for Your Startup

Private Equity vs Venture Capital: Critical Differences

Debt vs equity financing for startups

When evaluating debt and equity financing there are a few key major differences that a startup and founder have to evaluate.

The Cost

The major difference when evaluating debt and equity financing is the cost to your business. On one hand, you can take debt financing and will need to pay back the interest rate and principle at a later date. This generally assumes that your business is bringing in some type of predictable revenue. There is a clear cost associated with paying this back.

On the flip side, is the cost of equity financing. While there is not a set amount of capital you will need to pay back you will eventually need to pay the cost of the shares at a later date. This can be expensive if the business turns out to be worth a large amount.

The Business Model

When understanding debt vs. equity financing you need to understand the impact your business model will have on each as well. When raising debt financing, the lender will want your business to have predictable revenue and clear projections so they know that they will be repaid.

On the other hand, equity financing allows small businesses to pursue a new market where they may have little to no data. This is because someone buying equity, especially a venture capitalists, are investing in the future value of the company and the ability for the team to execute on the vision.

When to seek out debt vs equity financing

As we’ve discussed earlier in this post you need to understand the costs associated with both equity and debt financing.

Securing Debt Financing

For those who aren’t growing at 300% but rather 150% or 200% a good option would be to look into debt financing. While there are countless types of debt financing, Lighter Capital focuses on “revenue-based financing”. There are several factors that Lighter Capital looks into when evaluating a potential investment but as Allen Johnson of Lighter Capital puts it, “At the end of the day they’re assessing the risk to get repaid”.

Securing Equity Financing

To kick off the webinar, Mike discussed experiences from Visible’s own fundraising efforts and what we’ve seen from our partners and countless companies using Visible for investor relations.

The biggest takeaway from raising equity financing? It is very much a process and can be very time consuming. Raising equity financing is essentially a full time job for the CEO or founding team. It is not something that can be done lightly and viewed as a “side project”. You need to build relationships and a pipeline of investors, show momentum, generate inbound interests, etc.

Equity financing allows pre-revenue companies with a strong vision and adjustable market an opportunity to secure capital and pursue their vision. Investors are expecting a return and are often in pursuit of an “extreme upside”. As you can see below, Christoph Janz of Point Nine Capital breaks down what it takes to raise a Series A in SaaS below:

Basic Info and Docs You’ll Need While Raising Venture Capital:

As part of the process of raising venture capital, VCs will need to understand your past business performance. Venture capitalists are generally investing in a highly experienced team, intriguing and emerging market, and/or a world class product.

Related Reading: Building A Startup Financial Model That Works

With that being said, they will generally need a few of the info and docs below to evaluate their investment decision:

Legal Docs, Cap Table, Financials, etc.

A venture capitalist will want to see who owns the business and how it is structured. They will want to see the cap table to understand this. They will also want to get a look into historical financials to understand how the business is burning cash and handling their finances. In the wake of recent VC failures, it is especially important to have cash burn and financing under control.

Trends over time

VCs are largely investing in the founder and the team if there is little to no revenue or historical data. It is important that the founder and team takes the relationship and transparency seriously. A regular cadence and rapport leading up to the investment. Investors won’t make an investment in a single point of time.

Customer Acquisition Model

VCs will also want to understand your customer acquisition model and the sustainability of it moving forward. If it costs more to acquire a customer than they are paying, it is likely not a feasible business. To learn more about customer acquisition models, check out this post.

Total Addressable Market and Sensitivity analysis

If a business has little to no historical data, a VC may want to better understand the market they are investing. If a market has the opportunity to be large and the investment has the opportunity to penetrate a large percentage of the market, it may be an interesting investment. You can learn more about modeling this and sharing TAM with investors here.

Both debt financing and equity financing are solid options depending on your stage, metrics, and financials. Each has its pros and cons for each company. It is ultimately up to the founder to have a deep understanding of their business to make sure they are making the right decision for their business.

The Visible newsletter brings you weekly, curated fundraising news, articles, and events

Every Thursday we deliver curated insights to help founders raise capital, update investors, and track their key metrics in our newsletter, the Visible Weekly. Subscribe to the Visible Weekly and stay in the loop with fundraising data and insights here.

founders

Product Updates

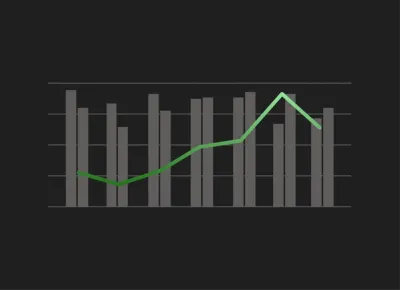

Your New & Improved Data Section

The Visible team recently pushed changes to the data section to provide more insights, context and usability.

We’ve broken down the data section into a couple of key components.

Experience Improvements

With just a single click you can automatically generate a chart for any metric. You’ll have the option to return to the data section to create additional metrics or you can go to the respective dashboard and continue to edit the chart.

Insights

With just a few clicks, you’ll be able to see the following metrics that we automatically calculate for you:

Growth % – the change from the previous year

Previous Year – the value for the same metric one year prior

Previous Year Change – The % change for the same metric from the previous year

Total – The cumulative total for all the values of a given metric

3 Period Rolling Avg. – The rolling average for the previous 3 periods.

6 Period Rolling Avg. – The rolling average for the previous 6 periods.

12 Period Rolling Avg – The rolling average for the previous 12 periods.

Frequencies

We will automatically roll data up to different frequencies. E.g. if you are bringing in daily data, you’ll be able to view it as:

Daily

Weekly

Quarterly

Annually

Metric Settings

This is where you can set the type of metric, the default color for your charting needs, description and any other pertinent settings for the metric.

We’ll be updating data connections and the chart builder in the near future to provide an ever more seamless workflow. As always ping hi@visible.vc should you have any questions or feedback.

Up & to the right,

-Ciarán & The Visible Team

founders

Fundraising

60+ Active Seed Stage SaaS Investors & Fundraising Tips

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Fundraising is difficult. On top of building a fundable business, founders need to find the right investors, build relationships, successfully pitch their companies, and more to close a round. In order to better help founders find the right investors, we’ve built a totally free, community-sourced investor database, Visible Connect.

SaaS startups and SaaS companies are commonly funded by different VC funds and angel investors. The list below is an active list of 60+ SaaS investors that are investing in seed rounds (some invest in later stages as well). The list uses our data from Visible Connect – we focus on key information like check size, investment location, fund size, and more. The link to “View their profile” will display firm information like their thesis, check sizes, focus, recent fund size, etc.

In order to better help you track your raise, you can also add investors directly from Visible Connect to your dedicated fundraising pipeline in Visible (Learn more about tracking a raise in Visible here).

Recommended Reading: The Understandable Guide to Startup Funding Stages

North America SaaS Seed VC Firms

Lightspeed Venture Partners

About: Lightspeed Venture Partners is a venture capital firm that is engaged in the consumer, enterprise, technology, and cleantech markets.

Location: Menlo Park, CA

Check size: $1-$100M

Recent investments: Flink, Netskope, AnyVision

To learn more, view their Visible Connect Profile >>>

Struck Capital

About: Founder-First Capital for Innovative Entrepreneurs who want to Change the World.

Location: Lose Angeles, CA

Check size: $500k – $5M

Recent Investments: Sendoso, BlackCart, Brainbase, Mojo Vision

To learn more, view their Visible Connect Profile >>>

Runway Venture Partners

About: New York City-based early-stage venture capital firm focused on investing in post-product-market fit software-enabled businesses.

Location: New York, NY

Check size: $500k – $1M

To learn more, view their Visible Connect Profile >>>

Cowboy Ventures

About: Cowboy Ventures is a seed-stage focused fund investing in digital startups.

Location: Palo Alto, CA

Check size: $500k – $750k

Recent Investments: Drata, Hone, Contra

To learn more, view their Visible Connect Profile >>>

Redpoint Ventures

About: Redpoint Ventures partners with visionary founders to create new markets or redefine existing ones at the seed, early and growth stages.

Location: Menlo Park, CA

Check size: $4M – $5M

Recent Investments: Hex Technologies, Orca Security, R2C

To learn more, view their Visible Connect Profile >>>

Moment Ventures

About: Early-stage venture capital firm investing entrepreneurs reimagining how we work.

Location: Palo Alto, CA

Recent Investments: Rune Labs, Flowspace, Rafay

To learn more, view their Visible Connect Profile >>>

Elizabeth Street Ventures

About: We are an early-stage investment firm focused on the digital consumer and next-generation brands that improve daily life.

Location: New York, NY

To learn more, view their Visible Connect Profile >>>

SV Angel

About: SV Angel is a San Francisco-based angel firm that helps startups with business development, financing, M&A, and other strategic advice.

Location: San Francisco, CA

Check size: $250k – $3M

Recent Investments: Valora, Outschool, Census

To learn more, view their Visible Connect Profile >>>

Matrix Partners

About: Matrix Partners is a venture capital firm focused on seed- and early-stage investments.

Location: San Francisco, CA

Check size: $5M – $20M

Recent Investments: LightForce Orthodontics, Sequin, Kolide

To learn more, view their Visible Connect Profile >>>

Contour Venture Partners

About: invests in companies focused on information technology, and the application of innovative software solutions into the financial services, enterprise SaaS and vertical B2B SaaS sectors.

Location: New York, NY

Check size: $500k – $1.5M

Recent Investments: Cutover, HowGood, Movable Ink

To learn more, view their Visible Connect Profile >>>

Harlem Capital Partners

About: Harlem Capital is an early-stage venture firm that invests in post-revenue tech-enabled startups, focused on minority and women founders.

Location: New York, NY

Check size: $500k – $1M

Recent Investments: Repeat, PreShow Interactive, Stuf

To learn more, view their Visible Connect Profile >>>

TechNexus

About: We build ecosystems by finding, funding, and accelerating technology ventures in collaboration with entrepreneurs and enterprises.

Location: Chicago, IL

Check size: $50k – $5M

Recent Investments: Catch Co., Rollick, Krisp

To learn more, view their Visible Connect Profile >>>

Moai Capital

About: Seed Capital for Impassioned Entrepreneurs.

Location: San Mateo, CA

Check size: $25k – $100k

To learn more, view their Visible Connect Profile >>>

Quake Capital

About: Investing in big ideas, killer startups, and extraordinary people.

Location: New York, NY

Check size: $150k – $250k

To learn more, view their Visible Connect Profile >>>

Battery Ventures

About: Battery Ventures finances technology sector companies with venture capital, private equity, and debt financing investments.

Location: Boston, MA

Check size: $10M – $75M

Recent Investments: Postman, Amplitude, ServiceTitan

To learn more, view their Visible Connect Profile >>>

Fuel Capital

About: Fuel Capital is a California-based early-stage venture fund focused on consumer, SaaS, and cloud infrastructure companies.

Location: Burlingame, CA

Check size: $500k – $1M

Recent Investments: Specto, ConductorOne, Goodcover

To learn more, view their Visible Connect Profile >>>

Illuminate Ventures

About: Illuminate Ventures invests in early-stage high-tech companies delivering enterprise cloud and mobile solutions.

Location: Oakland, CA

Check size: $250k – $1.5M

Recent Investments: Bedrock Analytics, Copper, Pex

To learn more, view their Visible Connect Profile >>>

Luma Launch

About: Luma Launch is a multi-million dollar early-stage fund with a Launch Program aimed at surfacing the most notable startups and entrepreneurs.

Location: Santa Monica, CA

Recent Investments: Trust & Will, Boulevard

To learn more, view their Visible Connect Profile >>>

Susa Ventures

About: Susa Ventures is an early-stage venture capital firm, investing in a growing family of dreamers and builders.

Location: San Francisco, CA

Check size: $1M – $1.5M

Recent Investments: Nelo, Ascend, Centaur Labs

To learn more, view their Visible Connect Profile >>>

NextWorld Capital

About: NextWorld Capital focuses on the enterprise technology sectors that are transforming existing markets and defining new ones.

Location: San Fracisco, CA

Check size: $1M – $10M

Recent Investments: Honeycomb, Aircall, Stampli

To learn more, view their Visible Connect Profile >>>

Primary Venture Partners

About: Primary Venture Partners (previously High Peaks) is a seed-stage VC firm based in NY, focused on eCommerce and enterprise SaaS.

Location: New York, NY

Check size: $1M – $7.5M

Recent Investments: Stellar Health, FlyMachine, Orum

To learn more, view their Visible Connect Profile >>>

Blumberg Capital

About: Blumberg Capital is an early-stage venture capital firm that invests in a range of technology companies.

Location: San Fracisco, CA

Check size: $1M – $10M

Recent Investments: Hunters, Zone7, Trulioo

To learn more, view their Visible Connect Profile >>>

Boldstart Ventures

About: Boldstart Ventures is a first check investor for technical enterprise founders.

Location: New York, NY

Check size: $250k – $2.5M

Recent Investments: Synk, Replicated, Cape Privacy

To learn more, view their Visible Connect Profile >>>

Founder Collective

About: Founder Collective is a Massachusetts-based seed-stage venture capital fund that helps entrepreneurs build their businesses.

Location: Cambridge, MA

Check size: $400k – $1.5M

Recent Investments: Verve Motion, ULesson, Smalls

To learn more, view their Visible Connect Profile >>>

Costanoa Ventures

About: Costanoa Ventures backs tenacious and thoughtful founders who change how business gets done.

Location: Palo Alto, CA

Check size: $1M – $15M

Recent Investments: Lively, Cresicor, Aserto

To learn more, view their Visible Connect Profile >>>

Engage Ventures

About: Engage Ventures is venture fund and platform established by 11 of the most influential corporations in the world.

Location: Atlanta, GA

Check size: $650k – $25M

Recent Investments: Chain,io, Verusen, Voxie

To learn more, view their Visible Connect Profile >>>

I2BF Global Ventures

About: I2BF invests in startups at the convergence of hardware&software technologies erasing the boundaries between the physical and digital world.

Location: New York, NY

Recent Investments: Shopmonkey, Portside, Inbox Health

To learn more, view their Visible Connect Profile >>>

Uncork Capital

About: Uncork Capital is a seed-stage venture firm that commits early, helps with the hard stuff, and sticks around.

Location: Palo Alto, CA

Check size: $750k – $2M

Recent Investments: Crossbeam, Groove, MakersPlace

To learn more, view their Visible Connect Profile >>>

Founders Fund

About: Founders Fund is a San Francisco-based venture capital firm investing in companies building revolutionary technologies.

Location: San Francisco, CA

Check size: $500k – $150M

Recent Investments: Cover, SUPLERLASTIC, Chronosphere

To learn more, view their Visible Connect Profile >>>

Freestyle VC

About: Freestyle Capital is a seed-stage investor and mentor for Internet software startups. We’re the ones you come to when you want more than just a check.

Location: Mill Valley, CA

Check size: $1M – $7.5M

Recent Investments: HiveWatch, Creator+, Ease

To learn more, view their Visible Connect Profile >>>

Chloe Capital

About: Chloe Capital is a seed stage VC firm investing in women-led innovation companies across North America.

Location: Ithaca, NY

Check size: $100k – $250k

To learn more, view their Visible Connect Profile >>>

Moonshots Capital

About: Seed stage venture capital firm that invests in extraordinary leadership.

Location: Austin, TX

Check size: $500k – $1.5M

Recent Investments: Gretel AI, Wildfire Systems, Cart.com

To learn more, view their Visible Connect Profile >>>

Romulus Capital

About: Romulus Capital is an American seed- and early-stage venture capital fund that invests in technology companies.

Location: Boston, MA

Check size: $500k – $5M

Recent Investments: Ceres Imaging

To learn more, view their Visible Connect Profile >>>

Upfront Ventures

About: We invest primary in the US but have a 20-year history of funding companies in Europe. Our managing partners (Yves Sisteron & Mark Suster) are both dual citizens of France & UK respectively.

Location: Santa Monica, CA

Check size: $1M – $20M

Recent Investments: Bevy, Ynsect, Rally

To learn more, view their Visible Connect Profile >>>

SignalFire

About: We use humans and technology for the hardest parts of building a company at every stage — recruiting, expert advice, and a corporate network.

Location: San Francisco, CA

Check size: $500k – $4M

Recent Investments: PlanetScale, Stampli, Ro

To learn more, view their Visible Connect Profile >>>

CRV

About: CRV has been a leading investor in early-stage technology companies for almost half a century, backing nearly 400 startups in its history.

Location: Palo Alto, CA

Check size: $1M – $25M

Recent Investments: Cord, Postman, Tribe

To learn more, view their Visible Connect Profile >>>

Acceleprise

About: Acceleprise invests in early-stage B2B SaaS and enterprise technology companies and unifies the global technology community through mentors.

Location: San Francisco, CA

Check size: $50k – $1M

To learn more, view their Visible Connect Profile >>>

Floodgate Ventures

About: Floodgate backs the top .1% Founders before the rest of the world believes in their movements.

Location: Palo Alto, CA

Check size: $1M – $10M

Recent Investments: Almanac, Around, IRL

To learn more, view their Visible Connect Profile >>>

Obvious Ventures

About: Obvious Ventures brings experience, capital, and focus to startups combining profit and purpose for a better world.

Location: San Francisco, CA

Check size: $250k – $6M

Recent Investments: Dexterity, One, SINAI Technologies

To learn more, view their Visible Connect Profile >>>

Switch Ventures

About: A community of talented founders who switched from the common path.

Location: San Francisco, CA

Check size: $50k – $5M

Recent Investments: Mode Analytics, Luxury Presence

To learn more, view their Visible Connect Profile >>>

Wing

About: Wing is a purpose-built venture capital firm founded by two industry veterans with a different perspective on what it takes to create enduring companies.

Location: Menlo Park, CA

Recent Investments: Lumigo, Drop Capital, Around

To learn more, view their Visible Connect Profile >>>

Arthur Ventures

About: Arthur Ventures invests in early-stage B2B software companies located outside Silicon Valley.

Location: Minneapolis, MN

Check size: $1M – $10M

Recent Investments: Athennian, Stream, Cybrary

To learn more, view their Visible Connect Profile >>>

Homebrew

About: Homebrew provides seed-stage fund and operational expertise for entrepreneurs building the bottom-up economy.

Location: San Francisco, CA

Check size: $750k – $2M

Recent Investments: Canopy Servicing, Z1, Orum

To learn more, view their Visible Connect Profile >>>

Connetic Ventures

About: Connetic is reinventing the VC industry by turning tables on intuition and biases to a more data-driven approach.

Location: Covington, KY

Check size: $100k – $800k

Recent Investments: TCare

To learn more, view their Visible Connect Profile >>>

High Alpha

About: High Alpha creates and funds companies through a new model for entrepreneurship that unites company building and venture capital.

Location: Indianapolis, IN

Check size: $1M – $3M

Recent Investments: SINAI Technologies, Encamp, Rheaply

To learn more, view their Visible Connect Profile >>>

M25

About: Early-stage VC investing in startups headquartered in the Midwest across a wide variety of industries.

Location: Chicago, IL

Check size: $250k – $500k

Recent Investments: Blumira, Breeze, Cashdrop

To learn more, view their Visible Connect Profile >>>

Europe SaaS Seed VC Firms

Startup Wise Guys

About: Startup Wise Guys is the leading B2B startup accelerator in Europe.

Location: Tallinn, Harjumaaa, Estonia

Check size: $20k – $270k

Recent Investments: Vochi

To learn more, view their Visible Connect Profile >>>

NDRC

About: NDRC is a business that transforms entrepreneurial teams and ideas into startups with early investment and research help.

Location: Dublin, Ireland

Check size: $135k – $500k

To learn more, view their Visible Connect Profile >>>

Newfund Capital

About: Newfund is an entrepreneurial VC firm focused on early-stage investments in France and the United States.

Location: Paris, France

Check size: $300k – $1.5M

Recent Investments: FairMoney

To learn more, view their Visible Connect Profile >>>

Peak Capital

About: Peak Capital is an Amsterdam-based venture capital firm.

Location: Amsterdam, Netherlands

Recent Investments: Route

To learn more, view their Visible Connect Profile >>>

Notion Capital

About: Notion is a London-based venture fund focused on the SaaS-based and cloud computing markets.

Location: London, UK

Check size: $1M – $7.5M

Recent Investments: Admix, Fiberplane, Dixa

To learn more, view their Visible Connect Profile >>>

Act Venture Capital

About: Act is a VC firm focused on the most promising technology companies.

Location: Dublin, Ireland

Recent Investments: Umba, Provizio, Buymie

To learn more, view their Visible Connect Profile >>>

Portugal Ventures

About: Portugal Ventures is a venture capital firm that invests in seed rounds of Portuguese startups in tech, life sciences, and tourism.

Location: Porto, Portugal

Check size: $57k – $1.7M

Recent Investments: Jscrambler, DefinedCrowd

To learn more, view their Visible Connect Profile >>>

Main Incubator

About: Main Incubator is an accelerator that in fintech startups and provides seed and Series A investments.

Location: Frankfurt, Germany

To learn more, view their Visible Connect Profile >>>

Frontline

About: Frontline Seed is a fund for early-stage businesses with global ambitions.

Location: London, UK

Recent Investments: Koyo, Localyze, Qualio